Beruflich Dokumente

Kultur Dokumente

Flash Cards

Hochgeladen von

Brandy CraigCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Flash Cards

Hochgeladen von

Brandy CraigCopyright:

Verfügbare Formate

Terms

A. Recognition G. Gains

B. Comprehensive Income H. Net Income

C. Faithful representation I. Earnings

D. Revenues J. Realization

E. Predictive Value K. Replacement Cost

F. Comparability L. Current Market Value

1. Component of relevance. E

2. Increases in net assets from incidental or peripheral

transactions affecting an entity.

G

3. The process of converting noncash resources and rights

into cash or claims to cash.

J

4. Enhancing qualitative characteristic of relevance and

faithful representation.

F

5. The process of formally recording an item in the

financial statements of an entity after it has met existing

criteria and been subject to cost-benefit constraints and

materiality thresholds.

A

6. All changes in net assets of an entity during a period

except those resulting from investments by owners and

distributions to owners.

B

7. Inflows or other enhancements of assets of an entity or

settlements of its liabilities from delivering or producing

goods, rendering services, or other activities that

constitute the entity's ongoing operations.

D

8. The amount of cash, or its equivalent, that could be

obtained by selling an asset in orderly liquidation.

L

9. The quality of information that helps users to increase

the likelihood of correctly forecasting the outcome of past

or present events.

E

10. A performance measure concerned primarily with cash-

to-cash cycles.

I

Table 1

1

What is the cash flow category for

collections of principal amounts on loans

made to other entities?

The category is Investing.

List the required categories for the

Statement of Cash Flows.

Net cash inflow or outflow from Operating Activities; Net cash inflow or

outflow from Investing Activities; Net cash inflow or outflow from

Financing Activities; Effects of Foreign Currency Translation;

Reconciliation of net cash inflows/outflows with the reported change in

cash and cash equivalents on the Balance Sheet; Non-cash Investing and

Financing Activities. What is the cash flow category for

interest paid and received?

This category is Operating Activities.

What is the basic purpose of the

statement of cash flows?

The basic purpose is to provide information about the cash receipts and

cash payments for an entity to help investors, creditors, and others.

Name the four major sections in the direct

method cash flow statement.

Operating cash flows; Investing cash flows; Financing cash flows;

Reconciliation of net income and net operating cash flows.

What is the indirect method on the

statement of cash flows?

Reconciles net income to cash flows from operating activities.

Name the two formats permitted for the

statement of cash flows.

Indirect; direct

What is the direct method on the

statement of cash flows?

This method presents actual inflows and outflows from cash operations.

Must also disclose the indirect method (reconciliation of net income to cash

flows from operations) as a supporting schedule.

When is a Statement of Cash Flows

required?

For all business enterprises that report both financial position (Balance

Sheet) and results of operations (Income Statement) for a period.

What is reported on the Statement of

Cash Flows?

Information about the cash receipts and cash payments for an entity; The

difference between net income and net operating cash flows; Information

about investing and financing activities which do not involve cash inflows

or outflows.

What is the reporting basis of the

statement of cash flows?

The reporting basis is cash and cash equivalents.

The first major section of the Statement

of Cash Flows reports cash flow from

operating activities.

TRUE

In the body of the Statement of Cash

Flows, only the "Cash Flows from

Operating Activities" section can be

different based on the method -- direct or

indirect -- used.

TRUE

The method used for presenting "Cash

Flows from Operating Activities," direct

or indirect, will affect how "Cash Flows

from Investing Activities" is presented.

FALSE

The Statement of Cash Flows provides

information that is useful to parties

external to the entity.

TRUE

The method used for presenting "Cash

Flows from Operating Activities," direct

or indirect, will affect how "Net Effect of

Foreign Currency Translation" is

presented.

FALSE

OIFF ("O IFF I could only remember") is

the mnemonic that reflects the major

sections of the Statement of Cash Flows.

TRUE

Under the indirect method, the

presentation of "Cash Flows from

Operating Activities" begins with Net

Income.

TRUE

The "Net Cash Flows from Operating

Activities" subtotal can be only a positive

amount.

FALSE

An investment in bonds which has been

held for three years will likely be treated

as a cash equivalent during the three

months prior to its maturity.

FALSE

Different additional disclosures will be

required if the direct method is used to

present "Cash Flows from Operating

Activities" than if the indirect method is

used.

TRUE

In order to be treated as a cash

equivalent, an asset must be convertible

into a known amount of cash.

TRUE

The reconciliation of net income with

cash flow from operating activities

presents the same information as the

"Cash Flows from Operating Activities"

presents using the indirect method.

TRUE

The difference between cash at the

beginning of the period and cash at the

end of the period must equal the sum of

the changes reported as cash inflows and

cash outflows.

TRUE

Any of the major sections of the

Statement of Cash Flows may be

presented using either the direct or

indirect method.

FALSE

The "Cash Flows from Financing

Activities" subtotal can be only a negative

amount.

FALSE

If the indirect method is used to develop

"Cash Flows from Operating Activities," a

separate schedule must be provided which

reconciles net income with cash flow.

FALSE

A ten-year treasury note will be treated as

a cash equivalent.

FALSE

The "Cash Flows from Financing

Activities" section of the Statement of

Cash Flows is primarily concerned with

how the entity is financed.

TRUE

The "Cash Flow from Investing

Activities" subtotal of the Statement of

Cash Flows is primarily concerned with

the acquisition and disposal of non-cash

assets.

TRUE

The method used for presenting "Cash

Flows from Operating Activities," direct

or indirect, will affect how "Cash Flows

from Financing Activities" is presented.

FALSE

The direct method of presenting "Cash

Flows from Operating Activities" requires

different additional disclosures than the

indirect method.

TRUE

There is only one way to present "Cash

Flows from Operating Activities" in the

Statement of Cash Flows.

FALSE

The Statement of Cash Flows discloses

only information about cash flows.

FALSE

When the direct method is used to present

"Cash Flows from Operating Activities," a

separate reconciliation of net income with

cash flow from operating activities must

be provided.

TRUE

The direct method of presenting "Cash

Flows from Operating Activities" presents

cash inflows and cash outflows based on

the kind of sources that generated cash

and the kind of recipients to which cash

was paid.

TRUE

Under the indirect method of presenting

"Cash Flows from Operating Activities,"

the presentation begins with net income.

TRUE

The direct method of presenting "Cash

Flows from Operating Activities" requires

an additional disclosure to reconcile net

income to cash flows from operating

activities.

TRUE

The "Cash Flows from Operating

Activities" section of the Statement of

Cash Flows reports only cash inflows.

FALSE

The net change in cash (and cash

equivalents) for a period is known.

TRUE

The "Net Cash Flows from Investing

Activities" section can be positive or

negative.

TRUE

The Statement of Cash Flows is a required

financial statement.

TRUE

The amount of "Cash Flows from

Operating Activities" will be the same

whether the direct of the indirect method

is used.

TRUE

Regardless of whether the direct or the

indirect method is used to present "Cash

Flows from Operating Activities" the

remainder of the body of the Statement of

Cash Flows will be the same.

TRUE

The Statement of Cash Flows treats

certain highly liquid assets as cash

equivalents.

TRUE

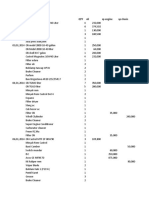

Operating Activities: Operating Cash Flows Direct Method

Operating Activities: Reconciliation Indirect MEthod

Investing Activities: Investing Cash Flows Direct Method & Indirect Method

Financing Activities: Financing Cash Flows Direct Method & Indirect Method

Type: Inflows (Cash Received) Operating Activity

Type: Cash fromcustomers Operating Activity

Type: Dividends (FromInvestment) Operating Activity

Type: Interest Operating Activity

Type: Sale of trading investments Operating Activity

Type: Cash paid to suppliers

(good/services)

Operating Activity

Type: Cash paid to employees (payroll) Operating Activity

Type: Cash paid for Interest Operating Activity

Type: Cash paid for income taxes Operating Activity

Type: Cash fromsale of long-termassets Investing Activity

Type: Cash fromcollection of loan principal Investing Activity

Type: Cash fromdisposal of debt and

equity securities (of others) (Held-to-

maturity and Available for sale

Classifications)

Investing Activity

Type: Cash fromsale of other productive

asset (e.g. patent; but not inventory)

Investing Activity

Type: Cash paid for purchase of long-term

asset

Investing Activity

Type: lending (to others) Investing Activity

Type: Investment in debt and equity

securities (of others) (HTM and AFS

classification)

Investing Activity

Type: Cash purchase of other productive

assets (e.g. patent; but not inventory)

Investing Activity

Type: Cash received for sale of (own) stock Financing Activity

Type: Cash proceeds fromborrowing

(Bonds, Notes, etc)

Financing Activity

Type: Cash fromIssuing debt Financing Activity

Type: Cash paid for repurchase of own

treasury stock

Financing Activity

Type: Paying back lenders (principal only) Financing Activity

Type: Payment of dividends Financing Activity

IFRS: Interest Paid Operating & Financing

GAAP: Interest Paid Operating

IFRS: Interest Received Operating & Investing

GAAP: Interest Received Operating

IFRS: Taxes Paid Operating, or - Financing or Investing if specifically identified with an item

GAAP: Taxes Paid Operating

IFRS: Dividends Received Operating & Investing

GAAP: Dividends Received Operating

IFRS: Dividends Paid Operating or Financing

GAAP: Dividends Paid Financing

IFRS: Cash & Cash Equivalents May Include bank overdrafts

GAAP: Cash & Cash Equivalents Overdrafts not allowed

2

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Green Solvents For Chemistry - William M NelsonDokument401 SeitenGreen Solvents For Chemistry - William M NelsonPhuong Tran100% (4)

- Master StationDokument138 SeitenMaster StationWilmer Quishpe AndradeNoch keine Bewertungen

- Recommended lubricants and refill capacitiesDokument2 SeitenRecommended lubricants and refill capacitiestele123Noch keine Bewertungen

- Lesson 3 - Materials That Undergo DecayDokument14 SeitenLesson 3 - Materials That Undergo DecayFUMIKO SOPHIA67% (6)

- ITIL - Release and Deployment Roles and Resps PDFDokument3 SeitenITIL - Release and Deployment Roles and Resps PDFAju N G100% (1)

- Vitamin D3 5GDokument7 SeitenVitamin D3 5GLuis SuescumNoch keine Bewertungen

- nrcs143 009445Dokument4 Seitennrcs143 009445mdsaleemullaNoch keine Bewertungen

- Numark MixTrack Pro II Traktor ProDokument3 SeitenNumark MixTrack Pro II Traktor ProSantiCai100% (1)

- NDU Final Project SP23Dokument2 SeitenNDU Final Project SP23Jeanne DaherNoch keine Bewertungen

- fr1177e-MOTOR CUMMINS 195HPDokument2 Seitenfr1177e-MOTOR CUMMINS 195HPwilfredo rodriguezNoch keine Bewertungen

- BC Specialty Foods DirectoryDokument249 SeitenBC Specialty Foods Directoryjcl_da_costa6894Noch keine Bewertungen

- Determining Total Impulse and Specific Impulse From Static Test DataDokument4 SeitenDetermining Total Impulse and Specific Impulse From Static Test Datajai_selvaNoch keine Bewertungen

- Experienced Leadership Driving Growth at Adlabs EntertainmentDokument38 SeitenExperienced Leadership Driving Growth at Adlabs EntertainmentvelusnNoch keine Bewertungen

- Discount & Percentage Word Problems SolutionsDokument4 SeitenDiscount & Percentage Word Problems SolutionsrheNoch keine Bewertungen

- ATmega32 SummaryDokument18 SeitenATmega32 SummaryRajesh KumarNoch keine Bewertungen

- ECED Lab ReportDokument18 SeitenECED Lab ReportAvni GuptaNoch keine Bewertungen

- Model Paper 1Dokument4 SeitenModel Paper 1Benjamin RohitNoch keine Bewertungen

- HSPA+ Compressed ModeDokument10 SeitenHSPA+ Compressed ModeAkhtar KhanNoch keine Bewertungen

- How To Make Pcbat Home PDFDokument15 SeitenHow To Make Pcbat Home PDFamareshwarNoch keine Bewertungen

- Movie Review TemplateDokument9 SeitenMovie Review Templatehimanshu shuklaNoch keine Bewertungen

- 1 N 2Dokument327 Seiten1 N 2Muhammad MunifNoch keine Bewertungen

- Resona I9 Neuwa I9 FDADokument2 SeitenResona I9 Neuwa I9 FDAMarcos CharmeloNoch keine Bewertungen

- Mechanical PropertiesDokument30 SeitenMechanical PropertiesChristopher Traifalgar CainglesNoch keine Bewertungen

- 2016 04 1420161336unit3Dokument8 Seiten2016 04 1420161336unit3Matías E. PhilippNoch keine Bewertungen

- SIWES Report Example For Civil Engineering StudentDokument46 SeitenSIWES Report Example For Civil Engineering Studentolayinkar30Noch keine Bewertungen

- Ultrasonic Examination of Heavy Steel Forgings: Standard Practice ForDokument7 SeitenUltrasonic Examination of Heavy Steel Forgings: Standard Practice ForbatataNoch keine Bewertungen

- Jodi Ridgeway vs. Horry County Police DepartmentDokument17 SeitenJodi Ridgeway vs. Horry County Police DepartmentWMBF NewsNoch keine Bewertungen

- Borneo United Sawmills SDN BHD V Mui Continental Insurance Berhad (2006) 1 LNS 372Dokument6 SeitenBorneo United Sawmills SDN BHD V Mui Continental Insurance Berhad (2006) 1 LNS 372Cheng LeongNoch keine Bewertungen

- The Causes of Cyber Crime PDFDokument3 SeitenThe Causes of Cyber Crime PDFInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Nmea Components: NMEA 2000® Signal Supply Cable NMEA 2000® Gauges, Gauge Kits, HarnessesDokument2 SeitenNmea Components: NMEA 2000® Signal Supply Cable NMEA 2000® Gauges, Gauge Kits, HarnessesNuty IonutNoch keine Bewertungen