Beruflich Dokumente

Kultur Dokumente

Pci Dss v3 Aoc Merchant

Hochgeladen von

Indarko Wiyogo0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

48 Ansichten8 SeitenPCI DSS for Merchant

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPCI DSS for Merchant

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

48 Ansichten8 SeitenPci Dss v3 Aoc Merchant

Hochgeladen von

Indarko WiyogoPCI DSS for Merchant

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

Payment Card Industry (PCI)

Data Security Standard

Attestation of Compliance for

Onsite Assessments Merchants

Version 3.0

February 2014

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 1

Section 1: Assessment Information

Instructions for Submission

This Attestation of Compliance must be completed as a declaration of the results of the merchants

assessment with the Payment Card Industry Data Security Standard Requirements and Security

Assessment Procedures (PCI DSS). Complete all sections: The merchant is responsible for ensuring that

each section is completed by the relevant parties, as applicable. Contact your acquirer (merchant bank)

or the payment brands for reporting and submission procedures.

Part 1. Merchant and Qualified Security Assessor Information

Part 1a. Merchant Organization Information

Company Name: DBA (doing

business as):

Contact Name: Title:

ISA Name(s) (if applicable): Title:

Telephone: E-mail:

Business Address: City:

State/Province: Country: Zip:

URL:

Part 1b. Qualified Security Assessor Company Information (if applicable)

Company Name:

Lead QSA Contact Name: Title:

Telephone: E-mail:

Business Address: City:

State/Province: Country: Zip:

URL:

Part 2. Executive Summary

Part 2a. Type of Merchant Business (check all that apply)

Retailer Telecommunication Grocery and Supermarkets

Petroleum E-Commerce Mail order/telephone order (MOTO)

Others (please specify):

What types of payment channels does your

business serve?

Mail order/telephone order (MOTO)

E-Commerce

Card-present (face-to-face)

Which payment channels are covered by this

assessment?

Mail order/telephone order (MOTO)

E-Commerce

Card-present (face-to-face)

Note: If your organization has a payment channel or process that is not covered by this assessment, consult

your acquirer or payment brand about validation for the other channels.

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 2

Part 2b. Description of Payment Card Business

How and in what capacity does your business

store, process and/or transmit cardholder data?

Part 2c. Locations

List types of facilities and a summary of locations included in PCI DSS review (for example, retail outlets,

corporate offices, data centers, call centers, etc.)

Type of facility Location(s) of facility (city, country)

Part 2d. Payment Application

Does the organization use one or more Payment Applications? Yes No

Provide the following information regarding the Payment Applications your organization uses:

Payment Application

Name

Version

Number

Application

Vendor

Is application

PA-DSS Listed?

PA-DSS Listing Expiry

date (if applicable)

Yes No

Yes No

Yes No

Part 2e. Description of Environment

Provide a high-level description of the

environment covered by this assessment.

For example:

Connections into and out of the cardholder

data environment (CDE).

Critical system components within the CDE,

such as POS devices, databases, web

servers, etc., and any other necessary

payment components, as applicable.

Does your business use network segmentation to affect the scope of your PCI DSS

environment?

(Refer to Network Segmentation section of PCI DSS for guidance on network segmentation)

Yes

No

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 3

Part 2f. Third-Party Service Providers

Does your company share cardholder data with any third-party service providers (for example,

gateways, payment processors, payment service providers (PSP), web-hosting companies,

airline booking agents, loyalty program agents, etc.)?

Yes

No

If Yes:

Name of service provider: Description of services provided:

Note: Requirement 12.8 applies to all entities in this list.

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 4

Section 2: Report on Compliance

This Attestation of Compliance reflects the results of an onsite assessment, which is documented in an

accompanying Report on Compliance (ROC).

The assessment documented in this attestation and in the ROC

was completed on:

Have compensating controls been used to meet any requirement in

the ROC?

Yes No

Were any requirements in the ROC identified as being not

applicable (N/A)?

Yes No

Were any requirements not tested? Yes No

Were any requirements in the ROC unable to be met due to a legal

constraint?

Yes No

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 5

Section 3: Validation and Attestation Details

Part 3. PCI DSS Validation

Based on the results noted in the ROC dated (completion date), the signatories identified in Parts 3b-3d, as

applicable, assert(s) the following compliance status for the entity identified in Part 2 of this document as of

(date) (check one):

Compliant: All sections of the PCI DSS ROC are complete, all questions answered affirmatively,

resulting in an overall COMPLIANT rating; thereby (Merchant Company Name) has demonstrated full

compliance with the PCI DSS.

Non-Compliant: Not all sections of the PCI DSS ROC are complete, or not all questions are answered

affirmatively, resulting in an overall NON-COMPLIANT rating, thereby (Merchant Company Name) has

not demonstrated full compliance with the PCI DSS.

Target Date for Compliance:

An entity submitting this form with a status of Non-Compliant may be required to complete the Action

Plan in Part 4 of this document. Check with your acquirer or the payment brand(s) before completing

Part 4.

Compliant but with Legal exception: One or more requirements are marked Not in Place due to a

legal restriction that prevents the requirement from being met. This option requires additional review

from acquirer or payment brand.

If checked, complete the following:

Affected Requirement Details of how legal constraint prevents requirement being met

Part 3a. Acknowledgement of Status

Signatory(s) confirms:

(Check all that apply)

The ROC was completed according to the PCI DSS Requirements and Security Assessment

Procedures, Version (version number), and was completed according to the instructions therein.

All information within the above-referenced ROC and in this attestation fairly represents the results of

my assessment in all material respects.

I have confirmed with my payment application vendor that my payment system does not store sensitive

authentication data after authorization.

I have read the PCI DSS and I recognize that I must maintain PCI DSS compliance, as applicable to

my environment, at all times.

If my environment changes, I recognize I must reassess my environment and implement any additional

PCI DSS requirements that apply.

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 6

Part 3a. Acknowledgement of Status (continued)

No evidence of full track data

1

, CAV2, CVC2, CID, or CVV2 data

2

, or PIN data

3

storage after

transaction authorization was found on ANY system reviewed during this assessment.

ASV scans are being completed by the PCI SSC Approved Scanning Vendor (ASV Name)

Part 3b. Merchant Attestation

Signature of Merchant Executive Officer Date:

Merchant Executive Officer Name: Title:

Part 3c. QSA Acknowledgement (if applicable)

If a QSA was involved or assisted with

this assessment, describe the role

performed:

Signature of QSA

Date:

QSA Name: QSA Company:

Part 3d. ISA Acknowledgement (if applicable)

If an ISA was involved or assisted with

this assessment, describe the role

performed:

Signature of ISA

Date:

ISA Name: Title:

1

Data encoded in the magnetic stripe or equivalent data on a chip used for authorization during a card-present transaction. Entities

may not retain full track data after transaction authorization. The only elements of track data that may be retained are primary

account number (PAN), expiration date, and cardholder name.

2

The three- or four-digit value printed by the signature panel or on the face of a payment card used to verify card-not-present

transactions.

3

Personal identification number entered by cardholder during a card-present transaction, and/or encrypted PIN block present

within the transaction message.

PCI DSS Attestation of Compliance for Onsite Assessments Merchants, v3.0 February 2014

2006-2014 PCI Security Standards Council, LLC. All Rights Reserved. Page 7

Part 4. Action Plan for Non-Compliant Requirements

Select the appropriate response for Compliant to PCI DSS Requirements for each requirement. If you

answer No to any of the requirements, you may be required to provide the date your Company expects to

be compliant with the requirement and a brief description of the actions being taken to meet the requirement.

Check with your acquirer or the payment brand(s) before completing Part 4.

PCI DSS

Requirement

Description of Requirement

Compliant to PCI

DSS Requirements

(Select One)

Remediation Date and Actions

(If NO selected for any

Requirement)

YES NO

1

Install and maintain a firewall

configuration to protect cardholder

data

2

Do not use vendor-supplied

defaults for system passwords and

other security parameters

3 Protect stored cardholder data

4

Encrypt transmission of cardholder

data across open, public networks

5

Protect all systems against

malware and regularly update anti-

virus software or programs

6

Develop and maintain secure

systems and applications

7

Restrict access to cardholder data

by business need to know

8

Identify and authenticate access to

system components

9

Restrict physical access to

cardholder data

10

Track and monitor all access to

network resources and cardholder

data

11

Regularly test security systems and

processes

12

Maintain a policy that addresses

information security for all

personnel

Das könnte Ihnen auch gefallen

- POS Hardware Software WhitepaperDokument11 SeitenPOS Hardware Software WhitepaperIndarko WiyogoNoch keine Bewertungen

- Tds Fs Ds 40f Loudspeaker PDFDokument6 SeitenTds Fs Ds 40f Loudspeaker PDFIndarko WiyogoNoch keine Bewertungen

- (Mitre) 10 Strategies of A World-Class Cybersecurity Operations CenterDokument346 Seiten(Mitre) 10 Strategies of A World-Class Cybersecurity Operations CenterIoio92100% (1)

- Plantilla para Cortar La Sim Card A Nanosim o Microsim PDFDokument1 SeitePlantilla para Cortar La Sim Card A Nanosim o Microsim PDFJuniorBasquezNoch keine Bewertungen

- 7 Types Hard CISSP Exam QuestionsDokument6 Seiten7 Types Hard CISSP Exam QuestionsIndarko WiyogoNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- E Wallet ReportDokument27 SeitenE Wallet ReportGovindaram RajeshNoch keine Bewertungen

- BTC FMT CodeDokument6 SeitenBTC FMT Codeall.service.supt100% (5)

- 1 6 2018 PDFDokument483 Seiten1 6 2018 PDFMohit KumarNoch keine Bewertungen

- Security in Computing - Lecture Notes, Study Material and Important Questions, AnswersDokument38 SeitenSecurity in Computing - Lecture Notes, Study Material and Important Questions, AnswersM.V. TVNoch keine Bewertungen

- List of Accepted Documents For Video Verification With WebidDokument4 SeitenList of Accepted Documents For Video Verification With WebidYassine BenzirNoch keine Bewertungen

- Event Management Ticket Booking Using BlockChainDokument5 SeitenEvent Management Ticket Booking Using BlockChainRitesh GuptaNoch keine Bewertungen

- IoT Security Multiple Choice Questions (MCQsDokument18 SeitenIoT Security Multiple Choice Questions (MCQsjhone100% (1)

- MOBOXDokument1 SeiteMOBOXCiwon KwonNoch keine Bewertungen

- Lost TIN ID affidavitDokument1 SeiteLost TIN ID affidavitmessageforjasonNoch keine Bewertungen

- What Is HTTPS - Why Secure A Web Site: Use HTTPS For Storefronts and Ecommerce Web SitesDokument5 SeitenWhat Is HTTPS - Why Secure A Web Site: Use HTTPS For Storefronts and Ecommerce Web SitesvgprasadNoch keine Bewertungen

- Vamsi AadharDokument1 SeiteVamsi Aadhargaming with ffNoch keine Bewertungen

- Babu BabuDokument27 SeitenBabu BabuBabu KuwalNoch keine Bewertungen

- The e-commerce ecosystem in Cape TownDokument1 SeiteThe e-commerce ecosystem in Cape Townvic2clarionNoch keine Bewertungen

- English Hindi DictionaryDokument8 SeitenEnglish Hindi DictionaryKalai PremNoch keine Bewertungen

- Advantages and Disadvantages of TechnologiesDokument4 SeitenAdvantages and Disadvantages of TechnologiesSally SamehNoch keine Bewertungen

- PRC AuthenticationDokument1 SeitePRC Authenticationjhovelle floresNoch keine Bewertungen

- SF PLT SF-IAS Integration Admin enDokument110 SeitenSF PLT SF-IAS Integration Admin enmopachameNoch keine Bewertungen

- White PaperDokument22 SeitenWhite PaperJeff De BrugesNoch keine Bewertungen

- Bank Statement WPS OfficeDokument2 SeitenBank Statement WPS OfficeAdventurous FreakNoch keine Bewertungen

- Name: Rohit Anil Kumar Chaubey: Your Savings A/C StatusDokument3 SeitenName: Rohit Anil Kumar Chaubey: Your Savings A/C Statusrohitboy123100% (1)

- Banter Bubbles - Crypto Market Visualiser With Fun ChatsDokument4 SeitenBanter Bubbles - Crypto Market Visualiser With Fun ChatsGAUTAMNoch keine Bewertungen

- MID Term Info SecDokument56 SeitenMID Term Info Secwildnixon100% (1)

- GPC Specification-2.2.1 PDFDokument303 SeitenGPC Specification-2.2.1 PDFThomas Ehren Schneider100% (1)

- Chap2 CryptographyDokument29 SeitenChap2 CryptographyHaslina MahmoodNoch keine Bewertungen

- Classical Encryption TechniquesDokument39 SeitenClassical Encryption TechniquesAbhishek UpadhyayNoch keine Bewertungen

- DOA Swift MT103 Direct Cash Transfer DOC-20240210-WA0000 - FathimohdabdulDokument4 SeitenDOA Swift MT103 Direct Cash Transfer DOC-20240210-WA0000 - FathimohdabdulChristianMNoch keine Bewertungen

- Keys for managing your Tron and Steemit accountsDokument2 SeitenKeys for managing your Tron and Steemit accountsDarcrackNoch keine Bewertungen

- Booking Confirmation On IRCTC, Train - 13484, 24-Nov-2017, 3A, DLI - MGS - Vivek - Shs@gmailDokument1 SeiteBooking Confirmation On IRCTC, Train - 13484, 24-Nov-2017, 3A, DLI - MGS - Vivek - Shs@gmailSakshi SaumyaNoch keine Bewertungen

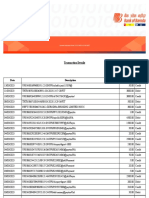

- Account Statement From 1 Jan 2022 To 13 Apr 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument7 SeitenAccount Statement From 1 Jan 2022 To 13 Apr 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubhojeet MazumdarNoch keine Bewertungen

- Trusted Bank Logs VendorsDokument5 SeitenTrusted Bank Logs Vendorstylermoore100% (4)