Beruflich Dokumente

Kultur Dokumente

Research Design in Corporation Bank

Hochgeladen von

srilakshmi1704910 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

223 Ansichten3 Seitenabout research process

Originaltitel

Research Design in corporation bank

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenabout research process

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

223 Ansichten3 SeitenResearch Design in Corporation Bank

Hochgeladen von

srilakshmi170491about research process

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

RESEARCH DESIGN

TITLE OF THE STUDY

CREDIT APPRAISAL PRACTISES AT CORPORATION BANK

Introduction

Credit appraisal is the conceptual structure within which the research is conducted.

It constitutes the blue print for the collection, measurement and analysis of data.

The design includes an outline of what the researcher will do from writing the

hypothesis and its operational implication to the final analysis of data. It constitutes

the steps taken beginning with the collection of data, classifying, analyzing and

interpretation, processing and finally putting in textual form. This is one important

chapter of project and can be considered as skeletal of project.

Statement of the Problem

The long term or short term loan provided to the company is known as Financing.

The banks should see the various risk related to the company before sanctioning

the loan for the project. The bank should see uncertainty involved in the project.

These risk and uncertainty may have an adverse impact on the Banks capital and

earnings. The credit appraisal is to identify measures, monitor and control various

risk arising for its lending.

When fierce competition is the rule, the banking sector is no exception. Banks

compete with each other to attract quality borrowers. In this scenario, a hasty or

adequate credit appraisal will result in growth of NPA. Therefore the banks should

have proper appraisal methods.

Objective of the study

To understand the analytical framework of financing and to

analyze the existing credit appraisal mechanism at bank.

To study the credit appraisal methods of Corporation Bank

To familiarize with the interrelationship among various aspects of

credit .

To understand the importance of credit appraisal in sharpening the

ability of the bank to identify investment opportunities of the project

undertaken.

To study the assessment of the various aspects of investment

proposition to arrive at a financing decision.

Need for the study

To have practical knowledge and experience towards financing.

To sharpen the ability of identification of various attractive

investment opportunities.

To familiarize with the inter relationship among the various aspects of

Credit appraisal.

To evaluate the project in order to give suggestions to the bank

Scope of the study

The scope of the study is limited to Corporation Bank Zonal office, Bangalore; It

will give an in depth theoretical and practical knowledge about the credit appraisal.

This study also covers ratio analysis, cash flow from proposed project, risk

involved in the project, analysis of the financial statement and the data found in the

appraisal statement.

Methodology of Data Collection

As regarded to methodology, normally both quantitative and qualitative

approaches are adopted. In order to collect the data, this study brings a live

analysis based on the live data collected from secondary type of data.

The techniques of ratio analysis have been made use for the analysis of the

financial statement of the bank.

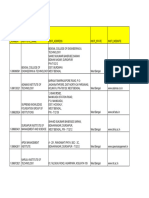

Das könnte Ihnen auch gefallen

- Project Estimating and Cost ManagementVon EverandProject Estimating and Cost ManagementBewertung: 4.5 von 5 Sternen4.5/5 (12)

- Credit AppraisalDokument11 SeitenCredit AppraisalKunal GoelNoch keine Bewertungen

- Credit Appraisal For Term Loan And: Working Capital FinancingDokument93 SeitenCredit Appraisal For Term Loan And: Working Capital FinancingRohit AggarwalNoch keine Bewertungen

- Credit Appraisal For Term Loan and Working Capital AssessmentDokument64 SeitenCredit Appraisal For Term Loan and Working Capital AssessmentTaran Deep Singh100% (2)

- Canara Bank Accounting SynopsisDokument3 SeitenCanara Bank Accounting Synopsiskapil sharmaNoch keine Bewertungen

- Project ReportDokument77 SeitenProject ReportPiyush MaheshwariNoch keine Bewertungen

- Review of LiteratureDokument7 SeitenReview of LiteraturekomalpreetdhirNoch keine Bewertungen

- General Information of The ArticleDokument4 SeitenGeneral Information of The ArticlehabtamuNoch keine Bewertungen

- Seminar 1 ProjectDokument25 SeitenSeminar 1 ProjectkhayyumNoch keine Bewertungen

- Credit Appraisal For Term Loan and Working Capital AssessmentDokument65 SeitenCredit Appraisal For Term Loan and Working Capital AssessmentMarius AngaraNoch keine Bewertungen

- 205 - F - Icici-A Study On Credit Appraisal System at Icici BankDokument71 Seiten205 - F - Icici-A Study On Credit Appraisal System at Icici BankPeacock Live Projects0% (1)

- Credit Risk Management in Banks Dissertation PDFDokument4 SeitenCredit Risk Management in Banks Dissertation PDFHelpPaperCanadaNoch keine Bewertungen

- An Overview of Credit Appraisal System With Special Reference To Micro Small and Medium Enterprises (MSME)Dokument11 SeitenAn Overview of Credit Appraisal System With Special Reference To Micro Small and Medium Enterprises (MSME)Abhi DNoch keine Bewertungen

- Origin of The ReportDokument5 SeitenOrigin of The Reporttonmoy63Noch keine Bewertungen

- New Report-1Dokument15 SeitenNew Report-1Ahmed BaigNoch keine Bewertungen

- Topic: Credit Assessment Process and Loan Repayment: A Case Study of Fidelity Bank (Head Office - Accra)Dokument75 SeitenTopic: Credit Assessment Process and Loan Repayment: A Case Study of Fidelity Bank (Head Office - Accra)SayedSafiullahHashimiNoch keine Bewertungen

- Research Methodology: Introduction To Credit AppraisalDokument3 SeitenResearch Methodology: Introduction To Credit AppraisalmanishgoyalmanishNoch keine Bewertungen

- Credit Facility in BankDokument45 SeitenCredit Facility in BankAbhas AgarwalNoch keine Bewertungen

- To Study The Credit Risk Analysis of Banking Industry With Reference To Sbi BankDokument56 SeitenTo Study The Credit Risk Analysis of Banking Industry With Reference To Sbi BankHussain SyedNoch keine Bewertungen

- CAPITAL STRUcture PRADEEPDokument9 SeitenCAPITAL STRUcture PRADEEPPooja KoiralaNoch keine Bewertungen

- A Study On Credit Risk Management at HDFC BankDokument58 SeitenA Study On Credit Risk Management at HDFC BankRajesh BathulaNoch keine Bewertungen

- 3 3 4 BalkeesDokument16 Seiten3 3 4 BalkeesJagapathi ReddyNoch keine Bewertungen

- SCFS Cooperative Bank LTDDokument64 SeitenSCFS Cooperative Bank LTDLïkïth RäjNoch keine Bewertungen

- Objective of The ProjectDokument2 SeitenObjective of The ProjectSnisha YadavNoch keine Bewertungen

- Credit Risk Management AT Punjab National BankDokument4 SeitenCredit Risk Management AT Punjab National BankSahil SethiNoch keine Bewertungen

- Effect of Commercial BankDokument5 SeitenEffect of Commercial BankRajat ShresthaNoch keine Bewertungen

- ProposalDokument10 SeitenProposalSagar KarkiNoch keine Bewertungen

- SynopsisDokument6 SeitenSynopsisShabreen SultanaNoch keine Bewertungen

- SBI Bank ProjectDokument150 SeitenSBI Bank Projectee23258Noch keine Bewertungen

- Finance SynopsisDokument14 SeitenFinance SynopsisNageshwar SinghNoch keine Bewertungen

- Dissertation Synopsis ON Credit Appraisal in Smes (Banks)Dokument7 SeitenDissertation Synopsis ON Credit Appraisal in Smes (Banks)Ankit AgrawalNoch keine Bewertungen

- Blackbook Project On Credit AppraisalDokument95 SeitenBlackbook Project On Credit AppraisalMausam PanchalNoch keine Bewertungen

- A Project Report On Credit AppraisalDokument167 SeitenA Project Report On Credit AppraisalParm Sidhu50% (4)

- A Study of Credit Risk ManagementDokument60 SeitenA Study of Credit Risk ManagementPrince Satish Reddy100% (2)

- Avi Thesis Final Credit Risk Management in Sonali Bank LTDDokument20 SeitenAvi Thesis Final Credit Risk Management in Sonali Bank LTDHAFIZA AKTHER KHANAMNoch keine Bewertungen

- Determinants of NonDokument6 SeitenDeterminants of Nonmedha mishraNoch keine Bewertungen

- Economic and Political Weekly Economic and Political WeeklyDokument11 SeitenEconomic and Political Weekly Economic and Political WeeklyjayaNoch keine Bewertungen

- Vimal Research ProposalDokument10 SeitenVimal Research ProposalVimal RamgoolamNoch keine Bewertungen

- Credit Risk Management Literature ReviewDokument6 SeitenCredit Risk Management Literature Reviewaflsbdfoj100% (1)

- Credit Risk in Banks Research PapersDokument7 SeitenCredit Risk in Banks Research Papersaypewibkf100% (1)

- Sujan Khatri PowerpointDokument17 SeitenSujan Khatri Powerpointniroj kafleNoch keine Bewertungen

- Master of Business AdministrationDokument94 SeitenMaster of Business AdministrationravikumarreddytNoch keine Bewertungen

- Credit Appraisal ArticlesDokument3 SeitenCredit Appraisal ArticlesSanthosh Soma0% (1)

- Development of A Credit Scoring Model For Retail Loan Granting Financial Institutions From Frontier MarketsDokument9 SeitenDevelopment of A Credit Scoring Model For Retail Loan Granting Financial Institutions From Frontier MarketsZakariya BelalNoch keine Bewertungen

- Loan Management SystemDokument58 SeitenLoan Management SystemTamboli Iqbal75% (8)

- Study On Sbi LoansDokument8 SeitenStudy On Sbi LoansNithya KarthikNoch keine Bewertungen

- Research Paper On Credit Risk Management in BanksDokument7 SeitenResearch Paper On Credit Risk Management in BanksafnhinzugpbcgwNoch keine Bewertungen

- A Project Report On Credit AppraisalDokument107 SeitenA Project Report On Credit AppraisalPrabhakar Kunal87% (115)

- Deposite MobilizationDokument10 SeitenDeposite MobilizationKimberly Fuller100% (1)

- Synopsis Kumar K NDokument8 SeitenSynopsis Kumar K Nswamy yashuNoch keine Bewertungen

- Qualitative and Quantitative Analysis of Credit RiskDokument9 SeitenQualitative and Quantitative Analysis of Credit Risktony BNoch keine Bewertungen

- Literature Review of Credit Appraisal ProcessDokument7 SeitenLiterature Review of Credit Appraisal Processtqpkpiukg100% (1)

- Wa0014 PDFDokument59 SeitenWa0014 PDFUthappa T SNoch keine Bewertungen

- Credit Appraisal IBDokument48 SeitenCredit Appraisal IBHenok mekuriaNoch keine Bewertungen

- Study The Procedure of Credit Appraisal System of Urban CoDokument4 SeitenStudy The Procedure of Credit Appraisal System of Urban CoJasmine KaurNoch keine Bewertungen

- Analytical Study of Capital Structure of Icici BankDokument22 SeitenAnalytical Study of Capital Structure of Icici BankKuldeep Ban100% (2)

- Synopsis Presentation of KumarDokument6 SeitenSynopsis Presentation of KumarKumar KnNoch keine Bewertungen

- Developing, Validating and Using Internal Ratings: Methodologies and Case StudiesVon EverandDeveloping, Validating and Using Internal Ratings: Methodologies and Case StudiesNoch keine Bewertungen

- Situational Sponsorship of Projects and Programs: An Empirical ReviewVon EverandSituational Sponsorship of Projects and Programs: An Empirical ReviewNoch keine Bewertungen

- Aleutia Solar Container ClassroomDokument67 SeitenAleutia Solar Container ClassroomaleutiaNoch keine Bewertungen

- Drug Addiction Final (Term Paper)Dokument15 SeitenDrug Addiction Final (Term Paper)Dessa Patiga IINoch keine Bewertungen

- John L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDokument12 SeitenJohn L. Selzer - Merit and Degree in Webster's - The Duchess of MalfiDivya AggarwalNoch keine Bewertungen

- Application Form InnofundDokument13 SeitenApplication Form InnofundharavinthanNoch keine Bewertungen

- The Influence of Irish Monks On Merovingian Diocesan Organization-Robbins BittermannDokument15 SeitenThe Influence of Irish Monks On Merovingian Diocesan Organization-Robbins BittermanngeorgiescuNoch keine Bewertungen

- Assistant Cook Learner Manual EnglishDokument152 SeitenAssistant Cook Learner Manual EnglishSang Putu Arsana67% (3)

- Siemens Make Motor Manual PDFDokument10 SeitenSiemens Make Motor Manual PDFArindam SamantaNoch keine Bewertungen

- ყვავილები ელჯერნონისთვისDokument348 Seitenყვავილები ელჯერნონისთვისNia NorakidzeNoch keine Bewertungen

- LM2576/LM2576HV Series Simple Switcher 3A Step-Down Voltage RegulatorDokument21 SeitenLM2576/LM2576HV Series Simple Switcher 3A Step-Down Voltage RegulatorcgmannerheimNoch keine Bewertungen

- Advanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsDokument74 SeitenAdvanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsetayhailuNoch keine Bewertungen

- Speech On Viewing SkillsDokument1 SeiteSpeech On Viewing SkillsMera Largosa ManlaweNoch keine Bewertungen

- rp10 PDFDokument77 Seitenrp10 PDFRobson DiasNoch keine Bewertungen

- Patrick Meyer Reliability Understanding Statistics 2010Dokument160 SeitenPatrick Meyer Reliability Understanding Statistics 2010jcgueinj100% (1)

- Iguana Joe's Lawsuit - September 11, 2014Dokument14 SeitenIguana Joe's Lawsuit - September 11, 2014cindy_georgeNoch keine Bewertungen

- WBDokument59 SeitenWBsahil.singhNoch keine Bewertungen

- Sample Resume For Supply Chain Logistics PersonDokument2 SeitenSample Resume For Supply Chain Logistics PersonAmmar AbbasNoch keine Bewertungen

- ASHRAE Journal - Absorption RefrigerationDokument11 SeitenASHRAE Journal - Absorption Refrigerationhonisme0% (1)

- Determination Rules SAP SDDokument2 SeitenDetermination Rules SAP SDkssumanthNoch keine Bewertungen

- ReadmeDokument2 SeitenReadmechethan100% (1)

- World Insurance Report 2017Dokument36 SeitenWorld Insurance Report 2017deolah06Noch keine Bewertungen

- A Survey On Security and Privacy Issues of Bitcoin-1Dokument39 SeitenA Survey On Security and Privacy Issues of Bitcoin-1Ramineni HarshaNoch keine Bewertungen

- ChatGpt PDFDokument19 SeitenChatGpt PDFsanx2014100% (1)

- JIS G 3141: Cold-Reduced Carbon Steel Sheet and StripDokument6 SeitenJIS G 3141: Cold-Reduced Carbon Steel Sheet and StripHari0% (2)

- Configuring BGP On Cisco Routers Lab Guide 3.2Dokument106 SeitenConfiguring BGP On Cisco Routers Lab Guide 3.2skuzurov67% (3)

- Executive Summary-P-5 181.450 To 222Dokument14 SeitenExecutive Summary-P-5 181.450 To 222sat palNoch keine Bewertungen

- AMULDokument11 SeitenAMULkeshav956Noch keine Bewertungen

- Continue Practice Exam Test Questions Part 1 of The SeriesDokument7 SeitenContinue Practice Exam Test Questions Part 1 of The SeriesKenn Earl Bringino VillanuevaNoch keine Bewertungen

- Introduction To Screenwriting UEADokument12 SeitenIntroduction To Screenwriting UEAMartín SalasNoch keine Bewertungen

- The cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayDokument7 SeitenThe cardioprotective effect of astaxanthin against isoprenaline-induced myocardial injury in rats: involvement of TLR4/NF-κB signaling pathwayMennatallah AliNoch keine Bewertungen

- Lesson 3 - ReviewerDokument6 SeitenLesson 3 - ReviewerAdrian MarananNoch keine Bewertungen