Beruflich Dokumente

Kultur Dokumente

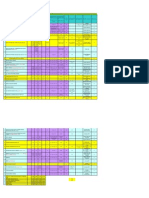

FII Inflows After Election

Hochgeladen von

kirang gandhiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FII Inflows After Election

Hochgeladen von

kirang gandhiCopyright:

Verfügbare Formate

www.fpindia.

in

FII inflows

Indian has managed to attract strong FII flows so far in the year 2014 despite geo-political

uncertainties and this was possible because India managed to bring down fiscal deficit,

current account deficit and revival in GDP growth.

Since the new Government took over, foreign investors have pumped in over Rs. 45,000

crore ($7.5 billion) into Indian equities, taking the total investments to Rs. 77,803.24 crore

($12.947 billion) this fiscal.

According to a study by Bank of America-Merrill Lynch, foreign institutional investors

ownership in the Sensex hit an all-time high of 22.5 per cent in the June quarter.

The mutual fund industrys assets under management crossed Rs. 10 lakh crore. What is

heartening is the interest of small investors in equity mutual funds. These investors have

avoided stocks since the 2008 rout.

Gautam Chhaochharia, Head of India Research, UBS, said several small steps in the right

direction have boosted the confidence on Indian equity.

Foreign direct investment in defence and railway infrastructure projects and proposals on

real estate investment trusts/ infrastructure investment trusts are some of the initiatives

welcomed by all, he said, adding UBS maintains a year-end target of 8,000 for Nifty.

There is progress even in complex areas such as labour reforms, Good and Services Tax

roll-out and initiating amendments to the Land Acquisition Act, Gautam added.

In a note, Mirae Asset Global Investments, one of the worlds largest investment managers

in emerging market equities, said Modis team had quickly settled down to address pressing

issues of policy paralysis. Modis growth model is a blend of China-like infrastructure,

coupled with Singapore-like bureaucratic efficiency, adapted to India, Mirae said. We

believe India is on the cusp of a multi-year bull market.

www.fpindia.in

Signs of recovery

Anoop Bhaskar, Group President and Head of Equity, UTI Mutual Fund, said: We are seeing

signs of economic recovery after three years of slowdown. Various sectors are now showing

signs of bottoming out from the slowdown. One has to wait and see whether it could be V-

shaped or U-shaped on the economic front.

Every general election presents optimism in stock markets and after the three months, the

momentum peters out. But this time, the market has been performing well as for the first

time after 1984 we got a single party rule, and expectations are running high, he added.

In this Government, no individual is trying to hog the limelight and for the first time in

several years, supremacy of the Prime Ministers authority has been visible.

Besides, a change in the Government work culture, empowering bureaucrats and fast

decision-making signal that the budgeted amount will be put to use more efficiently,

Bhaskar said.

"I agree that investor sentiment is really very solid. It is not just in India. We have talked to

many international investors and almost uniformly there is a lot of confidence in India's

growth potential now and we certainly are in a very good position," said Saugata

Bhattacharya, Economist, Axis Bank.

"A better environment is beginning to set up for a recovery to happen without really pushing

inflation higher because in this particular quarter (June qtr), if you look at GDP deflator

based inflation, it has actually gone up for the whole GDP by almost a per ..

Note : Meeting priority to appt. only

For Further Details kindly Contact :

Thanks and Regards,

Kirang Gandhi

Personal Financial Planner

http://www.fpindia.in

M-9028142155

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- European Central Bank Deposit Rates Are Now Negative.Dokument2 SeitenEuropean Central Bank Deposit Rates Are Now Negative.kirang gandhiNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- With Marriage Comes Greater Responsibilities - 1Dokument4 SeitenWith Marriage Comes Greater Responsibilities - 1kirang gandhiNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Market at High What To DoDokument2 SeitenMarket at High What To Dokirang gandhiNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Free Advice Vs Fees Based AdviceDokument4 SeitenFree Advice Vs Fees Based Advicekirang gandhiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Sensex Cross 100,000 by 2020Dokument2 SeitenSensex Cross 100,000 by 2020kirang gandhiNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Income Tax Calculator FY 2014/15 in ExcelDokument4 SeitenIncome Tax Calculator FY 2014/15 in Excelkirang gandhiNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Reality of Real EstateDokument2 SeitenReality of Real Estatekirang gandhiNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Common Money MistakesDokument3 SeitenCommon Money Mistakeskirang gandhiNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- FMPDokument2 SeitenFMPkirang gandhiNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Invite Finacial DisasterDokument5 SeitenInvite Finacial Disasterkirang gandhiNoch keine Bewertungen

- FCNR AccountsDokument2 SeitenFCNR Accountskirang gandhiNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Uncertainty On LiquidityDokument2 SeitenUncertainty On Liquiditykirang gandhiNoch keine Bewertungen

- FCNR DepositsDokument2 SeitenFCNR Depositskirang gandhiNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- FIIs Invest $1 BN in Debt MarketDokument1 SeiteFIIs Invest $1 BN in Debt Marketkirang gandhiNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Investors Lost Rs.1.5 Lakh CroreDokument7 SeitenInvestors Lost Rs.1.5 Lakh Crorekirang gandhiNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Invite Finacial DisasterDokument5 SeitenInvite Finacial Disasterkirang gandhiNoch keine Bewertungen

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Dokument2 SeitenFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- FD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)Dokument2 SeitenFD Ready Recknor (Fresh Deposits) : (Trust) For 14 Months (Ind)kirang gandhiNoch keine Bewertungen

- Health Insurance Comparison Chart NEWDokument10 SeitenHealth Insurance Comparison Chart NEWkirang gandhiNoch keine Bewertungen

- April F.D.Dokument14 SeitenApril F.D.kirang gandhiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Income Tax Calculator 2013-14Dokument2 SeitenIncome Tax Calculator 2013-14kirang gandhiNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Common Mistakes To Avoid The Situation of Financial CrisesDokument5 SeitenCommon Mistakes To Avoid The Situation of Financial Criseskirang gandhiNoch keine Bewertungen

- Lic Jeevan Sugam 5.59% After 10 YearsDokument2 SeitenLic Jeevan Sugam 5.59% After 10 Yearskirang gandhiNoch keine Bewertungen

- How Life Insurance Agents Fools Me Due To My Laziness.Dokument7 SeitenHow Life Insurance Agents Fools Me Due To My Laziness.kirang gandhiNoch keine Bewertungen

- Finland Prepares For Expected Euro Zone Break UpDokument1 SeiteFinland Prepares For Expected Euro Zone Break Upkirang gandhiNoch keine Bewertungen

- The Countdown Has Begun Euro Is The HistoryDokument2 SeitenThe Countdown Has Begun Euro Is The Historykirang gandhiNoch keine Bewertungen

- Eurozone Debt CrisisDokument2 SeitenEurozone Debt Crisiskirang gandhiNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Points To Consider When Buying Health InsuranceDokument7 SeitenPoints To Consider When Buying Health Insurancekirang gandhiNoch keine Bewertungen

- Few Days Are Left To Finish The EuroDokument2 SeitenFew Days Are Left To Finish The Eurokirang gandhiNoch keine Bewertungen

- Caase 31Dokument17 SeitenCaase 31Mohamed ZakaryaNoch keine Bewertungen

- PH Customer Pricelist 2017Dokument1 SeitePH Customer Pricelist 2017rosecel jayson ricoNoch keine Bewertungen

- Importance and Challenges of Smes: A Case of Pakistani Smes: EmailDokument8 SeitenImportance and Challenges of Smes: A Case of Pakistani Smes: EmailDr-Aamar Ilyas SahiNoch keine Bewertungen

- Case 1: Komatsu NotesDokument4 SeitenCase 1: Komatsu NotesCindy WangNoch keine Bewertungen

- Pampanga PB ValisesDokument20 SeitenPampanga PB Valisesallyssa monica duNoch keine Bewertungen

- PROBLEM1Dokument25 SeitenPROBLEM1Marvin MarianoNoch keine Bewertungen

- "Customer Relationship Management in ICICI Bank": A Study OnDokument6 Seiten"Customer Relationship Management in ICICI Bank": A Study OnMubeenNoch keine Bewertungen

- Chase Credit Card ApplicationDokument4 SeitenChase Credit Card ApplicationJames McguireNoch keine Bewertungen

- A SWOT Analysis On Six SigmaDokument10 SeitenA SWOT Analysis On Six SigmasmuNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FinalDokument107 SeitenFinalAarthi PriyaNoch keine Bewertungen

- Elaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Dokument15 SeitenElaine Valerio v. Putnam Associates Incorporated, 173 F.3d 35, 1st Cir. (1999)Scribd Government DocsNoch keine Bewertungen

- Accounting For Embedded DerivativesDokument22 SeitenAccounting For Embedded Derivativeslwilliams144Noch keine Bewertungen

- Auto Components Manufacturing IndustriesDokument9 SeitenAuto Components Manufacturing IndustriesAnubhuti SharafNoch keine Bewertungen

- Comprehensive Accounting Cycle Review ProblemDokument11 SeitenComprehensive Accounting Cycle Review Problemapi-253984155Noch keine Bewertungen

- Rami Reddy (Msbi) ResumeDokument3 SeitenRami Reddy (Msbi) ResumeHuur ShaikNoch keine Bewertungen

- Starvation Peak - Practice PaperDokument1 SeiteStarvation Peak - Practice Paperkashvisharma4488Noch keine Bewertungen

- ICMS Postgraduate Brochure 2019 e 0 PDFDokument23 SeitenICMS Postgraduate Brochure 2019 e 0 PDFPamela ConcepcionNoch keine Bewertungen

- Melissa Schilling: Strategic Management of Technological InnovationDokument25 SeitenMelissa Schilling: Strategic Management of Technological Innovation143himabinduNoch keine Bewertungen

- Shrey MehtaDokument1 SeiteShrey MehtaMatt RobertsNoch keine Bewertungen

- Demat Account Details of Unicon Investment SolutionDokument53 SeitenDemat Account Details of Unicon Investment SolutionManjeet SinghNoch keine Bewertungen

- Objectives of NABARDDokument5 SeitenObjectives of NABARDAbhinav Ashok ChandelNoch keine Bewertungen

- Dear CandidateDokument6 SeitenDear CandidateAdarsh SinghNoch keine Bewertungen

- Capital Investment Decisions and The Time Value of Money PDFDokument89 SeitenCapital Investment Decisions and The Time Value of Money PDFKelvin Tey Kai WenNoch keine Bewertungen

- Vodafone Idea EFE, IFE, CPM Analysis: Strategic Management Quiz-1Dokument5 SeitenVodafone Idea EFE, IFE, CPM Analysis: Strategic Management Quiz-1Faraaz Saeed100% (1)

- Answers Installment Sales Dayag PDFDokument11 SeitenAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- How To Start A Gold Refining Business - EHowDokument6 SeitenHow To Start A Gold Refining Business - EHowJack Rose100% (1)

- 555Dokument3 Seiten555Carlo ParasNoch keine Bewertungen

- Department of Labor: 2005 05 27 17 FLSA ShiftsDokument2 SeitenDepartment of Labor: 2005 05 27 17 FLSA ShiftsUSA_DepartmentOfLaborNoch keine Bewertungen

- Causes and Consequences of CorruptionDokument21 SeitenCauses and Consequences of CorruptionlebanesefreeNoch keine Bewertungen

- EMC Documentum Business Process Suite: Best Practices Guide P/N 300-009-005 A01Dokument118 SeitenEMC Documentum Business Process Suite: Best Practices Guide P/N 300-009-005 A01jjjjjjjhjjjhjjjjjjjjjNoch keine Bewertungen

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNVon Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNBewertung: 4.5 von 5 Sternen4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingVon EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingBewertung: 4.5 von 5 Sternen4.5/5 (17)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetVon EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetBewertung: 5 von 5 Sternen5/5 (2)