Beruflich Dokumente

Kultur Dokumente

Refinery Site Visit Presentation

Hochgeladen von

Clive Gibson0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

458 Ansichten57 SeitenEssar refinery

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenEssar refinery

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

458 Ansichten57 SeitenRefinery Site Visit Presentation

Hochgeladen von

Clive GibsonEssar refinery

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 57

Essar Energy Limited

Refinery Site Visit

November, 2012

Disclaimer

2

This Document and any information made available orally or in writing at any presentation or delivery of this Document (together the Materials) do not constitute or form part of and should not be

construed as, any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities, nor shall they (or any part of them), or the fact of their distribution, form

the basis of, or be relied on in connection with or act as any inducement to enter into, any contract, commitment or investment decision whatsoever.

The Materials are confidential and should not be distributed, published, copied or reproduced (in whole or in part) or disclosed by their recipients to any other person for any purpose, at any time or

in any form other than with the prior written consent of the Company. By accepting receipt of the Materials, you undertake not to forward the Materials to any other person, or to reproduce, copy or

publish the Materials, in whole or in part, for any purpose.

No undertaking, representation or warranty or other assurance, express or implied, is made or given as to the accuracy, completeness, sufficiency or fairness of the information or opinions

contained or expressed in the Materials and, to the extent permitted by law and regulation, no responsibility or liability, howsoever arising, directly or indirectly, is accepted by any person for any

loss, cost or damage suffered or incurred as a result of the reliance on such information or opinions or otherwise arising in connection with the Materials. In addition, no duty of care or otherwise is

owed by any person to recipients of this the Materials or any other person in relation to the Materials. The information contained in the Materials has not been independently verified. Recipients of

the Materials should conduct their own investigation, evaluation and analysis of the business, data and property described in the Materials.

Certain statements, beliefs and opinions contained in the Materials are or may be forward-looking statements. Forward-looking statements can be identified by the use of forward-looking

terminology, including, without limitation, the terms believes, estimates, anticipates, expects, intends, plans, goal, target, aim, may, will, would, could or should or, in each case,

their negative or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. By their nature, forward-looking statements involve

risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future and may be beyond the Company and or any of its subsidiarys (together

the Group) ability to control or predict. You are cautioned not to place any reliance on these forward-looking statements.

The information and opinions contained in the Materials, unless otherwise specified, are provided as at the date of this Document and are subject to change without notice. Past performance is not

indicative of future results. Forward-looking statements are not guarantees of future performance and actual results may differ materially. No representation is made that any of these statements or

forecasts will come to pass or that any forecast result will be achieved. The Company may alter, modify or otherwise change in any manner the content of the Materials, without obligation to notify

any person of such revision or changes. None of the Company or any member of its Group is under any obligation and expressly disclaims any intention or obligation to update or revise any

forward-looking statements or other information contained in the Materials, whether as a result of new information, future events or otherwise, except to the extent legally required.

Certain information included in these Materials relates to reserves, resources, capacity and other technical measurements. Such information is sourced from technical expert reports where possible

or Group data. Such information is based on engineering, economic, geological and other technical data assembled and analysed by the Group's staff, including engineers and geologists, and that

data in certain cases is reviewed by third parties. There are numerous uncertainties inherent in estimating quantities and qualities in respect of such information, including many factors beyond the

Groups control. No assurance can be given that the indicated amount of reserves or resources will be recovered or that the Group's assets can continuously operate at the capacities indicated.

By accepting or accessing the Materials or attending any presentation or delivery of the Materials you agree to be bound by the foregoing limitations and conditions and, in particular, will be taken to

have represented, warranted and undertaken that you have read and agree to comply with the contents of this notice.

Essar Oil

Refining & Marketing

Essar Energy Site Visit

1st November 2012

Agenda of Presentation

Industry Overview

Refinery Business

Supporting facilities at Refinery

Sales and Marketing

Annexure

4

Industry Overview

110

312

165

79

1000 1000

410

316

330

824

227

196

621

960

0

300

600

900

1,200

1,500

1,800

2,100

2009 2010 2011 2012 2013 2014

Asia Africa Europe US

Industry Trends

6 6

Global Oil Demand

84.8

86.1

86.3

85.2

88.2

88.9

89.8

90.6

81

83

85

87

89

91

2006 2007 2008 2009 2010 2011 2012 2013

Expected

Global Oil Demand has grown by 3.0 mbpd in 2010

one of highest in the history.

Demand growth moderated in 2011 to 0.7 mbpd,

however, IEA estimates global oil demand to grow

by 0.8 to 1.0 mbpd for 2012 & 13.

Global demand to grow mainly on account of

consumption driven growth in Non OECD

countries led by China, India & Middle East.

Refinery Closure / Shutdown

Expected closure

In last 4 years, 4.5 mbpd equivalent refineries

closed/ shutdown.

Center of gravity has shifted from OECD countries

to non-OECD countries as most of refining capacity

additions are taking place in non OECD countires.

Net refinery capacity additions are sufficient only to

meet the incremental oil demand.

Additional closures in Europe and US will put

upward pressures on refinery margin.

Refinery margins are expected to remain robust in

Asia in next 2-3yrs.

Source: IEA

Source: Industry reports

mbpd

kbpd

7

Crude Prices and Product Cracks

Movement in Crude Prices

101

102

107

103

95

82

88

94 95

111

120

127

120

110

95

103

113

113

110

116

122

117

107

94

99

109

111

80

90

100

110

120

130

Jan/12 Feb/12 Mar/12 Apr/12 May/12 Jun/12 Jul/12 Aug/12 Sep/12

WTI Brent Dubai (US$/bbl)

Product Cracks

(US$/bbl)

19.43

17.60 17.81

16.26

15.39

19.27

8.52

5.56

2.84 3.36

3.70

4.82

20.36

18.75 18.23

15.56 15.96

20.21

11.66

14.64

7.60

11.76

10.55

12.42

-$10

$0

$10

$20

$30

April - Jun,11 Jul-Sep,11 Oct-Dec, 11 Jan- Mar,12 April - Jun,12 July-Sept,12

Gasoil FO Jet Gasoline

Light & Heavy Differentials

2.8

2.5 2.4

3.55

3.3

2.95

2.4 2.4

2.8

5.30

5.50 5.56

6.85 6.76

7.01

6.9 6.8

7.2

8.69

10.74

13.74

12.20

9.50

8.50

11.0

13.0

12.0

0

4

8

12

16

Jan/12 Feb/12 Mar/12 Apr/12 May/12 Jun/12 Jul/12 Aug/12 Sep/12

AL -AH diff AL - Norooz BL - Maya

(US$/bbl.)

Benchmark Crude Prices continue to show volatility

on account of global economic outlook, geo-politics

in Middle East & Africa regions & European crisis.

Diff. between Dubai & WTI continue to remain wide

& expected to moderate only after reversal of

cushing pipeline.

Light & heavy difference remains range bound,

however, light to heavy & ultra heavy diff. improved,

providing incremental margin to highly complex

refineries

Middle & light dist. continue to remain strong on

account of demand from non OECD counties and

unplanned shutdown and closures of refineries and

low inventories

Source : Historical Platts (Singapore cracks)

Source : Historical Platts

Source : Historical Platts

Indian Refinery Capacity Additions & Petro Product Demand

8

Existing Refinery Capacity

Total Refining capacity 190 MMTPA

15

6

2

IOC Paradeep,

2014

NOCL, 2014

HPCL / CPCL,

2014

Estimated Capacity Additions

Total Refinery Capacity excludes RIL SEZ

refinery intended for exports of petro products.

No new refinery capacity addition expected in

next 3-5 years except as indicated above.

HPCLs Maharashtra refinery, Rajasthan refinery

& other expansion projects announced by PSUs

are not considered as they are still at the early

stage of planning.

30% Refining

Capacity - over

35 years old

Source: Industry ; EOL

As on June 2012 Source: Industry

mmtpa

mmtpa

Global Economies Shifting towards cleaner fuels

9

13 Major cities shifted to

EURO IV Norms from

2010 and 7 cities added

in 2012

Entire Nations is

expected to move Euro

IV in next 1-2 years and

government is planning

to implement Euro V in

major metro cities.

Source: EOL; Industry

EOL is well placed to capitalise on

growing domestic market (auto fuels

~8%) & demand of cleaner fuels.

Demand & Supply Balance of Petro Products

10

-5 -5

-6

-7

-9

-10

-12

-13

-15

3

3

5

4

2

-1

-3

-6

-9

3 3

3

3

2

2

1

1

0

5

8

7

1

-6

-14

-22

-31

-41

-50

-40

-30

-20

-10

0

10

20

FY 2011-12 FY 2012-13 FY 2013-14 FY 2014-15 FY 2015-16 FY 2016-17 FY 2017-18 FY 2018-19 FY 2019-20

LPG MS ATF HSD

Deficit of Gasoil

& Gasoline

Note : 1) Last 5 year (demand growth) CAGR replicated for projections.

2) We have assumed the base year as FY2011-12.

3) RIL SEZ assumed to continue in SEZ.

4) We have not considered the PSU refineries which are at conceptual stage.

Million tonnes

Source: EOL; Industry

Indian Oil and Gas Demand

11

22.3

9.7

5.5

3.7

2.6

1.1

USA EU Russia Brazil China India

Per capita oil consumption (annual barrels/person)-2012

Petro product growth in India

83.6

62.7

38.6

3.6

2.8

1.6

Russia USA EU Brazil China India

Per capita gas consumption (annual cubic feet/person)-

2012

9.0%

13.9%

11.5%

4.2%

8.5%

8.9%

6.7%

10.3%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

2008-09 2009-10 2010-11 April-Sept

2012

Gasoline Growth Gasoil Growth (Diesel)

Low per capita oil consumption

Low per capita Oil & Gas consumption in India;

provides a huge potential to grow at faster pace in

order to catch up with developed economies.

Petro products demand in India continues to be

strong led by growth in GDP, rising disposable

income, Govt. focus on development of infrastructure.

Gas demand is growing at 20%+ rate, however, this

is also restricted due to constrain from supply side.

Govt Policy to restrict Gasoil Price has created

abnormal demand growth in Gasoil, which has even

replaced Fuel Oil & CNG also apart from Gasoline.

Low per capita gas consumption

www.Indexmundi.com

IPR Report

www.Indexmundi.com

Why refining margins could remain high?

Contraction in refinery capacity due to unplanned shutdown :

Refinery capacity has contracted due to planned/unplanned refinery shutdown.

Market witnessed more than 1.5 mbpd of refinery capacity closure in FY12 & expected likely

closure of another 1mbpd for FY13; resulting net refinery capacity addition to be negative in FY13

and with expected demand growth at 0.8mbpd. This would support refinery margins in the near to

medium term

Global capacity utilisation under pressure : Refinery Utilisation unlikely to rise further due to high

average life of refineries and planned/ unplanned shutdown.

Low Inventory level: Five-year-low inventory level to provide support to diesel cracks in the coming

quarter

Strong diesel demand in India : Continuous strong diesel demand in India and Middle East will

benefit Asian diesel refiners and will result into healthy refinery margin.

12

Refinery Business

Business Structure

14

20 mmtpa refinery at

vadinar with complexity of

11.8

Low cost refining complex

centred around Vadinar

supersite

Essar Oil Limited - India

Essar Energy Plc

87.10%

Upstream

Midstream

Downstream

Leading Indian CBM Portfolio

with 10 tcf+ reserves &

resources across 5 CBM

blocks

Total reserves & resources ~

1.7 mmboe

Set up ~ 1600 retail

outlets through

franchisee model

Pan India presence of

Retail Outlets

Vadinar Refinery

15

Refinery Plot Plan

16

PROCESS

PLANTS

CCB & LAB

UTILITY &

POWER PLANT

PRODUCT TANKS

EFFLUENT TREATMENT

PLANT

ROAD

LOADING

DISPATCH

TANKS

RAIL LOADING

FLARE

UTILITY &

POWER PLANT

MAINTENANCE

FIRE

COKER

COOLING

TOWERS

PRODUCT TANKS

Strategic location & Global presence to drive the synergy

17

Crude intake

Crude intake

Proximity to the Middle East,

the largest crude oil source in

the world resulting in lower

crude freight costs

Presence in a major

maritime route from the

Middle East to the Far

East

Strategically located to cater the demand

of growing domestic market & supply to

global markets

Strong, captive infrastructure

like port / jetty, power plants of

Essar affiliated companies in

close proximity

Latin America

Major Units and Licensors

18

UNIT / FACILITY

CAPACITY

(MMTPA)

CAPACITY

Post OPTIMISATION

LICENCER /

TECHNOLOGY

DETAILED

ENGG

CDU / VDU*

10.5 (CDU)

7.2 (VDU)

18 (CDU)

10.9 (VDU)

VISBREAKER (VBU) 1.9 2.0 (CDU)

NAPHTHA HYDROTREATER (NHT) 1.6 1.8

CONTINUOUS CATALYTIC REFORMER UNIT (CCR) 0.9 1.1

FLUID CATALYTIC CRACKING UNIT / UNSATURATED

GAS SEPARATION SECTION (FCCU)

2.9 3.9

DIESEL HYDRODESULFURISATION UNIT (DHDS) 3.7 5.3

VGO HYDROTREATER (VGO HT) - 6.5

DIESEL HYDROTREATER (DHDT) - 4.0

DELAYED COKER UNIT (DCU) - 7.5

ISOMERISATION (ISOM) - 0.7

* Converted to CDU as part of optimisation project.

Unique Design Features for Vadinar Refinery

19

Tallest crude column (90 metres height,

76 trays)

Excellent swing capabilities

CDU

Low pressure steam ejectors & vacuum

Energy savings

VDU

Converted to CDU.

Capable to process ultra heavy crude on

standalone basis.

Improved economics

Maximum Conversion

VBU

Very high pressure hydro treatment

Capable of producing Euro V diesel

DHDT

6 Coker drum of 7.5 MT

One of the largest Coker unit in the world

Complete bottom of barrel vacuum residue into

valuable products.

DCU

Produces Euro IV/V grade diesel

DHDS

Produces LPG, Gasoline & Diesel streams

Improves overall refinery flexibility

FCCU

Produces Reformate & Hydrogen

Reformate is a key component of Gasoline

Hydrogen is used in DHDS

NHT/CCR

Enables to make the increased proportion of BS-

IV and BS-V grade gasoline.

Produces high octane Isomerate.

Converts Naphtha to Gasoline.

ISOM Unit

Hydro treat FCC feed to enable refinery to

produce premium quality low sulphur, high

octane product.

VGO-HDT

Vadinar Refinery Indias second largest private refinery

World class, high complexity refinery

405,000 bpd capacity

11.8 complexity

Low capital cost

Total cumulative capex : US$5.03 billion

Capex per barrel : US$12,746

Capex per complexity barrel : c.US$1,080

Low operating costs c.US$2.8 / bbl

Continuous focus on process innovation and

optimisation

20

Legends :

Indian Private Sector

NOC 1

NOC 2

NOC 3

NOC 4

NOC 5

23,000

19,800

26,500

18,000

20,400

10,700

12,746

-

5,000

10,000

15,000

20,000

25,000

30,000

World

Average

China Saudi

Arabia

India Indian

PSU

Refineries

Indian

Private

Sector

Essar

Energy

Vadinar

2

4

6

8

10

12

14

16

0 100,000 200,000 300,000 400,000 500,000 600,000 700,000

Indian Refineries

Capacity (bpd)

11.8

Large scale high complexity refineries

C

o

m

p

l

e

x

i

t

y

Source: EOL; Industry

Crude Mix and Sourcing Strategy

Higher complexity enables processing of

ultra heavy & toughest crudes thus overall

reduction in crude cost

Continuous optimization of crude diet ; 70-80

type of crudes processed in last 4 years.

Avg API of crude processed improved to 28

compared to 33 pre expansion, expected to

further improve to 25 API upon widening the

diff. between light & heavy crude.

21

19%

56%

53%

29%

28%

14%

0%

20%

40%

60%

80%

100%

Pre Expansion Post Expansion

Light Heavy Ultra Heavy

Requirement of ultra heavy crude is around 85

90 million barrel.

Substantial qty. of Ultra Heavy crudes tied up

from Domestic market ~ 15%-20%, Latin America

~ 35% - 40%, Middle East ~ 30% ~ 40%.

Focus has shifted towards Latin American

Countries like Venezuela, Brazil, Colombia,

Mexico.

Term contract with Cairn India to supply 65000

bpd mangala crude from Rajasthan.

Crude Sourcing Strategy

85-90 mmbbl

Ultra Heavy

Crudes

Total

requirement

~150 mmbbl

60-65 mmbbl

Light & Medium

Crude

Majority of

requirement tied up

with term contracts

with global &

domestic suppliers

partly tied up to

take the

advantage of any

opportunity

available in the

market

Source: EOL

Product Mix and Evacuation Strategy

~ 83% of product slate is middle and light

distillate

More than 50% of gasoil & gasoline will be Euro

IV & V compliant.

Refinery fully capable to convert low value fuel

oil into higher value added products.

Continue to focus on production of high margin

bitumen & fuel oil based on market dynamics.

22

31%

17%

42%

59%

27%

24%

0%

20%

40%

60%

80%

100%

Pre Expansion Post Expansion

Light Middle Heavy

Tied up with PSUs on long term contract for supply

of products in domestic market.

Executed agreement / MOUs with cement players

for supply of Pet coke.

High demand of auto fuels in India in last 6

months, resulted 80% domestic sales. We expect

to maintain 70% & 30% ratio going forward.

High complexity to provide an opportunity to

export high quality products for better realistion

Leverage the group presence by placing the

relevant product in different markets.

Product Evacuation Strategy

Domestic

Market

Export

Market

LPG, Gasoil,

Gasoline, Petcoke

Gasoline, VGO,

Fuel Oil &

Petcoke

Source: EOL

Saving on account of Coal based Power Plant

23

Coal Based Boilers and Power Plant provides a low cost source of Power and Steam to meet Refinerys

demand compared to liquid fuel or natural gas.

Post Expansion Projects, Fuel & Loss increased to 8%.

With start of Coal based power plant, fuel cost will reduced to 4.5%.

Refinery will use Coal for Power plant and Natural Gas for refinery internal processes.

This will save around 3%-3.5% of liquid fuel (Fuel Oil & Naphtha), which will be further converted into

other value added products.

This will save minimum US$ 0.8/bbl for the Refinery.

8%

4.5%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

Fuel & Loss ( based on crude throughput)

Pre Coal Power Plant Post Coal Power Plant

1.2 mmscmd

of Natural Gas

1.6 Million

Tones of Coal

Additional

Usage of Low

cost Coal &

Natural Gas in

Refinery

Source: EOL

10.30

11.60

15.00

12.20

6.60

8.40

8.70

7.60

3.62

1.60

4.53 4.23

4.69

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

FY 2006 FY 2007 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 Q1 FY13

Indian Complex Refinery Vadinar Refinery

Significant Gross Refining Margin uplift

24

Increased complexity to provide incremental margins

in line with the peers with similar complexity

FY12-13, refinery expected to deliver throughput ~

140 mn bbls

FY13-14 throughput ~ 150 mn bbls, resulting in

increased GRM.

Coal fired power and steam to add ~ US$0.8/ bbl to

GRM benefit expected in Q4FY12.

~ US$ 720mn uplift in GRM expected.

* Assumed on throughput of 150 mmbbl & subject to market

conditions.

Vadinar Incremental GRM*

US$/bbl

US$ Million

Source: EOL; Industry

Source :EOL

60

720

540

120

0

200

400

600

800

Capacity

Additions

Complexity

Impact

Coal based

Power Plant

Incremental

EBITDA

Vadinar Refinery received Refinery of the year Award from Petroleum federation of India.

Essar Refinery Integrated Management System(ERIMS) conforms to the requirement of ISO 9001:2008,

ISO 14001:2004 & OHSAS 18001:2007 .

Awarded first position in Safety, Health & Environment (SHE) Awards for year 2010 in manufacturing

sector (large) industries by CII.

Gold category award for implementation of the 5S, by the Quality Circle Forum of India.

British Safety Council -International Safety Award with Distinction for its Health & Safety performance .

Safety excellence award from Federation of Indian Chambers of Commerce & Industry (FICCI)

National Award for Excellence in Water Management from Confederation of Indian Industry (CII)

Safe, Reliable & Sustainable operations

25

LTI free Man - days 1643

LTI free Man-hours 13.68

Major fire free

days

1228

As on 30

th

Sept, 2012

Benchmark study by Solomon

26

11

6

5

4

MAJOR PERFORMANCE INDICATORS

1st Quartile

2nd Quartile

3rd Quartile

4th Quartile

EOL is among quartile 1

refineries in 11 of 26 major

performance indices among

Peer group Some of these are

Refinery Utilization

Non Energy cash operating

expenses

Maintenance Index

Maintenance cost efficiency

Index

Turn around index

Personnel cost index

ESSAR: 11 OUT OF 26 MAJOR PERFORMANCE INDICATORS IN FIRST QUARTILE

Fuel and Loss

27

Received 2

nd

Prize for performance

in Energy Optimization and

Hydrocarbon Loss Management by

CHT (under MOPNG) for

Jawaharlal Nehru Centenary

Awards-2011

Received 3

rd

Prize for managing

Steam Leaks by CHT (under

MOPNG) during Oil and Gas

Conservation Fortnight (OGCF-

2011) survey

7.02

6.50

6.05

5.83

6.31

2007-08 2008-09 2009-10 2010-11 2011-12

Year - wise Fuel & Loss

Commissioning of

expansion units

A dedicated energy cell to monitor and optimize energy

Case Studies

Essar Oil has a capability to produce upto

700 kT/Annum VG 30.

This process has been developed in house

and which resulted in avoiding the

investment for Bitumen Blowing unit.

Essar Oil also has capability to produce up

to 1500 kT / Annum of LSFO

The company has the flexibility to swing the

production based on prevailing market

conditions.

PCS made a feasibility study on the

conversion of VBU to CDU and submitted the

report . The report identifies modifications

needed to convert the VBU to a CDU/VDU at

a capacity of 2 MMTPA with 100% Mangala

crude oil from Rajasthan

After DCU Unit stabilization, VBU Shutdown

taken and all modifications carried out and

Unit restarted as CDU on 15/06/2012. Unit is

running normal now.

28

VG-30 BITUMEN AND LSFO OPTIMIZATION PROJECT VBU TO CDU

Sales & Marketing

Downstream sector in India

30

Sector

Deregulation in

2002

In March 2002, the Indian Government announced a new policy allowing private sector

companies to obtain rights to market automotive fuels and aviation fuels in India, subject

to a minimum investment of at least US$392mn in the domestic oil industry infrastructure

Commercial sales

Commercial sales include sales to domestic industrial customers on a bulk basis, as well

as sales to the National Oil Companies

These sales are made at Trade Parity prices for Auto fuels and Import Parity Prices for

Kerosene and LPG

Retail sales

As of today the Indian Fuel market is attempting to move towards a total decontrol of

pricing having already announced the deregulation of MS

Retail outlets owned or controlled by the Indian Government (c.94% of the retail outlets

in India) are pricing their petroleum products below cost

As a result, private sector oil companies have had to either similarly sell their petroleum

products below cost for a loss, or charge higher, non-competitive prices

The subsidy mechanisms in place by the government, compensates public sector OMCs

for majority of their losses by way of oil bonds and discounts from its upstream E&P

companies (ONGC, Oil India and GAIL)

Global oil players : Esso, Caltex,

Burmah Shell

Nationalised : Formation of IOC, BPCL and

HPCL

Liberalisation: Deregulation,

entry of private players such as Essar and

Reliance

Pricing of Refinery Products

31

Sales

Export

Petrol / FO /

VGO

FOB Vadinar

PSUs/Bulk

HSD / MS

Trade Parity

Price

Kero/LPG

Import Parity

Price

Retail

Petrol

TPP + Retail

Margin

HSD

Govt

regulated

Price

Trade Parity Price: Import parity (80%) & export parity prices (20%)

Import Parity Price: Import price + duties + freight + insurance + transport cost

VGO, Pet Coke and Sulhpur prices are determined on the basis of mutual discussions between

buyers & sellers while Naphtha prices are based on Refinery Transfer Pricing (RTP)

Sales Mix

32

26%

25%

32%

34%

20%

65%

60%

57%

59%

73%

3%

8%

5%

2%

6%

6%

8%

6%

5%

1%

0%

20%

40%

60%

80%

100%

FY09 FY10 FY11 FY12 Q1FY13

Export PSU Bulk Retail

Continue to focus on domestic market due to better price realization of petro products.

Export products include Gasoline, VGO, Fuel Oil and Petcoke.

Domestic sales in Q1FY13 higher than expected due to strong domestic demand and late monsoon.

Source :EOL

Retail Marketing

First private sector company to set up Retail Outlets on

Franchisee based Model ( DODO)*

Retail Network Strength ~ 1600 ; Operational ROs ~ 1400;

balance under various stages of construction.

Deregulation of Gasoline enabled us to ramp up of retail

sales volumes of Gasoline.

EOLs strategy to rationalise its retail network & future

expansion of network will be pursued in controlled manner

until sustainable pricing scenario linked with International

market prevails.

CNG/ALPG# & other Non Fuel Revenue activities

continue to bring additional revenue streams for

franchisees.

Total ALPG & CNG station increased to 21 and are

achieving impressive growth.

33

3

74

16

26

40

3

4

195

43

27

70

37

11

5

159

4

103

35

60

103

1

70

3

215

11

26

2

* DODO - Dealer Owned Dealer Operated, CNG Compressed Natural Gas; APLG Auto Liquefied Petroleum Gas.

Franchisee Business Model

34

Limiting EOLs capital commitment

Land owned by franchisee

Lease to EOL for 20-30 years

Land leaseback and franchise agreements

Investments for construction, installation, operation

borne by franchisee

Protection against downside

EOL pays 5% rental on land

Franchisee earns 5% RoI for setting up outlet,

linked to pre-agreed monthly sales target

Volume-linked sales commission (monthly)

High crude price 12.5% compensation to retain

retailer

Maximize margins when Oil price low

Outlets opened when oil price low

Potential upside from Indian fuel subsidy regime

reform

Non fuel retail

Revenue sharing agreements with channel

partners.

Revenue from sales of non-fuel products

Franchisee Model

Other Facilities at Vadinar

Fire Fighting and Fire Protection

36

Mobile facilities 5 Foam Tenders, 2 Foam Nursers, 1 DCP tender.

Round the clock trained fire fighting crew

Auxiliary fire fighting squad

Fire and gas detection system

Clean agent fire fighting system in process control rooms

Captive Power Plant & Utilities

37

POWER PLANT:

Three Boilers

Two STGs 77 MW power

Two GTs with HRSG 220

MW

Expansion Two coal

based boilers - 1500 TPH

steam

Three STGs 300 MW

World Class Laboratory

38

Modern Maintenance Workshop

39

Effluent Treatment Plant

40

Modern Effluent Facilities help in Recycling all effluent back to process units thus making Essar a

Zero Discharge Refinery

Supporting facilities at Refinery

41

Ports & Terminals (Owned by EPL)

1 SPM, Draft 32 m crude; intake capacity: 27 mmtpa

2 Jetties (1+1) for product offtake : 14 mmtpa

Pipelines & other supporting infrastructure facilities completed

Supporting facilities at Refinery

42

Tankages, Rail & Road Gantries (Owned by EPL)

136 tankages ( 106 + 30) for crude oils, products and Intermediates with capacity of ~ 2.94 Million KL

(1.96 Mn KL earlier + 0.98 Mn KL expansion);

Fully automated Loading Facilities; 3-White Oil truck Gantries, each 8-Bays; 2-LPG loading Gantries,

each 8-Bays; 1-Black Oil loading Gantry of 10-Bays

Fully automated loading Rail Gantry with 2 spurs (48 wagons @2400 mt ) - 5.5 mmtpa; Length of

Gantry: 680 mtrs

Products : LPG, Gasoline, SKO, ATF, Diesel, FO and Bitumen

First Petcoke Deliveries

43

RBI recently approved Essar

Oils proposal to raise $ 1.5

billion through external

commercial borrowings (ECB)

to refinance its rupee

denominated debts with

existing lenders.

Refinance of Rupee debt with

ECBs to provide an annual

interest saving of Rs4.5 5bn

crore, mainly due to reduction

of interest rate by 4-5%

Financial Engineering

44

CDR Exit

CDR Exit Proposal of

Company approved by CDR

Core Group August, 2012

CDR Exit to provide

operational flexibility for

decision making.

It also offer an opportunity to

reduce cost of debt through

restructure of debt Mix &

participation of foreign banks.

CDR expected to be

completed in next 2-3 months.

Sales Tax

Sales Tax matter concluded

with final judgement from

Supreme Court to pay the

balance sales tax liability in 8

quarterly instalment in 2 year

from Jan, 2013.

The Company is planning to

pay the sales tax liability out

of internal accruals

generated from business

operations and credit line of

Rs50bn available with bank,

if required.

ECB Funding

The Essar Advantage

45

Crude Sourcing

Located at nearest point to

major crude sources

All-weather, deep-draft port,

capable of handling VLCC.

No dredging requirement

50% term contract & balance

spot to take advantage of

opportunity crude

Approx. 90% heavy & ultra-

heavy crude post Phase-I &

Optimization

Blending of crude

Sourcing of domestic Mangala

crude 15%-20% of basket

Product Slate

Highly Complex Refinery,

capable to produce Euro IV/V

Specification products post

Expansion

Elimination of negative crack

FO, conversion into value

added light and middle

distillates

80% middle & light distillates

Utilization of Coal & NG for

refinery and power plant to

further reduce the operating

cost

Market Dynamics

Auto fuel (MS/HSD)

demand in India to grow at

5%-10%

Anchor load to come from

domestic market

Product pricing in India

(Trade Parity Pricing)

favoring sales in domestic

Market.

Export of High Value

products to developed

markets.

One of the most Complex Refineries globally

GRMs : Beating Benchmarks

Annexure

Refinery Safety

Refinery Safety Rules

48

Safe Entry and Safe Exit Policy

49

ZERO

ACCIDENTS

Safety Rules & Regulations

Induction & Training

Meeting

Audits

Compliance Enforcement

House Keeping

Tool Box Talks

Awards / Accreditations

50

Refinery has bagged the prestigious British Safety

Council International Safety Award 2009 and 2010

second time in a row.

Received Certificate of Merit for C.I.I. Award for

Excellence in Management of Health / Safety /

Environment for the year 2009 from ICI.

Essar has bagged OISD Safety Award for the year 2009-

10 in the category Oil Refinery. Essar is the first private

refiner to receive this award.

Gujarat Safety Council state award for excellence in

Safety for the year 2008 as well as for 2009.

Essar Oil has been selected for a Special

Commendation for the Golden Peacock Award for

Occupational Health & Safety for the year 2010.

Vadinar Terminal has achieved 5 Star in the

Environmental Audit conducted by the British Safety

Council in 2009 & 2010; only Terminal to achieve a

Double 5 Star In Health & Safety and Environment.

Essar Oil Ltd won National Safety Council USA, 2010

Industry leader award for achieving best safety

performance within its industry

Sustainability @ Essar Oil

51

Healthcare

Education

Environment

Sustainable livelihood

Corporate

Social

Responsibility

Financial support for local teachers and students.

Building, repair and maintenance of schools and

educational facilities.

Donation of computers, notebooks and stationary.

Support for and implementation of educational

schemes and projects of local governments.

Classes for computer education, language, and adult

literacy.

24 hour Community Health Center at Jankhar

village, near the Vadinar refinery.

Mobile medical clinics reach out to villages at our

operational sites in Vadinar and Raniganj.

Mother & Child welfare clinics and OPD centres at

various locations.

Health check up camps, including eye-care,

cancer, vaccination and general health check-ups

for school children

State-of-the-art air pollution control equipment at all sites.

Anti-plastic campaigns at schools.

Conservation of water and other natural resources.

Maintaining flora and fauna.

Afforestation and biodiversity conservation.

Construction of a water tank

Providing computers and sewing machine to a local

jail

Periodically vaccination programs.

Provides fodder and water assistance to

surrounding villages during summer.

Periodically vaccination programs.

Corporate Social Responsibility

52

Occupation Health Centres at Site, City and Township

Corporate Social Responsibility

53

Learning Centre

Health, Safety and Environment

54

MANGROVES PLANTATION

CORALS & MARINE LIFE

GREEN BELT 700 ACRES

Green Belt and Marine Life Protection

India Trends 2030

55

Indias GDP is expected to grow in the 7-8% range in the next five years

590 million people will live in cities, nearly twice the population of United States today

91 million urban households will be middle class, up from 22 million today

700-900 million square meters of commercial space and residential space needs to be built or a new

Chicago every year

2.5 billion square meters of roads will have to be paved, 20 times the capacity added in the past decade

7400 kilometers of metro and subways will need to be constructed 20 times the capacity added in the

past decade

Source : Various industry reports

Expansion Process Flow Diagram

56

VGO HT

DHDT

DCU

ISOM

CDU 2

CDU

CN

Blending

Mangala

Crude

Thank You

Das könnte Ihnen auch gefallen

- Waste and Biodiesel: Feedstocks and Precursors for CatalystsVon EverandWaste and Biodiesel: Feedstocks and Precursors for CatalystsNoch keine Bewertungen

- Petroleum Refinery Relocation Projects: 5-Phases of Project ManagementVon EverandPetroleum Refinery Relocation Projects: 5-Phases of Project ManagementNoch keine Bewertungen

- CIEP Paper 2018 - Refinery 2050Dokument46 SeitenCIEP Paper 2018 - Refinery 2050igor lyahnovichNoch keine Bewertungen

- Booz Company Feedstock Developments Nov26 PresentationDokument21 SeitenBooz Company Feedstock Developments Nov26 PresentationHưng LucaNoch keine Bewertungen

- A Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsDokument13 SeitenA Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsMukthiyar SadhullahNoch keine Bewertungen

- Distillate Hydrocracking Process and Calculations GuideDokument23 SeitenDistillate Hydrocracking Process and Calculations GuideMahmoud Nasr100% (1)

- Smart RefineryDokument22 SeitenSmart RefineryVeeramuthu100% (1)

- How To Find Energy Savings in Process Plants PDFDokument13 SeitenHow To Find Energy Savings in Process Plants PDFCamilo RuaNoch keine Bewertungen

- Refinery Revenue Optimization: Mr. Dharmendra MehtaDokument17 SeitenRefinery Revenue Optimization: Mr. Dharmendra MehtaSunil PillaiNoch keine Bewertungen

- ICIS Ethylene and Derivatives (S&D Outlooks) Jan 2019Dokument9 SeitenICIS Ethylene and Derivatives (S&D Outlooks) Jan 2019willbeacham100% (3)

- Crude Oil - Selection - Planning-IMA-17.01.12-by T.AdhikariDokument54 SeitenCrude Oil - Selection - Planning-IMA-17.01.12-by T.Adhikarimujeebmehar100% (1)

- HydrocrackingDokument1 SeiteHydrocrackingLeonardo MartinettoNoch keine Bewertungen

- Hydrocracking StrategyDokument5 SeitenHydrocracking StrategyDhanny MiharjaNoch keine Bewertungen

- Review of Small Stationary Reformers For Hydrogen ProductionDokument52 SeitenReview of Small Stationary Reformers For Hydrogen ProductionSoineth GuzmánNoch keine Bewertungen

- Global Refinery Shutdown Roundup SampleDokument71 SeitenGlobal Refinery Shutdown Roundup SampleFGINTERNATIONALNoch keine Bewertungen

- Lurgi Technology For GTL CTL Project Amitava BanerjeeDokument80 SeitenLurgi Technology For GTL CTL Project Amitava BanerjeePhoon Hee YauNoch keine Bewertungen

- 1 Ethylene PlantsDokument44 Seiten1 Ethylene PlantsErebert C. CaracasNoch keine Bewertungen

- Exxon Mobil New Refinery TrendsDokument45 SeitenExxon Mobil New Refinery TrendsWong Yee Sun100% (1)

- LENA Ethylene Furnace Brochure136 - 425872Dokument4 SeitenLENA Ethylene Furnace Brochure136 - 425872Thitikorn WassanarpheernphongNoch keine Bewertungen

- Omonbude - Oil Refining in Nigeria (Myths and Truths) RevisedDokument29 SeitenOmonbude - Oil Refining in Nigeria (Myths and Truths) RevisedEkpen J. OmonbudeNoch keine Bewertungen

- Hulsey PresentationDokument67 SeitenHulsey PresentationRupaliVajpayeeNoch keine Bewertungen

- Presentation Q2 APE-1Dokument24 SeitenPresentation Q2 APE-1mts1234Noch keine Bewertungen

- PETROLEUM CRACKING PROCESS GUIDEDokument23 SeitenPETROLEUM CRACKING PROCESS GUIDESrikrishnan KrishNoch keine Bewertungen

- At 03383 WP Refinery ProfitsDokument18 SeitenAt 03383 WP Refinery Profitszubair1951100% (1)

- Refinery Operating Cost: Chapter NineteenDokument10 SeitenRefinery Operating Cost: Chapter NineteenJuan Manuel FigueroaNoch keine Bewertungen

- Oil Price Trends in India and Its DeterminentsDokument16 SeitenOil Price Trends in India and Its DeterminentsDeepthi Priya BejjamNoch keine Bewertungen

- Catalytic cracking process enhances production of light olefinsDokument6 SeitenCatalytic cracking process enhances production of light olefinsswaggeroni yololo100% (1)

- Em FlexicokingDokument8 SeitenEm FlexicokingHenry Saenz0% (1)

- Crude Oil FoulingDokument5 SeitenCrude Oil FoulingJenny Carter100% (1)

- 002 Lecture OverView Refinery Lecture B W 002Dokument87 Seiten002 Lecture OverView Refinery Lecture B W 002Hassan ShahidNoch keine Bewertungen

- What Is NaphthaDokument4 SeitenWhat Is NaphthaMaria Popa100% (1)

- Olefins From Conventional and Heavy FeedstocksDokument27 SeitenOlefins From Conventional and Heavy FeedstocksTaylorNoch keine Bewertungen

- 138 Download Value Addition Through Refinery PetrochemicalDokument54 Seiten138 Download Value Addition Through Refinery PetrochemicaloptisearchNoch keine Bewertungen

- Refining-Petrochemical Integration-FCC Gasoline To PetrochemicalsDokument4 SeitenRefining-Petrochemical Integration-FCC Gasoline To PetrochemicalsKwangsjungNoch keine Bewertungen

- Troubleshooting FCC Circulation ProblemsDokument6 SeitenTroubleshooting FCC Circulation ProblemsLefter RinaldoNoch keine Bewertungen

- CHAPTER 5 HydrotreatingDokument41 SeitenCHAPTER 5 HydrotreatingNurfarhana JelenNoch keine Bewertungen

- Refinery ConfigurationDokument11 SeitenRefinery ConfigurationIoana Popescu100% (2)

- India refinery configurations-Meeting future demand & regulationsDokument9 SeitenIndia refinery configurations-Meeting future demand & regulationsphantanthanhNoch keine Bewertungen

- AromaticDokument173 SeitenAromaticParom Waikasikarn100% (1)

- Refining-Petrochemical Synergies & OpportunitiesDokument29 SeitenRefining-Petrochemical Synergies & OpportunitiesAhmed Khalid100% (1)

- The Structure of The Indian Petrochemical IndustryDokument56 SeitenThe Structure of The Indian Petrochemical IndustryAshwin RamayyagariNoch keine Bewertungen

- Hydrocracker Complex Presentation For BPST 23Dokument50 SeitenHydrocracker Complex Presentation For BPST 23fbriandityaNoch keine Bewertungen

- Overview of the Petrochemical IndustryDokument19 SeitenOverview of the Petrochemical Industrykaran_mukherjeeNoch keine Bewertungen

- Da Oil RefineriesDokument108 SeitenDa Oil RefineriesAffNeg.ComNoch keine Bewertungen

- Asia Petrochemical Outlook 2019 h1Dokument20 SeitenAsia Petrochemical Outlook 2019 h1Cindy GallosNoch keine Bewertungen

- Oil RefineryDokument129 SeitenOil Refinerydandiar1100% (1)

- 2 - TDVS GopalkrishnaDokument61 Seiten2 - TDVS GopalkrishnaManav GaneshNoch keine Bewertungen

- CHT BIP Shell Best Practice - MasterplanningDokument27 SeitenCHT BIP Shell Best Practice - MasterplanningRAJEEVKANNATTMUKUNDANoch keine Bewertungen

- Refining Capacity Study FE0000516 - FinalReportDokument323 SeitenRefining Capacity Study FE0000516 - FinalReportjeedanNoch keine Bewertungen

- Real-Time Optimization Boosts Refinery ProfitabilityDokument25 SeitenReal-Time Optimization Boosts Refinery ProfitabilityAshish SrivastavaNoch keine Bewertungen

- CPCL HydrocrackerDokument177 SeitenCPCL HydrocrackerKaustav Nayak100% (2)

- Refinery Processes-Kirk OthmerDokument49 SeitenRefinery Processes-Kirk OthmeramlhrdsNoch keine Bewertungen

- Petroleum Refinery StudiesDokument47 SeitenPetroleum Refinery StudiesH.J.Prabhu100% (3)

- Catalytic ReformingDokument25 SeitenCatalytic ReformingshanpyanNoch keine Bewertungen

- FCC Process Fundamentals & Technology EvolutionDokument42 SeitenFCC Process Fundamentals & Technology Evolutionranjith_asp0% (1)

- The Challenge of Crude BlendingDokument8 SeitenThe Challenge of Crude Blendingvicktorinox230388100% (1)

- Oe Repsol Polimeros Site 21nov2018Dokument52 SeitenOe Repsol Polimeros Site 21nov2018Paola Plazas AlarcónNoch keine Bewertungen

- Oil and Gas IndustryDokument5 SeitenOil and Gas Industryaravindan_arrNoch keine Bewertungen

- A Model For Blending Motor Gasoline PDFDokument77 SeitenA Model For Blending Motor Gasoline PDFMădălina GrigorescuNoch keine Bewertungen

- India's Petrochemical Growth: Threat or Opportunity for Asian ProducersDokument14 SeitenIndia's Petrochemical Growth: Threat or Opportunity for Asian ProducersClive GibsonNoch keine Bewertungen

- 18R 97Dokument16 Seiten18R 97Manoj Singh100% (4)

- GREET Life Cycle Analysis of Aviation FuelsDokument76 SeitenGREET Life Cycle Analysis of Aviation FuelsClive GibsonNoch keine Bewertungen

- 18R 97Dokument16 Seiten18R 97Manoj Singh100% (4)

- Oil PDFDokument1 SeiteOil PDFClive GibsonNoch keine Bewertungen

- Fake Credit Card Receipt TemplateDokument1 SeiteFake Credit Card Receipt TemplateClive Gibson0% (1)

- Nevada Reply BriefDokument36 SeitenNevada Reply BriefBasseemNoch keine Bewertungen

- Steps To Private Placement Programs (PPP) DeskDokument7 SeitenSteps To Private Placement Programs (PPP) DeskPattasan U100% (1)

- Claim Form - Group Health InsuranceDokument5 SeitenClaim Form - Group Health Insurancevizag mdindiaNoch keine Bewertungen

- Kj1010-6804-Man604-Man205 - Chapter 7Dokument16 SeitenKj1010-6804-Man604-Man205 - Chapter 7ghalibNoch keine Bewertungen

- Delem: Installation Manual V3Dokument73 SeitenDelem: Installation Manual V3Marcus ChuaNoch keine Bewertungen

- Habawel V Court of Tax AppealsDokument1 SeiteHabawel V Court of Tax AppealsPerry RubioNoch keine Bewertungen

- Critical Aspects in Simulating Cold Working Processes For Screws and BoltsDokument4 SeitenCritical Aspects in Simulating Cold Working Processes For Screws and BoltsstefanomazzalaiNoch keine Bewertungen

- TV/VCR Tuner Ic With DC/DC Converter: FeaturesDokument21 SeitenTV/VCR Tuner Ic With DC/DC Converter: FeaturesEdsel SilvaNoch keine Bewertungen

- MA5616 V800R311C01 Configuration Guide 02Dokument741 SeitenMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNoch keine Bewertungen

- AGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFDokument54 SeitenAGCC Response of Performance Completed Projects Letter of recommendAGCC SS PDFAnonymous rIKejWPuS100% (1)

- COKE MidtermDokument46 SeitenCOKE MidtermKomal SharmaNoch keine Bewertungen

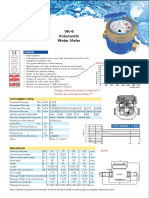

- Baylan: VK-6 Volumetric Water MeterDokument1 SeiteBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNoch keine Bewertungen

- CIGB B164 Erosion InterneDokument163 SeitenCIGB B164 Erosion InterneJonathan ColeNoch keine Bewertungen

- Contract of Lease-Water Refilling StationDokument4 SeitenContract of Lease-Water Refilling StationEkeena Lim100% (1)

- Chilled Beam SystemsDokument3 SeitenChilled Beam SystemsIppiNoch keine Bewertungen

- R20qs0004eu0210 Synergy Ae Cloud2Dokument38 SeitenR20qs0004eu0210 Synergy Ae Cloud2Слава ЗавьяловNoch keine Bewertungen

- MBA Stats Essentials: Measures, Prob, Hypothesis TestsDokument4 SeitenMBA Stats Essentials: Measures, Prob, Hypothesis TestsIbrahim JawedNoch keine Bewertungen

- Family health assessment nursing problemsDokument8 SeitenFamily health assessment nursing problemsMari MazNoch keine Bewertungen

- Brochure of H1 Series Compact InverterDokument10 SeitenBrochure of H1 Series Compact InverterEnzo LizziNoch keine Bewertungen

- Chrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDokument4 SeitenChrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDalton WiseNoch keine Bewertungen

- Application For Freshman Admission - PDF UA & PDokument4 SeitenApplication For Freshman Admission - PDF UA & PVanezza June DuranNoch keine Bewertungen

- Converted File d7206cc0Dokument15 SeitenConverted File d7206cc0warzarwNoch keine Bewertungen

- QA InspectionDokument4 SeitenQA Inspectionapi-77180770Noch keine Bewertungen

- Spec 2 - Activity 08Dokument6 SeitenSpec 2 - Activity 08AlvinTRectoNoch keine Bewertungen

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDokument6 SeitenNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoNoch keine Bewertungen

- Panda CheatsheetDokument17 SeitenPanda CheatsheetAdevair JuniorNoch keine Bewertungen

- HBL Power Systems Rectifier Division DocumentsDokument8 SeitenHBL Power Systems Rectifier Division Documentsmukesh_kht1Noch keine Bewertungen

- Socomec EN61439 PDFDokument8 SeitenSocomec EN61439 PDFdesportista_luisNoch keine Bewertungen

- Mercedes B-Class Accessories ListDokument34 SeitenMercedes B-Class Accessories ListmuskystoatNoch keine Bewertungen

- تقرير سبيس فريم PDFDokument11 Seitenتقرير سبيس فريم PDFAli AkeelNoch keine Bewertungen