Beruflich Dokumente

Kultur Dokumente

Critical SuccessCritical Success Factors For B2B E-Markets A Strategic Fit Perspective Factors For B2B E-Markets A Strategic Fit Perspective

Hochgeladen von

Ramūnas LiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Critical SuccessCritical Success Factors For B2B E-Markets A Strategic Fit Perspective Factors For B2B E-Markets A Strategic Fit Perspective

Hochgeladen von

Ramūnas LiCopyright:

Verfügbare Formate

Critical success factors for B2B

e-markets: a strategic fit

perspective

Michael Johnson

Aston Business School, Aston University, Birmingham, UK

Abstract

Purpose The objective of this paper is to explore and determine a set of factors that are critical to

the success of business-to-business (B2B) e-markets in the aerospace and defence, healthcare, higher

education and local government industry sectors, in order to advance our current understanding of

what factors facilitate e-market adoption and success. The paper examines critical success factors

(CSFs) for e-markets from a strategic fit perspective.

Design/methodology/approach The study adopted a semi-inductive qualitative approach based

on a review of the literature, followed by a pilot study and 58 indepth semi-structured interviews

with senior level executives in buyer, supplier, e-market and third-party organisations. Qualitative data

analysis software, QSR N6, was used to code and analyse the interview data for citations that

corresponded with the candidate e-market CSFs that had been identified either in the literature, pilot

study or during the course of the interviews with respondents. The CSFs for e-markets were ranked

by the frequency of respondents citing a particular CSF.

Findings The study found eight factors that are critical to e-market success and four factors (critical

mass, integration issues, value proposition, and leadership participation) were found to be conducive

to e-market success in all four industry sectors. Likewise, four factors (industry knowledge, revenue

model, branding and reputation, and rich content) were found to be only conducive to e-market success

in three of the four industry sectors.

Practical implications The paper can help academic researchers, managers, consultants,

practitioners and other professionals better understand what factors are critical to the success of

e-markets and other online enterprises operating in the B2B marketspace.

Originality/value There have been numerous calls for more empirical research on the dynamics of

e-market adoption for more than a decade. To date, research on the CSFs for e-markets has been

largely anecdotal and sporadic with a paucity of studies noting factors that are likely to be favourable

to e-market success. This study addresses the call for more research on e-markets and imparts

empirical evidence on factors that are perceived to be conducive to the success of e-markets.

It contributes to the base of knowledge on e-markets by relating the concept of CSFs with the theory

of strategic fit as, to date, no known study has examined CSFs for e-markets from a strategic

fit perspective. The study also presents the benefits capabilities-industry participants needs fit

conceptual model as a precursor for theory building in future studies on B2B e-markets and informs

stakeholders involved in developing e-markets or other online B2B ventures to better comprehend the

conditions and determinants of success.

Keywords Critical success factors, Business-to-business marketing, Electronic commerce,

B2B e-markets, E-market capabilities, Strategic fit, Dynamic capabilities, Buyers, Suppliers,

Industry participants, Benefits, Needs, Qualitative research

Paper type Research paper

The current issue and full text archive of this journal is available at

www.emeraldinsight.com/0263-4503.htm

Received 1 June 2012

Revised 17 October 2012

2 February 2013

Accepted 21 February 2013

Marketing Intelligence & Planning

Vol. 31 No. 6, 2013

pp. 698-727

rEmerald Group Publishing Limited

0263-4503

DOI 10.1108/MIP-10-2013-001

The author would like to thank all the interviewees and organisations who gave their time

selflessly to participate in the study, and the two anonymous reviewers for their constructive and

helpful comments on an earlier draft of the paper.

698

MIP

31,6

1. Introduction

The success of any business operating in a business-to-business (B2B) environment is

contingent on their ability to market their products and services effectively to buyers,

suppliers and other third-party organisations. In addition to the receptivity of the

market, their sustainable future is also contingent on a number of factors (e.g. tangible

and intangible assets, competences, resources and capabilities) that they possess.

Those factors must be aligned to, or fit with, market expectations and differentiate

their offerings from those of their competitors. Observing that some companies

thrive in environments characterised by turbulence and uncertainty while others

experience catastrophic failure suggests that successful companies possess and

exploit a set of factors that are critical to their success in a given environment, whereby

success is determined by their superior long-term performance over competitors.

Such factors, referred to as critical success factors (CSFs), have been studied in a

variety of industrial and organisational contexts (Huotari and Wilson, 2001) over the

past five decades.

While several streams of research (e.g. Al-Mashari et al., 2006; Slevin and Pinto,

1987; Teo and Ang, 1999) have identified CSFs in traditional bricks and mortar

industries, relatively few studies have examined CSFs for online service organisations

such as B2B electronic markets (e-markets). Consequently, the dearth of empirical

research pertaining to CSFs for e-markets has resulted in numerous calls for more

empirical research on the subject. Fong et al. (1997) argue that there is a need to better

understand of the characteristics of e-markets and identify factors that underpin their

success. Fairchild and Peterson (2003) note that there is still a fundamental need

for more empirical research that provides relevant insights and understanding of

e-markets. Joo and Kim (2004) suggest that research on identifying factors that

influence the proliferation of e-markets is a topic for further research. Likewise,

Hadaya (2006) states that very few empirical studies have endeavoured to identify the

factors that induce firms to adhere to e-markets. More recently, Chong et al. (2010)

suggest identifying the CSFs associated with the performance of e-markets as a topic

for further research to consider. Similarly, Standing et al. (2010) suggest identifying

the factors that enable organisations to successfully participate in e-markets as a key

research question for future research to consider. E-markets constitute a significant

part of the digital economy and are proliferating into every sphere of economic activity

in the developed world and are growing in use in developing countries. Thus, their

growing importance and impact on supply chain organisations in both industrial

markets and the public sector, and their contributions to regional, national and global

economies denote that further research on e-markets [is] required that elucidate the

factors that are conducive to their success ( Johnson, 2011a, p. 114).

There has been a recent resurgence of research interests on e-markets (e.g. Balocco

et al., 2010; Chien et al., 2012; Chong et al., 2010; Johnson, 2012, 2014; Loukis et al., 2011;

Matook, 2013; Saprikis, 2013; Wang et al., 2012) because they represent one of the most

promising opportunities for improving supply chain efficiency, growth and profitability

in interconnected and globalised markets, given that 90 per cent of all supply chain

transactions are B2B (Attaran and Attaran, 2007). Increasingly greater amounts of

B2B trade is being channelled through e-markets. In North America alone, it was

anticipated that more than 40 per cent of all B2B trade (amounting to more than US$2.9

billion) would be channelled through e-markets by 2006 (Truong and Jitpaiboon, 2008).

The global market for B2B applications and technologies was anticipated to reach

US$1.3 trillion by 2009 (Ratnasingam, 2007).

699

CSFs for

B2B e-markets

Rationale for the study

There has been considerable interest in e-markets among practitioner audiences

(Petersen et al., 2007) and academics (Li and Li, 2005; Saprikis, 2013; Truong and

Jitpaiboon, 2008). Notwithstanding, many of the key issues concerning e-markets have

not received the attention they deserve in the literature (Chien et al., 2012; Johnson,

2012). Furthermore, the number of empirical studies that exist on e-markets is paltry

(Truong and Jitpaiboon, 2008) and although over a decade of research has been

published on e-markets, Standing et al. (2010) note that many questions pertaining to

e-markets still remain unanswered or need clarification. For example, empirical studies

on success factors for e-markets are so few, that Li and Li (2005, p. 119) suggest that a

study to deduce such factors is very necessary.

The commercial environment has become increasingly more complicated

(Nagati and Rebolledo, 2012) especially due to the advent of e-business and other

digital technologies. Accordingly, e-markets operate in high velocity environments

characterised by significant turbulence and great uncertainty due to the emergent and

rapidly changing nature of the B2B marketspace (Ganesh et al., 2004; Wang et al., 2012).

This requires e-markets to continuously modify their business models to evolve with

changes in their environment. While a number of high profile e-markets have failed

(Cuganesan and Lee, 2006; Day et al., 2003; Doyle and Melanson, 2001; Oliver, 2001;

Truong and Jitpaiboon, 2008), many others have thrived and new e-markets continue

to emerge globally, particularly in rapidly developing markets and economies. For

example, Wang et al. (2012) suggest that although the number of e-markets in China

exceeded 4,500 in 2007, the potential market size for e-markets in China remains

substantial given that a myriad of small and medium-sized enterprises (SMEs) are

especially keen to launch new products, establish their brands and grow their markets

through e-markets which are key drivers of e-market proliferation in China.

The success and failure of e-markets serve to indicate that there is a requirement for

a much better understanding of the CSFs pertaining to such systems (Vaidya et al.,

2006). Identifying e-market CSFs can provides some important insights that can better

inform entrepreneurs launching new e-markets and managers in existing ones to

recognise and focus on the key areas of their business where intervention is required

(Francoise et al., 2009). For example, redefining their strategy, business model or value

proposition (Balocco et al., 2010), managing resources more effectively and developing

dynamic capabilities that respond to the needs of buyers and suppliers in the industries

in which they operate, given that some e-markets find it difficult to attract and retain

industry participants (Chien et al., 2012) and because industry participants exploit the

competition between e-markets by participating in those which furnish them with

the greatest value (Miller and Niu, 2012). Therefore, the aim of this empirical study is to

determine a set of CSFs for e-markets by answering the research question: What are

the CSFs for B2B e-markets?

This paper addresses the numerous calls for more empirical research on identifying

factors that are perceived to be critical to the success of e-markets and explicates how

they are important. It contributes to the base of knowledge on e-markets by relating

the concept of CSFs with the theory of strategic fit as, to date, no known study has

examined CSFs for e-markets from a strategic fit perspective. The study also presents

the e-market benefits capabilities industry participants needs fit conceptual model

as a precursor for theory building in future studies on B2B e-markets and informs

stakeholders involved in developing e-markets or other online B2B ventures to better

comprehend the conditions and determinants of success.

700

MIP

31,6

2. Background

CSFs

CSFs were initially observed in the early 1960s by Daniel (1961) who noted that there

were typically between three and six factors that govern an organisations success

within the majority of industry sectors. Rockart (1979) first defined the concept of CSFs

in the management literature and suggested they were measurable constructs directly

linked to the attainment of organisational goals and the competitive performance

of firms, which may differ between managers in an organisation and between similar

organisations in the same industry. CSFs are contingent on the context in which they

are being examined and, therefore, several definitions exits. According to Rockart

(1979), CSFs are [y] the limited number of areas [of a business] in which results,

if they are satisfactory, will ensure successful competitive performance for the

organisation. They are a few key areas where things must go right for the business to

flourish (Rockart, 1979, p. 85). However, this definition does not make it explicitly

apparent that some CSFs relate to the external environment in which organisations

operate. Moreover, the extant literature (e.g. Daniel, 1961; Rockart, 1979; Boynton and

Zmud, 1984; Slevin and Pinto, 1987; Peffers and Gengler, 1998) suggests that CSFs

relate to organisational information needs which have implications for organisational

planning and control activities. It follows that an inference can be made that CSFs

relate to managerial decisions that affect an organisations current and future

operations. Thus, for the context of this study, a definition of CSFs should also relate to

an organisations future, as provided by Boynton and Zmud (1984) who define CSFs as

[y] issues vital to an organizations current operating activities and to its future

success (Boynton and Zmud, 1984, p. 19).

E-markets and measures of their success

E-markets, which are sometimes referred to as B2B exchanges, digital markets

or industrial e-markets, are service-based firms that operate in the online B2B

marketspace within the private and public sectors. They are operated by either

a major buyer or supplier within a market, a multi-firm consortium or an independent

third-party (Strader and Shaw, 1997) to support the basic economic transactions of

demand and supply and information exchange that facilitate market efficiency.

Johnson (2011b) defines e-markets as inter-organisational trading systems that seek to

smooth out supply chain inefficiencies by facilitating buyer-supplier information

exchange on products, services, prices and transactions in an integrated and

synchronous internet-based environment ( Johnson, 2011b, p. 97).

The relative newness of e-markets makes it difficult to establish rigourous measures

of success (Ordanini et al., 2004). Johnson et al. (2001) suggest that e-market success is

determined by the extent to which the business benefits they provide address the

supply chain needs of industry participants and the financial benefits the owners of

e-markets gain. E-market success can also be determined by their profitability (Li and

Li, 2005), positive cash flow and high volume of transactions (Sehwail and Ingalls,

2005). However, e-market success is ultimately defined by their longevity in the

marketspace, i.e. their ability to out-perform competitors and competing mechanisms

of market co-ordination and exchange. A number of studies on e-markets and other

B2B e-commerce systems infer a number of factors that are perceived to contribute to

the success of e-markets. These factors are summarised in Table I below. While such

factors are considered to be important to e-market success, a comprehensive framework

that examines the factors that influence e-market success has not been developed to date

701

CSFs for

B2B e-markets

nor do existing theoretical frameworks and models of adoption adequately explain

e-market adoption in all contexts (Gengatharen and Standing, 2005). According to

Wang et al. (2012), a coherent theory of e-market performance (i.e. success) has not been

developed to date. This may stem from the notion that there is a lack of knowledge on

how the performance (i.e. success) of e-markets can be determined (Matook, 2013).

Notwithstanding, the success of e-markets can be examined from a strategic fit

perspective.

Strategic fit

The concept of strategic fit (alignment or co-alignment) has also been used to assess

organisational performance outcomes in different contexts for more than four decades

(Venkatraman, 1989). While several definitions of strategic fit exist, Smaczny (2001)

offers an interpretation which suggests that managers must collect and respond to

market intelligence pertaining to the internal and external domains of their

organisations in order to be successful. According to Smaczny (2001), strategic fit

results from [y] the ability to make decisions concerning a companys market

positioning based on external and internal environmental conditions (Smaczny, 2001,

p. 799). A number of studies on strategic fit (e.g. Bensaou and Venkatraman, 1996;

Venkatraman and Prescott, 1990; Venkatraman and Ramanujam, 1986) also argue that

the fit of organisational variables with the internal and external environment is related

to organisational performance. Miles and Snow (1994) maintain that organisations

possess a set of factors (i.e. resources and capabilities), which must have both an

internal fit within the organisation and an external fit with the external environment,

that must be constantly aligned with the internal and external environments in order to

remain in fit and achieve superior performance over competitors in the industries

in which they operate. Furthermore, fit is both a state and a process whereby, to

achieve strategic fit, organisations must [y] create, understand, develop, and sustain

a distinctive competence in the production of high-value goods or services that the

market desires (Miles and Snow, 1994, p. 186). In other words, organisations must

develop unique capabilities that provide exceptional benefits which address the needs

and desires of their customers.

Several studies on enterprise systems (e.g. Al-Mashari et al., 2003; Croteau and Li,

2003; Holland and Light, 1999; Hong and Kim, 2002; Lu et al., 2006; Soong et al., 2001;

Umble et al., 2003) support the view that the success of such systems is contingent on

how well they fit with the needs of stakeholders, the provision of benefits that match

perceived needs or other organisational variables. While Bensaou and Venkatraman

(1996) examined the performance of B2B relationships using the theory of strategic fit,

to date, no known study has examined the performance outcomes (i.e. success) of

e-markets from a strategic fit perspective. In the context of B2B relationships, such as

between a buyer and supplier, Bensaou and Venkatraman (1996) argue that achieving

a close fit between the information processing needs of one firm with the information

processing capabilities of another was a strong determinant of performance.

Extrapolating to the broader context of the B2B e-marketspace, it is analogous

that e-markets must possess capabilities that provide benefits that address the

supply chain needs of industry participants over and above competing means of

co-ordinating market exchange in order to be successful. Furthermore, an e-market

must continually develop dynamic capabilities that respond to the changing needs

of industry participants and do this better than its rivals in a given industry in order

to sustain its competitive advantage and long-term survival. There is no universal

702

MIP

31,6

framework for categorising the benefits that can be derived from e-market participation

( Johnson, 2011c). However, Shang and Seddon (2002) provide a useful framework for

assessing the types of higher level benefits that buyers and suppliers can gain from

e-market participation as noted in the extant literature (see Johnson, 2011a, b, c).

3. Methodology

Research approach

A semi-inductive qualitative means of enquiry, informed by the literature, was chosen

to answer the research question because CSFs are context-dependent and the research

was exploratory. There is a strong tradition of using qualitative approaches based on

the use of case studies and/or semi-structured interviews in research pertaining to

CSFs (e.g. Al-Mashari et al., 2006; Boynton and Zmud, 1984; Daniel, 1961; Fairchild

et al., 2004; Hong and Kim, 2002; Rockart, 1979) and B2B e-commerce (e.g. Bakker et al.,

2008; Lancastre and Lages, 2006; Petersen et al., 2007; Sehwail and Ingalls, 2005;

Vaidya et al., 2006) given that these approaches offer contextual richness which

emphasises the importance of the social context (see Bonoma, 1985; Gummesson,

2003). Furthermore, it has been argued that phenomenological approaches (e.g.

descriptive and interpretive) are legitimate modes of enquiry in qualitative studies

seeking to understand how contextual factors impinge on organisations adopting

information systems (Galliers and Land, 1987), which is pertinent to this study given

that it formed the basis of a larger research project on the organisational adoption

dynamics of e-markets in private and public sector environments.

Data collection

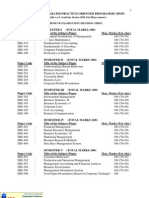

A research protocol, shown in Figure 1, was used to record the numerous stages

involved in the research process to improve the rigor, replicability and reliability of the

study as advocated by Yin (1994). A review of the literature pertaining to e-markets,

business and industrial marketing, and operations and supply chain management

relating to e-markets, B2B e-commerce and e-procurement systems was conducted to

identify candidate CSFs for e-markets. A pilot study was conducted that involved

14 in-depth interviews with e-market CEOs, managing directors, business development

managers and independent industry consultants to provide conceptual clarification

for a comprehensive set of candidate CSFs that corroborated or refuted any of the

candidate CSFs derived from the literature review, thereby operationalising

the measures of construct validity (see Yin, 1994). Table I shows the candidate CSFs

derived from a review of the literature and pilot study.

The main data collection phase involved the identification of potential e-markets

and key interview respondents that could participate in the research. A number of

e-market, buyer, supplier and third-party organisations were contacted by telephone

over an 18 months period between March 2002 and July 2003 to request their

participation in the study. A follow-up cover letter explaining the purpose of the

research was also e-mailed to potential respondents. The cover letter offered

respondents confidentiality and anonymity in order to engage their participation in

the research, encourage them to speak with candour about their experiences and

to freely express their opinions. It also mitigates against any possible apprehensions of

participating in the research especially where discussions relate to sensitive issues

(Oppenheim, 1992). Respondents agreed to participate in the project on the basis that

they and their organisations would be anonymised. Therefore, pseudonyms are used

for organisations in the study.

703

CSFs for

B2B e-markets

The e-markets in this study, shown in Table II, exhibited a diverse range of

characteristics in terms of ownership, transaction mechanism, business model and

supply chain focus that were prominent in their respective industry sectors at the time

of data collection. Table III shows the breakdown of respondents who had agreed

to participate in the research. They were selected for interview based on their

ability to answer the interview questions given their job roles and the industry

knowledge they possessed about the research context, as noted in the literature

(see Leidecker and Bruno, 1984), and because such industry insiders represent what

Eid et al. (2002, p. 111) identify as an excellent source of CSFs. The snowball

sampling technique (see Oppenheim, 1992; Robson, 1993) was used to recruit further

respondents to participate in the study as the data collection process proceeded. The

data in this paper relates to 54 (14 face-to-face and 40 telephone) in-depth interviews

with senior level executives in buyer, supplier, e-market and third-party organisations

in the aerospace and defence, healthcare, higher education and local government

industry sectors that occurred between April 2002 and August 2003. Open-ended

.

Figure 1.

Research protocol

704

MIP

31,6

questions were used to minimise researcher bias, enable interviewees to respond in

their own vernacular and to allow for a good conversational exchange that provides a

high degree of understanding about the research question. Such interviews enable a

researcher to concentrate on uncovering deeply held and shared themes among

respondents (Ringberg and Gupta, 2003, p. 610) in addition to observing any

idiosyncrasies that occur between interviews and any emergent themes that develop

during the course of the data collection process or subsequent analysis of the data.

During the interviews respondents were asked what they considered to be the

CSFs for their e-market (e-market companies), e-markets in which they participate

(buyer and supplier organisations) or e-markets in their industry sector (third-party

organisations). The approach of interviewing industry insiders, who are deeply

immersed or directly involved in the research context, is consistent with those

Candidate CSF for

e-markets Source to support candidate CSF for e-markets

Branding and reputation Hof and Hemelstein (1999), Calder (2000), Zott et al. (2000)

Business model Pilot interviewees

Critical mass Sculley and Woods (1999), Sehwail and Ingalls (2005), Wise and

Morrison (2000)

Deep integration Pilot interviewees

Deep pockets Pilot interviewees

Degree of industry

fragmentation

Pilot interviewees

E-commerce standards Pilot interviewees

E-market management

team

Pilot interviewees

Governance Bakos (1998), Zaheer et al. (1998), Agrawal et al. (2001)

Industry knowledge Timmers (1999), Sculley and Woods (1999), Baumgartner et al. (2001)

Industry standards Pilot interviewees

Industry structure Bailey and Bakos (1997), Bakos (1998), Gulati et al. (2000)

Leadership participation Sculley and Woods (1999), Ramsdell (2000), Dewan et al. (2000),

Markus et al. (2003)

Market attractiveness Pilot interviewees

Market readiness Pilot interviewees

Neutrality Sculley and Woods (1999), Timmers (1999), Cunningham (2000)

Organisational strategy Evans and Wurster (1999), Porter (2001), Raisch (2001), Sawhney and

Parikh (2001), Sehwail and Ingalls (2005)

Outsourcing Sculley and Woods (1999), Zott et al. (2000), Porter (2001)

Partnerships Ramsdell (2000), Werbach (2000), Ratnasingam (2000), Agrawal et al.

(2001)

Product characteristics Malone et al. (1987), Bailey and Bakos (1997), Bakos (1998)

Revenue model Pilot interviewees

Rich content Armstrong and Hagel (1995), Werbach (2000), Agrawal et al. (2001),

Raisch (2001)

Scope for diversification De Figueiredo (2000)

Transparency Sculley and Woods (1999), Timmers (1999), Cunningham (2000)

Trust Bailey and Bakos (1997), Bakos (1998), Timmers (1999), Soh and

Markus (2002), Zaheer et al. (1998), Cunningham (2000), Zott et al.

(2000)

Value proposition Dittrick (2000), Vaidya et al. (2006), Ramsdell (2000), Wise and

Morrison (2000), Agrawal et al. (2001), Soh and Markus (2002)

Table I.

Candidate CSFs

for e-markets

705

CSFs for

B2B e-markets

advocated by Leidecker and Bruno (1984). The interviews relating to this paper lasted

47 minutes, on average, and were tape-recorded where interviewees had granted prior

permission to do so. Recording the interviews, where permitted, preserved the veracity

of their content. It also increases the validity and reliability of qualitative studies

(Oppenheim, 1992). Detailed interview notes were taken to capture the content of

interviews where an interviewee did not grant permission to record their interview

and also safeguarded against the tape recorder failing to capture the contents of the

interviews where permission had been granted to record the interviews. No noticeable

difference was observed between the face-to-face and telephone interviews in terms

of establishing rapport with respondents because they were acutely aware that the

purpose of the interview was to engage them in research. The interviews were

transcribed verbatim and each respondent was presented with the opportunity to

review the transcript of their interview to ensure the veracity of their statements was

preserved.

Data analysis

Each interview transcripts was loaded onto the QSR N6 because qualitative data

analysis programmes can facilitate the analysis and interpretation of qualitative

data (Gummesson, 2003). The data was subsequently coded and analysed in a

systematic manner, whereby the process of coding and analysis was the same for

each interview transcript. It is suggested (see Coffey and Atkinson, 1996; Miles and

Aerospace and defence Healthcare Higher education Local government Total

E-markets 1 2 2 2 7

Buyers 3 7 5 9 24

Suppliers 2 11 7 0 20

Third-parties 0 0 2 1 3

Total 6 20 16 12 54

Table III.

A breakdown

of interviews by

sector and type of

interview respondent

E-market Established

Industry sector(s)

served Ownership

Geographic

scope

AeroDefence 2000 Aerospace and defence Buy-side

consortium

International

Lab-Procure 2001 Higher education and

life sciences

Independent UK

Education Exchange 2002 Higher education Independent UK

International Medical

Exchange

2000 Healthcare Supply-side

consortium

International

Public Sector Marketplace 2000 Healthcare and local

government

Independent UK

Local Authority Marketplace 2002 Local government Independent UK

Southern Council eXchange

a

2001 Local government Independent UK

Northern Council eXchange 2002

Note:

a

Southern Council eXchange and Northern Council eXchange are operated by the same parent

organisation

Table II.

E-market profiles

706

MIP

31,6

Huberman, 1994) that this approach increases the reliability and validity of qualitative

studies. Nodes corresponding to the candidate CSFs were created in N6 to categorise

and rank their importance based on the citation frequency relating to particular CSFs.

Free nodes were also created within N6 to account for CSFs that emerged from

the interviews with respondents or from analysing the data. Content analysis; i.e. the

systematic examination of a particular body of material [y] to identify patterns or

themes (Gengatharen and Standing, 2005, p. 422); is the most widely utilised technique for

analysing text-based data (Silverman, 2000). It has been utilised in studies on e-markets

and related research on B2B e-commerce, supply chain management and enterprise

resource planning systems (see Cullen and Webster, 2007; Finney and Corbett, 2007;

Johnson, 2012; Power, 2005) to extricate issues of relevance and ascribe meaning to the

data. The technique was used to analyse respondents interview responses for key words,

threads and comments relating to each CSF whereby excerpts of text relating to each CSF

were coded against corresponding nodes. This approach is consistent with other studies

on CSFs for B2B e-commerce systems (e.g. Sehwail and Ingalls, 2005; Vaidya et al., 2006)

that use the frequency or percentage of citations relating to a given CSF to assess their

relative importance. In other words, thematic content analysis was used to distil important

issues out of the data. A sample of interview data was test coded by another researcher

sufficiently acquainted with the research context to compare with the original coding to

evaluate the inter-coder reliability between the two sets of coding to ensure the consistency

of the original coding, to increase the overall rigour and reliability of the coding, and

the integrity of subsequent findings and the conclusions of the study (see Miles and

Huberman, 1994). The process also mitigates against any potential criticism relating to

qualitative studies lacking the rigour often associated with quantitative studies. The CSFs

were ranked according to the number of respondents citing a reference to each CSF. ACSF

was required to be cited by respondents in at least three of the four industry sectors to

qualify to be ranked and included in the research findings. Respondents statements that

expressed the importance of a given CSF were chosen as citations in the findings.

4. Research findings

The top eight e-market CSFs reported by respondents are shown in Table IV. The top

four CSFs were found to be cited by respondents across all four industry sectors while

the other four CSFs were only cited across three industry sectors.

A critical mass of actively trading participants

A critical mass of actively trading buyers and suppliers on e-markets is important

because they provide the cash flow derived from transaction revenues and other fees

that e-markets need to sustain its long-term survival. Achieving a critical mass of

e-market participants is linked with the revenue model an e-market utilises because

industry participants are unlikely to join e-markets charging excessive fees. On the

other hand, e-markets have to charge fees that enable them to attract a large share of

the marketspace in which they operate so that they can generate revenues to expand

their operations:

The critical mass is a critical success factors [in terms of] how much the e-marketplace can

grow in terms of the number of hospitals joining and also the number of suppliers that they

have on board. Although it [IME] is a not-for-profit organisation for equity members, they are

going to need to bring revenue in and that will only come from non-equity members and

hospitals. I guess they are going to have to make it [IME] available for a wider number of

organisations really (European Supply Chain Manager, supplier, healthcare industry sector).

707

CSFs for

B2B e-markets

Critical mass also relates to the value proposition because buyers and suppliers adopt

e-markets to receive business benefits over and above the conventional means of

market co-ordination and exchange but at minimal cost:

Getting suppliers and buyers on board is an issue of critical mass which is driven by the

ability of the e-marketplaces to deliver [benefits] at low cost. The benefits you are looking to

offer are cost savings on things that have already been negotiated and agreed so you [i.e. the

e-market] cant introduce much more additional cost. It needs critical mass and the need to be

cost efficient (Education Sector Manager, third-party, higher education industry sector).

Deeply integrating buyers and suppliers

Many of the supply chain benefits e-markets deliver to industry participants cannot

be delivered without achieving a deep level of integration between e-markets

and industry participants. Therefore, it is critically important that e-markets are able

to deeply integrate with a significant number of buyers and suppliers disparate back-

office enterprise systems to deliver on their value proposition. Examples of such

benefits include the provision of more management information, seamless error-free

transactions and auto-population of their finance systems. However, the degree to which

the value proposition is deliverable to buyers and suppliers is contingent on the type

of enterprise or finance systems industry participants have in place and the level of

integration that can be achieved with an e-market. In some low-tech industries buyers and

suppliers may be using antiquated finance systems that are not readily compatible with

e-markets which may result in only some of the procurement or supply processes being

supported. Partial integration will result in only partial benefits being delivered especially

where old finance systems are not using current industry standards for data exchange:

They [e-markets] need to be able to integrate with legacy systems. The standard upon which

everyone is developing it is on the cXML, and there are several legacy systems that you will

never be able to integrate with cXML. You should put 90 per cent of your time into

implementing the solution at a workable human level and make sure that the processes that

you are going to be using the e-marketplace for are complementary to the ones that you have

in existence (Post-Implementation e-Procurement Manager, large buyer, local government

industry sector).

Number of respondents who cite CSF by industry

sector

Rank

E-market

CSFs

Total number of

respondents

who cite CSF

b

Aerospace

and defence Healthcare

Higher

education

Local

government

1 Critical mass 37 4 15 13 5

2 Deep integration 30 3 10 9 8

3 Value proposition 25 4 8 5 8

4 Leadership participation 23 3 8 8 4

5 Industry knowledge 21 4 10 7

6 Revenue model 20 3 6 11

7 Branding and reputation 14 1 10 3

8 Rich content 8 3 3 2

n 6 n 20 n 16 n 12

Note:

b

n 58 based on the 58 interviews with 54 respondents

Table IV.

Critical success factors

ranked by frequency

of citation

708

MIP

31,6

In some instances, industry participants have modernised their ICT infrastructure and

replaced their old legacy systems in order to fully integrate with e-markets and receive

the full benefits of participation. In other instances, organisations have introduced

middle-ware applications to standardise the connection between their disparate and

old enterprise or finance systems and e-markets. The level of integration between

e-markets and industry participants also affect the transaction fees e-markets receive.

The more benefits e-markets can deliver to participants the more they can justify the

fees they charge participants:

In order to get that level of transactions there are certain CSFs that are key. The whole

implementation process is absolutely key [and] the ability to integrate with different ERP

systems is really key [because] at the end of the day you have to have people that are happy

using your system so that you can generate revenues from transaction charges, and if youre

making money, the chances are you are going to stay around (E-market Implementation

Consultant, third-party, higher education industry sector).

The e-market value proposition

The value proposition is important because industry participants are primarily

interested in the various organisational and supply chain benefits they will gain from

e-market participation that are over and above competing offerings of competitors and

alternative means of co-ordinating market exchange. The link between the business

benefits e-markets offer industry participants and their ability to attract a critical mass

of participants is clear. An e-market must offer greater value to industry participants

than its competitors in the marketspaces in which it operates in order to survive.

Notwithstanding, two e-markets providing services to industry participants in the

same marketspace can co-exist by focusing on different niches within the supply chain.

For example, in the healthcare industry sector, IME was perceived to focus on catering

to the needs of NHS Trusts with the provision of medical instruments and surgical

products from the large national and international suppliers who typically provided

up to 80 per cent of what the buy-side community ordered. Public Sector Marketplace,

on the other hand, was perceived to focus on providing the buy-side community with

a diverse range of medical and non-medical products from national and regional

suppliers:

It boils down to critical mass as they have to have enough buyer-supplier links. They will

achieve this by giving good value to their customers and by easing that link between the

buyer and the supplier. They have to do this better than the competition. In the UK that is

Public Sector Marketplace [i.e. compared to IME]. [y] Globally, Public Sector Marketplace is

probably one of the better competitors in terms of the value they give to their clients (Finance

and IS Manager, Supplier, healthcare industry sector).

However, the value proposition must be aligned to the cost of participating. In the

aerospace and defence industry sector, AeroDefence had to revise the subscription and

transaction fees it charged suppliers because many of the smallest suppliers in the

industry could not afford to participate in the e-market. This initially affected the speed

of which the e-market could recruit a critical mass of SMEs particularly as the benefits

for SMEs were questionable:

Another critical success factor would have to be the value proposition that the exchange

offers, and extricably linked to that is the whole cost model as well. I think that where a lot of

exchanges have gone wrong in the past is because they have not aligned the cost model with

709

CSFs for

B2B e-markets

the value proposition. AeroDefence certainly got it fundamentally wrong at the start. Initially

they were going for a supplier pays transaction-based charging model. [y] For small

suppliers there is a questionable value proposition for them joining the e-marketplace

other than their buyers suggesting that it would be a very good idea if they joined the

e-marketplace (E-commerce Sales Manager, large buyer, aerospace and defence industry

sector).

The participation of industry leaders

The participation of large industrial buyers or suppliers on e-markets is important

because they can help e-markets gain credibility and market acceptance through brand

association. Industry participants are attracted to e-markets that have their largest

trading partners on board. The participation of industry leaders can form a significant

proportion of an e-markets critical mass and, therefore, comprise part of the e-markets

value proposition which serves to attract other industry participants:

You also need the big players on board and that comes with the critical mass. If you dont

have the big players then you wont have a large market share. On the one hand, you need to

have diversified suppliers and, on the other hand, your ten big players will take about 70 to 80

per cent of what hospitals order. So if you [an e-market] miss five of them out you will never

achieve critical mass, because big names have big money (Head of E-Commerce for Europe,

Supplier, German healthcare industry sector).

In the aerospace and defence industry sector, the participation of five of the industrys

largest buyers gave AeroDefence instant credibility and a high likelihood of success,

particularly given their full order books, the significant volume throughput they

would provide through the e-market and the transaction revenues that would be

accrued from it:

So coming back to the critical factor success question, the very fact that we have a very large

piece of the aerospace and defence prize [market share], we feel that immediately the

exchange is more likely to succeed than any other, purely because of the number of big

players involved and the fact that our supply-base has a very significant overlap (E-commerce

Procurement Manager, large buyer, aerospace and defence industry sector).

Industry knowledge within the e-market domain

In-depth knowledge of an industry is important for an e-market because it is the basis

on which the supply chain needs within the industry are identified, and the e-market

business model, organisational strategy, technology strategy and value proposition are

formulated to address those needs. Consortia e-markets, such as AeroDefence and

IME, can capitalise on the substantial amount of domain-specific knowledge they

possess about issues that affect their supply chain:

Our industry knowledge of the medical supply chain and the human resources we employ

are the best people for the job. It means understanding the market and building a solution

[an e-market platform] that fits customers needs, and understanding that both buyers and

suppliers are customers that need to have equal attention (European Communications

Spokesperson for IME, healthcare industry sector).

Independent e-markets are frequently created by individuals or organisations that

often have in-depth knowledge of the industries in which they operate. For example,

Public Sector Marketplace was created by a clinician within the NHS and sponsored

by prominent figureheads within the NHS who were on its Board of Directors, who

clearly had much understanding of the industry. In contrast, e-markets developed

710

MIP

31,6

on a generic platform but tweaked for different industries may lack the industry-

specific knowledge to be able to formulate a value proposition that closely meets the

supply chain needs of any particular industry. Lack of industry-specific knowledge can

serve to alienate industry participants, particularly where an e-market has a direct

competitor with superior industry knowledge. According to an industry respondent,

the company operating the Northern and Southern Council eXchanges lacked

specialist knowledge of procurement in local government compared to their rival, Local

Authority Marketplace, which was developed by local government officers:

One of the main problems with the Northern Council eXchange is that their understanding of

the local authority procurement arena is poor, and poor is being kind. I think it is only with

the Northern Council eXchange and the Southern Council eXchange. [y] They should

concentrate on getting the basics to an art before they move on. [In contrast] the Local

Authority Marketplace is staffed by individuals who have been or are actively involved with

the local authorities and national health [service] type procurement scenario so they are aware

of all the hopes and difficulties that local authorities are faced with (Director of Procurement,

large buyer, local government industry sector).

Revenue model

The revenue model that an e-market employs is important because it is a key

determinant of an e-markets ability to attract, establish and maintain a critical mass of

industry participants based on the value proposition being offered, compared to

competitor offerings and alternative modes of market co-ordination and exchange. It is

the means by which e-markets gain revenue to sustain their longevity as noted above:

From their [AeroDefence] point of view and from a payment point of view, they will need

a critical mass of suppliers, as they charge fees from each of their suppliers for using it

[the e-market]. For survival, inevitably it will matter (Direct Materials Procurement Manager,

large buyer, aerospace and defence industry sector).

In the higher education industry sector Lab-Procure charged buyers joining and

consultancy fees to participate and charged suppliers transaction fees of between 3 and

10 per cent depending on their position in the supply chain. In contrast, Education

Exchange charged all suppliers a 1 per cent transaction fee and buyers were charged

consultancy fees only, which helped buyers and suppliers to mitigate their perception

of risk in adopting the e-market:

The fact that we are offering this [the e-market] free of charge, you simply cant ignore that is

a critical success factor. That fact is based on the perception of risk. The biggest fear among

institutions is laying out significant amounts of money on technology that may become

redundant or would prove inappropriate for them. So that is a risk. If you are not asking for any

money to sign them up then their risk is very minimal because even if we fell flat on our face

and the technology became redundant they will have lost very little. So I think that is a very

important factor (Managing Director of Education Exchange, higher education industry sector).

The branding and reputation of e-markets

Branding and reputation is important for e-markets to create credibility and

establish themselves within their industries. Education Exchange and Local Authority

Marketplace were marketed as the solution for the sector by the sector in their

respective industry sectors to create rapport with industry participants by conveying

the notion that they could relate to their needs. Public Sector Marketplace changed its

original name to expand its offering and reach beyond the healthcare market into

the local government domain because the company realised that its original brand

711

CSFs for

B2B e-markets

name prevented it from operating outside the healthcare industry. In other words,

a well-established brand name can become an obstacle to expanding or diversifying

an e-market offering:

We were originally called Healthcare-Buyer[1] [which was] set up to specifically look at the

use of e-commerce exchange services within the UK healthcare industry. We then spent

some months consulting with buyers and suppliers on their requirements. [y] It has been a

gradual process of expansion and in January 2002 we made a decision to expand the offering

to local government as well, and hence the name changed to Public Sector Marketplace (CEO

of Public Sector Marketplace, healthcare industry sector).

In the higher education industry sector, Lab-Procure found it difficult to fully convey to

the buy-side community (higher education institutions) that it traded in non-scientific

products after the e-market widened its scope and diversified its product offerings to

include office equipment and other maintenance, repair and operations (MRO) type

products. The brand name of the e-market was very well established and was

synonymous with laboratories and scientific products in the minds of the higher

education community, which was a perception that subsequently became very difficult

to change, especially given that the e-market decided not to rebrand itself:

With branding you need awareness because if people dont know who you are they will never

come to you. These are the things that need to be taken into account. I think that [the name

Lab-Procure] was a major branding issue because it started off as Lab-Procure and

Lab-Procure is associated with science. What was interesting was that it was a very strong

and recognisable brand. It had the highest prompted and unprompted brand name for a

neutral public e-marketplace in the UK. It was something that they wanted to hang onto.

It was interesting because the company did explore: now that we are providing more than

just life science products and consumables, what do we do with this brand name? So in their

communication they always promoted the idea that they did more than just life sciences

products. It was basically an issue that was never resolved (E-market Implementation

Consultant, third-party, higher education industry sector).

It follows that how an e-market chooses to brand, position and promote itself is a

strong determinant of gaining a critical mass of participants because they will only

attract industry participants that identify themselves with what the brand image and

reputation conveys.

Rich content

Rich content is important because suppliers want e-markets to provide their buyers

with information and other content that makes purchasing their products easier.

Some suppliers want catalogue-based e-markets to match their web site functionality

in terms of the amount of rich content it provides to buyers as a way of diminishing

the effects of comparison shopping by differentiating their offering from those of

competitors:

Researchers may have a need for up-to-date technical information. It would be difficult for us

to maintain data catalogues for [every] buyer. So from my point of view as a supplier, punch-

out is more attractive. I think it better fulfils our needs to differentiate ourselves, and it makes

odious comparisons based on price more difficult for the customer to do. I believe it [punching

out to their transactional website] provides more value-add for the customer because we put

an immense amount of scientific and technical content on our website. So its good to give

customers that at the time that they are looking for a new product or a new technique or

whatever (Director of Marketing, large supplier, higher education industry sector).

712

MIP

31,6

Buyers also want e-markets to provide rich content, such as pictures of products in

many dimensions, so that procurement staff can gauge the aesthetics of what they

intend to purchase. They seek content tools that provide ease-of-use, facilitates

purchasing, semi-automates processes to save time, decrease their transactional error

rates and decrease their information asymmetry. Buyers also want the e-market to

provide them with content tools with good search facilities that supports their

purchasing decisions. If an e-market does not facilitate the purchasing process, buyers

tend to revert back to the traditional methods of purchasing goods and services offline,

which does not reinforce contract compliance nor procurement best practice:

An e-marketplace needs to be easy to use, not that difficult to operate, and it has to be able to

store a lot of standard details like your billing address, your contact details, and your

purchase card number which are very useful. It [Southern Council eXchange] is based around

the principle of three-clicks-to-buy. It is a linear purchasing process and we try to make it

appear as similar to a manual process as possible in the fact that you go and find your goods

and there are pictures and descriptions in the catalogue. It has features like favourite

purchases where you can re-order things that you buy on a regular basis without keying in all

the details. This is very important when you populate a catalogues with 15,000 items. It has a

reasonably good search engine which is very important. The most frustration that you get

with users occurs when they cant find what they want to buy, so the tendency is to pick up

the phone to contact the suppliers (Post Implementation e-Procurement Manager in the local

industry government sector).

5. Discussion

It is interesting to note that the value proposition, the set of proposed benefits that

an e-market formulates to initially attract and subsequently retain a critical mass

of industry participants, was not considered to be the most primary CSF. This is

especially pertinent given that how e-markets are perceived to serve industry

participants is considered to be crucial to their success (Xing et al., 2012). Furthermore,

the provision of benefits can help e-markets generate a competitive advantage within

the industries in which they operate (Ordanini and Pol, 2001). This is because the

provision of benefits is a key criterion affecting the decision of industry participants to

adopt e-procurement systems (Yu, 2007) and the primary driver for organisations

to implement e-commerce systems (Cullen and Taylor, 2009). Nevertheless, a critical

mass of buyers and suppliers was found to be a key CSF in this study which concurs

with other research on e-markets and B2B e-commerce (e.g. Balocco et al., 2010;

Gengatharen and Standing, 2005; Lee and Lim, 2007). However, to sustain the

longevity of an e-market, such buyers and suppliers must also be active participants

(Fong et al., 1997; Li and Li, 2005) who regularly conduct their transactions through the

e-market to give it liquidity and transactional revenue (Sculley and Woods, 1999; Wise

and Morrison, 2000). Deep integration was also found to be important for e-markets,

which aligns with the observations of Vaidya et al. (2006) who note that systems

integration is positively associated with a high likelihood of engagement with

e-procurement systems. Deep integration enables e-markets to deliver on their value

proposition and thus receive transaction fees, and industry participants to receive the

full benefits of e-market participation as noted in the literature (e.g. Lin and Lin, 2008;

Lee et al., 2009). The value proposition must provide benefits that address the needs of

both the buy-side and supply-side communities (Li and Li, 2005) but importantly such

benefits should also entice SMEs to participate in e-markets, as a poorly articulated

713

CSFs for

B2B e-markets

value offering is likely to lead to e-market failure (Wise and Morrison, 2000).

This is particularly the case where industry participants cannot decode the benefits on

offer (Gengatharen and Standing, 2005). However, realisation of the value proposition

is also contingent on industry participants effecting the necessary organisational and

technical changes that facilitate receipt of those benefits ( Johnson, 2010b; Vaidya et al.,

2006). Similarly, where e-markets are unable to realise the business benefits they offer

industry participants, such unmet expectations lead to high attrition rates among

participants (Tao et al., 2007). The value proposition also distinguishes an e-market

from its competitors (Porter, 2001). Therefore, the success of an e-market is contingent

on its ability to offer and deliver greater value than competing e-markets and over

and above competing modes of co-ordinating market exchange, but at a cost that is

optimally aligned and proportionate to the organisational size of participants. It was

noted in the previous section that big names have big money. This concurs with

the observations of Ordanini (2006) who notes that e-markets receive three times the

transaction revenues from large organisations compared to SMEs. Large buying

organisations make large volume purchases (Angeles and Nath, 2007) that often

translate into large transaction revenues for e-markets. Industry leaders often bring their

trading partners with them when they join e-markets ( Johnson, 2011a) which expedite

e-markets reaching a critical mass of participants. Therefore, the participation of

industry leaders on an e-market is a strong determinant of e-market success as noted in

the literature (Li and Li, 2005).

The previous section highlights the notion that lack of in-depth knowledge about

an industry can serve to alienate industry participants. This is because in-depth

knowledge of an industry enables an e-market to articulate a value proposition

that aligns well with the needs of industry participants. It also gives e-markets

the credibility needed to gain industry acceptance and can act as an entry barrier

(Sculley and Woods, 1999). The revenue model is a strong determinant of whether

industry participants accept or reject an e-markets value proposition that addresses

their needs and, therefore, directly affects an e-markets long-term economic viability,

as the longevity of e-markets is contingent on their generating sufficient revenues from

fees (Fong et al., 1997). Ordanini (2006) observes that e-markets that earn most of their

revenues from transaction fees are likely to grow (i.e. succeed) compared to those who

earn most of the revenues from subscriptions, advertising and non-e-market services.

However, high e-market participation fees acts as a deterrent to e-market participation

as noted by Johnson (2010a). Therefore, the revenue model should be aligned to the

different types of participants and how much trade they are anticipated to conduct

through the e-market as noted by Johnson (2011c).

How an e-market chooses to brand, position and promote itself is a strong

determinant of attracting and retaining industry participants who accept the value

proposition and relate to what the e-market brand image and reputation conveys.

Having a very strong and recognisable brand name usually serves to help firms

become established in their industry. However, it can also become its Achilles heel

where an e-market subsequently decides to diversify its offering to a wider or new

market, unless it quickly rebrands with a more neutral brand name as in the case of

Public Sector Marketplace when it wanted to expand into the wider public sector.

Other e-markets (e.g. Education Exchange and Local Authority Marketplace) promoted

their brands and offerings based on the empathic message the solution for the sector

by the sector in order to identify with and build trust among industry participants.

This is consistent with, and reinforces, the notion that customers first and foremost

714

MIP

31,6

look for trusted brands when they deal online (Hof and Hemelstein, 1999). An e-market

must provide rich content and content tools (Sculley and Woods, 1999) and other

value-added services (Gengatharen and Standing, 2005; Li and Li, 2005) that inform

and facilitate the purchasing process. In other words, ease of use and usefulness

are key attributes of an e-market that serve to attract and retain industry participants,

which has been noted in the literature (see Chien et al., 2012; Johnson, 2011c).

For example, the ease of use and usefulness of e-markets in streamlining and

semi-automating parts of the procurement process can offer time savings of between 25

and 50 per cent that enable purchasing staff to engage in other value-added tasks

( Johnson, 2011c).

The eight CSFs discussed above support the observations of Gengatharen and

Standing (2005) who posit that it is a combination of characteristics of the e-market

participants, the firm operating the e-market, the underlying technology and the

environment that determine the success of e-markets. The eight CSFs are associated

with e-market goals and their competitive performance, as posited by Rockart (1979),

because each CSF is aligned to the goal of attracting industry participants to grow the

e-market and sustain its performance over competitor offerings and competing modes

of co-ordinating market exchange. The CSFs appear to be interrelated suggesting that

it is the collective, synchronous and synergistic effect among them that creates

and sustains an e-markets longevity in the B2B marketspace. This lends support to the

notions of Li and Li (2005) who suggest that CSFs are interconnected, the observations

of Akkermans and van Helden (2002) who suggest that CSFs seem to reinforce one

another, and the findings of Vaidya et al. (2006) who conclude that no single CSF is

overly dominant in the implementation of e-procurement systems. Although Li and Li

(2005) note that CSFs for e-markets differ from one another based on industry, region,

stage of development and other variables, this study found eight CSFs to be important

for e-market success. Four CSFs were found to be universally cited across all four

e-market industry sectors examined, which is consistent with Daniels (1961) premise

that in most industries there are between three and six critical factors that determine

the success of firms.

6. Research considerations and implications

Methodological considerations

Different research approaches and their associated means of data collection and

analyses have limitations which represent trade-offs between alternatives (see

Bonoma, 1985; Gummesson, 2003). A qualitative approach using a semi-inductive

means of enquiry, informed by the literature, was chosen to yield an information rich

empirical study (see McIvor and Humphreys, 2004) that identified and explicated a set

of factors that are perceived to be conducive to e-market success according to industry

insiders. The semi-inductive approach reconciles the need for themes to emerge out of

the data with the interviews being semi-structured and utilising open-ended questions

that are informed by the literature. While it could also be argued that coding densities,

i.e. the proportion of the interview that [is] coded against each theme (Hall et al.,

2003, p. 497), could have been used to evaluate the relative importance of the CSFs,

using N6 to assess the relative importance of the CSFs based on their frequency

of citation is consistent with similar studies on B2B e-commerce technologies

(e.g. Sehwail and Ingalls, 2005; Vaidya et al., 2006). Nevertheless, it could equally be

argued that both methods of analyses have comparable merit in the gamut of data

analysis techniques deployed in qualitative research. Moreover, neither approach

715

CSFs for

B2B e-markets

inherently distinguishes between positive and negative comments relating to CSFs in

the assessment of their relative importance or any other constructs they are being

applied to. It could also be argued that ranking the e-market CSFs that emerge out of

the qualitative data may constitute a quantitative step in a study utilising a

qualitative paradigm. However, it could equally be argued that presenting data in an

order of perceived relative importance helps to make sense of, and ascribe meaning to,

the data by giving it structure. It also addresses a limitation and trade-off inherent in

some qualitative approaches and does not detract from the notion that the research is

principally a qualitative study.

Implications for practice

CSFs for e-markets differ in importance among disparate groups of stakeholders

because managers perceptions of what they consider to be important are influenced

by their assumptions, perceptions and assessment of their organisational strengths

and weakness, and the opportunities and threats they are exposed to in the external

environment in which they operate. Furthermore, CSFs are temporal and thus their

assessment is also contingent on the stage of the industry life cycle at which the

e-markets is situated. Consequently, new CSFs are likely to emerge as e-markets evolve

along the industry life cycle. Therefore, senior managers within e-markets will need to

periodically assess their internal and external environments on a continuous basis,

and review and recalibrate their resources, capabilities and the associated CSFs aligned

to those environments accordingly in order to sustain their strategic advantage over

competitors as noted in the literature (e.g. Miles and Snow, 1994; Rockart, 1979; Slevin

and Pinto, 1987). Conversely, failure to periodically examine CSFs increases the

probability of poor performance or catastrophic failure. Thus, this paper may also help

entrepreneurs setting up a new e-market and senior management teams in new

e-markets to better understand how they can market and manage their service offering

to expedite their time to market and succeed in the B2B e-marketspace.

Implications for theory

This study proposes that the theory of strategic fit and the conceptual model

in Figure 2 are primers with which future research can examine factors that are

considered to be conducive to e-market success. The theory of strategic fit is an

important conceptual tool with which organisational performance can be examined

(Galbraith and Nathanson, 1979; Venkatraman and Prescott, 1990). This is particularly

the case from a CSFs perspective given that a number of studies (e.g. Miles and Snow,

1994; Rockart, 1979) suggest that effective management of CSFs directly relate to

organisational success, the provision of benefits for stakeholders (e.g. Al-Mashari et al.,

2003; Croteau and Li, 2003; Holland and Light, 1999; Lu et al., 2006; Soong et al., 2001)

or how well they meet the needs of stakeholders (e.g. Umble et al., 2003). It follows that

organisations must focus their resources, capabilities and activities on achieving CSFs

in order to be successful (Teo and Ang, 1999). In particular, they must focus on

developing, continuously managing and utilising market-oriented CSFs that will

furnish them with market intelligence relating to the changing needs of industry

participants (Veen-Dirks and Wijn, 2002). The use of market intelligence should also

enable them to anticipate future customer requirements in order to lead in the industry

marketspaces in which they operate. In the context of e-markets, their internal

capabilities and their ability to provide services that make use of market opportunities

are key determinants of success (Wang et al., 2012). Stated differently, the success of

716

MIP

31,6

E

-

m

a

r

k

e

t

p

l

a

t

f

o

r

m

U

p

s

t

r

e

a

m

(

s

u

p

p

l

y

-

s

i

d

e

c

o

m

m

u

n

i

t

y

)

S

u

p

p

l

y

c

h

a

i

n

n

e

e

d

s

:

O

p

e

r

a

t

i

o

n

a

l

M

a

n

a

g

e

r

i

a

l

S

t

r

a

t

e

g

i

c

I

C

T

i

n

f

r

a

s

t

r

u

c

t

u

r

e

O

r

g

a

n

i

s

a

t

i

o

n

a

l

D

o

w

n

s

t

r

e

a

m

(

b

u

y

-

s

i

d

e

c

o

m

m

u

n

i

t

y

)

B

u

y

-

s

i

d

e

b

e

n

e

f

i

t

s

S

u

p

p

l

y

-

s

i

d

e

b

e

n

e

f

i

t

s

S

u

p

p

l

y

c

h

a

i

n

n

e

e

d

s

:

O

p

e

r

a

t

i

o

n

a

l

M

a

n

a

g

e

r

i

a

l

S

t

r

a

t

e

g

i

c

I

C

T

i

n

f

r

a

s

t

r

u

c

t

u

r

e

O

r

g

a

n

i

s

a

t

i

o

n

a

l

S

u

p

p

l

i

e

r

'

s

f

i

n

a

n

c

e

s

y

s

t

e

m

D

e

e

p

I

n

t

e

g

r

a

t

i

o

n

D

e

e

p

I

n

t

e

g

r

a

t

i

o

n

B

u

y

e

r

'

s

e

-

p

r

o

c

u

r

e

m

e

n

t

s

y

s

t

e

m

B

u

y

-

s

i

d

e

c

a

p

a

b

i

l

i

t

i

e

s

S

u

p

p

l

y

-

s

i

d

e

c

a

p

a

b

i

l

i

t

i

e

s

F

l

o

w

s

o

f

p

a

y

m

e

n

t

s

F

l

o

w

s

o

f

i

n

f

o

r

m

a

t

i

o

n

F

l

o

w

s

o

f

g

o

o

d

s

a

n

d

s

e

r

v

i

c

e

s

E

x

t

e

r

n

a

l

(

e

n

v

i

r

o

n

m

e

n

t

a

l

)

C

S

F

s

I

n

t

e

r

n

a

l

(

e

-

m

a

r

k

e

t

)

C

S

F

s

T

h

e

B

2

B

e

-

m

a

r

k

e

t

s

p

a

c

e

R

e

s

o

u

r

c

e

s

a

n

d

c

a

p

a

b

i

l

i

t

i

e

s

F

I

T

P

e

r

f

o

r

m

a

n

c

e

(

s

u

c

c

e

s

s

)

P

e

r

f

o

r

m

a

n

c

e

(

s

u

c

c

e

s

s

)

F

I

T

Figure 2.

E-market benefits

capabilities industry

participants needs fit

conceptual model

717

CSFs for

B2B e-markets

e-markets is contingent on their internal resources, the capabilities that extend from

those resources and the value-added services (i.e. benefits) those capabilities provide

that respond to the needs of industry participants. Moreover, a turbulent and rapidly

changing marketspace requires e-markets to respond dynamically to the rapidly

changing needs of buyers and suppliers by acquiring resources that develop dynamic

capabilities that service those needs. In other words, e-markets must constantly

monitor whether their resources and capabilities (internal environment) are providing