Beruflich Dokumente

Kultur Dokumente

Analyzing Business Transactions

Hochgeladen von

EricJohnRoxas0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

198 Ansichten13 SeitenFor each transaction, we follow these steps: 1. State the transaction. 2. Analyze the transaction to determine which accounts are affected. 3. Apply the rules of double-entry accounting by using T-accounts to show how the transaction affects the accounting equation.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFor each transaction, we follow these steps: 1. State the transaction. 2. Analyze the transaction to determine which accounts are affected. 3. Apply the rules of double-entry accounting by using T-accounts to show how the transaction affects the accounting equation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

198 Ansichten13 SeitenAnalyzing Business Transactions

Hochgeladen von

EricJohnRoxasFor each transaction, we follow these steps: 1. State the transaction. 2. Analyze the transaction to determine which accounts are affected. 3. Apply the rules of double-entry accounting by using T-accounts to show how the transaction affects the accounting equation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 13

Analyzing Business Transactions

Business Transaction Analysis

Analyzing and Processing Transactions

Source documents invoices, receipts, checks, or contracts usually support the

details of a transaction.

For each transaction, we follow these steps:

1. State the transaction.

2. Analyze the transaction to determine which accounts are affected.

3. Apply the rules of double-entry accounting by using T-accounts to show how the

transaction affects the accounting equation. It is important to note that this step

is not part of the accounting records but is undertaken before recording a

transaction in order to understand the effects of the transaction on the

accounts.

4. Show the transaction in journal form.

The journal form is a way of recording a transaction with the date, debit account, and debit

amount shown on one line, and the credit account (indented) and credit amount on the next

line.

The amounts are shown in their respective debit and credit columns.

This step represents the initial recording of a transaction in the records and takes the following

form:

A series of transactions in this form results in a chronological record of the transactions called a

general journal (book of original entry).

Periodically, each debit and credit in an entry is transferred to its appropriate account in a list of

accounts called the general ledger (book of final entry).

5. Provide a short description of each journal entry that will help explain the nature

of the transaction.

Presently, this practice has become optional for experienced accountants.

Sample:

Economic events for the first month operation of a small firm named Miller Design Studio.

July 1: Joan Miller invests $40,000 in cash to form Miller Design Studio.

July 2: Orders office supplies, $5,200.

July 3: Rents an office; pays two months rent in advance, $3,200.

July 5: Receives office supplies ordered on July 2 and an invoice for $5,200.

July 6: Purchases office equipment, $16,320; pays $13,320 in cash and agrees to pay the rest

next month.

July 9: Makes a partial payment of the amount owed for the office supplies received on July 5,

$2,600.

July 10: Performs a service for an investment advisor by designing a series of brochures and

collects a fee in cash, $2,800.

July 15: Performs a service for a department store by designing a TV commercial; bills for the

fee now but will collect the fee later, $9,600.

July 19: Accepts an advance fee as a deposit on a series of brochures to be designed, $1,400.

July 22: Receives cash from customer previously billed on July 15, $5,000.

July 26: Pays employees four weeks wages, $4,800.

July 30: Receives, but does not pay, the utility bill that is due next month, $680.

July 31: Withdraws $2,800 in cash.

Solution:

July 1: Joan Miller invests $40,000 in cash to form Miller Design Studio.

Analysis:

An owners investment in the business increases the asset account Cash with a debit and

increases the owners equity account J. Miller, Capital with a credit.

July 2: Orders office supplies, $5,200.

Analysis:

When an economic event does not constitute a business transaction, no entry is made.

In this case, there is no confirmation that the supplies have been shipped or that title has passed.

July 3: Rents an office; pays two months rent in advance, $3,200.

Analysis: The prepayment of office rent in cash increases the asset account Prepaid Rent

with a debit and decreases the asset account Cash with a credit.

Note:

A prepaid expense is an asset because the expenditure will benefit future operations.

This transaction does not affect the totals of assets or liabilities and owners equity because it simply

trades one asset for another asset.

If the company had paid only Julys rent, the owners equity account Rent Expense would be debited

because the total benefit of the expenditure would be used up in the current month.

July 5: Receives office supplies ordered on July 2 and an invoice for $5,200.

Analysis:

The purchase of office supplies on credit increases the asset account Office Supplies with a

debit and increases the liability account Accounts Payable with a credit.

Note:

Office supplies are considered an asset (prepaid expense) because they will not be used up in the

current month and thus will benefit future periods.

Accounts Payable is used when there is a delay between the time of the purchase and the time of

payment.

July 6: Purchases office equipment, $16,320; pays $13,320 in cash and agrees to pay the

rest next month.

Analysis:

The purchase of office equipment in cash and on credit increases the asset account Office

Equipment with a debit, decreases the asset account Cash with a credit, and increases the

liability account Accounts Payable with a credit.

Note: As this transaction illustrates, assets may be paid for partly in cash and partly on

credit. When more than two accounts are involved in a journal entry, as they are in this

one, it is called a compound entry.

July 9: Makes a partial payment of the amount owed for the office supplies received on

July 5, $2,600.

Analysis:

A payment of a liability decreases the liability account Accounts Payable with a debit and

decreases the asset account Cash with a credit.

Note:The office supplies were recorded when they were purchased on July 5.

July 10: Performs a service for an investment advisor by designing a series of brochures

and collects a fee in cash, $2,800.

Analysis:

Revenue received in cash increases the asset account Cash with a debit and increases the

owners equity account Design Revenue with a credit.

Note:

For this transaction, revenue is recognized when the service is provided and the cash is received.

July 15: Performs a service for a department store by designing a TV commercial; bills

for the fee now but will collect the fee later, $9,600.

Analysis:

A revenue billed to a customer increases the asset account Accounts Receivable with a debit

and increases the owners equity account Design Revenue with a credit.

Accounts Receivable is used to indicate the companys right to collect the money in the future.

Note: In this case, there is a delay between the time revenue is earned and the time the

cash is received. Revenues are recorded at the time they are earned and billed

regardless of when cash is received.

July 19: Accepts an advance fee as a deposit on a series of brochures to be designed,

$1,400.

Analysis:

Revenue received in advance increases the asset account Cash with a debit and increases the

liability account Unearned Design Revenue with a credit.

July 22: Receives cash from customer previously billed on July 15, $5,000.

Analysis:

Collection of an account receivable from a customer previously billed increases the asset

account Cash with a debit and decreases the asset account Accounts Receivable with a credit.

Note:

The revenue related to this transaction was recorded on July 15. Thus, no revenue is recorded

at this time.

July 26: Pays employees four weeks wages, $4,800.

Analysis:

This cash expense increases the owners equity account Wages Expense with a debit and

decreases the asset account Cash with a credit.

July 30: Receives, but does not pay, the utility bill that is due next month, $680.

Analysis:

This cash expense increases the owners equity account Utilities Expense with a debit and

increases the liability account Accounts Payable with a credit.

Note: The expense is recorded if the benefit has been received and the amount is owed,

even if the cash is not to be paid until later. Note that the increase in Utilities Expense

will decrease owners equity.

July 31: Withdraws $2,800 in cash.

Analysis:

A cash withdrawal increases the owners equity account Withdrawals with a debit and

decreases the asset account Cash with a credit.

T-ACCOUNT

Das könnte Ihnen auch gefallen

- AITAS 8th Doctor SourcebookDokument192 SeitenAITAS 8th Doctor SourcebookClaudio Caceres100% (13)

- Foundations For Assisting in Home Care 1520419723Dokument349 SeitenFoundations For Assisting in Home Care 1520419723amasrurNoch keine Bewertungen

- Chapter 7 The Accounting EquationDokument57 SeitenChapter 7 The Accounting EquationCarmelaNoch keine Bewertungen

- Basic Accounting-Made EasyDokument20 SeitenBasic Accounting-Made EasyRoy Kenneth Lingat100% (1)

- Accounting Cycle of A Service BusinessDokument17 SeitenAccounting Cycle of A Service BusinessAmie Jane Miranda100% (1)

- Lesson 5 Analyzing Business Transactions PDFDokument25 SeitenLesson 5 Analyzing Business Transactions PDFZybel RosalesNoch keine Bewertungen

- ACCT101 - Prelim - THEORY (25 PTS)Dokument3 SeitenACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Journal Entries ExamplesDokument9 SeitenJournal Entries Examplesmoon_mohi50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Lesson 8 Elements of FsDokument53 SeitenLesson 8 Elements of FsSoothing BlendNoch keine Bewertungen

- Accounting For Merchandising Operation With Special JournalsDokument33 SeitenAccounting For Merchandising Operation With Special JournalsJasmine ActaNoch keine Bewertungen

- Simple and Compound EntryDokument4 SeitenSimple and Compound EntryJezeil DimasNoch keine Bewertungen

- Fabm2 Learning-Activity-1Dokument7 SeitenFabm2 Learning-Activity-1Cha Eun WooNoch keine Bewertungen

- Adjusting Entries - Theory #4Dokument27 SeitenAdjusting Entries - Theory #4Rae Antonette Solana100% (1)

- E Tech SLHT QTR 2 Week 1Dokument11 SeitenE Tech SLHT QTR 2 Week 1Vie Boldios Roche100% (1)

- Delegated Legislation in India: Submitted ToDokument15 SeitenDelegated Legislation in India: Submitted ToRuqaiyaNoch keine Bewertungen

- Normal Balances of AccountsDokument16 SeitenNormal Balances of AccountsKeith Elisa OlivaNoch keine Bewertungen

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Dokument9 SeitenBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNoch keine Bewertungen

- Branches of AccountingDokument8 SeitenBranches of AccountingBrace Arquiza50% (2)

- Chapter 2: Accounting Equation and The Double-Entry SystemDokument15 SeitenChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNoch keine Bewertungen

- Name: Date: Score: Course/Year/Section: Professor: Practice Activity 3: Journal Entries Problem 1Dokument1 SeiteName: Date: Score: Course/Year/Section: Professor: Practice Activity 3: Journal Entries Problem 1BathalaNoch keine Bewertungen

- Conceptual Framework and Accounting StandardsDokument3 SeitenConceptual Framework and Accounting StandardsJynilou PinoteNoch keine Bewertungen

- 5g-core-guide-building-a-new-world Переход от лте к 5г английскийDokument13 Seiten5g-core-guide-building-a-new-world Переход от лте к 5г английскийmashaNoch keine Bewertungen

- Abm-12 Midterm ExamDokument4 SeitenAbm-12 Midterm ExamMich Valencia100% (2)

- Fabm 1 Reviewer Q1Dokument8 SeitenFabm 1 Reviewer Q1raydel dimaanoNoch keine Bewertungen

- Lesson 1 ExtendDokument6 SeitenLesson 1 ExtendRoel Cababao50% (2)

- Quiz 4 Types of Major Accounts Without AnswerDokument5 SeitenQuiz 4 Types of Major Accounts Without AnswerHello KittyNoch keine Bewertungen

- South Asialink Finance Corporation (Credit Union)Dokument1 SeiteSouth Asialink Finance Corporation (Credit Union)Charish Kaye Radana100% (1)

- LESSON 10 Business TransactionsDokument8 SeitenLESSON 10 Business TransactionsUnamadable UnleomarableNoch keine Bewertungen

- Book of Accounts Part 1. JournalDokument12 SeitenBook of Accounts Part 1. JournalJace AbeNoch keine Bewertungen

- Basic BookkeepingDokument80 SeitenBasic BookkeepingCharity CotejoNoch keine Bewertungen

- Accounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloDokument41 SeitenAccounting Cycle of A Merchandising Business: Prepared By: Prof. Jonah C. PardilloRoxe XNoch keine Bewertungen

- Answer Keys - Test Bank - Fabm2Dokument10 SeitenAnswer Keys - Test Bank - Fabm2Kevin Pereña GuinsisanaNoch keine Bewertungen

- Module II - Analyzing Business TransactionsDokument4 SeitenModule II - Analyzing Business TransactionsIj IlardeNoch keine Bewertungen

- Adjusting Entries Company A ExercisesDokument19 SeitenAdjusting Entries Company A ExercisesRodolfo CorpuzNoch keine Bewertungen

- Financial Transaction WorksheetDokument6 SeitenFinancial Transaction WorksheetAnya DaniellaNoch keine Bewertungen

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDokument13 SeitenFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataNoch keine Bewertungen

- Individual Activity - Adjusting and Closing Entries - FABMDokument6 SeitenIndividual Activity - Adjusting and Closing Entries - FABMVenus Tek-ingNoch keine Bewertungen

- Accounting 1Dokument117 SeitenAccounting 1Mary Alyssa Claire Capate II100% (1)

- Manual Accounting Practice SetDokument13 SeitenManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- FabmDokument18 SeitenFabmYangyang Leslie100% (1)

- Dental Clinic AnswerDokument16 SeitenDental Clinic AnswerMaria Licuanan100% (1)

- Analysis of Common Business TransactionsDokument18 SeitenAnalysis of Common Business TransactionsClarisse RosalNoch keine Bewertungen

- Enclosure 1. Teacher-Made Learner's Home Task (Week 7-Week 8)Dokument6 SeitenEnclosure 1. Teacher-Made Learner's Home Task (Week 7-Week 8)Kim Flores100% (1)

- Assignment Qs 1 - Journalization and PostingDokument2 SeitenAssignment Qs 1 - Journalization and PostingShehzad Qureshi100% (1)

- ABM2 - 1st Semester - 1st Quarter - Accounting Practice SetDokument7 SeitenABM2 - 1st Semester - 1st Quarter - Accounting Practice SetROWELL SALAPARE100% (2)

- Fundamental of Accounting, Business, and Management 2 PDFDokument15 SeitenFundamental of Accounting, Business, and Management 2 PDFElijah AramburoNoch keine Bewertungen

- Adjusting Entries ProblemsDokument5 SeitenAdjusting Entries ProblemsDirck VerraNoch keine Bewertungen

- 6 Posting To The LedgerDokument3 Seiten6 Posting To The Ledgerapi-299265916Noch keine Bewertungen

- Basic Accounting Equation ExercisesDokument7 SeitenBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Accounting CycleDokument9 SeitenAccounting CycleRosethel Grace GallardoNoch keine Bewertungen

- Chapter 1 Acctg Equation JournalizingDokument4 SeitenChapter 1 Acctg Equation JournalizingNicole Marie Pontay BajadeNoch keine Bewertungen

- 2 Income and Business Taxation Midterm Slides 1 To 41Dokument41 Seiten2 Income and Business Taxation Midterm Slides 1 To 41Pathy PenidNoch keine Bewertungen

- Activity/Assignment #2 - Financial Models - Comparative DataDokument5 SeitenActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNoch keine Bewertungen

- Rules of Debit and CreditDokument4 SeitenRules of Debit and CreditGlesa SalienteNoch keine Bewertungen

- ADDU Worksheet, FS, CJE and EtcDokument67 SeitenADDU Worksheet, FS, CJE and EtcKen BorjaNoch keine Bewertungen

- AccountingDokument5 SeitenAccountingAbe Loran PelandianaNoch keine Bewertungen

- Basic Acctg 4th SatDokument11 SeitenBasic Acctg 4th SatJerome Eziekel Posada PanaliganNoch keine Bewertungen

- Perpetual Inventory SystemDokument5 SeitenPerpetual Inventory SystemRey ArudNoch keine Bewertungen

- Accounting Concepts and PrinciplesDokument26 SeitenAccounting Concepts and PrinciplesWindelyn Iligan100% (2)

- Journal, T Accounts, Worksheet and PostingDokument29 SeitenJournal, T Accounts, Worksheet and Postingkenneth coronelNoch keine Bewertungen

- Basic Accounting Module 4Dokument11 SeitenBasic Accounting Module 4Kristine Lou BaddongNoch keine Bewertungen

- Basic Accounting ModelDokument3 SeitenBasic Accounting Modeldlinds2X1Noch keine Bewertungen

- Math 11 Fabm1 Abm q2 Week 7Dokument14 SeitenMath 11 Fabm1 Abm q2 Week 7Marchyrella Uoiea Olin JovenirNoch keine Bewertungen

- 07 Case StudiesDokument4 Seiten07 Case Studiesravitarun31Noch keine Bewertungen

- Full Download Test Bank For Health Psychology Well Being in A Diverse World 4th by Gurung PDF Full ChapterDokument36 SeitenFull Download Test Bank For Health Psychology Well Being in A Diverse World 4th by Gurung PDF Full Chapterbiscuitunwist20bsg4100% (18)

- Responsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3Dokument172 SeitenResponsive Docs - CREW Versus Department of Justice (DOJ) : Regarding Investigation Records of Magliocchetti: 11/12/13 - Part 3CREWNoch keine Bewertungen

- Circular No 02 2014 TA DA 010115 PDFDokument10 SeitenCircular No 02 2014 TA DA 010115 PDFsachin sonawane100% (1)

- 30rap 8pd PDFDokument76 Seiten30rap 8pd PDFmaquinagmcNoch keine Bewertungen

- PS4 ListDokument67 SeitenPS4 ListAnonymous yNw1VyHNoch keine Bewertungen

- 1b SPC PL Metomotyl 10 MG Chew Tab Final CleanDokument16 Seiten1b SPC PL Metomotyl 10 MG Chew Tab Final CleanPhuong Anh BuiNoch keine Bewertungen

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDokument4 SeitenKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojNoch keine Bewertungen

- Hellwalker: "What Terrors Do You Think I Have Not Already Seen?"Dokument2 SeitenHellwalker: "What Terrors Do You Think I Have Not Already Seen?"mpotatoNoch keine Bewertungen

- Abnormal PsychologyDokument4 SeitenAbnormal PsychologyTania LodiNoch keine Bewertungen

- Annual Report Aneka Tambang Antam 2015Dokument670 SeitenAnnual Report Aneka Tambang Antam 2015Yustiar GunawanNoch keine Bewertungen

- 6401 1 NewDokument18 Seiten6401 1 NewbeeshortNoch keine Bewertungen

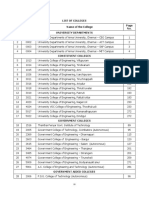

- TNEA Participating College - Cut Out 2017Dokument18 SeitenTNEA Participating College - Cut Out 2017Ajith KumarNoch keine Bewertungen

- MEAL DPro Guide - EnglishDokument145 SeitenMEAL DPro Guide - EnglishkatlehoNoch keine Bewertungen

- Commercial Private Equity Announces A Three-Level Loan Program and Customized Financing Options, Helping Clients Close Commercial Real Estate Purchases in A Few DaysDokument4 SeitenCommercial Private Equity Announces A Three-Level Loan Program and Customized Financing Options, Helping Clients Close Commercial Real Estate Purchases in A Few DaysPR.comNoch keine Bewertungen

- 5Dokument3 Seiten5Carlo ParasNoch keine Bewertungen

- Final Test General English TM 2021Dokument2 SeitenFinal Test General English TM 2021Nenden FernandesNoch keine Bewertungen

- Ulster Cycle - WikipediaDokument8 SeitenUlster Cycle - WikipediazentropiaNoch keine Bewertungen

- Ahts Ulysse-Dp2Dokument2 SeitenAhts Ulysse-Dp2IgorNoch keine Bewertungen

- Notice: Constable (Driver) - Male in Delhi Police Examination, 2022Dokument50 SeitenNotice: Constable (Driver) - Male in Delhi Police Examination, 2022intzar aliNoch keine Bewertungen

- Research PaperDokument9 SeitenResearch PaperMegha BoranaNoch keine Bewertungen

- The Rise of Political Fact CheckingDokument17 SeitenThe Rise of Political Fact CheckingGlennKesslerWPNoch keine Bewertungen

- Kipor Diesel Generator KDE23SS3 CatalogueDokument32 SeitenKipor Diesel Generator KDE23SS3 CatalogueAbbasNoch keine Bewertungen

- A Practical Guide To Transfer Pricing Policy Design and ImplementationDokument11 SeitenA Practical Guide To Transfer Pricing Policy Design and ImplementationQiujun LiNoch keine Bewertungen

- Damodaram Sanjivayya National Law University VisakhapatnamDokument6 SeitenDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyNoch keine Bewertungen

- Landslide Hazard Manual: Trainer S HandbookDokument32 SeitenLandslide Hazard Manual: Trainer S HandbookMouhammed AbdallahNoch keine Bewertungen