Beruflich Dokumente

Kultur Dokumente

Absolute Performance User Manual

Hochgeladen von

mr12323Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Absolute Performance User Manual

Hochgeladen von

mr12323Copyright:

Verfügbare Formate

REQUIRED U.S.

Government Disclaimer

NOTICE: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY

INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED

BELOW. NO REPRESENTATION IS BEING MADE THAT ANY

ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES

SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY

SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND

THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY

PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF

HYPOTHETICAL PERFORMANCE IS THEY ARE GENERALLY

PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION,

HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK

AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY

ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL

TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES

OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE

OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN

ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE

NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN

GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC

TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED

FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE

RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT

ACTUAL TRADING RESULTS.

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE

SUCCESS. DO NOT TRADE WITH MONEY YOU CAN NOT AFFORD

TO LOSE. ALL ASSET CLASSES INCLUDING FUTURES, OPTIONS,

FOREX, ETF'S AND STOCKS HAVE LARGE POTENTIAL REWARDS

BUT ALSO LARGE POTENTIAL RISKS. YOU MUST BE AWARE OF

THE RISKS AND WILLING TO ACCEPT THOSE RISKS IN ORDER TO

INVEST. ALWAYS CONSULT A REGISTERED FINANCIAL ADVISOR

BEFORE TRADING OR INVESTING TO DETERMINE IF THE

INVESTMENT IS APPROPRIATE FOR YOU. THIS WEBSITE IS FOR

INFORMATIONAL PURPOSES ONLY AND IS NOT A SOLICITATION

TO BUY OR SELL ANY ENTITY MENTIONED.

ABSOLUTE PERFORMANCE INDICATORS

Throughout this manual we refer to the Absolute Performance Indicators

as the AP Indicators. Whether you are a neophyte to trading or an

experienced trader, the AP Indicators and trading strategies will provide you

with tools that you can begin to use immediately to improve your technical

trading approach.

Every AP indicator is founded on evidence based technical analysis.

Evidence based technical analysis means that every indicator in this package

must show its medal as part of an empirical test using clear and simple entry

rules and clear and simple exit rules.

Right now you probably have a 100 or so technical indicators on your

technical analysis software. Not one of them comes with instructions that

shows you how to use the indicator, and/or provides any sort of evidence

that the indicator provides any edge that can aid in making profitable

trades. We will show you how each of our indicators works with some

simple entry/ exit strategies. All test rules are fully explained such that users

can program the same tests themselves.

AP INDICATOR FEATURES

Indicators can readily be displayed on a chart and called up just like

any other indicator your software displays.

Indicators can be easily imported to your own trading system or

strategy test as your software allows.

Indicators are displayed free of distracting screen clutter. Price

ultimately is what we are trading, and the indicators were designed to

be able to see price, with minimal competition from anything else on

on the trading screen.

Trading Set Ups are clearly explained and readily recognizable on the

fly as markets are trading. A trader can process only limited

information in the moment and the indicators are designed with that

philosophy.

The following explanations are as focused as possible, such that the info is

readily available when you are learning. We will give one example of each

buy and each sell set up.

SCOUPE

Our first indicator is Scoupe which rhymes with Scoop. The "Scoupe"

Indicator is designed to identify entry points for trades in the primary

direction of the market under study. There are no user inputs or optimizable

parameters in Scoupe and it is applicable to virtually any market on any time

frame.

The Scoupe chart display was designed to be clean, simple, and immediately

visually intuitive. The Buy Set Up occurs when the Scoupe Histogram is

above zero and the Scoupe Line is below zero. The Sell Set Up occurs when

Scoupe Histogram is below zero and Scoupe Line is above zero. These are

Set Ups representing potential trade entries, not immediate entries. We have

several techniques we use for entry as we will discuss next.

SCOUPE DAILY BASED TRADE ENTRY

In our testing on daily charts with Scoupe we used a couple of different

entry methods. Our tests were not designed to be finished trading systems.

They were basic bare bones modeling to try and help answer the question

does the Scoupe Indicator provide an edge?

The most straight forward test was a simultaneous Scoupe Buy Set Up and a

Trend and Retrace Buy Set Up or a simultaneous Scoupe Sell Set Up and a

Trend and Retrace Sell Set Up. When both Set Ups occurred together we did

not require any further entry trigger. The combination was the trigger and

entry was at the market at next open.

We used electronic market hour data to test using the 5 most liquid futures

markets including e-mini SP, Crude, Gold, Soybeans, and Euro Currency.

We used a modest profit objective such that the winning percentage was

above 80%. The only optimizable parameter was the size of the stop, which

was tuned to each market in the back test.

This was a very basic but complete system as it had all the basic components

of a system entry, exit, money management. It is the basis for further

system development, but is perhaps a little too basic to trade as is. But again

the purpose was not to develop a finished system, the purpose was to see if

the Scoupe Set Up has merit.

The second Scoupe test method we employed used the Daily Trend

Breakout. The Daily Trend Breakout is a formula we developed particularly

for daily based entry. This method facilitates buying on a stop entry if and

only if a breakout point is hit to the upside. Conversely it sells on a sell stop

if and only if a breakout point is hit to the downside.

The test we ran was a simple test. After a Scoupe Set Up a market was

bought or sold on a breakout that was calculated off the next day open price.

We used electronic market data where applicable, which includes overnight

trading.

The entry formulas in English stated:

Buy:

If Scoupe Histogram greater then zero and Scoupe Indicator Line less then

zero then buy at the next day open plus (Daily Trend Breakout * optimized

multiplier) on a stop.

Sell:

If Scoupe Histogram less then zero and Scoupe Indicator Line greater then

zero then buy at the next day open plus (Daily Trend Breakout * optimized

multiplier) on a stop.

The optimized multiplier was an amount that was multiplied times the

Daily Breakout Amount. This gave an optimized threshold for the entry

breakout point in the back test. This was the only optimized parameter in the

test.

This test always held through the day of entry. Thereafter it checked every

day open to see if it was profitable in relation to the entry price. If profitable

then exit at the market. Other then that the only exit in this test was a signal

in the other direction.

This was not a complete system test that could be traded as is. It had no

money management. It was not meant to test so much for profitability as

probability. It was meant to help answer the question as to whether the basic

Scoupe Set Up had merit most of the time. With those caveats, below are

results.

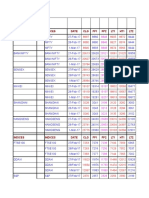

MARKET # TRADES #WINS #LOSSES % WINS $/TRADE

USD FOREX/CURRENCY

EUR

JPY

CHF

AUS

CAD

COMMODITIES

Corn

Soybeans

Wheat

Crude Oil

Heating Oil

Natural Gas

Cocoa

Cotton

Coffee

Sugar

10 Year Notes

Ger. Bund

Gold

Silver

HG Copper

STOCK INDEX FUTURES

E-mini SP

Ger. Dax

FTSE

STOCKS/ ETF's

SPY ETF Daily

SPY ETF Weekly

Goldman Sachs Daily

Goldman Sachs Weekly

Apple Daily

Apple Weekly

Google Daily

Google Weekly

Amazon Daily

Amazon Weekly

118

189

240

89

177

188

103

121

251

230

263

197

121

161

76

172

156

128

181

278

259

182

250

387

45

318

25

94

47

137

13

320

50

110

165

222

87

167

177

99

115

223

208

239

180

109

148

75

160

145

121

165

252

237

165

226

345

43

284

24

85

43

125

13

277

46

8

24

18

2

10

11

4

6

28

22

24

17

12

13

1

12

11

7

16

26

22

17

24

42

2

34

1

9

4

12

0

43

4

92.4%

87.3%

92.5%

97.8%

94.4%

94.1%

96.1%

95.0%

88.8%

90.4%

90.9%

91.4%

90.8%

91.9%

98.7%

93.0%

92.9%

94.5%

91.2%

90.6%

91.5%

90.7%

90.4%

89.1%

95.6%

89.3%

96.0%

90.4%

91.5%

91.3%

100%

86.6%

92.0%

$272

$215

$258

$228

$229

$121

$366

$200

$535

$553

$720

$158

$206

$265

$184

$126

$119

$343

$525

$260

$208

$414

$220

$187

$1684

$564

$1771

$675

$2448

$1425

$14,098

$308

$552

The table above is based on one contract per futures market and one thousand shares for stocks

and ETF's. Test period 2000 through February 2013 for futures and Forex and since inception

and/ or liquidity considerations for stocks and ETF's.

A SIMPLE SCOUPE ES SYSTEM

This is a simple system that tests consistently well every year in the ES v(e-

mini SP) using daily bars.

Buy Signal

If Scoupe Histogram > 0 and Scoupe Line < 0 then buy at (highest high of

last 2 days) or at the (close + (Daily Range Breakout Amount * 2.5)) on a

stop entry. Whichever level is lower will be elected first on the entry stop.

Exit Long

Entry Price + (Entry Price lowest low in the trade) * 1.5

Exit Long

Lowest low since up to the day before entry.

Exit Long

If occurrence of close > entry price and yesterday close > entry price and

close > yesterday close has happened since trade entry then stop loss at

lowest low since entry.

Exit Long

Stop Loss $500

Exit Long

Profit Target $1200.

Short Signal

If Scoupe Histogram < 0 and Scoupe Line > 0 then sell at (lowest low of last

2 days) or at the (close - (Daily Range Breakout Amount * 2.5)) on a stop

entry. Whichever level is higher will be elected first on the entry stop.

Exit Short

Entry Price (Highest high in the trade entry price) * 1.5

Exit Short

Highest High since up to the day before entry.

Exit Short

If occurrence of close < entry price and yesterday close < entry price and

close < yesterday close has happened since trade entry then stop loss at

lowest low since entry.

Exit Short

Stop Loss $500

Exit Short

Profit Target $1200.

211 trades

Average Trade $255

Win 55%

Total P/L since 2000 $53,000

Drawdown: $4175

Profit Factor 2.23

You can really jump the stats, but fewer trades if you require either the day

before entry to be lower then yesterday or lower then the day before for buys

and be higher then yesterday or higher then the day before for shorts.

With the above simple addition:

100 trades

Average Trade: $430

Win: 64%

Total P/L since 2000: $43,000

Drawdown: $2000

Profit Factor: 3.63

REQUIRED U.S. Government Disclaimer

NOTICE: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE

DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE

PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES

BETWEEN HYPOTHETICAL RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY

PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE IS THEY ARE

GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT

INVOLVE FINANCIAL RISK AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE

IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO

ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH

CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO

THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH

CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND

ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE SUCCESS. DO NOT TRADE WITH MONEY YOU CAN NOT

AFFORD TO LOSE. ALL ASSET CLASSES INCLUDING FUTURES, OPTIONS, FOREX, ETF'S AND STOCKS HAVE LARGE

POTENTIAL REWARDS BUT ALSO LARGE POTENTIAL RISKS. YOU MUST BE AWARE OF THE RISKS AND WILLING

TO ACCEPT THOSE RISKS IN ORDER TO INVEST. ALWAYS CONSULT A REGISTERED FINANCIAL ADVISOR BEFORE

TRADING OR INVESTING TO DETERMINE IF THE INVESTMENT IS APPROPRIATE FOR YOU. THIS WEBSITE IS FOR

INFORMATIONAL PURPOSES ONLY AND IS NOT A SOLICITATION TO BUY OR SELL ANY ENTITY MENTIONED.

SCOUPE INTRADAY

Scoupe Intraday we have had success trading based on Range Bars though

these same principles can be applied to time based bars.

A Range Bar is the same number of ticks in size then a new bar starts. Hence

a chart based on 10 Range Bars means all bars in the charts are 10 ticks from

high to low.

We often use 40 Range and 10 Range bars. These can be adjusted for the

relative volatility of the market you are trading. For example the ES may

require slightly smaller range bars perhaps 32 and 8. But this can change

a bit as volatility changes.

There are no magic numbers but getting down to less then 5 on the

smallest range bar and you get closer and closer to market noise.

In our example the 40 Range determines the direction we want to trade. We

want to trade in the direction of a Scoupe Set Up on the 40 Range.

At this point we also might be aware of the Pivot Trading Channels so we

are not trying short into long term support or buy into long term resistance.

You need a big picture chart somewhere on your trading screen at all

times. Trading in sympathy with the longer term chart and never against the

longer term chart is one of the keys to success!

Remember that the market is 90% losers so you want to avoid what

everyone else is doing. And as you probably already know most of that 90%

is fixated on very short term charts.

We construct the trading screen such that it has at least 2 time frames of

Scoupe displayed simultaneously in different windows.

-150

07112/201~ 07/1112013 0710312013 0710512013 0711012013

1.3000

1.2950

1.2900

1.2850

1.2800

1.3250

1.3200

1.3150

Fri 04126/1316:59:56(66E201306)0=1.3040 H=1.3047L=1.3011C=1.3033

: 711211316:59=1.3068(-0.0033)

... G6E067: 0212512013*0711212013 (40 tick breakout bars) Euro FX (Elee) CA<@J lEJ ~ ~@~

The above chart is the basic Scoupe Set Up. A Set Up by itself is not an

entry. The entry may occur at any time in the highlighted box and sometimes

not at all.

INTRADAY SET UP

A Scoupe Set Up is not the same as an entry. We do not catch falling knives

or stand in front of rockets!

So after we recognize the basic set up, we need to go to step 2, which now

means going down to the shorter term chart. We are looking to the short

term chart to confirm what the long term chart is telling us about the

potential direction.

Essentially the shorter term or 10 Range Bar chart time frame is used as a

confirmation or permission to enter a trade in sympathy with the longer

term or 40 Range Bar time frame.

The major way we look for confirmation or permission to attempt an entry

on the lower time frame is to see the 10 Range Bar momentum start to turn.

The sign that momentum is turning is shown by rising Scoupe lows for longs

and falling Scoupe highs for shorts..

After we see the Histogram and Scoupe Line turn then we are looking for a

10 Range bar closing at the high, then enter.

Even after the momentum turn, the price bar itself showing evidence is

needed to enter the trade. These bars would be referred to a pin bars or

engulfing candles or piercing candles.

When we go down to that lower time frame it is not going to look like the

higher time frame. The higher time frame has that intuitive set up that says

buy set up or sell set up by the contrast of each on either side of the zero

line.

On the short term or 10 Range Bar both the histogram and the line are going

to be on the same side of the zero line.

The best entry permission is when the histogram has rising troughs for longs

and falling peaks for shorts. The charts below show it much clearer then we

can say it.

150

07/12/201~ 07/11/2013 06/27/201307/02/2013 07105/201307/10/2013

75

1.2900

1.2850

1.2800

. .,'

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

, " ' ,

, ,

, ,

, ,

" , ~ .1 .. J -' .1 .I.

I ,. ,

, ,

~- - - ..- - - .. - - - - - . . - - - .. - - - - - .. - - - - ..- - - - - . . - - -

" ,

, ,

, ,

, ,

, ,

1.3250

1.3200

Men02125/13 02:2t:27 (66E- 201303) 0=1. 3209 H=I. 3237 L=I. 3197 C=I. 3237

7/12/13 16: 59=1. 3068 (- IJ . 0033);

. . . . G6E- 067: 0212512013" - 0711212013 (40 tick breakout bars) Euro FX (Elee) CA~0~ ~@)~

STEP 1

Identify on the 40 Range Bar chart a potential Scoupe Buy Set Up as shown

in the chart below.

-150

02:50 03:33 04:02 05:34 07:59 08:36 09:33 1022 1039 _

1.3100

Wed 05122/1316:59:57 (66201306) 0=1.2866 H=1.2868 L=1.2858 C=1.2866 Duffy Trading Band Lower=

7/1111311 :24=1.3051 (+;0.0165)

.;.. G6E067: 02/24/20130711212013 (10 tick breakout bars) EuroFX (Elee)cA<ffl013 b]@)@

STEP 2

Go down to the 10 Range Bar chart and look for rising momentum in the

Scoupe Oscillator.

The blue shaded box is the exact same area outlined on the 40 Range Bar

chart.

Points A and B clearly show rising momentum. This is the trade permission.

Against that backdrop buy the first 10 Range Bar that closes at the high.

08:25 08:51 09:47 10:26 1058 11:52 1400 15:06 15:51

1.3060

Tue04123/1316:18:14(66E-201306)O~1.3008 H~1.3016 L~1.3006 C~1.3016 DuffyTradingBandLower~

:7 /11/1321 :08=1.30931"".lI~'

J . G6E-067: 02124/2013" - 0711212013 (10 tick breakout bars) EUfOFX (Hee) (A~013 l]@)

The next best permission after rising lows in the histogram is rising lows in

the Scoupe line.

After the rising momentum at Point B and Point C in the Scoupe Line the

entry is the first 10 Bar strong close.

., ..,

1.2950

... G6[067: 0212512013*-07112/2013 (40tiek breakout bars) [uro FX(E1ee)CA~13 ~@)@

Next we'll look at the Sell Set Up that was highlighted in the Set Up example

Remember even though this short Set Up above does not look great on this

chart, at the right edge of the chart as it is happening no one knows how it

will turn out.

So we will proceed through with our rules to look for a sell short signal to

see how it would have played out.

1.2860

1.2880

... G6E-067: 02124/201307/1212013 (10 tick breakout bars) Euro FX (Elee) cA@lEJ lZl ~@]

First of all the rally yielded no falling momentum in the histogram until the

40 period set up had passed without any permission to enter on the 10 Bar.

The chart blow illustrates this.

Even if one decided to stretch the parameters and trade on the falling

histogram when it did show up at Point B, the trade would have been a

scratch or a small winner. We'll discuss our Trade Plan Exits in just a minute

that explain why.

12920

1.2900

1.2880

1.2860

1.2840

.... G6[067: 02/24120130711212013 (10 tick breakout bars) [uro FX ([lec) CA~~13 [';J @)

The more aggressive trade would have been to sell lower momentum at Point

C or Point D based on the falling Scoupe Line highs. Point C would have

yielded a good return according to our exit rules. Point D a small gain.

To recap always, always start the trade off on the longer term chart. If you

start to trade off the shorter term chart you will get beat around by the bigger

trends. Be the 10%, not the 90%!

Only go to the short term chart when you know what direction and exactly

what set up you are looking for. This will allow for calm, patience, and

discipline. You have a plan and are not ruled by the noise of lower time

frames.

TRADE PLAN EXITS

If we are entering intraday trades based off the 10 Range Bar we would use

an 11 tick stop. If our shortest Range Bar was 8 then we would use a 9 tick

stop etc.

We usually work in terms of 3 lot trades.

We set up the DOM such that upon any fill on the entry the 11 tick stop is

entered automatically.

We always set profit targets to exit. If the market is active we will use profit

targets at +11, +17, and +21 ticks from out entry price.

When the market hits the first target at +11 we then move our stop loss to -5

on the other 2 contracts or trail the stop at -15. We do not move the stop loss

to the entry point. When the +17 target is hit we use a trailing stop of -15

from the best price in the trade looking for +21 target on the last contract.

If the market is less active we will set targets at +6, +11 and +17 ticks from

entry price.

When the +6 target is hit move the stop loss to -5 on the other 2 contracts.

When the +11 target is hit we use a trailing stop of -14 from the best price in

the trade looking for +17 on the last contract.

The principle oft HOW to move the stop ---- and NOT to move the stop to

breakeven too quickly and knock the legs out from under your edge ----. are

principles that we have tested empirically across many different trading

systems and methods, not just with Scoupe.

In this sense the principles are important, the exact numbers are not. So

please feel free to change the 6-11-17-21 to whatever. But here are the

principles we adhere to:

Initial profit targets can between .5 and 1 of initial risk. You will need to be

right at least 3 of 4 in achieving first target at .5 to 1. Your edge should

provide that.

After first target do not move your stop loss to breakeven.

After first target do cut your stop loss amount by 50%.

By cutting your stop loss in half you now raise the risk/reward on your

remaining trades to better then 2:1 and better then 3:1.

Time in the trade is important to the edge. Remember that the longer the

time that has passed since the entry edge, the more likely the effect is to

dissipate. Act accordingly.

Price distance traveled is also important to the edge. The further price travels

from the entry price the less effect your initial edge continues to have.

PLEASE STOP HERE.

If you can manage the entries above with success you can read on. But what

follows is harder to do and not as reliable in intraday trading!

More Aggressive Scoupe Entries TREND

The trend occurs after the initial set up starts to move in the forecast

direction on the longer term or 40 Range Bar chart.

In these cases using just the Scoupe Set Up with the entry bar trigger is the

more aggressive entry.

A rabbit ears or double bottom or double top in the Scoupe Oscillator Line

can sometimes appear in these situations and when it does it adds to the

probability of the trade.

The the strong entry bar trigger is still required to enter the trade.

This is not as high a probability trade as the first set up we discussed. But in

sustained trends it is an absolute killer entry technique.

In the following chart we see a 10 Range Bar with no filters other then just

wait for the set up and then an entry trigger. In trends it works fantastic. But

when trends die and pullbacks rollover like at Point A

Points B and C did provide good entries with the trend.

07/09/2013 1500 1018

. - - - . ; _ . i - . . - - . . - - . . - . . . ; . . . - - . . - - . . - - . . - f - - - . - _ .- - _ .- - - + - _ .- I - _ . . - - . - - - - i--+ - _ .- - - - - - - - - - - _ . -75

1. 2820

1. 2830

1. 2840

*~- - - ~- - - '- - - - - - - - - - - - - - - - ~- - - - - - - - - - - - - - - _I. - - - - - - - - - - - - _, - _

i , , , l

, , ,

Mon07108/1307:33:09(66E201309) 0=1.2853 H=1.2855l=1.2845 C=1.2845DuffyTrading8andlower=

, , 7/~/1J, 04:27 =1,. 2~89 (+ 0. 0011)

, , i I ~ :

... G6[067: 02/24/2013" - 07112/2013 (10tickbreakoutbars) [uroFX(lee)CAl~13 [)@)~

In these circumstances also have a look at using the Scoupe set ups with

Down-A-Level divergence and pay attention to the information the Pivot

Channels are giving you. This is getting further away from combinations we

can test empirically and as such it is not as much our preference.

The rabbit ears or any type of double top or bottom in the Scoupe

oscillator is more reliable. Example in the chart above.

TREND AND RETRACE

As the name implies this indicator provides evidence based analysis to the

trader on two fronts; the strength of a trend and the identification of

retracement levels within that trend.

Through many, many historical tests we found that in most markets and

under most conditions entering on a signal after pullback in the direction of

the main trend is a superior strategy to entering on signals that do not follow

pullbacks.

Given this evidence we needed an indicator to help identify high probability

trade zones after a retracement in the trend.

Our research eventually led to another very important discovery; the strength

of the trend is directly related to the probabilities of successfully entering

during a retracement to the trend. The Trend and Retrace indicator therefore

first measures trend strength and second identifies the area of a potential

retracement.

There are zero user optimizable parameters in the Trend and Retrace

indicator. However in a system test, or using highlight bars, a strength of

trend measure is optimizable by the user if desired. This does not change the

indicator, as it is not an input into the indicator, rather it is a threshold

measure of how much strength does the indicator show.

For Trend and Retrace we set up another very basic entry and exit. Our test

is:

Buy Signal

If Trend and Retrace < -100 trend and strength of trend > 4 buy at the

market next day.

Sell Signal

If Trend and Retrace > 100 and strength of trend > 4 then sell at the market

next day.

You could optimize the threshold for different markets. For example instead

of strength of trend being set at 4, one could use an optimizable parameter

for this value. We set the default at 4 as that works for most markets on a

daily time frame.

The higher one sets the strength of trend parameter to higher more

demanding levels, the fewer trades one will get. This is logical as markets

are exceptionally strong or weak a smaller percentage of the time. We have

found that in general the higher the strength of trend requirement the fewer

trades, but the more high quality trades produced. Additionally some

markets in general will work better with a higher strength of trend

requirement then others.

We ran the test with no exits on the day of entry and thereafter exit any day

the market opened in a profitable position relative to the entry price. A

simple dollar stop loss amount was used as well.

The results below show the e-mini SP across various strength of trend

(SOT) parameters to illustrate the points made above.

Strategy Optimization Report ES

SOT Win% #Trds P/L P/F Avg Drawdown

-1 88.6% 175 $40,363 2.11 $231 ($3,600)

0 91.5% 130 $42,538 3.11 $327 ($3,600)

1 93.1% 102 $36,300 3.79 $356 ($3,450)

1 93.8% 80 $30,063 4.20 $376 ($3,450)

2 93.8% 64 $25,800 4.39 $403 ($3,450)

3 92.7% 55 $20,513 3.70 $373 ($3,450)

4 94.6% 37 $17,313 5.81 $468 ($1,800)

5 93.5% 31 $15,563 5.32 $502 ($1,800)

6 100.0% 21 $15,263 999 $727 $0

7 100.0% 17 $10,238 999 $602 $0

8 100.0% 14 $8,163 999 $583 $0

9 100.0% 11 $6,963 999 $633 $0

10 100.0% 10 $6,888 999 $689 $0

The general tendencies exhibited here hold true over pretty much every

market we have tested. This concept of buying dips after strength, or selling

rallies after weakness using the Trend & Retrace Indicator holds across all

markets we have tested including futures, forex, and stocks. Of course some

markets work better then others, but as a concept it is exceptionally robust

--- the latter meaning that across non correlated markets and different time

frames the concept still produces positive expectancies in historical testing.

Simple System for the 6E (Euro Currency) using Trend and Retrace

Based on Daily Bars

Buy Signal #1

If Trend Retrace < -100 and Strength of Trend > 4 buy at market

Buy Signal #2

If Trend Retrace <-50 and Strength of Trend > 7 buy at the S1 pivot point.

Exit Long

If occurrence of close > entry price and yesterday close > entry price and

close > yesterday close has happened since trade entry then stop loss at 50%

of original = (entry price - $1100 stop loss)

Exit Long

Entry price + ((Entry Price Lowest Low since day before Entry) * 1.5)

Exit Long

Entry Price + $50 but not on day of entry.

Exit Long

Entry Price +600 limit

Exit Long

Entry Price - $2200 stop.

Sell Signal #1

If Trend Retrace > 100 and Strength of Trend > 4 sell at market

Sell Signal #2

If Trend Retrace > 50 and Strength of Trend > 7 sell at the R1 pivot point.

Exit Short

If occurrence of close < entry price and yesterday close < entry price and

close < yesterday close has happened since trade entry then stop loss at 50%

of original = (entry price + $1100 stop loss)

Exit Short

Entry price ((Highest Low since day before Entry Entry Price ) * 1.5)

Exit Short

Entry Price - $50 but not on day of entry.

Exit Long

Entry Price - $600 limit

Exit Long

Entry Price + $2200 stop.

195 trades

Average Trade: $272

Win: 93.8%

Total P/L since 2000 $53,125

Drawdown: $2500

Profit Factor 3.00

DAILY TREND BREAKOUT

Some of the empirical tests we use particularly on daily data employ an

entry trigger commonly called Daily Trend Breakout. If you are not using

daily data, and not interested in running your own historical test trading

simulations, you can skip this section.

Those who have been around markets for a while may have heard of the

volatility breakout concept. It is nothing more then following an increase in

volatility in the direction of the volatility.

The thing about it though, is volatility breakout works. It works across a

wide variety of markets. It works across different decades. Markets cant

really move without it occurring. It is one of those concepts the market has a

hard time outsmarting! So we use it.

The theory of Volatility Breakout is that there is a threshold level above the

market that if breached triggers a buy entry. If and only if that price

threshold is reached or exceeded then one buys. Similarly there is a sell

threshold below the market. If and only if that sell threshold is reached or

penetrated then one sells short.

The major advantage of using volatility breakout on daily data is that it

allows intraday entry. If the trader had to wait until the close of the daily bar

to enter a trade, that would often prove to be a significant obstacle to

profitable trading. Volatility breakouts use stop order entries such that no

intraday monitoring is required. If the entry threshold is reached the resting

stop order becomes a market order.

Most volatility breakout uses average true range or simply a measure of

the average days trading range over recent history. Any test that we have run

that uses average true range as an entry breakout, can be in virtually all cases

improved using the Daily Trend Breakout.

In our tests we use a percentage of the Daily Trend Breakout formula and

that percentage is an optimzable parameter. For example in plain English a

buy signal would be coded as

Buy at the next day open price

+ (the Daily Trend Breakout Value * opt1) stop entry.

In this simple code above opt1 is the optimizable variable.

DOWN-A-LEVEL INDICATOR

The "Down-A-Level Indicator" was designed to be used as an adjunct to

"Scoupe" but it is optional. Intraday traders should keep things as simple as

possible. We use it our SP Trading System to good advantage. As the name

implies this indicator gets down "inside" the recent bars to give additional

information.

There are several ways we use the "Down-A-Level" Indicator to aid in entry

triggers after a "Scoupe" and/ or a "Trend & Retrace" entry set up. All are

simple, visually intuitive, and can be recognized easily and quickly on a

chart.

SIMPLE DIVERGENCE

Most traders are familiar with the concept of divergence. It simply means

that either a new high in price is not accompanied by a new high in the

indicator, or a new low in price is not accompanied by a new low in the

indicator.

03/01/11 01/18/11

-75

o

1.3800

1.3600

1.3400

1.3200

1.3000 - - <g >- , -

... G6E- 067: 0110312006 - 0711 212013 (Oaily bars) Euro FX (Elec] CAdj Uq -- Te[!, ]~J. ~@)

Of course divergence can and often does signal far too early in a strongly

trending market. Other times divergence can nail turns precisely. So how

does the trader differentiate when divergence will turn out to be valid?

Of course traders can never know anything for sure. However when using

Down-A-Level exclusively with a Scoupe Set Up, one narrows down the

market situations to those that we found provided an edge in historical

testing.

The charts below show the examples of divergence entry signals with the

Scoupe Set Ups and Down-A-Level Indicator on both the buy side and the

sell side.

I ;J\tAL~6 j\~~'~

J; ~: ~'T ; 0

06/05/12 06/19/12 07il 07/12120121/17/12 07/31/12 08/14/12 ...

Tn" 07/1212012(66E-2012091:0=1.2290 H=1.2298l=1.2215 C=1.2254Dully T.adingBandlowe.=1.2229

08/27/2012 =1.2541{..Q.0015} 2 00

- ~ 1. 8

.... G6E-067: 0110312006 -07/1212013 (Daily bars) EuroFX (Elee) CAdj Liq-- Te{E[f>J~. ~@)

FIVE WAVES

A 5 wave pattern on the Down-A-Level Oscillator consists of 3 waves in one

direction with 2 intermittent waves dividing such that a 5 wave structure

completes. This is a much better visual and will be readily seen in the chart

example below.

For an up 5 wave to complete the following guidelines are employed:

1. Start the count from most recent swing low in the Down-A-Level

Oscillator, which may or may not be also a swing low in price.

2. The Oscillator swing low start point should be below the 20 level.

3. Each of the 3 drives up has a higher high.

4. Each of the two drives lower has a higher low.

5. The 5

th

and last wave completes above the 80 level.

For a down 5 wave complete the following guidelines are employed:

1. Start the count from most recent swing high in the Down-A-Level

Oscillator, which may or may not be also a swing high in price.

2. The Oscillator swing high start point should be above the 80 level.

3. Each of the 3 drives down has a lower low.

4. Each of the two drives higher has a lower high.

5. The 5

th

and last wave completes below the 20 level.

PIVOT TRADING CHANNELS

The empirical testing on the channels though was focused on the times when

price closed outside the channels and what that was likely to mean for price

action in the near future. In practice it is our experience that the channels can

also be used effectively as support and resistance.

HOW TO USE PIVOT TRADING CHANNELS

We offer the channels as an adjunct to the indicators to aid in identifying

support, resistance, as well as early identification of new trends.

Closing outside of the trading channels on consecutive closes does not occur

very often and hence when it does there is information being given by the

market:

1. Two or more consecutive closes outside of the channel means the

emerging trend is strong enough that it should not be faded or played for a

reversal.

2. Two or more consecutive closes outside of the channel means that traders

should look to the first pullback to enter in the direction of the trend.

12200

12400

12600

f l r l l ~

~ I'I~ 1

F ri 07l 0612011I G 6[ 2012091: 0=1.1447 H =1.1453 l =1.1310 C =1.1337 <C ul l om H i gh6ghI B .,,) D uf f y T radi ng B and l ow er= 1.1345 D uf f y T radi ng B and U pper= 1.1811 T O oI M =5 T O ol Y =134

1 0 / 2 3 / 2 0 1 2 = 1.3020 (0.0057) 1.3400

.j. G 6[ 061: 0 1 1 0 3 1 2 0 0 6 ' 0 1 1 1 2 1 2 0 1 3 I D ai l y b ars) [ uro F X I E l ee) C A dj l i q .. T empl ate: T ri mae ~ m l 3~@]~

The strength of the trend as defined by the markets ability to close outside

the channel for consecutive or a series of closes shows a clear probability

that the first retrace can be traded. It is not an overwhelming majority, a little

over 60% depending on the definitions used.

CONCLUSION

The number of trades you make is usually inversely proportional to your

success.

Start with the bigger picture.

Know what you are looking for and know the only direction you will trade

when you go down to look at the shorter term charts.

Wait for the trigger.

Follow the exits in the Trade Plan.

If you have any questions about anything please contact me.

KeyPoint@sympatico.ca

Thank you.

Joe Duffy

REQUIRED U.S. Government Disclaimer

NOTICE: HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY

INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED

BELOW. NO REPRESENTATION IS BEING MADE THAT ANY

ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES

SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY

SHARP DIFFERENCES BETWEEN HYPOTHETICAL RESULTS AND

THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY

PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF

HYPOTHETICAL PERFORMANCE IS THEY ARE GENERALLY

PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION,

HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK

AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY

ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL

TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES

OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE

OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN

ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE

NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN

GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC

TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED

FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE

RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT

ACTUAL TRADING RESULTS.

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE SUCCESS.

DO NOT TRADE WITH MONEY YOU CAN NOT AFFORD TO LOSE.

ALL ASSET CLASSES INCLUDING FUTURES, OPTIONS, FOREX, ETF'S

AND STOCKS HAVE LARGE POTENTIAL REWARDS BUT ALSO

LARGE POTENTIAL RISKS. YOU MUST BE AWARE OF THE RISKS

AND WILLING TO ACCEPT THOSE RISKS IN ORDER TO INVEST.

ALWAYS CONSULT A REGISTERED FINANCIAL ADVISOR BEFORE

TRADING OR INVESTING TO DETERMINE IF THE INVESTMENT IS

APPROPRIATE FOR YOU. THIS WEBSITE IS FOR INFORMATIONAL

PURPOSES ONLY AND IS NOT A SOLICITATION TO BUY OR SELL

ANY ENTITY MENTIONED.

Das könnte Ihnen auch gefallen

- The Fat Cat : A Modern Day Forex StrategyVon EverandThe Fat Cat : A Modern Day Forex StrategyNoch keine Bewertungen

- The Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsVon EverandThe Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsNoch keine Bewertungen

- Ehlers (Measuring Cycles)Dokument7 SeitenEhlers (Measuring Cycles)chauchauNoch keine Bewertungen

- An Introduction To Trading Gartley and Butterfly Reversals Forex & Stock Trading LibraryDokument12 SeitenAn Introduction To Trading Gartley and Butterfly Reversals Forex & Stock Trading LibraryfalkynNoch keine Bewertungen

- Any Unauthorized Reproduction of This PDF File Is Prohibited and PunishableDokument34 SeitenAny Unauthorized Reproduction of This PDF File Is Prohibited and PunishableRaja RajNoch keine Bewertungen

- TD Rei PDFDokument12 SeitenTD Rei PDFzameerp73Noch keine Bewertungen

- How to Trade and Win in any market with High ProbabilityVon EverandHow to Trade and Win in any market with High ProbabilityBewertung: 1 von 5 Sternen1/5 (1)

- John J MurphyDokument4 SeitenJohn J Murphyapi-383140450% (2)

- Day Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexVon EverandDay Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexNoch keine Bewertungen

- The Simplified Theory of The Time Factor in Forex TradingVon EverandThe Simplified Theory of The Time Factor in Forex TradingNoch keine Bewertungen

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketVon EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNoch keine Bewertungen

- How to write a Rule Based Trading Plan as a Beginner TraderVon EverandHow to write a Rule Based Trading Plan as a Beginner TraderNoch keine Bewertungen

- Leon Wilson - Trading SuccessDokument20 SeitenLeon Wilson - Trading Successmanastha100% (1)

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeVon EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNoch keine Bewertungen

- Trading Strategies From Technical Analysis - 6Dokument19 SeitenTrading Strategies From Technical Analysis - 6GEorge StassanNoch keine Bewertungen

- Guppy Trading: Essential Methods for Modern TradingVon EverandGuppy Trading: Essential Methods for Modern TradingBewertung: 4 von 5 Sternen4/5 (1)

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingVon EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNoch keine Bewertungen

- The Solitary Trader: Tim RaymentDokument3 SeitenThe Solitary Trader: Tim RaymentAdemir Peixoto de AzevedoNoch keine Bewertungen

- The Encyclopedia Of Technical Market Indicators, Second EditionVon EverandThe Encyclopedia Of Technical Market Indicators, Second EditionBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Options for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesVon EverandOptions for Risk-Free Portfolios: Profiting with Dividend Collar StrategiesNoch keine Bewertungen

- Trading - Gartley Pattern PDFDokument8 SeitenTrading - Gartley Pattern PDFSwetha Reddy100% (3)

- 60 Post-Mortems on Nifty & BankNifty Q3 FY23-24Von Everand60 Post-Mortems on Nifty & BankNifty Q3 FY23-24Noch keine Bewertungen

- Motion Trader Five SecretsDokument11 SeitenMotion Trader Five SecretskalkadanNoch keine Bewertungen

- General ACDDokument41 SeitenGeneral ACDlaozi222Noch keine Bewertungen

- The Basis of Technical AnalysisDokument7 SeitenThe Basis of Technical AnalysisFranklin Aleyamma JoseNoch keine Bewertungen

- Make T Facility IndexDokument22 SeitenMake T Facility Indexpaul.tsho7504100% (1)

- (Trading) Carolyn Boroden - Anatomy of Ideal FibonaCCI Trade in CBOT Mini-Sized Dow FuturesDokument5 Seiten(Trading) Carolyn Boroden - Anatomy of Ideal FibonaCCI Trade in CBOT Mini-Sized Dow FuturesThie ChenNoch keine Bewertungen

- Range BarsDokument8 SeitenRange BarsMukul SoniNoch keine Bewertungen

- Dont Trade Like Tony MontanaDokument34 SeitenDont Trade Like Tony MontanaLuciano SuarezNoch keine Bewertungen

- DAX TradingDokument1 SeiteDAX TradingmysticblissNoch keine Bewertungen

- Volatility IlluminatedDokument319 SeitenVolatility IlluminatedMary HodgeNoch keine Bewertungen

- Follow The Smart MoneyDokument6 SeitenFollow The Smart MoneydashaggerNoch keine Bewertungen

- Intro Market ProfileDokument22 SeitenIntro Market Profileapi-26646448Noch keine Bewertungen

- Market Geometry Basic Monthly Statistics SheetDokument6 SeitenMarket Geometry Basic Monthly Statistics SheetBruno de LimaNoch keine Bewertungen

- LocatinDokument9 SeitenLocatinivolatNoch keine Bewertungen

- Wiley - Gaming The Market - Applying Game Theory To Create Winning Trading Strategies - 978-0-471-16813-3Dokument3 SeitenWiley - Gaming The Market - Applying Game Theory To Create Winning Trading Strategies - 978-0-471-16813-3AchuthamohanNoch keine Bewertungen

- Multiple Time Frame Analysis for Beginner TradersVon EverandMultiple Time Frame Analysis for Beginner TradersBewertung: 1 von 5 Sternen1/5 (1)

- Bollinger Band Manual - Mark DeatonDokument31 SeitenBollinger Band Manual - Mark DeatonYagnesh Patel100% (2)

- Forex Strategy 'Vegas-Wave'Dokument5 SeitenForex Strategy 'Vegas-Wave'douy2t12geNoch keine Bewertungen

- Pay Attention To What The Market Is SayingDokument11 SeitenPay Attention To What The Market Is SayingEmmy ChenNoch keine Bewertungen

- Relative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystDokument2 SeitenRelative Strength Index, or RSI, Is A Popular Indicator Developed by A Technical AnalystvvpvarunNoch keine Bewertungen

- Trading With The Odds: Using the Power of Statistics to Profit in the futures MarketVon EverandTrading With The Odds: Using the Power of Statistics to Profit in the futures MarketBewertung: 4 von 5 Sternen4/5 (1)

- Simple Market Flow SystemDokument12 SeitenSimple Market Flow SystemHartadiNoch keine Bewertungen

- Trading The RangeDokument3 SeitenTrading The Rangesuperandroid21Noch keine Bewertungen

- Channel Breakouts: Part 1: EntriesDokument5 SeitenChannel Breakouts: Part 1: EntriesdavyhuangNoch keine Bewertungen

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Dokument41 SeitenAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Critical Steps to Forex Trading Success for BeginnersVon EverandCritical Steps to Forex Trading Success for BeginnersNoch keine Bewertungen

- How to have $uccess in Financial Market Investing & TradingVon EverandHow to have $uccess in Financial Market Investing & TradingBewertung: 4 von 5 Sternen4/5 (1)

- Trend-Following Winners Are Not Lucky Monkeys: MarketDokument5 SeitenTrend-Following Winners Are Not Lucky Monkeys: MarketArvind KothariNoch keine Bewertungen

- Full View Integrated Technical Analysis: A Systematic Approach to Active Stock Market InvestingVon EverandFull View Integrated Technical Analysis: A Systematic Approach to Active Stock Market InvestingNoch keine Bewertungen

- Hurst Exponent and Trading Signals Derived From Market Time SeriesDokument8 SeitenHurst Exponent and Trading Signals Derived From Market Time SeriesJuan SchmidtNoch keine Bewertungen

- Pro Finance Group Inc.: GraphDokument1 SeitePro Finance Group Inc.: Graphmr12323Noch keine Bewertungen

- Indices Indices Date CLG FP1 FP2 LT1 HT1 LT2Dokument34 SeitenIndices Indices Date CLG FP1 FP2 LT1 HT1 LT2mr12323Noch keine Bewertungen

- Chifbaw Oscillator User GuideDokument12 SeitenChifbaw Oscillator User GuideHajar Aswad KassimNoch keine Bewertungen

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Dokument5 SeitenDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Noch keine Bewertungen

- Revision of Pension (c116063)Dokument1 SeiteRevision of Pension (c116063)mr12323Noch keine Bewertungen

- GN 5 41Dokument1 SeiteGN 5 41mr12323Noch keine Bewertungen

- Tims Trading MaximsDokument1 SeiteTims Trading Maximsmr12323Noch keine Bewertungen

- WolfeWaveDashboard UserGuideDokument4 SeitenWolfeWaveDashboard UserGuidemr12323Noch keine Bewertungen

- BitcoinsDokument45 SeitenBitcoinsSwadhin Sonowal100% (1)

- Addition 03.2013. TS LSFA BS PDFDokument1 SeiteAddition 03.2013. TS LSFA BS PDFmr12323Noch keine Bewertungen

- Scope of AnatomyDokument25 SeitenScope of Anatomymr12323Noch keine Bewertungen

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Dokument4 SeitenChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Dokument4 SeitenChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Trading Manual PDFDokument24 SeitenTrading Manual PDFmr12323Noch keine Bewertungen

- 14th Dec 2015 Chin MaoDokument8 Seiten14th Dec 2015 Chin Maomr12323Noch keine Bewertungen

- Advantages of Monitoring Open InterestDokument1 SeiteAdvantages of Monitoring Open Interestmr12323Noch keine Bewertungen

- Bertrand Russell's 10 Commandments of Teaching by Maria PopovaDokument2 SeitenBertrand Russell's 10 Commandments of Teaching by Maria Popovamr12323Noch keine Bewertungen

- Jose Rizal Writing and Activist CareerDokument2 SeitenJose Rizal Writing and Activist CareerJohn Carlo PascualNoch keine Bewertungen

- Basdev VS The State of PepsuDokument2 SeitenBasdev VS The State of PepsurajNoch keine Bewertungen

- Affidavit of Cancellation - DtiDokument1 SeiteAffidavit of Cancellation - Dtid-fbuser-5418440081% (21)

- Presumption - IOSDokument12 SeitenPresumption - IOSTANU100% (12)

- Whistle Blower PolicyDokument5 SeitenWhistle Blower PolicySumit TyagiNoch keine Bewertungen

- The Contemporary World: Chapter 1Dokument5 SeitenThe Contemporary World: Chapter 1Jean OpallaNoch keine Bewertungen

- Test Bank For Introduction To Global Business Understanding The International Environment and Global Business Functions 1st EdiDokument24 SeitenTest Bank For Introduction To Global Business Understanding The International Environment and Global Business Functions 1st Edichristianhartmanfzinkdtwya100% (43)

- Common Mistakes in EnglishDokument27 SeitenCommon Mistakes in EnglishBeril TanarNoch keine Bewertungen

- The Legend of Nani Palkhivala by Pai, M. RDokument109 SeitenThe Legend of Nani Palkhivala by Pai, M. Rfuckmeoff0% (1)

- Importance of Product Knowledge: STC ChennaimetroDokument20 SeitenImportance of Product Knowledge: STC ChennaimetrotsrajanNoch keine Bewertungen

- My Trip To ParisDokument1 SeiteMy Trip To ParisElias Cuartas GómezNoch keine Bewertungen

- Sales Representatives TrainingDokument27 SeitenSales Representatives Trainingsteve@air-innovations.co.zaNoch keine Bewertungen

- Dy vs. Koninklijke Philips Electronics, N.V. (G.R. No. 186088 March 22, 2017)Dokument3 SeitenDy vs. Koninklijke Philips Electronics, N.V. (G.R. No. 186088 March 22, 2017)ellavisdaNoch keine Bewertungen

- Icse 2023 - 581 HGT1Dokument8 SeitenIcse 2023 - 581 HGT1Rajdeep MukherjeeNoch keine Bewertungen

- Libres v. NLRCDokument3 SeitenLibres v. NLRCMary Rose AragoNoch keine Bewertungen

- JLD 32103 Introduction To Risk Management and InsuranceDokument3 SeitenJLD 32103 Introduction To Risk Management and InsurancehafidzNoch keine Bewertungen

- Hoer 1Dokument21 SeitenHoer 1Ranjeet SinghNoch keine Bewertungen

- Circular 16062023-Vivad Se Vishwas Il (Contractual Disputes)Dokument15 SeitenCircular 16062023-Vivad Se Vishwas Il (Contractual Disputes)1005 ABIRAME H.SNoch keine Bewertungen

- Valdez vs. Republic, 598 SCRA 646, September 08, 2009Dokument11 SeitenValdez vs. Republic, 598 SCRA 646, September 08, 2009Ramil GarciaNoch keine Bewertungen

- PDQ-39 EnglishDokument5 SeitenPDQ-39 EnglishRaissa Sandi GarciaNoch keine Bewertungen

- Merchandising Problem For AssessmentDokument1 SeiteMerchandising Problem For AssessmentGlend Lourd YbanezNoch keine Bewertungen

- Government of Jharkhand: Receipt of Online Payment of Stam VDokument6 SeitenGovernment of Jharkhand: Receipt of Online Payment of Stam VAniket RajNoch keine Bewertungen

- Show MultidocsDokument20 SeitenShow MultidocsAnonymous GF8PPILW5Noch keine Bewertungen

- Cfei Permit ChecklistDokument2 SeitenCfei Permit ChecklistThe MatrixNoch keine Bewertungen

- Sar V Estate Saunders 1931 Ad 276Dokument6 SeitenSar V Estate Saunders 1931 Ad 276Maka T ForomaNoch keine Bewertungen

- Ix Nazism and Rise of HitlerDokument10 SeitenIx Nazism and Rise of HitlerRanjana AnandNoch keine Bewertungen

- NullDokument209 SeitenNullTHULANI DERRICK NKUTA100% (3)

- Greenfield v. Mold Rite Plastics - ComplaintDokument61 SeitenGreenfield v. Mold Rite Plastics - ComplaintSarah BursteinNoch keine Bewertungen

- Last of The Black TitansDokument27 SeitenLast of The Black TitansKasesa ChimucoNoch keine Bewertungen

- Armed Forces of The Philippines - WikipediaDokument63 SeitenArmed Forces of The Philippines - WikipediaRodilla TijamNoch keine Bewertungen