Beruflich Dokumente

Kultur Dokumente

10 Chapter Two Investment Alternatives

Hochgeladen von

Muhammad Haris0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten15 SeitenThis document contains multiple choice and true-false questions about investment alternatives such as stocks, bonds, and money market securities. It discusses the characteristics of different types of fixed income securities including treasury bills, notes, bonds and zero-coupon bonds. It also covers equity securities like common stock and preferred stock. Some key points covered are the tax advantages of municipal bonds, characteristics of investment grade vs. speculative grade bonds, and features of options and futures contracts.

Originalbeschreibung:

chapter mcqs

Originaltitel

good topic

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document contains multiple choice and true-false questions about investment alternatives such as stocks, bonds, and money market securities. It discusses the characteristics of different types of fixed income securities including treasury bills, notes, bonds and zero-coupon bonds. It also covers equity securities like common stock and preferred stock. Some key points covered are the tax advantages of municipal bonds, characteristics of investment grade vs. speculative grade bonds, and features of options and futures contracts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten15 Seiten10 Chapter Two Investment Alternatives

Hochgeladen von

Muhammad HarisThis document contains multiple choice and true-false questions about investment alternatives such as stocks, bonds, and money market securities. It discusses the characteristics of different types of fixed income securities including treasury bills, notes, bonds and zero-coupon bonds. It also covers equity securities like common stock and preferred stock. Some key points covered are the tax advantages of municipal bonds, characteristics of investment grade vs. speculative grade bonds, and features of options and futures contracts.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 15

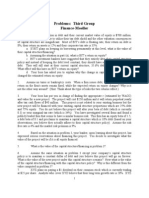

Files: ch02, Chapter 2: Investment Alternatives

Multiple Choice Questions

1. The largest single institutional owner o common stoc!s is:

a. mutual un"s.

#. insurance companies.

c. pension un"s

". commercial #an!s

Ans: c

$iicult%: Mo"erate

&e: 'rgani(ing Financial Assets

2. )hich o the ollowing is not one o the characteristics o the primar%

nonmar!eta#le inancial assets owne" #% most in"ivi"uals*

a. high li+ui"it%

#. high return

c. oten issue" #% the ,.-. government

". low ris!

Ans: #

$iicult%: Mo"erate

&e: .onmar!eta#le Financial Assets

/. -avings accounts are 0000000000 #ut are not000000000000.

a. negotia#le1 li+ui".

#. mar!eta#le1 li+ui".

c. li+ui"1 personal

". li+ui"1 mar!eta#le

Ans: "

$iicult%: "iicult

&e: .onmar!eta#le Financial Assets

2. .onmar!eta#le inancial assets that protect against inlation inclu"e:

a. .onnegotia#le certiicates o "eposit 3C$s4

#. Mone% mar!et "eposit accounts 3MM$As4

c. -eries 55 ,- government savings #on"s

". ,- government savings #on"s, I #on"s

Ans: "

$iicult%: Mo"erate

&e: .onmar!eta#le Financial Assets

10 Chapter Two

Investment Alternatives

6. Treasur% #ills are tra"e" in the 000000000000000000000 .

a. mone% mar!et.

#. capital mar!et.

c. government mar!et.

". regulate" mar!et.

Ans: a

$iicult%: 5as%

&e: Mone% Mar!et -ecurities

7. )hich o the ,.-. Treasur% securities is alwa%s sol" at a "iscount*

a. Treasur% #ills

#. Treasur% notes

c. Treasur% #on"s

". Treasur% inlation protecte" securities 3TI8-4

Ans: a

$iicult%: Mo"erate

&e: Mone% Mar!et -ecurities

9. )hich o the ollowing statements regar"ing mone% mar!et instruments is

not true*

a. The% ten" to #e highl% mar!eta#le.

#. The% have maturities rom 1 to / %ears.

c. The% ten" to have a low pro#a#ilit% o "eault.

". Their rates ten" to move together.

Ans: #

$iicult%: Mo"erate

&e: Mone% Mar!et -ecurities

:. )hich o the ollowing woul" not #e consi"ere" a capital mar!et securit%*

a. a 200%ear corporate #on"

#. a common stoc!

c. a 70month Treasur% #ill

". a mutual un" share

Ans: c

$iicult%: Mo"erate

&e: Capital Mar!et -ecurities

;. The coupon rate is another name or the:

a. mar!et interest rate.

#. current %iel".

11 Chapter Two

Investment Alternatives

c. state" interest rate.

". %iel" to maturit%

Ans: c

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

10. =ero0coupon #on"s are similar to Treasur% #ills in that #oth:

a. are issue" e<clusivel% #% the ,.-. Treasur%

#. are mone%0mar!et securities

c. are capital0mar!et securities

". are sol" at less than par

Ans: "

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

11. 5ach point on a #on" +uote represents:

a. >100

#. 1 percent o >100

c. 1 percent o >1000

". >1000

Ans: c

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

12. Treasur% -T&I8- are most similar to which t%pe o corporate securit%*

a. preerre" stoc!

#. premium #on"

c. high0%iel" #on"

". (ero0coupon #on"

Ans: "

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

1/. ?on"s tra"e on an accrual interest #asis. This means an investor:

a. can sell a #on" at an% time without losing the interest that has accrue"

#. can #u% a #on" at an% time an" gain the interest accrue" rom the time o the last

pa%ment

c. can sell a #on" at an% time an" retain the interest portion o the #on"

". #u% a #on" at an% time an" receive an imme"iate interest chec!

Ans: a

12 Chapter Two

Investment Alternatives

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

12. ?on"s calle" in are li!el% to #e:

a. #on"s alrea"% in "eault

#. reissue" as new #on"s with a lower interest rate

c. reissue" as new #on"s with a higher interest rate

". @un! #on"s

Ans: #

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

16. )hat will a #on" #e worth on the "a% it matures*

a. >0

#. >100

c. its ace value 3plus remaining coupon, i applica#le4

". its remaining coupon, i applica#le

Ans: c

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

17. )hich o the ollowing statements is true regar"ing an investment in mortgage0

#ac!e" securities*

a. There is little "eault ris!.

#. The state" maturit% is generall% 10 %ears.

c. The% receive a i<e" pa%ment per month.

". The% are not su#@ect to prepa%ment.

Ans: a

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

19. A municipal #on" issue that was sol" to inance a toll #ri"ge woul" most li!el% #e

a:

a. general o#ligation #on".

#. revenue #on".

c. special assessment #on".

". (ero0coupon #on".

Ans: #

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

1/ Chapter Two

Investment Alternatives

1:. )hat is the ma@or "ierence #etween municipal #on"s an" other t%pes o #on"s*

a. Municipal #on"s are alwa%s insure"1 other #on"s are not

#. ,nli!e other #on"s, municipal #on"s sell at a "iscount

c. Municipal #on" interest is ta<0e<empt1 interest on other #on"s is not

". There is no #ro!erage commission on municipal #on"s unli!e other #on"s

Ans: c

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

1;. An investor who pa%s ta<es at the 2:A marginal ta< rate woul" nee" to earn what

coupon rate on a corporate #on" similar in all respects other than ta<es to a 6A

coupon municipal #on":

a. 1.20A

#. 2.60A

c. 6.00A

". 7.;2A

Ans: "

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

20. Interest on #on"s is t%picall% pai":

a. monthl%

#. +uarterl%

c. semiannuall%

". annuall%

Ans: c

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

21. Treasur% #on"s generall% have maturities o:

a. 6 to 16 %ears

#. 6 to /0 %ears

c. 10 to 20 %ears

". 10 to /0 %ears

Ans: "

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

22. A corporate #on" with a rating o ???0 is consi"ere" to #e which o the

ollowing*

12 Chapter Two

Investment Alternatives

a. non0investment gra"e

#. investment gra"e

c. speculative gra"e

". @un!, or high0%iel"

Ans: #

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

2/. An unsecure" #on" is !nown as a:

a. "e#enture

#. in"enture

c. mortgage #on"

". @un! #on"

Ans: a

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

22. )hich o the ollowing 100%ear, AAA rate" #on"s woul" have the lowest %iel"*

a. corporate #on".

#. insure" municipal #on".

c. ,.-. Treasur% #on".

". mortgage0#ac!e" #on".

Ans: #

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

26. For ,.-. companies, "ivi"en"s are t%picall% pai":

a. monthl%

#. +uarterl%

c. semi0annuall%

". %earl%

Ans: #

$iicult%: 5as%

&e: 5+uit% -ecurities

27. I an investor states that Intel is overvalue" at 76 times, he is reerring to:

a. earnings per share

#. "ivi"en" %iel"

c. #oo! value

". 8B5 ratio

Ans: "

16 Chapter Two

Investment Alternatives

$iicult%: "iicult

&e: 5+uit% -ecurities

29. 0000000000000000 represent shares o oreign companies !ept in #an!s.

a. converti#le #on"s

#. American $epositor% &eceipts 3A$&s4

c. asset0#ac!e" securities

". C5A8-

Ans: #

$iicult%: 5as%

&e: 5+uit% -ecurities

2:. )hich o the ollowing statements regar"ing common stoc!s is true*

a. The par value o common stoc! is usuall% >100

#. The mar!et value o common stoc! is e+ual to its #oo! value

c. $ivi"en"s on common stoc! are at the "iscretion o the compan%

". Common stoc! has a senior claim on compan% assets

Ans: c

$iicult%: Mo"erate

&e: 5+uit% -ecurities

2;. I a preerre" stoc! issue is cumulative, this means:

a. unpai" preerre" stoc! "ivi"en"s are pai" at the en" o the %ear

#. unpai" preerre" stoc! "ivi"en"s are legall% #in"ing on the corporation

c. unpai" preerre" stoc! "ivi"en"s must #e pai" in the uture #eore common stoc!

"ivi"en"s can #e pai"

". unpai" preerre" stoc! "ivi"en"s are never repai"

Ans: c

$iicult%: Mo"erate

&e: 5+uit% -ecurities

/0. )hich o the ollowing statements is true regar"ing asset0#ac!e" securities

3A-?4*

a. The% oer relativel% high %iel"s

#. The% have relativel% long maturities

c. The% generall% have low cre"it ratings

". 5ach traunche has the same ris!

Ans: a

$iicult%: Mo"erate

&e: Asset ?ac!e" -ecurities

17 Chapter Two

Investment Alternatives

/1. )hat is the #iggest "ierence #etween an option an" a utures contract*

a. 'ptions are tra"e" on e<changes whereas utures are not

#. 'ptions give investors a wa% to manage portolio ris! while utures "o not

c. 'ptions can #e use" #% speculators to proit rom price luctuations while utures

cannot

". 'ptions give their hol"ers the right to #u% or sell whereas utures contract are

o#ligations to #u% or sell

Ans: "

$iicutl%: $iicult

&e: $erivative -ecurities

/2. The premium on an option is the:

a. par value o the option.

#. price o the option.

c. #oo! value o the option.

". price at which a securit% ma% #e #ought or sol" using the option.

Ans: #

$iicult%: Mo"erate

&e: $erivative -ecurities

//. I a call option has a >10 stri!e price, an" the un"erl%ing stoc! is tra"ing at >11,

then the option is consi"ere":

a. in the mone%.

#. at the mone%.

c. out o the mone%.

". worthless.

Ans: a

$iicult%: 5as%

&e: $erivative -ecurities

True0False Questions

1. $irect investing involves tra"es ma"e #% "irectl% purchasing shares o a inancial

interme"iar%.

Ans: F

$iicult%: Mo"erate

&e: 'rgani(ing Financial Assets

19 Chapter Two

Investment Alternatives

2. An e<ample o in"irect investing woul" #e #u%ing shares in a mutual un".

Ans: True

$iicult%: 5as%

&e: 'rgani(ing Financial Assets

/. .onmar!eta#le investments woul" inclu"e savings accounts at #an!s an" Treasur%

#ills.

Ans: F

$iicult%: Mo"erate

&e: .onmar!eta#le Financial Assets

2. Mar!eta#le securities all all into the categor% o capital mar!et securities.

Ans: F

$iicult%: Mo"erate

&e: .onmar!eta#le Financial Assets

6. All ,. -. government securities are consi"ere" mar!eta#le securities.

Ans: F

$iicult%: 5as%

&e: Mone% Mar!et -ecurities

7. Mone% mar!et securities generall% carr% a low chance o "eault.

Ans: T

$iicult%: Mo"erate

&e: Mone% Mar!et -ecurities

9. The mone% mar!et securit% most oten use" a #enchmar! or the ris!0ree rate is

mone% mar!et "eposit account rate.

Ans: False

$iicult%: 5as%

&e: Mone% Mar!et -ecurities

:. The rate sprea"s #etween the "ierent mone% mar!et securities o the same term ten"

to #e +uite large.

Ans: F

$iicult%: "iicult

&e: Mone% Mar!et -ecurities

;. Treasur% notes represent the nontra"e" "e#t o the ,.-. government.

Ans: F

1: Chapter Two

Investment Alternatives

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

10. The capital mar!et inclu"es #oth i<e"0income an" e+uit% securities.

Ans: T

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

11. Term #on"s have a single maturit%.

Ans: T

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

12. The return on a (ero0coupon #on" is "erive" rom the "ierence #etween

the purchase price o the #on" an" its par value.

Ans: T

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

1/. The "eeper the "iscount on a (ero0coupon #on", the lower the eective

return.

Ans: F

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

12. I a #on" has a coupon greater than the current mar!et %iel", it shoul" #e

selling at a premium.

Ans: T

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

16. Calla#le #on"s attract investors #ecause the% can #e re"eeme" earl%.

Ans: F

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

17. TI8- a"@ust or inlation #% a"@usting the rate o interest pai" on the #on".

Ans: F

$iicult%: "iicult

&e: Fi<e"0Income -ecurities

1; Chapter Two

Investment Alternatives

19. The ma@or attraction o municipal #on"s is their e<tremel% low ris!.

Ans: F

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

1:. Investors in high ta< #rac!ets woul" #e unli!el% to invest in municipal #on"s.

Ans: F

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

1;. In the case o a corporate #an!ruptc%, #on"hol"ers are pai" #eore an%

"istri#utions are pai" to preerre" or common stoc!hol"ers.

Ans: T

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

20. ?on" ratings are primaril% use" to assess interest rate ris!.

Ans: F

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

21. The ma@or #on" rating service is $un D ?ra"street.

Ans: F

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

22. The earnings retention rate is calculate" as 1 E "ivi"en" %iel".

Ans: T

$iicult%: 5as%

&e: 5+uit% -ecurities

2/. The par value on common stoc! sets the value that stoc!hol"ers will

receive in case o #an!ruptc%.

Ans: F

$iicult%: 5as%

&e: 5+uit% -ecurities

22. C5A8- have maturities "ates up to 10 %ears.

Ans: F

$iicult%: 5as%

20 Chapter Two

Investment Alternatives

&e: 5+uit% -ecurities

26. Most utures contracts are not e<ercise".

Ans: T

$iicult%: Mo"erate

&e: 5+uit% -ecurities

27. Converti#le #on"s give their investors the right to convert the #on" into common

stoc! whenever the% choose.

Ans: T

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

-hort0Answer Questions

1. $istinguish #etween "irect an" in"irect investing.

Answer: $irect investing E #u% #on"s an" stoc!s

In"irect investing E #u% mutual un"s, contri#ute to pension plans, #u% lie insurance

policies.

$iicult%: 5as%

2. Compare the cash lows an investor e<pects rom coupon #on"s, (ero0coupon

#on"s, an" preerre" stoc!.

Answer: Coupon #on"s E annuit% o interest pa%ments plus lump sum o

principal at maturit%

=ero0coupon #on"s E principal at maturit%

8reerre" stoc! E annuit% a" ininitum 3perpetuit%4

$iicult%: Mo"erate

/. Fow is the earnings retention rate relate" to the "ivi"en" pa%out rate*

Answer: 5arnings retention rate G 1 0 "ivi"en" pa%out rate

$iicult%: Mo"erate

&e: 5+uit% -ecurities

2. Fow is the total #oo! value o e+uit% aecte" #% stoc! splits*

Answer: -toc! splits "o not aect total value o e+uit% or the in"ivi"ual accounts,

other than the num#er o shares outstan"ing an" the par value.

$iicult%: Mo"erate

&e: 5+uit% -ecurities

21 Chapter Two

Investment Alternatives

6. In what sense is a stoc! selling or 12 times earnings HcheaperI than a stoc! with

a 8B5 ratio o 20*

Answer: I a stoc! is tra"ing at 12 times earnings, is cheaper than the one tra"ing at 20

times earnings in the sense investors get >1 o earnings or onl% a >12 investment

in #u%ing the stoc!.

$iicult%: Mo"erate

&e: 5+uit% -ecurities

7. )hat are two "irect an" one in"irect metho" or in"ivi"uals to invest in oreign

stoc!s*

Answer: ?u% securities "irectl% through e<changes or as American "epositor% receipts

an" in"irectl% through mutual un"s.

$iicult%: Mo"erate

&e: 'rgani(ing Financial Assets, 5+uit% -ecurities

9. 5<plain how writing option contracts 3#oth puts an" calls4 can generate income

or owners o the un"erl%ing stoc!.

Answer: The writer !eeps the option premium regar"less o whether or not the option is

e<ercise".

$iicult%: Mo"erate

&e: $erivative -ecurities

:. &an! 3lowest to highest4 the ollowing securities in terms o the ris!0e<pecte"

return tra"eo rom the investorsJ viewpoint: common stoc!, corporate #on"s, ,.

-. Treasur% #on"s, options, preerre" stoc!..

Answer: ,. -. Treasur% #on"s, corporate #on"s, preerre" stoc!, common stoc!, options

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities, 5+uit% -ecurities, $erivative -ecurities

;. )hat are some a"vantages o asset0#ac!e" securities to investors*

Answer: Figh %iel"s with managea#le ris!.

$iicult%: Mo"erate

10. )ho #eneits rom a utures contract, a call contract, an" a put contract, i prices

all*

Answer: The seller o the utures contract, the writer o the call contract, an" the #u%er o

the put contract.

$iicult: Mo"erate

&e: $erivative -ecurities

5ssa% Questions

22 Chapter Two

Investment Alternatives

1. $o the stoc! options mar!ets help sta#ili(e or "esta#ili(e the stoc! mar!ets*

5<plain.

Answer: 'ptions shoul" #e a sta#ili(ing orce i options are use" to he"ge stoc!

positions. 'ptions might #e "esta#ili(ing i use" or speculation.

$iicult%: "iicult

&e: 5+uit% -ecurities, $erivative -ecurities

2. Fow "o asset0#ac!e" securities improve the low o un"s rom savers to

#orrowers*

Answer: Asset0#ac!e" securities can #e sol" to a #roa"er mar!et o investors than the

un"erl%ing securities.

$iicult%: Mo"erate

&e: Fi<e"0Income -ecurities

1. )hat state" coupon rate woul" a ta<a#le corporate #on" have to have to #e

compara#le to a municipal #on" with a coupon rate o 9 percent i the investor is

in the 2: percent ta< #rac!et*

Ans: Ta<a#le e+uivalent %iel" is 0.09B3100.2:4 G ;.92A

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

2. A corporate investor in a /2A marginal income ta< #rac!et can #u% #on"s issue"

#% a petroleum e<ploration compan% %iel"ing 10.707A. The investor shoul" #e

willing to #u% ta<0e<empt municipal #on"s o similar +ualit% %iel"ing what

percent or higher*

Ans: 10.707 < 31.000./24 G 9.00 percent

$iicult%: 5as%

&e: Fi<e"0Income -ecurities

/. The par value o ?la(e, Inc. common stoc! is >0.60, the earnings per share is >2,

the mar!et price is >70, the "ivi"en" per share is >1. Calculate the "ivi"en" %iel".

Ans: $ivi"en" %iel" G >1B>70 G 0.0179 G 1.79A

$iicult%: Mo"erate

&e: 5+uit% -ecurities

2. The par value o ?la(e, Inc. common stoc! is >0.60, the earnings per share is >2,

the mar!et price is >70, the "ivi"en" per share is >1. Calculate the pa%out ratio.

Ans: 8a%out rate G >1B>2 G 0.26 G 26A

$iicult%: Mo"erate

&e: 5+uit% -ecurities

2/ Chapter Two

Investment Alternatives

6. The par value o Inerno, Inc. common stoc! is >0.60, the earnings per share is >7,

an" it tra"es at a 8B5 o 16. )hat is Inerno, Inc.Js stoc! price*

Ans: -toc! price per share is 5arnings per share < 8B5 G >7 < 16 G >;0

$iicult%: Mo"erate

&e: 5+uit% -ecurities

22 Chapter Two

Investment Alternatives

Das könnte Ihnen auch gefallen

- Technical AnalysisDokument69 SeitenTechnical AnalysisNikhil KhandelwalNoch keine Bewertungen

- Securities Regulation Code: Title and DefinitionsDokument56 SeitenSecurities Regulation Code: Title and Definitionskara_agliboNoch keine Bewertungen

- Etf Gold VS E-GoldDokument22 SeitenEtf Gold VS E-GoldRia ShayNoch keine Bewertungen

- Microstructure Survey MadhavanDokument24 SeitenMicrostructure Survey MadhavanbobmezzNoch keine Bewertungen

- Chuck Akre Interview ROIICDokument6 SeitenChuck Akre Interview ROIICKen_hoangNoch keine Bewertungen

- Cause and Effect ParagraphDokument4 SeitenCause and Effect ParagraphMuhammad HarisNoch keine Bewertungen

- CH 4 Money Market (Bharti Pathak)Dokument24 SeitenCH 4 Money Market (Bharti Pathak)Mehak Ayoub0% (1)

- Ross 9e FCF SMLDokument425 SeitenRoss 9e FCF SMLAlmayayaNoch keine Bewertungen

- PMP Sample QuestionsDokument15 SeitenPMP Sample QuestionsCarlos ChiribogaNoch keine Bewertungen

- Summary of William J. Bernstein's The Intelligent Asset AllocatorVon EverandSummary of William J. Bernstein's The Intelligent Asset AllocatorNoch keine Bewertungen

- Chap 004Dokument17 SeitenChap 004saud1411100% (1)

- Answers CH21Dokument5 SeitenAnswers CH21TodweNoch keine Bewertungen

- Summary of Aswath Damodaran's The Little Book of ValuationVon EverandSummary of Aswath Damodaran's The Little Book of ValuationNoch keine Bewertungen

- Chap 016Dokument77 SeitenChap 016limed1100% (1)

- Trends in Organizational DevelopmentDokument7 SeitenTrends in Organizational DevelopmentMuhammad HarisNoch keine Bewertungen

- PindyckRubinfeld Microeconomics Ch10Dokument50 SeitenPindyckRubinfeld Microeconomics Ch10Wisnu Fajar Baskoro50% (2)

- Designing Marketing Programmes To Build Brand Equity I Product Pricing and Channel StrategiesDokument35 SeitenDesigning Marketing Programmes To Build Brand Equity I Product Pricing and Channel StrategiesHassan ChaudharyNoch keine Bewertungen

- MBA Finance ProjectDokument89 SeitenMBA Finance ProjectSushil KumarNoch keine Bewertungen

- Lesson A - INTRODUCTION TO MERCHANDISING BUSINESSDokument21 SeitenLesson A - INTRODUCTION TO MERCHANDISING BUSINESSKatrinaMarieA.Tobias100% (1)

- Modern Financial Management Solutions ManualDokument559 SeitenModern Financial Management Solutions Manualrutemarlene40Noch keine Bewertungen

- CH 03Dokument18 SeitenCH 03Shoaib AkhtarNoch keine Bewertungen

- Chapter Seventeen Mutual Funds and Hedge FundsDokument17 SeitenChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaNoch keine Bewertungen

- Econ Exam 2006 Kyiv BDokument8 SeitenEcon Exam 2006 Kyiv BIgor MalianovNoch keine Bewertungen

- SecReg Carlson Fall 05Dokument37 SeitenSecReg Carlson Fall 05Erin JacksonNoch keine Bewertungen

- "Investment Environment and Your Savings": Paul Krugman (Nobel Laureate)Dokument7 Seiten"Investment Environment and Your Savings": Paul Krugman (Nobel Laureate)api-236467720Noch keine Bewertungen

- Chapter Twenty-One Managing Liquidity Risk On The Balance SheetDokument15 SeitenChapter Twenty-One Managing Liquidity Risk On The Balance SheetBiloni KadakiaNoch keine Bewertungen

- Categories of RatiosDokument6 SeitenCategories of RatiosNicquainCTNoch keine Bewertungen

- Solutions Manual The Investment SettingDokument7 SeitenSolutions Manual The Investment SettingQasim AliNoch keine Bewertungen

- Solutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsDokument7 SeitenSolutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsBiloni KadakiaNoch keine Bewertungen

- Chapter 25bDokument7 SeitenChapter 25bmas_999Noch keine Bewertungen

- Dokumen - Tips - MCQ Working Capital Management Cpar 1 84Dokument18 SeitenDokumen - Tips - MCQ Working Capital Management Cpar 1 84Sabahat JavedNoch keine Bewertungen

- Chap 012Dokument77 SeitenChap 012sucusucu3Noch keine Bewertungen

- Chap 002Dokument43 SeitenChap 002Jose MartinezNoch keine Bewertungen

- OTC Derivatives General Paper 112010 AaaaDokument5 SeitenOTC Derivatives General Paper 112010 Aaaaredearth2929Noch keine Bewertungen

- DC Presentations - SimunicDokument21 SeitenDC Presentations - Simunicjulita08Noch keine Bewertungen

- Leach TB Chap10 Ed3Dokument7 SeitenLeach TB Chap10 Ed3bia070386Noch keine Bewertungen

- Pearson Chaper 2 Exam v1 Answer KeyDokument15 SeitenPearson Chaper 2 Exam v1 Answer KeySozia TanNoch keine Bewertungen

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Dokument12 SeitenChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourNoch keine Bewertungen

- Fin 3013 Chapter 3Dokument48 SeitenFin 3013 Chapter 3Noni AlhussainNoch keine Bewertungen

- Problems: Third Group Finance-MoellerDokument4 SeitenProblems: Third Group Finance-MoellerEvan BenedictNoch keine Bewertungen

- Chap 004Dokument46 SeitenChap 004Jose MartinezNoch keine Bewertungen

- Chapter 15 Alternative Corporate Restructuring StrategiesDokument7 SeitenChapter 15 Alternative Corporate Restructuring StrategiesNishtha SethNoch keine Bewertungen

- Advanced Financial Accounting CH 6 NotesDokument18 SeitenAdvanced Financial Accounting CH 6 NotesLiz HopeNoch keine Bewertungen

- Tutorial Questions Weesadk 5. - Risk UncertainDokument3 SeitenTutorial Questions Weesadk 5. - Risk UncertainMinh VănNoch keine Bewertungen

- Chapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1Dokument16 SeitenChapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1samuel_dwumfourNoch keine Bewertungen

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDokument12 SeitenCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085Noch keine Bewertungen

- Chapter 2 Determinants of Interest Rates: True/False QuestionsDokument16 SeitenChapter 2 Determinants of Interest Rates: True/False QuestionsĐoàn Ngọc Thành LộcNoch keine Bewertungen

- Fin 3013 Chapter 4Dokument46 SeitenFin 3013 Chapter 4PookguyNoch keine Bewertungen

- A Study On Credit Management With Reference To Canara BankDokument93 SeitenA Study On Credit Management With Reference To Canara BankDeepika KrishnaNoch keine Bewertungen

- Chapter 01 Lasher PFMDokument20 SeitenChapter 01 Lasher PFMShibin Jayaprasad100% (1)

- Chap 001Dokument52 SeitenChap 001HàMềmNoch keine Bewertungen

- Financial Management - MasenoDokument42 SeitenFinancial Management - MasenoPerbz JayNoch keine Bewertungen

- EconomicsDokument13 SeitenEconomicsmarkanthonycorpinNoch keine Bewertungen

- CHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosDokument38 SeitenCHAPTER 1: Quantitative Methods - Introduction: Series 66: Textbooks, Software & VideosLeeAnn MarieNoch keine Bewertungen

- Chap 013Dokument56 SeitenChap 013saud1411100% (10)

- B Financial MGTDokument5 SeitenB Financial MGTimzeeroNoch keine Bewertungen

- Types and Costs of Financial Capital: True-False QuestionsDokument8 SeitenTypes and Costs of Financial Capital: True-False Questionsbia070386Noch keine Bewertungen

- Adv3 Group PaperDokument3 SeitenAdv3 Group PaperMarvin Joshua ChanNoch keine Bewertungen

- Audit of LiabilitiesDokument12 SeitenAudit of LiabilitiesElmer KennethNoch keine Bewertungen

- Revision 4 - Business Finance: Topic List 1. Internal Sources of Finance Exam Question ReferenceDokument33 SeitenRevision 4 - Business Finance: Topic List 1. Internal Sources of Finance Exam Question Referencesamuel_dwumfourNoch keine Bewertungen

- University of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisDokument6 SeitenUniversity of Technology, Jamaica Fundamentals of Finance (FOF) Unit 3: Financial Statements AnalysisBarby AngelNoch keine Bewertungen

- Insurance Company FailureDokument65 SeitenInsurance Company FailureMundu_1102Noch keine Bewertungen

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?Von EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?Noch keine Bewertungen

- Summary of William J. Bernstein's The Investor's ManifestoVon EverandSummary of William J. Bernstein's The Investor's ManifestoNoch keine Bewertungen

- Economic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsVon EverandEconomic, Business and Artificial Intelligence Common Knowledge Terms And DefinitionsNoch keine Bewertungen

- Categorization of HFDokument7 SeitenCategorization of HFMuhammad HarisNoch keine Bewertungen

- Male Warder (BPS - 05) PDFDokument275 SeitenMale Warder (BPS - 05) PDFMuhammad Haris0% (1)

- Team 1 Assesment Forms Report Date Nageen M.Haris Mian Idrees Rashidullah TotalDokument1 SeiteTeam 1 Assesment Forms Report Date Nageen M.Haris Mian Idrees Rashidullah TotalMuhammad HarisNoch keine Bewertungen

- Comparison and Contrast ParagraphsDokument8 SeitenComparison and Contrast ParagraphsMuhammad HarisNoch keine Bewertungen

- Bond Portfolio Management StrategiesDokument36 SeitenBond Portfolio Management StrategiesMuhammad HarisNoch keine Bewertungen

- Managing Your Brand SecurityDokument12 SeitenManaging Your Brand SecurityMuhammad HarisNoch keine Bewertungen

- Understanding Investments: Review QuestionsDokument6 SeitenUnderstanding Investments: Review QuestionsMuhammad HarisNoch keine Bewertungen

- 3 - Dragan Tevdovski 20-24Dokument5 Seiten3 - Dragan Tevdovski 20-24Muhammad HarisNoch keine Bewertungen

- Project On Indian Stock Market..........Dokument10 SeitenProject On Indian Stock Market..........Kirti ....0% (1)

- Lecture 6Dokument32 SeitenLecture 6Nilesh PanchalNoch keine Bewertungen

- Guide Emerging Market Currencies 2010Dokument128 SeitenGuide Emerging Market Currencies 2010ferrarilover2000Noch keine Bewertungen

- Glossary 2015 PDFDokument240 SeitenGlossary 2015 PDFNeelanjan BiswasNoch keine Bewertungen

- Derivatives Example ProblemsDokument2 SeitenDerivatives Example Problemschris7frantz0% (1)

- Welcome To Our PresentationDokument26 SeitenWelcome To Our Presentationnaimul_bariNoch keine Bewertungen

- ForexDokument62 SeitenForexVamshiKrishnaNoch keine Bewertungen

- P&B 33 Course Outline & CasesDokument3 SeitenP&B 33 Course Outline & CasesNiraj BhansaliNoch keine Bewertungen

- Buyback and Delisting of SharesDokument42 SeitenBuyback and Delisting of SharesSahil SinglaNoch keine Bewertungen

- Texas Comptroller Memo, STAR 200904303L (Apr. 24, 2009)Dokument2 SeitenTexas Comptroller Memo, STAR 200904303L (Apr. 24, 2009)Paul MastersNoch keine Bewertungen

- Evergreen Event Driven Marketing PDFDokument2 SeitenEvergreen Event Driven Marketing PDFEricNoch keine Bewertungen

- Giant Consumer ProductsDokument9 SeitenGiant Consumer ProductsPriyank BavishiNoch keine Bewertungen

- Management of Financial Institutions: DR Surendra Kumar VyasDokument36 SeitenManagement of Financial Institutions: DR Surendra Kumar VyasSurendra Kumar VyasNoch keine Bewertungen

- GalanzDokument2 SeitenGalanzChintan Jariwala100% (1)

- POM OutlineDokument3 SeitenPOM OutlineCupyCake MaLiya HaSanNoch keine Bewertungen

- Betting Against BetaDokument82 SeitenBetting Against BetaXad3rNoch keine Bewertungen

- Introduction To Economics and FinanceDokument10 SeitenIntroduction To Economics and FinanceShanti Prakhar AwasthiNoch keine Bewertungen

- MeritsDokument2 SeitenMeritsJyotika KodwaniNoch keine Bewertungen

- Sales Promotion For JNJDokument10 SeitenSales Promotion For JNJShailesh Bhadra100% (1)

- Foreign Exchange On First Security Islami Bank LTDDokument60 SeitenForeign Exchange On First Security Islami Bank LTDAhadul Islam100% (2)

- Bba 2011-2Dokument17 SeitenBba 2011-2xiaoM93Noch keine Bewertungen

- Credit Ratings: Amity Business SchoolDokument22 SeitenCredit Ratings: Amity Business SchoolRicky BhatiaNoch keine Bewertungen