Beruflich Dokumente

Kultur Dokumente

Ias 34

Hochgeladen von

Dammika Madusanka0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

116 Ansichten4 SeitenIAS 34

Originaltitel

IAS 34

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenIAS 34

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

116 Ansichten4 SeitenIas 34

Hochgeladen von

Dammika MadusankaIAS 34

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

IFRS AT A GLANCE

IAS 34 Interim Financial Reporting

As at 1 July 2014

IAS 34 Interim Financial Reporting

Also refer:

IFRIC 10 Interim Financial Reporting and Impairment

Effective Date

Periods beginning on or after 1 January 1999

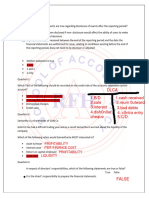

Specific quantitative disclosure requirements:

Applies to entities required by legislation or

other pronouncements or that elect to publish

interim financial reports

IAS 34 does not apply where interim financial

statements included in a prospectus

Standard does not mandate which entities

should produce interim financial reports.

If complete set is published in the interim report, full compliance with IFRS is required

If condensed set is published the interim report is required to include at a minimum:

- A condensed statement of financial position

- A condensed statement of comprehensive income (using either the one or two statement approach see IAS 1)

- A condensed statement of changes in equity

- A condensed statement of cash flows

- Selected explanatory notes (guidance is given in IAS 34.15 16A).

The condensed statements are required to include at least:

- Headings and subtotals included in most recent annual financial statements

- Selected minimum explanatory notes - explaining events and transactions significant to an understanding of the changes in financial position/performance since last annual

reporting date

- Selected line items or notes if their omission would make the condensed financial statements misleading

- Basic and diluted earnings per share (if applicable) on the face of statement of comprehensive income.

DEFINITIONS

Interim period financial period shorter than

full year

Interim financial report either a complete

(as described in IAS 1) or condensed set of

financial statements.

RECOGNITION AND MEASUREMENT

Principles for recognising assets, liabilities,

income and expenses are same as in the most

recent annual financial statements, unless:

- There is a change in an accounting

policy that is to be reflected in the next

annual financial statements.

Tax recognised based on weighted average

annual income tax rate expected for the full

year

Tax rate changes during the year are adjusted

in the subsequent interim period during the

year.

Revenue received during the year should not be anticipated or deferred

where anticipation would not be appropriate at year end

Recognised as it occurs.

Anticipated or deferred only if it would be

possible to defer or anticipate at year end.

Statement of financial position as at the end of the current interim period (e.g. 30 Sept. 20X2) and as of the end of the immediate preceding financial year (e.g.

31 December 20X1)

Statements of comprehensive income for the current interim period (e.g. July Sept. 20X2) and cumulatively for the current financial year (Jan. Sept. 20X2) (which will be

the same for half year ends), with comparatives for the interim period of the preceding financial year (Jan. Sept. 20X1)

Statements of changes in equity for the current financial year to date, with comparatives for the year to date of the immediately preceding financial year

Statements of cash flows for the current financial year to date, with comparatives for the year to date of the immediately preceding financial year.

For highly seasonal entities, consider reporting additional information for

12 months

Changes in accounting policies accounted as normal in terms of IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors

See appendix B for examples.

Interim reports require a greater use

of estimates than annual reports.

ACCOUNTING POLICIES SEASONAL, CYCLICAL OR OCCASIONAL REVENUE COSTS INCURRED UNEVENLY USE OF ESTIMATES

OTHER

PERIODS TO BE PRESENTED IMPAIRMENT

Guidance on impairment is given in IFRIC 10

Interim Financial Reporting and Impairment.

Disclose the fact that the interim financial statements comply with IAS 34.

COMPLIANCE WITH IAS 34

For further information about how BDO can assist you and your organisation, please get in touch with one of our key contacts listed below.

Alternatively, please visit www.bdointernational.com/Services/Audit/IFRS/IFRS Country Leaders where you can nd full lists of regional and

country contacts.

Caroline Allout France caroline.allouet@bdo.fr

Jens Freiberg Germany jens.freiberg@bdo.de

Teresa Morahan Ireland tmorahan@bdo.ie

Ehud Greenberg Israel ehudg@bdo.co.il

Ruud Vergoossen Netherlands ruud.vergoossen@bdo.nl

Reidar Jensen Norway reidar.jensen@bdo.no

Maria Sukonkina Russia m.sukonkina@bdo.ru

Ren Krgel Switzerland rene.kruegel@bdo.ch

Brian Creighton United Kingdom brian.creighton@bdo.co.uk

Asia Pacic

Wayne Basford Australia wayne.basford@bdo.com.au

Zheng Xian Hong China zheng.xianhong@bdo.com.cn

Fanny Hsiang Hong Kong fannyhsiang@bdo.com.hk

Khoon Yeow Tan Malaysia tanky@bdo.my

Latin America

Marcelo Canetti Argentina mcanetti@bdoargentina.com

Luis Pierrend Peru lpierrend@bdo.com.pe

Ernesto Bartesaghi Uruguay ebartesaghi@bdo.com.uy

North America & Caribbean

Armand Capisciolto Canada acapisciolto@bdo.ca

Wendy Hambleton USA whambleton@bdo.com

Middle East

Arshad Gadit Bahrain arshad.gadit@bdo.bh

Antoine Gholam Lebanon agholam@bdo-lb.com

Sub Saharan Africa

Nigel Grifth South Africa ngrifth@bdo.co.za

This publication has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. The publication cannot be relied

upon to cover specic situations and you should not act, or refrain from acting, upon the information contained therein without obtaining specic professional

advice. Please contact your respective BDO member rm to discuss these matters in the context of your particular circumstances. Neither BDO IFR Advisory

Limited, Brussels Worldwide Services BVBA, BDO International Limited and/or BDO member rms, nor their respective partners, employees and/or agents accept

or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any

decision based on it.

Service provision within the international BDO network of independent member rms (the BDO network) in connection with IFRS (comprising International

Financial Reporting Standards, International Accounting Standards, and Interpretations developed by the IFRS Interpretations Committee and the former Standing

Interpretations Committee), and other documents, as issued by the International Accounting Standards Board, is provided by BDO IFR Advisory Limited, a UK

registered company limited by guarantee. Service provision within the BDO network is coordinated by Brussels Worldwide Services BVBA, a limited liability

company incorporated in Belgium with its statutory seat in Brussels.

Each of BDO International Limited (the governing entity of the BDO network), Brussels Worldwide Services BVBA, BDO IFR Advisory Limited and the member

rms is a separate legal entity and has no liability for another such entitys acts or omissions. Nothing in the arrangements or rules of the BDO network shall

constitute or imply an agency relationship or a partnership between BDO International Limited, Brussels Worldwide Services BVBA, BDO IFR Advisory Limited and/

or the member rms of the BDO network.

BDO is the brand name for the BDO network and for each of the BDO member rms.

2014 BDO IFR Advisory Limited, a UK registered company limited by guarantee. All rights reserved.

www.bdointernational.com

Europe

Das könnte Ihnen auch gefallen

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNoch keine Bewertungen

- Ifrs at A Glance: IAS 10 Events After The ReportingDokument4 SeitenIfrs at A Glance: IAS 10 Events After The ReportingAlyssa Marie CagueteNoch keine Bewertungen

- Ias 26Dokument4 SeitenIas 26muhammadazmatullahNoch keine Bewertungen

- Illustrative Consolidated Financial StatementsDokument209 SeitenIllustrative Consolidated Financial Statementsalexichi100% (2)

- IFRS Illustrative Financial Statements (Dec 2014)Dokument238 SeitenIFRS Illustrative Financial Statements (Dec 2014)Aayushi AroraNoch keine Bewertungen

- Requirements For Financial Statements Under The International Financial Reporting StandardsDokument4 SeitenRequirements For Financial Statements Under The International Financial Reporting StandardsabdellaNoch keine Bewertungen

- VALUE IFRS PLC Interim June 2022 Final 26 MarchDokument45 SeitenVALUE IFRS PLC Interim June 2022 Final 26 MarchKatarina GojkovicNoch keine Bewertungen

- Sample Manufacturing Company Consolidated Financial StatementsDokument36 SeitenSample Manufacturing Company Consolidated Financial StatementstalhaadnanNoch keine Bewertungen

- Pas 34 Interim Financial Reporting Group 15Dokument56 SeitenPas 34 Interim Financial Reporting Group 15Faker MejiaNoch keine Bewertungen

- Ias 16Dokument4 SeitenIas 16Alloysius ParilNoch keine Bewertungen

- CHAPTER 12 - Interim Financial ReportingDokument47 SeitenCHAPTER 12 - Interim Financial ReportingChristian Gatchalian100% (1)

- IAS 34rDokument2 SeitenIAS 34rCristina Andreea MNoch keine Bewertungen

- HA2032 AssignmentDokument12 SeitenHA2032 AssignmentSajid ali KhanNoch keine Bewertungen

- Interim Financial ReportingDokument4 SeitenInterim Financial ReportingsharbularsNoch keine Bewertungen

- 0608 Ifric 10Dokument2 Seiten0608 Ifric 10Civite ZaharNoch keine Bewertungen

- What Are Form and Content of Interim Reports?Dokument5 SeitenWhat Are Form and Content of Interim Reports?Princess Camilla SmithNoch keine Bewertungen

- PAS 34 Interim Financial Reporting: ObjectiveDokument3 SeitenPAS 34 Interim Financial Reporting: ObjectivekristineNoch keine Bewertungen

- IFRS Illustrative Financial StatementsDokument306 SeitenIFRS Illustrative Financial Statementsjohnthorrr100% (1)

- SIC 31 GuidanceDokument4 SeitenSIC 31 GuidanceFrancisCzeasarChuaNoch keine Bewertungen

- Pas 1Dokument52 SeitenPas 1Justine VeralloNoch keine Bewertungen

- Thame and London Trading Update To Note Holders 2020 Q1 Final Web PublishedDokument6 SeitenThame and London Trading Update To Note Holders 2020 Q1 Final Web PublishedsaxobobNoch keine Bewertungen

- 2022 Interim FinancialDokument34 Seiten2022 Interim Financialsumanthsumi2023Noch keine Bewertungen

- F7p2int Examdocs2011Dokument5 SeitenF7p2int Examdocs2011wickygeniusNoch keine Bewertungen

- IAS 34 Interim Financial ReportingDokument4 SeitenIAS 34 Interim Financial ReportingKelvumNoch keine Bewertungen

- Slas 03Dokument11 SeitenSlas 03Dinushika MadhubhashiniNoch keine Bewertungen

- Interim Financial ReportingDokument3 SeitenInterim Financial ReportingBernie Mojico CaronanNoch keine Bewertungen

- TVL Finance PLC Trading Update Announcement 26 March 2020 FINALDokument6 SeitenTVL Finance PLC Trading Update Announcement 26 March 2020 FINALsaxobobNoch keine Bewertungen

- PWC - IfrsDokument65 SeitenPWC - Ifrsalmirb7Noch keine Bewertungen

- 2015 Earnings ReleaseDokument42 Seiten2015 Earnings ReleaseHasnain HasnainNoch keine Bewertungen

- PAS 1 - Presentation of FS For LMSDokument72 SeitenPAS 1 - Presentation of FS For LMSnot funny didn't laughNoch keine Bewertungen

- EY Xyz Holdings Singapore Limited 2014 PDFDokument234 SeitenEY Xyz Holdings Singapore Limited 2014 PDFMildred PagsNoch keine Bewertungen

- Ifrs Top20 Tracker 2013Dokument44 SeitenIfrs Top20 Tracker 2013ingridbachNoch keine Bewertungen

- Singapore Illustrative Financial Statements 2017Dokument380 SeitenSingapore Illustrative Financial Statements 2017Sergey MasloveNoch keine Bewertungen

- IFRS Illustrative Financial Statements (Dec 2019) FINALDokument290 SeitenIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNoch keine Bewertungen

- Financial Statements Ara 2021Dokument100 SeitenFinancial Statements Ara 2021Krishna HarshitaNoch keine Bewertungen

- F7p2int Examdocs2011Dokument5 SeitenF7p2int Examdocs2011crazyfaisalNoch keine Bewertungen

- Pas 34Dokument2 SeitenPas 34MMBRIMBAPNoch keine Bewertungen

- F7p2int Examdocs2012Dokument5 SeitenF7p2int Examdocs2012mrza135Noch keine Bewertungen

- FAR - Interim Financial ReportingDokument9 SeitenFAR - Interim Financial ReportingIra CuñadoNoch keine Bewertungen

- Thame and London Trading Update To Note Holders June 2020 VFDokument6 SeitenThame and London Trading Update To Note Holders June 2020 VFsaxobobNoch keine Bewertungen

- Interim Financial ReportingDokument9 SeitenInterim Financial ReportingNelly GomezNoch keine Bewertungen

- Indian Accounting Standard 34Dokument17 SeitenIndian Accounting Standard 34Reetika VaidNoch keine Bewertungen

- Thame and London Quarterly Report To Note Holders 2020 Q1 Final 27.5.2020Dokument33 SeitenThame and London Quarterly Report To Note Holders 2020 Q1 Final 27.5.2020saxobobNoch keine Bewertungen

- Income ChecklistDokument17 SeitenIncome ChecklistbanglauserNoch keine Bewertungen

- CHAPTER 24 - SMEs DefinitionDokument17 SeitenCHAPTER 24 - SMEs DefinitionChristian GatchalianNoch keine Bewertungen

- Iar-2021 Copy 2Dokument486 SeitenIar-2021 Copy 2Gordon ZNoch keine Bewertungen

- IFSR Guide by PWC PDFDokument67 SeitenIFSR Guide by PWC PDFFazlihaq DurraniNoch keine Bewertungen

- Interim Financial ReportingDokument4 SeitenInterim Financial ReportingBea ChristineNoch keine Bewertungen

- F3 Topics Single Entry RelatedParties Etc - Batuyong ConcepcionDokument27 SeitenF3 Topics Single Entry RelatedParties Etc - Batuyong ConcepcionAngelou Ferrer PrietoNoch keine Bewertungen

- Ias 34Dokument11 SeitenIas 34Shah Kamal100% (1)

- ComplianceDokument6 SeitenCompliancementinfusionNoch keine Bewertungen

- Ias 34Dokument2 SeitenIas 34Foititika.net100% (2)

- Chapter 19 Interim ReportingDokument6 SeitenChapter 19 Interim ReportingEllen MaskariñoNoch keine Bewertungen

- Pas 34Dokument17 SeitenPas 34rena chavezNoch keine Bewertungen

- CoverDokument284 SeitenCoverstoreroom_02Noch keine Bewertungen

- Ifrs and External Indepdent ReportDokument27 SeitenIfrs and External Indepdent ReportHyder AliNoch keine Bewertungen

- Deloitte Model Financial Statements 31dec2020Dokument192 SeitenDeloitte Model Financial Statements 31dec2020Sabina GartaulaNoch keine Bewertungen

- Secondary Market Financing Revenues World Summary: Market Values & Financials by CountryVon EverandSecondary Market Financing Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Von EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Noch keine Bewertungen

- May 2009 PDFDokument40 SeitenMay 2009 PDFDammika MadusankaNoch keine Bewertungen

- MIRAconnect GST MIRA 206 FormDokument1 SeiteMIRAconnect GST MIRA 206 FormDammika MadusankaNoch keine Bewertungen

- Cima P9Dokument38 SeitenCima P9Dammika MadusankaNoch keine Bewertungen

- 11 Smart Hacks For IELTSDokument19 Seiten11 Smart Hacks For IELTSDammika MadusankaNoch keine Bewertungen

- Acca Ssekitto Baker CpaDokument11 SeitenAcca Ssekitto Baker CpaDammika MadusankaNoch keine Bewertungen

- May 2009 PDFDokument40 SeitenMay 2009 PDFDammika MadusankaNoch keine Bewertungen

- Compilation ReportDokument4 SeitenCompilation ReportDammika MadusankaNoch keine Bewertungen

- 1453198480Dokument56 Seiten1453198480Dammika MadusankaNoch keine Bewertungen

- Acca Ssekitto Baker CpaDokument11 SeitenAcca Ssekitto Baker CpaDammika MadusankaNoch keine Bewertungen

- 20 Great Google SecretsDokument4 Seiten20 Great Google Secretsammad100% (7)

- Performance MeasurementDokument2 SeitenPerformance MeasurementDammika MadusankaNoch keine Bewertungen

- F3 Feb 07 FmarticleDokument4 SeitenF3 Feb 07 FmarticleDammika MadusankaNoch keine Bewertungen

- C 1 June 2011 FM ArticleDokument2 SeitenC 1 June 2011 FM ArticleDammika MadusankaNoch keine Bewertungen

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDokument30 SeitenFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaNoch keine Bewertungen

- Ias 8Dokument4 SeitenIas 8Dammika MadusankaNoch keine Bewertungen

- A Basic Guide To The InternetDokument4 SeitenA Basic Guide To The InternetHendra NugrahaNoch keine Bewertungen

- Complex Groups Masterclass QuestionsDokument34 SeitenComplex Groups Masterclass QuestionsSaniya KhanNoch keine Bewertungen

- Ias 1Dokument4 SeitenIas 1Dammika MadusankaNoch keine Bewertungen

- Working Capital Management StrategiesDokument3 SeitenWorking Capital Management StrategiesRAVC15Noch keine Bewertungen

- Business PlanDokument29 SeitenBusiness PlanDammika MadusankaNoch keine Bewertungen

- The CIPFA FM Model: Transform Your Financial HealthDokument2 SeitenThe CIPFA FM Model: Transform Your Financial HealthDammika MadusankaNoch keine Bewertungen

- New Student Welcome PackDokument28 SeitenNew Student Welcome PackDammika MadusankaNoch keine Bewertungen

- Working CapitalDokument24 SeitenWorking CapitalŠämýâkJâïňNoch keine Bewertungen

- Syllabus 2010Dokument88 SeitenSyllabus 2010Dammika MadusankaNoch keine Bewertungen

- Enterprise Operations (Revision Summaries) : Cima Operational Level - Paper E1Dokument105 SeitenEnterprise Operations (Revision Summaries) : Cima Operational Level - Paper E1ronita_9343248Noch keine Bewertungen

- P1 Revision SummariesDokument72 SeitenP1 Revision SummariesJoanna ChuNoch keine Bewertungen

- ,types of StrategiesDokument32 Seiten,types of StrategiesmrunmaikrishnaNoch keine Bewertungen

- CrispDokument33 SeitenCrispDammika MadusankaNoch keine Bewertungen

- 5 Days Tour PDFDokument4 Seiten5 Days Tour PDFDammika MadusankaNoch keine Bewertungen

- The Variable Costing: Profit ModellingDokument15 SeitenThe Variable Costing: Profit ModellingAngel Keith Mercado100% (1)

- Economic Value Added (EVA) of Sample CompaniesDokument44 SeitenEconomic Value Added (EVA) of Sample CompaniesRikesh Daliya83% (6)

- Chapter 5: Accounting For Merchandising OperationsDokument15 SeitenChapter 5: Accounting For Merchandising Operationskareem abozeedNoch keine Bewertungen

- Accounting FormulaDokument4 SeitenAccounting FormulaAndrea AbayaNoch keine Bewertungen

- Chapter 15 Capital BudgetingDokument16 SeitenChapter 15 Capital BudgetingCelestaire LeeNoch keine Bewertungen

- IFA Chapter 4Dokument15 SeitenIFA Chapter 4Suleyman TesfayeNoch keine Bewertungen

- 2022-2023 INTACC3 PAS 1 HandoutsDokument9 Seiten2022-2023 INTACC3 PAS 1 HandoutsJefferson AlingasaNoch keine Bewertungen

- Accounting Assignment Chapter 13 Answers - 6Dokument5 SeitenAccounting Assignment Chapter 13 Answers - 6alexie aurelioNoch keine Bewertungen

- Chap 012Dokument74 SeitenChap 012wesh80% (5)

- Integrative Case 2 Encore InternationalDokument37 SeitenIntegrative Case 2 Encore InternationalRiangelli Exconde100% (1)

- Template 16 4 30 21Dokument85 SeitenTemplate 16 4 30 21Ahmad Juma SuleimanNoch keine Bewertungen

- Uid46434 UCCD Financial Accounting Question PaperDokument7 SeitenUid46434 UCCD Financial Accounting Question PaperPhoenixFirebrdNoch keine Bewertungen

- Toaz - Info Quiz1 Set A PR PDFDokument8 SeitenToaz - Info Quiz1 Set A PR PDFNah HamzaNoch keine Bewertungen

- Break-Even Point NotesDokument3 SeitenBreak-Even Point NotesMinu Mary Jolly100% (1)

- Bossard Holding AG - Annual Report - 2021Dokument146 SeitenBossard Holding AG - Annual Report - 2021A ÁNoch keine Bewertungen

- Balance Sheet of Itc LTDDokument7 SeitenBalance Sheet of Itc LTDMarri Sushma Swaraj ReddyNoch keine Bewertungen

- Manufacturing OperationsDokument13 SeitenManufacturing OperationsAlyssa Camille CabelloNoch keine Bewertungen

- Rapport de MadioDokument88 SeitenRapport de Madioroni jeufoNoch keine Bewertungen

- Accounting For Merchandising OperationsDokument58 SeitenAccounting For Merchandising OperationsHEM CHEA100% (11)

- Chapter 32Dokument22 SeitenChapter 32Clifford BacsarzaNoch keine Bewertungen

- Absorption and Marginal Costing Multiple Choice Questions: The Difference Between Selling Price and Variable CostDokument3 SeitenAbsorption and Marginal Costing Multiple Choice Questions: The Difference Between Selling Price and Variable CostSuresh SubramaniNoch keine Bewertungen

- Fundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 2 Statement of Comprehensive IncomeDokument23 SeitenFundamentals of Accountancy, Business & Management 2: Quarter 1 - SLM 2 Statement of Comprehensive IncomeMark Joseph BielzaNoch keine Bewertungen

- DR - Mahesh Kumar: Prepared byDokument20 SeitenDR - Mahesh Kumar: Prepared bymahesh kumarNoch keine Bewertungen

- Dlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DDokument16 SeitenDlca 1.B/D 2.sale 3.interest 4.dish0n0ur Cheque 1.cash Received 2.reurn 0utward 3.bad Debts 4. C0ntra Entry 5.C/DIqra HanifNoch keine Bewertungen

- CH 01 SkousenDokument50 SeitenCH 01 SkousenEstiNoch keine Bewertungen

- The Philippine Public Sector Accounting StandardsDokument8 SeitenThe Philippine Public Sector Accounting StandardsRichel ArmayanNoch keine Bewertungen

- Inflation Accounting New CourseDokument11 SeitenInflation Accounting New CourseAkshay Mhatre100% (1)

- Mark Scheme Summer 2009: GCE Accounting (8011-9011)Dokument16 SeitenMark Scheme Summer 2009: GCE Accounting (8011-9011)Nooh donoNoch keine Bewertungen

- Basic Acctg MCQDokument20 SeitenBasic Acctg MCQJohn Ace100% (2)

- Befa Accounting Concepts and ConventionsDokument24 SeitenBefa Accounting Concepts and ConventionsJaipal Nayak BanavathNoch keine Bewertungen