Beruflich Dokumente

Kultur Dokumente

Tech Risk Management 201307

Hochgeladen von

vijay_paliwal9903Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tech Risk Management 201307

Hochgeladen von

vijay_paliwal9903Copyright:

Verfügbare Formate

www.pwc.

com/sg

July 2013

Issue 1

Global Regulatory

Technology Risk

Requirements

MAS Technology

Risk Management

Competitive

Intelligence

Appendix

Case Study

Useful Resources

2 5 27 32

Technology Risk Management

Managing

technology risk is

now a business

priority

PwC

Global

Regulatory

Technology

Risk

Requirements

2

PwC

Regulatory technology risk requirements

landscape have changed over the past 3 years

U.S. Securities and

Exchange Commission

(SEC)

Federal Deposit Insurance

Corporation (FDIC)

Consumer Financial

Protection Bureau (CFPB)

Financial Conduct Authority (FCA)

Prudential Regulation Authority

(PRA)

Financial Services Agency

(FSA), Japan

China Securities Regulatory

Commission (CSRC)

China Insurance Regulatory

Commission (CIRC)

China Banking Regulatory

Commission (CBRC)

Monetary Authority of

Singapore (MAS),

Singapore

Reserve Bank of India (RBI)

Insurance Regulatory and

Development Authority (IRDA)

Australian Prudential

Regulation Authority (APRA)

Federal Financial Supervisory

Authority (BaFin), Germany

Autorit des marchs financiers

(France) (AMF), France

Swiss Financial Market Supervisory

Authority, Switzerland

3

PwC

PwC

Impact of regulation: Overview

The interplay of

new technology

risk regulation

with other

market changes

is driving

wide-ranging

business

impacts

Change-driven business impacts

Strategic Impacts

Attractiveness of markets, business

models and portfolios under new rules

Operational effectiveness and cost

management

Driven by strategic business choices and

new reporting/transparency

requirements

Organisation, governance and culture

Incentives and governance rules the

subject of more intense regulatory

interest

GAAP

changes

Risk

Mgmt

Tax

Technology

Risk

FATCA

Accounting

policies

Capital &

liquidity

Risk

processes

Structuring/

levies

Reserving

Exec

Compensation

Disclosure

Payment

structures

Incentives

AML

External

Environment

FS Regulations

Slow growth

Depressed

yields

4

PwC

MAS

Technology

Risk

Management

Notices and

Guidelines

5

PwC

Technology Risk Management

Notice and Guidelines

The Notice and Guidelines were issued on 21 June 2013.

Notice will be effective on 1 July 2014.

All 12 notices tied to the Singapore Act and Laws will

impact:

All Financial Institutions (FIs) (See Appendix for

definitions)

Includes all IT systems

6

Non compliance to the Notice can result in:

Financial penalties

Reputational damage

Revocation of licence to operate in Singapore

The new MAS

Technology Risk

Management

Guidelines (TRMG)

have been

enhanced to help

financial

institutions

improve oversight

of technology risk

management and

security practices.

PwC

What are the implications of

the Notice ?

Perform a Business Impact Analysis

to identify Critical Systems

A FI shall put in place a framework and

process to identify critical systems

1

Test your Disaster Recovery (DR)

Plans are robust

Recovery Time Objective (RTO) of

4 hours for critical systems

2

Encrypt customer data to protect

A FI shall implement IT controls to protect

customer information from unauthorised

access or disclosure

3

Active: Active infrastructure

High availability for critical systems

4 hours of unscheduled downtime

4

Real time monitoring and reporting

procedures

Inform MAS of major security incidents,

systems malfunction within 60 minutes

and submit root cause with 14 days

5

7

With the new

TRM Notice and

Guidelines,

six grouped

areas that

impact your

business were

identified

1

Notice

2

System Availability,

Incident and Capacity

Management

4

Development and

Change Management

3

Operational

Infrastructure

Security and Access

Management

5

Mobile Online

Services

6

Others

8

PwC

The Notice has

clear definitions

and are legally

binding

requirement for

FIs

Notice

Consultation Paper TRMG 2013

Single Notice

Each type of FI (banks, insurance company, brokers, etc.) is

issued one Notice, but the contents is the same.

No Definitions

Redefinition of following terms:

Critical system: Failure of which will cause significant

disruption into the operations of the FI or materially impact

the FIs service to its customers

System malfunction: failure of any of the FI's critical systems

Relevant incident: System malfunction or IT security

incident, which has a severe and widespread impact on the

FI's operations or materially impacts the FI's service to its

customers

Notification to MAS

within 30 minutes for

all IT Security

Incidents

Notification: no later than 1 hour upon discovery of a relevant

incident. Upon discovery refers to after the FIs have ascertained

the nature and magnitude of an IT incident meets the criteria

set out in the Notice.

Submission of root

cause analysis within

one month

Root cause analysis changed to: submit within 14 days of

discovery. Can request for extension.

2 3 4 1 5 6

9

PwC

Consultation Paper TRMG 2013

Achieve near zero system

downtime for critical

systems

Achieve high availability for critical systems.

Public announcement of

major incidents should be

made in a timely manner

This requirement was removed. Expectation BCP will

address this matter.

Conduct quarterly trend

analysis

Removal of quarterly trend analysis.

No Requirements

FI should inform MAS as soon as possible in the event that

a critical system has failed over to its disaster recovery

system.

System

Availability,

Incident and

Capacity

Management

2 3 4 1 5 6

10

PwC

Consultation Paper TRMG 2013

No requirement to

encrypt USB disks.

Encrypt USB disks containing sensitive or confidential

information before transporting to off-site for storage. The

encrypting of sensitive information should be performed on

all mediums that are transported off-site.

No requirement for

timeframe of review.

Evaluate the recovery plan and incident response

procedures at least annually.

No detailed

requirements

New requirements:

FI to ensure that indicators such as performance,

capacity and utilisation are monitored and reviewed.

FI should establish monitoring processes and

implement appropriate thresholds to provide sufficient

time for the FI to plan and determine additional

resources to meet operational and business

requirements effectively.

System

Availability,

Incident and

Capacity

Management

2 3 4 1 5 6

11

PwC

Strong

authentication on

customer and

transactional

processing

Operational

Infrastructure

Security and

Access

Management

Consultation Paper TRMG 2013

Implement 2FA for

privileged users

Implement strong authentication mechanisms for

privileged users.

Quarterly Vulnerability

Assessment requirement

Frequency of vulnerability assessment is removed.

Expectation to perform annual penetration test is still

required.

2 3 4 1 5 6

12

PwC

Development

and Change

Management

Non-production

environments can

connect to the

internet

Consultation Paper TRMG 2013

Only allowed

production

environment to be

connected to the

Internet

Non-production environment is now allowed to connect to

the internet provided a risk assessment has been performed

and appropriate controls are in place.

2 3 4 1 5 6

13

PwC

Mobile

Online

Services

Magnetic

stripes are

allowed

Consultation Paper TRMG 2013

Transaction-signing for

high-risks / high-value

transactions

Online financial systems servicing institutional investors,

can use alternate controls, if assessed to be equivalent or

better than using token-based mechanisms to authorise

transaction.

Magnetic stripes were

not allowed

If, for interoperability reasons, transactions could only be

effected by using information from the magnetic stripe on a

card, the FI should ensure that adequate controls are

implemented to manage these transactions.

2 3 4 1 5 6

14

PwC

Others

More areas to

focus on

Consultation Paper TRMG 2013

Archival of

cryptographic key

The requirement that cryptographic keys should only be

used for a single purpose, and archival of keys has been

removed. Expectation a Key Management policy should

cover lifecycle of keys.

Reliability and resiliency

Requirement to implement mirrored / parity redundancy

for RAID (Redundant Array of Independent Disk), as well

as allocation and configuration for hot spares removed.

Requirement for IT

Audit to validate and

verify issues raised by

MAS inspection

Removal of IT audit (IA) requirement. Expectation that IT

Audit will review MAS findings.

It is good practice for IA to be aware of relevant issues and

consider as part of their risk universe.

2 3 4 1 5 6

15

PwC

Consultation Paper TRMG 2013

Requirement for

clearing browser cache

after online session did

not exist

Added one pre-caution that FI should advise the customer

to adopt "clear browser cache after the online session.

Expectation this be part of customer awareness.

Onsite visit to Data

centres, or service

providers should be

performed

Removed, good practice would verify data centres and

services providers are compliant to IT Outsourcing

requirements and MAS TRM guidelines.

Verify the authenticity

and integrity of the

mobile apps

Removed; but transaction-signing should be implemented

for authorising transactions.

PIN should be changed

regularly

Added or when there is any suspicion that it has been

compromised or impaired.

2 3 4 1 5 6

16

PwC

Others

More areas to

focus on

Summary of Gap Analysis between IBTRM

(Internet Banking and Technology Risk Management)

and the new TRM Notice and Guidelines

17

Applicable to all financial institutions and include all IT systems (inclusive internet).

64% 19% 17%

New and Enhanced

Requirements

No Change in

Requirements

Clarifications and

Statements Update

PwC

System Availability and Incident Management

Impact and Costs

18

PwC

Framework Processes Systems Cost

Define critical systems L

Critical Systems need to have high availability with

4 hours of unscheduled downtime

H

Mechanism to monitor downtime May be M-H

Develop and implement Recovery Plan for Critical

Systems (RTO) of 4 hours. Test & validate

annually

H

Develop and implement incident handling process

to achieve 1 hr response upon discovery of relevant

incident

H

Develop and capacity management process May be M-H

Dependency and complexity in involving 3

rd

party service providers

Legend: L Low; M Medium; H- High

Action Required Impact

Technology

Risk

Management

Guideline vs.

IBTRM v3-

Themes

19

PwC

1

Technology Risk

Management

Framework, Roles of

Senior Mgmt & Board

4

Operational

Infrastructure

Security Management

5

System Availability

and Infrastructure

Management

6

Others

3

Mobile Online

Services

2

Enhanced Data

Centre Requirements

Technology

Risk

Management

Framework

and Role of

Senior

Management

and the

Board

20

Key Requirements What you need to consider

Senior management involvement

in the IT decision-making process

Implementation of a robust risk

management framework

Effective risk register be

maintained and risks to be

assessed and treated

Implementation of a employee

screening process and annual

security awareness training

How is senior management

involved in IT decision making

and risk management?

Is there an effective governance in

place to ensure the board can

make informed decisions?

Is there a formalised IT risk

management framework in place?

Do employee screening processes

include the third parties?

2 3 4 1 5 6

PwC

Enhanced

Data Centre

Requirements

21

Key Requirements What you need to consider

Data centre security should

include physical: security guards,

card access systems, mantraps

and bollards etc.

Define your data centres and

classify the critical systems in

scope

The TVRA needs cover all

possible scenarios

A robust Threat and Vulnerability Risk

Assessment (TVRA) should be performed on

critical systems and data centres

2 3 4 1 5 6

PwC

Mobile

Online

Services

22

Key Requirements What you need to consider

A security strategy that included

the MAS requirements

Identification of fraud scenarios

and payment card fraud counter

measures on mobile devices

Sensitive data should be encrypted

Customers should be educated on

security

Does your current security strategy

encompass mobile banking

applications?

Does current risk assessment

consider mobile banking fraud,

mobile-application?

What is sensitive data? Is

information other than

authentication-specific information

encrypted on the local device?

2 3 4 1 5 6

PwC

Operational

Infrastructure

Security

Management

23

Key Requirements What you need to consider

Inventory of software and

hardware components and end of

support/life (EOS/L)

Baseline standards for security

configurations

A robust patch management

process

Real-time monitoring of security

events

Detection of unauthorised changes

to critical systems

An asset management database

that includes critical systems that

can be monitored

File and system integrity

monitoring

How does your current patch

management process classify

patches? Do you have a patch

management strategy that works?

How are you monitoring your

database configuration changes

and privileged access?

2 3 4 1 5 6

PwC

System

Availability

and

Infrastructure

Management

24

Key Requirements What you need to consider

Redundancies for single points of

failures (Cross-border)

Recovery time objective (RTO) and

recovery point objective (RPO)

Recovery plan and testing

Incident response procedures

Problem management process

(root-cause analysis)

Are you looking at an Active

/Active, or Active/Passive service

to meet these guidelines and the

Notice. (n+1)

Have all critical systems and

network components (on and

offshore) been included?

Do you have a dedicated CERT and

a defined plan for security and

major incidents?

How and who will manage the

public announcements and

disclosure?

2 3 4 1 5 6

PwC

Others - ITSM

(Information

Technology

Service

Management)

& Acquisition

and

Development

of

Information

Systems

25

Key Requirements What you need to consider

A robust IT service management

framework should be

implemented

Problem management trend

analysis

A project management framework

should be used and established

End user applications should be

developed inline with best

practices

Is there a problem management

process in place? Are you using

Information Technology

Infrastructure Library (ITIL)?

How and are you reviewing

projects and procurements of

systems against the needs of the

business post implementation?

Is a cost benefit analysis and

business case developed for all

system changes?

Do you know what end user

tools/spreadsheets/ macros are

critical to your business? What

was the methodology used to

develop these tools?

2 3 4 1 5 6

PwC

26

2 3 4 1 5 6

PwC

Others

Payment

Card Security

Key Requirements What you need to consider

Sensitive payment card data

should be encrypted

Secure chips should be deployed

to store sensitive payment card

FIs should only allow online

transaction authorisation

Implementation of Fraud

Detection Systems (FDS) with

behavioural scoring

Where is your payment card data

stored? and is the data encrypted

when stored and during

processing?

Is a FDS in place that uses

behavioural scoring?

PwC

Competitive

intelligence

Our observation

of industry

practices

27

PwC

What you should consider

Scope

Define your scope and risk assess your

critical systems

Feasibility

Perform a GAP analysis against the

TRM Notice and Guidelines

Ownership Obtain buy in from key stakeholders

Governance

Create a robust governance structure

that can guide the development of

organisation controls

Ensure a robust

Technology

Risk

Management

framework is in

operation to

meet your

compliance

responsibilities

28

PwC

27%

14%

10% 9%

8%

8%

7%

7%

7%

3%

3%

Operational Infrastructure Security Management

Access Control

Online Financial Services

IT Service Management

Oversight of Technology Risks by Board and Senior Management

Data Centres Protection and Controls

Systems Reliability, Availability, and Recoverability

Management of It Outsourcing Risks

Acquisition and Development of Information Systems

Technology Risk Management Framework

IT Audit

Banking benchmarking of issues

The single most popular issue:

Management of IT Outsourcing

Risks, representing 7% of issues

reported

1

2

Highest number of issues:

Operational Infrastructure Security

Management, representing 27% of

issues reported

1

2

Reported Issues by Domain

29

PwC

31%

13%

11%

10%

10%

9%

6%

4%

4%

1% 1%

Operational Infrastructure Security Management

Acquisition and Development of Information Systems

Online Financial Services

IT Service Management

Oversight of Tech Risks by Board and Senior Mgmt

Access Control

Management of It Outsourcing Risks

Data Centres Protection and Controls

Systems Reliability, Availability, and Recoverability

IT Audit

Technology Risk Management Framework

Insurance benchmarking of issues

The single most popular issue:

Management of IT Outsourcing

Risks, representing 6% of issues

reported

1

2

Highest number of issues:

Operational Infrastructure Security

Management, representing 31% of

issues reported

1

2

Reported Issues by Domain

30

PwC

A

c

t

i

v

i

t

y

PwCs 4-Step MAS TRM Compliance program

12

Gap analysis

followed by

risk prioritisation

Review existing

framework, processes

& systems

Implement

Processes &

Systems

Set up governance

structure and process

Test effectiveness of

solutions and controls

Design TRM

framework, policies,

processes and related

controls

Design governance

structure to address

new requirements

Define and design

technology solutions

Regular Post-

implementation

review

On-going monitoring

of risks and

effectiveness of

controls

Assess Define

Implementation

& Rollout

Review

& Monitor

D

e

l

i

v

e

r

a

b

l

e

s

Gap Analysis

results

Prioritise the

issues

Remediation

Action plan

TRM framework,

policies, processes

& controls

TRM governance

structure

Technology

Solution

Specification

Rolled out

processes solutions

Training materials

and procedure

documents

Pre-

implementation

test results

Technology risk

reporting and

regular test results,

e.g. RTO

Compliance review

report

31

PwC

Appendix:

Case Studies

32

PwC

Case Studies Onshore banking

Assisted all stakeholders to

understand their information

assets and technology risks.

Insights on regulations

helped the bank making cost-

effective decisions

Strong focus on adherence to

budgeted spend has been

observed when defining

systems that require RTO of 4

hours

Enabled the bank to report

to MAS that it has completed

its first round of assessments

in a timely manner

Provided an efficient

approach that enables the

bank to capture and address

risks in a uniform manner

The MAS completed its inspection

of Technology and issued a report

containing a number of findings.

1. Risk Management of process

around critical systems

2. Adhering to 4 hours RTO

PwC were engaged to

facilitate the remediation

effort:

understanding the current

production environment/

architecture for all critical

applications and the business

lines supported by those

applications

engaging stakeholders from

business, IT, technology risk

and operational risks in risk

assessment workshops

identify critical information

and technology assets residing

in each application and

analyse possible consequences

that bank may face

review the design effectiveness

of internal controls in place

assess residual risks and

facilitate the discussion with

stakeholders on treatment

plans if required

Impact

Issue Action

33

PwC

Case Studies Offshore banking

The Global bank engaged PwC to

perform an assessment to evaluate

their Global stance on Technology

polices, procedures and controls

adherence to APAC regulators, with

over 72 issues for Singapore.

To address these , issues, a MAS

program was initiated and PwC

were engaged to facilitate the

remediation effort:

understanding the current

prescriptive changes that can

processed for a quick wins

engaging stakeholders from

business, to develop multiple

plans to find cost effective

solution to especially with

global data centres hosting

critical systems for Singapore

The MAS program provides a

great opportunity to make policy

changes and innovate with cost

effect solutions already used

elsewhere in the bank:

PwC have developed a

framework to adhere to future

regulatory requirements

Developed innovate solutions

with the banks staff to save cost

and become compliant

Impact

Issue Action

34

PwC

Appendix:

Useful

Resources

35

PwC

Useful

Resources

The MAS TRM Notice:

http://www.mas.gov.sg/regulations-and-financial-stability/regulations-guidance-

and-licensing.aspx?sc_p=2&sc_y=&sc_type=&sc_q=

Useful documents:

Instructions on Incident Notification and Reporting to MAS

Incident Report Template

FAQs Notice on Technology Risk ManagementGuidelines

MAS TRM Guidelines

The documents above can be found by following the link below.

http://www.mas.gov.sg/Regulations-and-Financial-Stability/Regulatory-and-

Supervisory-Framework/Risk-Management/Technology-Risk.aspx

36

PwC

Definition of Financial Institution

Financial institution has the same meaning as in section 27A(6) of Monetary Authority of Singapore Act

(Cap.186).

(a) any bank licensed under the Banking Act (Cap. 19);

(b) any finance company licensed under the Finance Companies Act (Cap. 108);

(c) any person that is approved as a financial institution under section 28; [13/2007 wef 30/06/2007]

(d) any money-changer licensed to conduct money-changing business, or any remitter licensed to conduct remittance

business, under the Money-changing and Remittance Businesses Act (Cap. 187);

(e) any insurer registered or regulated under the Insurance Act (Cap. 142);

(f) any insurance intermediary registered or regulated under the Insurance Act;

(g) any licensed financial adviser under the Financial Advisers Act (Cap. 110);

(h) any approved holding company, securities exchange, futures exchange, recognised market operator, designated

clearing house or holder of a capital markets services license under the Securities and Futures Act (Cap. 289);

(i) any trustee for a collective investment scheme authorised under section 286 of the Securities and Futures Act, that is

approved under that Act;

(j) any trustee-manager of a business trust that is registered under the Business Trusts Act (Cap. 31A);

(k) any licensed trust company under the Trust Companies Act (Cap. 336);

(ka) any holder of a stored value facility under the Payment Systems (Oversight) Act (Cap. 222A); and [42/2007 wef

01/11/2007]

(l) any other person licensed, approved, registered or regulated by the Authority under any written law,

but does not include such person or class of persons as the Authority may, by regulations made under this section,

prescribe.

37

This presentation has been prepared for general guidance on matters of interest only, and

does not constitute professional advice. You should not act upon the information contained in

this publication without obtaining specific professional advice. No representation or warranty

(express or implied) is given as to the accuracy or completeness of the information contained

in this publication, and, to the extent permitted by law, PricewaterhouseCoopers, its members,

employees and agents do not accept or assume any liability, responsibility or duty of care for

any consequences of you or anyone else acting, or refraining to act, in reliance on the

information contained in this publication or for any decision based on it.

2013 PricewaterhouseCoopers Limited. All rights reserved. In this document, PwC refers to

PricewaterhouseCoopers Limited which is a member firm of PricewaterhouseCoopers

International Limited, each member firm of which is a separate legal entity.

Focus on risk, compliance will follow

Contact us

Tan Shong Ye

shong.ye.tan@sg.pwc.com

+65 6236 3262

Mark Jansen

mark.jansen@sg.pwc.com

+65 6236 7388

Manish Chawda

manish.chawda@sg.pwc.com

+65 6236 7447

Das könnte Ihnen auch gefallen

- Fitzpatrick's Color Atlas and Synopsis of Clinical DermatologyDokument1 SeiteFitzpatrick's Color Atlas and Synopsis of Clinical DermatologyFadhillaFitriAmi0% (1)

- New - AT1 Incident Response Plan Version2.0Dokument5 SeitenNew - AT1 Incident Response Plan Version2.0Neethu Pushkaran0% (2)

- International Baccalaureate (IB) Past Papers With Mark SchemesDokument128 SeitenInternational Baccalaureate (IB) Past Papers With Mark SchemesFirasco24% (42)

- Business Continuity Management And IT Disaster Recovery Management A Complete Guide - 2021 EditionVon EverandBusiness Continuity Management And IT Disaster Recovery Management A Complete Guide - 2021 EditionNoch keine Bewertungen

- Study Unit 5: Key Risk Indicators Key Performance IndicatorsDokument23 SeitenStudy Unit 5: Key Risk Indicators Key Performance IndicatorsThato SechoaroNoch keine Bewertungen

- Do407 Exam 1 4Dokument20 SeitenDo407 Exam 1 4phyo nyi aungNoch keine Bewertungen

- ES-341: Numerical Analysis: Dr. Mazhar Ali Mehboob Ul Haq (TA)Dokument32 SeitenES-341: Numerical Analysis: Dr. Mazhar Ali Mehboob Ul Haq (TA)MaheenNoch keine Bewertungen

- Agile System Development:: An Investigation of The Challenges and Possibilities of Using ScrumDokument36 SeitenAgile System Development:: An Investigation of The Challenges and Possibilities of Using ScrumJannpaul_08Noch keine Bewertungen

- Results Lesson Topic ContentDokument4 SeitenResults Lesson Topic ContentHitesh N RNoch keine Bewertungen

- Security PoliciesDokument3 SeitenSecurity PoliciesEdisonNoch keine Bewertungen

- Er Sit Risk Assessment ReportDokument5 SeitenEr Sit Risk Assessment ReportJefri ParaNoch keine Bewertungen

- Risk Management Toolkit - SummaryDokument12 SeitenRisk Management Toolkit - SummaryGerel GerleeNoch keine Bewertungen

- 4 - COSO ERM and More - Protiviti - Bob HirthDokument70 Seiten4 - COSO ERM and More - Protiviti - Bob HirthRena Rose MalunesNoch keine Bewertungen

- Audit of Business Continuity Planning PDFDokument22 SeitenAudit of Business Continuity Planning PDFNishimaNoch keine Bewertungen

- Engagement Details Consist of Engagement ObjectiveDokument12 SeitenEngagement Details Consist of Engagement ObjectiveJohn AbidNoch keine Bewertungen

- Business-Case-Template SampleDokument12 SeitenBusiness-Case-Template SampleAinur putriNoch keine Bewertungen

- Risk Assessment ChecklistDokument6 SeitenRisk Assessment Checklistilkerkozturk100% (1)

- Chapter 1 Computer SecurityDokument22 SeitenChapter 1 Computer SecurityAjay GuptaNoch keine Bewertungen

- Module 3 Saq: What Is Risk Methodology?Dokument6 SeitenModule 3 Saq: What Is Risk Methodology?RANDANoch keine Bewertungen

- DissertationDokument166 SeitenDissertationrenderingNoch keine Bewertungen

- Division of Information Technology Policy 18.2aDokument3 SeitenDivision of Information Technology Policy 18.2aBara DanielNoch keine Bewertungen

- BIA TI Business Impact Assessment TemplateDokument49 SeitenBIA TI Business Impact Assessment TemplateNicolas Alejandro Villamil GutierrezNoch keine Bewertungen

- Core Risk Management Policy enDokument13 SeitenCore Risk Management Policy enJaveed A. KhanNoch keine Bewertungen

- NERC LSE Standards Applicability Matrix Posted 02 10 2009Dokument15 SeitenNERC LSE Standards Applicability Matrix Posted 02 10 2009COE201Noch keine Bewertungen

- Risk Assessment Procedures - Step To Prepare Risk AssessmentDokument5 SeitenRisk Assessment Procedures - Step To Prepare Risk AssessmentaneethavilsNoch keine Bewertungen

- 5 Steps For Better Risk Assessments Ebook LogicManagerDokument15 Seiten5 Steps For Better Risk Assessments Ebook LogicManagerSANJAY KUMAR M ANoch keine Bewertungen

- Risk Based Approach Understanding and ImDokument18 SeitenRisk Based Approach Understanding and ImCalvin JeremiahNoch keine Bewertungen

- 54 Tabletop ExercisesDokument64 Seiten54 Tabletop ExercisesAllen Savage0% (1)

- Tabletop Exercises - Three Sample ScenariosDokument3 SeitenTabletop Exercises - Three Sample ScenariosedminyardNoch keine Bewertungen

- RCSA Session 1 Revised - FINAL PDFDokument9 SeitenRCSA Session 1 Revised - FINAL PDFTejendrasinh GohilNoch keine Bewertungen

- Risk Assessment Matrix ProcessDokument7 SeitenRisk Assessment Matrix ProcessEdwin CruzNoch keine Bewertungen

- Common Iso 27001 Gaps Issa0111Dokument4 SeitenCommon Iso 27001 Gaps Issa0111nishu128Noch keine Bewertungen

- Final SMS - Orlando - Session 3101 FinalDokument28 SeitenFinal SMS - Orlando - Session 3101 FinalDavidÉmileDurkheimNoch keine Bewertungen

- p2 Risk Management Strategy Example v01Dokument15 Seitenp2 Risk Management Strategy Example v01Bacet AleNoch keine Bewertungen

- Contingency Plan TemplateDokument6 SeitenContingency Plan TemplateKaren Feyt MallariNoch keine Bewertungen

- PSPF Infosec 11 Robust Ict SystemsDokument6 SeitenPSPF Infosec 11 Robust Ict SystemsScottNoch keine Bewertungen

- XRisk Assessment Questionnaire TemplateDokument15 SeitenXRisk Assessment Questionnaire TemplateFelicia GhicaNoch keine Bewertungen

- Using Business Impact Analysis To Inform Risk Prioritization and ResponseDokument24 SeitenUsing Business Impact Analysis To Inform Risk Prioritization and ResponseCristian Gamonal CastroNoch keine Bewertungen

- Project Risk ManagementDokument22 SeitenProject Risk ManagementZafar IqbalNoch keine Bewertungen

- Business Continuity Planning GuideDokument26 SeitenBusiness Continuity Planning GuideAbheejeet A100% (1)

- 3 - IT Risk Management PolicyDokument5 Seiten3 - IT Risk Management PolicyMelody ShekharNoch keine Bewertungen

- Risk Management Plan Preparation GuidelinesDokument17 SeitenRisk Management Plan Preparation Guidelineszenagit123456Noch keine Bewertungen

- Risk Managementand Insurance PlanningDokument6 SeitenRisk Managementand Insurance PlanningtomshadesNoch keine Bewertungen

- IT Asset Valuation Risk Assessment and Control Implementation Model - Joa - Eng - 0118Dokument9 SeitenIT Asset Valuation Risk Assessment and Control Implementation Model - Joa - Eng - 0118Alexander salazarNoch keine Bewertungen

- Case Study - ABCDokument25 SeitenCase Study - ABClizasaari100% (3)

- 013 Excel Risk TemplateDokument1 Seite013 Excel Risk TemplatesrsureshrajanNoch keine Bewertungen

- BC Management GuideDokument38 SeitenBC Management GuideHilal AlifianNoch keine Bewertungen

- Occupational Health and Safety Management System (OHSMS) - AuditDokument8 SeitenOccupational Health and Safety Management System (OHSMS) - AuditM SundaramNoch keine Bewertungen

- Human Resource Management: Balanced Score CardDokument34 SeitenHuman Resource Management: Balanced Score CardLumi LuminitaNoch keine Bewertungen

- FMDS1005 Disaster Recovery and Contingency Plan 2007Dokument8 SeitenFMDS1005 Disaster Recovery and Contingency Plan 2007CarlosCastroNoch keine Bewertungen

- Disaster Recovery AuditDokument25 SeitenDisaster Recovery Auditadane24100% (1)

- Gary Dimesky, Mba, Cissp, Cisa, NQV LVL Ii: Professional ExperienceDokument4 SeitenGary Dimesky, Mba, Cissp, Cisa, NQV LVL Ii: Professional ExperienceGary DimeskyNoch keine Bewertungen

- Intro RMFDokument19 SeitenIntro RMFssitha6Noch keine Bewertungen

- Risk ThreatAnalysis 201902 JLEDokument23 SeitenRisk ThreatAnalysis 201902 JLEJoachim LederNoch keine Bewertungen

- Baseline Security Controls PolicyDokument5 SeitenBaseline Security Controls PolicyClyde Ben BaleteNoch keine Bewertungen

- Risk ManagementDokument17 SeitenRisk ManagementMatthew SibandaNoch keine Bewertungen

- Risk Management - Policy and ProcedureDokument5 SeitenRisk Management - Policy and ProcedureMichelle BowkerNoch keine Bewertungen

- Agile Interview QuestionsDokument34 SeitenAgile Interview QuestionsSrikanth GowdaNoch keine Bewertungen

- Complete Guide To IT Risk ManagementDokument5 SeitenComplete Guide To IT Risk ManagementCornel BentNoch keine Bewertungen

- Testing Your Business Continuity Plan A Guide For Headteachers and GovernorsDokument4 SeitenTesting Your Business Continuity Plan A Guide For Headteachers and GovernorsJoyce Anne MoratoNoch keine Bewertungen

- MC1 Brake Forming 6-9-2009 FinalDokument18 SeitenMC1 Brake Forming 6-9-2009 Finalvijay_paliwal9903Noch keine Bewertungen

- Welcome To The Court of Emperor Jalaluddin Muhammad Akbar: Satyam - Integrated Engineering SolutionsDokument12 SeitenWelcome To The Court of Emperor Jalaluddin Muhammad Akbar: Satyam - Integrated Engineering Solutionsvijay_paliwal9903Noch keine Bewertungen

- Uncertainty, Risk, and Their Management 1: Uncertainty As A Central Feature of Effective Project ManagementDokument1 SeiteUncertainty, Risk, and Their Management 1: Uncertainty As A Central Feature of Effective Project Managementvijay_paliwal9903Noch keine Bewertungen

- Project Micromanagement - PaperDokument13 SeitenProject Micromanagement - Papervijay_paliwal9903Noch keine Bewertungen

- Bluescope Sheet Coil Product Guide Nov 20101Dokument54 SeitenBluescope Sheet Coil Product Guide Nov 20101vijay_paliwal9903Noch keine Bewertungen

- MCQ BookDokument2 SeitenMCQ BookManish GaNoch keine Bewertungen

- Istc Info - Brochure - 2014Dokument28 SeitenIstc Info - Brochure - 2014vijay_paliwal9903Noch keine Bewertungen

- Project Opportunity and RiskDokument7 SeitenProject Opportunity and Riskvijay_paliwal9903Noch keine Bewertungen

- Techniques For Operations Efficiency1Dokument8 SeitenTechniques For Operations Efficiency1vijay_paliwal9903Noch keine Bewertungen

- Techniques For Operations Efficiency 3Dokument3 SeitenTechniques For Operations Efficiency 3vijay_paliwal9903Noch keine Bewertungen

- APM Risk SIG View From The Chair - Complete ManuscriptDokument51 SeitenAPM Risk SIG View From The Chair - Complete Manuscriptvijay_paliwal9903Noch keine Bewertungen

- Techniques For Operations EfficiencyDokument17 SeitenTechniques For Operations Efficiencyvijay_paliwal9903Noch keine Bewertungen

- Harwood WarburtonDokument15 SeitenHarwood Warburtonvijay_paliwal9903Noch keine Bewertungen

- Business Process Re Engg 4Dokument17 SeitenBusiness Process Re Engg 4vijay_paliwal9903Noch keine Bewertungen

- Managerial Economics4Dokument24 SeitenManagerial Economics4vijay_paliwal9903Noch keine Bewertungen

- Techniques For Operations Efficiency 4Dokument28 SeitenTechniques For Operations Efficiency 4vijay_paliwal9903Noch keine Bewertungen

- Business Process Re Engg 2Dokument12 SeitenBusiness Process Re Engg 2vijay_paliwal9903Noch keine Bewertungen

- Business Process Re Engg 1Dokument34 SeitenBusiness Process Re Engg 1vijay_paliwal9903Noch keine Bewertungen

- Managerial Economics1Dokument20 SeitenManagerial Economics1vijay_paliwal9903Noch keine Bewertungen

- Business Process Re Engg 3Dokument22 SeitenBusiness Process Re Engg 3vijay_paliwal9903Noch keine Bewertungen

- Financial Management 3Dokument19 SeitenFinancial Management 3vijay_paliwal9903Noch keine Bewertungen

- Managerial Economics3Dokument23 SeitenManagerial Economics3vijay_paliwal9903Noch keine Bewertungen

- Managerial Economics5Dokument7 SeitenManagerial Economics5vijay_paliwal9903Noch keine Bewertungen

- Managerial Economics2Dokument34 SeitenManagerial Economics2vijay_paliwal9903Noch keine Bewertungen

- Materials Management 01Dokument81 SeitenMaterials Management 01vijay_paliwal9903Noch keine Bewertungen

- Marketing Management 5Dokument11 SeitenMarketing Management 5vijay_paliwal9903Noch keine Bewertungen

- List of Attempted Questions and AnswersDokument7 SeitenList of Attempted Questions and Answersvijay_paliwal9903Noch keine Bewertungen

- Materials Management 03Dokument65 SeitenMaterials Management 03vijay_paliwal9903Noch keine Bewertungen

- Marketing Management 4Dokument12 SeitenMarketing Management 4vijay_paliwal9903Noch keine Bewertungen

- VVP Engineering College: Assignment 2 DDLDokument12 SeitenVVP Engineering College: Assignment 2 DDLUugttt7Noch keine Bewertungen

- Manual Fiat Novo Uno 2012Dokument2 SeitenManual Fiat Novo Uno 2012Anonymous a8g5oM2Noch keine Bewertungen

- What'sNew SWOOD2019Dokument16 SeitenWhat'sNew SWOOD2019Muhammad Bustan100% (1)

- MQTTDokument9 SeitenMQTTAsistencia Técnica JLFNoch keine Bewertungen

- Computer Technician Training CourseDokument8 SeitenComputer Technician Training CourseApnhs ApequeñoNoch keine Bewertungen

- PM Debug InfoDokument256 SeitenPM Debug InfoGreg Edimilson GregNoch keine Bewertungen

- Parallel Computers Networking PDFDokument48 SeitenParallel Computers Networking PDFHemprasad BadgujarNoch keine Bewertungen

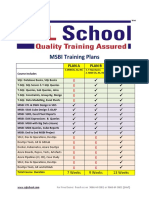

- MSBI Training Plans: Plan A Plan B Plan CDokument14 SeitenMSBI Training Plans: Plan A Plan B Plan CVeerendra ReddyNoch keine Bewertungen

- Ds Oop Lab ManualDokument63 SeitenDs Oop Lab ManualramaNoch keine Bewertungen

- Wpa Cli With Wpa SupplicantDokument7 SeitenWpa Cli With Wpa SupplicantCyber BellaaNoch keine Bewertungen

- User Manual Inspinia 8 10Dokument17 SeitenUser Manual Inspinia 8 10Smart House Soluții smart homeNoch keine Bewertungen

- Analysis of Algorithms: DR - Eid RehmanDokument8 SeitenAnalysis of Algorithms: DR - Eid RehmanOnsa piarusNoch keine Bewertungen

- 099 DefectDokument11 Seiten099 DefectKumud TembhareNoch keine Bewertungen

- I6.9 IP-10C MIB Reference (Rev A.03)Dokument110 SeitenI6.9 IP-10C MIB Reference (Rev A.03)Júnior SiqueiraNoch keine Bewertungen

- CEH v8 Labs Module 05 System HackingDokument117 SeitenCEH v8 Labs Module 05 System HackingDeris Bogdan Ionut100% (1)

- Comptia Data Da0 001 Exam Objectives (2 0)Dokument11 SeitenComptia Data Da0 001 Exam Objectives (2 0)John LawNoch keine Bewertungen

- Mobile Ip & Wap NotesDokument17 SeitenMobile Ip & Wap NotesMelissa HobbsNoch keine Bewertungen

- Avr 2807Dokument130 SeitenAvr 2807bechaseNoch keine Bewertungen

- An Interesting Guide 2Dokument58 SeitenAn Interesting Guide 2Orhan SelenNoch keine Bewertungen

- Medical Appointment Booking SystemDokument7 SeitenMedical Appointment Booking Systemsegun67% (3)

- TNB Lab 28.08.2020Dokument1 SeiteTNB Lab 28.08.2020Surendran RadhakrishnanNoch keine Bewertungen

- Integrating Usability Engineering and Agile Software Development A Literature ReviewDokument8 SeitenIntegrating Usability Engineering and Agile Software Development A Literature ReviewafdtukasgNoch keine Bewertungen

- SIPROTEC 5, Overcurrent Protection, Manual 9 C53000-G5040-C017-9, Edition 05.2018Dokument30 SeitenSIPROTEC 5, Overcurrent Protection, Manual 9 C53000-G5040-C017-9, Edition 05.2018Nguyễn MẫnNoch keine Bewertungen

- Impact of GOOSE Messages On IED Protection Schemes: Executive SummaryDokument5 SeitenImpact of GOOSE Messages On IED Protection Schemes: Executive SummaryNesma BOUDAMNoch keine Bewertungen

- Common Call Disconnection Cause CodesDokument10 SeitenCommon Call Disconnection Cause CodesUjjwal GoelNoch keine Bewertungen

- Unified Contact Center Enterprise (UCCE) and Customer Voice Portal (CVP) Installation Configuration and Deployment GuideDokument11 SeitenUnified Contact Center Enterprise (UCCE) and Customer Voice Portal (CVP) Installation Configuration and Deployment GuidesmairuraNoch keine Bewertungen