Beruflich Dokumente

Kultur Dokumente

PLCR Tutorial

Hochgeladen von

Syed Muhammad Ali SadiqCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PLCR Tutorial

Hochgeladen von

Syed Muhammad Ali SadiqCopyright:

Verfügbare Formate

FREE

TUTORIAL

www.navigatorPF.com

PROJECT LIFE COVER R PROJECT LIFE COVER R PROJECT LIFE COVER R PROJECT LIFE COVER RATIO ATIO ATIO ATIO

P PP PL LL LCR CR CR CR

Introduction

The Project Life Cover Ratio (PLCR) is commonly used

debt metric in project finance. Together with the Debt Service

Cover Ratio (DSCR) and Loan Life Cover Ratio (LLCR),

these debt metrics in one form or another usually appear in

project finance term sheets and loan documentation so need

to be modelled clearly and accurately.

In an earlier tutorial, we covered the definition and calculation of

the LLCR. Well the PLCR is akin to the LLCR and is the ratio of

the net present value of the cashflow over the remaining full life of

the project to the outstanding debt balance in the period.

This tutorial and the accompanied workbook cover the definition of

the PLCR, show how to calculate this ratio and highlights key

points to keep in mind when modelling PLCR.

Definition

Generally the PLCR is calculated as:

PLCR = X / Y, where:

X = NPV [ CFADS over Project Life ]

Y = Debt Balance B/f

Unlike the LLCR where the CFADS is calculated over the

scheduled life of the loan, the cashflow for PLCR is calculated

over the Project Life.

In practice, lenders often build in a safety cushion and ignore the

revenue or cashflow beyond a certain cut-off date. This allows

lenders to protect against relying on potentially more uncertain

future cashflows. It is common to encounter an end date for the

PLCR calculation in the term sheet or loan documentation before

the end of the project life. This means the qualifying period for

CFADS in PLCR calculation is only from Commercial Operation

Date (COD) and up to such end date.

The example in the workbook assumes the end date for the PLCR

calculation is 12 months before the end of the operations

PLCR Calculation

End Date for PLCR calculation Date 30-Jun-16

Discount Rate for PLCR post Final Maturity % p.a. 8.00%

Timing

Construction Operations

Start date 01-Jan-09 01-Jul-09

Duration 6.00 Mth(s) 8.00 Yr(s)

End date 31-Dec-08 30-Jun-09 30-Jun-17

Screenshot: Assumption for PLCR calculation

PLCR calculation

Calculation of PLCR is similar to that of LLCR, with certain

differences as highlighted below.

Step 1: Calculate the discount rate (r)

This is the discount rate for discounting the CFADS. Similar to the

LLCR, a typical Discount Rate would be the cost of debt and be

calculated efficiently as:

r = Interest / Debt Balance B/f

Note that the CFADS qualified for PLCR calculation extends

beyond the loan life. So what is the discount rate to be used post

loan final maturity date? This depends upon a lenders perception

on the certainty risk of the projected cashflows beyond the loan

life.

Loan documentation often states the discount rate to be used post

the loan life, which should be at least equal or even greater to the

cost of debt of the senior debt at final maturity date to account for

greater risk. Lets face it, if it was of similar perceived why not lend

out that far?

Our simple example assumes a discount rate for the PLCR

calculation post final maturity debt (final maturity of senior debt is

30-Jun-15) to be 8.00% p.a. or 1.94% p.q.

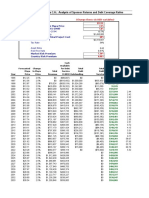

Period Start Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16

Period End Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16

Construction - - - - - - -

Operations 1 1 1 1 1 1 1

PLCR

Discount rate

Senior Debt: Interest 0.15 0.08 - - - - -

Senior Debt: Balance b/f 8.97 4.52 - - - - -

All-in Rate "r" 1.68% 1.70% 0.00% 0.00% 0.00% 0.00% 0.00%

r for PLCR calculation 1.68% 1.70% 1.94% 1.94% 1.94% 1.94% 0.00%

1 + r 1.017 1.017 1.019 1.019 1.019 1.019 1.000

r post final

maturity is 8.00%

p.a. or 1.94% p.q.

Screenshot: Discount rate for PLCR calculation

Step 2: Create binary flag for Project Life

PLCR takes into account the NPV of CFADS over the life of a

project or if otherwise a specified cut-off date (end date).

The end date for PLCR calculation is usually stated in the term

sheet or loan documentation, or else it should be the end of

operations date.

The qualifying CFADS for PLCR calculation shall then include the

period from start of operations or commercial operation date

(COD) up to the end date.

CFADS (Qualifying) = CFADS * Project Life (Binary Flag)

About Navigator Project Finance

Founded in 2004, Navigator Project Finance Pty Ltd (Navigator) is the project finance modelling expert. Headquartered

in Sydney, Australia, Navigator is raising the global benchmark in financial modelling services to the project finance

sector. Navigator designs and constructs financial models for complex project financings, offers training courses

throughout the Middle East, Asia and Europe, and conducts independent model reviews of project finance transaction

models. Navigator delivers fast, flexible and rigorously-tested project finance services that provide unparalleled

transparency and ease of use.

Customers include market leaders such as Deutsche Bank, ANZ Investment Bank, Bovis Lend Lease, Oxiana, Mirvac

Property, Westpac and the Commonwealth Bank of Australia, together with leaders from the finance, mining, property,

utilities, banking, chemical and infrastructure sectors.

Navigator Project Finance Pty Ltd P +61 2 9229 7400 E enquiry@navigatorPF.com

www.navigatorPF.com

Step 3: Calculate CFADS (NPV)

This is similar to the LLCR calculation except that the CFADS is

taken into account up to the end date as explained in Step 2

above.

r for PLCR calculation 1.70% 1.94% 1.94% 1.94% 1.94% 0.00%

1 + r 1.017 1.019 1.019 1.019 1.019 1.000

CFADS (NPV)

Loan Life 1 - - - - -

Project Life 1 1 1 1 1 -

CFADS 5.72 7.64 6.26 5.00 (2.00) (2.00)

CFADS (Qualifying) 5.72 7.64 6.26 5.00 (2.00) -

CFADS (NPV) 21.74 16.38 9.06 2.98 (1.96) -

=((1.96) + 5.00)

/ 1.019 = 2.98

Screenshot: Calculating CFADS (NPV)

Step 4: Calculate PLCR

Bring in the CFADS (NPV) that has been calculated in Step 3 and

the debt balance b/f.

PLCR shall then be calculated using formula below.

PLCR = CFADS (NPV) / Debt Balance B/f

Period Start Apr-14 Jul-14 Oct-14 Jan-15 Apr-15 Jul-15

Period End Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15

Construction - - - - - -

Operations 1 1 1 1 1 1

CFADS (NPV) 47.31 42.30 33.62 27.82 21.74 16.38

Senior Debt: Balance b/f 21.88 17.65 13.35 8.97 4.52 -

PLCR 2.16 x 2.40 x 2.52 x 3.10 x 4.80 x 0.00 x

Screenshot: PLCR Calculation

PLCR: Senior (x)

1.00 x

2.00 x

3.00 x

4.00 x

5.00 x

6.00 x

7.00 x

8.00 x

J

u

n

-

0

8

D

e

c

-

0

8

J

u

n

-

0

9

D

e

c

-

0

9

J

u

n

-

1

0

D

e

c

-

1

0

J

u

n

-

1

1

D

e

c

-

1

1

J

u

n

-

1

2

D

e

c

-

1

2

J

u

n

-

1

3

D

e

c

-

1

3

J

u

n

-

1

4

D

e

c

-

1

4

J

u

n

-

1

5

D

e

c

-

1

5

J

u

n

-

1

6

D

e

c

-

1

6

Screenshot: PLCR Chart

Variations in the PLCR definition

Similar to the LLCR definition, it is not uncommon to find the

balance of the projects cash account, or the Debt Service

Reserve Account (DSRA) added to the numerator or netted from

the numerator. Note that extreme caution needs to be applied

when assessing the economics of a project where the PLCR is

supported with cash account balances.

When the DSRA is included, the PLCR is calculated as:

PLCR = (NPV [CFADS over Project Life] + DSRA/c Balance b/f) / Debt

Balance b/f

Common mistakes in the PLCR calculation

Discount rate post loan final maturity date:

It is a common mistake to model the discount rate post loan final

maturity date to be 0.00% because the modelled cost of debt post

the final maturity date is nil or just the base rate.

Note that the projected cashflows beyond the loan life are even

more uncertain to be relied on and therefore should be discounted

with the rate at least equal to cost of debt of the senior debt at the

final maturity date. One school of thought is to add the default

margin to the cost of debt. The alternative is to leave it at the cost

of debt on the basis it could be refinanced. The reality is that it

makes little difference as it is so far out for long term financings.

Should the PLCR always be higher than LLCR?

Common sense would indicate that the PLCR should be higher

than the LLCR owing to a longer evaluation period.

Be careful, the PLCR could be less than the LLCR, because

projects particularly in mining or resource-based projects often

have a substantial mine rehab cost or closure costs towards the

end of the Project Life which can dramatically reduce the CFADS

(numerator for PLCR).

Please refer to our Tutorials on DSCR and LLCR to learn

more about Debt Metrics topics. If you have any feedback

or suggestions on any of our Tutorials or for future

developments we would like to hear from you!

The team at Navigator Project Finance

www.navigatorpf.com/training/tutorials

Public Courses by Navigator Project Finance

Project Finance Modelling (A)

Project Finance Modelling (B)

Debt Modelling Masterclass

VBA for Financiers

If this is new to you but you find yourself needing to

calculate the LLCR and PLCR metrics in your position as

a Project Finance analyst then I recommend you to

attend the Project Finance Modelling (A) course.

Nick Crawley, Managing Director

Navigator Project Finance

Das könnte Ihnen auch gefallen

- CFADS Calculation ApplicationDokument2 SeitenCFADS Calculation Applicationtransitxyz100% (1)

- CFADS Calculation ApplicationDokument2 SeitenCFADS Calculation ApplicationSyed Muhammad Ali Sadiq100% (2)

- Mod - Features of A Cash Flow Waterfall in Project FinanceDokument4 SeitenMod - Features of A Cash Flow Waterfall in Project FinancepierrefrancNoch keine Bewertungen

- Semi-Annual Debt in A Quarterly ModelDokument2 SeitenSemi-Annual Debt in A Quarterly ModelSyed Muhammad Ali SadiqNoch keine Bewertungen

- Cash Sweep TutorialDokument2 SeitenCash Sweep Tutorialsourabh manglaNoch keine Bewertungen

- Cashflow Waterfall TutorialDokument2 SeitenCashflow Waterfall TutorialRichard Neo67% (3)

- Pre Operating CFADSDokument2 SeitenPre Operating CFADSpolobook378250% (2)

- Average DSCR Calculation 1 01cDokument20 SeitenAverage DSCR Calculation 1 01cLuharuka100% (1)

- Debt Sculpting TutorialDokument2 SeitenDebt Sculpting TutorialYogesh More100% (1)

- CFADS Calculation & Application PDFDokument2 SeitenCFADS Calculation & Application PDFJORGE PUENTESNoch keine Bewertungen

- Debt Sizing For Minimum DSCR With VBA Goal Seek - Solve For Zero Delta!Dokument5 SeitenDebt Sizing For Minimum DSCR With VBA Goal Seek - Solve For Zero Delta!serpepeNoch keine Bewertungen

- Mezzanine DebtDokument2 SeitenMezzanine DebtIan Loke100% (1)

- The Use of Mini Perms in UK PFI Passing Fad or Here To StayDokument18 SeitenThe Use of Mini Perms in UK PFI Passing Fad or Here To Stayaditya29121980Noch keine Bewertungen

- Introduction to Infrastructure in IndiaDokument61 SeitenIntroduction to Infrastructure in Indiaanilnair88Noch keine Bewertungen

- 1.0 Financial Modeling Intro v2Dokument28 Seiten1.0 Financial Modeling Intro v2Arif JamaliNoch keine Bewertungen

- Merger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryDokument14 SeitenMerger and Acquisition As A Survival Strategy in The Nigeria Banking IndustryOtunba Olowolafe MichaelNoch keine Bewertungen

- Ch02 P14 Build A Model AnswerDokument4 SeitenCh02 P14 Build A Model Answersiefbadawy1Noch keine Bewertungen

- FNCE90048 Project Finance AssignmentDokument29 SeitenFNCE90048 Project Finance AssignmentNguyen Hong HiepNoch keine Bewertungen

- Valuation Report DCF Power CompanyDokument34 SeitenValuation Report DCF Power CompanySid EliNoch keine Bewertungen

- Custom Number Formats ExcelDokument2 SeitenCustom Number Formats ExcelKwaaziNoch keine Bewertungen

- CEC Case Study - Capital Structure and Financial Leverage OptionsDokument9 SeitenCEC Case Study - Capital Structure and Financial Leverage OptionsChirag Maheshwari100% (1)

- Sustainable Finance: The Imperative and The OpportunityDokument70 SeitenSustainable Finance: The Imperative and The OpportunityNidia Liliana TovarNoch keine Bewertungen

- Mezzanine Debt Benefits and DrawbacksDokument8 SeitenMezzanine Debt Benefits and DrawbacksDhananjay SharmaNoch keine Bewertungen

- Week 2 - TVM Problem Set PDFDokument7 SeitenWeek 2 - TVM Problem Set PDFLittle Man ChinatownNoch keine Bewertungen

- LBO Valuation Model 1 ProtectedDokument14 SeitenLBO Valuation Model 1 ProtectedYap Thiah HuatNoch keine Bewertungen

- LBO Modeling Test ExampleDokument19 SeitenLBO Modeling Test ExampleJorgeNoch keine Bewertungen

- Financing and Investing in Infrastructure Week 1 SlidesDokument39 SeitenFinancing and Investing in Infrastructure Week 1 SlidesNeindow Hassan YakubuNoch keine Bewertungen

- EY Infrastructure Investments For Insurers PDFDokument24 SeitenEY Infrastructure Investments For Insurers PDFDallas DragonNoch keine Bewertungen

- Session 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceDokument25 SeitenSession 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceSaurabh GuptaNoch keine Bewertungen

- Loan and Revolver For Debt Modelling Practice On ExcelDokument2 SeitenLoan and Revolver For Debt Modelling Practice On ExcelMohd IzwanNoch keine Bewertungen

- Pitchprogram 10 Minutepitch 131112165615 Phpapp01 PDFDokument16 SeitenPitchprogram 10 Minutepitch 131112165615 Phpapp01 PDFpcmtpcmtNoch keine Bewertungen

- Projecting Financials & ValuationsDokument88 SeitenProjecting Financials & ValuationsPratik ModyNoch keine Bewertungen

- Valuation of Distressed CompaniesDokument18 SeitenValuation of Distressed CompaniesfreahoooNoch keine Bewertungen

- Legal Disclaimer: Read and Accept Before Accessing The Tutorial WorkbookDokument15 SeitenLegal Disclaimer: Read and Accept Before Accessing The Tutorial WorkbooksubhashbuddanaNoch keine Bewertungen

- Mezzanine Finance 12Dokument8 SeitenMezzanine Finance 12bryant_bedwellNoch keine Bewertungen

- Habib Bank Limited - Financial ModelDokument69 SeitenHabib Bank Limited - Financial Modelmjibran_1Noch keine Bewertungen

- Lecture 6 and 7 Project Finance Model 1Dokument61 SeitenLecture 6 and 7 Project Finance Model 1w_fibNoch keine Bewertungen

- Project Finance - Practical Case StudiesDokument9 SeitenProject Finance - Practical Case StudiesiamitoNoch keine Bewertungen

- MegaPower Project Memo VfinalDokument5 SeitenMegaPower Project Memo VfinalSandra Sayarath AndersonNoch keine Bewertungen

- 8 LMS-Tutorial CFW PDFDokument6 Seiten8 LMS-Tutorial CFW PDFEnriko SagaNoch keine Bewertungen

- Venture Capital Deal Structuring PDFDokument5 SeitenVenture Capital Deal Structuring PDFmonaNoch keine Bewertungen

- Discussion of Valuation MethodsDokument21 SeitenDiscussion of Valuation MethodsCommodityNoch keine Bewertungen

- Clean Energy UK Finance Guide 2014Dokument82 SeitenClean Energy UK Finance Guide 2014cetacean00Noch keine Bewertungen

- 1-Deal StructuringDokument13 Seiten1-Deal StructuringNeelabhNoch keine Bewertungen

- Valuation Cash Flow A Teaching NoteDokument5 SeitenValuation Cash Flow A Teaching NotesarahmohanNoch keine Bewertungen

- Sample Model Training | 25.8% IRRDokument282 SeitenSample Model Training | 25.8% IRRKumar SinghNoch keine Bewertungen

- MezzanineDokument14 SeitenMezzaninevirtualatallNoch keine Bewertungen

- Levered Vs Unlevered Cost of Capital.Dokument7 SeitenLevered Vs Unlevered Cost of Capital.Zeeshan ShafiqueNoch keine Bewertungen

- Analysis of Petrolera Zuata Petrozuata Debt CoverageDokument2 SeitenAnalysis of Petrolera Zuata Petrozuata Debt CoveragedewanibipinNoch keine Bewertungen

- Dessert Dilemma - A Capital Case StudyDokument9 SeitenDessert Dilemma - A Capital Case StudyBurhan Bakkal0% (1)

- Project Finance: Valuing Unlevered ProjectsDokument41 SeitenProject Finance: Valuing Unlevered ProjectsKelsey GaoNoch keine Bewertungen

- Project FinanceDokument9 SeitenProject FinanceAditi AggarwalNoch keine Bewertungen

- MTN PitchbookDokument21 SeitenMTN PitchbookGideon Antwi Boadi100% (1)

- Framing Global DealsDokument35 SeitenFraming Global DealsLeonel KongaNoch keine Bewertungen

- XLS EngDokument21 SeitenXLS EngRudra BarotNoch keine Bewertungen

- Startup Financial ModelDokument136 SeitenStartup Financial ModelChinh Lê ĐìnhNoch keine Bewertungen

- PLCR Notes PDFDokument2 SeitenPLCR Notes PDFArti RahangdaleNoch keine Bewertungen

- MBA-622 - Financial ManagementDokument11 SeitenMBA-622 - Financial Managementovina peirisNoch keine Bewertungen

- Project Management - 6 Financing - Investment CriteriaDokument17 SeitenProject Management - 6 Financing - Investment CriteriaHimanshu PatelNoch keine Bewertungen

- 11 5Dokument47 Seiten11 5Syed Muhammad Ali SadiqNoch keine Bewertungen

- Business Plan Contents PDFDokument2 SeitenBusiness Plan Contents PDFSyed Muhammad Ali SadiqNoch keine Bewertungen

- Business Plan ContentsDokument28 SeitenBusiness Plan ContentsSyed Muhammad Ali SadiqNoch keine Bewertungen

- Roxio Easy VHS To DVD: Getting Started GuideDokument28 SeitenRoxio Easy VHS To DVD: Getting Started GuideSyed Muhammad Ali SadiqNoch keine Bewertungen

- Promotech Gulf Industry LLC March 2015 QuotationDokument1 SeitePromotech Gulf Industry LLC March 2015 QuotationSyed Muhammad Ali SadiqNoch keine Bewertungen

- A Detailed Comparison BetweenDokument11 SeitenA Detailed Comparison BetweenSyed Muhammad Ali SadiqNoch keine Bewertungen

- Star Vega Insurance Software BrochureDokument8 SeitenStar Vega Insurance Software BrochureSyed Muhammad Ali SadiqNoch keine Bewertungen

- Bank Signature Authority LetterDokument1 SeiteBank Signature Authority LetterSyed Muhammad Ali SadiqNoch keine Bewertungen

- CIO DashboardDokument1 SeiteCIO DashboardrfgouveiasNoch keine Bewertungen

- Animated Panels-Patent Not IssuedDokument14 SeitenAnimated Panels-Patent Not IssuedSyed Muhammad Ali SadiqNoch keine Bewertungen

- Draft TT Ali SadiqDokument1 SeiteDraft TT Ali SadiqSyed Muhammad Ali SadiqNoch keine Bewertungen

- Analysis: RES Core IndicatorDokument1 SeiteAnalysis: RES Core IndicatorSyed Muhammad Ali SadiqNoch keine Bewertungen

- Draft TT Ali SadiqDokument1 SeiteDraft TT Ali SadiqSyed Muhammad Ali SadiqNoch keine Bewertungen

- Bank Signature Authority LetterDokument1 SeiteBank Signature Authority LetterSyed Muhammad Ali SadiqNoch keine Bewertungen

- Company Value, Real Options and Financial LeverageDokument3 SeitenCompany Value, Real Options and Financial LeverageSyed Muhammad Ali SadiqNoch keine Bewertungen

- Company Value, Real Options and Financial LeverageDokument3 SeitenCompany Value, Real Options and Financial LeverageSyed Muhammad Ali SadiqNoch keine Bewertungen

- Complaint LetterDokument1 SeiteComplaint LetterSyed Muhammad Ali SadiqNoch keine Bewertungen

- Chief Financial Officer For An ElectronicsDokument2 SeitenChief Financial Officer For An ElectronicsSyed Muhammad Ali SadiqNoch keine Bewertungen

- Risk Aggregation1Dokument72 SeitenRisk Aggregation1Syed Muhammad Ali SadiqNoch keine Bewertungen

- ERM Guide July 09Dokument109 SeitenERM Guide July 09Syed Muhammad Ali SadiqNoch keine Bewertungen

- Corporate Rates (Summer 2011)Dokument4 SeitenCorporate Rates (Summer 2011)Syed Muhammad Ali SadiqNoch keine Bewertungen

- MovieDokument1 SeiteMovieSyed Muhammad Ali SadiqNoch keine Bewertungen

- L 2 Ss 12 Los 39Dokument9 SeitenL 2 Ss 12 Los 39Syed Muhammad Ali SadiqNoch keine Bewertungen

- Risk Aggregation2 PDFDokument57 SeitenRisk Aggregation2 PDFSyed Muhammad Ali SadiqNoch keine Bewertungen

- OECD - Thinking Beyond Basel III - Necessary Solutions For Capital and LiquidityDokument23 SeitenOECD - Thinking Beyond Basel III - Necessary Solutions For Capital and LiquidityFederico CellaNoch keine Bewertungen

- Epct Filing GuidelinesDokument39 SeitenEpct Filing GuidelinesSyed Muhammad Ali SadiqNoch keine Bewertungen

- CV of Muhammad Ali SadiqDokument5 SeitenCV of Muhammad Ali SadiqSyed Muhammad Ali SadiqNoch keine Bewertungen

- Muhammad Ali Sadiq: Career ObjectiveDokument3 SeitenMuhammad Ali Sadiq: Career ObjectiveSyed Muhammad Ali SadiqNoch keine Bewertungen

- ABDC ContainerStudy Trucking Prefeasibility FinalDokument16 SeitenABDC ContainerStudy Trucking Prefeasibility FinalSyed Muhammad Ali SadiqNoch keine Bewertungen

- Scan0012 PDFDokument1 SeiteScan0012 PDFSyed Muhammad Ali SadiqNoch keine Bewertungen

- POMOFFICIALLECTUREDokument919 SeitenPOMOFFICIALLECTURER A GelilangNoch keine Bewertungen

- Ocean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeDokument6 SeitenOcean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeJayzie LiNoch keine Bewertungen

- FM59 New GuideDokument190 SeitenFM59 New GuideDr. Naeem MustafaNoch keine Bewertungen

- 10 Resource Management Best PracticesDokument3 Seiten10 Resource Management Best PracticesnerenNoch keine Bewertungen

- Ifrs8 Paper Nov08Dokument3 SeitenIfrs8 Paper Nov08John YuNoch keine Bewertungen

- JV Agreement V1 - AmendedDokument10 SeitenJV Agreement V1 - AmendedYusuf AhmedNoch keine Bewertungen

- (N-Ab) (1-A) : To Tariffs)Dokument16 Seiten(N-Ab) (1-A) : To Tariffs)Amelia JNoch keine Bewertungen

- Case Study BookDokument106 SeitenCase Study BookshubhaomNoch keine Bewertungen

- Project Report On HR Policies and Its Implementation at Deepak Nitrite LimitedDokument64 SeitenProject Report On HR Policies and Its Implementation at Deepak Nitrite LimitedRajkumar Das75% (4)

- WSCMDokument9 SeitenWSCMNishant goyalNoch keine Bewertungen

- Inventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Dokument9 SeitenInventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Abhilash JhaNoch keine Bewertungen

- Retail Management: A Strategic Approach: 11th EditionDokument9 SeitenRetail Management: A Strategic Approach: 11th EditionMohamed El KadyNoch keine Bewertungen

- WEEK 10-Compensating Human Resources and Employee Benfeits and ServicesDokument8 SeitenWEEK 10-Compensating Human Resources and Employee Benfeits and ServicesAlfred John TolentinoNoch keine Bewertungen

- Vishal JainDokument2 SeitenVishal JainVishal JainNoch keine Bewertungen

- Pt. Aruna Karya Teknologi Nusantara Expenses Reimbushment FormDokument12 SeitenPt. Aruna Karya Teknologi Nusantara Expenses Reimbushment Formfahmi ramadhanNoch keine Bewertungen

- EFFECTS OF ECONOMIC GROWTH AND GST RISEDokument41 SeitenEFFECTS OF ECONOMIC GROWTH AND GST RISESebastian ZhangNoch keine Bewertungen

- Five Forces ModelDokument6 SeitenFive Forces Modelakankshashahi1986Noch keine Bewertungen

- The Entrepreneurial Decision Process for Startups ExplainedDokument13 SeitenThe Entrepreneurial Decision Process for Startups ExplainedFe P. ImbongNoch keine Bewertungen

- DevelopmentThatPays Scrumban CheatSheet 3 - 0Dokument1 SeiteDevelopmentThatPays Scrumban CheatSheet 3 - 0Hamed KamelNoch keine Bewertungen

- Solutions Manual: Introducing Corporate Finance 2eDokument9 SeitenSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNoch keine Bewertungen

- Stratman NotesDokument2 SeitenStratman NotesWakin PoloNoch keine Bewertungen

- Elizade Acc 101 Revision Lecture NotesDokument18 SeitenElizade Acc 101 Revision Lecture NotesTijani OladipupoNoch keine Bewertungen

- Accenture - Five Ways To Win With Digital PlatformsDokument14 SeitenAccenture - Five Ways To Win With Digital PlatformsSGNoch keine Bewertungen

- Queen's MBA Operations Management CourseDokument9 SeitenQueen's MBA Operations Management CourseNguyen Tran Tuan100% (1)

- RFP 2019-100-KB Development of A Mixed-Use Project With A Cultural Component - ByRON DEVELOPMENTDokument63 SeitenRFP 2019-100-KB Development of A Mixed-Use Project With A Cultural Component - ByRON DEVELOPMENTNone None NoneNoch keine Bewertungen

- Project Report On Birla Sun LifeDokument62 SeitenProject Report On Birla Sun Lifeeshaneeraj94% (34)

- Payroll Systems in EthiopiaDokument16 SeitenPayroll Systems in EthiopiaMagarsaa Hirphaa100% (3)

- Import Direct From ChinaDokument29 SeitenImport Direct From Chinagrncher100% (2)

- StatementDokument10 SeitenStatementdoninsgusts016Noch keine Bewertungen

- How to Immigrate to Australia GuideDokument9 SeitenHow to Immigrate to Australia GuideBárbara LimaNoch keine Bewertungen