Beruflich Dokumente

Kultur Dokumente

How To Make Money in The Stock Market

Hochgeladen von

nirav_k_pathakOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How To Make Money in The Stock Market

Hochgeladen von

nirav_k_pathakCopyright:

Verfügbare Formate

H o w t o ma k e mo n e y i n t h e s t o c k ma r k e t ?

I n r o d u c t i o n

This article is a COMPLETE guide to the basics of making money in

the stock market If you are considering in!esting in the stock

market" you M#$T read this article %e ha!e e&'lained all the

conce'ts and talked about all the (myths( that 'eo'le ha!e about the

stock market

%h a t a r e s t o c k s ? )e f i n i t i o n *

Plain and sim'le" a +stock, is a share in the ownershi' of a com'any-

. stock re'resents a claim on the com'any/s assets and earnings- .s

you ac0uire more stocks" your ownershi' stake in the com'any

becomes greater-

1ote* $ome times different words like shares" e0uity" stocks etc- are

used- .ll these words mean the same thing-

$ o wh a t d o e s o wn e r s h i ' o f a c o m' a n y g i ! e y o u ?

Holding a com'any/s stock means that you are one of the many

owners 2shareholders3 of a com'any and" as such" you ha!e a claim

to e!erything the com'any owns-

This means that technically you own a tiny little 'iece of all the

furniture" e!ery trademark" and e!ery contract of the com'any- .s an

owner" you are entitled to your share of the com'any/s earnings as

well-

These earnings will be gi!en to you- These earnings are called

+di!idends, and are gi!en to the shareholders from time to time-

. stock is re'resented by a (stock certificate(- This is a 'iece of 'a'er

that is 'roof of your ownershi'- Howe!er" now4a4days you could also

ha!e a +demat, account- This means that there will be no +stock

certificates,- E!erything will be done though the com'uter

electronically- $elling and buying stocks can be done 5ust by a few

clicks-

6eing a shareholder of a 'ublic com'any does not mean you ha!e a

say in the day4to4day running of the business- Instead" +one !ote 'er

share, to elect the board of directors of the com'any at annual

meetings is all you can do- 7or instance" being a Microsoft

shareholder doesn/t mean you can call u' 6ill 8ates and tell him how

you think the com'any should be run-

The management of the com'any is su''osed to increase the !alue

of the firm for shareholders- If this doesn/t ha''en" the shareholders

can !ote to ha!e the management remo!ed- In reality" indi!idual

in!estors like you and I don/t own enough shares to ha!e a material

influence on the com'any- It/s really the big boys like large

institutional in!estors and billionaire entre'reneurs who make the

decisions-

7or ordinary shareholders" not being able to manage the com'any

isn/t such a big deal- .fter all" the idea is that you don/t want to ha!e

to work to make money" right? The im'ortance of being a

shareholder is that you are entitled to a 'ortion of the com'any9s

'rofits and ha!e a claim on assets-

Profits are sometimes 'aid out in the form of di!idends as mentioned

earlier- The more shares you own" the larger the 'ortion of the 'rofits

you get- :our claim on assets is only rele!ant if a com'any goes

bankru't- In case of li0uidation" you/ll recei!e what/s left after all the

creditors ha!e been 'aid-

.nother e&tremely im'ortant feature of stock is (limited liability("

which means that" as an owner of a stock" you are (not 'ersonally

liable( if the com'any is not able to 'ay its debts-

In other legal structures such as 'artnershi's" if the 'artnershi' firm

goes bankru't the creditors can come after the 'artners +'ersonally,

and sell off their house" car" furniture" etc- To understand all this in

more detail you could read our +How to incor'orate?, article-

Owning stock means that" no matter what ha''ens to the com'any"

the ma&imum !alue you can lose is the !alue of your stocks- E!en if a

com'any of which you are a shareholder goes bankru't" you can

ne!er lose your 'ersonal assets-

%hy would the founders share the 'rofits with thousands of 'eo'le

when they could kee' 'rofits to themsel!es? This is the ob!ious

0uestion that comes u' ne&t- This what the ne&t section is all about

1e&t 4 %hy do com'anies issue stocks? ;;

%h y d o e s a c o m' a n y i s s u e s t o c k s ?

%hy would the founders share the 'rofits with thousands of 'eo'le

when they could kee' 'rofits to themsel!es? The reason is that at

some 'oint e!ery com'any needs to (raise money(- To do this"

com'anies can either borrow it from somebody or raise it by selling

'art of the com'any" which is known as issuing stock-

. com'any can borrow by taking a loan from a bank or by issuing

bonds- 6oth methods come under (debt financing(- On the other

hand" issuing stock is called +e0uity financing,- Issuing stock is

ad!antageous for the com'any because it does not re0uire the

com'any to 'ay back the money or make interest 'ayments along

the way-

.ll that the shareholders get in return for their money is the ho'e

that the shares will someday be worth more than what they 'aid for

them- The first sale of a stock" which is issued by the 'ri!ate

com'any itself" is called the initial 'ublic offering 2IPO3-

It is im'ortant that you understand the distinction between a

com'any financing through debt and financing through e0uity- %hen

you buy a debt in!estment such as a bond" you are guaranteed the

return of your money 2the 'rinci'al3 along with 'romised interest

'ayments-

This isn/t the case with an e0uity in!estment- 6y becoming an owner"

you assume the risk of the com'any not being successful 4 5ust as a

small business owner isn/t guaranteed a return" neither is a

shareholder- $hareholders earn a lot if a com'any is successful" but

they also stand to lose their entire in!estment if the com'any isn/t

successful-

I t 9 s a t r i c k y g a me

1ote that* There are no guarantees when it comes to indi!idual

stocks- $ome com'anies 'ay out di!idends" but many others do not-

.nd there is no obligation to 'ay out di!idends- %ithout di!idends" an

in!estor can make money on a stock only through its a''reciation of

the stock 'rice in the o'en market-

On the downside" any stock may go bankru't" in which case your

in!estment is worth nothing-

Ha!ing understood this" we now want to know what makes stock

'rices rise and fall? If we know this" we will know which stocks to

buy- In the ne&t section we will try to understand what makes stock

'rices go u' and down-

%h a t ma k e s s t o c k ' r i c e s g o ( u ' ( a n d ( d o wn ( ?

$tock 'rices change e!ery day because of market forces- 6y this we

mean that stock 'rices change because of +su''ly and demand,- If

more 'eo'le want to buy a stock 2demand3 than sell it 2su''ly3" then

the 'rice mo!es u'

Con!ersely" if more 'eo'le wanted to sell a stock than buy it" there

would be greater su''ly than demand" and the 'rice would fall-

26asics of economics3

#nderstanding su''ly and demand is easy- %hat is difficult to

understand is what makes 'eo'le like a 'articular stock and dislike

another stock- If you understand this" you will know what 'eo'le are

buying and what 'eo'le are selling- If you know this you will know

what 'rices go u' and what 'rices go down

To figure out the likes and dislikes of 'eo'le" you ha!e to figure out

what news is 'ositi!e for a com'any and what news is negati!e and

how any news about a com'any will be inter'reted by the 'eo'le-

The most im'ortant factor that affects the !alue of a com'any is its

earnings- Earnings are the 'rofit a com'any makes" and in the long

run no com'any can sur!i!e without them- It makes sense when you

think about it- If a com'any ne!er makes money" it isn/t going to stay

in business- Public com'anies are re0uired to re'ort their earnings

four times a year 2once each 0uarter3-

)alal $treet watches with great attention at these times" which are

referred to as earnings seasons- The reason behind this is that

analysts base their future !alue of a com'any on their earnings

'ro5ection-

If a com'any/s results are better than e&'ected" the 'rice 5um's u'-

If a com'any/s results disa''oint and are worse than e&'ected" then

the 'rice will fall-

Of course" it/s not 5ust earnings that can change the feeling 'eo'le

ha!e about a stock- It would be a rather sim'le world if this were the

case )uring the +dotcom bubble," for e&am'le" the stock 'rice of

do<ens of internet com'anies rose without e!er making e!en the

smallest 'rofit- .s we all know" these high stock 'rices did not hold"

and most internet com'anies saw their !alues shrink to a fraction of

their highs- $till" this fact demonstrates that there are factors other

than current earnings that influence stocks-

$o" what are (all the factors( that affect the stocks 'rice? The best

answer is that nobody really knows for sure- $ome belie!e that it

isn/t 'ossible to 'redict how stock 'rices will change" while others

think that by drawing charts and looking at 'ast 'rice mo!ements"

you can determine when to buy and sell- The only thing we do know

is that stocks are !olatile and can change in 'rice !ery !ery ra'idly-

=ust remember this* .t the most fundamental le!el" su''ly and

demand in the market determines stock 'rice-

There are many ty'es of techni0ues and methods that in!estors use

to figure out whether a stock 'rice will go u' or down %e will try to

gi!e you an introduction to these techni0ues in this article-

6ut before we go into the conce'ts of stocks 'icking" and the

techi0ues of analysis" let us understand one last basic thing----

1e&t 4 %hat are the $ense& > the 1ifty? ;;

%h a t a r e t h e $ e n s e & > t h e 1 i f t y ?

The $ense& is an (inde&(- %hat is an inde&? .n inde& is basically an

indicator- It gi!es you a general idea about whether most of the

stocks ha!e gone u' or most of the stocks ha!e gone down-

The $ense& is an indicator of all the ma5or com'anies of the 6$E-

The 1ifty is an indicator of all the ma5or com'anies of the 1$E-

If the $ense& goes u'" it means that the 'rices of the stocks of most

of the ma5or com'anies on the 6$E ha!e gone u'- If the $ense& goes

down" this tells you that the stock 'rice of most of the ma5or stocks

on the 6$E ha!e gone down-

=ust like the $ense& re'resents the to' stocks of the 6$E" the 1ifty

re'resents the to' stocks of the 1$E-

=ust in case you are confused" the 6$E" is the 6ombay $tock

E&change and the 1$E is the 1ational $tock E&change- The 6$E is

situated at 6ombay and the 1$E is situated at )elhi- These are the

ma5or stock e&changes in the country- There are other stock

e&changes like the Calcutta $tock E&change etc- but they are not as

'o'ular as the 6$E and the 1$E-Most of the stock trading in the

country is done though the 6$E > the 1$E-

6esides $ense& and the 1ifty there are many other inde&es- There is

an inde& that gi!es you an idea about whether the mid4ca' stocks go

u' and down- This is called the +6$E Mid4ca' Inde&,- There are many

other ty'es of inde&es-

There is an inde& for the metal stocks- There is an inde& for the

7MC8 stocks- There is an inde& for the automobile stocks etc- If you

are interested in knowing how the $E1$E? is actually calculated---you

must check4out our (How to calculate 6$E $E1$E??( article

6ut" before we go ahead and try to understand (How to make money

in the stock market?( you M#$T read the ne&t 'age----

1e&t 4 @ things e!ery stock in!estor M#$T remember ;;

@ i m' o r t a n t t h i n g s y o u mu s t k n o w a n d f o l l o w a s a n

n e w i n ! e s t o r

:ou need to A1O% some +unforgettable basics, before you enter the

world of in!esting in stocks- The stock market is a field dominated by

sa!!y in!estors who know the ins4and4outs of the market- 7or 'eo'le

who are not +on the inside," the stock market can be a BEC:

dangerous 'lace- *

)on/t e!en consider (ti's( that tell you about (hot stocks(- Consider

the source* There are many 'eo'le in the market who 'ut in all their

time and effort in 'romoting certain stocks- They do this because they

ha!e their money in!ested in those stocks- If they can get enough

'eo'le to buy the stock and they can get the stock 'rice to rise" they

will sell the stock for a huge 'rice" the stock 'rice will crash and they

will walk off to 'romote another stock-

.lways use your own brain* It/s e&tremely im'ortant- :ou must always

use your own brain- Celying on the ad!ice of others" no matter how

well intentioned it may be" is almost always a com'lete disaster- Make

sure you dig in and really e&amine the (facts about the com'anies(

before you in!est- Ignore 'ress releases which ha!e !ery little

substance" and rely on (hy'e( to tell the com'any/s story-

.nd finally the most im'ortant ti'

Only in!est money you can afford to lose $ure this is a basic 'oint"

but many many 'eo'le miss it- :ou should only in!est money that you

can honestly afford to lose E!eryone enters into in!estments with

the idea of earning big 'rofits" but in many cases" this ne!er works-

2Es'ecially if you are new to in!esting in the stock market3

Please understand that the abo!e ti's are ti's for beginners- Once you

really get into the stock market you do not need to follow these rules

anymore- 6ut if you are a new in!estor" you M#$T follow these rules-

They are for your own safety-

6ut then again" nothing comes free- E!erything has a 'rice- :ou will

ha!e to loose some money" make some bad decisions and then only

will you really understand the market- :ou cannot understand the

market by 5ust looking at it from far- 6y following these rules" you will

basically not loose too much

1e&t 4 How to decide which stocks to buy? ;;

$ t o c k P i c k i n g 4 %h i c h s t o c k s t o b u y ?

Ha!ing understood all the basics of the stock market and the risk

in!ol!ed" now we will go into stock 'icking and how to 'ick the right

stock- 6efore 'icking the right stock you need to do some analysis-

There are two ma5or ty'es of analysis*

D- 7undamental .nalysis

E- Technical .nalysis

7undamental analysis is the analysis of a stock on the basis of core

financial and economic analysis to 'redict the mo!ement of stocks

'rice-

On the other hand" technical analysis is the study of 'rices and

!olume" for forecasting of future stock 'rice or financial 'rice

mo!ements-

$im'ly 'ut" fundamental analysis looks at the actual com'any and

tries to figure out what the com'any 'rice is going to be like in the

future- On the other hand technical analysis look at the stocks chart"

'eo'les buying beha!ior etc- to try and figure out what the stock

'rice is going to be like in the future-

In this article we will go into the basics of +fundamental analysis,-

Technical analysis is a little more com'licated- It is much more of an

(art( than a science- It de'ends more on e&'erience and in!ol!es

some statistics and mathematics" so e&'laining technical analysis is

out of the sco'e of this article-

Next - Basics of fundamental anallysis! >>

T h e 6 a s i c s o f 7 u n d a me n t a l . n a l y s i s

7 u n d a me n t a l . n a l y s i s )e f i n i t i o n

7undamental analysis is a stock !aluation method that uses financial

and economic analysis to 'redict the mo!ement of stock 'rices-

The fundamental information that is analy<ed can include a com'any/s

financial re'orts" and non4financial information such as estimates of

the growth of demand for 'roducts sold by the com'any" industry

com'arisons" and economy4wide changes" changes in go!ernment

'olicies etc--

8 e n e r a l $ t r a t e g y

To a fundamentalist" the market 'rice of a stock tends to mo!e

towards it/s +real !alue, or +intrinsic !alue,- If the +intrinsicFreal !alue,

of a stock is abo!e the current market 'rice" the in!estor would

'urchase the stock because he knows that the stock 'rice would rise

and mo!e towards its +intrinsic or real !alue,

If the intrinsic !alue of a stock was below the market 'rice" the

in!estor would sell the stock because he knows that the stock 'rice is

going to fall and come closer to its intrinsic !alue-

.ll this seems sim'le- 1ow the ne&t ob!ious 0uestion is how do you

find out what the intrinsic !alue of a com'any is? Once you know this"

you will be able to com'are this 'rice to the market 'rice of the

com'any and decide whether you want to buy it 2or sell it if you

already own that stock3-

To start finding out the intrinsic !alue" the fundamentalist analy<er

makes an e&amination of the current and future o!erall health of the

economy as a whole-

.fter you analy<ed the o!erall economy" you ha!e to analy<e firm you

are interested in- :ou should analy<e factors that gi!e the firm a

com'etiti!e ad!antage in it9s sector such as management e&'erience"

history of 'erformance" growth 'otential" low cost 'roducer" brand

name etc- 7ind out as much as 'ossible about the com'any and their

'roducts-

)o they ha!e any +core com'etency, or +fundamental strength, that

'uts them ahead of all the other com'eting firms?

%hat ad!antage do they ha!e o!er their com'eting firms?

)o they ha!e a strong market 'resence and market share?

Or do they constantly ha!e to em'loy a large 'art of their 'rofits and

resources in marketing and finding new customers and fighting for

market share?

.fter you understand the com'any > what they do" how they relate to

the market and their customers" you will be in a much better 'osition

to decide whether the 'rice of the com'anies stock is going to go u'

or down-

Ha!ing understood the basics of fundamental analysis" let us go into

some more details-

%hen in!esting in the stocks" we want the 'rice of our stock to rise-

1ot only do we want our stock 'rice to rise" we want it to rise 7.$T

$o the challenge is to figure out* which stock 'rices are going to rise

fast?

$ome stocks are chea' and some are costly- $ome are worth Cs-GHH

and some are e!en worth GH'aise- 6ut the 'rice of the stock is not

im'ortant- The 'rice of the stock does not make a stock good to buy-

%hat is im'ortant is how much the 'rice of the stock is likely to rise-

If you in!est Cs-GHH in one stock of Cs-GHH and the 'rice goes u' to

Cs-GIH you will make Cs-IH- Howe!er" if you in!est Cs-GHH in a

GH'aise stock" you will ha!e DHHH stocks- If the 'rice of the stock

goes u' from GH'aise to Cs-D" then the Cs-GHH you in!ested is now

Cs-DHHH- :ou made a 'rofit of Cs-GHH-

If you understand this" you can see that the 'rice of the stock is not

im'ortant- %hat is im'ortant is the rise in the stock9s 'rice- More

s'ecifically the +'ercentage, rise in the stock 'rice is im'ortant-

If the Cs-GHH stock becomes worth Cs-GIH" then that is a JK rise-

This JK rise only makes us Cs-IH- On the other hand when we in!est

the same Cs-GHH in the GH'aise stock and the stock 'rice goes u' to

Cs-D" it is a DHHK rise as the stock 'rice has doubled- This DHHK rise

makes us Cs-GHH-

The 'oint is that when 'icking a com'any" we are interested in a

com'any whose stock 'rice will rise by a large 'ercentage-

Please note* Looking at the abo!e 'aragra'hs" it may seem like a

good idea to buy all the really chea' GH'aise and Cs-D stocks ho'ing

that their 'rice will rise by DHHK or more- This sounds good" but it

can also be really really bad some times These really small stocks are

!ery !olatile and unless you know what you are doing" do 1OT get

into them-

Howe!er" the 'oint to be noted is that we are interested in stocks that

will ha!e the highest K rise in the stock 'rice- 1ow the 0uestion is"

how do you com'are stocks- How do you com'are a stock worth

Cs-GHH to a stock worth GH'aise and figure out which one will ha!e a

higher 'ercentage rise-

How do you com'are two com'anies that are in different fields and

different industries? How do you know which one is fundamentally

strong and which one is week?

If you try to com'are two com'anies in different industries and

different customers it is like com'aring a''les and ele'hants- There is

no way to com'are them

$o fundamental analysts use different tools and ratios to com'are all

sorts of com'anies no matter what business they are in or what they

do

1e&t let us get into the tools and ratios that tell us about the

com'anies and their com'arison----

1e&t 4 %hat is Earnings Per $hare 2EP$3 ratio?? ;;

E a r n i n g s ' e r s h a r e 2 E P $ 3 r a t i o > wh a t i t me a n s

E!en com'aring the earnings of one com'any to another really

doesn9t make any sense" if you think about it- Earnings will tell you

nothing about how many shares the com'any has- 6ecause you do

not know how many shares a com'any has" you do not know how

many 'arts that com'anies earnings ha!e to be di!ided into- If the

com'any has more shares" the earnings will be di!ided into more

'arts-

7or e&am'le" com'anies . and 6 both earn Cs-DHH" but com'any .

has DH shares outstanding" so each share holder has in effect earned

Cs-DH-

On the other hand" if com'any 6 has GH shares outstanding and they

too ha!e earned Cs-DHH then each shareholder has earned Cs-E- $o

you see it is im'ortant to know what is the total number of

outstanding shares are as well as the earnings-

Thus it makes more sense to look at earnings 'er share 2EP$3" as a

com'arison tool- :ou calculate earnings 'er share by taking the net

earnings and di!ide by the outstanding shares-

EP$ L 1et Earnings F Outstanding $hares

$o looking at the EP$ ratio" you should go buy Com'any . with an

EP$ of DH" right? EP$ is not the only basis of com'aring two

com'anies" but it is one of the methods used-

1ote that there are three ty'es of EP$ numbers*

Trailing EP$ M last year9s numbers and the only actual EP$

Current EP$ M this year9s numbers" which are still 'ro5ections

7orward EP$ M future numbers" which are ob!iously

'ro5ections

EP$ doesn9t tell you whether it9s a good stock to buy or what the

market thinks of it- 7or that information" we need to look at some

other ratios ne&t----

1e&t 4 Price to earnings ratio 2PFE3 ratio > what is it? ;;

P r i c e t o e a r n i n g 2 P F E 3 r a t i o > wh a t i t me a n s ?

If there is one number that 'eo'le look at than more any other

number" it is the +Price to Earning Catio 2PFE3,- The PFE is a ratio that

in!estors throw around with confidence as if it told the com'lete story-

Of course" it doesn9t tell the whole story 2if it did" we wouldn9t need all

the other numbers-3

The PFE looks at the relationshi' between the stock 'rice and the

com'any9s earnings- The PFE is the most 'o'ular stock analysis ratio"

although it is not the only one you should consider-

:ou calculate the PFE by taking the share 'rice and di!iding it by the

com'any9s EP$ 2Earnings Per $hare that we saw abo!e3

PFE L $tock Price F EP$

7or e&am'le* . com'any with a share 'rice of Cs-IH and an EP$ of J

would ha!e a PFE of* 2IH F J3 L G

%h a t d o e s P F E t e l l y o u ?

$ome in!estors read a high PFE as an +o!er'riced stock,-

Howe!er" it can also indicate the market has high ho'es for this

stock9s future and has bid u' the 'rice-

Con!ersely" a low PFE may indicate a +!ote of no confidence, by the

market or it could mean that the market has 5ust o!erlooked the

stock- Many in!estors made their fortunes s'otting these o!erlooked

but fundamentally strong stocks before the rest of the market

disco!ered their true worth-

In conclusion" the PFE tells you what the market thinks of a stock- It

tells you whether the market likes or dislikes the stock- If things are

!ague and unclear to you" do not worry- The ne&t ratio will make

e!erything you read till now make sense--

1e&t 4 PE8 ratio > what it means-- ;;

P E 8 2 P r i c e t o f u t u r e g r o wt h r a t i o 3 a n d wh a t i t t e l l s

y o u

The market is usually more concerned about the future than the

'resent" it is always looking for some way to figure out what is going

to ha''en in the com'anies future-

. ratio that will hel' you look at future earnings growth is called the

PE8 ratio-

:ou calculate the PE8 by taking the PFE and di!iding it by the

'ro5ected growth in earnings-

PE8 L 2PFE3 F 2'ro5ected growth in earnings3

7or e&am'le" a stock with a PFE of @H and 'ro5ected earning growth

ne&t year of DGK would ha!e a PE8 of @H F DG L E-

%h a t d o e s t h e + E , me a n ?

Technically s'eaking* The lower the PE8 number" the less you 'ay for

each unit of future earnings growth- $o e!en a stock with a high PFE"

but high 'ro5ected earning growth may be a good !alue-

$o" to 'ut it !ery sim'ly" we are interested in stocks with a low PE8

!alue-

=ust for the sake of understanding" consider this situation" you ha!e a

stock with a low PFE- $ince the stock is has a low PFE" you start do

wonder why the stock has a low PFE- Is it that the stock market does

not like the stock? Or is it that the stock market has o!erlooked a

stock that is actually fundamentally !ery strong and of good !alue?

To figure this out" you look at the PE8 ratio- 1ow" if the PE8 ratio is

big 2or close to the PFE ratio3" you can understand that this is

'robably because the +'ro5ected growth earnings, are low- This is the

kind of stock that the stock market thinks is of not much !alue-

On the other hand" if the PE8 ratio is small 2or !ery small as

com'ared to the PFE ratio" then you know that it is a !aluable stock3

you know that the 'ro5ected earnings must be high- :ou know that

this is the kind of fundamentally strong stock that the market has

o!erlooked for some reason-

Im'ortant note* :ou must understand that the PE8 ratio relies on the

'ro5ected K earnings- These earnings are not always accurate and so

the PE8 ratio is not always accurate-

Ha!ing understood these basic three ratios" you 'robably ha!e

started to understand how these ratios hel' you understand a stock

and what is !aluable and what is not-

In the ne&t section we shall look at some of the things that e!ery

in!estor must know about- $omething that $ILE1TL: eats into the

'rofits of each and e!ery in!estor and how to beat it---

1e&t 4 Inflation and how it silently eats your money ;;

( I n f l a t i o n ( > h o w i t e a t s y o u r mo n e y s i l e n t l y > a f f e c t s

y o u r i n ! e s t me n t s

Inflation" is an economic conce't- %hat the cause of inflation is" is

not im'ortant to us from the 'oint of !iew of this article- %hat is

im'ortant to us is the effect of inflation The effect of inflation is the

'rices of e!erything going u' o!er the years-

. mo!ie ticket was for a few 'aise in my dad9s time- 1ow it is worth

Cs-GH- My dads first salary for the month was Cs-IHH and o!er he

years it has now become Cs-NG"HHH- This is what inflation is" the

'rice of e!erything goes u'- 6ecause the 'rice goes u'" the salaries

go u'-

If you really thing about it" inflation makes the worth of money

reduce- %hat you could buy in my dad9s time for Cs-DH" now a days

you will not be able to buy for Cs-IHH also- The worth of money has

reduced If this is still not clear consider this" when my father was a

kid" he used to get GH'aise 'ocket money- He used to use this money

to go and watch a mo!ie 2.t that time you could watch a mo!ie for

GH'aise3

1ow" 5ust for the sake of understanding assume that my dad decided

in his childhood to sa!e GH'aise thinking" that one day when he

becomes big" he will go for a mo!ie- Many years 'ass- The year now

is EHHO- My dad goes to the theater and asks for a ticket- He offers

the ticket4booth4guy at the theater GH'aise and asks for a ticket- The

ticket booth guy says" +I am sorry sir" the ticket is worth Cs-GH- :ou

will not be able to e!en buy a +'aan, with the GH'aise,

The moral of the story is that" the worth of the GH'aise reduced

dramatically- GH'aise could buy a whole lot when my dad was a kid-

1ow" GH'aise can buy nothing- This is inflation- This tells us two

im'ortant things-

7irstly* )o not kee' your money stagnant- If you 5ust sa!e money by

'utting it your safe it will loose !alue o!er time- If you ha!e Cs-DHHH

in your safe today and you kee' it there for DHyears or so" it will be

worth a lot less after DH years- If you can buy something for Cs-DHHH

today" you will 'robably re0uire Cs-DGHH to buy it DH years from now-

$o do not kee' money locked u' in your safe-

.lways in!est money-

If you can9t think where to in!est your money" then 'ut it in a bank-

Let it grow by gaining interest- 6ut whate!er you do" do not 5ust lock

your money u' in your safe and kee' it stagnant- If you do this" you

will be loosing money without e!en knowing it- The more money you

kee' stagnant the more money you will be loosing-

$econdly* %hen in!esting" you ha!e to make sure that the rate of

return on your in!estment is higher than the rate of inflation-

%h a t i s t h e r a t e o f i n f l a t i o n ?

.s we said earlier" the 'rices of e!erything goes u' o!er time and this

'henomenon is called inflation- The 0uestion is* 6y how much do the

'rices go u'? .t what rate do the 'rices do u'?

The rate at which the 'rices of e!erything go u' is called the (rate of

inflation(- 7or e&am'le" if the 'rice of something is Cs-DHH this year

and ne&t year the 'rice becomes a''ro&imately Cs-DHI then the rate

of inflation is IK- If the 'rice of something is Cs-JH then after a year

with a rate of inflation of IK the 'rice go u' to 2JH & D-HI3 L J@-E

$o" when you make an in!estment" make sure that your rate of

return on the in!estment is higher than the rate of inflation in your

country- In our county India" for the year EHHG4EHHO the rate of

inflation was IK 2%hich is really low and ama<ing3- This rate kee's

changing e!ery year- The finance minister generally gi!es the official

statement on the inflation rate of the country for a 'articular year-

%h a t i s t h e r a t e o f r e t u r n ?

The rate of return is how much you make on an in!estment- $u''ose

you in!est Cs-DHH in the market and o!er a year" you make Cs-DEH"

then you rate of return is EHK-

If you in!est Cs-DHH in the market today and you make money at a

@K (rate of return( in one year you will ha!e Cs-DH@- 6ut now" since

the rate of inflation is at IK" an item costing Cs-DHH today will cost

Cs-DHI a year from now- $o what you can buy with today9s Cs-DHH"

you will only be able to buy with Cs-DHI a year from now-

6ut the Cs-DHH that you in!ested has grown only at a @K rate of

return and so it is worth Cs-DH@- In effect" you are loosing money

$o in conclusion" the rate of return on your in!estments" ha!e to be

higher than the rate of inflation-

7rom the abo!e 'aragra'hs you can note how silently" inflation eats

into your money- :ou would not e!en know about it an your money

would sit loosing !alue for no fault of yours- 6ut inflation is not the

only thing you should be considering" there are other things too that

eat into you money- The first thing is +brokerage, and the second

thing is +ta&ation,-

1e&t 4 6rokerage > Ta&ation-- ;;

I n ! e s t o r s b e wa r e o f * 6 r o k e r a g e a n d t a & a t i o n

:ou 'robably know the conce't that all your transactions in the stock

market are done though a (stockbroker(- . stockbroker earns a

commission on whate!er transaction you make- $u''ose you make a

transaction of Cs-EHHH" and the stockbroker charges you a @K

commission" then you ha!e to 'ay the stockbroker Cs-OH 2@K of

Cs-EHHH3 for the transaction- $o your total in!estment in the

transaction in +not Cs-EHHH,- The total in!estment in the transaction

is Cs-EHOHF4

$o after sometime" if the 'rice of the stocks you in!ested in goes u'

to Cs-EHOH then you ha!e not made any money because the total

amount you in!ested was Cs-EHOHF4

%hat is more" e!en when you sell the stocks" you ha!e to 'ay the

broker brokerage of @K- This means that" when you sell the

stocks for Cs-EHOH" you ha!e to 'ay the broker Cs-OD-O so the 'rofit

of Cs-OH you made on the transaction is gone" in fact you actually

make a loss of Cs-D-O

$o in effect e!en though you made a 'rofit of Cs-OH because your

stock 'rice went u'" you ha!e actually made a loss-

If combine this with the fact that inflation reduces the !alue of money

o!er time" you are 5ust loosing money if you do not in!est wisely

without understanding brokerage and inflation-

Im'ortant note about brokerage* 6rokers make money on whate!er

transaction you make- %hether you buy or sell" brokers will make

money- 6ecause brokers basically make money on transactions-

6ecause of this" brokers tend to encourage you to trade- They don9t

really care about whether you make a 'rofit or loss- They 5ust care

about whether you are trading- The more money you are using for

trading" the more they will make- 6ecause of this" it would be wise to

not blindly follow your brokers ad!ise- The broker will gi!e you +hot

ti's, etc- not because they are looking out for you and your 'rofit"

but because they are thinking about their own 'ersonal 'rofit

There is e!en one more factor that eats into your money- Ta&

Please note* %e are not in any way encouraging you to not 'ay ta&

%e are 5ust educating you about it-

There is a +short term ca'ital gain ta&, in our country- 7or a short

term 2less than one year3 you ha!e to 'ay ta& on any ca'ital gain

you make though the stock market trading- How much K ta& you

ha!e to 'ay" de'ends on which (ta& bracket( you fall in-

=ust to gi!e you an idea- If I make Cs-DHH though a transaction in the

stock market" since I fall in the @@K ta& bracket- It ha!e to 'ay

Cs-@@ of that to the go!ernment

Please note* The go!ernment encourages you to be a long term4

in!estor by ha!ing no long term ca'ital gain ta&- If you make a

ca'ital gain by in!esting for a 'eriod greater than one year" the you

do not ha!e to 'ay any ta& on the money you make-

1ow combine this short term ca'ital gain ta& with brokerage and

inflation Think about it for some time- :ou will almost make nothing

on a small 'rofit gains If you want to make money out of the stock

market" you must make large 'rofit gains-

Conclusion* .s a general rule" 5ust for the sake of sim'licity" your

in!estments must grow at a minimum rate of DGK 'er year to stay

ahead of inflation" ta& and brokerage Cemember this when making

all your in!estments-

This concludes our basics of the stock market guide- There is lot

more to learn .nd the best way to do it is to start in!esting 2)on9t

in!est too much in the beginning but do start3 Once you ha!e your

money in the market" you will start to understand things a whole lot

better

6est of luck

=ai Hind-

Das könnte Ihnen auch gefallen

- The Rules, Part XI: Could An Investment Bank Go To Junk Status?Dokument12 SeitenThe Rules, Part XI: Could An Investment Bank Go To Junk Status?ekmoekmoNoch keine Bewertungen

- IPO - NetworthDokument73 SeitenIPO - NetworthsaiyuvatechNoch keine Bewertungen

- Trading Basics: Trade Buy or SellDokument4 SeitenTrading Basics: Trade Buy or SellTanja IvanovskaNoch keine Bewertungen

- Bulls On Wall StreetDokument50 SeitenBulls On Wall StreetKushal RaoNoch keine Bewertungen

- Securities Regulation HyposDokument46 SeitenSecurities Regulation HyposErin JacksonNoch keine Bewertungen

- The Secrets of Stock Market Success: How to Make Money Using Just a Few Blue Chip SharesVon EverandThe Secrets of Stock Market Success: How to Make Money Using Just a Few Blue Chip SharesNoch keine Bewertungen

- Chuck Akre Interview ROIICDokument6 SeitenChuck Akre Interview ROIICKen_hoangNoch keine Bewertungen

- How Stock Market WorksDokument9 SeitenHow Stock Market Worksmansi_patel150Noch keine Bewertungen

- Mandee's Stock Market Lesson Number TwoDokument3 SeitenMandee's Stock Market Lesson Number TwoJon Vincent DeaconNoch keine Bewertungen

- Debt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredDokument5 SeitenDebt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredRajat KaushikNoch keine Bewertungen

- Objective of The StudyDokument68 SeitenObjective of The StudyArchie SrivastavaNoch keine Bewertungen

- Random Musings Stocks and SharesDokument5 SeitenRandom Musings Stocks and SharesThavamNoch keine Bewertungen

- 10 Mistakes Every Investor Makes and How To Avoid ThemDokument26 Seiten10 Mistakes Every Investor Makes and How To Avoid ThemCarmenMoldovan100% (1)

- How To Make Money in Stock MarketDokument16 SeitenHow To Make Money in Stock MarketGanapatibo GanapatiNoch keine Bewertungen

- How To Start in Share Market.Dokument15 SeitenHow To Start in Share Market.amit_shahidNoch keine Bewertungen

- Stock Market Investing: Pathway to Wealth CreationVon EverandStock Market Investing: Pathway to Wealth CreationBewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Alternate Road To InvestingDokument13 SeitenThe Alternate Road To InvestingnatesanviswanathanNoch keine Bewertungen

- How To Make Money in The Stock Market?: InroductionDokument15 SeitenHow To Make Money in The Stock Market?: InroductionmarwahsanjeevNoch keine Bewertungen

- Modern Financial Management Solutions ManualDokument559 SeitenModern Financial Management Solutions Manualrutemarlene40Noch keine Bewertungen

- 03.stock Basics TutorialDokument13 Seiten03.stock Basics TutorialAMAN KUMAR KHOSLANoch keine Bewertungen

- How Stocks and The Stock Market Work.Dokument6 SeitenHow Stocks and The Stock Market Work.Andreea CristeaNoch keine Bewertungen

- Stocks A Newbies' Guide: An Everyday Guide to the Stock Market: Newbies Guides to Finance, #3Von EverandStocks A Newbies' Guide: An Everyday Guide to the Stock Market: Newbies Guides to Finance, #3Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- Penny StocksDokument16 SeitenPenny StocksDanaeus Avaris Cadmus100% (1)

- Analysis of Indian Mutual Funds Industry: A Project Report OnDokument77 SeitenAnalysis of Indian Mutual Funds Industry: A Project Report OnSohel BangiNoch keine Bewertungen

- Synthesis On Stock ValuationDokument2 SeitenSynthesis On Stock ValuationRu MartinNoch keine Bewertungen

- Safe Mode Stock Trading: Building up the trader's personality firstVon EverandSafe Mode Stock Trading: Building up the trader's personality firstNoch keine Bewertungen

- Section 2: EQUITY: Chapter 2:getting Familiar With Market Related ConceptsDokument7 SeitenSection 2: EQUITY: Chapter 2:getting Familiar With Market Related ConceptsRagavendra RagsNoch keine Bewertungen

- Trend Following: Learn to Make a Fortune in Both Bull and Bear MarketsVon EverandTrend Following: Learn to Make a Fortune in Both Bull and Bear MarketsBewertung: 4.5 von 5 Sternen4.5/5 (40)

- Choi (1) 1.SecuritiesRegulation - Fall2006Dokument32 SeitenChoi (1) 1.SecuritiesRegulation - Fall2006Erin JacksonNoch keine Bewertungen

- Equity MasterDokument24 SeitenEquity MasterAbhay AgrahariNoch keine Bewertungen

- How To Make Money in The Stock MarketDokument4 SeitenHow To Make Money in The Stock MarketKarthik PatilNoch keine Bewertungen

- Successful Stock Trading by Nick RadgeDokument64 SeitenSuccessful Stock Trading by Nick RadgeAli Sahbani Harahap100% (1)

- What Has QE Wrought?Dokument10 SeitenWhat Has QE Wrought?richardck61Noch keine Bewertungen

- Chapter 15 Alternative Corporate Restructuring StrategiesDokument7 SeitenChapter 15 Alternative Corporate Restructuring StrategiesNishtha SethNoch keine Bewertungen

- Chapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsDokument5 SeitenChapter Fifteen Money and Banking: Answers To End-Of-Chapter QuestionsSteven HouNoch keine Bewertungen

- Chap 001 FinanceDokument36 SeitenChap 001 FinanceNirmal SasidharanNoch keine Bewertungen

- Sell Short: A Simpler, Safer Way to Profit When Stocks Go DownVon EverandSell Short: A Simpler, Safer Way to Profit When Stocks Go DownBewertung: 1 von 5 Sternen1/5 (2)

- Basics of Stocks and Stock MarketsDokument13 SeitenBasics of Stocks and Stock MarketsPraveen R VNoch keine Bewertungen

- Know Penny Stock Trading: How to Start Trading Penny Stocks and Make MoneyVon EverandKnow Penny Stock Trading: How to Start Trading Penny Stocks and Make MoneyBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The Investor's Guide to Active Asset Allocation: Using Technical Analysis and ETFs to Trade the MarketsVon EverandThe Investor's Guide to Active Asset Allocation: Using Technical Analysis and ETFs to Trade the MarketsBewertung: 2.5 von 5 Sternen2.5/5 (2)

- Financial Accounting and Statement Analysis HEC MBA Program Frequently Asked Questions and Additional InformationDokument16 SeitenFinancial Accounting and Statement Analysis HEC MBA Program Frequently Asked Questions and Additional InformationZaidpzaidNoch keine Bewertungen

- Rule 1 of Investing: How to Always Be on the Right Side of the MarketVon EverandRule 1 of Investing: How to Always Be on the Right Side of the MarketBewertung: 4 von 5 Sternen4/5 (3)

- Stock Market Investing for Beginners & DummiesVon EverandStock Market Investing for Beginners & DummiesBewertung: 4.5 von 5 Sternen4.5/5 (25)

- 1035unit 1 FranchisingDokument18 Seiten1035unit 1 FranchisingMagdalena Bonis100% (1)

- Customer Satisfaction in Retail IndustryDokument59 SeitenCustomer Satisfaction in Retail Industrypriya682Noch keine Bewertungen

- Simple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedVon EverandSimple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedNoch keine Bewertungen

- In The Same Order The Questions Are Posed. Write Your Answers Only On The Front, Not The BackDokument14 SeitenIn The Same Order The Questions Are Posed. Write Your Answers Only On The Front, Not The BackCacaCamenforteNoch keine Bewertungen

- Binary Options BullyDokument54 SeitenBinary Options BullyWilliam Merino QuinterosNoch keine Bewertungen

- Stock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksVon EverandStock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksNoch keine Bewertungen

- Financial Freedom Blueprint: 7 Steps to Accelerate Your Path to ProsperityVon EverandFinancial Freedom Blueprint: 7 Steps to Accelerate Your Path to ProsperityNoch keine Bewertungen

- Vsa Basics From MTMDokument32 SeitenVsa Basics From MTMabanso100% (1)

- Mandee's Stock Lesson Number 1Dokument2 SeitenMandee's Stock Lesson Number 1Jon Vincent DeaconNoch keine Bewertungen

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDokument3 SeitenHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraNoch keine Bewertungen

- Chad Mason-EipDokument10 SeitenChad Mason-Eipapi-242260881Noch keine Bewertungen

- How To ResignDokument22 SeitenHow To ResigndskymaximusNoch keine Bewertungen

- MM CM Inch ('') Feet (') M KM Mile Yard 1 MM 1 CM 1 Inch ('') 1 Feet (') 1 M 1 KM 1 Mile 1 YardDokument1 SeiteMM CM Inch ('') Feet (') M KM Mile Yard 1 MM 1 CM 1 Inch ('') 1 Feet (') 1 M 1 KM 1 Mile 1 Yardnirav_k_pathakNoch keine Bewertungen

- Aus VELSDokument153 SeitenAus VELSnirav_k_pathakNoch keine Bewertungen

- Parent TitleDokument18 SeitenParent Titlenirav_k_pathakNoch keine Bewertungen

- Advanced SQL SkillsDokument22 SeitenAdvanced SQL Skillsnirav_k_pathakNoch keine Bewertungen

- Reading Comprehension Strategies: Make Connections Visualize Ask QuestionsDokument1 SeiteReading Comprehension Strategies: Make Connections Visualize Ask Questionsnirav_k_pathakNoch keine Bewertungen

- Irregular Verbs: Base Form Past Simple Past ParticipleDokument5 SeitenIrregular Verbs: Base Form Past Simple Past Participlenirav_k_pathakNoch keine Bewertungen

- How To Teach Preschool ReadingDokument3 SeitenHow To Teach Preschool Readingnirav_k_pathakNoch keine Bewertungen

- The Demand Curve Facing A Competitive Firm The ...Dokument3 SeitenThe Demand Curve Facing A Competitive Firm The ...BLESSEDNoch keine Bewertungen

- OA Frame Work Students GuideDokument545 SeitenOA Frame Work Students GuideutphalrainaNoch keine Bewertungen

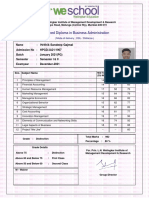

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDokument1 SeiteAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNoch keine Bewertungen

- A Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaDokument18 SeitenA Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaShailav SahNoch keine Bewertungen

- Case OverviewDokument9 SeitenCase Overviewmayer_oferNoch keine Bewertungen

- UniqloDokument13 SeitenUniqloMohit Budhiraja100% (1)

- The Investment Portfolio: Maria Aleni B. VeralloDokument11 SeitenThe Investment Portfolio: Maria Aleni B. VeralloMaria Aleni100% (1)

- High Line CorruptionDokument3 SeitenHigh Line CorruptionRobert LedermanNoch keine Bewertungen

- Starbucks PowerPointDokument20 SeitenStarbucks PowerPointAdarsh BhoirNoch keine Bewertungen

- Lowrider - June 2018Dokument92 SeitenLowrider - June 2018Big Flores100% (2)

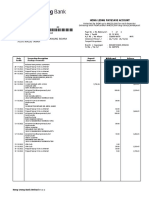

- HLB Receipt-2023-03-08Dokument2 SeitenHLB Receipt-2023-03-08zu hairyNoch keine Bewertungen

- Export PromotionDokument16 SeitenExport Promotionanshikabatra21167% (3)

- IC Accounts Payable Ledger 9467Dokument2 SeitenIC Accounts Payable Ledger 9467Rahul BadaikNoch keine Bewertungen

- Auditing NotesDokument1 SeiteAuditing NotesEhsan Umer FarooqiNoch keine Bewertungen

- 2-Rethinking The Influence of Agency Theory in The Accounting Academy Cohen & Webb 2006Dokument15 Seiten2-Rethinking The Influence of Agency Theory in The Accounting Academy Cohen & Webb 2006Ompong KaosNoch keine Bewertungen

- Case Problem The Hands On CEO of JetblueDokument3 SeitenCase Problem The Hands On CEO of JetblueMarinelEscotoCorderoNoch keine Bewertungen

- International Business NotesDokument28 SeitenInternational Business NotesLewis McLeodNoch keine Bewertungen

- Spread Trading Guide PDFDokument18 SeitenSpread Trading Guide PDFMiguel Teixeira CouteiroNoch keine Bewertungen

- LICENSES Full Documentation STDDokument511 SeitenLICENSES Full Documentation STDffssdfdfsNoch keine Bewertungen

- hrm4111 Recruitment and Selection Assignment Five Employment Contract Christina RanasinghebandaraDokument3 Seitenhrm4111 Recruitment and Selection Assignment Five Employment Contract Christina Ranasinghebandaraapi-3245028090% (1)

- Detailed Report On Privatisation and DisinvestmentDokument37 SeitenDetailed Report On Privatisation and DisinvestmentSunaina Jain50% (2)

- May 2017Dokument7 SeitenMay 2017Patrick Arazo0% (1)

- LllllllolllDokument24 SeitenLllllllolllAgustiar ZhengNoch keine Bewertungen

- Sap BW Cheat SheetDokument2 SeitenSap BW Cheat Sheetrohit80042Noch keine Bewertungen

- LandersMembership PDFDokument2 SeitenLandersMembership PDFRoiland Atienza BaybayonNoch keine Bewertungen

- Scheme of WorkDokument45 SeitenScheme of WorkZubair BaigNoch keine Bewertungen

- Materi Otit IndonesiaDokument26 SeitenMateri Otit IndonesiaLpk Bangkit IndNoch keine Bewertungen

- PESTLE Analysis of IndiaDokument19 SeitenPESTLE Analysis of IndiaAbhishek7705100% (1)

- Agile User Stories and Workshop - Moduele 1Dokument24 SeitenAgile User Stories and Workshop - Moduele 1Ajersh Paturu100% (1)

- National Municipal Accounting Manual PDFDokument722 SeitenNational Municipal Accounting Manual PDFpravin100% (1)