Beruflich Dokumente

Kultur Dokumente

Chapter 5

Hochgeladen von

suitup666Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 5

Hochgeladen von

suitup666Copyright:

Verfügbare Formate

Information Approach

Assuming market efficiency, the market is going to react to any format of information

Accountant has the responsibility to provide that information, in financial information, MD&A, footnotes (doesn't matter)

Information is useful if it leads investors to change their beliefs and actions, which triggers buy and sell decisions, thus affects prices

Information affects people differently, requiring complex cost benefit tradeoffs to balance the competing interests of differ ent constituencies

INFORMATION APPROACH

The information approach to decision usefulness is an approach to financial reporting that recognizes individual responsibili ty for predicting future firm performance and that

concentrates on providing useful information for this purpose. The approach assumes securities market efficiency, recognizing that the market will react to useful information

from any source, including financial statements.

Prior to release of firm's current net income

Investors have prior beliefs about a firm's future performance (dividends, cash flows, earnings), which affect the expected returns and risk of the firm's securities

Using Bayes' Theorem to analyze higher than expected net income (good news)

Upon release of the current period's net income, some investors will decide to become more informed by analyzing the income number

Evaluation of riskiness of share may also be revised

Investors who have revised their beliefs about future firm performance upward will be inclined to buy the firm's shares at their current market price, and vice versa for

those who have revised their beliefs downwards

Volume should be greater, the greater are the differences in investors' prior beliefs and in their interpretations of the current financial information

If the investors who interpret reported net income as good news (and hence have increased their expectations of future performance) outweigh those who interpret

it as bad news, we would expect to observe an increase in the market price of the firm's shares

Dramatic increase in volume during the week of release of earnings announcement

We would expect to observe the volume of shares traded to increase when the firm reports its net income

Reasons for Market Response

Important to know when the current year's reported net income first became publicly known

Earlier the observation, greater the effect between volume and price

Efficient market theory implies that the market will react quickly to new information

If the investors expectation resembles closely to the actual reported net income, the information content in reported net income is very low because the investor

would have to revise their prior beliefs (using the Bayes' Theorem for good/bad news)

If there is a discrepancy between expected and actual, the good or bad news would trigger rapid belief revision about the future performance of the firm

The good or bad news in reported net income is usually evaluated relative to what investors expected

The effect on the share prices may show a downfall, largely due to the government announcement and not due to the current year's net income of the firm

It is important to separate the impacts of market-wide and firm-specific factors on share returns to avoid some a distortion between price and F/S information

A firm could have released its current year's net income, containing good news, on the same day the federal government first announced a substantial increase in the

deficit (bad news)

There are always many events taking place that affect a firm's share volume and price

Finding the Market Response

Actual return = R jt = [a j + B j R Mt + E jt]

Abnormal return (E jt) = actual return - expected return (a j + B j R Mt)

Can also be interpreted as the rate of return on firm j's shares for day t after removing the influence of market wide factors

Conceptually, if firm reports higher net income than expected by investors, logically the difference is due to firm specific factors, which is the error amount

The error amount is an estimate of the abnormal, or firm specific, return on firm j's shares for that day

Separating Market-Wide and Firm-Specific Factors

Recall expected return can be obtain from CAPM (a j + B j R Mt)

E jt > 0 (good news)

If unexpected net income is good news (a positive unexpected net income), then, given securities market efficiency, a positive abnormal share return constitutes evidence

that investors on average are reacting favorably to the unexpected good news in earning

If positive and negative abnormal returns surrounding good or bad earnings news are found to hold across a sample of firms, the researcher may conclude that predictions

based on the decision theory and efficient securities market theory are supported

It is difficult to observe whether stock prices / market response reflected one or the other

Complications arise when there are multiple firm specific factors on the same day as earnings release, such as stock dividend

Another complication is the estimation of firm's beta, which is needed to calculated expected return and to separate firm specific to market wide factors according to the

market model

Comparing Returns and Income

Higher trading volume

Adjustment in price

adjustment of the price if it's not what the investor is expecting

volume increase when investors have more information

if financial statement contain no new information, then we wouldn't be expecting any reactions

if it's new news (not expected), then there will be a reaction

Expected Market Reaction to Information

Relative to market expectation

If actual earnings is different from expected earnings, there would be a reaction

Good estimation: past earnings, analyst estimation, how well the industry is doing; company guidance.

Information Content of Earnings

tend to focus on share price

change in price as a way measuring market reaction (share return)

worry about industry effects, the whole market effect (factoring into measurement)

close to when announcement are done

when to worry about market reaction?

Measurement of Market Reaction

The earliest day when information is released

Timing of Market Reaction

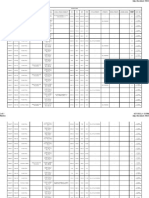

BALL AND BROWN RESEARCH STUDY

does the firms' share returns respond to the information content of financial statements?

try to determine if security prices responded to financial statements

is information content in the accounting income number, does the market react to this accounting income number, assuming the market is efficient (and information will

be used in pricing)

Research Question

Design of Study

Chapter 5 - THE INFORMATION APPROACH TO DECISION

USEFULNESS

Wednesday, October 23, 2013

12:30 PM

Chapter 5 Page 1

be used in pricing)

measure the information content of earnings (whether reported earnings were greater or less than the market had expected)

evaluate the market return on the shares of the sample firms near the time of each earning announcement

see good news and bad news and see how prices will react to it

actual more than expect (good news)

actual less than expect (bad news)

looked at earnings per share (expectation is last years earnings per share)

worked with monthly data

Design of Study

Recall abnormal return > 0 is due to good news, < 0 is due to bad news

this pattern is repeated across the sample

the reason for the positive abnormal return was that investors were reacting favorably to the GN information in earning

the market did respond to the good or bad news in earnings during a narrow window consisting of the month earnings announcement is made

In the 11 months calculation, market began to anticipate the GN or BN as much as a year early, with the result that returns accumulated steadily over the period

BB estimated that, on average, 85%-90% of the information in annual earnings was already built into share price by the time annual earnings were announced

measured cumulative earnings of 12 months

for good news firms, there is a positive share return versus bad news firm of a negative share return; this tells us that stock market reacted when earnings were released

Market is quite sophisticated in how it uses information

Results

Reason is because during a narrow window there are relatively few firm specific events other than net income to affect share returns

in other words, a narrow-window association between security returns and accounting information suggests that accounting disclosures are the sourceof new

information to investors

in a narrow window, it can be argued that the accounting information is the causeof the market reaction (causation)

firms are doing well should have much of the effect on their share prices anticipated by the market before the GN appears in the financial statements

net income and returns are associated (it is the real economic performance of the firm that generates the association since both price (with lag) and net income

reflect real performance)

association between share returns and earnings increases as the window widens

as the window is widened the relative effect of lag decreases

in the months before the release of the firm's earning, there could have been other information about the firm, therefore we see a stead increase/decrease in the

share price upon the release of earning information

I.e., an investor, 3 months prior to earning release, might have used past financial statements and other available informati on to estimate the firms earning.

Then, on the earning release date, the investor may either be correct, thus no unexpected earnings, or he may revise his esti mate using Bayes' Theorem,

depending on GN (positive unexpected earnings) or BN (negative unexpected earnings) to derive a new probability and to calcul ate new expected earnings

Most of the information in net income was anticipated prior to earnings announcement date, as a result it cannot be claimed that reported net income caused the

abnormal return during the periods leading up to the earnings announcement date

in a wide window, prices lead earnings (association)

In the long run, the total income earned by the firm will approach total income under ideal condition

In a narrow window, it provides stronger support for decision usefulness

Important distinction between narrow and wide window studies

BCW found that the greater the change in unexpected earnings, the greater the security market response

Logical next step: whether the magnitude of unexpected earnings is related to the magnitude of the security market response

Outcomes

EARNINGS RESPONSE COEFFICIENTS

An earnings response coefficient measures the extent of a securitys abnormal market return in response to the unexpected component of reported earnings of the firm

issuing that security.

Trying to understand why the reaction differs across firms

For a company what is the return on its shares (factoring out market return) compared to accounting earnings of the firm (fac toring out the expected earnings)

How the unexpected earnings drive the abnormal share return

Shares should not change if the expected earnings and actual earnings are the same

Abnormal share return does not equal abnormal earnings (net income)

Abnormal share return can be obtained from the Market Model

Unexpected earnings = Actual - Expected (accretion of discount)

Assume that abnormal share return and unexpected earnings does not change in proportions

ERC= abnormal share return / unexpected earnings for the period (result is abnormal return per dollar of abnormal earnings)

ERC factors

the demand for the GN firms share will be lower the higher is its beta (more risky)

lower demand implies a lower increase in market price and share return in response to the GN, a lower ERC

risk adverse investors have limited demand for risky investment

Beta:

for highly levered firms, the good news in earnings goes to the debt holders rather than the shareholders

the ERC for a highly levered firm should be lower than that of a firm with little or no debt, other things equal

the higher the debt equity ratio, the less the ERC

the higher the debt equity, that means more of earnings are going to debt holders and not shareholders and not available to shareholders

Capital structure:

the higher the probabilities of the main diagonal of the associated information system, the higher we would expect the ERC tobe

Higher quality earnings, it allows investor to infer future earnings

persistence is measured as the extent o which earnings changes of the past two years continued into the current year

the ERC will be higher the more the good/bad new in current earning is expected to persist into the future, since current ear nings then provide a better

indication of future firm performance (earnings persistence)

permanent, expected to persist indefinitely (ERC=(1+Rf)/Rf or 1+ 1/Rf)

Transitory, affect earnings in the current year only (ERC=1)

price-irrelevant, persistence 0 (ERC =0)

Rf is the risk free rate of interest under ideal condition)

3 types of earning events

when earnings persists beyond the current year, the magnitude of the ERC varies inversely with the interest rate

Earnings persistence

Net income = Cash flow from operations + Net accruals

Net accruals include changes in non-cash working capital

To measure accrual quality, those accruals that are of high quality are to the extent of current period working capital accruals that show up as cash flows next

period

WC = b0 + b1CFOt-1+b2CFOt+b3CFOt+1+t

Earning quality is based on the variability of the t residuals, where high t variability indicates a poor match between current accruals WC and the subsequent

actual operating cash flow realization

The firms ERC and the share prices respond positively to accrual quality as measured by this procedure

Accruals Quality:

Two dimensions of earnings quality:

Earnings Quality:

Chapter 5 Page 2

The firms ERC and the share prices respond positively to accrual quality as measured by this procedure

The higher the accruals quality, the higher the ERC

This will lead to good cash flow in the future and will be earnings to the shareholders

The GN or BN in current earnings may suggest future growth prospects for the firm, and hence a higher ERC

Growth Opportunities:

the more similar the earnings expectations the greater the effect of a dollar of abnormal earnings on sharethe greater the ERC, other things equal

different investors will have different expectations of a firms next-period earnings, depending on their prior information and the extent of their abilities to evaluate

financial statement information

Similarity of Investor Expectation:

the more informative is price, the less will be the information content of current accounting earnings, other things equal, the lower the ERC

Informativeness of Price:

FINANCIAL REPORTING

I.e., lower informativeness of price for smaller firms implies that expanded disclosure for these firms would be useful for investors, contrary to a common argument

that larger firms should have greater reporting responsibilities

For highly levered firms, ERCs are lower, thus to the extend that liabilities in this situation affects market's response to net income, then liabilities should be disclosed

Growth opportunities suggest to investors that the desirability of disclosure of segment information, since profitability information by segments would better enable

investors to isolate the profitable, and unprofitable, operations of the firm

Earnings persistence to the ERC means that disclosure of the components of net income is useful for investors

Improved understanding of market response suggests ways that they can further improve the decision usefulness of financial statements

Implications of ERC Research

Helpful in reducing inefficiencies in the market, thereby enabling securities market to work better

Accounts must ensure that unusual, non recurring items are fully disclosed, otherwise investors may overestimate the persistence of current reported earnings

Role of Additional Information

Banking

ARTICLE 1: New Benchmarks Crop Up in Companies Financial Reports

Average investors know what it is?

Performance measure: adjusted consolidated segment net income

SEC wants everyone to have the same information as opposed to just some individuals

Is the information good or bad?

Groupons IPO

Chapter 5 Page 3

Das könnte Ihnen auch gefallen

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Reactions of Capital Markets To Financial ReportingDokument25 SeitenReactions of Capital Markets To Financial ReportingnarmadaNoch keine Bewertungen

- Chapter 5 - The Value Relevance of Accounting Information (Group 3 Presentation)Dokument19 SeitenChapter 5 - The Value Relevance of Accounting Information (Group 3 Presentation)Shintia Cristin Min DalaNoch keine Bewertungen

- Stuvia 1217723 Summary Seminar Financial Accounting Research Grade 85Dokument28 SeitenStuvia 1217723 Summary Seminar Financial Accounting Research Grade 85kejsi bylykuNoch keine Bewertungen

- Scott 7e 2015 Chapter 05 The Value Relevance of Accounting InformationDokument26 SeitenScott 7e 2015 Chapter 05 The Value Relevance of Accounting InformationWiday Wijaksana100% (1)

- Capital Market Research and Accounting: Powerpoint Presentation by Matthew Tilling ©2012 John Wiley & Sons Australia LTDDokument35 SeitenCapital Market Research and Accounting: Powerpoint Presentation by Matthew Tilling ©2012 John Wiley & Sons Australia LTDSamah Omar Khanshiri100% (1)

- Earning ReportDokument2 SeitenEarning Reportdayanarshad1337Noch keine Bewertungen

- Session 8 - Growth (1)Dokument11 SeitenSession 8 - Growth (1)Ngọc Minh VũNoch keine Bewertungen

- 2015 Chapter 05-Ppt Scot Bab 5Dokument26 Seiten2015 Chapter 05-Ppt Scot Bab 5AGANoch keine Bewertungen

- Resume 12Dokument3 SeitenResume 12MariaNoch keine Bewertungen

- Impact of Accounting Profits Announcements On Share PricesDokument9 SeitenImpact of Accounting Profits Announcements On Share PricesAdzhana AprillaNoch keine Bewertungen

- Financial Aspects of MarketingDokument428 SeitenFinancial Aspects of MarketingAnonymous 1NnelvPl100% (2)

- Week 11-12 - Stock Valuation - INF516 InvestmentsDokument66 SeitenWeek 11-12 - Stock Valuation - INF516 InvestmentshuguesNoch keine Bewertungen

- Financial ForecastingDokument31 SeitenFinancial ForecastingMaulina Ayu Sabrina PertiwiNoch keine Bewertungen

- How to Interpret Business Plan FindingsDokument9 SeitenHow to Interpret Business Plan FindingsGODNoch keine Bewertungen

- Corporate ReportingDokument27 SeitenCorporate ReportingPankaj MahantaNoch keine Bewertungen

- Ball and Brown RelatedDokument5 SeitenBall and Brown RelatedLin XinNoch keine Bewertungen

- Post-announcement drift anomalyDokument5 SeitenPost-announcement drift anomalyRonald Ian GoontingNoch keine Bewertungen

- Scotts Chapter 4 Efficient Securities MarketDokument4 SeitenScotts Chapter 4 Efficient Securities MarketDylan XJNoch keine Bewertungen

- Stock Valuation and RiskDokument4 SeitenStock Valuation and RiskZephyra ViolettaNoch keine Bewertungen

- Lec-14 Sales ForecastingDokument13 SeitenLec-14 Sales ForecastingPavan YadavNoch keine Bewertungen

- Effects of Dividends On Common Stock Prices: The Nepalese EvidenceDokument33 SeitenEffects of Dividends On Common Stock Prices: The Nepalese EvidenceShreeja DhungelNoch keine Bewertungen

- Financial Forecasting 1Dokument44 SeitenFinancial Forecasting 1ABOOBAKKERNoch keine Bewertungen

- LintnerDokument51 SeitenLintneramt801Noch keine Bewertungen

- Accounting For Manager: Accounting Period April and Ends On 31 March Every Year Unless Otherwise Specifically MentionedDokument66 SeitenAccounting For Manager: Accounting Period April and Ends On 31 March Every Year Unless Otherwise Specifically Mentionedbaburao1762Noch keine Bewertungen

- Investment Analysis and Portfolio Management GuideDokument55 SeitenInvestment Analysis and Portfolio Management Guidesarakhan06220% (1)

- Forecasting Financial StatementsDokument30 SeitenForecasting Financial StatementsChris Jays100% (1)

- FIN 302 Notes 1Dokument55 SeitenFIN 302 Notes 1Tekego TlakaleNoch keine Bewertungen

- Lecture 3: Fundamental Analysis & Trading Strategies: D. MacauleyDokument118 SeitenLecture 3: Fundamental Analysis & Trading Strategies: D. MacauleymeprarthNoch keine Bewertungen

- Chapter 7 - Appraising Investment RiskDokument32 SeitenChapter 7 - Appraising Investment RiskRika Yunita Chandra HarimurtiNoch keine Bewertungen

- Beaver, W 1968. The Information Content of Annual Earnings AnnouncementsDokument15 SeitenBeaver, W 1968. The Information Content of Annual Earnings Announcementsgagakatalaga100% (1)

- Teori AkuntansiDokument30 SeitenTeori AkuntansiAdillah UtamiNoch keine Bewertungen

- COMPANY ANALYSIS: Assessing Financials, Non-Financials & Future ProspectsDokument23 SeitenCOMPANY ANALYSIS: Assessing Financials, Non-Financials & Future ProspectsRocky KumarNoch keine Bewertungen

- Market EfficiencyDokument31 SeitenMarket EfficiencyLinh NguyenNoch keine Bewertungen

- Lec 11Dokument20 SeitenLec 11Ritik KumarNoch keine Bewertungen

- 3.1. Problem Statement: Supply DemandDokument29 Seiten3.1. Problem Statement: Supply DemandAysha LipiNoch keine Bewertungen

- Does Dividend Policy Foretell Earnings Growth?: Draft: December 2001 Comments WelcomeDokument34 SeitenDoes Dividend Policy Foretell Earnings Growth?: Draft: December 2001 Comments WelcomeSnehanshu BanerjeeNoch keine Bewertungen

- Forecasting Financial Statements and Financial PlanningDokument12 SeitenForecasting Financial Statements and Financial PlanningBrian Daniel BayotNoch keine Bewertungen

- EF4314 Class 9 The Analysis of GrowthDokument53 SeitenEF4314 Class 9 The Analysis of GrowthJerry LoNoch keine Bewertungen

- Module 2Dokument33 SeitenModule 2Rishi CharanNoch keine Bewertungen

- Workshop 4 Presentation (Topic 1 Paper 2)Dokument15 SeitenWorkshop 4 Presentation (Topic 1 Paper 2)MaleboNoch keine Bewertungen

- Finman2 - Financial Forecasting & PlanningDokument12 SeitenFinman2 - Financial Forecasting & PlanningKeaster DiazNoch keine Bewertungen

- Funds AnalysisDokument21 SeitenFunds AnalysisvvkmassNoch keine Bewertungen

- Chapter 3: The Quality of Financial InformationDokument31 SeitenChapter 3: The Quality of Financial InformationEnrique Miguel Gonzalez ColladoNoch keine Bewertungen

- Investment-Ch 3Dokument18 SeitenInvestment-Ch 3bereket nigussieNoch keine Bewertungen

- Teori Akuntansi 12 GodfreyDokument33 SeitenTeori Akuntansi 12 Godfreyindra kumalaNoch keine Bewertungen

- Slide AKT 405 Teori Akuntansi 12 GodfreyDokument33 SeitenSlide AKT 405 Teori Akuntansi 12 Godfreyadinugroho0% (1)

- What is Business ValuationDokument6 SeitenWhat is Business ValuationShaik ChandNoch keine Bewertungen

- Returns and VolatilityDokument35 SeitenReturns and VolatilitymonikatatteNoch keine Bewertungen

- IMPACT OF DIVIDENDS ON STOCK PRICESDokument12 SeitenIMPACT OF DIVIDENDS ON STOCK PRICESShalini VermaNoch keine Bewertungen

- Impact of Dividend Announcement On Stock PricesDokument5 SeitenImpact of Dividend Announcement On Stock Pricesolive_3Noch keine Bewertungen

- CH 2 Concept of Return and RiskDokument48 SeitenCH 2 Concept of Return and RiskRanjeet sawNoch keine Bewertungen

- Conceptual FrameworkDokument4 SeitenConceptual FrameworkDat VuNoch keine Bewertungen

- 2 Part Financial AnalysisDokument20 Seiten2 Part Financial AnalysisAbebe TilahunNoch keine Bewertungen

- FINMAN Mod01 - 3e - 030512 2Dokument46 SeitenFINMAN Mod01 - 3e - 030512 2Anonymous XCpe2nNoch keine Bewertungen

- Financial Analysis of Skillmart International CollegeDokument21 SeitenFinancial Analysis of Skillmart International CollegeTadele DandenaNoch keine Bewertungen

- Chapter 10 - The Financial Plan PDFDokument21 SeitenChapter 10 - The Financial Plan PDFzulkifli alimuddinNoch keine Bewertungen

- Notes - Timeliness of Reporting and Stock Price Reaction To Earnings AnnoucementsDokument12 SeitenNotes - Timeliness of Reporting and Stock Price Reaction To Earnings AnnoucementsChacko JacobNoch keine Bewertungen

- EF4314 Class 10Dokument32 SeitenEF4314 Class 10Jason NgNoch keine Bewertungen

- Merchant and Investment Banking: History and Management ProfileDokument2 SeitenMerchant and Investment Banking: History and Management ProfileSrevanth MadirajuNoch keine Bewertungen

- 2006 Pii-1Dokument2 Seiten2006 Pii-1suitup666Noch keine Bewertungen

- Chapter 1Dokument1 SeiteChapter 1suitup666Noch keine Bewertungen

- Chapter 10Dokument4 SeitenChapter 10suitup666Noch keine Bewertungen

- Chapter 9Dokument4 SeitenChapter 9suitup666Noch keine Bewertungen

- Chapter 11Dokument4 SeitenChapter 11suitup666Noch keine Bewertungen

- Chapter 6Dokument4 SeitenChapter 6suitup666Noch keine Bewertungen

- Chapter 8Dokument3 SeitenChapter 8suitup666Noch keine Bewertungen

- Chapter 7Dokument4 SeitenChapter 7suitup666Noch keine Bewertungen

- Chapter 1Dokument1 SeiteChapter 1suitup666Noch keine Bewertungen

- Sindh Workers Welfare Fund Act SummaryDokument4 SeitenSindh Workers Welfare Fund Act SummaryAamir ShehzadNoch keine Bewertungen

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDokument6 SeitenBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoNoch keine Bewertungen

- Finnifty Sum ChartDokument5 SeitenFinnifty Sum ChartchinnaNoch keine Bewertungen

- RTB Taxation II ReviewerDokument59 SeitenRTB Taxation II Reviewerdiazadie100% (1)

- FIN3102 Fall14 Investments SyllabusDokument5 SeitenFIN3102 Fall14 Investments SyllabuscoffeedanceNoch keine Bewertungen

- HDokument21 SeitenHFaizal KhanNoch keine Bewertungen

- FIAC6211 - Workbook 2023Dokument88 SeitenFIAC6211 - Workbook 2023Panashe SimbiNoch keine Bewertungen

- MCS-Responsibility Centres & Profit CentresDokument24 SeitenMCS-Responsibility Centres & Profit CentresAnand KansalNoch keine Bewertungen

- Project Report On Readymade GarmentsDokument8 SeitenProject Report On Readymade Garmentsrocky57% (7)

- Mba Interview QuestionsDokument3 SeitenMba Interview QuestionsAxis BankNoch keine Bewertungen

- Bachan Das - Banking Final ProjectDokument27 SeitenBachan Das - Banking Final ProjectbachandasNoch keine Bewertungen

- Presentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceDokument32 SeitenPresentation Made To Analyst/Institutional Investors at Motilal Oswal Investor ConferenceShyam SunderNoch keine Bewertungen

- Standard Promissory Note: 1. PAYMENTS: The Full Balance of This Note, Including All Accrued Interest and LateDokument3 SeitenStandard Promissory Note: 1. PAYMENTS: The Full Balance of This Note, Including All Accrued Interest and LateThalia Guerrero100% (1)

- Pag-IBIG Fund Public Auction Properties in Cavite, Laguna, Bulacan & Metro ManilaDokument24 SeitenPag-IBIG Fund Public Auction Properties in Cavite, Laguna, Bulacan & Metro ManilaSilvino CatipanNoch keine Bewertungen

- 45 Profit and Loss AccountDokument15 Seiten45 Profit and Loss AccountJitender Gupta100% (1)

- SBD HPPWD Final2016Dokument108 SeitenSBD HPPWD Final2016KULDEEP KAPOORNoch keine Bewertungen

- Control Design Effectiveness Quality Review ChecklistDokument6 SeitenControl Design Effectiveness Quality Review ChecklistRodney LabayNoch keine Bewertungen

- Flybe Group PLC FLYBGB Annual Report For Period End 31mar2015 English PDFDokument136 SeitenFlybe Group PLC FLYBGB Annual Report For Period End 31mar2015 English PDFtheredcornerNoch keine Bewertungen

- Jackson Automotive Financial Crisis RecoveryDokument3 SeitenJackson Automotive Financial Crisis RecoveryErika Theng25% (4)

- Ch16 Answer KeyDokument30 SeitenCh16 Answer KeyWed Cornel0% (1)

- Ch8 AR Test 9902Dokument7 SeitenCh8 AR Test 9902ايهاب غزالةNoch keine Bewertungen

- W19196-PDF-EnG ChimpChange - How To Raise Capital To GrowDokument17 SeitenW19196-PDF-EnG ChimpChange - How To Raise Capital To GrowbobbyNoch keine Bewertungen

- OlaDokument2 SeitenOlaanderspeh.realestateNoch keine Bewertungen

- Trading Plan TemplateDokument18 SeitenTrading Plan TemplateGuyEye100% (3)

- Capital Gains Tax (CGT) RatesDokument15 SeitenCapital Gains Tax (CGT) RatesMargaretha PaulinaNoch keine Bewertungen

- Risk Maturity Determines Framework CompletenessDokument186 SeitenRisk Maturity Determines Framework CompletenessNagendra KrishnamurthyNoch keine Bewertungen

- Capacity To ContractDokument33 SeitenCapacity To ContractAbhay MalikNoch keine Bewertungen

- New Challenges For Wind EnergyDokument30 SeitenNew Challenges For Wind EnergyFawad Ali KhanNoch keine Bewertungen

- Vocabulary Power Through Shakespeare: David PopkinDokument19 SeitenVocabulary Power Through Shakespeare: David PopkinimamjabarNoch keine Bewertungen

- Financial Analysis On Scooters India LimitedDokument9 SeitenFinancial Analysis On Scooters India LimitedMohit KanjwaniNoch keine Bewertungen