Beruflich Dokumente

Kultur Dokumente

Term of The Day-"Arbitrage" Definition

Hochgeladen von

Varun BhandariOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Term of The Day-"Arbitrage" Definition

Hochgeladen von

Varun BhandariCopyright:

Verfügbare Formate

Term of the day-"Arbitrage"

Definition:-

The simultaneous purchase and sale of an asset in order to profit from a difference in the price. It is a

trade that profits by exploiting price differences of identical or similar financial instruments, on different

markets or in different forms. Arbitrage exists as a result of market inefficiencies.

A Simple Example:-

For example, if Company XYZ's stock trades at $5.00 per share on the New York Stock Exchange

(NYSE) and the equivalent of $5.05 on the London Stock Exchange (LSE), an arbitrageur would

purchase the stock for $5 on the NYSE and sell it on the LSE for $5.05 -- pocketing the difference of

$0.05 per share.

Theoretically, the prices on both exchanges should be the same at all times, but arbitrage opportunities

arise when they're not. In theory, arbitrage is a riskless activity because traders are simply buying and

selling the same amount of the same asset at the same time. For this reason, arbitrage is often referred

to as "riskless profit."

Term of the day - "Quantitative Easing"

An unconventional monetary policy in which a central bank purchases government securities or other

securities from the market in order to lower interest rates and increase the money supply. Quantitative

easing increases the money supply by flooding financial institutions with capital in an effort to promote

increased lending and liquidity. Quantitative easing is considered when short-term interest rates are at or

approaching zero, and does not involve the printing of new banknotes.

Explanation of the term-

Typically, central banks target the supply of money by buying or selling government bonds. When the

bank seeks to promote economic growth, it buys government bonds, which lowers short-term interest

rates and increases the money supply. This strategy loses effectiveness when interest rates approach

zero, forcing banks to try other strategies in order to stimulate the economy. QE targets commercial bank

and private sector assets instead, and attempts to spur economic growth by encouraging banks to lend

money. However, if the money supply increases too quickly, quantitative easing can lead to higher rates

of inflation. This is due to the fact that there is still a fixed amount of goods for sale when more money is

now available in the economy. Additionally, banks may decide to keep funds generated by quantitative

easing in reserve rather than lending those funds to individuals and businesses.

Term of the day - "Tapering"

A gradual winding down of central bank activities used to improve the conditions for economic growth.

Tapering activities is primarily aimed at interest rates and investor expectations of what those rates will be

in the future. These can include conventional central bank activities, such as adjusting the discount rate

or reserve requirements, or more unconventional ones, such as quantitative easing (QE).

Explanation of the term -

Central banks can employ a variety of policies to improve growth, and they must balance short-term

improvements in the economy with longer-term market expectations. If the central bank tapers its

activities too quickly, it may send the economy into a recession. If it does not taper its activities, it may

lead to high inflation.

Tapering is best known in the context of the Federal Reserve's quantitative easing program. In reaction to

the 2007 financial crisis, the Federal Reserve began to purchase assets with long maturities to lower

long-term interest rates. This activity was undertaken to entice financial institutions to lend money, and it

began when the Federal Reserve purchased mortgage-backed securities. In 2013, Ben Bernanke

commented that the Federal Reserve would lower the amount of assets purchased by the Fed each

month if economic conditions, such as inflation and unemployment, were favorable.

Being open with investors regarding future bank activities helps set market expectations. This is why

central banks typically employ a gradual taper rather than an abrupt halt to loosen monetary policies.

Central banks reduce market uncertainty by outlining their approach to tapering, and under what

conditions that tapering will either continue or discontinue.

Term of the Day - "Forward Contract"

A forward contract is a private agreement between two counter parties - a buyer and a seller, giving the

buyer an obligation to purchase an asset (and the seller an obligation to sell the asset) at a set price at a

future point in time. The delivery of the asset occurs at a later time but the price is determined at the time

of purchase.

The assets often traded includes anything from:

Foreign currencies, Financial instruments, Grains, Precious metals to Electricity, Oil, Natural gas, Orange

juice, etc. The underlying asset could even be interest rates.

A pictorial representation:

Some essential features of the contract"

- Highly customized

- All parties exposed to counter party default risk

- Transactions take place in large, private and largely unregulated markets

Term of the day "Stock Exchange"

Organised and regulated financial markets where securities (bonds, notes and shares) are bought and

sold at prices governed by the forces of demand and supply.

They serve as:

1. Primary markets - This is where new issues are first sold through initial public offerings. Institutional

investors typically purchase most of these shares from investment banks.

2. Secondary markets - All subsequent trading goes on in the secondary market where participants

include both institutional and individual investors.

The core function of a stock exchange is to ensure fair and orderly trading, as well as efficient

dissemination of price information for any securities trading on that exchange.

The stock market lets investors participate in the financial achievements of the companies whose shares

they hold. When companies are profitable, stock market investors make money through the dividends the

companies pay out and by selling appreciated stocks at a profit called a capital gain. The downside is that

investors can lose money if the companies whose stocks they hold lose money, the stocks' prices goes

down and the investor sells the stocks at a loss.

Exchanges are located all around the globe, with some of the more famous ones being the New York

Stock Exchange, Nasdaq, London Stock exchange and the Tokyo Stock Exchange. London Stock

Exchange is the oldest in the world, while Bombay Stock Exchangeis the oldest in India.

Das könnte Ihnen auch gefallen

- Federal RserveDokument4 SeitenFederal RserveShandyNoch keine Bewertungen

- Theory of Finance NotesDokument36 SeitenTheory of Finance Notesroberto piccinottiNoch keine Bewertungen

- Fin5N Monetary ResearchDokument4 SeitenFin5N Monetary ResearchT-boy T-boyNoch keine Bewertungen

- Types of Financial InstitutionsDokument9 SeitenTypes of Financial InstitutionsfathimabindmohdNoch keine Bewertungen

- Financial Asset Valuation IntroductionDokument7 SeitenFinancial Asset Valuation IntroductionGiga Kutkhashvili100% (1)

- Chapter 11 The Money MarketsDokument8 SeitenChapter 11 The Money Marketslasha KachkachishviliNoch keine Bewertungen

- FM&BODokument17 SeitenFM&BOvinaydevrukhkar2629Noch keine Bewertungen

- Do You Think Having A Stock Market Is A Necessity? Give Your Reasons WhyDokument5 SeitenDo You Think Having A Stock Market Is A Necessity? Give Your Reasons WhyCẩm NhungNoch keine Bewertungen

- FMI NotesDokument93 SeitenFMI Notesjain_ashish_19888651Noch keine Bewertungen

- Types of Money Market Securities: Junio, Jassen CDokument9 SeitenTypes of Money Market Securities: Junio, Jassen CJessa De GuzmanNoch keine Bewertungen

- Introduction To Fixed Income MarketsDokument12 SeitenIntroduction To Fixed Income MarketsJeremy PageNoch keine Bewertungen

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Dokument6 SeitenTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelNoch keine Bewertungen

- Monertary MarketsDokument6 SeitenMonertary MarketsMaryden BurgosNoch keine Bewertungen

- Ict2 ST Agnes Bulaon Jun 7pmquizDokument18 SeitenIct2 ST Agnes Bulaon Jun 7pmquizArjeune Victoria BulaonNoch keine Bewertungen

- Money Market Bond Market Derivatives MarketDokument19 SeitenMoney Market Bond Market Derivatives MarketRamil Jr GaciasNoch keine Bewertungen

- Lim Yew Joon B19080668 FMI Tutorial 4Dokument7 SeitenLim Yew Joon B19080668 FMI Tutorial 4Jing HangNoch keine Bewertungen

- Financial Market and InstitutionsDokument6 SeitenFinancial Market and InstitutionsTofazzal HossainNoch keine Bewertungen

- Central Bank - WikipediaDokument143 SeitenCentral Bank - WikipediaDaxesh BhoiNoch keine Bewertungen

- Jaspal and ParminderDokument25 SeitenJaspal and ParminderAnonymous 7nMwL9Noch keine Bewertungen

- 3.the Money Market Refers To A Segment of The Financial Market Where ShortDokument6 Seiten3.the Money Market Refers To A Segment of The Financial Market Where Shortkhageswarsingh865Noch keine Bewertungen

- Muhammad Abdullah (6772) Capital & Money MarketDokument5 SeitenMuhammad Abdullah (6772) Capital & Money MarketMuhammad AbdullahNoch keine Bewertungen

- Chapter 2 INVESTMENT ALTERNATIVES StudentDokument75 SeitenChapter 2 INVESTMENT ALTERNATIVES StudentDawitNoch keine Bewertungen

- A Quanittative Study of Nepalese Stock ExchangeDokument87 SeitenA Quanittative Study of Nepalese Stock ExchangenirajNoch keine Bewertungen

- FM Chapter 1Dokument6 SeitenFM Chapter 1mearghaile4Noch keine Bewertungen

- Money & Banking: Capitalist EconomiesDokument7 SeitenMoney & Banking: Capitalist Economiesmabvuto phiriNoch keine Bewertungen

- Bond and YieldDokument6 SeitenBond and Yielddayanarshad1337Noch keine Bewertungen

- Fin Mkts Unit IV Lec NotesDokument6 SeitenFin Mkts Unit IV Lec Notesprakash.pNoch keine Bewertungen

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDokument16 SeitenMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNoch keine Bewertungen

- Investment Key TermsDokument32 SeitenInvestment Key TermsAnikaNoch keine Bewertungen

- The Role of The Financial MarketsDokument6 SeitenThe Role of The Financial Marketsrosalyn mauricioNoch keine Bewertungen

- CH 4 FMDokument13 SeitenCH 4 FMTHRISHA JINKALANoch keine Bewertungen

- Investment BankingDokument12 SeitenInvestment BankingmehnazzNoch keine Bewertungen

- Algorithmic Trading (ALGO Trading) : Algorithmic Trading (Also Called Automated Trading, BlackDokument5 SeitenAlgorithmic Trading (ALGO Trading) : Algorithmic Trading (Also Called Automated Trading, BlacksamikhanNoch keine Bewertungen

- Currency: Financial Market Refers To The Place Where Creation and Exchange of Financial InstrumentsDokument3 SeitenCurrency: Financial Market Refers To The Place Where Creation and Exchange of Financial Instrumentsarsal4lllNoch keine Bewertungen

- FM ClipDokument16 SeitenFM ClipNidhi SatvekarNoch keine Bewertungen

- Module 1 - The Role of Financial Markets and Financial IntermediariesDokument11 SeitenModule 1 - The Role of Financial Markets and Financial IntermediariesAriaga CapsuPontevedraNoch keine Bewertungen

- Unit 3 Money MarketDokument25 SeitenUnit 3 Money Marketshree ram prasad sahaNoch keine Bewertungen

- FINA 101 Part IV The Money Markets Group 1Dokument8 SeitenFINA 101 Part IV The Money Markets Group 1noeljrpajaresNoch keine Bewertungen

- Bond MarketDokument17 SeitenBond Marketjai shree ramNoch keine Bewertungen

- Economic DictionaryDokument58 SeitenEconomic DictionarySKYISTHELIMITNoch keine Bewertungen

- What Are Financial MarketsDokument15 SeitenWhat Are Financial MarketsAbhinandan soniNoch keine Bewertungen

- Financial SystemsDokument33 SeitenFinancial SystemsGAURAVNoch keine Bewertungen

- Notes Econ350 Money and FinanceDokument5 SeitenNotes Econ350 Money and FinanceJoshNoch keine Bewertungen

- Money Market - A BriefDokument6 SeitenMoney Market - A BriefasfaarsafiNoch keine Bewertungen

- 5 C)Dokument2 Seiten5 C)CHORE SYLIVESTERNoch keine Bewertungen

- Central Bank - WikipediaDokument21 SeitenCentral Bank - WikipediaiazpiazuNoch keine Bewertungen

- Prototyping PresentationDokument8 SeitenPrototyping PresentationMed HimNoch keine Bewertungen

- Chapter 1Dokument13 SeitenChapter 1mark sanadNoch keine Bewertungen

- Money Market and Central BankDokument10 SeitenMoney Market and Central BankCLEO COLEEN FORTUNADONoch keine Bewertungen

- Definition of 'Money Market': HistoryDokument29 SeitenDefinition of 'Money Market': HistorySan Deep SharmaNoch keine Bewertungen

- Module 1-3 - FMDokument4 SeitenModule 1-3 - FMryokie dumpNoch keine Bewertungen

- DocxDokument3 SeitenDocxbeyyNoch keine Bewertungen

- Chapter One Introduction To InvestmentDokument10 SeitenChapter One Introduction To InvestmentMIKIYAS BERHENoch keine Bewertungen

- Financial Markets FinalsDokument64 SeitenFinancial Markets FinalssisoncrisanneNoch keine Bewertungen

- FM 02-Financial Markets and Institutions The Process of Capital AllocationDokument3 SeitenFM 02-Financial Markets and Institutions The Process of Capital AllocationJPIA Scholastica DLSPNoch keine Bewertungen

- FN302 01-FinAssets&Mkts RevisionDokument17 SeitenFN302 01-FinAssets&Mkts RevisionAmani UrassaNoch keine Bewertungen

- Active InvestingDokument9 SeitenActive InvestingArmanNoch keine Bewertungen

- Gen Math Stocks and BondsDokument41 SeitenGen Math Stocks and BondsDaniel VillahermosaNoch keine Bewertungen

- Corporate FinanceDokument110 SeitenCorporate FinanceLuckmore ChivandireNoch keine Bewertungen

- Industry 4 0Dokument52 SeitenIndustry 4 0Varun Bhandari100% (6)

- Ten Top Techniques For Startup ValuationDokument4 SeitenTen Top Techniques For Startup ValuationVarun BhandariNoch keine Bewertungen

- Your Body Language Shapes Who You AreDokument1 SeiteYour Body Language Shapes Who You AreVarun BhandariNoch keine Bewertungen

- BR Ambedkar JayantiDokument2 SeitenBR Ambedkar JayantiVarun BhandariNoch keine Bewertungen

- Niveshak Feb15Dokument34 SeitenNiveshak Feb15Varun BhandariNoch keine Bewertungen

- Assignment DataDokument10 SeitenAssignment DataVarun BhandariNoch keine Bewertungen

- Width and LengthDokument63 SeitenWidth and LengthAmaresh PatilNoch keine Bewertungen

- Ballou, R. - Introduction To Business LogisticsDokument48 SeitenBallou, R. - Introduction To Business LogisticsGhani RizkyNoch keine Bewertungen

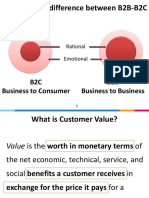

- Fundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessDokument24 SeitenFundamental Difference Between B2B-B2C: B2C Business To Consumer B2B Business To BusinessALOK PRADHANNoch keine Bewertungen

- Bowman's Strategy ClockDokument5 SeitenBowman's Strategy ClockRandika Fernando0% (1)

- NCFM Commodity Derivatives Mock TestDokument12 SeitenNCFM Commodity Derivatives Mock TestsimplypaisaNoch keine Bewertungen

- Writing A Marketing Plan: For Your Food ProductDokument5 SeitenWriting A Marketing Plan: For Your Food Productnimaboat4589Noch keine Bewertungen

- Marketing ManagementDokument13 SeitenMarketing ManagementHOMEWARE GALAXYNoch keine Bewertungen

- Syllabus ECON 001 - Introduction To Microeconomics Hanna WangDokument3 SeitenSyllabus ECON 001 - Introduction To Microeconomics Hanna WangMarkChristianRobleAlmazanNoch keine Bewertungen

- Jay Abraham - Questionnaire Plus PDFDokument39 SeitenJay Abraham - Questionnaire Plus PDFAmerican Urban English LoverNoch keine Bewertungen

- Cos Australia Marketing PlanDokument17 SeitenCos Australia Marketing PlanMbuguz BeNel Muya100% (1)

- Rosewood StrategyDokument4 SeitenRosewood StrategyJohn SmithNoch keine Bewertungen

- Strength: 1) Theme Park - 2) Grab - 3) RestaurantDokument2 SeitenStrength: 1) Theme Park - 2) Grab - 3) Restaurantflower boomNoch keine Bewertungen

- Answer All Questions - Time 2 HourDokument4 SeitenAnswer All Questions - Time 2 Hournotebook99Noch keine Bewertungen

- Module 1 - Introduction To Airline MarketingDokument30 SeitenModule 1 - Introduction To Airline MarketingBhaskar SaileshNoch keine Bewertungen

- Forex NumericalsDokument8 SeitenForex NumericalsVenkata Raman Redrowtu100% (1)

- CHPT 1 AnsDokument7 SeitenCHPT 1 Answoqjwq100% (1)

- Micro Economics Syllabus FYBFM - FYBBI Sem-IDokument3 SeitenMicro Economics Syllabus FYBFM - FYBBI Sem-IbuggatikalashNoch keine Bewertungen

- Chapter 3Dokument5 SeitenChapter 3Anh Thu VuNoch keine Bewertungen

- Retailing VocabularyDokument19 SeitenRetailing VocabularyAnand50% (2)

- Microeconomics Problems SetDokument33 SeitenMicroeconomics Problems SetBeri Z HunterNoch keine Bewertungen

- Sales and Marketing Report 7psDokument10 SeitenSales and Marketing Report 7psShriya SamsonNoch keine Bewertungen

- Parle G Marketing ProjectDokument63 SeitenParle G Marketing ProjectHrdk Dve88% (8)

- Effectiveness of Utilizing Brand Ambassadors of Skin Care Products in Building Brand Equity Among Online Customers in Selected Areas of CaviteDokument7 SeitenEffectiveness of Utilizing Brand Ambassadors of Skin Care Products in Building Brand Equity Among Online Customers in Selected Areas of CaviteVENICE LARA SOLIVERESNoch keine Bewertungen

- Section C - Group 6 Kshitij Yash H21145 - Lakshmi Venkatesh H21146 - Meghna Puri H21147 - Mohan Krishna Yalla H21148 - Shashwat Krishna H21166Dokument2 SeitenSection C - Group 6 Kshitij Yash H21145 - Lakshmi Venkatesh H21146 - Meghna Puri H21147 - Mohan Krishna Yalla H21148 - Shashwat Krishna H21166SHASHWAT KRISHNANoch keine Bewertungen

- Anna Chun Was in Charge of The Returns Department atDokument1 SeiteAnna Chun Was in Charge of The Returns Department atAmit PandeyNoch keine Bewertungen

- Course Detail 7th Sem Mkm. BBADokument8 SeitenCourse Detail 7th Sem Mkm. BBAHari AdhikariNoch keine Bewertungen

- Using The Internet in The E-MarketingDokument7 SeitenUsing The Internet in The E-Marketingusama ahmadNoch keine Bewertungen

- IIM-K EPGP 11 CS-B S7-8 2019-20 Comp Dynamics StrategyDokument40 SeitenIIM-K EPGP 11 CS-B S7-8 2019-20 Comp Dynamics Strategysumantra sarathi halderNoch keine Bewertungen

- 4 Types of Pricing Methods - Explained!Dokument5 Seiten4 Types of Pricing Methods - Explained!Bharti PahujaNoch keine Bewertungen

- Quote 202320janDokument40 SeitenQuote 202320janToqeer RazaNoch keine Bewertungen