Beruflich Dokumente

Kultur Dokumente

Pobf 2

Hochgeladen von

lowchangsongOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pobf 2

Hochgeladen von

lowchangsongCopyright:

Verfügbare Formate

University of London 2014

UL14/0230 Page 1 of 1

D1

~~FN1024 ZB d0

This paper is not to be removed from the Examination Halls

UNIVERSITY OF LONDON FN1024 ZB

BSc degrees and Diplomas for Graduates in Economics, Management, Finance

and the Social Sciences, the Diplomas in Economics and Social Sciences and

Access Route

Principles of Banking and Finance

Friday, 16 May 2014 : 10:00 to 13:00

Candidates should answer FOUR of the following EIGHT questions: ONE from Section

A, ONE from Section B and TWO further questions from either section. All questions

carry equal marks.

A calculator may be used when answering questions on this paper and it must comply

in all respects with the specification given with your Admission Notice. The make and

type of machine must be clearly stated on the front cover of the answer book.

PLEASE TURN OVER

University of London 2014

UL14/0230 Page 2 of 2

D1

SECTION A

Answer one question and no more than two further questions from this section.

1. (a) Explain the process of securitization carried out by banks and discuss the reasons why

banks may wish to engage in such a process. (12 marks)

(b) Discuss the causes and consequences of asset price bubbles in relation to US internet-

based company stocks in the late 1990s and the 2007/8 global financial crisis.

(13 marks)

2. (a) Discuss how asymmetric information can cause problems in financial markets.

(12 marks)

(b) Discuss the solutions aimed at reducing moral hazard in debt markets. (13 marks)

3. (a) Discuss the risks arising from both the banking book (intermediation business) and

trading book of banks. (8 marks)

(b) Examine how Value at Risk models can be used by a bank to manage its market risk

exposure. Discuss the problems with these models. (10 marks)

(c) Explain how interest rate risk can affect a bank. (7 marks)

4. (a) Discuss the role of market discipline in regulating banks. (6 marks)

(b) Discuss the reasons for the lender of last resort facility provided by central banks and

discuss the problems with the provision of this facility. (7 marks)

(c) Discuss the reasons for the proposed changes in capital regulation under Basel 3.

(12 marks)

University of London 2014

UL14/0230 Page 3 of 3

D1

SECTION B

Answer one question and no more than two further questions from this section.

5. (a) Distinguish between income gap and duration gap analysis in managing interest rate

risk. Critically examine the limitations of each. (12 marks)

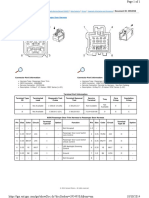

(b) Consider the following balance sheet of Valubank:

Assets () Duration Liabilities () Duration

Variable-rate

mortgages

1400 4.1 Money market

deposits

1000 1.3

Fixed-rate mortgages

1200 8.1 Savings deposits 3000 2.3

Commercial loans 4000 3.2 Variable-rate CDs

(>1 year)

1000 1.2

Physical capital 1400 Equity 3000

Total 8000 Total 8000

Calculate the impact of an increase in interest rates from 3% to 4% on the equity of

Valubank. (7 marks)

(c) Explain what a duration gap of zero implies for a bank and discuss why banks generally

do not operate with duration gaps of zero. (6 marks)

University of London 2014

UL14/0230 Page 4 of 4

D1

6. (a) Discuss the empirical evidence on the risk-return relationship for the following US

securities: Treasury bills, Treasury bonds, large firm common stocks and small firm

common stocks. (8 marks)

(b) Consider the following information about two stocks, White and Black:

Stock Expected return Variance

White 8% 13

Black 3% 5

The correlation between the two securities returns is 0.2

Calculate the expected return and standard deviation of the following four portfolios:

Portfolio proportions (%)

Portfolio White Black

A 30 70

B 50 50

C 75 25

D 100 0

(4 marks)

(c) How can investors identify the best set of efficient portfolios of common stocks? What

does best mean? (4 marks)

(d) Discuss the benefits and limits to diversification in relation to investment in common

stocks. (5 marks)

(e) Consider the following portfolio composed of three stocks (A, B, C):

Stock Quantity Price () CAPM Beta

A 200 1.5 0.8

B 500 1.2 1.0

C 300 2.3 1.5

What is the CAPM beta of this portfolio? (4 marks)

7. (a) Theoretically derive the efficient market hypothesis. (7 marks)

(b) Explain what an excess return is in a financial market. Discuss the main predictions of

the efficient markets hypothesis. (6 marks)

(c) Explain weak form efficiency and discuss the empirical evidence in relation to this form

of efficiency. (12 marks)

University of London 2014

UL14/0230 Page 5 of 5

D1

8. (a) Consider the following stocks:

Stock X is expected to pay a dividend 8 next year then 5 forever;

Stock Y is expected to pay a dividend of 4 next year, 3 in year 2, with dividend

growth expected to be 5% per annum thereafter.

If the required return on similar equities is 7%, calculate the price of each stock.

(6 marks)

(b) Discuss the problems of valuing common stocks, preferred stocks and corporate bonds.

(7 marks)

(c) Explain the Gordon growth model as a technique for the valuation of common stocks

and discuss what kind of stocks this model is more appropriate for valuing.

(6 marks)

(d) Explain the yield to maturity of a bond and explain why it is inversely related to the price

of the bond. (6 marks)

END OF PAPER

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Lecture07 SlidesDokument40 SeitenLecture07 SlideslowchangsongNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- DASC7600 Data Science Project Registration Form: ( Please Delete As Appropriate)Dokument1 SeiteDASC7600 Data Science Project Registration Form: ( Please Delete As Appropriate)lowchangsongNoch keine Bewertungen

- 2016年5月FRM二级模拟考试一(题目)Dokument30 Seiten2016年5月FRM二级模拟考试一(题目)lowchangsongNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2015.11 FRM 二级 mock 题: Societe Generale'sDokument29 Seiten2015.11 FRM 二级 mock 题: Societe Generale'slowchangsongNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 2016年5月FRM二级模拟考试一(答案)Dokument16 Seiten2016年5月FRM二级模拟考试一(答案)lowchangsongNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- 2018 AssignmentDokument1 Seite2018 AssignmentlowchangsongNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- 2 Cost Function With Cobb DouglasDokument5 Seiten2 Cost Function With Cobb DouglaslowchangsongNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- ST439 - Chapter 1: Financial Derivatives, Binomial ModelsDokument27 SeitenST439 - Chapter 1: Financial Derivatives, Binomial ModelslowchangsongNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Homework 5Dokument1 SeiteHomework 5lowchangsongNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Get Started With DropboxDokument10 SeitenGet Started With DropboxYan HakimNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- F2 - Past PapersDokument298 SeitenF2 - Past Papersbilligee73% (11)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 1999Dokument7 Seiten1999lowchangsongNoch keine Bewertungen

- Project Marksheet FRM 2018Dokument1 SeiteProject Marksheet FRM 2018lowchangsongNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Bse 500Dokument4 SeitenBse 500atma12321Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 3int 2006 Dec QDokument9 Seiten3int 2006 Dec QlowchangsongNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- MSC RMFE Programme Handbook 2012-13Dokument367 SeitenMSC RMFE Programme Handbook 2012-13lowchangsongNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ST202 Lecture NotesDokument70 SeitenST202 Lecture NoteslowchangsongNoch keine Bewertungen

- 3int 2005 Jun ADokument7 Seiten3int 2005 Jun Aapi-19836745Noch keine Bewertungen

- 3int - 2006 - Dec - Ans CAT T3Dokument7 Seiten3int - 2006 - Dec - Ans CAT T3asad19Noch keine Bewertungen

- T3int 2010 Jun QDokument9 SeitenT3int 2010 Jun QlowchangsongNoch keine Bewertungen

- 3int - 2005 - Dec - Ans CAT T3Dokument8 Seiten3int - 2005 - Dec - Ans CAT T3asad19Noch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- EC201 Lecture Notes Michaelmas 2014Dokument185 SeitenEC201 Lecture Notes Michaelmas 2014lowchangsongNoch keine Bewertungen

- 3int 2005 Jun QDokument9 Seiten3int 2005 Jun QlowchangsongNoch keine Bewertungen

- Lect 1Dokument26 SeitenLect 1lowchangsongNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 1998Dokument5 Seiten1998lowchangsongNoch keine Bewertungen

- 1997Dokument5 Seiten1997lowchangsongNoch keine Bewertungen

- 1996Dokument6 Seiten1996lowchangsongNoch keine Bewertungen

- PobfDokument5 SeitenPobflowchangsongNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Maurice Nicoll The Mark PDFDokument4 SeitenMaurice Nicoll The Mark PDFErwin KroonNoch keine Bewertungen

- X606 PDFDokument1 SeiteX606 PDFDany OrioliNoch keine Bewertungen

- Evaluation of Performance of Container Terminals T PDFDokument10 SeitenEvaluation of Performance of Container Terminals T PDFjohnNoch keine Bewertungen

- B&G 3DX LiteratureDokument2 SeitenB&G 3DX LiteratureAnonymous 7xHNgoKE6eNoch keine Bewertungen

- Phet Body Group 1 ScienceDokument42 SeitenPhet Body Group 1 ScienceMebel Alicante GenodepanonNoch keine Bewertungen

- Freelance Contract TemplateDokument7 SeitenFreelance Contract TemplateAkhil PCNoch keine Bewertungen

- RS485 ManualDokument7 SeitenRS485 Manualndtruc100% (2)

- Median FilteringDokument30 SeitenMedian FilteringK.R.RaguramNoch keine Bewertungen

- Manual MIB 303S-13/33Dokument58 SeitenManual MIB 303S-13/33Daniel Machado100% (1)

- ASTM A586-04aDokument6 SeitenASTM A586-04aNadhiraNoch keine Bewertungen

- A88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9Dokument7 SeitenA88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9mahmoudNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- SMPLEDokument2 SeitenSMPLEKla AlvarezNoch keine Bewertungen

- East St. Louis, Illinois - Wikipedia, The Free EncyclopediaDokument9 SeitenEast St. Louis, Illinois - Wikipedia, The Free Encyclopediadavid rockNoch keine Bewertungen

- A Study On Impact of Smartphone AddictioDokument4 SeitenA Study On Impact of Smartphone AddictiotansuoragotNoch keine Bewertungen

- 50 Hotelierstalk MinDokument16 Seiten50 Hotelierstalk MinPadma SanthoshNoch keine Bewertungen

- Hilti AnchorDokument5 SeitenHilti AnchorGopi KrishnanNoch keine Bewertungen

- Analysis and Design of Foundation of ROB at LC-9 Between Naroda and Dabhoda Station On Ahmedabad-Himmatnagar RoadDokument10 SeitenAnalysis and Design of Foundation of ROB at LC-9 Between Naroda and Dabhoda Station On Ahmedabad-Himmatnagar RoadmahakNoch keine Bewertungen

- Course Syllabus: Ecommerce & Internet MarketingDokument23 SeitenCourse Syllabus: Ecommerce & Internet MarketingMady RamosNoch keine Bewertungen

- AMCA 210-07 PreDokument10 SeitenAMCA 210-07 PretiagocieloNoch keine Bewertungen

- 3D Archicad Training - Module 1Dokument3 Seiten3D Archicad Training - Module 1Brahmantia Iskandar MudaNoch keine Bewertungen

- 1.reasons For VariationsDokument2 Seiten1.reasons For Variationsscribd99190Noch keine Bewertungen

- RFBT - Law On Sales Cont. Week 11Dokument1 SeiteRFBT - Law On Sales Cont. Week 11Jennela VeraNoch keine Bewertungen

- Chinaware - Zen PDFDokument111 SeitenChinaware - Zen PDFMixo LogiNoch keine Bewertungen

- Ab 1486 Developer Interest ListDokument84 SeitenAb 1486 Developer Interest ListPrajwal DSNoch keine Bewertungen

- Cap. 1Dokument34 SeitenCap. 1Paola Medina GarnicaNoch keine Bewertungen

- Summative-Test-3-5 Tve ExploratoryDokument3 SeitenSummative-Test-3-5 Tve ExploratoryMjnicole MartejaNoch keine Bewertungen

- QT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDokument3 SeitenQT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDoan Ngoc DucNoch keine Bewertungen

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDokument16 SeitenPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNoch keine Bewertungen

- How To Make Affidavit at Pune Collector OfficeDokument1 SeiteHow To Make Affidavit at Pune Collector Officejayram1961Noch keine Bewertungen

- A Comprehensive Review On Renewable and Sustainable Heating Systems For Poultry FarmingDokument22 SeitenA Comprehensive Review On Renewable and Sustainable Heating Systems For Poultry FarmingPl TorrNoch keine Bewertungen

- Student Application Form BCIS - 2077Dokument2 SeitenStudent Application Form BCIS - 2077Raaz Key Run ChhatkuliNoch keine Bewertungen

- Summary of Noah Kagan's Million Dollar WeekendVon EverandSummary of Noah Kagan's Million Dollar WeekendBewertung: 5 von 5 Sternen5/5 (1)

- The First Minute: How to start conversations that get resultsVon EverandThe First Minute: How to start conversations that get resultsBewertung: 4.5 von 5 Sternen4.5/5 (57)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverVon EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverBewertung: 4.5 von 5 Sternen4.5/5 (186)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersVon EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersBewertung: 4.5 von 5 Sternen4.5/5 (95)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceVon EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceBewertung: 5 von 5 Sternen5/5 (22)

- Spark: How to Lead Yourself and Others to Greater SuccessVon EverandSpark: How to Lead Yourself and Others to Greater SuccessBewertung: 4.5 von 5 Sternen4.5/5 (132)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobVon EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobBewertung: 4.5 von 5 Sternen4.5/5 (36)