Beruflich Dokumente

Kultur Dokumente

Business Aviation

Hochgeladen von

Vikash Pandey0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

67 Ansichten3 Seitenregarding BA

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenregarding BA

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

67 Ansichten3 SeitenBusiness Aviation

Hochgeladen von

Vikash Pandeyregarding BA

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Indian Aviation Industry

Major Highlights in 2013

Jet Airways-Etihad Airways deal

AirAsia and the Tata Group queuing up to start new airline in India

Tatas planning to start a full service airline in India in partnership with Singapore Airlines.

SpiceJet interline agreement with Tiger Airways

Existing Position

India is the 9

th

largest civil aviation market in the world

India ranks fourth in domestic passenger volumes (116.3 million)

79% of aircraft movement happens from international airport 21% from other airport

84% Passenger Traffic happens from International Airport and 16% from other airport

Business travel USD 30.9 bn in 2013

Opportunity

By 2020 going to be 3

rd

largest aviation market

Passenger traffic expected to be 450 million by 2020

Domestic and international passenger traffic are expected to grow at annual average rate

of 12% and 8% in next five years

Business travel expected to be USD 85.6 bn by 2023

Additional 30 airports required to handle the growing passenger and cargo traffic in next

five years

Investment to the tune of US $4 Billion required for General Aviation aircrafts in next 5

years

Challenges

Lack of infrastructure

Tax & Duties

Shortage of manpower

Fuel Prices

Local Connectivity

Reserve Routes

Indian Business Aviation Market- Overview

Number of Business Aviation aircraft around 680 as per Business Aviation Association

including private jet helicopters, turboprops and piston engines and this number are

expected to reach 2000 by 2020

Number of Private Jet in India around 140

India represents 12% of Private Jet Market

As per Bombardier in next 20 years India would have 1340 private jet

Demand driver for Indian Business Aviation market

Economic growth- Over the next 20 years, real GDP in India is forecasted to grow at an

average of 6.8% per year.

Globalization- Continuously expanding reaches on a global scale to improve efficiencies

and expanding market opportunities.

Productivity & Poor Connectivity-.Commercial aviation does an inadequate job of

connecting second and third-tier cities, creating a great opportunity for business aviation

to save time and increase business travelers productivity through point-to-point travel.

Bombardier study reveals that the use of a mid-size jet saves around 20 percent of

management time, compared to the use of regular airline services

Number of billionaires- Growing by 20%, expected number of billionaire 119 by 2023

and India will rank 4

th

in world.

Challenges

India does not have any guidelines or policy for the business aviation sector.

Inflexible access to takeoff and landing slots

Airspace constraints

Inadequate infrastructure in terms of airports

Ground support

Aircraft maintenance and training

Limited parking and hanger space

Fixed Base Operator

Only two FBO operating in India, Delhi Airport & Mumbai Airport

SHAURYA AERONAUTICS PVT LTD- 1

st

FBO of India at IGI Airport

Challenges

References:-

http://www.india-aviation.in/pages/view/38/an_overview.html

http://www.ficci.com/pressrelease/1556/ficci-press-release-india-aviation-2014.pdf

http://www.pwc.in/en_IN/in/assets/pdfs/publications/2013/changing-dynamics-final-copy-feb-4-

2013.pdf

http://businessaircraft.bombardier.com/content/dam/bombardier/en/ownership/whitepapers/4500

_Bombardier_MarketForecast%202013_V24-LR.pdf

http://www.ibef.org/industry/indian-aviation.aspx

FBO at Mumbai Airport- http://www.handbook.aero/hb_airportpage.html?recnum=2447

Das könnte Ihnen auch gefallen

- FINAL TERM PROJECT OF Airline ManagementDokument3 SeitenFINAL TERM PROJECT OF Airline ManagementSoni VirgoNoch keine Bewertungen

- Integrated Solution - Sep 2018 .G.Ops PDFDokument28 SeitenIntegrated Solution - Sep 2018 .G.Ops PDFsutopo yuwonoNoch keine Bewertungen

- Air India Cargo Finalised NewDokument37 SeitenAir India Cargo Finalised NewHrishikesh RaneNoch keine Bewertungen

- Airline Business Process OptimizationDokument26 SeitenAirline Business Process OptimizationPeggytaBruinhart100% (1)

- Ground AIPORTOPSDokument271 SeitenGround AIPORTOPSAnushka SeebaluckNoch keine Bewertungen

- CWBPO Shared Service Location Index 2016 PDFDokument32 SeitenCWBPO Shared Service Location Index 2016 PDFTrần KiệtNoch keine Bewertungen

- Moe P 2 Rev 1Dokument63 SeitenMoe P 2 Rev 1Trailblazer487Noch keine Bewertungen

- Role of GSADokument13 SeitenRole of GSANishit KanchanNoch keine Bewertungen

- National Air CargoDokument40 SeitenNational Air CargoNvs Murthy100% (3)

- Growing Aviation Industry in IndiaDokument41 SeitenGrowing Aviation Industry in IndiaAastha ChhatwalNoch keine Bewertungen

- ROAIR Airlines Flight Operations Course GuideDokument15 SeitenROAIR Airlines Flight Operations Course GuideDanielNoch keine Bewertungen

- A CarsDokument24 SeitenA CarsNaveenn NarraaNoch keine Bewertungen

- AOC Check ListDokument10 SeitenAOC Check Listarun100% (1)

- Airline Industry AnalysisDokument70 SeitenAirline Industry Analysisfahadjavaid0321100% (1)

- Airlines Revenue ManagementDokument7 SeitenAirlines Revenue Managementmyalerts_npNoch keine Bewertungen

- Bag tag identification and historyDokument11 SeitenBag tag identification and historyAna Clara HortaNoch keine Bewertungen

- Service and Safety Quality in US Airlines Pre - and Post-September 11thOKDokument11 SeitenService and Safety Quality in US Airlines Pre - and Post-September 11thOKchrysobergiNoch keine Bewertungen

- Day01 04 IATA AcostaDokument58 SeitenDay01 04 IATA AcostaManuel ReyesNoch keine Bewertungen

- COVID 19 Outlook For Airlines' Cash BurnDokument12 SeitenCOVID 19 Outlook For Airlines' Cash BurnTatiana RokouNoch keine Bewertungen

- 28 Vasigh Erfani Aircraft ValueDokument4 Seiten28 Vasigh Erfani Aircraft ValueW.J. ZondagNoch keine Bewertungen

- Ssim Impguide 03 1 Oct03Dokument147 SeitenSsim Impguide 03 1 Oct03api-3845390Noch keine Bewertungen

- AmadeusDokument4 SeitenAmadeusANIKET SINGH SHANKHALANoch keine Bewertungen

- MBAA 523 Online Syllabus 0514Dokument7 SeitenMBAA 523 Online Syllabus 0514HeatherNoch keine Bewertungen

- Civil Aviation PolicyDokument20 SeitenCivil Aviation Policyxmen3489Noch keine Bewertungen

- World Air Cargo Forecast 2014 2015Dokument68 SeitenWorld Air Cargo Forecast 2014 2015Ankit VarshneyNoch keine Bewertungen

- Module 4 Airline Route PlanningDokument54 SeitenModule 4 Airline Route PlanningYohanes Seda100% (1)

- HSE Aircraft Turnround HSG209Dokument22 SeitenHSE Aircraft Turnround HSG209Panayiotis GrNoch keine Bewertungen

- Uses Limitations of Biomathematical Fatigue ModelsDokument2 SeitenUses Limitations of Biomathematical Fatigue ModelsIrfan AzmiNoch keine Bewertungen

- Capital and Operating Leases A Capital Research 90 PagesDokument90 SeitenCapital and Operating Leases A Capital Research 90 PagesDick TsangNoch keine Bewertungen

- Minimum Equipment List Handling: I. PurposeDokument7 SeitenMinimum Equipment List Handling: I. PurposebnolascoNoch keine Bewertungen

- Airports Requiring Mandatory SLOT RequestsDokument97 SeitenAirports Requiring Mandatory SLOT RequestsUwe Nitsche0% (1)

- Airline IndustryDokument176 SeitenAirline Industrykutty3031100% (2)

- Economics Factors Affecting Demand and SupplyDokument16 SeitenEconomics Factors Affecting Demand and SupplyVaibhav P. BhagwatNoch keine Bewertungen

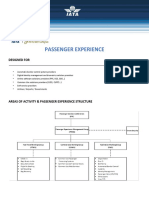

- Passenger ExperienceDokument6 SeitenPassenger ExperienceTANYA PRAJAPATINoch keine Bewertungen

- Eva Air 2018 Annual ReportDokument379 SeitenEva Air 2018 Annual ReportCherry LouNoch keine Bewertungen

- StandardGroundHandlingAgreementIATASGHA20132008 PDFDokument138 SeitenStandardGroundHandlingAgreementIATASGHA20132008 PDFhectorjavier.martinezvargasNoch keine Bewertungen

- Value the Metal and the Money: An Assessment of Aircraft Valuation TrendsDokument16 SeitenValue the Metal and the Money: An Assessment of Aircraft Valuation TrendsMarius AngaraNoch keine Bewertungen

- Making RFID Work - The Most Effective Solution To Lost Baggage?Dokument4 SeitenMaking RFID Work - The Most Effective Solution To Lost Baggage?Vartika BaiswarNoch keine Bewertungen

- CRNA GORA MONTENEGRO AOC GuideDokument23 SeitenCRNA GORA MONTENEGRO AOC Guideadi100% (1)

- IOSA Pre-Audit Questionnaire SummaryDokument9 SeitenIOSA Pre-Audit Questionnaire SummaryVelikovNoch keine Bewertungen

- Flight-Catering Jones, P 2007Dokument15 SeitenFlight-Catering Jones, P 2007andrewpunNoch keine Bewertungen

- Air Cargo GuideDokument211 SeitenAir Cargo Guideulya100% (1)

- CMA Online Framework ModulesDokument33 SeitenCMA Online Framework ModulesAnandaMandalNoch keine Bewertungen

- IATA Cargo Claims and Loss Prevention Conference RecapDokument112 SeitenIATA Cargo Claims and Loss Prevention Conference RecapShaivik Sharma100% (1)

- ACRIS Seamless Travel Business Requirement Document 0.99Dokument234 SeitenACRIS Seamless Travel Business Requirement Document 0.99Demo TokpedNoch keine Bewertungen

- Airline OverridesDokument3 SeitenAirline OverridesMawaheb ContractingNoch keine Bewertungen

- RJ Vs Tprop Fuel Burn AnalysisDokument7 SeitenRJ Vs Tprop Fuel Burn Analysisavianova100% (1)

- Operations of Air-CargoDokument18 SeitenOperations of Air-CargoRitika SinghNoch keine Bewertungen

- презентация ISAGO PDFDokument135 Seitenпрезентация ISAGO PDFСергей ТолстыхNoch keine Bewertungen

- AEA Deicing v27Dokument50 SeitenAEA Deicing v27Miroslav StoyanovNoch keine Bewertungen

- Set Your Business Free: AirlineDokument24 SeitenSet Your Business Free: AirlineGauri RajputNoch keine Bewertungen

- Dangerous Goods Training ProgrammeDokument96 SeitenDangerous Goods Training ProgrammebabrulhasantaponbabulNoch keine Bewertungen

- Design and Implementation of RFID Based Air-Cargo Monitoring SystemDokument12 SeitenDesign and Implementation of RFID Based Air-Cargo Monitoring SystemNavi gNoch keine Bewertungen

- Training tscg02 Air Cargo Security PDFDokument2 SeitenTraining tscg02 Air Cargo Security PDFJulián David Serrano RodriguezNoch keine Bewertungen

- SMS MANUAL TITLEDokument55 SeitenSMS MANUAL TITLEDORELVISNoch keine Bewertungen

- Airline Inventory PoolingDokument10 SeitenAirline Inventory PoolingopoloplusNoch keine Bewertungen

- Global Megatrends and Aviation: The Path to Future-Wise OrganizationsVon EverandGlobal Megatrends and Aviation: The Path to Future-Wise OrganizationsNoch keine Bewertungen

- 1Dokument1 Seite1Vikash PandeyNoch keine Bewertungen

- Business Development SpecialistDokument1 SeiteBusiness Development SpecialistVikash PandeyNoch keine Bewertungen

- Q 1Dokument1 SeiteQ 1Vikash PandeyNoch keine Bewertungen

- Mercury Athletic Footwear Acquisition AnalysisDokument8 SeitenMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- Investment Policy for Mr R K SinghDokument2 SeitenInvestment Policy for Mr R K SinghVikash PandeyNoch keine Bewertungen

- Investment Policy for Mr R K SinghDokument2 SeitenInvestment Policy for Mr R K SinghVikash PandeyNoch keine Bewertungen

- Mercury Athletic Footwear Acquisition AnalysisDokument8 SeitenMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- Assignment SAPM Group2Dokument2 SeitenAssignment SAPM Group2Vikash PandeyNoch keine Bewertungen

- Laddering The OyDokument26 SeitenLaddering The OyVikash PandeyNoch keine Bewertungen

- Laddering The OyDokument26 SeitenLaddering The OyVikash PandeyNoch keine Bewertungen

- PAF Course Outline IIMR 2013 14Dokument4 SeitenPAF Course Outline IIMR 2013 14Vikash PandeyNoch keine Bewertungen

- Niche Market: Name-Vikash Kumar Pandey Roll no-12PGP051Dokument2 SeitenNiche Market: Name-Vikash Kumar Pandey Roll no-12PGP051Vikash PandeyNoch keine Bewertungen

- Final ReportDokument20 SeitenFinal ReportVikash PandeyNoch keine Bewertungen

- Industry Analysis ServiceDokument2 SeitenIndustry Analysis ServiceVikash PandeyNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledVikash PandeyNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledVikash PandeyNoch keine Bewertungen

- Missionary Sisters of Our Lady of Fatima vs. AlzonaDokument4 SeitenMissionary Sisters of Our Lady of Fatima vs. AlzonaMariaFaithFloresFelisartaNoch keine Bewertungen

- Sample Mid-Career Construction Supervisor ResumeDokument2 SeitenSample Mid-Career Construction Supervisor ResumeMarcela MaNoch keine Bewertungen

- PTV PresentationDokument80 SeitenPTV PresentationAfshan SattiNoch keine Bewertungen

- Auditing and Assurance: Ntermediate OurseDokument235 SeitenAuditing and Assurance: Ntermediate OurseSandeep SinghNoch keine Bewertungen

- ODI's First Year: Annual ReportDokument56 SeitenODI's First Year: Annual ReportOpen Data Institute100% (1)

- Business Ethics: Case Study-River BlindnessDokument3 SeitenBusiness Ethics: Case Study-River BlindnessMUHAMMAD USAMANoch keine Bewertungen

- Chapter Two The Accounting CycleDokument30 SeitenChapter Two The Accounting CycleFantayNoch keine Bewertungen

- Introduction To Business EthicsDokument46 SeitenIntroduction To Business EthicsGlai zaNoch keine Bewertungen

- August 2022Dokument1 SeiteAugust 2022amitdesai92Noch keine Bewertungen

- Mpob Term On Learning OrganizationDokument40 SeitenMpob Term On Learning OrganizationAbbas AnsariNoch keine Bewertungen

- Crescent PureDokument4 SeitenCrescent PurerakeshNoch keine Bewertungen

- Risk, Return and The Historical Record: Bodie, Kane, and Marcus Eleventh EditionDokument35 SeitenRisk, Return and The Historical Record: Bodie, Kane, and Marcus Eleventh EditionFederico PortaleNoch keine Bewertungen

- 03-Sep. Followup Call and LeadDokument5 Seiten03-Sep. Followup Call and Leadkrishna vermaNoch keine Bewertungen

- Velpuri Venkata Gopi - ModtDokument5 SeitenVelpuri Venkata Gopi - ModtBhanu GNoch keine Bewertungen

- Ensuring Global Insurance Compliance with Local LawsDokument9 SeitenEnsuring Global Insurance Compliance with Local LawsDjordje NedeljkovicNoch keine Bewertungen

- Meralco v. Prov of LagunaDokument2 SeitenMeralco v. Prov of LagunaJoms TenezaNoch keine Bewertungen

- Concept of EntrepreneurshipDokument9 SeitenConcept of EntrepreneurshipAryanNoch keine Bewertungen

- Spec Com Final1Dokument153 SeitenSpec Com Final1Paula Bianca EguiaNoch keine Bewertungen

- Noe FHRM8e PPT Ch01-1Dokument42 SeitenNoe FHRM8e PPT Ch01-1nur shakilah binti mohd azizNoch keine Bewertungen

- Harshavardhan CVDokument2 SeitenHarshavardhan CVStigan IndiaNoch keine Bewertungen

- Review Materials CompiledDokument338 SeitenReview Materials Compilednomercykilling100% (1)

- Business Studies 2021 22Dokument27 SeitenBusiness Studies 2021 22kan PadmasreeNoch keine Bewertungen

- Cost-Volume-Profit Relationships: Solutions To QuestionsDokument106 SeitenCost-Volume-Profit Relationships: Solutions To QuestionsAbene Man Wt BreNoch keine Bewertungen

- AW101-OCCUPATIONAL SAFETY AND HEALTH TOPIC: WORKPLACE ERGONOMICSDokument7 SeitenAW101-OCCUPATIONAL SAFETY AND HEALTH TOPIC: WORKPLACE ERGONOMICSMuhamad Amirul Adhwa50% (2)

- Surge Arrestors and Insulator CatalogueDokument4 SeitenSurge Arrestors and Insulator CatalogueLucas MlbNoch keine Bewertungen

- Services ProcurementDokument17 SeitenServices ProcurementlarisaschiopuNoch keine Bewertungen

- Economic Reality of Architecture in IndiaDokument9 SeitenEconomic Reality of Architecture in IndiaRNoch keine Bewertungen

- Module #2 WORKSHOPDokument12 SeitenModule #2 WORKSHOPJeimy GomezNoch keine Bewertungen

- SAP ERP IntroductionDokument4 SeitenSAP ERP Introductionmorya19Noch keine Bewertungen

- rdb11 07Dokument18 Seitenrdb11 07Mircea BobarNoch keine Bewertungen