Beruflich Dokumente

Kultur Dokumente

IFRS Seminar Loan Loss Provisioning

Hochgeladen von

williamcplaiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IFRS Seminar Loan Loss Provisioning

Hochgeladen von

williamcplaiCopyright:

Verfügbare Formate

35

35

III. Loan Loss Provisioning

36

36

Agenda

Loan Loss Provisioning a key to a true and fair view in

bank accounting and prudent banking supervision

Incurred Loss Model of IAS 39

The Model

Shortcomings

Expected Loss Model (IASB ED/2009/12)

The Model

Application challenges

Accounting Impairment vs. Expected Loss in Basel II

37

37

Loan Loss Provisioning

Key for a faithful presentation in the Accounts of Banks

Key for Bank Accounts as a sound basis for banking

supervision purposes

Inherent trade off as Loan Loss Provisioning should

lead to a reliable measurement of financial assets (loans)

not over estimate financial assets (loans)

not result in hidden reserves

lead to a timely recognition of risk provisioning

In addition Loan Loss Provisioning should have a counter-

cyclical effect from a stability point of view

38

38

Incurred Loss Model of IAS 39

The Model (1)

Impairment Identification for Financial Instruments at cost

At each balance sheet date, financial assets or group of

financial assets to be tested for objective evidence of

impairment (IAS 39.58 and .59)

Impairment measurement

No Loan Loss Provisions at initial recognition (day one)

Financial Instruments that are individually significant

- testing for objective indication of impairment

- testing for actual impairment individually

Otherwise testing for actual impairment collectively (portfolio basis)

To be recognised it is necessary that there is objective evidence

of impairment; that impairment-events have arisen after

issuance (trigger events IAS 39.59)

39

39

Incurred Loss Model of IAS 39

The Model (2)

Impairment measurement calculation of specific

impairment (IAS 39.63, AG84)

Impairment loss as the difference between carrying amount

and discounted value of the estimated future cash flow using

the original effective interest rate

Effective interest rate on variable-rate financial instruments is

the current contractual effective interest rate

Short-term receivables are not discounted if the resulting

effect is immaterial

Valuation at current market price permissible as a simplification

measure

Impairment loss to be included in profit and loss

40

40

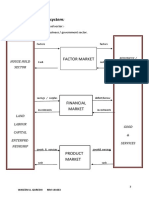

Incurred Loss Model of IAS 39

The Model (3)

objective evidence

of impairment

(trigger events)

individually significant not individually significant

test of actual

impairment

impairment

individually collectively

individually collectively

indication

no indication

impairment

no impairment

41

41

Incurred Loss Model of IAS 39

The Model (4)

Impairment measurement calculation of portfolio value

Financial assets are grouped due to similar credit risk

characteristics (IAS 39.AG87)

IAS 39.59(f) observable data indicate that there is a measurable

decrease in the estimated future cash flows

Future cash flow to be calculated from historical default rates

adjusted for current market conditions (IAS 39.AG89)

According to IAS 39, an allowance for collective (portfolio)

impairment on a performing portfolio has to be established for

incurred but not (yet) reported losses

Formula-based approaches or statistical methods may be used for

calculation (IAS 39.AG92)

Similarities to Basel II EL calculation possible

Formula need amongst others Loss Identification Period (LIP-Factor)

EL = (Carrying Amount Collateral) x PD x LIP

42

42

Incurred Loss Model of IAS 39

Shortcomings

Expected losses not recognised before trigger events occur

Overstatement of interest revenue before trigger event

(front-loading)

Does not reflect the underlying economics of the transaction

Triggers inconsistently applied in practices

Loss recognition too late

During the financial crisis there has been clear evidence that

IAS 39 incurred loss model resulted in delayed loss recognition

and has a cyclical effect

43

43

Forward Looking Provisioning

G 20 request (April 2009 London Summit)

We agree [] to call on the accounting standard setters to

work urgently with supervisors and regulators to improve

standards on valuation and provisioning and achieve a single

set of high-quality global accounting standards

We have agreed that accounting standard setters should []

strengthen accounting of loan-loss provisions by incorporating

a broader range of credit information

Strengthened regulation and supervision must [] dampen

rather than amplify the financial and economic cycle

In future, regulation must [] require buffers of resources to

be built up in good times

44

44

Expected Loss Model

(IASB ED/2009/12)

June 2009: Request for Information

Impairment of Financial Assets: Expected Cash Flow

Approach (Expected Loss Model)

5

th

November 2009 ED/2009/12

(phase 2 of IAS 39-Replacemet Project)

Financial Instruments: Amortised Cost and Impairment

Establishment of Expert Advisory Panel

Comment deadline: 30

th

June 2010

Final Standard: 2010

Application: 2013 ?

(around 3 years after final standard)

45

45

Expected Loss Model (IASB ED/2009/12)

The Model (1)

Main outcomes of the ECF approach

Single impairment model to be used

Earlier recognition of impairment losses

Eliminates front loading of interest revenue

Better reflects underlying economics

(e.g. pricing of instruments when lending decision is made)

Main features of the ECF approach

Interest revenue is recognised on the basis of expected cash

flows (including initial expected credit losses)

Impairment results from an adverse change in credit loss

expectations

Reversal of impairment loss when expectations change

favourably

Re-estimation of expected cash flows each period

46

46

Expected Loss Model (IASB ED/2009/12)

The Model (2)

Objective:

To improve the accounting for provisions for losses on loans

taking into consideration expected losses, resulting in more

timely recognition of losses

To reflect the economic reality of lending by recognising

interest revenue as a credit cost adjusted return, which

eliminates the frontloading of interest revenue

Scope:

The requirements of the ED shall be applied to all items

within the scope of IAS 39 that are measured at amortised

cost

47

47

Expected Loss Model (IASB ED/2009/12)

The Model (3)

The Expected Loss Model requires

to determine the expected credit loss on the financial asset

when that asset is first obtained

to recognise contractual interest revenue, less the initial

expected credit losses, over the life of the instrument

to build up a provision over the life of the instrument for the

expected credit loss

to reassess the expected credit loss each period

to recognise immediately the effects of any changes in credit

loss expectations

48

48

Expected Loss Model (IASB ED/2009/12)

The Model (4)

Measurement Principles

Amortised cost shall be calculated using the effective interest

method. Hence, amortised cost is the present value calculated

using

- the expected cash flows over the remaining life of the

financial instrument

- the effective interest rate as the discount rate

The estimate for the cash flow inputs are expected values.

Hence, estimates of the amounts and timing of cash flows are

the probability-weighted possible outcomes

49

49

Expected Loss Model (IASB ED/2009/12)

The Model (5)

Amortised cost is the amount at which a financial asset is

measured at initial recognition adjusted over time as

follows

minus principal repayments

plus or minus the cumulative amortisation using the effective

interest method of any difference between the initial amount

and the maturity amount

plus or minus any addition or reduction resulting from the

effect of revising estimates of expected cash flows (e.g.

regarding prepayments or uncollectibility) at each

measurement date

The estimate of expected cash flows has to consider

All contractual terms of the financial instrument

(e.g. prepayment, call or similar options)

Credit losses over the entire life of the asset

50

50

Expected Loss Model (IASB ED/2009/12)

The Model (6)

Presentation

The statement of comprehensive income shall inter alia include

the following:

Gross interest revenue ( = contractual interest revenue)

- Initial expected credit losses (portion allocated to the period)

_________________________________________________

= Net interest income revenue ( = economic interest revenue)

Gains and losses resulting from changes in credit loss expectation

51

51

Expected Loss Model (IASB ED/2009/12)

Application Challenges

Establishment of a Expert Advisory Group

Advise the Board on how operational challenges of the ECF

approach might be solved

Assist in field testing

Extensive outreach activities

Many practical issues in applying the new impairment rules

have to be solved

52

52

Accounting Impairment vs. Expected

Loss in Basel II

Time horizon

IASB / Accounting: Lifetime of the financial instrument

Basel / Supervision: one-year PDs

Calculation base

IAS 39: focus on categories at amortised cost;

different methods

Basel II: investment book; EL = EAD x LGD x PD

Default definition

IAS 39.59: trigger events

Basel II: debtor is unlikely to pay / 90 day past due

Interest rate

Basel: no reflection

IAS 39: relevance of effective interest rate

Common use of data base seems to be possible

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- GW 2013 Arab World Sample PagesDokument9 SeitenGW 2013 Arab World Sample PagesAlaaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- U Ii NBFCDokument272 SeitenU Ii NBFCDeepshi GargNoch keine Bewertungen

- Letter of AdviceDokument2 SeitenLetter of AdviceAndrew100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Twenty4: How To Ace Four of The Toughest Job Interview QuestionsDokument2 SeitenTwenty4: How To Ace Four of The Toughest Job Interview QuestionsAlliant Credit UnionNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Union County Real Estate Tax Debt ListDokument92 SeitenUnion County Real Estate Tax Debt ListDelinquencyReport.com100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Research Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessDokument59 SeitenResearch Report The Contribution of Micro Finance Banks in The Empowerment of Small-Scale BusinessAvik BarmanNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Customer Relationship and Wealth ManagementDokument65 SeitenCustomer Relationship and Wealth ManagementbistamasterNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Statement 29489630 USD 2023-03-20 2023-03-24Dokument1 SeiteStatement 29489630 USD 2023-03-20 2023-03-24Aires C FestoNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Sports Hub Traffic BrochureDokument2 SeitenSports Hub Traffic BrochureDavidLiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- 17k Carding Dorks 2019Dokument16 Seiten17k Carding Dorks 2019Kenia Flores100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- 14TH Annual Report: Year Ended - 3 (. O3.2Oo9Dokument19 Seiten14TH Annual Report: Year Ended - 3 (. O3.2Oo9ravalmunjNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Liquidity Ratio 001Dokument4 SeitenLiquidity Ratio 001Anurag SahrawatNoch keine Bewertungen

- Sample StatementDokument1 SeiteSample StatementMurali TNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Jyoiti PathakDokument53 SeitenJyoiti PathakNitinAgnihotriNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Advance Portfolio ManagementDokument7 SeitenAdvance Portfolio ManagementKinza ZaheerNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Percentages Shortcuts Formulas For CAT - EDUSAATHIDokument4 SeitenPercentages Shortcuts Formulas For CAT - EDUSAATHITushar Tiku100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Anamika HDFC RecutimetDokument119 SeitenAnamika HDFC RecutimetAbhijeet KumarNoch keine Bewertungen

- Banking Law Notes 11Dokument4 SeitenBanking Law Notes 11Afiqah IsmailNoch keine Bewertungen

- Gulbarga TalukDokument88 SeitenGulbarga TalukRajesh JelleluNoch keine Bewertungen

- FIN80004 Lecture1Dokument28 SeitenFIN80004 Lecture1visha183240Noch keine Bewertungen

- IRM Sessional Test Notes - Introduction To Risk and InsuranceDokument5 SeitenIRM Sessional Test Notes - Introduction To Risk and InsuranceRupesh SharmaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Notes Payable, Long-Term Debt, and Interest NarrativeDokument3 SeitenNotes Payable, Long-Term Debt, and Interest NarrativeCaterina De Luca100% (3)

- Deepak Mohanty: Implementation of Monetary Policy in IndiaDokument11 SeitenDeepak Mohanty: Implementation of Monetary Policy in Indianitin_panditNoch keine Bewertungen

- Report Header: Message 1Dokument2 SeitenReport Header: Message 1Yash EmrithNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- H2Hspecs PDFDokument174 SeitenH2Hspecs PDFziaur060382Noch keine Bewertungen

- The Nature and History of InsuranceDokument24 SeitenThe Nature and History of InsuranceAdnan RasheedNoch keine Bewertungen

- Setting Credit LimitDokument5 SeitenSetting Credit LimitYuuna Hoshino100% (1)

- Extended Settlement PlanDokument3 SeitenExtended Settlement PlanMadushike JayawickramaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- R05 Time Value of Money IFT Notes PDFDokument28 SeitenR05 Time Value of Money IFT Notes PDFAbbas0% (1)

- PRM Study Guide Exam 1Dokument29 SeitenPRM Study Guide Exam 1StarLink1Noch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)