Beruflich Dokumente

Kultur Dokumente

Exam

Hochgeladen von

Kristen WalshCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exam

Hochgeladen von

Kristen WalshCopyright:

Verfügbare Formate

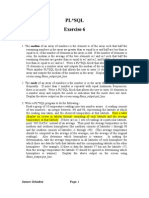

Problem 1-1 (AICPA adapted)

In an effort to increase sales, Mills Company inaugurated a sales promotional campaign on June 30,

2013. The entity placed a coupon redeemable for a premium each package of cereal sold. Each premium

cost P20 and five coupons must be presented by a customer to receive a premium. The entity estimated

that only 60% of the coupons issued would be redeemed. For the six months ended December 31, 2013,

the following information is available.

Packages Premiums Coupons

cereal sold purchased redeemed

160,000 12,000 40,000

What is the estimated liability for premiums on Dec. 31, 2013?

A. 160,000

B. 224,000

C. 288,000

D. 384,000

Problem 1-8 (IAA)

Love Company included one coupon in each package sold. Atowel is offerd as premium to customers

who send in 10 coupons:

2013 2014

Packages of cereal sold 5000,000 800,000

Number of towel distributed as premium 30,000 60,000

Number of towel to be distributed 20,000 50,000

Premium next period 5,000 3,000

What amount should be reported as premium expense in 2014?

A. 2,400,000

B. 2,000,000

C. 2,120,000

D. 1,920,000

Problem 1-9 (IAA)

Clam Company offers the customers a pottery cereal bowl if they send in three box tops from the

products and P10. The entity estimated that 60% of the box tops would be redeemed. In 2013, he entity

sold 675,000 boxes and customers redeemed 330,000 box tops receiving 110,000. The cost bowl is P25.

What is the liability for outstanding premiums on Dec 31, 2013?

A. 250,000

B. 375,000

C. 625,000

D. 875,000

Problem 1-14 (AICPA Adapted)

Miles Company sells washing machines that carry a three-year warranty against manufactures defects.

Based on the entitys experience, warranty costs are estimated at P300 per machine. During the current

year, the entity sold 2,400 washing machines and paid warranty costs of P170, 000. What should be

reported as warranty expense for the current year?

A. 170,000

B. 240,000

C. 550,000

D. 720,000

Problem 1-18 (IAA)

Bass Company manufactures high-end home electronics systems. The entity provides a one-year

warranty for all products sold. The entity estimated that the warranty cost of P650, 000 on Jan. 1, 2013.

During the current year, the entity sold 5,000 units for a total of P9, 000,000 and paid warranty claims of

P750, 000 on current and prior years sales. What is the warranty liability on Dec. 31, 2013?

A. 250,000

B. 350,000

C. 900,000

D. 750,000

Problem 3-1 (AICPA Adapted)

Kemp Company must determine the Dec. 31, 2013 accruals for advertising and rent expense. P50, 000

advertising bill was received Jan. 7, 2014 comprising costs of P35, 000 for advertisements in Dec 2013

issues, and P15, 000 for advertisements in Jan 2014 issues of the newspapers.

A store lease, effective Dec. 16, 2013, calls for fixed rent of P120,000 per month, payable one month

from the effective date and monthly thereafter. In addition, rent equal to 5% of the net sales over P6,

000,000 per calendar year payable on Jan 31 of the following year. What sales for 2013 totaled

P9, 000,000? On Dec. 31, 2013 what amount should be reported as accrued liabilities?

A. 260,000

B. 185,000

C. 210,000

D. 245,000

Problem 3-13 (AICPA Adapted)

Leslie Company pays all salaried employees on a Monday for the five-day workweek ended the previous

Friday. The last payroll recorded for the year ended December 31,2013 was for the week ended

December 25,2013. The payroll for the week ended January 1,2014, included regular weekly salaries of

P80,000 and vacation pay of P25,000 for vacation time earned in 2013 not taken by December 31,2013.

The entity has accrued a liability of P20,000 for vacation pay on December 31,2012. On December

31,2013, what amount should be reported as accrued salary and vacation pay?

A. 64,000

B. 68,000

C. 69,000

D. 89,000

Problem 4-9 (IAA)

Concord Company sells motorcycle helmets. In 2013, the entity sold 4,000,000 helmets before

discovering a significant defect in their construction. By December 31,2013, two lawsuits had been

filed against the entity. The first lawsuit, which the entity has little chance of winning , is expected to

be settled out of court for P1,500,000 in January 2014. The legal counsel believed that the entity has a

50-50 chance of winning the second lawsuit, which is for P1,000,000. What is the accrued liability on

December 31, 2013 as a result of the lawsuits?

A. 1,500,00

B. 1,000,000

C. 2,500,000

D. 0

Problem 4-10 (IAA)

Prime company has long owned a manufacturing site that has now been discovered to be

contaminated with toxic waste. The entity has acknowledged its responsibility for the contamination.

An initial clean up feasibility study has shown that it will cost at least P500,000 to clean up the toxic

waste. During the current year, the entity has been sued for patent infringement and lost the case. A

preliminary judgment of P300,000 was issued and is under appeal. The entitys attorneys agree that it

probable that the entity will lose this appeal. What amount of provision should be accrued as liability?

A. 500,000

B. 800,000

C. 300,000

D. 0

Problem 4-11 (IAA)

Eastern company has several contingent liabilities on December 31,2013. The auditor obtained the

following brief description of each liability.

In may 2013, Eastern Company became involved in litigation. In December 2013, the court assessed a

judgment for P1, 600,000 against Eastern. The entity is appealing the amount of the judgment. The

entitys attorneys believed it is probable that they can reduce the assessment on appeal by 50%.

In July 2013, Pasig City brought action against Eastern Company for polluting the Pasig River with its

waste products. It is probable that Pasig City will be successful but the amount of damages Eastern

might have to pay should not exceed P1,500,000. What total amount should be accrued as provision

on December 31, 2013?

A. 1,600,000

B. 1,500,000

C. 3,100,000

D. 2,300,000

Problem 5-1(AICPA Adapted)

On September 1, 2013, Pine Company issued a note payable to National Bank in the amount of P1,

800,000, bearing interest at 12%, and payable in three equal annual principal payments of P600, 000.

On this date, the banks prime was 11%. The first interest and principal was made on September 1,

2014. On December 31, 2014, what amount should be reported as accrued interest payable?

A. 44,000

B.48, 000

C.66, 000

D.72, 000

Problem 5-3 (AICPA Adapted)

On December 31, 2013, Roth Company issued a P1, 000,000 face value note payable to Wake

Company in exchange for services rendered to Roth. The note, made at usual trade terms, is due in

nine months and bears interest, payable at maturity, at the annual rate of 3%. The market interest is

8%. The compound interest factor of 1 due in nine months at 8% is.944.At what amount should the

note payable be reported on December 31, 2013?

A.1, 030,000

B.1, 000,000

C.965, 200

D.944, 000

Problem 5-5 (IAA)

Joshua Company bought a new machine on January 1,2013 and agreed to pay in equal annual

installment of P600, 000 at the end of each of the next five years . The prevailing interest rate is 12%.

The present value of an ordinary annuity of 1 at 12% for five periods is 3.60. The value of 1 at 12% for

five periods is 0.567. What is the interest expense on the note payable for 2013?

A.259, 200

B.187, 200

C.360, 000

D.457, 200

Problem 15-15 (AICPA Adapted)

On January 1, 2013, Jonathan Company borrowed P500, 000 8% noninterest-bearing note due in four

years. The present of the note on January 1, 2013 was P367, 500. The entity elects the fair value

method for reporting financial liabilities. On December 31, 2013, the fair value of the note is P408,

150. At what amount should the discount on note payable be presented on December 31, 2013?

A.132, 500

B.103, 100

C.91, 850

D. 0

Problem 7-1 (AICPA Adapted)

Glen Company had the following long-term debt:

Sinking funds bond, maturing in installments 2, 200, 000

Industrial revenue bonds, maturing in installments 1, 800, 000

Subordinated bonds, maturing on a single date 3, 000, 000

What is the total amount of serial bonds?

A.3, 000, 000

B.4, 000 ,000

C.4, 800, 000

D.7, 000, 000

Problem 7-7 (AICPA Adapted)

On November 1, 2013, Mason Company issued P8,000, 000 of 10-year, 8% term bonds dated October

1, 2013, 2013. The bonds were sold to yield 10% with total proceeds of P7, 000, 000 plus accrued

interest. Interest is paid every April 1 and October 1. What amount should be reported for accrued

interest payable on December 31, 2013?

A.175, 000

B.160, 000

C.116, 667

D.106, 667

Problem 7-9 (AICPA Adapted)

On June 30, 2013, Huff Company issued at 99, five thousand of 8%, P1,000 face value bonds were

issued through an underwriter to whom the entity paid bond issue cost of P425, 000. On June 30,

2013, what amount should be reported as bond liability?

A.4,525, 000

B.4, 950, 000

C.5, 000, 000

D.4, 575, 000

Das könnte Ihnen auch gefallen

- Local Media271226407970108268Dokument17 SeitenLocal Media271226407970108268Jana Rose PaladaNoch keine Bewertungen

- Audit of Liabiities and She-1Dokument9 SeitenAudit of Liabiities and She-1Yaj CruzadaNoch keine Bewertungen

- p1 IaDokument1 Seitep1 IaLeika Gay Soriano OlarteNoch keine Bewertungen

- Quiz - M1 M2Dokument12 SeitenQuiz - M1 M2Jenz Crisha PazNoch keine Bewertungen

- Quiz Week 8 Akm 2Dokument6 SeitenQuiz Week 8 Akm 2Tiara Eva TresnaNoch keine Bewertungen

- Receivable Practice Problem 1Dokument2 SeitenReceivable Practice Problem 1ayeeeNoch keine Bewertungen

- First QuizDokument4 SeitenFirst QuizArn HicoNoch keine Bewertungen

- Migriño - Quizzer 2 - Employee Benefits Part 1Dokument13 SeitenMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNoch keine Bewertungen

- Review Exercise ADokument5 SeitenReview Exercise AFitz Gerald BalbaNoch keine Bewertungen

- Discussion 2 CHAPDokument4 SeitenDiscussion 2 CHAPHannah LegaspiNoch keine Bewertungen

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDokument4 SeitenAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNoch keine Bewertungen

- Far Review - Notes and Receivable AssessmentDokument6 SeitenFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNoch keine Bewertungen

- Chapter 5Dokument11 SeitenChapter 5Ro-Anne LozadaNoch keine Bewertungen

- Investments Problem 1Dokument9 SeitenInvestments Problem 1Rex AdarmeNoch keine Bewertungen

- Final PreboardDokument10 SeitenFinal PreboardJan Victor AdanNoch keine Bewertungen

- BLTDokument4 SeitenBLTJaylord PidoNoch keine Bewertungen

- Accountancy 10-2018 Room AssignmentDokument41 SeitenAccountancy 10-2018 Room AssignmentPRC Baguio100% (1)

- Exercise - Part 2Dokument5 SeitenExercise - Part 2lois martinNoch keine Bewertungen

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Dokument7 SeitenRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelNoch keine Bewertungen

- Andiam: January 2, 2019Dokument5 SeitenAndiam: January 2, 2019Avox EverdeenNoch keine Bewertungen

- Armhyla Olivar FM Taxation 8Dokument4 SeitenArmhyla Olivar FM Taxation 8Grace Umbaña YangaNoch keine Bewertungen

- She QuizDokument4 SeitenShe QuizJomar Villena100% (1)

- Accounting - Inventory Test BankDokument3 SeitenAccounting - Inventory Test BankAyesha RGNoch keine Bewertungen

- PPE Government Grant Borrowing Cost Intangible AssetsDokument7 SeitenPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- AP Equity 1Dokument3 SeitenAP Equity 1Mark Michael Legaspi100% (1)

- Sinking Fund and DerivativesDokument4 SeitenSinking Fund and DerivativesCharice Anne VillamarinNoch keine Bewertungen

- ExamView Pro - DEBT FINANCING - TST PDFDokument15 SeitenExamView Pro - DEBT FINANCING - TST PDFShannon ElizaldeNoch keine Bewertungen

- FAR-04 Share Based PaymentsDokument3 SeitenFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Ae 211 Solutions-PrelimDokument10 SeitenAe 211 Solutions-PrelimNhel AlvaroNoch keine Bewertungen

- MAS Review CVP and Variable CostingDokument7 SeitenMAS Review CVP and Variable CostingAizzy ManioNoch keine Bewertungen

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDokument4 SeitenLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNoch keine Bewertungen

- Mahusay Acc227 Module 4Dokument4 SeitenMahusay Acc227 Module 4Jeth MahusayNoch keine Bewertungen

- INVESTMENTSDokument9 SeitenINVESTMENTSKrisan RiveraNoch keine Bewertungen

- Equity YyyDokument33 SeitenEquity YyyJude SantosNoch keine Bewertungen

- Cup 3 Questions Answer KeyDokument34 SeitenCup 3 Questions Answer KeyDenmarc John AragosNoch keine Bewertungen

- Janet Wooster Owns A Retail Store That Sells New andDokument2 SeitenJanet Wooster Owns A Retail Store That Sells New andAmit PandeyNoch keine Bewertungen

- QUIZ1PRAC1Dokument23 SeitenQUIZ1PRAC1Marinel Felipe0% (1)

- CE On Agriculture T1 AY2020-2021Dokument2 SeitenCE On Agriculture T1 AY2020-2021Luna MeowNoch keine Bewertungen

- Intermediate Accounting Exercise 2 FinalsDokument2 SeitenIntermediate Accounting Exercise 2 FinalsJune Maylyn MarzoNoch keine Bewertungen

- Multiple Choice Questions 1 A Method That Excludes Residual Value FromDokument1 SeiteMultiple Choice Questions 1 A Method That Excludes Residual Value FromHassan JanNoch keine Bewertungen

- Essay QuestionsDokument1 SeiteEssay QuestionsNicole Allyson AguantaNoch keine Bewertungen

- Zakaria Ch4Dokument15 SeitenZakaria Ch4Zakaria Hasaneen0% (2)

- Pre-Test 5Dokument3 SeitenPre-Test 5BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Intermediate Accounting - Practical Accounting 1Dokument72 SeitenIntermediate Accounting - Practical Accounting 1Luke Robert HemmingsNoch keine Bewertungen

- CEL 1 PRAC 1 Answer KeyDokument12 SeitenCEL 1 PRAC 1 Answer KeyRichel ArmayanNoch keine Bewertungen

- Process CostingDokument3 SeitenProcess CostingenzoNoch keine Bewertungen

- Review 105 - Day 3 Theory of AccountsDokument13 SeitenReview 105 - Day 3 Theory of Accountschristine anglaNoch keine Bewertungen

- Far 6660Dokument2 SeitenFar 6660Glessy Anne Marie FernandezNoch keine Bewertungen

- Budgeted Cash Disbursements For Merchandise PurchasesDokument27 SeitenBudgeted Cash Disbursements For Merchandise PurchasesMavis LiuNoch keine Bewertungen

- You Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123Dokument3 SeitenYou Have Successfully Unlocked This Question.: University of Cabuyao (Pamantasan NG Cabuyao) Acctg. ACCTG. 123chiji chzzzmeowNoch keine Bewertungen

- Partnership FormationDokument13 SeitenPartnership FormationGround ZeroNoch keine Bewertungen

- Finals Quiz 2 Buscom Version 2Dokument3 SeitenFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNoch keine Bewertungen

- FINACC-Homework Exercise 2Dokument3 SeitenFINACC-Homework Exercise 2Jomel BaptistaNoch keine Bewertungen

- Phinma - University of Iloilo Bam 006: Midterm Exam: Amount UncollectibleDokument4 SeitenPhinma - University of Iloilo Bam 006: Midterm Exam: Amount Uncollectiblehoneyjoy salapantanNoch keine Bewertungen

- Chapter 1liabilities2Dokument12 SeitenChapter 1liabilities2Herrika Red Gullon RoseteNoch keine Bewertungen

- CPA ReviewDokument14 SeitenCPA ReviewnikkaaaNoch keine Bewertungen

- Practical Accounting 1Dokument22 SeitenPractical Accounting 1Mica Gonzales63% (8)

- Ce P1 12-13Dokument13 SeitenCe P1 12-13shudayeNoch keine Bewertungen

- Bonds PayableDokument5 SeitenBonds PayableAmbray Felyn Joy67% (3)

- AP Review LiabDokument10 SeitenAP Review LiabTuya DayomNoch keine Bewertungen

- E. What Was The Chinese POW Death Rate in WW2 and The Second Sino-Japanese WarDokument3 SeitenE. What Was The Chinese POW Death Rate in WW2 and The Second Sino-Japanese WarPamela SantosNoch keine Bewertungen

- Design Report of STOL Transport AircraftDokument64 SeitenDesign Report of STOL Transport Aircrafthassan wastiNoch keine Bewertungen

- NBPME Part II 2008 Practice Tests 1-3Dokument49 SeitenNBPME Part II 2008 Practice Tests 1-3Vinay Matai50% (2)

- Bhakra Nangal Project1Dokument3 SeitenBhakra Nangal Project1Sonam Pahuja100% (1)

- Analisis Perencanaan Rekrutmen Aparatur Sipil Negara Kabupaten Mamuju UtaraDokument11 SeitenAnalisis Perencanaan Rekrutmen Aparatur Sipil Negara Kabupaten Mamuju UtarafitriNoch keine Bewertungen

- TV ExplorerDokument2 SeitenTV Explorerdan r.Noch keine Bewertungen

- Getting Things Done BasicsDokument60 SeitenGetting Things Done Basicswestelm12100% (10)

- SAP HR and Payroll Wage TypesDokument3 SeitenSAP HR and Payroll Wage TypesBharathk Kld0% (1)

- Civil Engineering Construction Manager in ST Louis MO Resume Mark JensenDokument3 SeitenCivil Engineering Construction Manager in ST Louis MO Resume Mark JensenMark JensenNoch keine Bewertungen

- Monster Energy v. Jing - Counterfeit OpinionDokument9 SeitenMonster Energy v. Jing - Counterfeit OpinionMark JaffeNoch keine Bewertungen

- EWC 662 English Writing Critical Group Work Portfolio: Submitted ToDokument31 SeitenEWC 662 English Writing Critical Group Work Portfolio: Submitted ToNurul Nadia MuhamadNoch keine Bewertungen

- Anodizing PDFDokument12 SeitenAnodizing PDFsanjay ukalkarNoch keine Bewertungen

- Honeymoon in Vegas Word FileDokument3 SeitenHoneymoon in Vegas Word FileElenaNoch keine Bewertungen

- Materials Science and Engineering-Chapter 11Dokument3 SeitenMaterials Science and Engineering-Chapter 11JurgenNoch keine Bewertungen

- Relative ClausesDokument11 SeitenRelative Clausessaeed100% (1)

- Marketing Plan Potato Food TruckDokument25 SeitenMarketing Plan Potato Food TruckAhasan h. ShuvoNoch keine Bewertungen

- Data Mining With Apriori AlgorithmDokument12 SeitenData Mining With Apriori AlgorithmMAYANK JAINNoch keine Bewertungen

- Micron Serial NOR Flash Memory: 3V, Multiple I/O, 4KB Sector Erase N25Q256A FeaturesDokument92 SeitenMicron Serial NOR Flash Memory: 3V, Multiple I/O, 4KB Sector Erase N25Q256A FeaturesAENoch keine Bewertungen

- EL119 Module 2Dokument4 SeitenEL119 Module 2Kristine CastleNoch keine Bewertungen

- Lecture # 3 Introduction To JqueryDokument88 SeitenLecture # 3 Introduction To JqueryDanial AhmadNoch keine Bewertungen

- MAF 451 Suggested Solutions - A) I) Process 1Dokument9 SeitenMAF 451 Suggested Solutions - A) I) Process 1anis izzatiNoch keine Bewertungen

- Eimco Elecon Initiating Coverage 04072016Dokument19 SeitenEimco Elecon Initiating Coverage 04072016greyistariNoch keine Bewertungen

- Popis Na OK KoziDokument325 SeitenPopis Na OK KoziViktor ArsovNoch keine Bewertungen

- PL SQL Exercise6Dokument2 SeitenPL SQL Exercise6Nishant AndhaleNoch keine Bewertungen

- A Cultura-Mundo - Resposta A Uma SociedDokument7 SeitenA Cultura-Mundo - Resposta A Uma SociedSevero UlissesNoch keine Bewertungen

- 3.6.4 Details of Courses For Nuclear Medicine TechnologyDokument2 Seiten3.6.4 Details of Courses For Nuclear Medicine TechnologyhemendrasingNoch keine Bewertungen

- 2017-Process Tracing in Social SciencesDokument28 Seiten2017-Process Tracing in Social SciencesTudor CherhatNoch keine Bewertungen

- Robotech Hannibal Digital 114dpi V1.0Dokument119 SeitenRobotech Hannibal Digital 114dpi V1.0nonfarb14thNoch keine Bewertungen

- Vibration Absorbers: Scan This QR CodeDokument4 SeitenVibration Absorbers: Scan This QR CodeMohamed RaafatNoch keine Bewertungen

- The USP AdvantageDokument30 SeitenThe USP AdvantageGabriel A. RamírezNoch keine Bewertungen