Beruflich Dokumente

Kultur Dokumente

Venture Capital

Hochgeladen von

PrafulPatilCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Venture Capital

Hochgeladen von

PrafulPatilCopyright:

Verfügbare Formate

aa

Intro

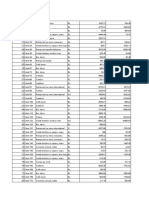

Various types of loans provided by banks

intro:-

Venture capital (VC) is al provided to early-stage, high-potential, growth startup companies. The

venture capital fundearns money by owning equity in the companies it invests in, which usually have

a novel technology or business model in high technology industries, such

as biotechnology, IT and software. The typical venture capital investment occurs after the seed

fundinground as the first round of institutional capital to fund growth (also referred to as Series

round) in the interest of generating a return through an eventual reali!ation event, such as

an I"# or trade sale of the company. $enture capital is a type of private equity.

%&'

In addition to angel investing and other seed funding options, venture capital is attractive for new

companies with limited operating history that are too small to raise capital in the public mar(ets and

have not reached the point where they are able to secure a ban( loan or complete a debt offering. In

e)change for the high ris( that venture capitalists assume by investing in smaller and less mature

companies, venture capitalists usually get significant control over company decisions, in addition to a

significant portion of the company*s ownership (and consequently value).

$enture capital is also associated with +ob creation (accounting for ,- of .S /0"),

%,'

the (nowledge

economy, and used as a pro)y measure of innovation within an economic sector or geography.

1very year, there are nearly , million businesses created in the .S, and 2334533 get venture

capital funding. ccording to the 6ational $enture 7apital ssociation, &&- of private sector +obs

come from venture bac(ed companies and venture bac(ed revenue accounts for ,&- of .S /0".

%8'

It is also a way in which public and private sectors can construct an institution that systematically

creates networ(s for the new firms and industries, so that they can progress. This institution helps in

identifying and combining pieces of companies, li(e finance, technical e)pertise, (now-hows of

mar(eting and business models. #nce integrated, these enterprises succeed by becoming nodes in

the search networ(s for designing and building products in their domain.

%9'

History%edit'

venture may be defined as a pro+ect prospective converted into a process with an adequate

assumed ris( and investment. :ith few e)ceptions, private equity in the first half of the ,3th century

was the domain of wealthy individuals and families. The :allenbergs, $anderbilts, :hitneys,

;oc(efellers, and :arburgs were notable investors in private companies in the first half of the

century. In &<85, =aurance S. ;oc(efeller helped finance the creation of both 1astern ir

=ines and 0ouglas ircraft, and the ;oc(efeller family had vast holdings in a variety of

companies. 1ric >. :arburg founded 1.>. :arburg ? 7o. in &<85, which would ultimately

become :arburg "incus, with investments in bothleveraged buyouts and venture capital.

The :allenberg family started Investor @ in &<&2 in Sweden and were early investors in several

Swedish companies such as @@, tlas 7opco, 1ricsson, etc. in the first half of the ,3th century.

Origins of modern private equity%edit'

@efore :orld :ar II (&<8<4&<9A), money orders (originally (nown as Bdevelopment capitalB)

remained primarily the domain of wealthy individuals and families. #nly after &<9A did BtrueB private

equity investments begin to emerge, notably with the founding of the first two venture capital firms in

&<92C merican ;esearch and 0evelopment 7orporation(;07) and D.E. :hitney ? 7ompany.

%A'%2'

/eorges 0oriot, the Bfather of venture capitalismB

%F'

(and former assistant dean of Earvard @usiness

School), founded I6S10 in &<AF. long with ;alph Glanders and Harl 7ompton (former president

of >IT), 0oriot founded ;07 in &<92 to encourage private-sector investments in businesses run by

soldiers returning from :orld :ar II. ;07 became the first institutional private-equity investment

firm to raise capital from sources other than wealthy families, although it had several notable

investment successes as well.

%5'

;07 is credited

%by whom?'

with the first tric( when its &<AF investment

of IF3,333 in 0igital 1quipment 7orporation (017) would be valued at over I8AA million after the

company*s initial public offering in &<25 (representing a return of over &,33 times on its investment

and an annuali!ed rate of return of &3&-).

%<'

Gormer employees of ;07 went on to establish several prominent venture-capital firms

including /reyloc( "artners (founded in &<2A by 7harlie :aite and @ill 1lfers) and>organ, Eolland

$entures, the predecessor of Glagship $entures (founded in &<5, by Dames >organ).

%&3'

;07

continued investing until &<F&, when 0oriot retired. In &<F, 0oriot merged ;07 with Te)tron after

having invested in over &A3 companies.

Dohn Eay :hitney (&<394&<5,) and his partner @enno Schmidt (&<&84&<<<) founded D.E. :hitney

? 7ompany in &<92. :hitney had been investing since the &<83s, founding"ioneer "ictures in &<88

and acquiring a &A- interest in Technicolor 7orporation with his cousin 7ornelius $anderbilt

:hitney. Glorida Goods 7orporation proved :hitney*s most famous investment. The company

developed an innovative method for delivering nutrition to merican soldiers, later (nown as >inute

>aid orange +uice and was sold to The 7oca-7ola 7ompany in &<23. D.E. :hitney ?

7ompany continued to ma(e investments in leveraged buyout transactions and raised IFA3 million

for its si)th institutional private equity fund in ,33A.

Early venture capital and the growth of ilicon Valley%edit'

highway e)it for Sand Eill ;oad in>enlo "ar(, 7alifornia, where many @ay rea venture capital firms are based

#ne of the first steps toward a professionally managed venture capital industry was the passage of

the Small @usiness Investment ct of &<A5. The &<A5 ct officially allowed the ..S. Small @usiness

dministration (S@) to license private BSmall @usiness Investment 7ompaniesB (S@I7s) to help the

financing and management of the small entrepreneurial businesses in the .nited States.

%&&'

0uring the &<23s and &<F3s, venture capital firms focused their investment activity primarily on

starting and e)panding companies. >ore often than not, these companies were e)ploiting

brea(throughs in electronic, medical, or data-processing technology. s a result, venture capital

came to be almost synonymous with technology finance. n early :est 7oast venture capital

company was 0raper and Dohnson Investment 7ompany, formed in &<2,

%&,'

by :illiam Eenry 0raper

III and Gran(lin ". Dohnson, Dr. In &<2A, Sutter Eill $entures acquired the portfolio of 0raper and

Dohnson as a founding action. @ill 0raper and "aul :ythes were the founders, and "itch Dohnson

formed sset >anagement 7ompany at that time.

It is commonly noted that the first venture-bac(ed startup is Gairchild Semiconductor (which

produced the first commercially practical integrated circuit), funded in &<A< by what would later

become $enroc( ssociates.

%&8'

$enroc( was founded in &<2< by =aurance S. ;oc(efeller, the fourth

of Dohn 0. ;oc(efeller*s si) children as a way to allow other ;oc(efeller children to develop

e)posure to venture capital investments.

It was also in the &<23s that the common form of private equity fund, still in use today,

emerged. "rivate equity firms organi!ed limited partnerships to hold investments in which the

investment professionals served as general partner and the investors, who were passivelimited

partners, put up the capital. The compensation structure, still in use today, also emerged with limited

partners paying an annual management fee of &.34,.A- and a carried interest typically representing

up to ,3- of the profits of the partnership.

The growth of the venture capital industry was fueled by the emergence of the independent

investment firms on Sand Eill ;oad, beginning with Hleiner, "er(ins, 7aufield?@yersand Sequoia

7apital in &<F,. =ocated in >enlo "ar(, 7, Hleiner "er(ins, Sequoia and later venture capital firms

would have access to the many semiconductor companies based in the Santa 7lara $alley as well

as early computer firms using their devices and programming and service companies.

%&9'

Throughout the &<F3s, a group of private equity firms, focused primarily on venture capital

investments, would be founded that would become the model for later leveraged buyout and venture

capital investment firms. In &<F8, with the number of new venture capital firms increasing, leading

venture capitalists formed the 6ational $enture 7apital ssociation(6$7). The 6$7 was to serve

as the industry trade group for the venture capital industry.

%&A'

$enture capital firms suffered a

temporary downturn in &<F9, when the stoc( mar(et crashed and investors were naturally wary of

this new (ind of investment fund.

It was not until &<F5 that venture capital e)perienced its first ma+or fundraising year, as the industry

raised appro)imately IFA3 million. :ith the passage of the 1mployee ;etirement Income Security

ct (1;IS) in &<F9, corporate pension funds were prohibited from holding certain ris(y investments

including many investments in privately heldcompanies. In &<F5, the .S =abor 0epartment rela)ed

certain of the 1;IS restrictions, under the Bprudent man rule,B

%&2'

thus allowing corporate pension

funds to invest in the asset class and providing a ma+or source of capital available to venture

capitalists.

!"#$s%edit'

The public successes of the venture capital industry in the &<F3s and early &<53s (e.g., 0igital

1quipment 7orporation, pple Inc., /enentech) gave rise to a ma+or proliferation of venture capital

investment firms. Grom +ust a few do!en firms at the start of the decade, there were over 2A3 firms

by the end of the &<53s, each searching for the ne)t ma+or Bhome runB. The number of firms

multiplied, and the capital managed by these firms increased from I8 billion to I8& billion over the

course of the decade.

%&F'

The growth of the industry was hampered by sharply declining returns, and certain venture firms

began posting losses for the first time. In addition to the increased competition among firms, several

other factors impacted returns. The mar(et for initial public offerings cooled in the mid-&<53s before

collapsing after the stoc( mar(et crash in &<5F and foreign corporations, particularly from Dapan and

Horea, flooded early stage companies with capital.

%&F'

In response to the changing conditions, corporations that had sponsored in-house venture

investment arms, including /eneral 1lectric and "aine :ebber either sold off or closed these

venture capital units. dditionally, venture capital units within 7hemical @an( and 7ontinental Illinois

6ational @an(, among others, began shifting their focus from funding early stage companies toward

investments in more mature companies. 1ven industry founders D.E. :hitney ?

7ompany and :arburg "incus began to transition toward leveraged buyouts and growth

capital investments.

%&F'%&5'%&<'

Venture capital boom and the Internet %ubble%edit'

@y the end of the &<53s, venture capital returns were relatively low, particularly in comparison with

their emerging leveraged buyout cousins, due in part to the competition for hot startups, e)cess

supply of I"#s and the ine)perience of many venture capital fund managers. /rowth in the venture

capital industry remained limited throughout the &<53s and the first half of the &<<3s, increasing

from I8 billion in &<58 to +ust over I9 billion more than a decade later in &<<9.

fter a sha(eout of venture capital managers, the more successful firms retrenched, focusing

increasingly on improving operations at their portfolio companies rather than continuously ma(ing

new investments. ;esults would begin to turn very attractive, successful and would ultimately

generate the venture capital boom of the &<<3s. Jale School of >anagement "rofessor ndrew

>etric( refers to these first &A years of the modern venture capital industry beginning in &<53 as the

Bpre-boom periodB in anticipation of the boom that would begin in &<<A and last through the bursting

of the Internet bubble in ,333.

%,3'

The late &<<3s were a boom time for venture capital, as firms on Sand Eill ;oad in >enlo

"ar( and Silicon $alley benefited from a huge surge of interest in the nascent Internet and other

computer technologies. Initial public offerings of stoc( for technology and other growth companies

were in abundance, and venture firms were reaping large returns.

&rivate equity crash%edit'

The technology-heavy 6S0K 7ompositeinde) pea(ed at A,395 in >arch ,333 reflecting the high point of the dot-

com bubble.

The 6asdaq crash and technology slump that started in >arch ,333 shoo( virtually the entire

venture capital industry as valuations for startup technology companies collapsed. #ver the ne)t two

years, many venture firms had been forced to write-off large proportions of their investments, and

many funds were significantly Bunder waterB (the values of the fund*s investments were below the

amount of capital invested). $enture capital investors sought to reduce si!e of commitments they

had made to venture capital funds, and, in numerous instances, investors sought to unload e)isting

commitments for cents on the dollar in thesecondary mar(et. @y mid-,338, the venture capital

industry had shriveled to about half its ,33& capacity. 6evertheless, "ricewaterhouse7oopers*s

>oneyTreeSurvey

%,&'

shows that total venture capital investments held steady at ,338 levels through

the second quarter of ,33A.

lthough the post-boom years represent +ust a small fraction of the pea( levels of venture

investment reached in ,333, they still represent an increase over the levels of investment from &<53

through &<<A. s a percentage of /0", venture investment was 3.3A5- in &<<9, pea(ed at &.35F-

(nearly &< times the &<<9 level) in ,333 and ranged from 3.&29- to 3.&5,- in ,338 and ,339. The

revival of an Internet-driven environment in ,339 through ,33F helped to revive the venture capital

environment. Eowever, as a percentage of the overall private equity mar(et, venture capital has still

not reached its mid-&<<3s level, let alone its pea( in ,333.

$enture capital funds, which were responsible for much of the fundraising volume in ,333 (the height

of the dot-com bubble), raised only I,A.& billion in ,332, a ,--decline from ,33A and a significant

decline from its pea(.

%,,'

Funding%edit'

#btaining venture capital is substantially different from raising debt or a loan from a lender. =enders

have a legal right to interest on a loan and repayment of the capital, irrespective of the success or

failure of a business. $enture capital is invested in e)change for an equity sta(e in the business. s

a shareholder, the venture capitalist*s return is dependent on the growth and profitability of the

business. This return is generally earned when the venture capitalist Be)itsB by selling its

shareholdings when the business is sold to another owner.

$enture capitalists are typically very selective in deciding what to invest inL as a result, firms are

loo(ing for the e)tremely rare, yet sought after, qualities, such as innovative technology, potential for

rapid growth, a well-developed business model, and an impressive management team. #f these

qualities, funds are most interested in ventures with e)ceptionally high growth potential, as only such

opportunities are li(ely capable of providing the financial returns and successful e)it event within the

required timeframe (typically 84F years) that venture capitalists e)pect.

@ecause investments are illiquid and require the e)tended timeframe to harvest, venture capitalists

are e)pected to carry out detailed due diligence prior to investment. $enture capitalists also are

e)pected to nurture the companies in which they invest, in order to increase the li(elihood of

reaching an I"# stage when valuations are favourable. $enture capitalists typically assist at four

stages in the company*s developmentC

%,8'

Idea generationL

Start-upL

;amp upL and

1)it

@ecause there are no public e)changes listing their securities, private companies meet venture

capital firms and other private equity investors in several ways, including warm referrals from the

investors* trusted sources and other business contactsL investor conferences and symposiaL and

summits where companies pitch directly to investor groups in face-to-face meetings, including a

variant (nown as BSpeed $enturingB, which is a(in to speed-dating for capital, where the investor

decides within &3 minutes whether he wants a follow-up meeting. In addition, there are some new

private online networ(s that are emerging to provide additional opportunities to meet investors.

%,9'

This need for high returns ma(es venture funding an e)pensive capital source for companies, and

most suitable for businesses having large up-front capital requirements, which cannot be financed by

cheaper alternatives such as debt. That is most commonly the case for intangible assets such as

software, and other intellectual property, whose value is unproven. In turn, this e)plains why venture

capital is most prevalent in the fast-growing technology and life sciences or biotechnology fields.

If a company does have the qualities venture capitalists see( including a solid business plan, a good

management team, investment and passion from the founders, a good potential to e)it the

investment before the end of their funding cycle, and target minimum returns in e)cess of 93- per

year, it will find it easier to raise venture capital.

'inancing stages%edit'

There are typically si) stages of venture round financing offered in $enture 7apital, that roughly

correspond to these stages of a company*s development.

%,A'

Seed fundingC =ow level financing needed to prove a new idea, often provided by angel

investors. 7rowd funding is also emerging as an option for seed funding.

Start-upC 1arly stage firms that need funding for e)penses associated with mar(eting and

product development

/rowth (Series round)C 1arly sales and manufacturing funds

Second-;oundC :or(ing capital for early stage companies that are selling product, but not

yet turning a profit

1)pansion C lso called >e!!anine financing, this is e)pansion money for a newly profitable

company

1)it of venture capitalist C lso called bridge financing, 9th round is intended to finance the

Bgoing publicB process

@etween the first round and the fourth round, venture-bac(ed companies may also see( to

ta(e venture debt.

%,2'

Firms and funds%edit'

Venture capitalists%edit'

venture capitalist is a person who ma(es venture investments, and these venture capitalists are

e)pected to bring managerial and technical e)pertise as well as capital to their investments.

venture capital fund refers to a pooled investment vehicle (in the .nited States, often an =" or ==7)

that primarily invests the financial capital of third-party investors in enterprises that are too ris(y for

the standard capital mar(ets or ban( loans. These funds are typically managed by a venture capital

firm, which often employs individuals with technology bac(grounds (scientists, researchers),

business training andMor deep industry e)perience.

core s(ill within $7 is the ability to identify novel technologies that have the potential to generate

high commercial returns at an early stage. @y definition, $7s also ta(e a role in managing

entrepreneurial companies at an early stage, thus adding s(ills as well as capital, thereby

differentiating $7 from buy-out private equity, which typically invest in companies with proven

revenue, and thereby potentially reali!ing much higher rates of returns. Inherent in reali!ing

abnormally high rates of returns is the ris( of losing all of one*s investment in a given startup

company. s a consequence, most venture capital investments are done in a pool format, where

several investors combine their investments into one large fund that invests in many different startup

companies. @y investing in the pool format, the investors are spreading out their ris( to many

different investments versus ta(ing the chance of putting all of their money in one start up firm.

0iagram of the structure of a generic venture capital fund

tructure%edit'

$enture capital firms are typically structured as partnerships, the general partners of which serve as

the managers of the firm and will serve as investment advisors to the venture capital funds raised.

$enture capital firms in the .nited States may also be structured as limited liability companies, in

which case the firm*s managers are (nown as managing members. Investors in venture capital funds

are (nown as limited partners. This constituency comprises both high net worth individuals and

institutions with large amounts of available capital, such as state and private pension funds,

university financial endowments, foundations, insurancecompanies, and pooled investment vehicles,

called funds of funds.

(ypes%edit'

$enture 7apitalist firms differ in their approaches. There are multiple factors, and each firm is

different.

Some of the factors that influence $7 decisions includeC

@usiness situationC Some $7s tend to invest in new ideas, or fledgling companies. #thers

prefer investing in established companies that need support to go public or grow.

Some invest solely in certain industries.

Some prefer operating locally while others will operate nationwide or even globally.

$7 e)pectations often vary. Some may want a quic(er public sale of the company or e)pect

fast growth. The amount of help a $7 provides can vary from one firm to the ne)t.

)oles%edit'

:ithin the venture capital industry, the general partners and other investment professionals of the

venture capital firm are often referred to as Bventure capitalistsB or B$7sB. Typical career

bac(grounds vary, but, broadly spea(ing, venture capitalists come from either an operational or a

finance bac(ground. $enture capitalists with an operational bac(ground (operating partner) tend to

be former founders or e)ecutives of companies similar to those which the partnership finances or will

have served as management consultants. $enture capitalists with finance bac(grounds tend to

have investment ban(ing or other corporate finance e)perience.

lthough the titles are not entirely uniform from firm to firm, other positions at venture capital firms

includeC

&osition )ole

$enture

partners

$enture partners are e)pected to source potential investment opportunities (Bbring

in dealsB) and typically are compensated only for those deals with which they are

involved.

"rincipal

This is a mid-level investment professional position, and often considered a

Bpartner-trac(B position. "rincipals will have been promoted from a senior

associate position or who have commensurate e)perience in another field, such

as investment ban(ing, management consulting, or a mar(et of particular interest

to the strategy of the venture capital firm.

ssociate

This is typically the most +unior apprentice position within a venture capital firm.

fter a few successful years, an associate may move up to the Bsenior associateB

position and potentially principal and beyond. ssociates will often have wor(ed

for &4, years in another field, such as investment ban(ing or management

consulting.

1ntrepreneur-

in-residence

1ntrepreneurs-in-residence (1I;s) are e)perts in a particular domain and

perform due diligence on potential deals. 1I;s are engaged by venture capital

firms temporarily (si) to &5 months) and are e)pected to develop and pitch startup

ideas to their host firm although neither party is bound to wor( with each other.

Some 1I;s move on to e)ecutive positions within a portfolio company.

tructure of the funds%edit'

>ost venture capital funds have a fi)ed life of &3 years, with the possibility of a few years of

e)tensions to allow for private companies still see(ing liquidity. The investing cycle for most funds is

generally three to five years, after which the focus is managing and ma(ing follow-on investments in

an e)isting portfolio. This model was pioneered by successful funds in Silicon $alley through the

&<53s to invest in technological trends broadly but only during their period of ascendance, and to cut

e)posure to management and mar(eting ris(s of any individual firm or its product.

In such a fund, the investors have a fi)ed commitment to the fund that is initially unfunded and

subsequently Bcalled downB by the venture capital fund over time as the fund ma(es its investments.

There are substantial penalties for a limited partner (or investor) that fails to participate in a capital

call.

It can ta(e anywhere from a month or so to several years for venture capitalists to raise money from

limited partners for their fund. t the time when all of the money has been raised, the fund is said to

be closed, and the &3-year lifetime begins. Some funds have partial closes when one half (or some

other amount) of the fund has been raised. Thevintage year generally refers to the year in which the

fund was closed and may serve as a means to stratify $7 funds for comparison. This

%,F'

shows the

difference between a venture capital fund management company and the venture capital funds

managed by them.

Grom investors* point of view, funds can beC (&) traditionalNwhere all the investors invest with equal

termsL or (,) asymmetricNwhere different investors have different terms. Typically the asymmetry is

seen in cases where there*s an investor that has other interests such as ta) income in case of public

investors.

%,5'

Compensation%edit'

Main article: Carried interest

$enture capitalists are compensated through a combination of management fees and carried

interest (often referred to as a Btwo and ,3B arrangement)C

&ayment Implementation

>anagement

fees

an annual payment made by the investors in the fund to the fund*s manager to pay

for the private equity firm*s investment operations.

%,<'

In a typical venture capital fund,

the general partners receive an annual management fee equal to up to ,- of the

committed capital.

7arried

interest

a share of the profits of the fund (typically ,3-), paid to the private equity fundOs

management company as a performance incentive. The remaining 53- of the

profits are paid to the fund*s investors

%,<'

Strong limited partner interest in top-tier

venture firms has led to a general trend toward terms more favorable to the venture

partnership, and certain groups are able to command carried interest of ,A483- on

their funds.

@ecause a fund may run out of capital prior to the end of its life, larger venture capital firms usually

have several overlapping funds at the same timeL doing so lets the larger firm (eep specialists in all

stages of the development of firms almost constantly engaged. Smaller firms tend to thrive or fail

with their initial industry contactsL by the time the fund cashes out, an entirely new generation of

technologies and people is ascending, whom the general partners may not (now well, and so it is

prudent to reassess and shift industries or personnel rather than attempt to simply invest more in the

industry or people the partners already (now.

*lternatives%edit'

@ecause of the strict requirements venture capitalists have for potential investments, many

entrepreneurs see( seed funding from angel investors, who may be more willing to invest in highly

speculative opportunities, or may have a prior relationship with the entrepreneur.

Gurthermore, many venture capital firms will only seriously evaluate an investment in a start-up

company otherwise un(nown to them if the company can prove at least some of its claims about the

technology andMor mar(et potential for its product or services. To achieve this, or even +ust to avoid

the dilutive effects of receiving funding before such claims are proven, many start-ups see( to self-

finance sweat equity until they reach a point where they can credibly approach outside capital

providers such as venture capitalists or angel investors. This practice is called BbootstrappingB.

There has been some debate since the dot com boom that a Bfunding gapB has developed between

the friends and family investments typically in the I3 to I,A3,333 range and the amounts that most

$7 funds prefer to invest between I& million to I, million.

%citation needed'

This funding gap may be

accentuated by the fact that some successful $7 funds have been drawn to raise ever-larger funds,

requiring them to search for correspondingly larger investment opportunities. This gap is often filled

by sweat equity and seed fundingvia angel investors as well as equity investment companies who

speciali!e in investments in startup companies from the range of I,A3,333 to I& million. The

6ational $enture 7apital ssociation estimates that the latter now invest more than I83 billion a year

in the .S in contrast to the I,3 billion a year invested by organi!ed venture capital funds.

%citation needed'

7rowd funding is emerging as an alternative to traditional venture capital. 7rowd funding is an

approach to raising the capital required for a new pro+ect or enterprise by appealing to large

numbers of ordinary people for small donations. :hile such an approach has long precedents in the

sphere of charity, it is receiving renewed attention from entrepreneurs such as independent film

ma(ers, now that social media and online communities ma(e it possible to reach out to a group of

potentially interested supporters at very low cost. Some crowd funding models are also being

applied for startup funding such as those listed at 7omparison of crowd funding services. #ne of the

reasons to loo( for alternatives to venture capital is the problem of the traditional $7 model. The

traditional $7s are shifting their focus to later-stage investments, and return on investment of many

$7 funds have been low or negative.

%,9'%83'

In 1urope and India, >edia for equity is a partial alternative to venture capital funding. >edia for

equity investors are able to supply start-ups with often significant advertising campaigns in return for

equity.

In industries where assets can be securiti!ed effectively because they reliably generate future

revenue streams or have a good potential for resale in case of foreclosure, businesses may more

cheaply be able to raise debt to finance their growth. /ood e)amples would include asset-intensive

e)tractive industries such as mining, or manufacturing industries. #ffshore funding is provided via

specialist venture capital trusts, which see( to utilise securiti!ation in structuring hybrid multi-mar(et

transactions via an S"$ (special purpose vehicle)C a corporate entity that is designed solely for the

purpose of the financing.

In addition to traditional venture capital and angel networ(s, groups have emerged, which allow

groups of small investors or entrepreneurs themselves to compete in a privati!ed business plan

competition where the group itself serves as the investor through a democratic process.

%8&'

=aw firms are also increasingly acting as an intermediary between clients see(ing venture capital

and the firms providing it.

%8,'

#ther forms include $enture ;esources, that see( to provide non-monitary support to launch a new

venture.

Geographical differences%edit'

$enture capital, as an industry, originated in the .nited States, and merican firms have traditionally

been the largest participants in venture deals with the bul( of venture capital being deployed in

merican companies. Eowever, increasingly, non-.S venture investment is growing, and the

number and si!e of non-.S venture capitalists have been e)panding.

$enture capital has been used as a tool for economic development in a variety of developing

regions. In many of these regions, with less developed financial sectors, venture capital plays a role

in facilitating access to finance for small and medium enterprises (S>1s), which in most cases

would not qualify for receiving ban( loans.

In the year of ,335, while $7 funding were still ma+orly dominated by ..S. money (I,5.5 billion

invested in over ,AA3 deals in ,335), compared to international fund investments (I&8.9 billion

invested elsewhere), there has been an average A- growth in the venture capital deals outside the

.S, mainly in 7hina and 1urope.

%88'

/eographical differences can be significant. Gor instance, in

the .H, 9- of @ritish investment goes to venture capital, compared to about 88- in the ..S.

%89'

+nited tates%edit'

$enture capitalists invested some I,<.& billion in 8,FA, deals in the ..S. through the fourth quarter

of ,3&&, according to a report by the 6ational $enture 7apital ssociation. The same numbers for all

of ,3&3 were I,8.9 billion in 8,9<2 deals.

%8A'

6ational $enture 7apital ssociation survey found that

a ma+ority (2<-) of venture capitalists predicted that venture investments in the ..S. would have

leveled between I,34,< billion in ,33F.

%citation needed'

ccording to a report by 0ow Dones $entureSource, venture capital funding fell to I2.9 billion in the

.S in the first quarter of ,3&8, an &&.5- drop from the first quarter of ,3&,, and a ,3.5- decline

from ,3&&. $enture firms have added I9., billion into their funds this year, down from I2.8 billion in

the first quarter of ,3&8, but up from I,.2 billion in the fourth quarter of ,3&,.

%82'

,e-ico%edit'

The $enture 7apital industry in >e)ico, is a fast growing sector in the country that, with the support

of institutions and private funds, is estimated to reach .SI&33 billion invested by ,3&5.

%8F'

Technology in Israel

Israel%edit'

In Israel, high-tech entrepreneurship and venture capital have flourished well beyond the country*s

relative si!e. s it has very little natural resources and, historically has been forced to build its

economy on (nowledge-based industries, its $7 industry has rapidly developed, and nowadays has

about F3 active venture capital funds, of which &9 international $7s with Israeli offices, and

additional ,,3 international funds which actively invest in Israel. In addition, as of ,3&3, Israel led the

world in venture capital invested per capita. Israel attracted I&F3 per person compared to IFA in the

.S.

%85'

bout two thirds of the funds invested were from foreign sources, and the rest domestic. In

,3&8, :i).com +oined 2, other Israeli firms on the 6asdaq.

%8<'

;ead more about $enture capital in

Israel.

Canada%edit'

7anadian technology companies have attracted interest from the global venture capital community

partially as a result of generous ta) incentive through the Scientific ;esearch and 1)perimental

0evelopment (S;?10) investment ta) credit program.

%citation needed'

The basic incentive available to any

7anadian corporation performing ;?0 is a refundable ta) credit that is equal to ,3- of BqualifyingB

;?0 e)penditures (labour, material, ;?0 contracts, and ;?0 equipment). n enhanced 8A-

refundable ta) credit of available to certain (i.e. small) 7anadian-controlled private corporations

(77"7s). @ecause the 77"7 rules require a minimum of A3- 7anadian ownership in the company

performing ;?0, foreign investors who would li(e to benefit from the larger 8A- ta) credit must

accept minority position in the company, which might not be desirable. The S;?10 program does

not restrict the e)port of any technology or intellectual property that may have been developed with

the benefit of S;?10 ta) incentives.

7anada also has a fairly unique form of venture capital generation in its =abour Sponsored $enture

7apital 7orporations (=S$77). These funds, also (nown as ;etail $enture 7apital or =abour

Sponsored Investment Gunds (=SIG), are generally sponsored by labor unions and offer ta)

brea(s from government to encourage retail investors to purchase the funds. /enerally, these ;etail

$enture 7apital funds only invest in companies where the ma+ority of employees are in 7anada.

Eowever, innovative structures have been developed to permit =S$77s to direct in 7anadian

subsidiaries of corporations incorporated in +urisdictions outside of 7anada.

wit.erland%edit'

>any Swiss start-ups are university spin-offs, in particular from its federal institutes of technology

in =ausanne and Purich.

%93'

ccording to a study by the =ondon School of 1conomics analysing

&83 1TE Purich spin-offs over &3 years, about <3- of these start-ups survived the first five critical

years, resulting in an average annual I;; of more than 98-.

%9&'

Europe%edit'

1urope has a large and growing number of active venture firms. 7apital raised in the region in ,33A,

including buy-out funds, e)ceeded Q23 billion, of which Q&,.2 billion was specifically allocated to

venture investment. The 1uropean $enture 7apital ssociation

%9,'

includes a list of active firms and

other statistics. In ,332, the top three countries receiving the most venture capital investments were

the .nited Hingdom (A&A minority sta(es sold for Q&.F5 billion), Grance (&<A deals worth Q5FA

million), and /ermany (,3F deals worth Q9,5 million) according to data gathered by =ibrary Eouse.

%98'

1uropean venture capital investment in the second quarter of ,33F rose A- to Q&.&9 billion from the

first quarter. Eowever, due to bigger si!ed deals in early stage investments, the number of deals was

down ,3- to ,&8. The second quarter venture capital investment results were significant in terms of

early-round investment, where as much as Q233 million (about 9,.5- of the total capital) were

invested in &,2 early round deals (which comprised more than half of the total number of deals).

%99'

In ,33F, private equity in Italy was Q9.,@.

%citation needed'

In ,3&,, in Grance, according to a study

%9A'

by GI7 (the Grench ssociation of $7 firms), Q2.&@ have

been invested through &,A95 deals (8<- in new companies, 2&- in new rounds).

study published in early ,3&8 showed that contrary to popular belief, 1uropean startups bac(ed by

venture capital do not perform worse than .S counterparts.

%92'

1uropean venture bac(ed firms have

an equal chance of listing on the stoc( e)change, and a slightly lower chance of a Btrade saleB

(acquisition by other company).

In contrast to the .S, 1uropean media companies and also funds have been pursuing a media for

equity business model as a form of venture capital investment.

=eading early-stage venture capital investors in 1urope include >ar( Tlus!c! of >angrove 7apital

"artners and 0anny ;imer of Inde) $entures, both of which were named onForbes >aga!ine*s

>idas =ist of the world*s top dealma(ers in technology venture capital in ,33F.

%9F'

*sia%edit'

India is fast catching up with the :est in the field of venture capital and a number of venture capital

funds have a presence in the country (I$7). In ,332, the total amount of private equity and venture

capital in India reached IF.A billion across ,<< deals.

%95'

In the Indian conte)t, venture capital

consists of investing in equity, quasi-equity, or conditional loans in order to promote unlisted, high-

ris(, or high-tech firms driven by technically or professionally qualified entrepreneurs. It is also

defined as Bproviding seedB, Bstart-up and first-stage financingB.

%9<'

It is also seen as financing

companies that have demonstrated e)traordinary business potential. $enture capital refers to capital

investmentL equity and debt Lboth of which carry indubitable ris(. The ris( anticipated is very high.

The venture capital industry follows the concept of Rhigh ris(, high returnS, innovative

entrepreneurship, (nowledge-based ideas and human capital intensive enterprises have ta(en the

front seat as venture capitalists invest in ris(y finance to encourage innovation.

%A3'

7hina is also starting to develop a venture capital industry (7$7).

$ietnam is e)periencing its first foreign venture capitals, including I0/ $enture $ietnam

(I&33 million) and 0GD $inacapital (I8A million)

%A&'

,iddle East and /orth *frica%edit'

The >iddle 1ast and 6orth frica (>16) venture capital industry is an early stage of development

but growing. The >16 "rivate 1quity ssociation /uide to $enture 7apital for entrepreneurs lists

$7 firms in the region, and other resources available in the >16 $7 ecosystem. 0iaspora

organi!ation Tech:adi aims to give >16 companies access to $7 investors based in the .S.

outhern *frica%edit'

This section does not cite any references or sources. "lease help improve this

section by adding citations to reliable sources. .nsourced material may be challenged

and removed. (March 2014)

The Southern frican venture capital industry is developing.

South frica, with the help of the South frican /overnment and ;evenue Service, has reali!ed the

necessity to follow the international trend of using ta) efficient vehicles to propel economic growth

and +ob creation through venture capital. Section &, D of the Income Ta) ct was updated to include

$enture 7apital 7ompanies allowing a ta) efficient structure similar to $7T*s in the .H. Section &, D

provides investors the opportunity to invest in $enture 7apital through a ta) efficient structure.

0espite the above structure /overnment needs to ad+ust regulation around intellectual property,

e)change control and other legislation to ensure that $enture 7apital succeeds in South frica.

7urrently, there are not many $enture 7apital Gunds in operation and it is a small community

however funds are available. Gunds are difficult to come by and very few firms have managed to get

funding despite demonstrating tremendous growth potential.

The ma+ority of the venture capital in Southern frica is centered around South frica and Henya.

Definition of 'Venture Capital'

Money provided by investors to startup firms and small businesses with

perceived long-term growth potential. This is a very important source of funding

for startups that do not have access to capital markets. It typically entails high

risk for the investor, but it has the potential for above-average returns.

Investopedia explains 'Venture Capital'

Venture capital can also include managerial and technical expertise. Most

venture capital comes from a group of wealthy investors, investment banks and

other financial institutions that pool such investments or partnerships. This form

of raising capital is popular among new companies or ventures with limited

operating history, which cannot raise funds by issuing debt. The downside for

entrepreneurs is that venture capitalists usually get a say in company decisions,

in addition to a portion of the euity.

Advantages and Disadvantages of

VC Financing

Watch 0

Read

Teaching Resources

Quizzes Readings PowerPoints

Propose a change

Edit Discussion istor!

A"out this content

#ound$ess $everages the power of an acade%ic co%%unit! to create and curate educationa$ content&

'earn (ore

While VC financing provides the benefit of significant

resources, costs include loss of ownership and autonomy.

KEY POINTS

With VC financing, companies can acuire large sums of capital that

!ould not "e possi"le through "an) loans or other conventional methods#

Venture capitalists provide expertise and industry connections that can

"e extremely valua"le#

$ccounting and legal costs ma%e securing a VC deal a difficult process# If

a deal is secured, VC investors !ill "e highly involved in deciding on the

company's strategic direction#

TERM

venture capital

&oney invested in an innovative enterprise in !hich "oth the potential for

profit and the ris) of loss are considera"le#

$dvantages' (he primary advantage of venture capita$ *nancing is an a"ility

for company expansion that !ould not "e possi"le through "an% loans or

other methods# (his is essential for start)ups !ith limited operating histories

and high upfront costs# In addition, repayment of VC investors isn't

necessarily an o"ligation li%e it !ould "e for a "an% loan# *ather, investors are

shouldering theinvest%ent ris% "ecause they "elieve in the company's future

success#

In addition to financial capital, venture capitalists provide valua"le expertise,

advice and industry connections# $ stipulation of many VC deals includes

appointing a venture capitalist as a mem"er of the company's "oard# (his !ay,

the VC firm has intimate involvement in the direction of the company#

Venture capital is also associated !ith +o" creation ,accounting for -. of /0

GD12, the %no!ledge economy, and used as a pro+! measure of innovation

!ithin an economic sector or geography#

Disadvantages' 0ecuring a VC deal can "e a difficult process due to accounting

and legal costs a firm must shoulder# (he start)up company must also give up

some o!nership sta%e to the VC company investing in it# (his results in a

partial loss of autonomy that finds venture capitalists involved in decision)

ma%ing processes# VC deals also come !ith stipulations and restrictions in

composition of the start)up's management team, employee salary and other

factors# Furthermore, !ith the VC firm literally invested in the company's

success, all "usiness operations !ill "e under constant scrutiny# (he loss of

control varies depending on the terms of the VC deal#

"ros ? 7ons of $enture 7apitalist Gunding

rguably, the largest obstacle that lies in the path between a simple idea and a profitable"usiness

is cash. 1very new "usiness needs it, but depending on the state of the economy and the

perceived strength of the idea, whether you*ll obtain cash to move your idea off the drawing board is

often a great un(nown. #ne of the most venerated paths to securing startup funds is wor(ing

through investors such as venture capitalist firms or angel investors.

$enture capitalist firms, put simply, are corporations that ma(e calculated investments in the

startup companies that show the best potential of turning a profit. >ost firms of this nature focus on a

specific industry, so finding one that suits your particular business planshouldn*t be difficult.

Eowever, funding may come with stipulations that you may or may not be willing to obligate yourself

to. So be sure you*re very clear on all the terms before accepting investment funds.

Similarly, ngel investors offer startup funds, but on a much smaller scale. They are often private

individuals or small capital groups that invest smaller amounts of cash, but still more than your

average small business loan. Gurthermore, ngel investors are less regulated than venture capitalist

firms.

@oth types of investment groups encompass similar ris(s and rewards. @elow are some pros and

cons to consider before you decide whether to see( startup capital though such investors.

&ro

7ash 4 #bviously. $enture capitalist dollars far surpass most of what you can acquire via debt

capital or other financing venues. These companies have portfolios that range into the billions of

dollars. n influ) of high dollar figures into a fast growing corporation can mean the difference

between success and failure.

It*s not a loan 4 :al(ing down to your local ban( or credit union and ta(ing out a small business loan

may be more convenient and immediate, but it*s li(ely that your neighborhood branch cannot loan

you the amount of money you need to weather the storm should you fall on down times. dditionally,

should your loans go into default, itOs the start of a tic(ing time bomb to ban(ruptcy. $enture capitalist

dollars have no repay schedule. ;ather these monies are an investment that is repaid by the

profits !our co%pan! generates. This eliminates repayment of debt as a cost of doing business.

Con

7ontrol 4 Jou may lose it, depending on how much cash you accept and how early on in the process

you acquire the venture capital. #n occasion, angel investors will invest cash in a concept before it*s

an actual company in e)change for a good deal of control over how the formed corporation is

managed. s( yourself before you accept an offer of IA33,333 if it*s worth 23- of your company.

This equals the total loss of control.

"rofit Share 4 The very nature of ta(ing money from outside sources means you will see a drastic

cut in the percentage of the profits your company will (eep for itself if it does succeed. @efore ta(ing

investment dollars from an angel investor or $7 firm, consider if your company will receive more or

less money when all parties have been paid their share. It*s not unheard of for a company to forgo

high dollar investment, counting on smaller scale success to generate more income than they would

actually receive after paying out their obligation to investors.

ummary

There are definitely pros and cons of wor(ing with venture capitalist firms and angel investors, and

the bottom line can be summari!ed li(e thisC Jou get the needed cash, but you run the ris( of losing

control of your company. =oo( over your "usiness p$an and carefully decide whether this option

suits !our "usiness

,"-ective

./to )now vc

0/to )now how it is "eing provided "! "an)s

1/para%eters and criterias

2/trends in vc

'iterature review

Cha .

Vc

#an)s various t!pes of $oans

vc34

"an)s vc provides venture capita$

criteria

docu%ents

securit!

intrest

genera$

ch1

a+is "an)

vc

detai$

f%cg4%aggi5sause5d-5%4soft

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Quiz 1 & 2 - MidtermDokument11 SeitenQuiz 1 & 2 - MidtermJoshua Cabinas100% (4)

- Acctng Reviewer 2Dokument21 SeitenAcctng Reviewer 2alliahnah33% (3)

- Realtors Officers Database SampleDokument18 SeitenRealtors Officers Database SamplesurajNoch keine Bewertungen

- Internal Corporate Governance MechanismDokument23 SeitenInternal Corporate Governance MechanismSyed AhmadNoch keine Bewertungen

- Allergan Complaint RE: VRX Ackman 9thcircuitDokument51 SeitenAllergan Complaint RE: VRX Ackman 9thcircuittheskeptic21100% (1)

- NIFTY MidSmallcap ConstituentsDokument15 SeitenNIFTY MidSmallcap ConstituentsamitNoch keine Bewertungen

- End Term - MGV - Team FlipkartDokument23 SeitenEnd Term - MGV - Team Flipkartmillenium sankhlaNoch keine Bewertungen

- CRISIL Mutual Fund Ranking ListDokument50 SeitenCRISIL Mutual Fund Ranking ListRajan MahyavanshiNoch keine Bewertungen

- Top MLM MentorsDokument3 SeitenTop MLM MentorsradinstiNoch keine Bewertungen

- Middle East DistiDokument23 SeitenMiddle East Distidarren5566Noch keine Bewertungen

- Course Outline - Agency, Trust & Partnership (1st Sem, AY 2022-23)Dokument16 SeitenCourse Outline - Agency, Trust & Partnership (1st Sem, AY 2022-23)Carina FrostNoch keine Bewertungen

- Local Subsidiary - DC: Being Subject To Philippine Law Requirements On Corporate Structure. Like All StockDokument20 SeitenLocal Subsidiary - DC: Being Subject To Philippine Law Requirements On Corporate Structure. Like All Stockred gynNoch keine Bewertungen

- PitchBook Dediq 2023 03 03 09 03 28Dokument3 SeitenPitchBook Dediq 2023 03 03 09 03 28Hans WurstNoch keine Bewertungen

- Lesson 19 - Preparation of Capital Statement and Balance SheetDokument6 SeitenLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayNoch keine Bewertungen

- On January 1 2013 Morey Inc Exchanged 178 000 For 25Dokument1 SeiteOn January 1 2013 Morey Inc Exchanged 178 000 For 25Miroslav GegoskiNoch keine Bewertungen

- Indian Institute of Legal Studies: Submitted ByDokument14 SeitenIndian Institute of Legal Studies: Submitted ByPritha ChakrabortyNoch keine Bewertungen

- Authorised v. Paid Up SCDokument3 SeitenAuthorised v. Paid Up SChridayNoch keine Bewertungen

- Pandora Acquires Sophocles CompanyDokument4 SeitenPandora Acquires Sophocles CompanyAstria Arha DillaNoch keine Bewertungen

- WhirlpoolDokument7 SeitenWhirlpoolShilpaNoch keine Bewertungen

- BPML Annual Report 26th 2019 PDFDokument166 SeitenBPML Annual Report 26th 2019 PDFF.m.mahmudul.hasangmail.com HasanNoch keine Bewertungen

- Business Combination and Consolidated FS Part 1Dokument6 SeitenBusiness Combination and Consolidated FS Part 1markNoch keine Bewertungen

- Draft SOPDokument48 SeitenDraft SOPshanti arisantiNoch keine Bewertungen

- Ray WhiteDokument6 SeitenRay WhiteLokiNoch keine Bewertungen

- Comparative Ratio Analysis For TCS and InfosysDokument11 SeitenComparative Ratio Analysis For TCS and InfosysChaitanya89% (9)

- Ar Icbc 2016 GCGDokument118 SeitenAr Icbc 2016 GCGMelany PutryNoch keine Bewertungen

- Record Label LogosDokument2 SeitenRecord Label Logosx-x-b-e-c-k-y-x-xNoch keine Bewertungen

- Baza Date Test Excel - Varianta 2019 FADokument654 SeitenBaza Date Test Excel - Varianta 2019 FAMierlea Alexandru-Nicolae100% (1)

- Icici Prudential PMS PerformanceDokument74 SeitenIcici Prudential PMS PerformanceDhanraj MNoch keine Bewertungen

- Joint Ventures: Key Examples and BenefitsDokument15 SeitenJoint Ventures: Key Examples and BenefitsNargis NoordeenNoch keine Bewertungen

- EnronDokument6 SeitenEnronabhdonNoch keine Bewertungen