Beruflich Dokumente

Kultur Dokumente

Serial System LTD Annual Report 2013

Hochgeladen von

WeR1 Consultants Pte LtdOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Serial System LTD Annual Report 2013

Hochgeladen von

WeR1 Consultants Pte LtdCopyright:

Verfügbare Formate

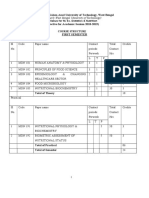

CONTENTS

CORPORATE PROFILE

OUR VISION, MISSION & VALUES

02 - 03

EXTENSIVE DISTRIBUTION NETWORK &

PRODUCT LINE CARDS

04 - 05

CORPORATE HISTORY

06 - 07

FINANCIAL HIGHLIGHTS

08 - 09

CHAIRMANS STATEMENT

10 - 11

OPERATIONS & FINANCIAL REVIEW

12 - 14

OTHER BUSINESSES

15 -17

GROUP STRUCTURE

FINANCIAL CALENDAR &

CORPORATE INFORMATION

18 - 19

CORPORATE SOCIAL RESPONSIBILITY

20 - 21

BOARD OF DIRECTORS

22 - 23

MANAGEMENT TEAM

24 -26

CORPORATE GOVERNANCE REPORT

27 - 34

FINANCIAL CONTENTS

35

Established in 1988 and listed on the Main Board of the Singapore Stock Exchange

since July 2000, Serial System has developed a synergistic global network that is

built on strong partnerships with its suppliers and customers. In 2013, Serial System

celebrated its 25th anniversary by crossing the S$1 billion revenue mark, making it

the largest electronic components distributor listed in Singapore.

Serial System has a customer base of more than 6,000, spanning a diverse range

of industries such as consumer electronics, household appliances, industrial,

telecommunication, electronics manufacturing services, automotive and medical. Its

major suppliers include Texas Instruments, ON Semiconductor, Avago Technologies,

TE Connectivity, Advanced Micro Devices and OSRAM Opto Semiconductors.

With 900 employees in over fty ofces and seven warehouses in key Asian markets,

namely, Singapore, China, Hong Kong, India, Indonesia, Japan, Malaysia, Philippines,

South Korea, Taiwan, Thailand and Vietnam. Serial System has one of the largest

and most extensive distribution networks in the region. Being in close proximity to

its partners gives Serial System the ability to align to the goals of its customers and

suppliers, understand their needs better to reduce time-to-market and response

time, as well as improve inventory management. In meeting their engineering and

supply chain needs, Serial System has become their integral component to success.

Serial System also enhances the demand of its suppliers components and the

product development of its customers by adding value to the components through

design and other demand-creation activities.

Moving forward, Serial System will continue to help its partners to be more competitive

in the marketplace, today and in the future.

CORPORATE

PROFILE

Annual Report 2013 3

OUR

VISION

To be the leading electronic component distribution partner,

known for our dynamic demand creation activities, extensive

network and strong local expertise.

OUR

MISSION

To provide a wealth of growth opportunities for our

stakeholders.

Towards our partners

We provide market insights to our business partners to enable

faster time-to-market. To our suppliers, we help expand their

market reach. To our customers, we provide innovative and

competitive solutions.

Towards our staff

By empowering our staff with the right resources and looking after

their well-being, we help them to be their best at work, grooming

them to be our leaders of tomorrow.

Towards our shareholders

We strive to make steady progress in every aspect of our business,

providing our shareholders with consistent and favourable

dividend yields.

Towards our community

By staying in touch with the community, we are able to contribute

in ways that are close to their needs.

Progressiveness

Derived from the drive to achieve our targets and the courage to

change for the better.

Empowerment

Encouraged by giving our staff the power to make decisions.

Teamwork

Striving towards a common goal in one spirit despite our cultural

or individual differences.

Efciency

Arose from working smart, doing our work well, and using our

resources effectively to serve our customers and suppliers well.

OUR

VALUES

4 Annual Report 2013 444444 An An An An Annnu nu nnn l al RRep eppppppppor ort t t 200 20 20 20013 13 13 133 13 13333

PRODUCT LINE CARDS

Texas Instruments

ON Semiconductor

Avago Technologies

TE Connectivity

Advanced Micro Devices

OSRAM Opto Semiconductors

Analog Devices

BCD Semiconductor

Elo Touch Solutions

Fingerprints Cards AB

GigaDevice Semiconductor

Hisilicon Technologies

InvenSense

Lelon

Littelfuse

Micro Crystal AG

SHARP

Silicon Motion Technology

TOSHIBA

TT Electronics

Walsin Technologies

China

North China

Beijing

Tianjin

Qingdao

Chengdu

Chongqing

Xian

Zhengzhou

Shenyang

Jinan

East China

Shanghai

Suzhou

Hangzhou

Wuxi

Nanjing

Wuhan

Hefei

South China

Shenzhen

Guangzhou

Huizhou

Zhuhai

Dongguan

Zhongshan

Xiamen

Changsha

Hong Kong

India

Bengaluru

New Delhi

Pune

Mumbai

Chennai

Nashik

Hyderabad

Indonesia

Jakarta

Japan

Tokyo

Nagoya

Malaysia

Penang

Kuala Lumpur

Philippines

Manila

South Korea

Seoul

Gwangju

Daegu

Taiwan

Taipei

Hsinchu

Taichung

Thailand

Bangkok

Chiang Mai

Vietnam

Ho Chi Minh

Hanoi

EXTENSIVE

DISTRIBUTION

NETWORK

The Groups ofces and representations

Annual Report 2013 5 An An An An An An An AAAA nu nu nu nu nu nu nual al al al al al al RRRRRRRRRRRep ep ep ep ep ep ep ep ep ep ep epor or or or or or or orr or or orrt tt t t t t t tttt t 20 20 20 20 20 20 20 20 20 220 200 2013 13 13 13 13 13 13 13 33 13 13 555555555555

MALAYSIA

INDONESIA

VIETNAM

PHILIPPINES

TAIWAN

CHINA

JAPAN

SOUTH KOREA

SINGAPORE

HEADQUARTER

INDIA

THAILAND

HONG KONG

S

HHHEE

6 Annual Report 2013

1988

Set up of Serial System as a sole

proprietorship

1992

Incorporation of Serial System as a

private limited company

1997

Listed on SESDAQ, the second board

of the Singapore Stock Exchange

1999

Included as an index stock in the

Straits Times Industrial Index on

the Singapore Stock Exchange

Placement of 27 million new

ordinary shares of Serial System

Ltd at an issue price of S$1.46

per share

Received the Technology

Achievement Award jointly-

organised by Arthur Anderson

Business Consulting, National

Science & Technology Board and

The Straits Times

2001

Set up a joint venture company, Serial

Microelectronics (HK) Limited in Hong Kong to

venture into Greater China

2005

S$25 million transferable

loan facility; together with

the renounceable rights

issue of 75,968,779

warrants at an issue price of

S$0.045 for each warrant,

each warrant carrying the

right to subscribe for one

new ordinary share of Serial

System Ltd at an exercise

price of S$0.12 per share

Renounceable rights issue

of 60,776,270 new ordinary

shares of Serial System Ltd

at an issue price of S$0.12

per share

Set up a joint venture

company, Serial

Microelectronics Inc. to

expand into Taiwan

2004

Ofcial opening of the Serial Systems

corporate building at 8 Ubi View, Singapore

2002

Acquisition of Serial Microelectronics Korea

Limited to expand into South Korea

1996

Ranked the Most Enterprising Company in the Singapore Enterprise 50 Award

jointly-organised by Anderson Consulting and the Business Times and supported by

the Singapore Economic Development Board.

CORPORATE

HISTORY

2000

Serial System upgraded

to the Main Board of the

Singapore Stock Exchange

Annual Report 2013 7

2006

Incorporation of Serial

Microelectronics (Shenzhen)

Co., Ltd as the Groups operational

headquarter in China

2007

Acquisition of 34.3% interest

in Bull Will Co., Ltd, a Taiwan

company listed on the

Over-The-Counter Securities

Exchange in Taiwan

2009

Rights issue of 120,685,480 new

ordinary shares of Serial System Ltd

at an issue price of S$0.055 per share

Set up a joint venture company, Serial

Multivision Pte. Ltd.

2010

Serial Multivision Pte. Ltd. was

appointed the exclusive outdoor LED

media wall operator for Grand Park

Orchard @ Knightsbridge in Orchard

Road

2011

Listing of shares of Serial System

Ltd as Taiwan Depository Receipts

on the Taiwan Stock Exchange

Adoption of Share Buyback

Mandate

Acquisition of Intraco Technology

Pte Ltd to expand product line in

South East Asia and India

Acquisition of ofce units in Taipei,

Taiwan, to serve as the Groups

operational headquarter for Taiwan

Acquisition of Contract Sterilization

Services Pte Ltd to expand into the

medical device distribution industry

Acquisition of TeamPal Enterprise

Corp. to expand product line in

Taiwan

Acquisition of Taein System Inc. to

expand product line in South Korea

2012

Acquisition of ofce units in Shenzhen,

China, to serve as the Groups

operational headquarter for South

China

2013

Incorporation of Serial Microelectronics Sdn. Bhd. in

Malaysia

Investment in a joint venture company, Serial AMSC

Microelectronics Co., Ltd, to establish a presence in

Japan

Acquisition of 13.58% interest in SGX Catalist-listed,

Jubilee Industries Holdings Ltd

Acquisition of ofce units in Seoul, South Korea, to serve

as the Groups operational headquarter for South Korea

Acquisition of ofce units in Shanghai, China, to serve as

the Groups operational headquarter for East China

Serial System celebrates its 25

th

Anniversary on

1 November 2013 and distributes special one-off

interim cash dividend of 0.25 Singapore cent per share

Set up a joint venture company, Nippon Denka Serial

Pte. Ltd. to expand the electronic components

distribution business in South Asia Pacic

8 Annual Report 2013

2013 2012

0

200

400

600

800

1000

2013 2012 2011

0

10

20

30

40

50

60

70

80

2013 2012 2011

0

5

10

15

20

25

2013 2012 2011

0

2

4

6

8

10

12

2013 2012 2011

Revenue by Markets

Revenue

(US$ million)

EBITDA

(US$ million)

Gross Prot

(US$ million)

Prot Attributable

to Equity Holders

(US$ million)

57.5

62.6

73.5

616.4

658.1

817.1

FINANCIAL HIGHLIGHTS

19.9

10.1

7.9

11.2

18.9

22.0

Greater China

57%

South East Asia

and India

18%

South Korea

17%

Taiwan

6%

Japan

2%

South East Asia

and India

19%

South Korea

18%

Taiwan

7%

Greater China

56%

Annual Report 2013 9

2013

US$000

2012

US$000

2011

US$000

Capital Employed

Working Capital 58,385 64,521 70,757

Total Assets 343,476 267,150 267,096

Net Assets 109,962 104,538 98,732

Net Assets per Share (United States cents) 12.27 11.67 10.90

Net Debts 97,865 56,312 71,168

Share Capital

Issued and Fully Paid (including Treasury Shares) 72,648 72,626 72,689

Number of Shares Issued (thousands) 905,788 905,508 905,508

Number of Treasury Shares (thousands) (9,946) (9,946) -

Number of Shares Issued excluding Treasury Shares (thousands) 895,842 895,562 905,508

Earnings and Dividend per Share

Earnings per Share (United States cents)

(1)

1.25 0.88 1.22

Dividend per Share (Singapore cent) 0.79 0.52 0.79

Dividend Yield (%)

(2)

6.3 5.0 7.9

Ratios

Current Ratio 1.27 1.44 1.48

AR Turnover (days) 62 61 55

AP Turnover (days) 32 33 36

Inventory Turnover (days) 30 41 51

Cash Conversion Cycle (days) 60 69 70

Net Gearing Ratio 0.89 0.54 0.72

(1)

Earnings per share is calclated based on prot after tax on weighted average of 895,773,065 shares in issue for 2013,

899,491,136 shares in issue for 2012 and 841,545,500 shares in issue for 2011.

(2)

Dividend yield is calculated based on dividend per share over Serial System Ltds share price as at the end of each

respective nancial year.

10 Annual Report 2013

Dear Shareholders,

It is with great pleasure that I present the annual report for

the nancial year ended 31 December 2013 (FY2013)

a momentous year during which we celebrated our 25th

anniversary by crossing the S$1 billion revenue milestone for

the rst time.

FY2013 In Review

The electronic component distribution industry continues

to operate in a fragmented and challenging environment in

Asia. Amidst broader concerns of the global macro-economic

environment and the slower economic growth in China, intense

competition means that margins and cash ows are constantly

under pressure.

Against this backdrop, the Board and Management conducted

a major strategic review in the year under review to put in place

the foundations and systems necessary to help us compete

better. The resulting three-pronged strategy seeks to increase

revenue, deepen our combined value proposition and improve

internal efciencies.

Rather than merely bridging buyer and seller, Serial System

has long pondered how it can add value to the supply chain.

Through the review we have taken the rst decisive steps which

include, amongst others:

expanding our product portfolio so as to increase our

customers bill of material, with particular emphasis on the

fast-growing automotive sector in North Asia, increasing

exposure to mobile devices and enterprise cloud solutions.

partnering design houses in China to offer value-added

component modules that provide our customers greater

convenience; in turn improving our margins. In FY2013

alone, from a standing start, we shipped US$70 million of

such modules.

widening our distribution network via organic growth and

acquisitions (to 50 ofces and 7 warehouses in 12 Asian

countries currently)

implementing an internal business intelligence software

to better understand customer behaviour and improving

inventory management and internal efciencies, while also

promoting greater use of Electronic Data Interchange with

suppliers and customers.

The nancial performance in FY2013 clearly underscores the

success of these measures. Revenue rose 24% to US$817.1

million from US$658.1 million in FY2012. Net prot attributable

to shareholders outpaced revenue growth, increasing 41% to

US$11.2 million in FY2013 from US$7.9 million in the preceding

year. Our net margin in FY2013 rose to 1.4% from 1.2% in FY2012

despite intense competition, higher operating expenses and a

one-off expense incurred for the 25

th

anniversary celebrations.

CHAIRMANS STATEMENT

Dr. Derek Goh Bak Heng

Executive Chairman & Group CEO

In implementing our three-

pronged strategy to grow

revenue and improve our

value proposition and internal

efciencies, the Group is striving

to achieve its target revenue of

US$1 billion in FY2014.

Annual Report 2013 11

Reecting the improved internal efciencies, we have slashed

inventory turnover days to 30 in FY2013 (outperforming the

industry average of 60) from 41 in FY2012.

Shareholders should also pay particular attention to our

performance in the October-December 2013 period (4Q2013),

when the strategic thrusts began to gather greater momentum.

On a year-on-year basis, net prot for 4Q2013 grew 63% to

US$3.1 million, outpacing the 34% growth in 4Q2013 revenue

to US$216.8 million and setting the stage for better performance

in FY2014 and beyond.

Our cash position remains healthy at US$40.5 million as at 31

December 2013, marking a 9.1% increase in the preceding

year.

Fully diluted earnings per share for FY2013 rose to 1.25 US

cents in FY2013 compared to 0.88 US cent in FY2012 while

net assets backing per share improved to 12.27 US cents as at

31 December 2013 from 11.67 US cents as at 31 December

2012.

Dividend

As shareholders are aware, Serial System has consistently paid

dividends every year. As FY2013 coincides with our quarter

century, I am pleased to inform you that the directors have

proposed a nal cash dividend of 0.3 Singapore cent per share

on top of the 0.24 Singapore cent interim cash dividend per

share distributed in September 2013 and the 0.25 Singapore

cent special one-off interim cash dividend per share distributed

in December 2013 to mark the 25

th

anniversary celebrations.

Corporate Social Responsibility

Serial System celebrated its silver jubilee at Resorts World

Sentosa on 1 November 2013, with our closest business

partners, investors and staff in an occasion during which we

remembered the importance of giving back to society. Serial

System, since inception, has always been mindful of remaining

a responsible corporate citizen. Hence, to commemorate this

momentous milestone in conjunction with Zhi Zhen Tan Dao

Xue Hui (Zhi Zhen Tan), a Taoist charity organization founded

by myself we donated S$150,000 (with Serial System

contributing S$100,000) each to ve Community Development

Councils. With the help of government matching, Serial System

and Zhi Zhen Tan will raise S$4.5 million (with Serial System

contributing S$1.5 million in total) over three years, from Year

2014 to Year 2016. The funds will be used to encourage an

active and fullling life after retirement for the pioneers of the

country, who has contributed their youth to our country and

to nurture and groom our youths who will become the future

leaders of the country.

In addition, to aid nancially needy students, Serial System

presented S$100,000 and S$150,000 to the Nanyang

Technological University to set up the Serial System Bursary

Fund and the Serial System Scholarship Fund, valued at

S$250,000 and S$375,000, respectively, after a 1.5 times

matching by the government.

Outlook

The strategic review outlined above has set a clear blueprint

for our growth in the coming years. Beyond improving our

value proposition and internal efciencies further, we will

also explore merger and acquisition opportunities to expand

our network beyond Asia Pacic into new markets, such as

Europe and the United States.

We will continue working resolutely to build upon the

momentum achieved last year to achieve our next revenue

target of US$1 billion by FY2014 and improve our net margin

further.

Appreciation

I wish to take this opportunity to express my heartfelt

gratitude to my fellow Directors for their invaluable guidance

and support and to members of the Serial System family at

all levels for their dedication, drive and contributions during

this eventful and signicant year.

I would also like to express my sincere appreciation to our

valued customers, suppliers, bankers, business partners,

and shareholders for their continued support.

Dr. Derek Goh Bak Heng

March 2014

12 Annual Report 2013

OPERATIONS & FINANCIAL REVIEW

Background

In view of the challenging operating environment with increasing

costs and margin pressures, the Board and Management

conducted a major strategic review during the year under review.

The resulting three-pronged strategy seeks to increase revenue,

deepen the combined value proposition and improve internal

efciencies, together putting in place the foundations and

systems necessary for future growth. The Groups performance

has already started to see positive effects following this review.

Financial Performance

The Group recorded a turnover of US$817.1 million for FY2013,

a 24% increase and crossing the S$1 billion mark for the rst

time. The increase was driven by geographical growth as

well as expansion of existing product lines, new product lines

introduced and addition of new customers. The Group also

beneted from sale of higher-value semiconductor modules.

From a standing start, the Group distributed about US$70

million worth of such modules in FY2013.

By geographical contribution, the North Asia region, which

accounted for 82% of the Groups turnover in FY2013,

recorded a 26% increase in sales compared to FY2012. Higher

contribution from existing product lines and expansion of

customer base led to a 25%, 18% and 13% increase in revenue

for Greater China, South Korea, and Taiwan, respectively. South

East Asia and India recorded a 18% rise in revenue mainly

due to higher sales to existing and new customers and higher

contribution from a new product line.

The setup of joint venture company, Serial AMSC

Microelectronics Co., Ltd with Japan distributor, AMSC Co.,

Ltd in Japan in May 2013, which the Group has a 70% stake

in, contributed revenue of US$16.4 million in FY2013. This

joint venture has allowed the Group to establish a foothold in

Japan one of Asias largest and most difcult semiconductor

markets to penetrate.

Gross Margins

The Groups gross prot margin declined from 9.5% in

FY2012 to 9.0% in FY2013 mainly due to lower margins

earned from the Groups South Korea and Singapore

subsidiaries arising from increased market competition

in South Korea and higher quantum of sales of lower

margin products in South East Asia.

Expenses and Net Prots

The 15% increase in distribution expenses was mainly

attributable to increased direct costs, such as increased

staff salary and related costs to grow newer product

lines and expand customer base, and higher freight and

transportation costs due to increased sales and higher

fuel and petrol prices.

The 34% increase in administrative expenses was mainly due

to a one-off tax compliance cost incurred by a South Korea

subsidiary, a one-off expense incurred for the 25

th

anniversary

celebrations, service fees incurred by the Group for engineering

services rendered by a supplier and higher bank charges

resulting from higher utilisation of trade nancing facilities.

The 10% increase in other operating expenses was mainly

due to higher staff salary and related costs as well as higher

depreciation charges from new ofce buildings in China and

South Korea, and higher allowance for impairment losses on

inventory obsolescence and trade receivables.

Despite the higher expenses, total expenses as a percentage

of turnover declined from 8.6% in FY2012 to 8.0% in FY2013,

underscoring the Groups efforts to improve operational and

cost efciencies.

In line with the higher adoption of business intelligence and

efforts to improve internal efciency, the Groups inventory

turnover days reduced to 30 in FY2013 from 41 in FY2012.

The Group posted a net prot after tax of US$11.2 million, an

increase of 41% as compared to US$7.9 million for FY2012,

mainly due to increased gross prot from higher sales and

higher other operating income earned. The net margin in

FY2013 increased to 1.4% from 1.2% in FY2012, reecting the

positive impact from the strategic review outlined above.

Electronic Components Distribution

Electronic components distribution segment remains the

Groups core business, contributing approximately 99.4% to the

Groups total revenue in FY2013. Segment operating prot for

the Groups electronic components distribution business was at

US$16.6 million compared to US$12.5 million in FY2012.

Annual Report 2013 13

Principal Suppliers

The Group continues to be a top electronic components

distributor in the Asia Pacic region representing leading

suppliers around the globe with well-established names, such

as Texas Instruments, ON Semiconductor, Avago Technologies,

TE Connectivity, Advanced Micro Devices, OSRAM Opto

Semiconductors, Analog Devices, BCD Semiconductor,

elo Touch Solutions, Fingerprints Cards AB, GigaDevice

Semiconductor, Hisilicon Technologies, InvenSense, Lelon,

Littelfuse, Micro Crystal AG, SHARP, Silicon Motion Technology,

TOSHIBA, TT Electronics and Walsin Technologies.

Bull Will Co., Ltd

Bull Will Co., Ltd (Bull Will) is a Taiwan company listed on the

Over-The-Counter Securities Exchange in Taiwan. The Groups

equity interest in Bull Will increased from 40.76% to 43.35%

as at 31 December 2013 due to an off-market purchase of

1,246,198 shares at NT$9.00 (US$0.30) per share totalling

about NT$11.2 million (US$0.37 million) from an existing

shareholder of Bull Will.

The Groups share of loss in Bull Will was US$0.4 million in

FY2013 as compared to US$0.5 million in FY2012. The loss,

despite achieving higher sales in FY2013, was mainly due to

high xed expenses incurred by Bull Wills manufacturing plants

in China. Bull Will has over the past two years geared up its

production capacity to prepare for its future growth plans.

Other Businesses

Serial Multivision Pte. Ltd., a 65% owned subsidiary in the

outdoor advertising media and hospitality solutions business,

recorded higher advertising income of US$1.5 million for its

outdoor advertising media business as compared to US$0.7

million in FY2012. Its hospitality solutions business recorded

revenue of US$1.3 million as compared to US$1.4 million in

FY2012. Serial Multivision incurred a loss of US$0.1 million for

the year under review, an improvement on its loss of US$0.6

million recorded in FY2012. The loss was mainly attributable to

lower sales and high xed expenses for the hospitality solutions

business.

Contract Sterilization Services Pte Ltd is a wholly owned

subsidiary engaged in the assembly, sterilization and

distribution of heart-lung packs for use in cardiopulmonary

bypass procedures and other medical component accessories.

Contract Sterilization Services recorded an increase in revenue

of US$0.6 million to US$3.5 million in FY2013 as compared

to US$2.9 million in FY2012 mainly due to increase in sales to

existing customers. It earned a net prot of US$0.6 million for

the year under review as compared to US$0.2 million in FY2012

mainly due to higher sales and gross prot achieved in FY2013.

Financial Positions

Current Assets

Trade and other receivables increased by US$48.3 million

mainly due to higher sales by the Groups subsidiaries. Trade

receivables average turnover days increased slightly from 61 in

FY2012 to 62 in FY2013.

Higher purchases by the Groups Singapore and Greater

China subsidiaries contributed to a US$13.4 million increase

in inventories due to increase in average monthly sales. The

increase in inventories attributable to newly-acquired Serial

AMSC Microelectronics Co., Ltd amounted to US$3.7 million.

Non-Current Assets

Financial assets, available-for-sale increased by US$3.9 million

mainly due to an investment in a SGX-listed equity security

amounting to US$3.8 million. Fair value loss amounting to

US$0.9 million for this investment has been recognised as fair

value reserve in equity in FY2013.

Non-current nancial assets, at fair value through prot or loss,

increased by US$0.5 million mainly due to an investment in a

convertible note with principal amount of US$0.5 million issued

by an unlisted entity incorporated in the United States.

14 Annual Report 2013

The Companys investment in subsidiaries increased by

US$15.0 million mainly due to the capitalisation of a loan due

by a wholly owned subsidiary in FY2013.

Property, plant and equipment increased by US$9.6 million

mainly due to the acquisition of new ofce units for own use

in South Korea and Shanghai, China, amounting to US$5.5

million and US$3.5 million, respectively, and new ofce

renovation costs incurred by the Groups China and South

Korea subsidiaries amounting to U$2.4 million. These increases

are negated by depreciation provided for in FY2013.

Investment properties decreased by US$2.5 million mainly

due to sale of a Singapore investment property owned by the

Company.

Current and Non-Current Liabilities

Trade and other payables increased by US$25.8 million due to

higher purchases by the Groups Hong Kong, Singapore and

South Korea subsidiaries due to higher expected sales for the

rst quarter of 2014. The increase attributable to Serial AMSC

Microelectronics Co., Ltd amounted to US$2.6 million. Trade

payable average payment days decreased slightly from 33 in

FY2012 to 32 in FY2013.

Borrowings increased by US$44.9 million mainly due to

higher bank borrowings by the Groups South Korea, Hong

Kong, Taiwan and Singapore subsidiaries to part nance the

acquisition of new ofce units in South Korea, and to provide

working capital to support higher business volume for these

subsidiaries in FY2013. Increased working capital loans

attributable to Serial AMSC Microelectronics Co., Ltd amounted

to US$9.0 million.

Earnings and Net Assets Per Share

Fully diluted earnings per share for FY2013 rose to 1.25 US

cents in FY2013 as compared to 0.88 US cent in FY2012.

Based on the issued share capital base as at the end of

FY2013, the Groups net assets backing per share improved to

12.27 US cents from 11.67 US cents last year.

Share Capital

As at the end of FY2013, the total number of issued and fully

paid ordinary shares (excluding treasury shares of 9,946,000)

were 895,841,914 on a share capital of US$72.65 million as

compared to 895,561,914 on a share capital of US$72.63

million in FY2012. The increase of 280,000 shares arose

from the exercise of share options under the Serial System

Executives Share Option Scheme. The Serial System Executives

Share Option Scheme which expired on 29 January 2014

will be renewed and subject to shareholders approval at the

forthcoming Extraordinary General Meeting of the Company on

26 April 2014.

Outlook

Having crossed the S$1 billion revenue milestone in FY2013, a

year during which it also embarked on a major strategic review,

the Group will strive towards reaching its goal of US$1 billion in

sales in FY2014. Having attained an increase in net margin to

1.4% in FY2013 from 1.2% in FY2012, the Group will also strive

to improve this further.

In line with the strategic review, some of the key thrusts which

the Group will build upon in FY2014 and beyond are:

1) expanding the Portfolio and Value-Added Products, with

particular emphasis on raising its customers bill of material

from about 60% in FY2013 to 90% in the next two to three

years. The key initiatives in this regard are:

achieve 20% penetration in the automotive sector in

the next two to three years from 8% currently;

increase exposure to mobile devices and enterprise

cloud solutions, in line with the shift towards such

devices and adoption of cloud technology; and

increase the sales volume of higher-margin

semiconductor modules from US$70 million in FY2013

to US$300 million in the next three years.

2) improving Business Intelligence and Operational Efciency,

including via higher adoption of internal forecasting and

workow improvements, centralized asset management

and greater adoption of Electronic Data Interchange by the

Groups suppliers and customers.

3) deepening penetration in existing markets and widening

geographical reach via establishing joint ventures and

merger and acquisition opportunities, including having

footprint in major markets such as Europe and the United

States.

With the implementation of these strategies, the Group will

continue working resolutely to build upon the momentum to

achieve the next revenue target of US$1 billion and further drive

improvement to the net margin.

Annual Report 2013 15

OTHER BUSINESSES

Bull Will Co., Ltd, a Taiwan company listed on the

Over-The-Counter Securities Exchange in Taiwan

became an associated company when Serial

System acquired a 34.3% interest in 2007. Serial

Systems interest in Bull Will has since increased

to 43.35%.

Bull Will, which started as a passive electronic

components distributor, has over the years

transformed itself to one with capabilities

in research and development, design and

manufacturing of a full range of magnetic

components for electronic products.

Bull Will's component products are broad-based,

including sensors, over-current protection devices,

control systems, and discrete components. These

components are widely used in power supplies,

LCD monitors, smartphones, notebooks, servers,

air-conditioners, automotives, solar inverters, etc.

Bull Will's vertical integration, production capacity,

and technical know-how enable it to quickly adapt to customers' requirements, and achieve the best price, quality, and delivery.

Bull Will aims to be the leading value-added supplier of magnetic, passive, electromechanical and discrete components with

demand-creation capabilities for all tiers of customers in the electronic industry.

Headquartered in Taipei, Taiwan, Bull Will now operates six manufacturing plants in China, supported by more than 2,100 staff.

Bul l Wi l l Co. , Ltd

( Tai wan Stock Code 6259)

Automotive Magnetics Choke

Hybrid Series (BW Patent)

Wireless Antenna Choke

16 Annual Report 2013

Serial Multivision Pte. Ltd., a 65% owned subsidiary of the

Group, has two core business divisions: Outdoor Advertising

Media and Hospitality Solutions.

The Outdoor Advertising Media business consists of large

format outdoor LED and billboard advertising displays. Our

key LED display is at Grand Park Orchard @ Knightbridge

(GPO LED), which is one of the largest outdoor commercial

LED display in Asia. GPO LED has proven itself to be a key

advertising display in Singapore. Samsung is currently taking

up the advertising display exclusively. Serial Multivision has two

more LED advertising locations at Northpoint Shopping Center.

The Hospitality Solutions business consists of Proprietary

i-connect solution that includes Intelligence Room

Infotainment Solution (IRIS), Venue360 media content

management system and Soft-based Solution (SBS). One of

our key SBS product brand is eMOS (Electronic Meal Ordering

System), which is the next-generation meal ordering system co-

developed by real nurses, dietitians and kitchen and operational

staff with the aim to transform the traditional meal ordering

process into a fully integrated system. The eMOS delivers

leading-edge applications for food service management,

hospital kitchen operations, nutrition and dietetics ofce,

hospital paperless mobile menus, clinical nutritional care,

automated food allergy checking, safety nets for special

dietetics requirement and much more. For seamless end-to-

end workow, eMOS also provides customized HL7 interfaces

with real-time information to support patients nutritional care

and meal order delivery. Our clients include local and overseas

hospitals and hotels such as Khoo Teck Puat Hospital, Jurong

Hospital, Changi General Hospital, and Alexandra Hospital

in Singapore, Samativej Hospital, Rutnin Eye Hospital and

BNH Hospital in Thailand, Fairmount Hotel Singapore, Grand

Copthorne Hotel and Great World City Service Apartment

in Singapore, Hardrock Caf Penang and Sunway Pyramid

Penang in Malaysia.

Grand Park Orchard @ Knightsbridge LED fully leased to Samsung

Serial Multivision Pte. Ltd.

Touch Medical Pad at Khoo Teck Puat Hospital

Digital Signage System and Touch Screen at Sunway Pyramid Penang

Northpoint Shopping Center iPad Touch for Nurse/Patient at Khoo Teck Puat Hospital

Annual Report 2013 17

Contract Sterilization Services Pte Ltd, a wholly owned

subsidiary of the Group, is principally engaged in the

assembly and distribution of medical devices in the medical

industry.

Contract Sterilization Services offers a full range of standard

and customized perfusion tubing packs. These products

are marketed all over the Asia Pacic region and are the

choice for many leading hospitals. The company utilises the

best components from the United States and Europe and

customizes majority of its products in accordance with its

customers stringent demands.

Contract Sterilization Services is ISO 13485 certied and

has been awarded the CE marking for its range of perfusion

products. The companys reputation for quality and innovative

designs is a result of consistent attention to materials,

machining and manufacturing techniques. Contract

Sterilization Services engineers and technicians work

closely with customers and clinical consultants to provide

the best solutions to complex problems and applications.

It implements the principals of total quality management

from initial contact with clinical professional, until the delivery

of sterile nished goods that meet customers stringent

requirements.

Contract Sterilization Services is currently strategically

Contract Sterilization Services Pte Ltd

Customized Heart Lung Pack - use in

Cardiac Bypass Surgery

Angio Pack - use in interventional

radiology

Sterile Procedural Pack

Blood Cardioplegia Set

Products Range

located near the Medtech Hub@Tukang which will house

world-class medical companies in Singapore. The Medtech

Hub is one of the initiatives by the government to actively

promote Singapore as Asias medical hub. The company is

set to harness this strategic position in commitment to meet

the stringent demands of the medical industry.

Serial System Ltd

Electronic Components Distribution

Serial Microelectronics Pte Ltd

100%

Bull Will Co., Ltd

43.35%

Serial Microelectronics Korea Limited

98.2%

Serial Microelectronics (HK) Limited

91%

Serial Microelectronics (Shenzhen)

Co.,Ltd - 100%

Serial Design Limited - 100%

Serial Microelectronics Inc.

95.5%

Teampal Enterprise Corp. - 100%

New Chinese Corporation - 100%

Bridge Electronics (Shenzhen)

Co., Ltd - 100%

Other Businesses

Serial Investment Pte Ltd

100%

SCE Enterprise Pte. Ltd.

100%

Serial Investment

(Taiwan) Inc.

100%

Contract Sterilization Services Pte Ltd

100%

Serial Multivision Pte. Ltd.

65%

Serial Multivision (Thailand)

Company Limited - 49%

Globaltronics International Pte. Ltd.

45%

Agricola Pte. Ltd.

80%

GROUP STRUCTURE

As at 26 March 2014

18 Annual Report 2013

Serial Technology Pte Ltd

100%

Serial Microelectronics Sdn. Bhd.

100%

Nippon Denka Serial Pte. Ltd.

60%

Serial AMSC Microelectronics Co., Ltd

70%

PT. Serial Microelectronics Indonesia

99%

Board of Directors

Dr. Derek Goh Bak Heng

(Executive Chairman & Group CEO)

Mr. Peter Ho I Chin

Mr. Tan Lye Heng Paul

Mr. Ravindran s/o Ramasamy

Mr. Lee Teck Leng Robson

Mr. Goi Kok Neng Ben

Audit Committee

Mr. Tan Lye Heng Paul (Chairman)

Mr. Ravindran s/o Ramasamy

Mr. Lee Teck Leng Robson

Nominating Committee

Mr. Lee Teck Leng Robson (Chairman)

Mr. Tan Lye Heng Paul

Mr. Ravindran s/o Ramasamy

Dr. Derek Goh Bak Heng

Remuneration Committee

Mr. Ravindran s/o Ramasamy (Chairman)

Mr. Tan Lye Heng Paul

Mr. Lee Teck Leng Robson

Dr. Derek Goh Bak Heng

Company Secretary

Mr. Alex Wui Heck Koon

Registered Ofce

8 Ubi View #05-01

Serial System Building

Singapore 408554

FINANCIAL CALENDAR & CORPORATE INFORMATION

2013

1st Quarter 14 February 2013 Announcement of Fourth Quarter and Financial Year 2012 Results

2nd Quarter

08 April 2013

27 April 2013

27 April 2013

15 May 2013

Release of Annual Report 2012

Annual General Meeting 2013

Announcement of First Quarter 2013 Results

Payment of 2012 Final Cash Dividend

3rd Quarter

06 August 2013

03 September 2013

Announcement of Second Quarter and Half Year 2013 Results

Payment of 2013 Interim Cash Dividend

4th Quarter

31 October 2013

04 December 2013

Announcement of Third Quarter and Nine Months 2013 Results

Payment of 2013 Special One-Off Interim Cash Dividend

2014

1st Quarter 19 February 2014 Announcement of Fourth Quarter and Financial Year 2013 Results

2nd Quarter

09 April 2014

26 April 2014

19 May 2014

Release of Annual Report 2013

Annual General Meeting 2014

Payment of 2013 Final Cash Dividend

(Subject to Shareholders approval at Annual General Meeting 2014)

Company Registration Number

199202071D

Group Website

www.serialsystem.com

Registrar & Share Transfer Ofce

B.A.C.S. Private Limited

63 Cantonment Road

Singapore 089758

Auditors

Moore Stephens LLP

Public Accountants and Chartered Accountants

10 Anson Road #29-15

International Plaza

Singapore 079903

Audit Partner : Mr. Christopher Bruce Johnson (appointed in Year 2012)

Principal Bankers

Australia and New Zealand Banking Group Limited

Bank of China (Hong Kong) Limited

BNP Paribas

China Construction Bank (Asia)

China Development Industrial Bank

Citibank, N.A.

DBS Bank Ltd

Hang Seng Bank Limited

Malayan Banking Berhad

RHB Bank Berhad

Shinhan Bank

Taipei Fubon Bank

The Hongkong and Shanghai Banking Corporation Limited

Tokyo-Mitsubishi UFJ

United Overseas Bank Limited

Annual Report 2013 19

20 Annual Report 2013

CORPORATE SOCIAL RESPONSIBILITY

Giving back to society has been deeply imbued

in Serial Systems corporate culture and we

continue to believe strongly and fulll our duties

as a responsible corporate citizen. For 19 years,

without fail, we have celebrated each Lunar

New Year at Tai Pei Old Folks Home, distributing

goody bags, red packets and bringing festive

cheer to the elderly with traditional lion dance

performances.

In Year 2013 alone, Serial System contributed

a total of S$417,000 (about US$333,000) to a

wide variety of programmes and organizations in

Singapore. Our CSR efforts have been broad in

scope, but in general, focus on contributing to

the elderly, to the poor and needy, to education

and youth development, to medical and art

programmes and to culture and heritage.

On top of the S$150,000, each CDC will match

the donations dollar-for-dollar to set up a unique

three-year (Year 2014 to Year 2016) bursary

programme amounting to S$4.5 million (with

Serial System contributing S$1.5 million in total)

to encourage active living and lifelong learning

after retirement for the pioneers of our country and

to nurture and groom our youths to become future

leaders of our country.

Apart from its contribution to the CDCs, Serial

System also presented S$100,000 and S$150,000

to the Nanyang Technological University to set up

the Serial System Ltd Bursary Fund and the Serial

System Scholarship Fund, valued at S$250,000

and S$375,000, respectively, after a 1.5 times

matching by the government.

Visit to Tai Pei Old Folks Home

25th Anniversary Donations Striving forward, giving back, Asias trusted electronic component distributor

On 1 November 2013, we celebrated our silver jubilee with the shared value that we always believed in since inception giving

back to society. At our gala dinner celebrations graced by the presence of guest of honour Deputy Prime Minister Mr. Teo Chee

Hean our theme was Striving forward, giving back, Asias trusted electronic component distributor. In line with this theme, we

presented donations of S$150,000 (with Serial System contributing S$100,000) each to ve Community Development Councils

(CDCs) in conjunction with Zhi Zhen Tang Dao Xue Hui (Zhi Zhen Tan), a Taoist charity organization founded by Dr. Derek Goh.

Deputy Prime Minister Mr. Teo Chee Hean (centre) shares a toast with Dr. Derek Goh (right) and Mr. Larry Tan (left, Asia

President, Texas Instrument) during the 25

th

Anniversary gala dinner celebrations at Resort World Sentosa.

Annual Report 2013 21

At the same event attended by several distinguished ministers,

foreign delegates, customers, suppliers, bankers, business

partners, guests and staff, Serial System and Zhi Zhen Tan

also committed to a three-year programme from Year 2014

to Year 2016 with Singapore Childrens Society, for a total of

S$105,000 (with Serial System contributing S$75,000) to be

distributed equally over the course of the programme.

Contributions to the Education and Youth Development

This year, Serial System also contributed S$100,000 towards

the building of Xinmin Secondary Schools Creative Arts

Complex and S$75,000 as co-sponsor for the World Learner

Exchange Scholarship, to be disbursed over three years from

Year 2014 to Year 2016.

Happy 25

th

Anniversary, Serial System

Serial System believes that youths should not be denied

education and development due to nancial difculties. It is

through this belief that the Group donated a total of S$49,000

to various youth development programmes such as those in

the Halogen Foundation Singapore, Heartware Network, ITE

Education Fund, Loving Heart Multi-Service Centre, Malay

Youth Literary Association and National University of Singapore,

etc.

Other Contributions

Serial System has also contributed in excess of S$93,000

to various organisations and programmes, both locally and

internationally during Year 2013.

As part of this years contribution to the poor and needy, Serial

System donated a total of S$7,000 to Tan Tock Seng Hospital to

provide nancial assistance for the less fortunate, and the Lions

Home for the Elders. It has also donated a total of S$27,000 to

Zhi Zhen Tan in support of its community programmes for the

youth, elderly and needy.

This year, Serial System contributed S$10,000 to the

preservation of Singapore heritage through its donation to the

National Heritage Board to support conservation efforts of the

iconic National Museum of Singapore, and a donation to the

Singapore Wushu Dragon and Lion Dance Federation.

World Learner Exchange Scholarship - Yang Zheng Primary School

L-R: Dr. Mohamad Maliki Osman, Mayor, South East District, Dr. Amy Khor, Mayor of South West

District, Dr. Derek Goh, Dr Teo Ho Pin, Mayor of North West District, Mr. Sam Tan Chin Siong,

Mayor, Central District, Mr. Zainal bin Sapari, Vice Chairman Of CDC

L-R: Mr. Tan Yap Peng, Associate Chair, School of Electrical & Electronic Engineering

with Dr. Derek Goh

22 Annual Report 2013

Derek Goh Bak Heng

Executive Chairman &

Group CEO

Dr. Derek Goh Bak Heng founded Serial System as a sole proprietorship in 1988,

incorporated Serial System Ltd in 1992 and was the founding Chairman and CEO when

the Company was listed in 1997.

Dr. Goh is currently the Chairman and CEO of Serial System Ltd with overall management

responsibilities for the Group. As Executive Chairman, Dr. Goh leads the Board in charting

the future direction for the Group. He is currently also a member of the Remuneration

Committee and Nominating Committee.

Dr. Goh holds an Honorary MBA degree from the American University of Hawaii and the

Honorary Doctor of Business Administration in Marketing degree from the Wisconsin

International University. He was conferred the degree of Honorary Doctor of Philosophy

in Business Administration by the Kennedy-Western University. Dr. Goh was appointed

Adjunct Professor, Faculty of Business and Design for Swinburne University of Technology

Sarawak Campus in Malaysia on 1 September 2013.

In 1996, Dr. Goh won the Entrepreneur of the Year Award, organised by the Rotary Club

of Singapore and the Association of Small and Medium Enterprises, supported by the

Trade Development Board. In 1997, Dr. Goh was elected the National President of JCI

Singapore and was conferred the Singapore Youth Award (Individual) for entrepreneurship,

the nations highest honour for youths. In 1999, Dr. Goh was conferred the ASEAN Best

Young Entrepreneur Award 1999 by the ASEAN Secretariat, and the World Association of

Small and Medium Enterprises (WASME) Special Honour Award by the World Association

of Small and Medium Enterprises on 29 March 2000. In 2004, Dr. Goh was awarded the

Public Service Medal by the President of the Republic of Singapore and in 2010, the Public

Service Star Medal (Bintang Bakti Masyarakat) on the National Day Honours 2010. In 2010,

Dr. Goh won the Asia Pacic Entrepreneurship Awards 2010 Entrepreneur of the Year

organised by Enterprise Asia and APF Group Pte Ltd and in 2011, he won the Ernst &

Young Entrepreneur Of The Year

2011 Singapore Award for the Electronic Components

Distribution Category. In 2014, Dr. Goh was elected the President of JCI Senators of South

East Asian Nations.

As at 26 March 2014, Dr. Goh holds 338,742,698 shares (37.81%) in Serial System Ltd. Dr.

Goh is a substantial shareholder of Serial System Ltd.

BOARD OF DIRECTORS

Mr. Peter Ho I Chin joined the Board of Directors on 17 August 2009. He is currently the

Executive Chairman and Group CEO of Bull Will Co., Ltd, a 43.35% owned associated

company of Serial System Ltd. As Executive Chairman and Group CEO of Bull Will Co., Ltd,

Mr. Ho assists the board in developing business strategies and charting the future direction

for the group.

Mr. Ho graduated from the Tung-Hai University in Taiwan with a Bachelor of Accountancy

degree. He has over 29 years of experience in the semiconductor and technology elds,

having held senior level positions in various multinational corporations.

As at 26 March 2014, Mr. Ho holds 500,000 shares (0.06%) in Serial System Ltd.

Peter Ho I Chin

Executive Director

Annual Report 2013 23

Mr. Tan Lye Heng Paul joined the Board of Directors on 16 June 2011. He is currently

the Chairman of the Audit Committee and a member of the Nominating Committee and

Remuneration Committee.

Apart from Serial System Ltd, Mr. Tan is also a Non-Executive and Independent Director of

SGX-listed China Sunsine Chemical Holdings Ltd and Sin Ghee Huat Corporation Ltd.

Mr. Tan holds a MBA from the University of Birmingham in the United Kingdom. He is currently

the managing director of CA TRUST PAC, a fellow member of the Institute of Singapore

Chartered Accountants, the Association of Chartered Certied Accountants and CPA

Australia and, a member of Singapore Institute of Accredited Tax Professionals Limited and

Singapore Institute of Directors.

As at 26 March 2014, Mr. Tan holds 100,000 shares (0.01%) in Serial System Ltd.

Ravindran s/o Ramasamy

Non-Executive &

Independent Director

Mr. Ravindran s/o Ramasamy joined the Board of Directors on 14 August 2001. He is currently

the Chairman of the Remuneration Committee and a member of the Audit Committee and

Nominating Committee.

Apart from Serial System Ltd, Mr. Ravindran is also a Non-Executive and Independent

Director of SGX-listed Best World International Ltd.

Mr. Ravindran holds a Master of Law from the National University of Singapore and is a

partner with Colin Ng & Partners.

Lee Teck Leng Robson

Non-Executive &

Independent Director

Mr. Lee Teck Leng Robson joined the Board of Directors on 30 December 2002. He is

currently the Chairman of the Nominating Committee and a member of the Audit Committee

and Remuneration Committee.

Apart from Serial System Ltd, Mr. Lee is also a Non-Executive and Independent Director of

several SGX-listed companies, such as Best World International Ltd, Matex International

Limited, Sim Lian Group Limited, Youyue International Limited, Sheng Siong Group Ltd and

OKH Global Ltd and Hong Kong Stock Exchange - listed Man Wah Holdings Limited.

Mr. Lee graduated from the National University of Singapore with a Second Class Upper

Honours degree in law. He is a trustee of the land on which both Hwa Chong Institution and

Hwa Chong International are situated and further holds the position of Executive Committee

member in the Board of Governors of Hwa Chong Institution. He is also the Director and

Secretary to the Board of Directors of Singapore Chinese High School. Mr. Lee is currently

a partner in Shook Lin & Bok LLPs corporate nance and international nance practice and

has been with the rm since 1994. He is also a partner in the rms China practice, focusing

on cross-border corporate transactions in China.

Mr. Goi Kok Neng Ben joined the Board of Directors on 27 April 2013.

Apart from Serial System Ltd, Mr. Goi is also a Non-Executive Director of SGX-listed Yamada

Green Resources Limited.

Mr. Goi is currently the Head of Corporate Development at SGX-listed Xpress Holdings Ltd,

a provider of print management services. Prior to joining Xpress Holdings Ltd, Mr. Goi was

Deputy Director of Overseas Sales at Hong Kong Stock Exchange-listed Trigiant Group Ltd,

a leading manufacturer of mobile telecommunications cables in China, from November 2009

to August 2013, and General Manager of Singapore-based Honjji Foods (2005) Pte Ltd from

2005 to 2009. Mr. Goi started his career with global frozen foods manufacturer, TYJ Group

in 1999 in various aspects of the business namely sales, marketing and operations.

Tan Lye Heng Paul

Non-Executive &

Independent Director

Goi Kok Neng Ben

Non-Executive Director

24 Annual Report 2013

MANAGEMENT TEAM

Derek Goh

Group Chief Executive Ofcer

Serial System Ltd

Alex Wui

Group Chief Financial Ofcer &

Group Company Secretary

Alex Wui joined Serial System Ltd in August 2000 and

was appointed Group Financial Controller in August

2006. He was re-designated as Group Chief Financial

Ofcer in April 2011.

As Group Chief Financial Ofcer, Alex is responsible

for the Groups accounting, nance, treasury and tax

functions. As Group Company Secretary, he ensures

the Group complies with all established procedures and

relevant statutes and regulations.

Alex is a Chartered Accountant with corporate advisory

and public accounting experiences gained with an

international accounting rm. He holds a Bachelor of

Accountancy degree with Honours from the Nanyang

Technological University and a MBA from the Warwick

Business School in the United Kingdom.

Sidney Thong re-joined Serial System Ltd in May 2009

as the Senior Director for Information Technology.

Sidney is in-charge of charting the IT roadmap and

managing the IT initiatives and systems for the Group.

Sidney is a Certied Project Management Professional

and Certied SAP Consultant, with extensive project

management experiences gained with SAP Asia. He

holds a Bachelor of Electrical Engineering degree from

the University of Illinois in the United States.

Sidney Thong

Senior Director

Information Technology

Sean Goh joined Serial Microelectronics Pte Ltd in June

2004 as its Sales Engineer. He was appointed Vice

President of Regional Marketing in October 2009 and

Senior Vice President of Corporate Planning, Development

and Regional Marketing in July 2011.

Sean is in-charge of marketing, planning and development

activities for the Group.

Sean holds a Bachelor of Engineering degree with

Honours from the Nanyang Technological University.

Sean Goh

Senior Vice President

Corporate Planning,

Development & Regional Marketing

As Group Chief Executive Ofcer, Derek leads the

management team in executing strategies to achieve

the goals set by the Board of Directors.

Derek Goh

Group Chief Executive Ofcer

SERIAL SYSTEM LTD

Annual Report 2013 25

Chow Tak Liang

Vice President

South Asia Pacic

TL Chow joined Serial Microelectronics Pte Ltd in October

2012 as its Vice President.

TL oversees the Groups electronic components

distribution business in South East Asia and India.

TL has over 21 years of experience in the electronic and

semiconductor industry and had held senior positions at

NXP Semiconductors and Philips Semiconductors prior

to joining the Group.

TL holds a Bachelor of Engineering Degree in Electrical

and Electronic Engineering and a Postgraduate Diploma

in Marketing from the University of Strathclyde in Scotland,

United Kingdom.

Ng Teck Cheng

Senior Vice President

Operations & Asset Management

TC Ng joined Serial Microelectronics Pte Ltd in June

2004 as its Operations and Logistics Director. He was

appointed Senior Vice President, Operations and Asset

Management in October 2009.

Prior to joining the Group, TC held senior level positions

at Texas Instruments Singapore and Kintetsu World

Express. He holds a Bachelor of Science degree from the

National University of Singapore and a Master of Business

in Information Technology from RMIT.

Adrian Chu

Group Chief Operating Ofcer

Adrian Chu joined Serial Microelectronics Pte Ltd in June

2011 as its Group Chief Operating Ofcer.

Adrian is responsible for charting the business roadmap,

developing strategic plans and implementing programs to

ensure the attainment of corporate goals for the growth

and protability of the Groups electronic components

distribution business.

Adrian has over 28 years of experience in the electronic

and semiconductor industry. Prior to joining the Group,

he was the Senior Vice President, Asia Pacic Sales

& Marketing and General Manager for the Standard

Products Business Group in NASDAQ-listed Fairchild

Semiconductor, and was Vice President of NASDAQ-

listed NXP Semiconductors.

Adrian holds a Bachelor of Business Administration degree

from the Royal Melbourne University in Australia. He also

graduated from Singapore Polytechnic in Electronics and

Communications and Singapore Institute of Management

in Management Studies.

SERIAL MICROELECTRONICS PTE LTD

William Low joined Serial Microelectronics Pte Ltd in

August 2013 as its Vice President.

William oversees the Groups electronic components

distribution business in Japan and Taiwan.

William has over 30 years of experience in the electronic

and semiconductor industry and had held senior

level positions at Excelpoint Systems and Dovatron

International Inc. prior to joining the Group.

William holds a Diploma in Production Engineering

from Singapore Polytechnic and a Manufacturing

Consultant certicate from SANNO Institute of Business

Administration, Japan. He is also a qualied practitioner

of MTMII from the MTM Association, Sweden.

William Low

Vice President

Japan & Taiwan

26 Annual Report 2013

Peter Ho was appointed Group Chief Executive Ofcer of

Bull Will Co., Ltd in March 2011.

As Group Chief Executive Ofcer, Peter leads the

management team of Bull Will in executing strategies to

achieve the goals set by its board of directors.

Peter Ho

Group Chief Executive Ofcer

Bull Will Co., Ltd

Taiwan

Kim Sang Yeol

President

Serial Microelectronics Korea Limited

South Korea

SY Kim was appointed President of Serial Microelectronics

Korea Limited (SMKR) in May 1999.

As Country Head of SMKR, SY oversees the Groups

electronic components distribution business in South

Korea.

SY has over 30 years of experience in the semiconductor

and technology eld and had held senior level positions

at Space Semiconductor Trading Limited and Alpha

Technology Industries Limited.

SY holds a Bachelor of Electronics Engineering degree

from KwangWoon University in South Korea.

Lawrence Ho

President

Serial Microelectronics (HK) Limited

Hong Kong & China

Lawrence Ho was appointed President of Serial

Microelectronics (HK) Limited (SMHK) in July 2001.

As Country Head of SMHK, Lawrence oversees the

Groups electronic components distribution business in

Hong Kong and China (Greater China).

Prior to joining SMHK, Lawrence owned Innowave

Technology Ltd, a company engaged in trading and

distribution of electronic components in Hong Kong.

Lawrence holds a Bachelor of Electronics Engineering

degree from Hong Kong Polytechnic University in Hong

Kong.

Jesse Jeng

President

Serial Microelectronics Inc.

Taiwan

Jesse Jeng was appointed President of Serial

Microelectronics Inc. (SMTW) in January 2007.

As Country Head of SMTW, Jesse oversees the Groups

electronic components distribution business in Taiwan.

Jesse has over 27 years of experience in the electronic

trading and distribution industry, including 4 years at

Chander Electronics Corp and 11 years at Arrow Electronics

(Taiwan) Ltd.

Jesse holds a Bachelor of Electrical Engineering degree

from Johns University and a Physics degree from Tamkang

University in Taiwan.

Simon Choo

Chief Executive Ofcer

Serial Multivision Pte. Ltd.

Simon Choo joined Serial Multivision Pte. Ltd. as its Chief

Executive Ofcer in November 2009.

Simon is responsible for the day-to-day operations, strategic

business development, as well as sales and marketing of

Serial Multivision.

Simon has over 18 years of entrepreneurial experience

in media, advertising and venue management solutions.

Prior to joining Serial Multivision, he was the co-founder of

MediaBoxOfce Pte Ltd.

Simon holds a Diploma of Manufacturing from Singapore

Polytechnic in Singapore and a Bachelor of Business

(Marketing) from Queensland University of Technology

(QUT) in Australia.

COUNTRY HEADS

Annual Report 2013 27

Both Board of Directors (the Board) and Management are committed to high standards of corporate governance and have

adopted practices contained in the Best Practices Guide issued by the Singapore Exchange Securities Trading Limited (the SGX-

ST).

The Boards conduct of its affairs

The Boards primary role is to protect and enhance the long-term shareholders value. Besides setting the overall strategic direction

for the Group, the Board also provides entrepreneurial stewardship such as establishing goals for the Management and regularly

monitoring the achievement of these goals.

The Board monitors Management performance and oversees the processes for evaluating the adequacy of internal controls,

nancial reporting and compliance.

For the effective execution of its responsibilities, the Board has delegated most of its functions to the various Board committees.

These are the Audit Committee (AC), Nominating Committee (NC), and Remuneration Committee (RC). All the Board

Committees are actively engaged and play an important role in ensuring good corporate governance in the Company and within

the Group.

The Board is informed of the key matters discussed in each Board Committee meeting. At all times, the Board and the Board

Committees have independent access to the Chief Executive Ofcer (CEO), members of the Management and the Company

Secretary. There is a clear demarcation of responsibilities between the Board and the Management.

Matters which require Boards approval

The Board continues to approve matters, which, under the Companies Act and SGX-STs Listing Manual, require the Boards

approval. Specically, the Board has direct responsibility for decision making in the following:

Jo|nt ventures, acqu|s|t|ons, and mergers

Sa|es and purchases of shares |n Ser|a| System |td and |ts subs|d|ar|es and assoc|ated compan|es, and other compan|es

Oap|ta| expend|ture exceed|ng S$2.0 m||||on equ|va|ent to S$1.6 m||||on}

D|sposa| of assets exceed|ng S$2.0 m||||on equ|va|ent to S$1.6 m||||on}

Borrow|ng exceed|ng S$5.0 m||||on equ|va|ent to S$4.0 m||||on}

lnterested person transact|ons for an amount equa| to or more than S$100,000 equ|va|ent to S$80,000}

Dec|arat|on of d|v|dends by Ser|a| System |td

Appo|ntment of D|rectors and Oh|ef Execut|ve Offcer of Ser|a| System |td

Orientation and training for directors

A formal letter of appointment is provided to every new director, indicating the duties and obligations under the Groups policies,

processes and best practices in corporate governance.

The Company conducts briengs, which is presented by CEO and Management, to familiarise new directors with its business,

operations and management structure. These briengs give directors an understanding of the Companys businesses to enable

them to assimilate into their new roles. Directors also meet with Management in order to understand the Companys businesses

more effectively.

All directors are kept informed of updates and developments in relevant areas such as corporate governance, nancial reporting

standards and applicable rules and regulations. The Company will enroll all incoming directors to courses which cover roles and

responsibilities of directors for a listed company, so as to enable them to properly discharge their duties.

New directors can request for further explanations, briengs or information on any aspect of the Groups operations or issues from

Management.

CORPORATE GOVERNANCE REPORT

28 Annual Report 2013

Board composition and balance

The composition of the current Board and Board Committees, and attendance at meetings held in the year under review are as

shown below:

Table 1: Board and Board Committees:

Name of Director

Date of

appointment

Date of last

re-election

Main Board

Audit

Committee

Nominating

Committee

Remuneration

Committee

Status Position Position Position Position

Derek Goh Bak Heng

(1)

26 October 1998 26 October 1998

Executive/

Non-independent

Executive

Chairman &

Group CEO

- Member Member

Peter Ho I Chin

(2)

17 August 2009 27 April 2013

Executive/

Non-independent

Member - - -

Tan Lye Heng Paul 16 June 2011 28 April 2012

Non-Executive/

Independent

Member Chairman Member Member

Ravindran s/o

Ramasamy

14 August 2001 27 April 2013

Non-Executive/

Independent

Member Member Member Chairman

Lee Teck Leng Robson 30 December 2002 28 April 2012

Non-Executive/

Independent

Member Member Chairman Member

Goi Kok Neng Ben

(3)

27 April 2013 -

Non-Executive/

Non-Independent

Member - - -

(1)

Appointed Group Managing Director on 1 March 2001 and is not subjected to retirement by rotation pursuant to Serial System Ltds Articles of

Association

(2)

Executive Chairman and Group CEO of Bull Will Co., Ltd, a 43.35% owned associated company of Serial System Ltd

(3)

Son of Mr. Goi Seng Hui, a substantial shareholder of Serial System Ltd

Table 2: Attendance at Board and Board Committee Meetings:

Name of Director Board

Audit

Committee

Nominating

Committee

Remuneration

Committee

Number of meetings held 5 4 1 1

Number of meetings attended:

Derek Goh Bak Heng 5 NA 1 1

Peter Ho I Chin 3 NA NA NA

Tan Lye Heng Paul 5 4 1 1

Ravindran s/o Ramasamy 5 4 1 1

Lee Teck Leng Robson 4 3

1 1

Goi Kok Neng Ben

(1)

2 NA

NA NA

(1)

Two meetings were held in Year 2013 subsequent to his appointment on 27 April 2013

NA Not Applicable

Currently, the Board comprises two executive directors, one non-executive director and three independent directors.

The Board is guided by the denition of independence given in the Code of Corporate Governance issued by the Corporate

Governance Committee in determining if a director is independent. Mr. Lee Teck Leng Robson, an independent director, is a

partner at Shook Lin & Bok LLP (SLB). SLB had during FY2013 provided legal advisory services to the Group. The aggregate

value of professional fees paid to SLB by the Group in FY2013, in respect of work undertaken in FY2012 and FY2013, was

approximately S$165,000 (equivalent to US$131,000). Mr. Lee was however not the partner in charge of the relevant matters nor

had he in any way acted in a professional capacity in relation to the legal advisory services that had been provided by SLB to the

Group.

The NC (excluding Mr. Lee Teck Leng Robson) has reviewed and conrmed that, notwithstanding the foregoing, Mr. Lee Teck

Leng Robson remains an independent director. The conduct of the relevant legal advisory services was not undertaken by Mr.

Lee, and the fees paid to SLB over a period of two nancial years were entirely in accordance with the prevailing market rates

for such professional legal services that had been vigorously negotiated and agreed independently by the Management with the

concurrence of the Board (without the participation of Mr. Lee Teck Leng Robson).

Annual Report 2013 29

The NC has also reviewed and conrmed that Mr. Tan Lye Heng Paul and Mr. Ravindran s/o Ramasamy are independent directors.

In determining the size, the Board maintains the view that there are sufcient directors to serve on the various committees without

over-burdening them and making it convenient for them to discharge their responsibilities. As for composition, the Board is of the

opinion that at least one-third of the number should be independent and non-executive.

Directors appointed by the Board are subject to election by shareholders at the annual general meeting (AGM). All directors are

subject to re-election once every three years, if re-nominated by the NC.

The NC (with Mr. Tan Lye Heng Paul and Mr. Lee Teck Leng Robson abstaining in respect of their re-nomination) recommended

to the Board that Mr. Tan Lye Heng Paul and Mr. Lee Teck Leng Robson who retire pursuant to Article 89 of Serial System Ltds

Articles of Association and Mr. Goi Kok Neng Ben who retires pursuant to Article 88 of Serial System Ltds Articles of Association,

be nominated for re-appointment at the forthcoming AGM on 26 April 2014.

Chairman and Chief Executive Ofcer

Dr. Derek Goh Bak Heng is the Founder, Executive Chairman and Group Chief Executive Ofcer (CEO), playing a pivotal and

instrumental role in developing the Groups businesses and providing the Group with strong leadership and vision. In addition to

the day-to-day running of the Group, he is to ensure that each member of the Board and the Management work well together with

integrity and competency. He also takes on a leading role in ensuring the Groups drive to achieve and maintain a high standard

of corporate governance practices.

Dr. Derek Goh Bak Hengs performance and remuneration package are reviewed periodically by the NC and RC, respectively. As

such, the Board is of the view that adequate safeguards are in place to ensure a good balance of power and responsibility.

The Board has decided that it would currently not be in the Groups interests to institute a separation in the role of the Chairman

from that of the CEO. The Board views that in the best interests of the Group, Dr. Derek Goh Bak Heng should continue to be the

Chairman of the Board and CEO of the Group for the current year.

Nominating Committee

Mr. Lee Teck Leng Robson chairs the NC. Other members of the NC are Mr. Tan Lye Heng Paul, Mr. Ravindran s/o Ramasamy

and Dr. Derek Goh Bak Heng. Besides Dr. Derek Goh Bak Heng, all the other three members of the NC are independent directors.

The NC has its terms of reference. Specically, it:

determ|nes the cr|ter|a for |dent|fy|ng cand|dates and rev|ew|ng nom|nat|ons for the appo|ntments as d|rectors and OEO

dec|des how the Board`s performance may be eva|uated and proposes object|ve performance cr|ter|a for the Board`s

approval

assesses the effect|veness of the Board as a who|e

assesses the contr|but|on by each |nd|v|dua| d|rector to the effect|veness of the Board

re-nom|nates any d|rector, hav|ng regard to the d|rector`s contr|but|on and performance

determ|nes on an annua| bas|s whether a d|rector |s |ndependent

dec|des whether a d|rector |s ab|e to and has been adequate|y carry|ng out h|s or her dut|es as a d|rector of the Group,

particularly when the director has multiple board representations and

|dent|fes gaps |n the m|x of sk|||s, exper|ences and other qua||t|es requ|red |n an effect|ve board so as to better nom|nate

or recommend suitable candidates to ll the gaps

A member of the NC holds ofce until the next AGM following his appointment and may, subject to the prior approval of the Board,

be re-appointed to such ofce.

The NC held one meeting in Year 2013 and the attendance by the members is tabulated in Table 2 Attendance at Board and

Board Committee Meetings above.

30 Annual Report 2013

Board performance

The Board, through the NC, has used its best effort to ensure that directors appointed to the Board, whether individually or

collectively, possess the background, experience, knowledge in the business, as well as competencies in nance and management

skills critical to the Groups businesses. It has also ensured that each director, with his special contributions, brings to the Board an

independent and objective perspective to enable sound, balanced and well-considered decisions to be made.

The NC has reviewed the performance and effectiveness of the Board as a whole, the respective Board Committees, as well as the