Beruflich Dokumente

Kultur Dokumente

World Specialty Silicas

Hochgeladen von

Michael WarnerCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

World Specialty Silicas

Hochgeladen von

Michael WarnerCopyright:

Verfügbare Formate

Freedonia Focus Reports

World Collection

World

Specialty Silicas

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

July 2014

World Overview and Forecasts

Demand by Product | Demand by Market | Production Trends

CH

UR

Highlights

BR

O

Regional Trends and Forecasts

Regional Demand Overview | North America | Western Europe | Asia/Pacific

Other Regions

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure

Industry Composition and Characteristics | Additional Companies Cited

www.freedoniafocus.com

World Specialty Silicas

ABOUT THIS REPORT

Scope & Method

This report forecasts total world demand in 2018 for specialty silicas by product, market,

and major world region in metric tons. Product segments include:

precipitated silica

silica gel

silica sol

fumed silica.

Natural silica sand, fused silica, fused silica glass, fused quartz, and vitreous silica are

excluded from the scope of this report.

Reported markets encompass:

rubber

chemicals

food and feed

cosmetics and toiletries

industrial processing

other markets such as batteries, paper, and packaging.

Major world regions include:

North America

Western Europe

Asia/Pacific

all other regions.

Demand by market segment is also forecast for each major world region.

To illustrate historical trends, world, product, market, and regional demand are provided

for 2008 and 2013. Further, regional demand is segmented by product for 2013.

Finally, world production is segmented by major world region and provided for 2008,

2013, and 2018.

Forecasts are developed via the identification and analysis of pertinent statistical

relationships and other historical trends/events as well as their expected

progression/impact over the forecast period. Changes in quantities between reported

years of a given total or segment are typically provided in terms of five-year compound

annual growth rates (CAGRs). For the sake of brevity, forecasts are generally stated in

smoothed CAGR-based descriptions to the forecast year, such as demand is projected

to rise 3.2% annually through 2018. The result of any particular year over that period,

however, may exhibit volatility and depart from a smoothed, long-term trend, as

i

2014 by The Freedonia Group, Inc.

World Specialty Silicas

historical data typically illustrate.

Other various topics, including profiles of pertinent leading suppliers, are covered in this

report. A full outline of report items by page is available in the Table of Contents.

Sources

World Specialty Silicas is based on a comprehensive industry study published by The

Freedonia Group in July 2014. Reported findings represent the synthesis and analysis

of data from various primary, secondary, macroeconomic, and demographic sources

including:

firms participating in the industry, and their suppliers and customers

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated January 2014

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

325188

2819

3297

327125

All Other Basic Inorganic Chemical

Manufacturing

Nonclay Refractory Manufacturing

Industrial Inorganic Chemicals, NEC

Nonclay Refractories

Copyright & Licensing

The full report is protected by copyright laws of the United States of America and

international treaties. The entire contents of the publication are copyrighted by The

Freedonia Group, Inc.

2014 by The Freedonia Group, Inc.

ii

World Specialty Silicas

Table of Contents

Section

Page

About This Report .......................................................................................................................................................... i

Highlights .......................................................................................................................................................................1

World Overview & Forecasts ..........................................................................................................................................2

Demand by Product..................................................................................................................................................2

Chart 1 | World Specialty Silicas Demand by Product, 2013 ..............................................................................2

Precipitated Silica. ..............................................................................................................................................2

Silica Gel. ...........................................................................................................................................................3

Silica Sol. ............................................................................................................................................................4

Fumed Silica. ......................................................................................................................................................5

Table 1 | World Specialty Silicas Demand by Product; 2008, 2013, 2018 (000 metric tons)..............................5

Demand by Market ...................................................................................................................................................6

Chart 2 | World Specialty Silicas Demand by Market, 2013................................................................................6

Rubber. ...............................................................................................................................................................6

Chemicals. ..........................................................................................................................................................7

Food & Feed. ......................................................................................................................................................7

Cosmetics & Toiletries. .......................................................................................................................................8

Industrial Processing. .........................................................................................................................................9

Other Markets. .................................................................................................................................................. 10

Table 2 | World Specialty Silicas Demand by Market; 2008, 2013, 2018 (000 metric tons) ............................. 10

Production Trends .................................................................................................................................................. 11

Table 3 | World Specialty Silicas Production by Region; 2008, 2013, 2018 (000 metric tons) ......................... 11

Regional Trends & Forecasts ....................................................................................................................................... 12

Regional Demand Overview ................................................................................................................................... 12

Chart 3 | World Specialty Silicas Demand by Region, 2013 ............................................................................. 12

Table 4 | World Specialty Silicas Demand by Region; 2008, 2013, 2018 (000 metric tons)............................. 13

North America ........................................................................................................................................................ 14

Chart 4 | North America: Specialty Silicas Demand by Product, 2013 .............................................................. 14

Table 5 | North America: Specialty Silicas Demand by Market; 2008, 2013, 2018 (000 metric tons)............... 15

Western Europe ..................................................................................................................................................... 16

Chart 5 | Western Europe: Specialty Silicas Demand by Product, 2013 ........................................................... 16

Table 6 | Western Europe: Specialty Silicas Demand by Market; 2008, 2013, 2018 (000 metric tons)............ 17

Asia/Pacific ............................................................................................................................................................. 18

Chart 6 | Asia/Pacific: Specialty Silicas Demand by Product, 2013 .................................................................. 18

Table 7 | Asia/Pacific: Specialty Silicas Demand by Market; 2008, 2013, 2018 (000 metric tons) ................... 19

Other Regions ........................................................................................................................................................ 20

Chart 7 | Other Regions: Specialty Silicas Demand, 2013................................................................................ 20

Central & South America. ................................................................................................................................. 20

Eastern Europe. ................................................................................................................................................ 21

Africa/Mideast. .................................................................................................................................................. 21

Table 8 | Other Regions: Specialty Silicas Demand; 2008, 2013, 2018 (000 metric tons) ............................... 22

Industry Structure ......................................................................................................................................................... 23

Industry Composition & Characteristics .................................................................................................................. 23

Company Profile 1 | Evonik Industries AG ........................................................................................................ 24

Company Profile 2 | WR Grace & Company ..................................................................................................... 25

Company Profile 3 | Solvay SA ......................................................................................................................... 26

Additional Companies Cited ................................................................................................................................... 27

Resources .................................................................................................................................................................... 28

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

iii

2014 by The Freedonia Group, Inc.

Das könnte Ihnen auch gefallen

- Specialty Biocides: United StatesDokument4 SeitenSpecialty Biocides: United StatesMichael WarnerNoch keine Bewertungen

- World Lighting FixturesDokument4 SeitenWorld Lighting FixturesMichael WarnerNoch keine Bewertungen

- Salt: United StatesDokument4 SeitenSalt: United StatesMichael WarnerNoch keine Bewertungen

- World SaltDokument4 SeitenWorld SaltMichael WarnerNoch keine Bewertungen

- World Motor Vehicle BiofuelsDokument4 SeitenWorld Motor Vehicle BiofuelsMichael WarnerNoch keine Bewertungen

- Labels: United StatesDokument4 SeitenLabels: United StatesMichael WarnerNoch keine Bewertungen

- Motor Vehicle Biofuels: United StatesDokument4 SeitenMotor Vehicle Biofuels: United StatesMichael WarnerNoch keine Bewertungen

- World LabelsDokument4 SeitenWorld LabelsMichael WarnerNoch keine Bewertungen

- Polyurethane: United StatesDokument4 SeitenPolyurethane: United StatesMichael WarnerNoch keine Bewertungen

- Graphite: United StatesDokument4 SeitenGraphite: United StatesMichael WarnerNoch keine Bewertungen

- World Medical DisposablesDokument4 SeitenWorld Medical DisposablesMichael WarnerNoch keine Bewertungen

- World Material Handling ProductsDokument4 SeitenWorld Material Handling ProductsMichael WarnerNoch keine Bewertungen

- Industrial & Institutional Cleaning Chemicals: United StatesDokument4 SeitenIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNoch keine Bewertungen

- Education: United StatesDokument4 SeitenEducation: United StatesMichael WarnerNoch keine Bewertungen

- World GraphiteDokument4 SeitenWorld GraphiteMichael WarnerNoch keine Bewertungen

- Ceilings: United StatesDokument4 SeitenCeilings: United StatesMichael WarnerNoch keine Bewertungen

- Jewelry, Watches, & Clocks: United StatesDokument4 SeitenJewelry, Watches, & Clocks: United StatesMichael WarnerNoch keine Bewertungen

- World BearingsDokument4 SeitenWorld BearingsMichael WarnerNoch keine Bewertungen

- Aluminum Pipe: United StatesDokument4 SeitenAluminum Pipe: United StatesMichael WarnerNoch keine Bewertungen

- Caps & Closures: United StatesDokument4 SeitenCaps & Closures: United StatesMichael WarnerNoch keine Bewertungen

- Industrial & Institutional Cleaning Chemicals: United StatesDokument4 SeitenIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerNoch keine Bewertungen

- Public Transport: United StatesDokument4 SeitenPublic Transport: United StatesMichael WarnerNoch keine Bewertungen

- Plastic Pipe: United StatesDokument4 SeitenPlastic Pipe: United StatesMichael WarnerNoch keine Bewertungen

- Municipal Solid Waste: United StatesDokument4 SeitenMunicipal Solid Waste: United StatesMichael WarnerNoch keine Bewertungen

- Pharmaceutical Packaging: United StatesDokument4 SeitenPharmaceutical Packaging: United StatesMichael WarnerNoch keine Bewertungen

- Motor Vehicles: United StatesDokument4 SeitenMotor Vehicles: United StatesMichael WarnerNoch keine Bewertungen

- Housing: United StatesDokument4 SeitenHousing: United StatesMichael WarnerNoch keine Bewertungen

- World HousingDokument4 SeitenWorld HousingMichael WarnerNoch keine Bewertungen

- World Drywall & Building PlasterDokument4 SeitenWorld Drywall & Building PlasterMichael WarnerNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Benefits of Group Discussion as a Teaching MethodDokument40 SeitenBenefits of Group Discussion as a Teaching MethodSweety YadavNoch keine Bewertungen

- Edtpa Literacy Context For Learning - Olgethorpe KindergartenDokument3 SeitenEdtpa Literacy Context For Learning - Olgethorpe Kindergartenapi-310612027Noch keine Bewertungen

- Promoting Communal Harmony and World PeaceDokument3 SeitenPromoting Communal Harmony and World PeaceManila VaidNoch keine Bewertungen

- Introduction To Well ServiceDokument16 SeitenIntroduction To Well ServiceDini Nur IslamiNoch keine Bewertungen

- 978 0 387 95864 4Dokument2 Seiten978 0 387 95864 4toneiamNoch keine Bewertungen

- Historic Costume: (Early 15 Century) 1400-1500 European FashionDokument33 SeitenHistoric Costume: (Early 15 Century) 1400-1500 European FashionRaina varshneyNoch keine Bewertungen

- PDF 11 46 12 04 02 2014 Esthetic Rehabilitation With Laminated Ceramic Veneers Reinforced by Lithium Disilicate PDFDokument5 SeitenPDF 11 46 12 04 02 2014 Esthetic Rehabilitation With Laminated Ceramic Veneers Reinforced by Lithium Disilicate PDFAnnaAffandieNoch keine Bewertungen

- Ossy Compression Schemes Based On Transforms A Literature Review On Medical ImagesDokument7 SeitenOssy Compression Schemes Based On Transforms A Literature Review On Medical ImagesijaitjournalNoch keine Bewertungen

- DCV 03 hk66t102Dokument15 SeitenDCV 03 hk66t102seaqu3stNoch keine Bewertungen

- Technical Report: Design of Metal Anchors For Use in Concrete Under Seismic ActionsDokument16 SeitenTechnical Report: Design of Metal Anchors For Use in Concrete Under Seismic ActionsJulioGoesNoch keine Bewertungen

- Lesson 1 - Introduction To EntrepreneurshipDokument27 SeitenLesson 1 - Introduction To EntrepreneurshipEm PunzalanNoch keine Bewertungen

- Service Manual: NSX-SZ80 NSX-SZ83 NSX-AJ80 NSX-SZ80EDokument47 SeitenService Manual: NSX-SZ80 NSX-SZ83 NSX-AJ80 NSX-SZ80EDjalma MotaNoch keine Bewertungen

- Java Interview Guide - 200+ Interview Questions and Answers (Video)Dokument5 SeitenJava Interview Guide - 200+ Interview Questions and Answers (Video)Anand ReddyNoch keine Bewertungen

- Propoxur (WHO Pesticide Residues Series 3)Dokument26 SeitenPropoxur (WHO Pesticide Residues Series 3)Desye MeleseNoch keine Bewertungen

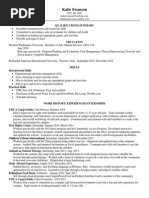

- Katie SwansonDokument1 SeiteKatie Swansonapi-254829665Noch keine Bewertungen

- Injectable Polyplex Hydrogel For Localized and Long-Term Delivery of SirnaDokument10 SeitenInjectable Polyplex Hydrogel For Localized and Long-Term Delivery of SirnaYasir KhanNoch keine Bewertungen

- India's Elite Anti-Naxalite Force CoBRADokument6 SeitenIndia's Elite Anti-Naxalite Force CoBRAhumayunsagguNoch keine Bewertungen

- DepEd Camarines Norte Daily Lesson PlanDokument5 SeitenDepEd Camarines Norte Daily Lesson PlanjuriearlNoch keine Bewertungen

- TCS Case StudyDokument21 SeitenTCS Case StudyJahnvi Manek0% (1)

- Hubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliDokument12 SeitenHubungan Kelimpahan Dan Keanekaragaman Fitoplankton Dengan Kelimpahan Dan Keanekaragaman Zooplankton Di Perairan Pulau Serangan, BaliRirisNoch keine Bewertungen

- Singer BDDokument46 SeitenSinger BDSummaiya Barkat100% (1)

- IILM Institute For Higher EducationDokument8 SeitenIILM Institute For Higher EducationPuneet MarwahNoch keine Bewertungen

- 10 Simultaneous - in - Situ - Direction - Finding - and - Field - Manipulation - Based - On - Space-Time-Coding - Digital - MetasurfaceDokument10 Seiten10 Simultaneous - in - Situ - Direction - Finding - and - Field - Manipulation - Based - On - Space-Time-Coding - Digital - MetasurfaceAnuj SharmaNoch keine Bewertungen

- VVBVBVBBDokument19 SeitenVVBVBVBBnasimakhtarNoch keine Bewertungen

- A Comparative Study of Engine Mounting System For NVH ImprovementDokument8 SeitenA Comparative Study of Engine Mounting System For NVH ImprovementIndranil BhattacharyyaNoch keine Bewertungen

- Process Control Lecture 9 (M2)Dokument53 SeitenProcess Control Lecture 9 (M2)lalusebanNoch keine Bewertungen

- Anti-Photo and Video Voyeurism Act SummaryDokument3 SeitenAnti-Photo and Video Voyeurism Act SummaryHan SamNoch keine Bewertungen

- Answer: D. This Is A Function of Banks or Banking InstitutionsDokument6 SeitenAnswer: D. This Is A Function of Banks or Banking InstitutionsKurt Del RosarioNoch keine Bewertungen

- Software House C CURE 9000 v2.90: - Security and Event Management SystemDokument5 SeitenSoftware House C CURE 9000 v2.90: - Security and Event Management SystemANDRES MORANoch keine Bewertungen

- s7 1500 Compare Table en MnemoDokument88 Seitens7 1500 Compare Table en MnemoPeli JorroNoch keine Bewertungen