Beruflich Dokumente

Kultur Dokumente

ACCT30100-1 Syllabus S2014

Hochgeladen von

notnow3333Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACCT30100-1 Syllabus S2014

Hochgeladen von

notnow3333Copyright:

Verfügbare Formate

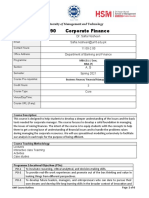

University of Notre Dame

Department of Accountancy

ACCT 30100 Spring 2014

Corporate Financial Reporting

I. Professor and Office Hours

Instructor: Chao-Shin Liu

Professor's Office Location: 387 Mendoza College of Business

Professor's Office Hours: TuTh 11:00 12:15 and by Appointment

Professor's Phone #: 574-631-6029

Professor's E-mail Address: cliu@nd.edu

II. Required Course Materials:

Text: Financial Reporting & Analysis, 5

th

ed., Revsine et al (McGraw-Hill), 2012

(http://www.mhhe.com/revsine5e)

III. III. Course Goals and Objectives

To understand the role financial reporting plays in providing decision useful information

for internal managers and external decision makers.

To understand the economics underlying the business transactions studied.

To learn the Generally Accepted Accounting Principles (GAAP) that set the reporting

and disclosure requirements for these transactions.

To evaluate the efficacy of GAAP (i.e., do the principles capture the economics of the

transaction and if not, why).

To gain an appreciation of the motivations that lead managers to select one accounting

principle over another (e.g., contracting arrangements between managers and owners or

between companies and creditors may play a significant role in explaining accounting

method choice).

To gain an understanding of how external decision makers use financial statement data

to make investment and credit decisions (e.g., investigate why accounting earnings per

share is considered valuation relevant information for security pricing).

To help students prepare the CFA exams.

IV. IV. Grading

Your grade will be determined based on your total score on the following items:

Attendance 20

Cases (20 points* 2) 40

Unannounced Quizzes (30 points*2) 60

Exam 1 125

Exam 2 125

370 points

No late assignment will be accepted and no extra credit will be assigned.

Make-up exams/quizzes will only be given with university approved excuses and

with appropriate document from the Mendoza College of Business.

Students who miss 3 or more classes or take my 30100 course for the second

time will receive zero attendance point; students are not allowed to leave the

classroom in the middle of the class.

Students with less than 222 total points (60%) will receive an F grade.

V. Course Organization & Administration

Attendance and Participation: The active student involvement is required. In order to

participate, you will have to be prepared. It is virtually impossible to do well in this class

without devoting a considerable amount of time to solving homework assignments.

Regular attendance and active participation is expected for at least three reasons. First,

exams will include material not covered in the text; therefore it will be difficult to do well

on the exams without regular attendance. Second, a richer classroom environment exists

when each student has prepared prior to class and comes to class ready to discuss the

assigned materials in greater detail. Third, class participation helps students develop the

ability to formulate and respond to questions in the presence of peers. While attendance

is necessary in order to receive credit for class participation, it is not sufficient. The

discussion portion of the participation grade requires that you ask meaningful questions

and provide substantive solutions and comments.

Homework Assignments: The objectives of the homework assignments are to enhance

learning, stimulate class discussion, and aid in exam preparation. Students are expected

to be prepared to respond to homework-related questions during class discussions.

Exams: Two exams are scheduled during the semester. The second exam (and its make-up

exam) will take place according to the universitys Final Exam Schedule.

VI. Code of Honor

Students will not give or receive aid on exams. This includes, but is not limited to,

viewing the exams of others, sharing answers with others, and using books or notes while

taking the exam. It also includes discussing the exam in order to help those who are

taking it later.

For case assignments, students must work completely independently of other individuals.

Copying solutions from other students constitutes plagiarism.

Students are expected to avoid plagiarism. See The Mendoza College of Business

Honor Code (available in the Dean=s Office) for actions that constitute plagiarism.

The honor code requires that a student, with knowledge of the above violations,

report such occurrences. If a perceived honor code violation occurs, the procedures

outlined in The Mendoza College of Business Honor Code will be followed.

************

To the extent possible, I will follow the schedule of assignments in this syllabus. The

schedule may be altered (add, delete, change timing, etc.) in order to enhance

student learning opportunities or for other reasons.

Date

Topic

Textbook Reading

Assignments

Cases & Readings

Session 1

T, 1-14

Introductions - Instructor, course structure

Distribute & Discuss Syllabus

CFA Gains Momentum at B-Schools

Officials Say They Sought To Avoid Bear Bailout

Session 2

Th, 1-16

Institutional Setting for Financial Reporting

C1: 10-37

P1-11, P1-14, C1-5

WorldCom Internal Probe Uncovers Massive Fraud

U.S. Nears Accounting Shift

Session 3

T, 1-21

Accrual Accounting and Income

Determination

C2: 57-71

E2-2, P2-7

Session 4

Th, 1-23

Accrual Accounting and Income

Determination (continued)

C2: 71-89

P2-11, P2-13

For Annual-Report Purposes, Hurricane Katrina Is 'Ordinary'

FASB Finalizes Guidance on Presentation of

Comprehensive Income

Session 5

T, 1-28

Additional Topics in Income Determination

C3: 131-168

E3-2, E3-14, P3-7 SolvGen Inc. Case (Assignment #1, Due 2-4)

Session 6

Th, 1-30

Balance Sheet and Statement of Cash Flows

C4: 193-208

P4-6, C4-1

Tech Titans in Bidding War

Session 7

T, 2-4

SolvGen Inc. Case Due

Financial Statement Analysis

C5: 249-276

E5-6, P5-4, P5-9

Session 8

Th, 2-6

Financial Statement Analysis (continued)

Valuation and Credit Risk Assessment

C5: 276-284

C6: 313-317

C5-2 The Decline of the P/E Ratio

Session 9

T, 2-11

Valuation and Credit Risk Assessment

(continued)

C6: 317-336

P6-3, P6-9, C6-3

Back to Basics: How To Spot Growth

Session 10

Th, 2-13

Financial Information in Contracting

C7: 375-399

P7-4, C7-1

GM Races to Correct Errors for Report to SEC

Snack CEO Ousted in Accounting Inquiry

Session 11

T, 2-18

Receivables

C8: 425-440

E8-2, E8-3, P8-4, C8-1

Deloitte Receives $1 Million Fine

Session 12

Th, 2-20

Receivables (continued)

C8: 441-459

P8-15, P8-17 Lehman Repo 105

Session 13

T, 2-25

Inventories

C9: 477-496

P9-1, P9-11

Rush to Defend Tax Rule on Inventory and Profits

Session 14

Th, 2-27

Inventories (continued)

Review for Exam 1

C9: 496-519

E9-12, C9-3

Session 15

T, 3-4

Exam 1

C1-C9

Session 16

Th, 3-6

Long-Lived Assets and Depreciation

C10: 551-567

P10-1, E10-13

WorldCom Case (see related articles from session 2)

*****SPRING BREAK*****

Session 17

T, 3-18

Long-Lived Assets and Depreciation

(continued)

C10: 567-582,586-

591

P10-8, P10-9

Ciena Swings to Loss on Write-off

Strike Three: Is Ciena Out?

Session 18

Th, 3-20

Financial Instruments as Liabilities

C11: 611-635

P11-2, P11-3, P11-12

Cash-Rich Microsoft Sells Its First Bonds

Apple's Record Plunge Into Debt Pool

Session 19

T, 3-25

Financial Instruments as Liabilities

(continued)

C11:637-664

P11-5, P11-18, C11-4

Coke Long-term Debt Case

Session 20

Th, 3-27

Leases

C12:693-712, 726-

729

P12-1, C12-1

Accounting Change Could Boost Companies' Debt

Session 21

T, 4-1

Income Taxes

C13:749-763, 778-

791

P13-2, P13-5

Many companies pay no income taxes

Apple Tax Bill Overstated to Investors

Merck Income Tax Case

Session 22

Th, 4-3

Pensions and OPEB

C14:821-832, 838-

850

E14-7, E14-14

AMR Does About-Face

IASB Issues Amendments to IAS 19

Session 23

T, 4-8

Pensions and OPEB (continued)

C14: 852-866

E14-16

PepsiCo Pensions-OPEB Case

Rewriting Pension History

GM Acts to Pare Pension Liability

Pension Assumptions and Manipulations

Session 24

Th, 4-10

Equity

C15: 889-911

P15-1, P15-3, P15-6

Citigroup Instantly Becomes a $40 Stock

Microsoft Equity Case (Assignment #2, Due 4-22)

Session 25

T, 4-15

Equity (continued)

C15: 911-930

P15-14

Facebook Compensation

Session 26

Th, 4-17

Investments

C16: 949-961

P16-1, P16-2

PepsiCo and PepsiAmericas Case

Session 27

T, 4-22

Microsoft Equity Case Due

Statement of Cash Flows

C17: 1025-1053

P17-1 (2)

Justin Inc. Case

Session 28

Th 4-24

Statement of Cash Flows under IFRS

C17: 1053-1058

C17-1

Apple to Pay Dividend, Plans $10 Billion Buyback

Session 29

T 4-29

Review for Exam 2

(Exam Date: ? , 7:30-9:30)

Das könnte Ihnen auch gefallen

- SyllabusDokument9 SeitenSyllabusMichael KirschNoch keine Bewertungen

- FIN3301 Spring2021 SyllabusDokument7 SeitenFIN3301 Spring2021 SyllabusAmine NaitlhoNoch keine Bewertungen

- ACCT 2210 06 - SS2 2018 - OutlineDokument5 SeitenACCT 2210 06 - SS2 2018 - OutlineSOHAIB SOHAIBNoch keine Bewertungen

- ACCT2542 Corporate Financial Reporting and Analysis S2 2015 Part A (Updated On Page 17)Dokument21 SeitenACCT2542 Corporate Financial Reporting and Analysis S2 2015 Part A (Updated On Page 17)Bob CaterwallNoch keine Bewertungen

- Acct408 - Cheng Nam SangDokument5 SeitenAcct408 - Cheng Nam SangHohoho134Noch keine Bewertungen

- ACCT2542 Corporate Financial Reporting and Analysis S22012 PartADokument16 SeitenACCT2542 Corporate Financial Reporting and Analysis S22012 PartAAngela AuNoch keine Bewertungen

- Financial AccountingDokument471 SeitenFinancial AccountingJasiz Philipe Ombugu80% (10)

- ACCT2542 Corporate Financial Reporting and Analysis S22014Dokument26 SeitenACCT2542 Corporate Financial Reporting and Analysis S22014Piyal HossainNoch keine Bewertungen

- BSBFIM601A Manage Finances Trainer Assessment GuideDokument59 SeitenBSBFIM601A Manage Finances Trainer Assessment Guidenanda53% (17)

- UT Dallas Syllabus For Acct6201.mbc.11f Taught by Suresh Radhakrishnan (Sradhakr)Dokument7 SeitenUT Dallas Syllabus For Acct6201.mbc.11f Taught by Suresh Radhakrishnan (Sradhakr)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Acct101 - Charmayne HighfieldDokument5 SeitenAcct101 - Charmayne Highfieldrachel.mack.2022Noch keine Bewertungen

- Pearson LCCI Certificate in Management Accounting (VRQ) Level 4Dokument17 SeitenPearson LCCI Certificate in Management Accounting (VRQ) Level 4Aung Zaw HtweNoch keine Bewertungen

- Financial Accounting and Reporting Course OverviewDokument5 SeitenFinancial Accounting and Reporting Course OverviewAmrutha JeevanandamNoch keine Bewertungen

- Sjerris@sfsu - Edu: Intermediate Financial Accounting Accounting 302Dokument6 SeitenSjerris@sfsu - Edu: Intermediate Financial Accounting Accounting 302ArshSinghNoch keine Bewertungen

- Intermediate Accounting, 13 Edition by Dionald Kieso, Jerry Weygandt, and Terry WarfieldDokument3 SeitenIntermediate Accounting, 13 Edition by Dionald Kieso, Jerry Weygandt, and Terry Warfieldrishad30Noch keine Bewertungen

- ACCT5170 Syllabus - 2023Dokument7 SeitenACCT5170 Syllabus - 2023bafsvideo4Noch keine Bewertungen

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Dokument7 Seiten1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelNoch keine Bewertungen

- UT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)Dokument3 SeitenUT Dallas Syllabus For Aim6333.521 06u Taught by Michael Tydlaska (Tydlaska)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Learn Advanced Finance TopicsDokument5 SeitenLearn Advanced Finance TopicsBhavana KiranNoch keine Bewertungen

- Syllabus 5161 MasterDokument13 SeitenSyllabus 5161 Masterhsnpdr365Noch keine Bewertungen

- CIMA-F2 Area B - Self Study Guide: Over View of The Syllabus Area CDokument3 SeitenCIMA-F2 Area B - Self Study Guide: Over View of The Syllabus Area CSadeep MadhushanNoch keine Bewertungen

- ACCT335 PT Public VersionDokument6 SeitenACCT335 PT Public VersionNurhanifah SoedarsNoch keine Bewertungen

- Foundations of AccountingDokument7 SeitenFoundations of AccountingAlex PontNoch keine Bewertungen

- MGMT 35000 Sec 001 SyllabusDokument5 SeitenMGMT 35000 Sec 001 SyllabusElaine LuNoch keine Bewertungen

- Global Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchDokument4 SeitenGlobal Management and Politics Financial Reporting and Performance Measurement Prof. Jonathan BerkovitchFanny BozziNoch keine Bewertungen

- ACCA Advanced Corporate Reporting 2005Dokument763 SeitenACCA Advanced Corporate Reporting 2005Platonic100% (2)

- Reserach MethodologyDokument26 SeitenReserach MethodologyhvnirpharakeNoch keine Bewertungen

- Accounting Information Systems TextbooksDokument4 SeitenAccounting Information Systems TextbooksAn LeNoch keine Bewertungen

- BSBFIM501A - Manage Budgets and Financial PlansDokument4 SeitenBSBFIM501A - Manage Budgets and Financial Plansbluemind200517% (6)

- FINN 200 - Intermediate Finance-Bushra NaqviDokument4 SeitenFINN 200 - Intermediate Finance-Bushra NaqviazizlumsNoch keine Bewertungen

- MBA (Evening) Program Department of Finance University of Dhaka F-508Managerial Finance Spring 2019 Semester Section: B Course SyllabusDokument2 SeitenMBA (Evening) Program Department of Finance University of Dhaka F-508Managerial Finance Spring 2019 Semester Section: B Course SyllabusMohammad NayeemNoch keine Bewertungen

- May 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeDokument18 SeitenMay 2018 Professional Examinations Audit & Assurance (Paper 2.3) Chief Examiner'S Report, Questions and Marking SchemeMahediNoch keine Bewertungen

- MGAB02 Financial Accounting II Summer 2019Dokument10 SeitenMGAB02 Financial Accounting II Summer 2019Mick MendozaNoch keine Bewertungen

- M.Com Syllabus GuideDokument30 SeitenM.Com Syllabus GuideMd Sharif HossainNoch keine Bewertungen

- ACCT224 Course Outline Term 1 AY2022-23Dokument12 SeitenACCT224 Course Outline Term 1 AY2022-23yong kianNoch keine Bewertungen

- Cma Cso 2015Dokument12 SeitenCma Cso 2015Thasveer AvNoch keine Bewertungen

- Standard For HSM UMT (Corporate Finance)Dokument6 SeitenStandard For HSM UMT (Corporate Finance)Ali ANoch keine Bewertungen

- MCom syllabus and exam patternDokument22 SeitenMCom syllabus and exam patternPrateek UpadhyayNoch keine Bewertungen

- Financial Accounting FundamentalsDokument7 SeitenFinancial Accounting FundamentalsBHAVJOT SINGHNoch keine Bewertungen

- Examiner's Report: Financial Reporting (FR) March 2019Dokument10 SeitenExaminer's Report: Financial Reporting (FR) March 2019Hira AamirNoch keine Bewertungen

- Acct221 - Wong Suay PengDokument3 SeitenAcct221 - Wong Suay PengHohoho134Noch keine Bewertungen

- LM300Dokument8 SeitenLM300Sharma GokhoolNoch keine Bewertungen

- Khalifa Al Blooshi (1) FinalDokument11 SeitenKhalifa Al Blooshi (1) FinalArushi GuptaNoch keine Bewertungen

- Jaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Dokument14 SeitenJaipuria Institute of Management PGDM Trimester I Academic Year 2019-21Utkarsh padiyarNoch keine Bewertungen

- BUS 106.030.spring 2016.syllabusDokument6 SeitenBUS 106.030.spring 2016.syllabusHenryNoch keine Bewertungen

- Applications in Corporate Finance: Course Syllabus Spring Semester 2006Dokument7 SeitenApplications in Corporate Finance: Course Syllabus Spring Semester 2006yazanNoch keine Bewertungen

- S2 Course OutlineDokument19 SeitenS2 Course OutlineNovels4lyfNoch keine Bewertungen

- TIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoDokument6 SeitenTIM 305 Financial Management of Travel Industry SPRING 2022 W F 09:00 - 10:15 A.M. Jan 10 - May 13 Kwanglim SeoS JNoch keine Bewertungen

- ECMC40 Syllabus 2012 Lec 01Dokument5 SeitenECMC40 Syllabus 2012 Lec 01Adele BreakNoch keine Bewertungen

- Examiner's Report: Financial Reporting (FR) June 2019Dokument10 SeitenExaminer's Report: Financial Reporting (FR) June 2019saad aliNoch keine Bewertungen

- Cii Coursework ResubmissionDokument4 SeitenCii Coursework Resubmissionemlwymjbf100% (2)

- UoS Outline ACCT1006 SEM2 2014 ApprovedDokument6 SeitenUoS Outline ACCT1006 SEM2 2014 ApprovedAbdulla ShaheedNoch keine Bewertungen

- MBA 8230 Applications in Corporate Finance: Course Syllabus Spring Semester 2005Dokument7 SeitenMBA 8230 Applications in Corporate Finance: Course Syllabus Spring Semester 2005yazanNoch keine Bewertungen

- Corporate Finance MG TN DLMDokument470 SeitenCorporate Finance MG TN DLMKrishnamurari RaiNoch keine Bewertungen

- Syllabus BCOMACCT NEP2023-2024Dokument13 SeitenSyllabus BCOMACCT NEP2023-2024Vdj AtmaNoch keine Bewertungen

- A312 SyllabusDokument7 SeitenA312 SyllabusHenry ZhuNoch keine Bewertungen

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCVon EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNoch keine Bewertungen

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsVon EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNoch keine Bewertungen

- The Complete Project Management Exam Checklist: 500 Practical Questions & Answers for Exam Preparation and Professional Certification: 500 Practical Questions & Answers for Exam Preparation and Professional CertificationVon EverandThe Complete Project Management Exam Checklist: 500 Practical Questions & Answers for Exam Preparation and Professional Certification: 500 Practical Questions & Answers for Exam Preparation and Professional CertificationNoch keine Bewertungen

- Oil Immersed TransformerDokument8 SeitenOil Immersed TransformerAbdul JabbarNoch keine Bewertungen

- Economic Globalization: Actors, Categories, and StagesDokument28 SeitenEconomic Globalization: Actors, Categories, and StagesJoshua PunganNoch keine Bewertungen

- CARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Dokument3 SeitenCARAGA REGIONAL SCIENCE HIGH SCHOOL ASSESSMENT #1Joana Jean SuymanNoch keine Bewertungen

- OCFINALEXAM2019Dokument6 SeitenOCFINALEXAM2019DA FT100% (1)

- Manoj KR - KakatiDokument5 SeitenManoj KR - Kakatimanoj kakatiNoch keine Bewertungen

- Ys 1.7 Convergence PramanaDokument1 SeiteYs 1.7 Convergence PramanaLuiza ValioNoch keine Bewertungen

- Hamodia Parsonage ArticleDokument2 SeitenHamodia Parsonage ArticleJudah KupferNoch keine Bewertungen

- Chapter 2 Phil. HistoryDokument4 SeitenChapter 2 Phil. HistoryJaylene AlbayNoch keine Bewertungen

- SOP For Storage of Temperature Sensitive Raw MaterialsDokument3 SeitenSOP For Storage of Temperature Sensitive Raw MaterialsSolomonNoch keine Bewertungen

- 2 Obligations General Provisions 1156 1162Dokument15 Seiten2 Obligations General Provisions 1156 1162Emanuel CenidozaNoch keine Bewertungen

- Gautam KDokument12 SeitenGautam Kgautam kayapakNoch keine Bewertungen

- Diagnostic Test in Mapeh 8: Department of EducationDokument4 SeitenDiagnostic Test in Mapeh 8: Department of Educationcarl jayNoch keine Bewertungen

- MEPQ7202 Security OfficerDokument55 SeitenMEPQ7202 Security OfficerSALMANNoch keine Bewertungen

- Arup Blockchain Technology ReportDokument74 SeitenArup Blockchain Technology ReportHarin VesuwalaNoch keine Bewertungen

- JNVD Souvenir FinalDokument67 SeitenJNVD Souvenir Finalkundanno1100% (1)

- Solving Problems Involving Simple Interest: Lesson 2Dokument27 SeitenSolving Problems Involving Simple Interest: Lesson 2Paolo MaquidatoNoch keine Bewertungen

- Pengayaan Inisiasi 6-SynonymyDokument35 SeitenPengayaan Inisiasi 6-SynonymyAriNoch keine Bewertungen

- Classification of IndustriesDokument17 SeitenClassification of IndustriesAdyasha MohapatraNoch keine Bewertungen

- Solar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of AggregatedDokument5 SeitenSolar PV Power Plants Harmonics Impacts: Abstract - The Power Quality (PQ) Effects of Aggregatederic saputraNoch keine Bewertungen

- (AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Dokument3 Seiten(AC-S08) Week 08 - Pre-Task - Quiz - Weekly Quiz - INGLES III (14653)Eduardo Arucutipa60% (5)

- Chemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryDokument53 SeitenChemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryMarthaAlbaGuevaraNoch keine Bewertungen

- Diagnostic Laboratory TestsDokument6 SeitenDiagnostic Laboratory TestsKiana Mae Wong Diwag100% (1)

- CES Wrong Answer SummaryDokument4 SeitenCES Wrong Answer SummaryZorg UANoch keine Bewertungen

- Assignment No1 of System Analysis and Design: Submitted To Submitted byDokument7 SeitenAssignment No1 of System Analysis and Design: Submitted To Submitted byAnkur SinghNoch keine Bewertungen

- Tarea 1Dokument36 SeitenTarea 1LUIS RVNoch keine Bewertungen

- 09 User Guide Xentry Diagnosis Kit 4 enDokument118 Seiten09 User Guide Xentry Diagnosis Kit 4 enDylan DY100% (2)

- A To Z of Architecture PDFDokument403 SeitenA To Z of Architecture PDFfaizan100% (1)

- F77 - Service ManualDokument120 SeitenF77 - Service ManualStas MNoch keine Bewertungen

- Geometry First 9 Weeks Test Review 1 2011Dokument6 SeitenGeometry First 9 Weeks Test Review 1 2011esvraka1Noch keine Bewertungen

- Facebook Privacy FTC Complaint Docket No. C-4365Dokument19 SeitenFacebook Privacy FTC Complaint Docket No. C-4365David SangerNoch keine Bewertungen