Beruflich Dokumente

Kultur Dokumente

Icbelsh 2006

Hochgeladen von

International Jpurnal Of Technical Research And Applications0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten6 Seiten.

Originaltitel

ICBELSH 2006

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten6 SeitenIcbelsh 2006

Hochgeladen von

International Jpurnal Of Technical Research And Applications.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

18 | P a g e

BOARD OF DIRECTORS CHARACTERISTICS

AND FIRMS PERFORMANCE AMONG

JORDANIAN FIRMS, PROPOSING

CONCEPTUAL FRAMEWORK

Mohammed Hassan Makhlouf

1

, Nur Hidayah Binti Laili

2

, Mohamad Yazis Ali Basah

3

1

PhD candidate,

2,3

Assistant Professor

Faculty of Economics and Muamalat

Universiti Sains Islam Malaysia (USIM)

Bandar Baru Nilai, 71800, Nilai, Negeri Sembilan, Malaysia

Abstract This paper proposes a conceptual framework to

investigate the relationship between board of directors'

characteristics (Board of directors' independence, board of

directors' size, family members at board of directors, board of

directors meetings, CEO duality, and existence of nominations

and compensation committee) and firms' performance among

industrial companies listed on Amman Stock Exchange. Previous

studies focused on the importance of board of directors as a main

component of corporate governance rules and pointed out that

the main role of board of directors is monitoring the firm's

operations with the aim of developing and improving the firms'

performance. In Jordan, in light of the development of the

Jordanian national economy at all levels, and in light of the

government's efforts to attract foreign and domestic investments

and to stimulate companies to perform better, this study argues

that the firms with effective of board of directors characteristics

are able to enhance and increase the firms' performance.

Key words Board of directors, corporate governance,

Firm performance, J ordan.

I. INTRODUCTION

Applying corporate governance rules has become important

for public and private sectors, and a tool for enhancing

confidence in any national economy and an evidence of the

existence of fair and transparent polices for protecting investors

and traders alike. It is also an indication to the level of

professional commitments reached by the firm's managements

towards good governance, transparency and accountability, the

existence of measures to limit corruption, and consequently

raise the economys attractiveness to local and foreign

investments and bolstering its competitiveness [1].

Corporate governance enhances the firms' performance and

protects the shareholders interests. Also, good corporate

governance helps the firms to manage its resource by attracting

new investors and capital funds. Another important benefit of

corporate governance is an effective tool to help the firm to

achieve better performance [2].

Along with the importance of corporate governance , there

is a growing interest to study the effect of corporate governance

rules on firm performance, is that poor performance, due to

confiscated of minority shareholders and misuse of the firms'

resources, has a significant result to business and the economy

[3]. Also, poor performance leads to loss of reputation and to

shakes the confidence of shareholders and investors in

shareholding firms [3].

Boards of directors as a rule of corporate governance

become important for smooth functioning of firms and improve

the performance. Boards are expected to perform different

functions, for example, monitoring of management to mitigate

agency costs, hiring and firing of management, provide and

give access to resources, grooming CEO and providing

strategic direction for the firm to enhance the performance [4];

[5]; [6].

Boards also have a responsibility to initiate organizational

change and facilitate processes that support the organizational

mission. Further, the boards seek to protect the shareholders

interest in an increasingly competitive environment while

maintaining managerial professionalism and accountability in

pursuit of good firm performance [7].

This study aimed to investigate in the importance of the

board of directors' characteristics and firm performance. So,

this study chosen the financial performance indicators based on

some points; first, it is commonly widely used, and it is useful

and meaningful. Second, it is free of bias, because it is depend

on real figures extracted from audited financial statements.

Third, it is used as a tool for identifying irregularities in

management behavior and firm's opportunities [8].

This paper proposes a conceptual framework to investigate

the relationship between board of directors' characteristics

(Board of directors' independence, board of directors' size,

family members at board of directors, Board of directors

meetings, CEO Dual, and Nominations and compensation

committee) and firms' performance among industrial

companies listed on Amman Stock Exchange. The remainder

of the paper is organized as follows: Introduces the background

of the study in section 2. Literatures review in section 3, the

conceptual framework and hypothesis development presented

in section 4. Summaries and concludes this paper in section 5.

II. BACKGROUND

In light of the development of the Jordanian national

economy at all levels, and consistent with the Jordan Securities

Commissions efforts to develop the national capital market,

the Jordanian corporate governance code was issued in 2009.

The Jordanian corporate governance code contains rules of

corporate governance for shareholding companies listed at

Amman Stock Exchange (ASE) for the purpose of creating a

framework that regulates their relations and management and

defines their rights, duties and responsibilities in order to

realize their objectives and safeguard the rights of all

stakeholders. These rules are based principally on a number of

legislations, mainly the Securities Law and related regulations,

the Companies Law, and the international principles

established by the Organization of Economic Cooperation and

Development (OECD) 2008 [1].

The Jordanian corporate governance code stated, to enhance

the firms performance that the board of directors should include

a balance of executive directors and non- executive directors in

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

19 | P a g e

order to ensure that the boards decision making is not

dominated by a certain party [1]. The best practices of the code

also recommend that the responsibilities of the chairman and

the chief operating officer should not be held by the same

person to ensure that there is a balance of power and authority

[1]. The appointments to the board should be made by a

nomination committee and the directors should undergo an

orientation and education programs [1].

III. LITERATURE REVIEW

The board of directors is the top executive unit of a

company and be responsible for supervising of the companys

management. And it is legally and ethically responsible for the

shareholders.

Limited numbers of previous studies have examined the

relationship between the firm performance and board of

directors' characteristics. These studies argued that the board of

directors as a significant part of corporate governance code is

responsible for the decline in shareholders wealth, corporate

failure and the decline in the performance of firms. This due to

the lack of vigilant oversight functions by the board of

directors, the board relinquishing control to corporate managers

who pursue their own self-interests [9]. So, various corporate

governance reforms have specifically emphasized on

appropriate changes to be made to the board of directors in

terms of its composition, structure and ownership configuration

to arrive to better performance [9].

There is believed that corporate governance enhances the

firm performance and protects shareholders interests. The

effective economic roles of practicing good corporate

governance are to provide a good connection between the firm

and its environment and to secure its critical resource by

attracting new investors and capital funds [2]. Another

important benefit of corporate governance is to act as a

mechanism of internal governance and monitoring of

management. Practicing good corporate governance is an

effective tool to help the firm to achieve better performance [2].

IV. CONCEPTUAL FRAMEWORK AND HYPOTHESES

This study aimed to investigate in the relationship between

the characteristics of board of directors' and its effect on firm

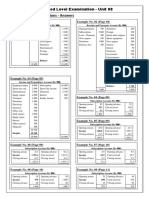

performance? Figure 1 explains the relationship between

characteristics of board of directors' and its effect on firms'

performance.

Fig 1; Relationship between board of directors' characteristics and firm

performance.

1. Board of directors independence and firm performance

Independence of Board of directors are more professional in

shareholding firms and can more easily achieve the supervising

function, reduce the possibility of collusion of top executives,

and prevent the abuse of company resources, thus improving

performance [10]. So, Jordanian corporate governance code

(JCGC) and Jordanian companies' law focused on the

independence of the members of board of directors as a

mechanism to overcoming the bias. JCGC stated that at least

one third of the board members are independent members [1].

The relation between the proportion of outside directors

(board independence), and firm performance is mixed [11].

Numerous of previous studies indicates that board

independence arrive to increase firm performance. [12] argued

that when the boards dominated by the independents are able to

find the best solution to the agency problems between

managers and owners and able to monitor the executive

decisions. Also, they pointed out that the independents

directors prefer to use measurable indicators to assess the

performance and what is achieved by the executives. A

positive relationship between board independence and firm

performance because the existence of greater board

independence is a help factor in improving company

performance [13].

In spite of the belief that independence of board of directors

can lead to improved firms' performance, previous empirical

studies examining the relationship between board of directors'

independence and firms' performance have reported mixed

results. Studies by [14]; [15]; [5], found a positive relationship

between independence of board of directors and firms'

performance. They gave the reasons that, independent directors

being financially independent of management, free of bias, they

can protect the rights of shareholders, mitigation of agency

problems and provide the monitoring in the best form to

manage the firm resources. Board independence leads to the

board being better able to replace any executives who breach

the accepted managerial code of practice [16].

In contrary, there are studies argued that relation between

independent directors and firms' performance is negative. [17]

Found there is no relationship between board of directors'

independence and firms' performance, especially when

independent directors were not selected based on their expertise

and experience. [18] Explained that the existence of

independent directors minimizing the firms' performance

especially in financial crises. [19]; [20] indicated that firm

performance is negatively associated with board independence;

due to the mechanism of elected the board members or with the

lack of experience among boards' members. Therefore, this

study expects that:

H1: There is a positive relationship between independence

of board of directors and firms' performance.

2. Board of directors' size and firm performance

JCGC state that the board of directors whose members shall

be not less than five and not more than thirteen, as determined

by the Companys memorandum of association 1]. The optimal

number of directors represents a problem for companies. Large

numbers of directors will lead to reduce the efficiency and

performance, because there is an increased difficulty in

achieving agreement concerning decisions [10].

The board size is a critical element of achieving the board

effectiveness and improves firm performance. Shorter

communication distance between members help to increase the

efficiency of the board's decision making, so, small boards

have positive relationship with firm performance [21]. In a

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

20 | P a g e

study in the Jordanian banks, the boards with many members

lead to problems of coordination in decision making. So, there

is a significant negative relation between board size and banks

performance as measured by ROE and EPS but insignificant

negative association of board size with ROA. [22].

The board size has negative significant relationship with

firm's performance [14]. [23] argued that the Smaller boards

are more efficient and faster in decision-making because it is

more difficult for the firm to arrange board meetings and for

the board to reach a consensus, and when the board size is

bigger it will be easier for CEO to have a dominant on the

board and increase the CEO power in decision-making.

In contrast, board size have a positive impact on firm

performance, especially, with larger board size because it

contributes more towards firm performance because larger

board size means that there are more ideas and skills that can

be shared among board members [24]. Large boards can't

monitor or control the agency problem as well as smaller

boards [25]. [6] reported that board size is positively related

with firm performance. Therefore, this study hypothesizes that:

H2: There is a positive relationship between board of

directors' size and firms' performance.

3. Family members at board of directors and firm

performance

There is a belief that the family members at the board of

directors have a loyalty, belonging and perform better more

than other members. Because they have a belief that the firm is

their own business and they have a greater knowledge of the

firm. Family members prefer to hold positions on the board of

directors and appoint a family representative CEO to handle the

daily operations of the firm [26].

Firms that have balance in representation between family

members and the independent members have been most

valuable. In contrast, when the board of directors under the

family members and there are few of independent members in

the board of directors, the impact on the firm performance will

be negatively [27]. Furthermore, family members try to reduce

the representation's independent members on the board, while

outside shareholders seeking to increase the representations of

independent members [28].

In controlling shareholder firms that have a degree of

transparent, outside CEOs perform better than founder CEOs,

who perform better than heir CEOs. The important thing, under

any type of CEOs (Professional, founder, or heir) the

transparency and independent should be available [29]. In other

words, all of the CEOs should practice a high degree of

transparency without any types of bias to any party regardless

of their affiliations.

Presence of family members in board of directors, helps the

firms achieve higher performance than those managed by

outside directors and family ownership creates more value

when the founder is as CEO of the family firm or as Chairman

with a hired CEO [30]. There is a positive effect on

performance for family CEOs in unlisted family firms [31].

Presence of professional managers is more significant in

family-controlled firms. Because the firms with situations like

bankruptcy or low cash flow need to outside directors who

have skills to improve the firms' performance [26]. So, there is

no relationship between family directors and firm performance.

And there is a negative effect among family directors and

performance [4]; [26]. Firm performance has a negative effect

on the likelihood that a firm is run by one of its founders [4].

Therefore, this study expects that:

H3: There is a positive relationship between existence of

family members at the board of directors and firms'

performance.

4. Board of directors meetings and firm performance

Good corporate governance practices require from board of

directors should meet regularly to discuss the firm situations,

any matter arise, or any new suggestions. So, According to

JCGC, The board of directors meetings in the fiscal year must

not be less than six meetings. Little number of previous studies

is hinted to the board of directors meetings and its impact on

firm's performance.

Firms in still lack experiences in managing and supervising,

the expected benefits of frequent meetings outweigh the costs.

So, board meeting frequency is positively related to firm

performance [32]. Frequency of board meetings is considered

as a measure of monitoring power and effectiveness of board

of directors. Boards of directors that have higher number of

meetings through the year their performance will be higher 33].

Where the frequently meetings of board of directors considered

one of monitoring procedures that lead to increase firm value [

34].

There isn't any effect of the frequency of board meetings on

firm performance [35]. Firms with a higher number of Board

meetings exhibit the lowest price to book value [36]. Because

the big number of meetings is an indicator to the lower efficient

of the board of directors and maybe are because the weakness

in communication matters between board members is available

[36].Therefore, this study hypothesizes that:

H4: There is a positive relationship between frequency of

board meetings and firms' performance.

5. CEO duality and firm performance

Agency theory mentioned to be a clear separation among

CEO responsibilities and chairman of board of directors. [6],

defined the CEO duality as the same person has a position of

company CEO and chairman of the board of directors. It's

necessary separation among CEO and chairman of the board,

because if one person holds the two positions, there would be

no other person to monitor his actions and that maybe leads to

maximize his own interest at the expense of the shareholders

interests then affect on firm performance [37]. JCGC states, it

is not allowed for one person to hold the positions of chairman

of the board of directors and any executive position in the

company at the same time.

When back to literature that studied the relationship

between CEO duality and firm performance results found are

mixed. The duality is more effective, because when one person

can do effective control over the firm and to be easy make a

focus on achieving firm's objectives is realistic and available

[38].

There are some of the previous studies confirm that the

CEO duality is healthy and more benefit for the firms. The

CEO separating process would incur higher costs, and this is

maybe bearable for big firms but unsuitable for the small firms

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

21 | P a g e

[39]. [40] found a positive relationship between CEO duality

and firm performance when measured by Tobin's Q, ROA and

operating profit. Also, a study by [41] reported that firm

performance is not affected by a separation between CEO and

chairman and this means that there is a positive relationship

between CEO duality and firm performance.

In contrast, Studies by [6] ; [17]; [42]; [43] found a negative

relation between firm performance and CEO dual, they explain

that when there is a separation between the chairman and CEOs

the performance will be better. They argued that the reason for

the duality is a weakness in legal system in internal control unit

of firms. Therefore, this study expects that:

H5: There is a positive relationship between CEOs dual and

firms' performance.

6. Nominations and Compensation Committee and firm

performance

Existence of nomination and compensation committee in

the firm is considered as a mechanism to encourage

management to run a firm in the interest of shareholders. And

these lead to improve the firm performance [7]. This committee

plays a significant role in monitor the actions of executive and

non-executive directors and ensures that they seek

shareholder's interest [44].

The compensation of board members has positive effects on

the performance of firms. And it is important to take an

appropriate compensation level of boards members. Because

the compensation will provide a better relation between

shareholders and firm's management and this relation will

enhance firms performance to increase firm's value [7]. [42]

reported that the existence of a remuneration committee has a

positive effect on financial performance.

Family members consider firms as an own business, that

leading to believe that they have a right to use the firm's

resources as they see appropriate. For example, higher salaries

or higher compensations and that's may lead to a negative

effect on firm performance and causes to losses. So the

independence is very important to the committee members

[45]. [46] argued that the interaction between independent

directors and a compensation committee has significant

consequences for CEO incentive systems as well as corporate

governance mechanisms.

Previous studies on the existence of a compensation and

nominations committee and its effect on firm performance

found mixed results. [42] Indicates that presence of the

compensation committee have a positive effects on the

performance of firms. [47] argued that providing a suitable

salary as remuneration have positively effects the motivation of

shareholders to increase firm performance. [46] pointed out

that board independence produces a stronger relationship

between executive compensation and firm performance in

Chinese listed firms. [48] found a significant positive

relationship between executive cash compensation and Korean

shares performance. Therefore, this study hypothesizes that:

H6: There is a positive relationship between existence of

nominations and compensations committee and firms'

performance.

V. CONCLUSION

Board of directors is responsible to maximizing the

shareholders wealth and improves firms' performance. To

achieve that, vigilant oversight functions should be available

and effective by board of directors. Various corporate

governance reforms have specifically emphasized on

appropriate changes to be made to the board of directors in

terms of its composition, structure and ownership configuration

till arrive to the best performance and achieving the goals.

The purpose of this study is to examine the importance of

one of corporate governance aspects, namely characteristics of

board of directors and study its effect in enhance and improve

the firms' performance among industrial firms listed on the

Amman Stock Exchange. this study propose some of

characteristics according to prior studies namely, board of

directors' independence, board of directors' size, family

members at board of directors, Board of directors meetings,

CEO Dual, and nominations and compensation committee.

According to previous studies, when the firms' commitment

with the characteristics' of board of directors is consider a

significant factor to support and improve the firms'

performance. There are some factors supporting this; electing

the members according to their experience and qualifications.

Should be a clear separation among the positions of CEOs and

chairman. Set of committees should be existence to monitor

the firm's business such as audit committee and nominations

and compensations committee.

REFERENCES

[1] Jordan Securities Commission. (2008) Corporate Governance

code for Shareholdings companies Listed on the Amman Stock

Exchange. [Online]. HYPERLINK

"http://jsc.gov.jo/library/634365426651890968.pdf"

http://jsc.gov.jo/library/634365426651890968.pdf

[2] Mohammad Ahid Ghabayen, "Board Characteristics and Firm

Performance: Case of Saudi Arabia," International Journal of

Accounting and Financial Reporting. Vol. 2 (2), pp. P. 168-200,

2012.

[3] Hui Zhang, "Corporate governance, firm performance, and

information leakage: an empirical analysis of the Chinese stock

market," unpublished, 2012.

[4] Renee Adams, Heitor Almeida, and Daniel Ferreira,

"Understanding the relationship between founderCEOs and

firmperformance," Journal of Empirical Finance, pp. 136-150,

2009.

[5] Jeffrey L. Colesa, Naveen D. Danielb, and Lalitha Naveen,

"Boards: Does one size fit all?," Journal of Financial Economics

(87) 2, pp. 329-356, 2012.

[6] Abdelmohsen M. Desoky and Gehan A. Mousa, "Do Board

Ownership and Characteristics Affect on Firm Performance?

Evidence from Egypt," Global Advanced Research Journal of

Economics, Accounting and Finance (1) 2, pp. 15-32, 2012.

[7] Duc Vo and Thuy Phan, "Corporate governance and firm

performance: emperical evidence from Vitenam," 2013.

[8] Abdulhadi H. Ramadan, "Determinants of Capital Structure and

the Firm's Financial Performance: An Application on the UK

Markrt ," (Doctoral theses). University of Surrey, 2009.

[9] Zubaidah ZainalAbidin, Nurmala Mustaffa Kamal, and

Kamaruzaman Jusoff, "Board Structure and Corporate

Performance in Malaysia," International Journal of Economics

and Finance. Vol.(1) 1, pp. 150-164, 2009.

[10] Hsiang Chiang, "An Empirical Study of Corporate Governance

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

22 | P a g e

and Corporate Performance," Journal of American academy of

business (31)1, pp. 122-140, 2005.

[11] Marcus L. Caylor Lawrence D. Brown, "Corporate Governance

and Firm Operating Performance.," Review of Quantitative

Finance and Accounting. Vol. 32 (2), pp. P. 129-144, 2009.

[12] Lutfi, Rr. Iramani, and MellyzaSilvy, "The role of board of

commissioners and transparency in improving bank operational

effeciency and profitability," in The 3rd International Conference

on Business and Banking , Pattaya, Thailand, 2014, pp. 167-179.

[13] OConnel and Crame, "The relationship between firm

performance and board characteristics in Ireland," European

Management Journal, 28, pp. 387-399, 2010.

[14] Adebayo O. S, Ayeni Gabriel Olusola, and Oyewole Felicia

Abiodun, "Relationship Between Corporate Governance And

Organizational Performance: Nigerian Listed Organizations

Experience," International Journal of Business and Management

Invention (2) 9, pp. 1-6, 2013.

[15] Aamir Khan and Sajid Hussain Awan, "Effect on board

composition on firm performance: A case of Pakistan listed,"

Interdisciplinary Journal of Contemporary Research in Business

(3)10, 2012.

[16] Eliezer M. Fich and Anil Shivdasani, "Are Busy Boards Effective

Monitors?," The Journal of Finance (61)2, pp. 689-724, 2006.

[17] Kajola, "Corporate Governance and Firm Performance: The Case

of Nigerian Listed Firms ," European Journal of Economics,

Finance and Administrative Sciences 14 ISSN 1450-2275, pp.

16-28, 2008.

[18] Roman Horvath and Persida Spirollari, "Do the Board of

Directors' Characteristics Influence Firm's Performance? The

U.S. Evidence," Prague Economic Papers, pp. 470-486, 2012.

[19] Sanjai Bhagat and Brian Bolton, "Corporate Governance and

Firm Performance: Recent Evidence," 2009.

[20] Roberto Mura, "Firm Performance: Do Non-Executive Directors

Have a Mind of Their Own? Evidence from Uk Panel Data,"

Available at SSRN: http://ssrn.com/abstract=676971 or

http://dx.doi.org/10.2139/ssrn.676971, 2006.

[21] Paul Guest, "The Impact of Board Size on Firm Value: Evidence

from the UK," he European Journal of Finance, 15 (4), pp. 385-

404, 2009.

[22] Al-Manaseer, "The Impact of Corporate Governance on the

Performance of Jordanian Banks," European Journal of Scientific

Research 67(3), pp. 349-359, 2012.

[23] Shijun Cheng, "Board size and the variability of corporate

performance," Journal of Financial Economics 87 (1), pp. 157-

176, 2008.

[24] Nor Azizah ZainalAbidin and Halimah Nasibah Ahmad,

"Corporate Governance in Malaysia: the Effect of Corporate

Performs and State Business Relation in Malaysia," Asian

Academy of Management Journa. Vol. 12. (1), pp. P. 2334,

2007.

[25] Meziane Lasfer, "The Interrelationship Between Managerial

Ownership and Board Structure," Journal of Business Finance &

Accounting, Vol. 33(7-8), pp. pp. 1006-1033, 2006.

[26] En-Te Chen, Stephen Gray, and John Nowland, "Family

involvement and family firm performance," City University of

Hong Kong, 2011.

[27] Ronald Andersona, Augustine Durub, and David Reeb,

"Founders, Heirs, and Corporate Opacity in the U.S.," Journal of

Financial Economics (92) 2, pp. 205-222, 2009.

[28] Ronald C. Andersona and David M. Reeb, "Board Composition:

Balancing Family Influence in S&P 500 Firms," Administrative

Science (49)2 , pp. 209-237, 2004.

[29] Ronald Andersona, Augustine Durub, and David Reebc,

"Founders, Heirs, and Corporate Opacity in the U.S.," Journal of

Financial Economics (92) 2, pp. 205-222, 2009.

[30] Belen Villalonga and Raphael Amit, "How do family ownership,

control and management affect firm value?," Journal of Financial

Economics , pp. 385-417, 2006.

[31] Alessandro Minichilli, Guido Corbetta, and Ian C. MacMillan,

"Top management teams in family-controlled companies:

Familiness, faultlines and their impact on financial

performance," Journal of Management Studies (47), pp. 205-222,

2010.

[32] Shenghui Tong, Eddy Junarsin, and Wallace N. Davidson, "A

Comparison of Chinese State-Owned Enterprise Firms Boards

and Private Firms Boards," in 23rd International Business

Research Conference, Melbourne, Australia, 2013.

[33] Collins G. Ntim and Kofi A. Osei, "The Impact of Corporate

Board Meetings on Corporate Performance in South Africa,"

African Review of Economics and Finance (2) 2, pp. 83-103,

2011.

[34] Ivan E. Brick and N.K. Chidambaran, "Board Meetings,

Committee Structure, and Firm Performance,"

http://ssrn.com/abstract=1108241 or

http://dx.doi.org/10.2139/ssrn.1108241, 2007.

[35] Roman Horvath and Persida Spirollari, "Do the Board of

Directors' Characteristics Influence Firm's Performance? The

U.S. Evidence," Prague Economic Papers, pp. 470-486, 2012.

[36] Nikos Vafeas, "Board meeting frequency and firms performance

," Journal of Financial Economics, pp. 113-142, 1999.

[37] Metin Coskun and Ozlem Sayilir, "Relationship Between

Corporate Governanceand Financial Performance of Turkish

Companies," International Journal of Business and Social Science

(3) 14, pp. 59-64, 2012.

[38] Tin Yan Lam and Shu Kam Lee, "CEO Duality and Firm

Performance: Evidence from Hong Kong ," Journal of Corporate

Governance. vol. 8 (3), pp. P. 299-316., 2008.

[39] James A. Brickley, Jeffrey L. Coles, and Gregg Jarrell,

"Leadership structure: Separating the CEO and Chairman of the

Board," Journal of Corporate Finance , pp. 189-220, 1997.

[40] Maretno A. Harjoto and Hoje Jo, "Board Leadership and Firm

Performance," Journal of International Business and Economics

(8), pp. 143-154, 2008.

[41] Mohammed M. Omran, Ali Bolbolc, and Ayten Fatheldin,

"Corporate governance and firm performance in Arab equity

markets: Does ownership concentration matter?," International

Review of Law and Economics (28) 1, pp. 32-45, 2008.

[42] Charlie Weir, David Laing, and Philip J McKnight, "Internal and

external governance mechanisms: their impact on the

performance of large UK public companies.," Journal of Business

Finance & Accounting (29) , pp. 579611, 2002.

[43] Roszaini Haniffa and Mohammad Hudaib, "Corporate

Governance Structure and Performance of Malaysian Listed

Companies," Journal of Business Finance & Accounting (33) 7-8,

pp. 1034-1062, 2006.

[44] Palanisamy Saravanan, "Corporate Governance and Company

Performance: A Study with Reference to Manufacturing Firms in

India," http://ssrn.com/abstract=2063677 or

http://dx.doi.org/10.2139/ssrn.2063677, 2012.

[45] Lamia Chourou, "Compensation of owner managers in Canadian

family-owned businesses: expropriation of minority

shareholders," Canadian Journal of Administrative Sciences. Vol.

27 (2), pp. P. 95-106, 2010.

[46] Yuqing Zhu, Gary G. Tian, and Shiguang Ma, "Executive

compensation, board characteristics and firm performance in

China: the impact of compensation committee," in 22nd

Australasian Finance and Banking Conference, Sydney , 2009,

pp. 1-48.

[47] Mary Ellen Carter and Valentina Zamora, "Shareholder

Remuneration Votes and CEO Compensation Design ," Available

International Journal of Technical Research and Applications e-ISSN: 2320-8163,

www.ijtra.com Volume-2, Special Issue 4 (July-Aug 2014), PP. 18-23

23 | P a g e

at SSRN: http://ssrn.com/abstract=1004061 or

http://dx.doi.org/10.2139/ssrn.1004061, 2008.

[48] Takao Kato, Woochan Kim, and Ju Ho Lee, "Executive

Compensation, Firm Performance, and Chaebols in Korea:

Evidence from New Panel Data," Pacific-Basin Finance Journal

(15) 1, pp. 36-55, 2007.

[49] Noor Afsa Amran, "Corporate governance mechanisms and

company performance evidence from Malaysian companies,"

International Review of Business Research Papers (7)6, pp. 101-

114, 2011.

[50] Muhammad Agung Prabowo and John L. Simpson, "Independent

directors and firm performance in family controlled firms:

Evidence from Indonesia ," Asian-Pacific Economic Literature

(25) (1), pp. 121-132, 2011.

[51] Noor Afza Amran and Ayoib Che Ahmad, "Family Business,

Board Dynamics and Firm Vaiue: Evidence from Malaysia ,"

Joumal of Financial Reporting & Accounting (7) 1, pp. 53-74,

2009.

[52] Haslindar Ibrahim and Fazilah Abdul Samad, "Corporate

Governance Mechanisms and Performance of Public-Listed

Family-Ownership in Malaysia," International Journal of

Economics and Finance, 3 (1), 2011.

[53] Yabei Hu and Shigemi Izumida, "The Relationship between

Ownership and Performance: A Review of Theory and

Evidence," International Business Research. Vol. 1(4), pp. P.72-

81, 2008.

[54] Tin Yan Lam and Shu Kam Lee, "CEO duality and firm

performance: evidence from Hong Kong," Corporate Governance

(8) 3, pp. 299-316, 2008.

[55] Lamia Chourou, "Compensation of Owner Managers in Canadian

Family-Owned Businesses: Expropriation of Minority

Shareholders," Canadian Journal of Administrative Sciences (27)

2, pp. 95-106, 2010.

Das könnte Ihnen auch gefallen

- Sumita PDFDokument5 SeitenSumita PDFInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Sumita PDFDokument5 SeitenSumita PDFInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Postponement of Scheduled General Surgeries in A Tertiary Care Hospital - A Time Series Forecasting and Regression AnalysisDokument6 SeitenPostponement of Scheduled General Surgeries in A Tertiary Care Hospital - A Time Series Forecasting and Regression AnalysisInternational Jpurnal Of Technical Research And Applications100% (2)

- Modelling The Impact of Flooding Using Geographic Information System and Remote SensingDokument6 SeitenModelling The Impact of Flooding Using Geographic Information System and Remote SensingInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Qualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraDokument9 SeitenQualitative Risk Assessment and Mitigation Measures For Real Estate Projects in MaharashtraInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Exponential Smoothing of Postponement Rates in Operation Theatres of Advanced Pediatric Centre - Time Series Forecasting With Regression AnalysisDokument7 SeitenExponential Smoothing of Postponement Rates in Operation Theatres of Advanced Pediatric Centre - Time Series Forecasting With Regression AnalysisInternational Jpurnal Of Technical Research And Applications100% (2)

- Study of Nano-Systems For Computer SimulationsDokument6 SeitenStudy of Nano-Systems For Computer SimulationsInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Digital Compressing of A BPCM Signal According To Barker Code Using FpgaDokument7 SeitenDigital Compressing of A BPCM Signal According To Barker Code Using FpgaInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Energy Gap Investigation and Characterization of Kesterite Cu2znsns4 Thin Film For Solar Cell ApplicationsDokument4 SeitenEnergy Gap Investigation and Characterization of Kesterite Cu2znsns4 Thin Film For Solar Cell ApplicationsInternational Jpurnal Of Technical Research And Applications100% (1)

- Aesthetics of The Triumphant Tone of The Black Woman in Alice Walker's The Color PurpleDokument30 SeitenAesthetics of The Triumphant Tone of The Black Woman in Alice Walker's The Color PurpleInternational Jpurnal Of Technical Research And Applications100% (2)

- Pod-Pwm Based Capacitor Clamped Multilevel InverterDokument3 SeitenPod-Pwm Based Capacitor Clamped Multilevel InverterInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- An Experimental Study On Separation of Water From The Atmospheric AirDokument5 SeitenAn Experimental Study On Separation of Water From The Atmospheric AirInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Time Efficient Baylis-Hillman Reaction On Steroidal Nucleus of Withaferin-A To Synthesize Anticancer AgentsDokument5 SeitenTime Efficient Baylis-Hillman Reaction On Steroidal Nucleus of Withaferin-A To Synthesize Anticancer AgentsInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Implementation of Methods For Transaction in Secure Online BankingDokument3 SeitenImplementation of Methods For Transaction in Secure Online BankingInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Li-Ion Battery Testing From Manufacturing To Operation ProcessDokument4 SeitenLi-Ion Battery Testing From Manufacturing To Operation ProcessInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Parametric Modeling of Voltage Drop in Power Distribution NetworksDokument4 SeitenParametric Modeling of Voltage Drop in Power Distribution NetworksInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Scope of Replacing Fine Aggregate With Copper Slag in Concrete - A ReviewDokument5 SeitenScope of Replacing Fine Aggregate With Copper Slag in Concrete - A ReviewInternational Jpurnal Of Technical Research And Applications100% (1)

- Effect of Trans-Septal Suture Technique Versus Nasal Packing After SeptoplastyDokument8 SeitenEffect of Trans-Septal Suture Technique Versus Nasal Packing After SeptoplastyInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Performance Analysis of Microstrip Patch Antenna Using Coaxial Probe Feed TechniqueDokument3 SeitenPerformance Analysis of Microstrip Patch Antenna Using Coaxial Probe Feed TechniqueInternational Jpurnal Of Technical Research And Applications100% (1)

- The Construction Procedure and Advantage of The Rail Cable-Lifting Construction Method and The Cable-Hoisting MethodDokument3 SeitenThe Construction Procedure and Advantage of The Rail Cable-Lifting Construction Method and The Cable-Hoisting MethodInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- A Study On The Fresh Properties of SCC With Fly AshDokument3 SeitenA Study On The Fresh Properties of SCC With Fly AshInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Evaluation of Drainage Water Quality For Irrigation by Integration Between Irrigation Water Quality Index and GisDokument9 SeitenEvaluation of Drainage Water Quality For Irrigation by Integration Between Irrigation Water Quality Index and GisInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- An Inside Look in The Electrical Structure of The Battery Management System Topic Number: Renewable Power Sources, Power Systems and Energy ConversionDokument5 SeitenAn Inside Look in The Electrical Structure of The Battery Management System Topic Number: Renewable Power Sources, Power Systems and Energy ConversionInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Overview of TCP Performance in Satellite Communication NetworksDokument5 SeitenOverview of TCP Performance in Satellite Communication NetworksInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Open Loop Analysis of Cascaded Hbridge Multilevel Inverter Using PDPWM For Photovoltaic SystemsDokument3 SeitenOpen Loop Analysis of Cascaded Hbridge Multilevel Inverter Using PDPWM For Photovoltaic SystemsInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Production of Starch From Mango (Mangifera Indica.l) Seed Kernel and Its CharacterizationDokument4 SeitenProduction of Starch From Mango (Mangifera Indica.l) Seed Kernel and Its CharacterizationInternational Jpurnal Of Technical Research And Applications100% (1)

- Physico-Chemical and Bacteriological Assessment of River Mudzira Water in Mubi, Adamawa State.Dokument4 SeitenPhysico-Chemical and Bacteriological Assessment of River Mudzira Water in Mubi, Adamawa State.International Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Structural and Dielectric Studies of Terbium Substituted Nickel Ferrite NanoparticlesDokument3 SeitenStructural and Dielectric Studies of Terbium Substituted Nickel Ferrite NanoparticlesInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Investigation of Coverage Level and The Availability of GSM Signal in Ekpoma, NigeriaDokument6 SeitenInvestigation of Coverage Level and The Availability of GSM Signal in Ekpoma, NigeriaInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- Study of Carbohydrate Metabolism in Severe Acute Malnutrition and Correlations of Weight and Height With Pp-Sugar and BmiDokument9 SeitenStudy of Carbohydrate Metabolism in Severe Acute Malnutrition and Correlations of Weight and Height With Pp-Sugar and BmiInternational Jpurnal Of Technical Research And ApplicationsNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FCL 2W Pan India Online Auction EventDokument64 SeitenFCL 2W Pan India Online Auction EventAnonymous rtDlncdNoch keine Bewertungen

- Statement 20140508Dokument2 SeitenStatement 20140508franraizerNoch keine Bewertungen

- Case Digest On SALES LAW PDFDokument21 SeitenCase Digest On SALES LAW PDFleoNoch keine Bewertungen

- SEC 109 Exempt Transactions VATDokument3 SeitenSEC 109 Exempt Transactions VATRanin, Manilac Melissa SNoch keine Bewertungen

- Hoboken-United Water Agreement (1994)Dokument69 SeitenHoboken-United Water Agreement (1994)GrafixAvengerNoch keine Bewertungen

- COA Circular 2014-002Dokument4 SeitenCOA Circular 2014-002sedanzamNoch keine Bewertungen

- (Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Dokument231 Seiten(Manufacturing and Production Engineering) Fariborz Tayyari - Cost Analysis For Engineers and Scientists-CRC Press (2021)Radar NhậtNoch keine Bewertungen

- Q 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility CentersDokument3 SeitenQ 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility Centersmadhura_454Noch keine Bewertungen

- Enron Scandal - Wikipedia, The Free EncyclopediaDokument31 SeitenEnron Scandal - Wikipedia, The Free Encyclopediazhyldyz_88Noch keine Bewertungen

- Finance of International Trade and Related Treasury OperationsDokument2 SeitenFinance of International Trade and Related Treasury OperationsmuhammadNoch keine Bewertungen

- Negotiable Instruments Law DigestsDokument4 SeitenNegotiable Instruments Law DigestsJay-ar Rivera BadulisNoch keine Bewertungen

- Not-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dokument12 SeitenNot-for-Profit Organizations - Answers: Advanced Level Examination - Unit 08Dimuthu JayasuriyaNoch keine Bewertungen

- Reliable Exports Lease DeedDokument27 SeitenReliable Exports Lease DeedOkkishoreNoch keine Bewertungen

- Cases For FinalsDokument106 SeitenCases For FinalsMyn Mirafuentes Sta AnaNoch keine Bewertungen

- PrabhakarDokument91 SeitenPrabhakaransari naseem ahmadNoch keine Bewertungen

- Uniform Commercial Code - Discharge and PaymentDokument43 SeitenUniform Commercial Code - Discharge and Paymentmo100% (1)

- Technology Company FERFICS Secures EUR 1.7 Million Funding: News ReleaseDokument2 SeitenTechnology Company FERFICS Secures EUR 1.7 Million Funding: News ReleaseRita CahillNoch keine Bewertungen

- Global Professional Accountant ACCA BrochureDokument12 SeitenGlobal Professional Accountant ACCA BrochureRishikaNoch keine Bewertungen

- Hajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPDokument140 SeitenHajj Rituals - Ayatullah Sayyid Ali Al-Hussaini As-Sistani (Seestani) - XKPIslamicMobilityNoch keine Bewertungen

- DGL Price/Time Projections: Resistance Support VDokument1 SeiteDGL Price/Time Projections: Resistance Support VRajender SalujaNoch keine Bewertungen

- Risk Aversion, Neutrality, and PreferencesDokument2 SeitenRisk Aversion, Neutrality, and PreferencesAryaman JunejaNoch keine Bewertungen

- Employees Provident Fund RulesDokument74 SeitenEmployees Provident Fund RulesRAKESH NANDANNoch keine Bewertungen

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionDokument11 SeitenChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGNoch keine Bewertungen

- 2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Dokument116 Seiten2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Maha8888Noch keine Bewertungen

- Head Hunter ListDokument5 SeitenHead Hunter ListJulius Yasdi0% (1)

- Call money market development in IndiaDokument17 SeitenCall money market development in IndiaAnkit SaxenaNoch keine Bewertungen

- PBD Cluster 27Dokument48 SeitenPBD Cluster 27Datu Puwa MamalacNoch keine Bewertungen

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFDokument2 SeitenSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFPratik TekawadeNoch keine Bewertungen

- Barber Shop Business PlanDokument25 SeitenBarber Shop Business PlanStephen FrancisNoch keine Bewertungen

- Introduction to Derivatives MarketsDokument37 SeitenIntroduction to Derivatives MarketsMichael Thomas JamesNoch keine Bewertungen