Beruflich Dokumente

Kultur Dokumente

FM 02 - Mfis Notes

Hochgeladen von

Corey PageOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FM 02 - Mfis Notes

Hochgeladen von

Corey PageCopyright:

Verfügbare Formate

Definition of 'Financial System'

A financial system can be defined at the global, regional or firm specific level. The firm's financial system

is the set of implemented procedures that track the financial activities of the company. On a regional

scale, the financial system is the system that enables lenders and borrowers to exchange funds. The

global financial system is basically a broader regional system that encompasses all financial institutions,

borrowers and lenders within the global economy.

There are multiple components making up the financial system of

different levels: Within a firm, the financial system encompasses all aspects of finances. For example, it

would include accounting measures, revenue and expense schedules, wages and balance sheet

verification. Regional financial systems would include banks and other financial institutions, financial

markets, financial services In a global view, financial systems would include the International Monetary

Fund, central banks, World Bank and major banks that practice overseas lending.

Introduction - Types Of Financial Markets and Their Roles

A financial market is a broad term describing any marketplace where buyers and sellers participate in

the trade of assets such as equities, bonds, currencies and derivatives. Financial markets are typically

defined by having transparent pricing, basic regulations on trading, costs and fees, and market forces

determining the prices of securities that trade.

Financial markets can be found in nearly every nation in the world. Some are very small, with only a few

participants, while others - like the New York Stock Exchange (NYSE) and the forex markets - trade

trillions of dollars daily.

Investors have access to a large number of financial markets and exchanges representing a vast array of

financial products. Some of these markets have always been open to private investors; others remained

the exclusive domain of major international banks and financial professionals until the very end of the

twentieth century.

Capital Markets

A capital market is one in which individuals and institutions trade financial securities. Organizations and

institutions in the public and private sectors also often sell securities on the capital markets in order to

raise funds. Thus, this type of market is composed of both the primary and secondary markets.

Any government or corporation requires capital (funds) to finance its operations and to engage in its

own long-term investments. To do this, a company raises money through the sale of securities - stocks

and bonds in the company's name. These are bought and sold in the capital markets.

Stock Markets

Stock markets allow investors to buy and sell shares in publicly traded companies. They are one of the

most vital areas of a market economy as they provide companies with access to capital and investors

with a slice of ownership in the company and the potential of gains based on the company's future

performance.

This market can be split into two main sections: the primary market and the secondary market. The

primary market is where new issues are first offered, with any subsequent trading going on in the

secondary market.

Bond Markets

A bond is a debt investment in which an investor loans money to an entity (corporate or governmental),

which borrows the funds for a defined period of time at a fixed interest rate. Bonds are used by

companies, municipalities, states and U.S. and foreign governments to finance a variety of projects and

activities. Bonds can be bought and sold by investors on credit markets around the world. This market is

alternatively referred to as the debt, credit or fixed-income market. It is much larger in nominal terms

that the world's stock markets. The main categories of bonds are corporate bonds, municipal bonds, and

U.S. Treasury bonds, notes and bills, which are collectively referred to as simply "Treasuries." (For more,

see the Bond Basics Tutorial.)

Money Market

The money market is a segment of the financial market in which financial instruments with high liquidity

and very short maturities are traded. The money market is used by participants as a means for

borrowing and lending in the short term, from several days to just under a year. Money market

securities consist of negotiable certificates of deposit (CDs), banker's acceptances, U.S. Treasury bills,

commercial paper, municipal notes, eurodollars, federal funds and repurchase agreements (repos).

Money market investments are also called cash investments because of their short maturities.

The money market is used by a wide array of participants, from a company raising money by selling

commercial paper into the market to an investor purchasing CDs as a safe place to park money in the

short term. The money market is typically seen as a safe place to put money due the highly liquid nature

of the securities and short maturities. Because they are extremely conservative, money market

securities offer significantly lower returns than most other securities. However, there are risks in the

money market that any investor needs to be aware of, including the risk of default on securities such as

commercial paper. (To learn more, read our Money Market Tutorial.)

Cash or Spot Market

Investing in the cash or "spot" market is highly sophisticated, with opportunities for both big losses and

big gains. In the cash market, goods are sold for cash and are delivered immediately. By the same token,

contracts bought and sold on the spot market are immediately effective. Prices are settled in cash "on

the spot" at current market prices. This is notably different from other markets, in which trades are

determined at forward prices.

The cash market is complex and delicate, and generally not suitable for inexperienced traders. The cash

markets tend to be dominated by so-called institutional market players such as hedge funds, limited

partnerships and corporate investors. The very nature of the products traded requires access to far-

reaching, detailed information and a high level of macroeconomic analysis and trading skills.

Derivatives Markets

The derivative is named so for a reason: its value is derived from its underlying asset or assets. A

derivative is a contract, but in this case the contract price is determined by the market price of the core

asset. If that sounds complicated, it's because it is. The derivatives market adds yet another layer of

complexity and is therefore not ideal for inexperienced traders looking to speculate. However, it can be

used quite effectively as part of a risk management program. (To get to know derivatives, read The

Barnyard Basics Of Derivatives.)

Examples of common derivatives are forwards, futures, options, swaps and contracts-for-difference

(CFDs). Not only are these instruments complex but so too are the strategies deployed by this market's

participants. There are also many derivatives, structured products and collateralized obligations

available, mainly in the over-the-counter (non-exchange) market, that professional investors,

institutions and hedge fund managers use to varying degrees but that play an insignificant role in private

investing.

Forex and the Interbank Market

The interbank market is the financial system and trading of currencies among banks and financial

institutions, excluding retail investors and smaller trading parties. While some interbank trading is

performed by banks on behalf of large customers, most interbank trading takes place from the banks'

own accounts.

The forex market is where currencies are traded. The forex market is the largest, most liquid market in

the world with an average traded value that exceeds $1.9 trillion per day and includes all of the

currencies in the world. The forex is the largest market in the world in terms of the total cash value

traded, and any person, firm or country may participate in this market.

There is no central marketplace for currency exchange; trade is conducted over the counter. The forex

market is open 24 hours a day, five days a week and currencies are traded worldwide among the major

financial centers of London, New York, Tokyo, Zrich, Frankfurt, Hong Kong, Singapore, Paris and

Sydney.

Until recently, forex trading in the currency market had largely been the domain of large financial

institutions, corporations, central banks, hedge funds and extremely wealthy individuals. The emergence

of the internet has changed all of this, and now it is possible for average investors to buy and sell

currencies easily with the click of a mouse through online brokerage accounts. (For further reading, see

The Foreign Exchange Interbank Market.)

Primary Markets vs. Secondary Markets

A primary market issues new securities on an exchange. Companies, governments and other groups

obtain financing through debt or equity based securities. Primary markets, also known as "new issue

markets," are facilitated by underwriting groups, which consist of investment banks that will set a

beginning price range for a given security and then oversee its sale directly to investors.

The primary markets are where investors have their first chance to participate in a new security

issuance. The issuing company or group receives cash proceeds from the sale, which is then used to fund

operations or expand the business. (For more on the primary market, see our IPO Basics Tutorial.)

The secondary market is where investors purchase securities or assets from other investors, rather than

from issuing companies themselves. The Securities and Exchange Commission (SEC) registers securities

prior to their primary issuance, then they start trading in the secondary market on the New York Stock

Exchange, Nasdaq or other venue where the securities have been accepted for listing and trading. (To

learn more about the primary and secondary market, read Markets Demystified.)

The secondary market is where the bulk of exchange trading occurs each day. Primary markets can see

increased volatility over secondary markets because it is difficult to accurately gauge investor demand

for a new security until several days of trading have occurred. In the primary market, prices are often set

beforehand, whereas in the secondary market only basic forces like supply and demand determine the

price of the security.

Secondary markets exist for other securities as well, such as when funds, investment banks or entities

such as Fannie Mae purchase mortgages from issuing lenders. In any secondary market trade, the cash

proceeds go to an investor rather than to the underlying company/entity directly. (To learn more about

primary and secondary markets, read A Look at Primary and Secondary Markets.)

The OTC Market

The over-the-counter (OTC) market is a type of secondary market also referred to as a dealer market.

The term "over-the-counter" refers to stocks that are not trading on a stock exchange such as the

Nasdaq, NYSE or American Stock Exchange (AMEX). This generally means that the stock trades either on

the over-the-counter bulletin board (OTCBB) or the pink sheets. Neither of these networks is an

exchange; in fact, they describe themselves as providers of pricing information for securities. OTCBB and

pink sheet companies have far fewer regulations to comply with than those that trade shares on a stock

exchange. Most securities that trade this way are penny stocks or are from very small companies.

Third and Fourth Markets

You might also hear the terms "third" and "fourth markets." These don't concern individual investors

because they involve significant volumes of shares to be transacted per trade. These markets deal with

transactions between broker-dealers and large institutions through over-the-counter electronic

networks. The third market comprises OTC transactions between broker-dealers and large institutions.

The fourth market is made up of transactions that take place between large institutions. The main

reason these third and fourth market transactions occur is to avoid placing these orders through the

main exchange, which could greatly affect the price of the security. Because access to the third and

fourth markets is limited, their activities have little effect on the average investor.

Financial institutions and financial markets help firms raise money. They can do this by taking out a loan

from a bank and repaying it with interest, issuing bonds to borrow money from investors that will be

repaid at a fixed interest rate, or offering investors partial ownership in the company and a claim on its

residual cash flows in the form of stock.

Role and Function of the Reserve Bank of India (RBI)

In every country there is one organization which works as the central bank. The function of the

central bank of a country is to control and monitor the banking and financial system of the

country. In India, the Reserve Bank of India (RBI) is the Central Bank.

The RBI was established in 1935. It was nationalised in 1949. The RBI plays role of regulator of

the banking system in India. The Banking Regulation Act 1949 and the RBI Act 1953 has given

the RBI the power to regulate the banking system.

The RBI has different functions in different roles. Below, we share and discuss some of the

functions of the RBI.

RBI is the Regulator of Financial System

The RBI regulates the Indian banking and financial system by issuing broad guidelines and

instructions. The objectives of these regulations include:

Controlling money supply in the system,

Monitoring different key indicators like GDP and inflation,

Maintaining peoples confidence in the banking and financial system, and

Providing different tools for customers help, such as acting as the Banking

Ombudsman.

RBI is the Issuer of Monetary Policy

The RBI formulates monetary policy twice a year. It reviews the policy every quarter as well.

The main objectives of monitoring monetary policy are:

Inflation control

Control on bank credit

Interest rate control

The tools used for implementation of the objectives of monetary policy are:

Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR),

Open market operations,

Different Rates such as repo rate, reverse repo rate, and bank rate.

RBI is the Issuer of Currency

Section 22 of the RBI Act gives authority to the RBI to issue currency notes. The RBI also takes

action to control circulation of fake currency.

RBI is the Controller and Supervisor of Banking Systems

The RBI has been assigned the role of controlling and supervising the bank system in India. The

RBI is responsible for controlling the overall operations of all banks in India. These banks may

be:

Public sector banks

Private sector banks

Foreign banks

Co-operative banks, or

Regional rural banks

The control and supervisory roles of the Reserve Bank of India is done through the following:

Issue Of Licence: Under the Banking Regulation Act 1949, the RBI has been given

powers to grant licenses to commence new banking operations. The RBI also grants

licenses to open new branches for existing banks. Under the licensing policy, the RBI

provides banking services in areas that do not have this facility.

Prudential Norms: The RBI issues guidelines for credit control and management. The

RBI is a member of the Banking Committee on Banking Supervision (BCBS). As such,

they are responsible for implementation of international standards of capital adequacy

norms and asset classification.

Corporate Governance: The RBI has power to control the appointment of the chairman

and directors of banks in India. The RBI has powers to appoint additional directors in

banks as well.

KYC Norms: To curb money laundering and prevent the use of the banking system for

financial crimes, The RBI has Know Your Customer guidelines. Every bank has to

ensure KYC norms are applied before allowing someone to open an account.

Transparency Norms: This means that every bank has to disclose their charges for

providing services and customers have the right to know these charges.

Risk Management: The RBI provides guidelines to banks for taking the steps that are

necessary to mitigate risk. They do this through risk management in basel norms.

Audit and Inspection: The procedure of audit and inspection is controlled by the RBI

through off-site and on-site monitoring system. On-site inspection is done by the RBI on

the basis of CAMELS. Capital adequacy; Asset quality; Management; Earning;

Liquidity; System and control.

Foreign Exchange Control: The RBI plays a crucial role in foreign exchange

transactions. It does due diligence on every foreign transaction, including the inflow and

outflow of foreign exchange. It takes steps to stop the fall in value of the Indian Rupee.

The RBI also takes necessary steps to control the current account deficit. They also give

support to promote export and the RBI provides a variety of options for NRIs.

Development: Being the banker of the Government of India, the RBI is responsible for

implementation of the governments policies related to agriculture and rural

development. The RBI also ensures the flow of credit to other priority sectors as well.

Section 54 of the RBI gives stress on giving specialized support for rural development.

Priority sector lending is also in key focus area of the RBI.

Apart from the above, the RBI publishes periodical review and data related to banking. The role

and functions of the RBI cannot be described in a brief write up. The RBI plays a very important

role in every aspect related to banking and finance. Finally the control of NBFCs and others in

the financial world is also assigned with RBI.

Das könnte Ihnen auch gefallen

- Financial Markets and Their RolesDokument4 SeitenFinancial Markets and Their RolesAbdul BasitNoch keine Bewertungen

- Introduction To Financial MarketsDokument7 SeitenIntroduction To Financial MarketsMuhammad Azhar SaleemNoch keine Bewertungen

- Financial Markets TheoryDokument4 SeitenFinancial Markets TheorySandeep Singh SikerwarNoch keine Bewertungen

- Financial MarketsDokument2 SeitenFinancial MarketsSaira Ishfaq 84-FMS/PHDFIN/F16Noch keine Bewertungen

- Risk Management in Financial MarketDokument49 SeitenRisk Management in Financial MarketAashika ShahNoch keine Bewertungen

- Financial Markets and Their Role in EconomyDokument6 SeitenFinancial Markets and Their Role in EconomyMuzammil ShahzadNoch keine Bewertungen

- Module 04 Financial Markets and InstrumentsDokument13 SeitenModule 04 Financial Markets and InstrumentsGovindNoch keine Bewertungen

- Types of Financial Markets Stock Markets: Secondary Market NasdaqDokument6 SeitenTypes of Financial Markets Stock Markets: Secondary Market NasdaqLuise MauieNoch keine Bewertungen

- Presented By:: Mohammad Maksudul Huq Chowdhury Branch Manager Exim Bank, Islampur Branch, DhakaDokument43 SeitenPresented By:: Mohammad Maksudul Huq Chowdhury Branch Manager Exim Bank, Islampur Branch, DhakaKazi Mahbubur RahmanNoch keine Bewertungen

- BFI Financial MarketsDokument7 SeitenBFI Financial MarketsAbdul Wahid BataloNoch keine Bewertungen

- Finl Markets and FinDokument24 SeitenFinl Markets and FinLunaNoch keine Bewertungen

- MarketDokument7 SeitenMarketVerlyn ElfaNoch keine Bewertungen

- Financial MarketDokument48 SeitenFinancial MarketAHUTI SINGHNoch keine Bewertungen

- International Financial MarketDokument36 SeitenInternational Financial MarketSmitaNoch keine Bewertungen

- Financial Market SEM-3Dokument5 SeitenFinancial Market SEM-3naomiNoch keine Bewertungen

- Money Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewDokument16 SeitenMoney Market vs. Capital Market: What's The Difference? Money Market vs. Capital Market: An OverviewyanaNoch keine Bewertungen

- A Financial MarketDokument5 SeitenA Financial MarketSalvador SantosNoch keine Bewertungen

- Debt InstrumentsDokument45 SeitenDebt InstrumentsKajal ChaudharyNoch keine Bewertungen

- Financial Markets OverviewDokument5 SeitenFinancial Markets OverviewNicole Gapuz TicnangNoch keine Bewertungen

- Introduction To Finacial Markets Final With Refence To CDSLDokument40 SeitenIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Final Capital MarketDokument15 SeitenFinal Capital MarketBea SubalisidNoch keine Bewertungen

- Debt InstrumentsDokument53 SeitenDebt Instrumentskinjalkapadia087118100% (6)

- 5 6206307345643864568Dokument58 Seiten5 6206307345643864568SURYANoch keine Bewertungen

- Ty Bba Project1Dokument37 SeitenTy Bba Project1Shivam KharuleNoch keine Bewertungen

- Key Takeaways: Understanding The Financial MarketsDokument4 SeitenKey Takeaways: Understanding The Financial MarketsAk LelouchKaiNoch keine Bewertungen

- Money MarketDokument7 SeitenMoney MarketjkbilandaniNoch keine Bewertungen

- 6-Functions of Financial MarketsDokument4 Seiten6-Functions of Financial MarketsTahir RehmaniNoch keine Bewertungen

- Financial Markets: Kashis Chakma ID-20IUT0360029Dokument23 SeitenFinancial Markets: Kashis Chakma ID-20IUT0360029Ak LelouchKaiNoch keine Bewertungen

- Financial Market DefinitionDokument9 SeitenFinancial Market DefinitionMARJORIE BAMBALANNoch keine Bewertungen

- Benavidez, Ramcie A. Bsba FM TF-7:00-8:30pm 4FM6Dokument3 SeitenBenavidez, Ramcie A. Bsba FM TF-7:00-8:30pm 4FM6Ramcie Aguilar BenavidezNoch keine Bewertungen

- FMI NotesDokument93 SeitenFMI Notesjain_ashish_19888651Noch keine Bewertungen

- A Quanittative Study of Nepalese Stock ExchangeDokument87 SeitenA Quanittative Study of Nepalese Stock ExchangenirajNoch keine Bewertungen

- Capital MarketDokument3 SeitenCapital MarketPratap, BiswasNoch keine Bewertungen

- Lesson 2 FM: Money MarketDokument4 SeitenLesson 2 FM: Money MarketChristina MalaibaNoch keine Bewertungen

- Money MarketDokument19 SeitenMoney Marketramesh.kNoch keine Bewertungen

- Stock MarketDokument9 SeitenStock MarketFrank KenyanNoch keine Bewertungen

- Week 3 FinmanDokument10 SeitenWeek 3 FinmanZavanna LaurentNoch keine Bewertungen

- Fim Ug 4Dokument21 SeitenFim Ug 4Nahum DaichaNoch keine Bewertungen

- Bond Market: Primary Market, Also Called The New Issue Market, Is The Market For Issuing NewDokument5 SeitenBond Market: Primary Market, Also Called The New Issue Market, Is The Market For Issuing NewparulvrmNoch keine Bewertungen

- Chapter Two Financial Markets and InstrumentsDokument61 SeitenChapter Two Financial Markets and InstrumentsKume MezgebuNoch keine Bewertungen

- Drive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingDokument21 SeitenDrive: Summer 2016 Program: MBA Semester: 3 Subject Code: MB0036 Subject Name: Financial System and Commercial BankingPalash DaveNoch keine Bewertungen

- Intro To Financial MarketsDokument2 SeitenIntro To Financial MarketsarmskhatriNoch keine Bewertungen

- Capital MarketDokument66 SeitenCapital MarketPriya SharmaNoch keine Bewertungen

- Investment Pattern in Commodities and Associated RisksDokument121 SeitenInvestment Pattern in Commodities and Associated RisksWWW.150775.BUGME.PW0% (1)

- Report in MTH of IntDokument6 SeitenReport in MTH of IntAngie ValenzuelaNoch keine Bewertungen

- Ifim Units 3&4Dokument19 SeitenIfim Units 3&4kushalNoch keine Bewertungen

- Financial MarketsDokument18 SeitenFinancial MarketsMuhammad YamanNoch keine Bewertungen

- Global Finance and Electronic BankingDokument16 SeitenGlobal Finance and Electronic BankingKrishaNoch keine Bewertungen

- Essay. FM.Dokument1 SeiteEssay. FM.Roseanne RebucasNoch keine Bewertungen

- Raja Shekar ReddyDokument42 SeitenRaja Shekar ReddypavithrajiNoch keine Bewertungen

- Types of Financial MarketsDokument2 SeitenTypes of Financial MarketsMher Edrolyn Cristine LlamasNoch keine Bewertungen

- Index: SR No. Content Page No. 1Dokument71 SeitenIndex: SR No. Content Page No. 1Vikram JainNoch keine Bewertungen

- An Overview of Financial SystemDokument4 SeitenAn Overview of Financial SystemYee Sin MeiNoch keine Bewertungen

- Financial Market & InstrumentDokument73 SeitenFinancial Market & InstrumentSoumya ShettyNoch keine Bewertungen

- (NR) Financial Markets and InstitutionDokument8 Seiten(NR) Financial Markets and InstitutionMichael MendozaNoch keine Bewertungen

- CH04 FimDokument4 SeitenCH04 Fimfentaw melkieNoch keine Bewertungen

- Portfolio InvestmentDokument129 SeitenPortfolio Investmentanchal1987Noch keine Bewertungen

- ABIYDokument9 SeitenABIYEyob HaylemariamNoch keine Bewertungen

- 10 Science Notes 06 Life Processes 1Dokument12 Seiten10 Science Notes 06 Life Processes 1All Rounder HindustanNoch keine Bewertungen

- Extra Questions-ElectricityDokument2 SeitenExtra Questions-ElectricityCorey PageNoch keine Bewertungen

- 12.3 QB-q3Dokument5 Seiten12.3 QB-q3Corey PageNoch keine Bewertungen

- Test Human EyeDokument1 SeiteTest Human EyeCorey PageNoch keine Bewertungen

- E.G. Bacterium NitrosomonasDokument1 SeiteE.G. Bacterium NitrosomonasCorey PageNoch keine Bewertungen

- Test ElectricityDokument12 SeitenTest ElectricityCorey PageNoch keine Bewertungen

- Notes-Winds, Storms and CyclonesDokument5 SeitenNotes-Winds, Storms and CyclonesCorey PageNoch keine Bewertungen

- Behavioural Skills-4 PDFDokument24 SeitenBehavioural Skills-4 PDFPragati VatsaNoch keine Bewertungen

- Tense-Mixed ExerciseDokument2 SeitenTense-Mixed ExerciseCorey PageNoch keine Bewertungen

- Test WindsDokument1 SeiteTest WindsCorey PageNoch keine Bewertungen

- Chapter 8 Winds Storms and CyclonesDokument19 SeitenChapter 8 Winds Storms and CyclonesCorey PageNoch keine Bewertungen

- OpTransactionHistoryUX3 - PDF02 07 2019Dokument1 SeiteOpTransactionHistoryUX3 - PDF02 07 2019Corey PageNoch keine Bewertungen

- 7 Challenges - A Workbook On CommunicationsDokument104 Seiten7 Challenges - A Workbook On CommunicationsRaj100% (2)

- Exercise Questions-Winds, CycloneDokument5 SeitenExercise Questions-Winds, CycloneCorey PageNoch keine Bewertungen

- Subham Bhaiya 5 PDFDokument31 SeitenSubham Bhaiya 5 PDFRazor RockNoch keine Bewertungen

- Stress Analysis On Hotel Employees PDFDokument12 SeitenStress Analysis On Hotel Employees PDFCorey PageNoch keine Bewertungen

- READMEDokument1 SeiteREADMESuyog TangadkarNoch keine Bewertungen

- IBC 301 Question Bank - Hindi 2017-18Dokument5 SeitenIBC 301 Question Bank - Hindi 2017-18Corey PageNoch keine Bewertungen

- Gold Monetization Scheme 150703111313 Lva1 App6891Dokument25 SeitenGold Monetization Scheme 150703111313 Lva1 App6891Corey PageNoch keine Bewertungen

- Synopsis GSTDokument16 SeitenSynopsis GSTCorey PageNoch keine Bewertungen

- New QUESTIONNAIRE OF EMPLOYEE WELFARE MEASURES 1Dokument4 SeitenNew QUESTIONNAIRE OF EMPLOYEE WELFARE MEASURES 1Corey Page100% (1)

- Principles & Practices of BankingDokument33 SeitenPrinciples & Practices of BankingPritam BhadadeNoch keine Bewertungen

- Balance of Payment (BOP)Dokument35 SeitenBalance of Payment (BOP)Ritick KannaNoch keine Bewertungen

- BankingDokument153 SeitenBankingBijit KarmakarNoch keine Bewertungen

- RMDokument7 SeitenRMCorey PageNoch keine Bewertungen

- Ecological Solid Waste Management Act of PDFDokument35 SeitenEcological Solid Waste Management Act of PDFCorey Page100% (1)

- Roles of Government in Business1214Dokument21 SeitenRoles of Government in Business1214Corey PageNoch keine Bewertungen

- Types of PlanningDokument14 SeitenTypes of PlanningCorey Page100% (2)

- Presentation 1Dokument19 SeitenPresentation 1Corey PageNoch keine Bewertungen

- Blue Sky & Red SunsetsDokument15 SeitenBlue Sky & Red SunsetsCorey PageNoch keine Bewertungen

- Individual Assignment 3 MicroDokument2 SeitenIndividual Assignment 3 MicroDang Mai Linh (K16HL)Noch keine Bewertungen

- Chap-9, The Cost of Capital, 2015 PDFDokument10 SeitenChap-9, The Cost of Capital, 2015 PDFMd. Monirul islamNoch keine Bewertungen

- FINANCE MANAGEMENT FIN420 CHP 5Dokument14 SeitenFINANCE MANAGEMENT FIN420 CHP 5Yanty IbrahimNoch keine Bewertungen

- ME2Dokument2 SeitenME2Anonymous oYT7mQt3100% (1)

- Economic Theory by ShumPeterDokument16 SeitenEconomic Theory by ShumPeterPalak AhujaNoch keine Bewertungen

- A Case Study of TanzaniaDokument15 SeitenA Case Study of TanzaniaVladGrigoreNoch keine Bewertungen

- Refer For RolDokument43 SeitenRefer For RolDivya PuriNoch keine Bewertungen

- Production Possibilities and Resources: Part 1-Key Terms: Define The Following TermsDokument2 SeitenProduction Possibilities and Resources: Part 1-Key Terms: Define The Following Termskawii.fighting10Noch keine Bewertungen

- Final IFC DisruptiveTechnology Interior FIN WEB March 13 2019Dokument112 SeitenFinal IFC DisruptiveTechnology Interior FIN WEB March 13 2019Mian MaidaNoch keine Bewertungen

- 德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页Dokument112 Seiten德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页HungNoch keine Bewertungen

- Break Even Point ExampleDokument10 SeitenBreak Even Point Examplerakesh varmaNoch keine Bewertungen

- Allianz Case Study Risk ManagementDokument16 SeitenAllianz Case Study Risk ManagementluzgarayNoch keine Bewertungen

- Capitalist Economics Samuel A Chambers Full ChapterDokument67 SeitenCapitalist Economics Samuel A Chambers Full Chapterrichard.harris150100% (2)

- Supply Chain Modeling: School of Business & EconomicsDokument4 SeitenSupply Chain Modeling: School of Business & EconomicsHamza KhalidNoch keine Bewertungen

- Case Fair Oster: MacroeconomicsDokument23 SeitenCase Fair Oster: Macroeconomicsroaa ghanimNoch keine Bewertungen

- Pricing of ServicesDokument30 SeitenPricing of ServicesAnand VANoch keine Bewertungen

- Luxury Sharing, Meet High FashionDokument16 SeitenLuxury Sharing, Meet High FashionnemonNoch keine Bewertungen

- Measuring Investment Returns of Portfolios Containing Futures and OptionsDokument9 SeitenMeasuring Investment Returns of Portfolios Containing Futures and Optionskusi786Noch keine Bewertungen

- Gross, S., Klemmer, L. (Eds.) - Introduction To Tourism Transport-CABI (2014)Dokument250 SeitenGross, S., Klemmer, L. (Eds.) - Introduction To Tourism Transport-CABI (2014)Camila Teixeira50% (2)

- History Never Repeats Itself, But It Rhymes Dot-Com BubbleDokument162 SeitenHistory Never Repeats Itself, But It Rhymes Dot-Com BubbleHanifa FissalmaNoch keine Bewertungen

- ProblemDokument3 SeitenProblemNicole LabbaoNoch keine Bewertungen

- Micro Slides Summer 2021Dokument305 SeitenMicro Slides Summer 2021Shahid NaseemNoch keine Bewertungen

- Econ 3803a Ayoo w20Dokument4 SeitenEcon 3803a Ayoo w20Omotara YusufNoch keine Bewertungen

- Capital BugetingDokument6 SeitenCapital BugetingMichael ReyesNoch keine Bewertungen

- Unit 5 - Foreign Trade & Exchange RateDokument8 SeitenUnit 5 - Foreign Trade & Exchange RateSurekha RammoorthyNoch keine Bewertungen

- BerkshireDokument30 SeitenBerkshireNimra Masood100% (3)

- Nature and Scope of Macro-Economics: TH THDokument15 SeitenNature and Scope of Macro-Economics: TH THParth SharmaNoch keine Bewertungen

- Amtek Auto Analysis AnuragDokument4 SeitenAmtek Auto Analysis AnuraganuragNoch keine Bewertungen

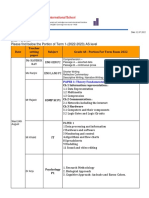

- Dear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelDokument5 SeitenDear Parents, Please Find Below The Portion of Term 1 - (2022-2023) AS LevelPrayrit JainNoch keine Bewertungen

- MGMT 1063 - Strama Module 3Dokument8 SeitenMGMT 1063 - Strama Module 3Kay AbawagNoch keine Bewertungen