Beruflich Dokumente

Kultur Dokumente

Advices For Intraday Weekly Commodity Market

Hochgeladen von

rajnishtrifidCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Advices For Intraday Weekly Commodity Market

Hochgeladen von

rajnishtrifidCopyright:

Verfügbare Formate

18 AUGUST 22 AUGUST 2014

W E E K L Y

R

E

P

O

R

T

Blow by Blow

On

Bullions,

Base metals,

Energy

WWW.TRIFIDRESEARCH.COM

MAJOR EVENTS

COMEX Gold is holding steady after being supported in the last session though the

worries over investment demand are curbing the upside in the yellow metal. As per

the latest Gold Demand Trends report released by World Gold Council, world gold

demand for Q22014 was 964 tonnes, down 16% year on year from 1,148 tonnes

followed by a major drop in bar and coin demand. COMEX Gold futures are trading at

$1314.10 per ounce, down 20 centsper ounce on the day. Prices had hit a three week

high around $1325 per ounce last Friday. MCX Gold futures for October are trading at

Rs 28679 per 10 grams, down Rs 9 per 10 gramson the day. As per the latest Gold

Demand Trends report released by World Gold Council, world golddemand for Q2

2014 was 964 tonnes, down 16% year on year from 1,148 tonnes, central

bankpurchases rose 28 % year on year, to 118 tonnes from 92 tonnes, total bar and

coin demandfell by 56% year on year to 275 tonnes from 628 tonnes, ETF outflows

were 40 tonnes, atenth of the outflows seen in the same period last year. Total

jewellery demand fell by 30% year on year, to 510 tonnes from 727 tonnes.

Technology demand came in at 101 tonnes,down 3% versus the same period last year.

Total supply increased by 10% to 1,078 tonnes.

ConocoPhillips (COP) and Royal Dutch Shell Plc (RDSA) are among global oil

companies needing crude prices as high as $150 a barrel to turn a profit from

Canadas oil sands, the costliest petroleum projects in the world, according to a

study. The next most-expensive crude projects are in the deep waters off the coasts

of Africa and Brazil, with each venture needing prices between $115 and $127 a

barrel.

As the U.S. shale drilling boom floods the worlds biggest crude market with supply,

explorers are at greater risk of a price collapse that would turn some investments

into money losers. Energy explorers are willing to invest in high-cost oil-sands

developments because once they are up and running, they produce crude for

decades longer than other ventures such as deepwater wells. Where else can you

get 10 to 30 years of predictable cash flow? estimated new oil sands projects require

$60 to $100 crude to make sense. The returns may not be stellar compared to some

other projects but they are steady.

Oil Sands are

Biggest Losers

From Low Crude

Prices.

Copper

Rebounds as U.S.

Factory Output

Beats Estimates.

Copper rose in London for the first time in six sessions as factory production topped

analyst estimates in the U.S., the worlds second-largest metal consumer.

Output at manufacturers increased in July at the fastest pace in five months and was

more than estimated, figures from the Federal Reserve showed today.

Global copper inventories monitored by exchanges in London, New York and Shanghai

fell for the second straight week. The strong factory number might promote some

buying.

Copper for delivery in three months rose 0.7 percent to settle at $6,870 a metric ton

($3.12 a pound) at 5:50 p.m. on the London Metal Exchange. This week, the price fell

1.8 percent, the third straight drop, partly amid signs of stalled economies in Germany,

the third-biggest user, and France. Aluminum, lead and tin advanced today in London,

while zinc and nickel declined. Copper futures for December delivery rose 0.4 percent

to $3.1245 a pound on the Comex in New York. The price has dropped 8 percent this

year. China is the top consumer.

Gold Standstill

After Poor

Investment

Demand Data.

E C O N O M I C C A L E N D E R

DATE & TIME

DESCRIPTION FORECAST PREVIOUS

Aug 18 7:30pm NAHB Housing Market Index 53 53

Aug 19 6:00pm Building Permits 1.00M 0.97M

6:00pm

CPI m/m 0.1% 0.3%

6:00pm

Core CPI m/m 0.2% 0.1%

6:00pm

Housing Starts 0.97M 0.89M

Aug 20 8:00pm

Crude Oil Inventories 1.4M

11:30pm

FOMC Meeting Minutes

Aug 21 6:00pm

Unemployment Claims 299K 311K

7:15pm

Flash Manufacturing PMI 55.7 55.8

7:30pm

Existing Home Sales 5.01M 5.04M

7:30pm

Philly Fed Manufacturing Index 20.3 23.9

7:30pm

CB Leading Index m/m 0.6% 0.3%

8:00pm

Natural Gas Storage 78B

Day 1 ALL

Jackson Hole Symposium

Aug 22 7:30pm

Fed Chair Yellen Speaks

Day 2 ALL

Jackson Hole Symposium

Aug 23 Day 3 ALL

Jackson Hole Symposium

S1 S2 S3 R1 R2 R3

28390 27600 27360 29050 29400 29900

S1 S2 S3 R1 R2 R3

42900 42200 41500 44000 44800 45500

T E C H N I C A L V I E W

MCX GOLD showed sideways

movement in whole week, and

correction lead to took important

support of 28500 and also traded near

to trendline. Now, if it sustain below

28250 then next support is seen

around 27900. On other hand if it

traded in the range of 28800-29050

then it may lead it towards the

resistance level of 29500.

S T R A T E G Y

Better strategy in MCX GOLD is to buy

above 28950 for the targets of 29500-

30000 with stop loss of 28350.

PIVOT TABLE

G O L D

PIVOT TABLE

S I L V E R

T E C H N I C A L V I E W

MCX SILVER on daily charts last week

showed sideways to bearish

movement and traded in between of

downward channel pattern and also

took support around 50% retracement.

Now, if it maintains above 44050 then

next resistance is seen around 45000.

On the other hand if it sustain below

42900 then next support level is seen

around 42200.

S T R A T E G Y

Better strategy in MCX SILVER at this

point of time is to sell below 42900 for

the targets of 42000, with stop loss of

44400.

C R U D E O I L

C O P P E R

S1 S2 S3 R1 R2 R3

5795 5640 5500 5935 6065 6200

S1 S2 S3 R1 R2 R3

415 409.90 404.20 420.30 425 429

T E C H N I C A L V I E W

MCX Copper last week showed steep

fall in last two trading sessions and fell

upto 50% retracement level and also

closed below it. Now, if it sustain

below 415 then immidiate support is

seen around 61.8% retracement i.e.

411. On other hand if it took some

correction towards higher side then

422 will act as important resistance

level.

S T R A T E G Y

Better strategy in MCX CRUDEOIL is to sell

below 5790 for the target of 5650, with

stop loss of 5950.

PIVOT TABLE

T E C H N I C A L V I E W

MCX Crude oil last week showed

downward movement and gave

breakout of its important support of

5935 on weekly chart. Now, If the

downward movement continues then

near term support is seen around 5800

below which it may drag towards 5650.

On higher side some correction may

lead it towards the resistance level of

5940.

S T R A T E G Y

Better strategy in MCX COPPER is to sell

below 415, with stop loss of 423 for the

target of 410-405.

PIVOT TABLE

WWW.TRIFIDRESEARCH.COM

DISCLAIMER

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Equity Tips To Bost Your TradingDokument4 SeitenEquity Tips To Bost Your TradingrajnishtrifidNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Excellent Weekly Equity Tips & News PortalDokument6 SeitenExcellent Weekly Equity Tips & News PortalrajnishtrifidNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Investment Tips On Equity MarketDokument4 SeitenInvestment Tips On Equity MarketrajnishtrifidNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Excellent Weekly Currency Tips & News PortalDokument5 SeitenExcellent Weekly Currency Tips & News PortalrajnishtrifidNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Excellent Weekly MCX Tips & News PortalDokument6 SeitenExcellent Weekly MCX Tips & News PortalrajnishtrifidNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Excellent Equity Tips & News PortalDokument4 SeitenExcellent Equity Tips & News PortalrajnishtrifidNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Trifid Research - Equity Tips For BeginnersDokument4 SeitenTrifid Research - Equity Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Free Equity Trading Tips and Market NewsDokument4 SeitenFree Equity Trading Tips and Market NewsrajnishtrifidNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Weekly Free Equity Trading Tips & NewsDokument6 SeitenWeekly Free Equity Trading Tips & NewsrajnishtrifidNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- To Find Live Equity Tips and Equity Market NewsDokument4 SeitenTo Find Live Equity Tips and Equity Market NewsrajnishtrifidNoch keine Bewertungen

- Accurate Equity Tips ProviderDokument4 SeitenAccurate Equity Tips ProviderrajnishtrifidNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Weekly Free Commodity Trading Tips & NewsDokument6 SeitenWeekly Free Commodity Trading Tips & NewsrajnishtrifidNoch keine Bewertungen

- Equity Tips For Intelligent Market TraderDokument4 SeitenEquity Tips For Intelligent Market TraderrajnishtrifidNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Online Stock Tips For BeginnersDokument4 SeitenOnline Stock Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Equity Tips and Online Market NewsDokument4 SeitenEquity Tips and Online Market NewsrajnishtrifidNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- To Find Free Stock Tips For BeginnersDokument4 SeitenTo Find Free Stock Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- Currency Trading Tips For BeginnersDokument5 SeitenCurrency Trading Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- MCX Trading Tips For BeginnersDokument6 SeitenMCX Trading Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- Weekly Stock Tips and Market NewsDokument6 SeitenWeekly Stock Tips and Market NewsrajnishtrifidNoch keine Bewertungen

- Online Commodity Tips For BeginnersDokument3 SeitenOnline Commodity Tips For BeginnersrajnishtrifidNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Morning Free MCX Market NewsDokument3 SeitenMorning Free MCX Market NewsrajnishtrifidNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Profitable Free Stock Tips of Stock MarketDokument4 SeitenProfitable Free Stock Tips of Stock MarketrajnishtrifidNoch keine Bewertungen

- Morning Free Stock Market NewsDokument4 SeitenMorning Free Stock Market NewsrajnishtrifidNoch keine Bewertungen

- Equity Tips For Professional TradersDokument4 SeitenEquity Tips For Professional TradersrajnishtrifidNoch keine Bewertungen

- Free Stock Tips & News For Non Risky TradingDokument4 SeitenFree Stock Tips & News For Non Risky TradingrajnishtrifidNoch keine Bewertungen

- On Time With High Accuracy Free Stock TipsDokument4 SeitenOn Time With High Accuracy Free Stock TipsrajnishtrifidNoch keine Bewertungen

- Equity Tips and News For Online Market TraderDokument4 SeitenEquity Tips and News For Online Market TraderrajnishtrifidNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Weekly MCX Tips and Market NewsDokument6 SeitenWeekly MCX Tips and Market NewsrajnishtrifidNoch keine Bewertungen

- Stock Tips by The Trifid ExpertDokument4 SeitenStock Tips by The Trifid ExpertrajnishtrifidNoch keine Bewertungen

- Weekly Stock Tips and Market NewsDokument6 SeitenWeekly Stock Tips and Market NewsrajnishtrifidNoch keine Bewertungen

- Serial Analysis of Gene Expression (SAGE)Dokument34 SeitenSerial Analysis of Gene Expression (SAGE)Rohit PhalakNoch keine Bewertungen

- Hot Topic 02 Good Light Magazine 56smDokument24 SeitenHot Topic 02 Good Light Magazine 56smForos IscNoch keine Bewertungen

- Full Download Short Term Financial Management 3rd Edition Maness Test BankDokument35 SeitenFull Download Short Term Financial Management 3rd Edition Maness Test Bankcimanfavoriw100% (31)

- Course Structure and Content For Mechatronics, Systems and CDokument32 SeitenCourse Structure and Content For Mechatronics, Systems and CAnimonga HajimeNoch keine Bewertungen

- Case StudyDokument61 SeitenCase StudyA GNoch keine Bewertungen

- Igcse Revision BookDokument23 SeitenIgcse Revision BookJo Patrick100% (2)

- Aluminium Alloy - Wikipedia, The Free EncyclopediaDokument12 SeitenAluminium Alloy - Wikipedia, The Free EncyclopediaAshishJoshi100% (1)

- Ge Fairchild Brochure PDFDokument2 SeitenGe Fairchild Brochure PDFDharmesh patelNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Iron Ore ProcessDokument52 SeitenIron Ore Processjafary448067% (3)

- Brief Summary of Catalytic ConverterDokument23 SeitenBrief Summary of Catalytic ConverterjoelNoch keine Bewertungen

- Cell Structure, Function Practice Test With AnswersDokument16 SeitenCell Structure, Function Practice Test With AnswersDJ ISAACSNoch keine Bewertungen

- 2 Contoh Narative TextDokument9 Seiten2 Contoh Narative TextRini RienzNoch keine Bewertungen

- The Unofficial Aterlife GuideDokument33 SeitenThe Unofficial Aterlife GuideIsrael Teixeira de AndradeNoch keine Bewertungen

- Me8072 Renewable Sources of EnergyDokument13 SeitenMe8072 Renewable Sources of EnergyNallappan Rajj ANoch keine Bewertungen

- Texto CuritibaDokument1 SeiteTexto CuritibaMargarida GuimaraesNoch keine Bewertungen

- SSCNC Turning Tutorial ModDokument18 SeitenSSCNC Turning Tutorial ModYudho Parwoto Hadi100% (1)

- ST 36Dokument4 SeitenST 36ray72roNoch keine Bewertungen

- AR BuildingDokument819 SeitenAR BuildingShithin KrishnanNoch keine Bewertungen

- Vehicle Intercom Systems (VIS)Dokument4 SeitenVehicle Intercom Systems (VIS)bbeisslerNoch keine Bewertungen

- Single Door Feeder Pillar 200A MCCBDokument1 SeiteSingle Door Feeder Pillar 200A MCCBMiqdad AliNoch keine Bewertungen

- Chemical Bonds WorksheetDokument2 SeitenChemical Bonds WorksheetJewel Mae MercadoNoch keine Bewertungen

- DCS YokogawaDokument17 SeitenDCS Yokogawasswahyudi100% (1)

- RhythmDokument10 SeitenRhythmSalcedo NoelNoch keine Bewertungen

- Donna Hay Magazine 2014-10-11 PDFDokument172 SeitenDonna Hay Magazine 2014-10-11 PDFlekovic_tanjaNoch keine Bewertungen

- Superposition and Statically Indetermina - GDLCDokument25 SeitenSuperposition and Statically Indetermina - GDLCAnonymous frFFmeNoch keine Bewertungen

- Psychology 114: Chapters 3 & 4Dokument18 SeitenPsychology 114: Chapters 3 & 4Grace AndersonNoch keine Bewertungen

- Abdominal Examination OSCE GuideDokument30 SeitenAbdominal Examination OSCE Guideزياد سعيدNoch keine Bewertungen

- (Eng) Zx890lch 5a Ks En316Dokument13 Seiten(Eng) Zx890lch 5a Ks En316MC TAK LEENoch keine Bewertungen

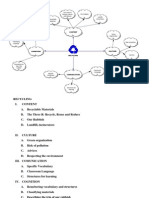

- Recycling Mind MapDokument2 SeitenRecycling Mind Mapmsole124100% (1)

- Thermoplastic Tubing: Catalogue 5210/UKDokument15 SeitenThermoplastic Tubing: Catalogue 5210/UKGeo BuzatuNoch keine Bewertungen