Beruflich Dokumente

Kultur Dokumente

National Seminar on IFRS

Hochgeladen von

psawant77Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

National Seminar on IFRS

Hochgeladen von

psawant77Copyright:

Verfügbare Formate

Prepared By: CA. Abhijeet N.

Bobade

KEY POINTS ON NATIONAL SEMINAR ON INTERNATIONAL FINANCIAL REPORTING STANDARD

(Conducted by Institute of Chartered Accountants of India & Shivaji University at Kolhapur)

In present era of globalization Indian accounting are mainly divided in two parts:

1) INDIAN GAAP :

Indian GAAP presently follows all accounting standards issued by the ICAI (Institute of

Chartered Accountants of India), it comprising of total 32 accounting standards and

interpretations. Compliance of AS is compulsory for every organization.

2) IFRS

With the growth of Indian economy & increasing integration with the global economies,

Indian corporate is raising capital globally. Under the circumstances it would be

imperative for Indian corporate to adopt IFRS for their financial reporting. Presently Indian

companies which listed on global stock exchanges are following IFRS for their financial

reporting.

IFRS Composition

29 (IAS) + 11 (SIC) + 8 (IFRS) + 16 (IFRIC) = 64 IFRS

IAS stands for International Accounting standard issued before April 2001

IFRS stands for International financial reporting standards issued after April 2001

SIC & IFRIC are stands for Interpretations on IAS & IFRS respectively

Some of the divergences between Indian GAAP and IFRS are summarized as under:

1) Special Purpose Entities (SPE) falling under the definition of control as per IAS 27

on Consolidated and Separate Financial Statements shall be consolidated

2) Potential Voting Rights that are currently exercisable or convertible shall be

considered to assess the Existence of control

3) All business combinations shall be accounted as per purchase method at fair

values.

4) Contingent liabilities, taken over in a business combination, shall be included in

net Assets, measured at fair value, if contingencies have since been resolved, a

reliable estimate can be made and payment is probable.

5) Negative goodwill arising on business combination/ consolidation shall be

accounted as income instead of capital reserve.

Prepared By: CA. Abhijeet N. Bobade

6) Goodwill shall not be amortized. It shall only be tested for impairment.

7) PP&E and Intangible assets shall be measured either at cost or at revalued

amount. Periodical valuation of entire classes of assets is required when

revaluation option is chosen.

8) Intangible assets can be revalued only when there is an active market for the

same.

9) Depreciation on revalued portion cannot recoup out of revaluation reserve.

10) Depreciation to be calculated based on useful life, which along with residual

value and depreciation method shall be reviewed annually.

11) Intangible assets may have an indefinite life e.g. Trademarks, Goodwill,

Franchise.

12) Investment Properties. Land or building held to earn rentals or for capital

appreciation, shall be measured either at cost or fair values.

13) If fair value model is adopted changes in fair value measured annually, shall be

recognized in the income statement.

14) No distinction shall be made between integral and non integral foreign

operations. All foreign operations to be consolidated using non-integral

approach.

15) Exchanges differences shall not be capitalized except to the extent of that

allowed by IAS 23 Borrowing Costs.

16) Share Based Payments shall be measured at fair value.

17) Deferred Tax shall be created on temporary difference instead of timing

difference.

18) Liability portion of compound financial instruments, such as convertible

debentures, shall be separately accounted for.

19) Financial assets and Liabilities shall be classified and measured accordingly as

per the requirements of IAS 39 Financial Instruments: Recognition and

Measurement.

20) All derivative financial assets and liabilities including embedded derivatives shall

be accounted for as on the balance sheet items.

Prepared By: CA. Abhijeet N. Bobade

21) Derivatives classified as hedge shall have to comply with various requirements

of IAS 39 viz. documentation. Hedge effective testing and ineffectiveness

measurement.

22) De-recognition of financial assets, as in the case of securitization, shall be based

on risks and reward, transfer of control being a secondary test.

23) Provision shall be created only to the extent they relate to a specified risk that

can be measured reliable and for incurred losses. No provisions are permitted for

future or expected losses i.e. general provisions.

Current Perspective in India:

The accounting standards board (ASB) of ICAI formulates accounting standards based on IFRS

keeping in view the local conditions including legal & economic environment, which have

recently notified by central government. New Indian IFRS is renamed as IND-AS.

Now Indian accounting standards are getting converted into IND-AS (Convergence with IFRS)

Here convergence means to achieve harmony with IFRS. Convergence doesnt mean that IFRS

adopted word by word (as it did by Pakistan & Lanka)

Prepared By: CA. Abhijeet N. Bobade

Consistent financial reporting basis:

A consistent financial reporting basis would allow a multinational company like us to apply

common accounting standards with its Holding / Subsidiaries worldwide, which would improve

internal communications, quality of reporting and group decision making.

On the basis of this examination, the ICAI has classified various IFRSs into the following five

categories:

Category I - IFRSs which do not involve any legal or regulatory issues nor have any issues with

regard to their suitability in the existing economic environment, preparedness of industry and

any conceptual differences from the Indian Accounting Standards. This category has further

been classified into two parts as follows:

Category IA - IFRSs which can be adopted immediately as these do not have any differences

with the corresponding Indian Accounting Standards. The following IFRSs have been identified in

this category:

1) IAS 11, Construction Contracts

2) IAS 23, Borrowing Costs

Category I B - IFRSs which can be adopted in near future as there are certain minor differences

with the corresponding Indian Accounting Standards. The following IFRSs have been identified in

this category:

1) IAS 2 Inventories

2) IAS 7,Cash Flow Statements

3) IAS 20, Accounting for Government Grants and Disclosure of Government Assistance

Access to International

capital market

Improves

management

information

Streaming

reporting

processes

Benchmarking

eith global

peers

Better information to

Investors

IND-AS

Prepared By: CA. Abhijeet N. Bobade

4) IAS 33, Earnings Per Share

5) IAS 36, Impairment of Assets

6) IAS 38, Intangible Assets

Category II - IFRSs which may require some time to reach a level of technical preparedness by

the industry and professionals keeping in view the existing economic environment and other

factors. This category also includes those IFRSs corresponding to which Indian Accounting

Standards are under preparation/revision. The following IFRSs have been identified in this

category:

1) IAS 18, Revenue

2) IAS 21,The Effects of Changes in Foreign Exchange Rates

3) IAS 26, Accounting and Reporting by Retirement Benefit Plans

4) IAS 40, Investment Property (Corresponding Indian Accounting Standard is under

preparation)

5) IFRS 2, Share-based Payment (Corresponding Indian Accounting Standard is under

preparation)

6) IFRS 5, Non-current Assets Held for Sale and Discontinued Operations (Corresponding

Indian Accounting Standard is under preparation)

Category III - IFRSs which have conceptual differences with the corresponding Indian

Accounting Standards. This category has further been divided into two parts as follows:

Category III A - IFRSs having conceptual differences with the corresponding Indian Accounting

Standards that should be taken up with the IASB. The following IFRSs have been identified in this

Category:

A) IAS 17,Leases

B) IAS 19, Employee Benefits

C) IAS 27,Consolidated and Separate Financial Statements

D) IAS 28, Investments in Associates

E) IAS 31, Interests in Joint Ventures

F) IAS 37, Provisions, Contingent Liabilities and Contingent Assets

Category III B - IFRSs having conceptual differences with the corresponding Indian Accounting

Standards that need to be examined to determine whether these should be taken up with the

IASB or should be removed by the ICAI itself. The following IFRSs have been identified in this

Category:

1) IAS 12, Income Taxes

2) IAS 24, Related Party Disclosures

3) IAS 41, Agriculture (Corresponding Indian Accounting Standard is under preparation)

4) IFRS 3, Business Combinations

5) IFRS 6, Exploration for and Evaluation of Mineral Resources

6) IFRS 8, Operating Segments

Prepared By: CA. Abhijeet N. Bobade

Category IV - IFRSs, the adoption of which would require changes in laws/regulations because

compliance with such IFRSs is not possible until the regulations/laws are amended. The following

IFRSs have been identified in this Category:

1) IAS 1, Presentation of Financial Statements

2) IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors

3) IAS 10, Events After the Balance Sheet Date

4) IAS 16, Property, Plant and Equipment

5) IAS 32, Financial Instruments: Presentation (Exposure Draft of the Corresponding Indian

Accounting Standard has been issued)

6) IAS 34, Interim Financial Reporting

7) IAS 39, Financial Instruments: Recognition and Measurement (Exposure Draft of the

Corresponding Indian Accounting Standard has been issued)

8) IFRS 1, First-time Adoption of International Financial Reporting Standards

9) IFRS 4, Insurance Contracts

10) IFRS 7, Financial Instruments: Disclosures

Category V - IFRSs corresponding to which no Indian Accounting Standard is required for the

time being. However, the relevant IFRSs, when adopted upon full convergence, can be used as

the fallback option where needed.

1) IAS 29, Financial Reporting in Hyper-inflationary Economies

Prepared By: CA. Abhijeet N. Bobade

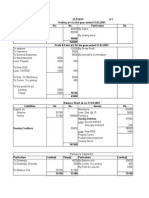

MODIFICATIONS TO SCHEDULE VI TO THE COMPANIES ACT, 1956 (Applicable for 1.04.2011

31.03.2012)

The Revised Schedule VI is however a step towards convergence to IFRS to some extent with

regard to presentation of financial statements, as many features has been adopted from these

international standards. But it is important to note that the notification for Revised Schedule VI

contains reference to the existing Accounting Standards not converged IND-IFRS.

Following are the changes in the Balance Sheet format:

Items on the Liability Side: Items on the Asset Side:

I. EQUITY AND LIABILITIES

(1) Shareholders fund

a. Share Capital

b. Reserves and Surplus

c. Money received against share warrants

(2) Share Application Money pending Allotment

(3) Non Current Liabilities

a. Long Term Borrowings

b. Deferred Tax Liabilities (Net)

c. Other Long Term Liabilities

d. Long Term Provisions

(4) Current Liabilities

a. Short Term Borrowings

b. Trade Payables

c. Other Current Liabilities

d. Short Term Provisions

II. ASSETS

Noncurrent Assets

(1) (a) Fixed Assets

(i) Tangible Assets

(ii)Intangible Assets

(iii)Capital Work in Progress

(iv)Intangible Assets under Development

(b) NonCurrent Investments

(c) Deferred Tax Assets (Net)

(d) Long Term loans and advances

(e) Other noncurrent assets

(2) Current Assets

(a) Current Investments

(b) Inventories

(c) Trade Receivables

(d) Cash and Cash equivalents

(e) Short term loans and advances

(f) Other Current Assets

Prepared By: CA. Abhijeet N. Bobade

Changes in the format of the Profit and Loss Account

Revenue

1) Revenue from operations

2) Other income

Total Revenue (I + II)

Expenses:

1) Cost of materials consumed

2) Purchases of Stock-in-Trade

3) Changes in inventories of finished goods work-in-progress and Stock-in-Trade

4) Employee benefits expense

5) Finance costs

6) Depreciation and amortization expense

7) Other expenses

Total expenses

Profit before exceptional and extraordinary items and tax (III-IV)

Exceptional items

Profit before extraordinary items and tax (V - VI)

Extraordinary Items

Profit before tax (VII- VIII)

Tax expense:

(1) Current tax

(2) Deferred tax

Profit (Loss) for the period from continuing operations (VII-VIII)

Profit/(loss) from discontinuing operations

Tax expense of discontinuing operations

Profit/(loss) from Discontinuing operations (after tax) (XII-XIII)

Profit (Loss) for the period (XI + XIV)

Earnings per equity share:

1) Basic

2) Diluted

Prepared By: CA. Abhijeet N. Bobade

Das könnte Ihnen auch gefallen

- Wage Structure & AdministrationDokument18 SeitenWage Structure & AdministrationYogpatterNoch keine Bewertungen

- Cambridge SummaryDokument1 SeiteCambridge SummaryMausam Ghosh100% (1)

- Pecking Order TheoryDokument2 SeitenPecking Order TheorymavimalikNoch keine Bewertungen

- Internal Financial Controls-IFCOR PDFDokument47 SeitenInternal Financial Controls-IFCOR PDFAliah GhinaNoch keine Bewertungen

- IFRS Basics: Standards, Structure and RequirementsDokument16 SeitenIFRS Basics: Standards, Structure and RequirementsAnonymous rkZNo8Noch keine Bewertungen

- Fed Ex CaseDokument7 SeitenFed Ex CasePallavi GhaiNoch keine Bewertungen

- Project Report on Types of Partnership FirmsDokument25 SeitenProject Report on Types of Partnership FirmsAarush Jain90% (10)

- Wiley IFRS: Practical Implementation Guide and WorkbookVon EverandWiley IFRS: Practical Implementation Guide and WorkbookNoch keine Bewertungen

- CISA Exam 100 Practice QuestionDokument22 SeitenCISA Exam 100 Practice Questionharsh100% (1)

- Design of E-Commerce Information System On Web-Based Online ShoppingDokument11 SeitenDesign of E-Commerce Information System On Web-Based Online ShoppingHARINoch keine Bewertungen

- Financial StatementsDokument35 SeitenFinancial StatementsTapish GroverNoch keine Bewertungen

- Ifrs - An Overview: International Financial Reporting StandardsDokument19 SeitenIfrs - An Overview: International Financial Reporting Standardskitta880% (2)

- International Financial Reporting Standards (IFRS)Dokument10 SeitenInternational Financial Reporting Standards (IFRS)soorajsooNoch keine Bewertungen

- An Innovative Step in Loyalty programs-LOYESYSDokument18 SeitenAn Innovative Step in Loyalty programs-LOYESYSJason MullerNoch keine Bewertungen

- Accounting of Insurance CompaniesDokument8 SeitenAccounting of Insurance CompaniesShishir DhamijaNoch keine Bewertungen

- Advance Accounts Part 2Dokument4 SeitenAdvance Accounts Part 2ashish.jhaa756Noch keine Bewertungen

- Convergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaDokument4 SeitenConvergence With International Financial Reporting Standards ('IFRS') - Impact On Fundamental Accounting Practices and Regulatory Framework in IndiaVinodh RathnamNoch keine Bewertungen

- Indian Accounting Standards (Ind AS) : Basic ConceptsDokument18 SeitenIndian Accounting Standards (Ind AS) : Basic ConceptsSivasankariNoch keine Bewertungen

- List of International Financial Reporting Standards in 2022 Updated - 62f2074aDokument18 SeitenList of International Financial Reporting Standards in 2022 Updated - 62f2074aCA Naveen Kumar BalanNoch keine Bewertungen

- Introduction To IFRSDokument13 SeitenIntroduction To IFRSgovindsekharNoch keine Bewertungen

- Accounting StandardsDokument6 SeitenAccounting StandardsJohnsonNoch keine Bewertungen

- Indian Accounting Standards (Ind As)Dokument33 SeitenIndian Accounting Standards (Ind As)sandeshNoch keine Bewertungen

- IFRS Financials Jun 2014Dokument25 SeitenIFRS Financials Jun 2014Navin KumarNoch keine Bewertungen

- IFRS Convergence in IndiaDokument11 SeitenIFRS Convergence in IndiaCA Raj KanwalNoch keine Bewertungen

- Assignment On Accounting For ManagersDokument43 SeitenAssignment On Accounting For ManagersShashankNoch keine Bewertungen

- Accounts - ASDokument35 SeitenAccounts - ASNooral AlfaNoch keine Bewertungen

- Accounting Standards and their ImportanceDokument27 SeitenAccounting Standards and their ImportanceVeerNoch keine Bewertungen

- CRDMGT Module II CH 7 Indian Accounting StandardDokument22 SeitenCRDMGT Module II CH 7 Indian Accounting StandardMikeNoch keine Bewertungen

- IND As Vs As ComparisonDokument42 SeitenIND As Vs As ComparisonGeetikaNoch keine Bewertungen

- Financial Reporting ChangesDokument7 SeitenFinancial Reporting ChangesyogeshNoch keine Bewertungen

- Name: Adewole Oreoluwa AdesinaDokument7 SeitenName: Adewole Oreoluwa Adesinaoreoluwa adewoleNoch keine Bewertungen

- Financial AccountingDokument16 SeitenFinancial AccountingSREYANoch keine Bewertungen

- 6 - IasDokument25 Seiten6 - Iasking brothersNoch keine Bewertungen

- Audit of Consolidated Financial StatementsDokument7 SeitenAudit of Consolidated Financial StatementsDheeraj VermaNoch keine Bewertungen

- Board of Studies The Institute of Chartered Accountants of India AnnouncementDokument6 SeitenBoard of Studies The Institute of Chartered Accountants of India AnnouncementSivasankariNoch keine Bewertungen

- Accounting Standards (Basics)Dokument10 SeitenAccounting Standards (Basics)Sohail AhmedNoch keine Bewertungen

- IFRS Reporting Standards ExplainedDokument15 SeitenIFRS Reporting Standards ExplainedSugufta ZehraNoch keine Bewertungen

- Convergence of IAS With IFRS in IndiaDokument12 SeitenConvergence of IAS With IFRS in Indiaksmuthupandian2098Noch keine Bewertungen

- Overview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPDokument16 SeitenOverview of Significant Differences Between International Financial Reporting Standards (IFRS) and Indian GAAPvcsekhar_caNoch keine Bewertungen

- Ifrs ANISH MODIDokument7 SeitenIfrs ANISH MODIanishmodi667Noch keine Bewertungen

- Attock Refinery 2009 Annual Report NotesDokument26 SeitenAttock Refinery 2009 Annual Report NotesSohail Humayun KhanNoch keine Bewertungen

- IFRS ConvergenceDokument27 SeitenIFRS Convergencespchheda4996Noch keine Bewertungen

- International Financial Reporting Standards (IFRS) : An OverviewDokument10 SeitenInternational Financial Reporting Standards (IFRS) : An Overviewsanjay guptaNoch keine Bewertungen

- IMPACT OF IFRS ON THE INDIAN REAL ESTATE SECTORDokument46 SeitenIMPACT OF IFRS ON THE INDIAN REAL ESTATE SECTORNayan JhunjhunwalaNoch keine Bewertungen

- Ca10 0120Dokument16 SeitenCa10 0120Amit KumarNoch keine Bewertungen

- IND AS 1 and 2 SummaryDokument22 SeitenIND AS 1 and 2 SummaryAbhishek GolechhaNoch keine Bewertungen

- Topic-8 Difference Between Indian Accounting Standards and IfrsDokument69 SeitenTopic-8 Difference Between Indian Accounting Standards and IfrsPahul Walia83% (6)

- IFRS, GAAP and Ind-AS ComparisonDokument47 SeitenIFRS, GAAP and Ind-AS ComparisonDevyansh GuptaNoch keine Bewertungen

- Ifrs PDFDokument6 SeitenIfrs PDFkeenu23Noch keine Bewertungen

- Lect-4 IFRS Frame WorkDokument28 SeitenLect-4 IFRS Frame WorkRipu RanjanNoch keine Bewertungen

- Overview of Indian Accounting Standards For SMEsDokument44 SeitenOverview of Indian Accounting Standards For SMEsSamrat JonejaNoch keine Bewertungen

- Ifrs NotesDokument4 SeitenIfrs NotesAnshika AroraNoch keine Bewertungen

- AS-01 Financial Statement StandardsDokument9 SeitenAS-01 Financial Statement StandardsAtaulNoch keine Bewertungen

- Basic of AS & AS 1Dokument19 SeitenBasic of AS & AS 1Harsh JainNoch keine Bewertungen

- FRA Submission - II BankingDokument2 SeitenFRA Submission - II BankingAtul KarwasaraNoch keine Bewertungen

- UNIT-II KMBN-103 Financial Accounting and Analysis 20-21Dokument5 SeitenUNIT-II KMBN-103 Financial Accounting and Analysis 20-21pranavNoch keine Bewertungen

- IFRSDokument9 SeitenIFRSPulkit JainNoch keine Bewertungen

- Indian Accounting Standards 2 Marks question and answersDokument5 SeitenIndian Accounting Standards 2 Marks question and answersharsha100% (2)

- Accounting Standards Tanmay AroraDokument133 SeitenAccounting Standards Tanmay AroratanmayaroraNoch keine Bewertungen

- Ifrs 22 Aug 09 - VC - 4Dokument32 SeitenIfrs 22 Aug 09 - VC - 4Darshan ToreNoch keine Bewertungen

- International Financial Reporting Standards (Ifrs)Dokument24 SeitenInternational Financial Reporting Standards (Ifrs)amuliya v.sNoch keine Bewertungen

- Assignment 1 Describe The System of Developing Indian Accounting StandardsDokument20 SeitenAssignment 1 Describe The System of Developing Indian Accounting StandardsShashank100% (1)

- India: IFRS andDokument18 SeitenIndia: IFRS andragmudradiNoch keine Bewertungen

- IFRS BasicsDokument8 SeitenIFRS BasicsgeorgebabycNoch keine Bewertungen

- Accounting StandardsDokument109 SeitenAccounting StandardsJugal Shah100% (1)

- Accounting Information ProcessDokument12 SeitenAccounting Information Processhasib santobuNoch keine Bewertungen

- Index: SR No Particulars Page NoDokument33 SeitenIndex: SR No Particulars Page NoKaran KhatriNoch keine Bewertungen

- Indian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideDokument8 SeitenIndian Accounting Standard: (1) To Provide Information: The Main Objectives of Accounting Standards Is To ProvideAkrutNoch keine Bewertungen

- Answer Sheet v-1 24052014Dokument7 SeitenAnswer Sheet v-1 24052014psawant77Noch keine Bewertungen

- XI PaperDokument1 SeiteXI Paperpsawant77Noch keine Bewertungen

- ImpDokument1 SeiteImppsawant77Noch keine Bewertungen

- BK Paper 45 MarksR3 PrelimDokument5 SeitenBK Paper 45 MarksR3 Prelimpsawant770% (1)

- Oc Paper1Dokument1 SeiteOc Paper1psawant77Noch keine Bewertungen

- Secretarial Practice 2Dokument2 SeitenSecretarial Practice 2psawant77Noch keine Bewertungen

- Mvat Computation 2014-2015Dokument23 SeitenMvat Computation 2014-2015psawant77Noch keine Bewertungen

- Admision Form 18.6.2014Dokument2 SeitenAdmision Form 18.6.2014psawant77Noch keine Bewertungen

- Ocm Objective XiiDokument15 SeitenOcm Objective Xiipsawant77Noch keine Bewertungen

- DraftDokument1 SeiteDraftpsawant77Noch keine Bewertungen

- Tds Rate Chart AY 14 15Dokument1 SeiteTds Rate Chart AY 14 15dhyanuNoch keine Bewertungen

- Answer Sheet BK Papers1Dokument34 SeitenAnswer Sheet BK Papers1psawant77Noch keine Bewertungen

- CPT PaperDokument4 SeitenCPT Paperpsawant77Noch keine Bewertungen

- SP Paper 1Dokument2 SeitenSP Paper 1psawant77Noch keine Bewertungen

- Deficit Finance MeaningDokument3 SeitenDeficit Finance Meaningpsawant77Noch keine Bewertungen

- BFMDokument28 SeitenBFMPratik RambhiaNoch keine Bewertungen

- Different Types of ForestsDokument7 SeitenDifferent Types of Forestspsawant77Noch keine Bewertungen

- Cost Acc. 27-10-14Dokument5 SeitenCost Acc. 27-10-14psawant77100% (1)

- KulluDokument2 SeitenKullupsawant77Noch keine Bewertungen

- Functions of RBIDokument3 SeitenFunctions of RBITarun BhatejaNoch keine Bewertungen

- PartnershipDokument4 SeitenPartnershippsawant77Noch keine Bewertungen

- Dematofshares PDFDokument3 SeitenDematofshares PDFpsawant77Noch keine Bewertungen

- Demat Simplified: A Guide To Dealing in Dematerialised SecuritiesDokument2 SeitenDemat Simplified: A Guide To Dealing in Dematerialised SecuritiesBalraj PadmashaliNoch keine Bewertungen

- Types of Bank AccountDokument5 SeitenTypes of Bank Accountpsawant77Noch keine Bewertungen

- Economics Exam with Questions on Demand, Supply, Elasticity, Costs and MoreDokument13 SeitenEconomics Exam with Questions on Demand, Supply, Elasticity, Costs and Morepsawant77Noch keine Bewertungen

- XL Shortfreecut KeysDokument25 SeitenXL Shortfreecut Keyspsawant77Noch keine Bewertungen

- Case LawsDokument37 SeitenCase LawsKiran Sebastian RozarioNoch keine Bewertungen

- Project Report: Overview of E-Commerce Impacts On Telecommunications ManagementDokument24 SeitenProject Report: Overview of E-Commerce Impacts On Telecommunications Managementpsawant77Noch keine Bewertungen

- b5 Special Solving Set 5Dokument6 Seitenb5 Special Solving Set 5MSHANA ALLYNoch keine Bewertungen

- Azithromycin Brands in PakistanDokument4 SeitenAzithromycin Brands in PakistanibNoch keine Bewertungen

- Oracle Payments R12 User GuideDokument184 SeitenOracle Payments R12 User GuideppmurilloNoch keine Bewertungen

- Pass Papers CAC 4201Dokument26 SeitenPass Papers CAC 4201tαtmαn dє grєαtNoch keine Bewertungen

- Elizabeth SeyoumDokument57 SeitenElizabeth SeyoumDawit A AmareNoch keine Bewertungen

- Module 7 CVP Analysis SolutionsDokument12 SeitenModule 7 CVP Analysis SolutionsChiran AdhikariNoch keine Bewertungen

- BCG Presentation FinalDokument24 SeitenBCG Presentation FinalNitesh SinghNoch keine Bewertungen

- Sai Khant Kyaw Za - Task 2Dokument4 SeitenSai Khant Kyaw Za - Task 2Lean CosmicNoch keine Bewertungen

- Chapter 1: The Problem and Its BackgroundDokument3 SeitenChapter 1: The Problem and Its BackgroundPatricia Anne May PerezNoch keine Bewertungen

- Ap9208 Cash 2Dokument2 SeitenAp9208 Cash 2Onids AbayaNoch keine Bewertungen

- International Trade: application exercisesDokument10 SeitenInternational Trade: application exercisesHa Nguyen Pham HaiNoch keine Bewertungen

- Alia Instruments General Conditions of SaleDokument4 SeitenAlia Instruments General Conditions of SaleLucas Martins da SilvaNoch keine Bewertungen

- Proposal On Human Resource MagmtDokument15 SeitenProposal On Human Resource MagmtKalayu KirosNoch keine Bewertungen

- Attachment 2 - Sample Master Service AgreementDokument11 SeitenAttachment 2 - Sample Master Service AgreementAnubha MathurNoch keine Bewertungen

- Job Advertisement - Finance ManagerDokument3 SeitenJob Advertisement - Finance ManagerBawakNoch keine Bewertungen

- Taxation Part 2Dokument101 SeitenTaxation Part 2Akeefah BrockNoch keine Bewertungen

- Kelompok 8Dokument10 SeitenKelompok 8dewi murniNoch keine Bewertungen

- MY AnnualReport 2019 PDFDokument164 SeitenMY AnnualReport 2019 PDFSivaram KumarNoch keine Bewertungen

- Topic 3 Product DesignDokument19 SeitenTopic 3 Product Designjohn nderituNoch keine Bewertungen

- Overview of Indian Securities Market: Chapter-1Dokument100 SeitenOverview of Indian Securities Market: Chapter-1tamangargNoch keine Bewertungen

- Role of the Sleeping PartnerDokument15 SeitenRole of the Sleeping PartnerKhalid AsgherNoch keine Bewertungen

- Chapter 16 Employee Safety and HealthDokument13 SeitenChapter 16 Employee Safety and HealthAmmarNoch keine Bewertungen