Beruflich Dokumente

Kultur Dokumente

CBM Group 3 Sbi and HDFC

Hochgeladen von

minalgargOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CBM Group 3 Sbi and HDFC

Hochgeladen von

minalgargCopyright:

Verfügbare Formate

Commercial Bank Management

Report on

Bank Performance and Profitability Analysis

of

and

Submitted to : Prof D.N.Panigrahi

Submitted by: Group 3, ABC1

Abhinav Kohale (2013004)

Abirbira Samal (2013007)

Anil Kumar Reddy (2013031)

Anshul Rajora (2013046)

B.N.V. Kartik (2013072)

Ganesh Kamath (2013100)

INTRODUCTION

ABOUT HDFC

HDFC Bank was incorporated in 1994 by Housing Development Finance Corporation Limited (HDFC), India's

largest housing finance company. It was among the first companies to receive an 'in principle' approval

from the Reserve Bank of India (RBI) to set up a bank in the private sector. The Bank started

operations as a scheduled commercial bank in January 1995 under the RBI's liberalization policies.

Times Bank Limited (owned by Bennett, Coleman & Co. / Times Group) was merged with HDFC Bank Ltd., in 2000.

This was the first merger of two private banks in India. Shareholders of Times Bank received 1 share of HDFC Bank for

every 5.75shares of Times Bank. In 2008 HDFC Bank acquired Centurion Bank of Punjab taking its total branches

tomorrow than 1,000. The amalgamated bank emerged with a base of about Rs. 1, 22,000 crore and net

advances of about Rs.89, 000 crore. The balance sheet size of the combined entity is more than Rs. 1, 63,000

crore

ABOUT SBI

State Bank of India is a multinational banking and financial services company based in India. It is a

government-owned corporation with its headquarters in Mumbai, Maharashtra. As of December 2013,

it had assets of US$170 billion, making it the largest banking and financial services company in India

by assets.

[3][4]

State Bank of India is one of the Big Four banks of India, along with ICICI Bank, Punjab

National Bank and Bank. The bank traces its ancestry to British India, through the Imperial Bank of

India, to the founding, in 1806, of the Bank of Calcutta, making it the oldest commercial bank in the

Indian Subcontinent. Bank of Madras merged into the other two "presidency banks" in British India,

Bank of Calcutta and Bank of Bombay, to form the Imperial Bank of India, which in turn became the

State Bank of India. Government of India owned the Imperial Bank of India in 1955, with Reserve

Bank of India (India's Central Bank) taking a 60% stake, and renamed it the State Bank of India. In

2008, the government took over the stake held by the Reserve Bank of India.

State Bank of India is a regional banking behemoth and has 20% market share in deposits and loans

among Indian commercial banks

RECENT DATA ABOUT HDFC & SBI (In 2014)

Bank Number of employees Number of branches Number of

ATMs

HDFC 68165 3403 11256

SBI 222033 15869 100000

BALANCESHEETS OF SBI AND HDFC (Rs in Cr )

Bank SBI HDFC

Parameter FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

Deposits 933933 1043647 1202740 1394409 208586 246706 296247 367337

Growth/change(YOY) 16% 12% 15% 16% 25% 18% 20% 24%

Advances 756719 867579 1045617 1209829 159983 195420 239721 303000

Growth 20% 15% 21% 16% 27% 22% 23% 26%

Total business mix

(deposits+advances)

1690652 1911226 2248357 2604238 368569 442126 535968 670337

Growth 18% 13% 18% 16% 26% 20% 21% 25%

Savings A/C deposits 323394 359847 414907 469262 63448 73998 88211 103113

Current A/C deposits 107059 98273 110581 150273.9 46460 45408 52310 61488

CASA ratio 46.1% 43.9% 43.7 % 44.4 % 52.7% 48.4% 47.4% 44.8%

(CASA/Total

deposits)

Shareholders equity 635.08 671.13 684.12 746.57 465.23 469.34 475.88 479.81

TOTAL ASSETS 1223736 1335519 1566261 1792235 277352 337909 400332 491600

Interpretation:

Though the deposits and advances of HDFC bank is lesser than SBI bank; the growth rate

is higher for HDFC bank because of aggressive business strategy.

The CASA ratio for HDFC bank is higher than SBI bank but it is decreasing year by year.

As other banks like YES bank and Kotak Mahindra bank are providing more interest on

saving deposits.

PROFIT & LOSS STATEMENT

Bank SBI HDFC

Parameter (in Rs. Cr.) FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

1.Interest income

81394 106521 119657 136351 19928 27874 35065 41135

2. Interest expenditure 48868 63230 75326 87069 9385 14989 19254 22653

3.Net interest income (NII) (1-2) 32526 43291 44331 49282 10543 12885 15811 18482

4. Non interest income 15825 14351 16035 18553 4335 5783 6853 7920

5. Total Operating income (1+4) 97219 120872 135692 154904 24263 33657 41918 49055

6. Net operating income(3+4) 48351 57642 60366 67835 14878 18668 22664 26402

7. Operating expenditure 23015 26069 29284 35726

7153 9278 11236 12042

8. Operating profit (6-7) 25336 31573 31082 32109 7725 9390 11428 14360

9. Provisions & contingencies 17071 19866 16977 21218

3799 4223 4701 5882

10. Profit after tax (8-9) 8265 11707 14105 10891 3926 5167 6727 8478

ASSET QUALITY

Banks SBI HDFC

Parameter (in Rs. Cr.) FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

1.Gross loans or Credit

756719 867579 1045617 1209829 159982 195420 239721 303000

2.Gross NPA

25326 39676 51189 61605

1694 1999 2335 2989

3.NPA provisions

12979 23857 29233 30509

1398 1647 1866 2169

4.Net NPA (2-3) 12347 15819 21956 31096 296 352 469 820

5. Net loan or credit (1-3) 743740 843722 1016384 1179320 158584 193773 237855 300831

6. Gross NPA ratio (Gross

NPA to Gross Credit)= 2/1

3.35% 4.57% 4.90% 5.09% 1.06% 1.02% 0.97% 0.99%

7. Net NPA ratio (Net NPA

to Net Credit) = 4/5

1.66% 1.87% 2.16% 2.64% 0.19% 0.18% 0.20% 0.27%

8.Povision Coverage Ratio

(PCR) = 3/2

51.25% 60.13% 57.11% 49.52% 82.53% 82.39% 79.91% 72.57%

*All value in Rs. Cr.

Interpretation:

Both the gross and net NPA ratio is higher for SBI bank as compared to HDFC bank. It

shows that NPA is managed effectively by HDFC bank.

PCR is lesser for SBI bank, which should be minimum 70 % as per RBI guidelines.

HDFC bank has maintained this ratio

PRODUCTIVITY

Parameters

SBI HDFC

(in Rs. Cr.) FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

Avg. profit per

employee (Net

Income/avg. no. of

employees) 0.037075582 0.05433 0.061784 0.049051 0.070419 0.078198 0.097401 0.124375

Avg. business per

employee (Bus. Mix/

avg. no. of

employees)

7.5840178 8.86958 9.84843 11.7291 6.61087 6.69117 7.76034 9.83404

Avg. profit per

branch

0.61032344 0.83046 0.95201 0.68631 1.97684 2.03105 2.19693 2.49133

Avg. business per

branch

124.845075 135.577 151.752 164.109 185.584 173.792 175.039 196.984

INTERPRETATION:

Average profit per employee, average profit per branch and average business mix per branch is

higher for HDFC bank as compared to SBI bank. So, HDFC bank is more efficient in utilizing its

resources.

Though average business mix per employee is increasing for SBI bank, the average profit per

employee is decreasing.

VULNERABILTY

Basel 2

Banks SBI HDFC

Parameter FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

Tier-1 capital

63901 82125 94947 112333 23718 28067 33881 42154

Tier-2 capital 34629 34200 34415 33512 7743 11898 17519 15424

Total capital funds (T-1 + T-2) 98530 116325 129362 145845 31461 39965 51400 57578

CAR or CRAR (Basel-1)

15.32% 15.71%

15.94%

CAR or CRAR (Basel-2) 11.98% 13.86% 12.92% 12.96% 16.22% 16.52%

16.80% 16.10%

INTERPRETATION:

Both SBI and HDFC bank have maintained the minimum CAR of 9% as per RBI

guidelines.

HDFC bank has maintained a higher CAR as compared to SBI bank. This will help

HDFC bank to protect depositors and promote the stability and efficiency of financial

systems around the world in better way.

PERFORMANCE AND PROFITABILITY

SBI HDFC

Parameter FY 11 FY 12 FY 13 FY 14 FY 11 FY 12 FY 13 FY 14

NIM

2.69% 3.38% 3.06% 2.93% 1.02% 4.19% 4.28% 4.14%

Cost to income

ratio

0.4760 0.4523 0.4851 0.5267 0.4808 0.4970 0.4958 0.4561

% of Non

interest income

to Total

operating

income

16.28% 11.87% 11.82% 11.98% 17.87% 17.18% 16.35% 16.15%

Overhead

efficiency

(Non Int.

Income/Non

Int. Exp.)

68.76% 55.05% 54.76% 51.93% 60.60% 62.33% 60.99% 65.77%

Efficiency

Ratio

0.2367 0.2157 0.2158 0.2306 0.2948 0.2757 0.2680 0.2455

ROA

(AU*NPM)

0.68% 0.88% 0.90% 0.61% 1.42% 1.53% 1.68% 1.72%

AU 7.94% 9.05% 8.66% 8.64% 8.75% 9.96% 10.47% 9.98%

NPM 8.50% 9.69% 10.39% 7.03% 16.18% 15.35% 16.05% 17.28%

ROE

(ROA*EM)

13.01% 17.44% 20.62% 14.59% 8.44% 11.01% 14.14% 17.67%

EM (A/E) 1926.90 1989.96 2289.45 2400.63 596.16 719.97 841.25 1024.57

INTERPRETATION:

NIM of HDFC bank is higher as compared to SBI bank.

Cost to income ratio for HDFC bank is higher than SBI bank from 2011 to 2013 and it

has decreased drastically and lesser than SBI bank.

Overhead efficiency of SBI bank is in the range of 50 to 70% and for HDFC bank it is in

the range of 60 to 66%.

Return on Assets is higher for HDFC bank than SBI bank & it is increasing year by year.

Return on Equity of HDFC bank is lower than SBI bank and it id increasing year by year.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Accounting Equation For PracticeDokument3 SeitenAccounting Equation For PracticeminalgargNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Project Financial Accounting For Managers PGDM 2013-2015Dokument11 SeitenProject Financial Accounting For Managers PGDM 2013-2015minalgargNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- CBM Group 3 Sbi and HDFCDokument9 SeitenCBM Group 3 Sbi and HDFCminalgargNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- National Income and Business Cycles: Shyam Sreekumaran Nair Institute of Management Technology NagpurDokument10 SeitenNational Income and Business Cycles: Shyam Sreekumaran Nair Institute of Management Technology NagpurminalgargNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Business Environment: Shyam Sreekumaran NairDokument16 SeitenBusiness Environment: Shyam Sreekumaran NairminalgargNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Those With MoonDokument1 SeiteThose With MoonRosee AldamaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Chemical Engineering Projects List For Final YearDokument2 SeitenChemical Engineering Projects List For Final YearRajnikant Tiwari67% (6)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Goals in LifeDokument4 SeitenGoals in LifeNessa Layos MorilloNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Reaction Paper-RprDokument6 SeitenReaction Paper-Rprapi-543457981Noch keine Bewertungen

- S ELITE Nina Authors Certain Ivey This Reproduce Western Material Management Gupta Names Do OntarioDokument15 SeitenS ELITE Nina Authors Certain Ivey This Reproduce Western Material Management Gupta Names Do Ontariocarlos menaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 204-04B - Tire Pressure Monitoring System (TPMS)Dokument23 Seiten204-04B - Tire Pressure Monitoring System (TPMS)Sofia AltuzarraNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Dressmaking - Q1 TASK-SHEET v1 - Schalemar OmbionDokument2 SeitenDressmaking - Q1 TASK-SHEET v1 - Schalemar OmbionAlvaCatalinaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 2 Dawn150Dokument109 Seiten2 Dawn150kirubelNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Analysis of Pure Copper - A Comparison of Analytical MethodsDokument12 SeitenAnalysis of Pure Copper - A Comparison of Analytical Methodsban bekasNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Null 6 PDFDokument1 SeiteNull 6 PDFSimbarashe ChikariNoch keine Bewertungen

- Bedwetting TCMDokument5 SeitenBedwetting TCMRichonyouNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ArticleDokument5 SeitenArticleJordi Sumoy PifarréNoch keine Bewertungen

- ISO 45001:2018 & OHSAS 18001:2007 Clause-Wise Comparison MatrixDokument3 SeitenISO 45001:2018 & OHSAS 18001:2007 Clause-Wise Comparison MatrixvenkatesanNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Heart Sounds: Presented by Group 2A & 3ADokument13 SeitenHeart Sounds: Presented by Group 2A & 3AMeow Catto100% (1)

- Starkville Dispatch Eedition 9-10-20Dokument12 SeitenStarkville Dispatch Eedition 9-10-20The DispatchNoch keine Bewertungen

- Not Really A StoryDokument209 SeitenNot Really A StorySwapnaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- ACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationDokument2 SeitenACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional InformationkietNoch keine Bewertungen

- Potato Storage and Processing Potato Storage and Processing: Lighting SolutionDokument4 SeitenPotato Storage and Processing Potato Storage and Processing: Lighting SolutionSinisa SustavNoch keine Bewertungen

- D6228 - 10Dokument8 SeitenD6228 - 10POSSDNoch keine Bewertungen

- Science and TechnologyDokument21 SeitenScience and TechnologyPat MillerNoch keine Bewertungen

- Study Notes On Isomers and Alkyl HalidesDokument3 SeitenStudy Notes On Isomers and Alkyl HalidesChristian Josef AvelinoNoch keine Bewertungen

- Inducement of Rapid Analysis For Determination of Reactive Silica and Available Alumina in BauxiteDokument11 SeitenInducement of Rapid Analysis For Determination of Reactive Silica and Available Alumina in BauxiteJAFAR MUHAMMADNoch keine Bewertungen

- DX340LC: Crawler ExcavatorDokument20 SeitenDX340LC: Crawler ExcavatorFeristha Meriani TabitaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Carboset CA-600 - CST600 - CO - enDokument3 SeitenCarboset CA-600 - CST600 - CO - enNilsNoch keine Bewertungen

- Demages Goods RecordDokument22 SeitenDemages Goods Recordtariq malikNoch keine Bewertungen

- Iomm VFD-3 030112Dokument100 SeitenIomm VFD-3 030112Alexander100% (1)

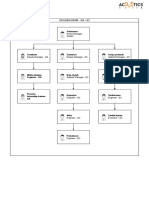

- Organogram - Qa / QC: Srinivasan SrinivasanDokument4 SeitenOrganogram - Qa / QC: Srinivasan SrinivasanGowtham VenkatNoch keine Bewertungen

- Psychoanalysis AND History: Freud: Dreaming, Creativity and TherapyDokument2 SeitenPsychoanalysis AND History: Freud: Dreaming, Creativity and TherapyJuan David Millán MendozaNoch keine Bewertungen

- Dr. Nastiti K - Manajemen Asma Pada Anak 2018 PDFDokument72 SeitenDr. Nastiti K - Manajemen Asma Pada Anak 2018 PDFagnesspratiwiNoch keine Bewertungen

- Impact of Employee Motivation in The Banking SectorDokument48 SeitenImpact of Employee Motivation in The Banking Sectormohd talalNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)