Beruflich Dokumente

Kultur Dokumente

En (1119)

Hochgeladen von

reacharunkOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

En (1119)

Hochgeladen von

reacharunkCopyright:

Verfügbare Formate

t!HAP. I.

VALUATION OF PROPEHTY.

1097

But there niny be a fiiril.er expo^iiliture for siir\ey'>rs' charges, solicitors' cliar^ts for

transferring the projierty, and loss of capital by selling out of the funds, wliicli it may

!>e

often necessary to deduct from that amount. A matter also of consideration is wlietlKT

the building is in a good state of repair, both in structure and decoration, as ready for a

tenant.

Wlien the property is hasehold, then, as soon as the clear income has been ascertained, it

will have to be multiplied hy the n\imher of years' purchase at the rate of interest required

for the term (Fourth 'JVilile), to find tlie amount that the property is worth. The number

of years' purchase pi o\ ides for tlie percentage and to get back the ]irincipal, tlie annual

instalments of which must be invested at the same rate of interest to produce tlie total sum

at the end of the term (in lieu of the rebuilding fund in the freehold property). Among

Imvood's Tallies, 16th ediiion, 1855, is one

(p.

177"), whereby to calculate

"

tlie present

value of an income fur a ceitain number of years, wliicli is to pay duiing its continuance a

given rate of interest on the purchase-money, and to replace the purchase-money at the end

of the same number of years at a rate of interest to be selected.

'

F'roin the former method of expressing the valuation, it would appear that a purchaser

may realise 8 per cent, upon his outlay

;

and so indeed he may, for a few years, if" every-

thing connected with the property be very favourable

;

but the latter calculation shows

exactly wluit may be expected, namely, that on capitalising a fiirther sum to form a sinking

fund for certain repayments, then

.'> jier cent, per annum may be appropriated as income,

the remainder of the rent being set aside to supply a fund to meet exigencies of no uncom-

mon occurrence. The rial value of the property, moreover, is found to be much less than

What tlie rough calculation would show it to be worth.

I'lie deductions for losses dejiend entirely upon the class of house. First class houses

in good situations let so readily to responsible tenants, who for their own comlbrt and

display maintain the fabric, that the sums to be deducted for the occasional want of occu-

jiants and expenses of reletting are reduced to a minimum. On the other hand, a much

lower class of house, together with the present unsatisfaetorj' mode of letting houses on

three years' agreements, and the still more ineligible arrangement by the year, throw so

much larger amounts for repairs, decorations, and change of tenancy, upon the landlord,

that the total of the sums to be deducted is raised to a very high estimate. Herein the

best judgment of the valuator is called into requisition, and it requires the knowledge ob-

tained by the practical architect to assist his judgment in such matters.

After tlie actual value has been ascertained, another item for consideration is the additional

sum that a purchaser will be induced to give for some reasonsuch as the property being in

a fashionable neighbourhood; the house possessing arrangements peculiarly suited to his

wishes, and so on : this amount may be called a

"

fancy price," and when paid had better

be considered as money sunk.

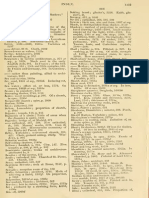

For making rough calculations, according to the first instance, the value of freehold

land in the country is generally considered worth from 30 to SS years' purchase, being cal-

culated on the 3 per cent, tables. In a few very exceptional cases as much as 40 years'

jjurchase has been given

;

but the difference constituted a

'

fancy price." F'or town plots

from 25 to 30 years' is more usual. Freehold houses and buildings, 1st and 2nd class, fiom

18 to 20 years' purchase, or 5 per cent.; 3rd and 4th cluss, about 16 years' purcha.se. or 6

per cent.

for Leasehold properly :

1st and 2nd class, from 15 to 16 years' purchase or 6 per cent,

2nd and 3rd

14 to 15 ,, 7

3rd and 4th 12 to 13

8

4th and 5th 11 to 12

9

5th and 6th 10

10

Freehold Ground-rents are valuable in proportion to the extent to which they are

covered by the rack-rent and by the period of reversion. A good ground-rent ought to

be six times covered, that is, five parts are brick and mortar rent, and one part ground-

rent. A reversion, however, unless williin forty years, is not much taken into account.

Some ground-rents in the City of London (where the ground-rent is larger in proportion)

bare sold for Sl^- years' purchase ;

those only covered by three times the rack rent, sold

for 25 years' purchase. Leasehold and freehold giound-rents can only be valued according

to locality, circumstances, length of holding, &c. Unsecured ground-rents are usually

valued at 25 years' purchase, but those well-secured at from 30 to 33 years' purchase.

Jniproved ground-rents are not worth so much as the freehold ground-rent, in consequence

of the covenants of sujierior leases, danger of breaches of covenants, &c.

In the valuation of leases held on lives, the operation, after bringing the rent to a clear

annuity, is conducted by means of the sixth, seventh, and eighth tables, given hereafter, as

the case may require.

In the valuation of warehouses, the only safe inethod of coming at the value of a rentl

Das könnte Ihnen auch gefallen

- Of Property.: Money MakeDokument1 SeiteOf Property.: Money MakereacharunkNoch keine Bewertungen

- En (1118)Dokument1 SeiteEn (1118)reacharunkNoch keine Bewertungen

- En (1116)Dokument1 SeiteEn (1116)reacharunkNoch keine Bewertungen

- Coming Developments in Business Property Leasing by Robert BakerDokument4 SeitenComing Developments in Business Property Leasing by Robert Bakerreal-estate-historyNoch keine Bewertungen

- Long Term Leases by John Grosse of PasadenaDokument4 SeitenLong Term Leases by John Grosse of Pasadenareal-estate-historyNoch keine Bewertungen

- Income Approach To ValuationDokument35 SeitenIncome Approach To Valuation054 Modi TanviNoch keine Bewertungen

- En (1120)Dokument1 SeiteEn (1120)reacharunkNoch keine Bewertungen

- RA 386 - Civil Code of The Philippines (Book 4 - Obligations & Contracts (Title 8 - Lease) )Dokument3 SeitenRA 386 - Civil Code of The Philippines (Book 4 - Obligations & Contracts (Title 8 - Lease) )remramirez100% (1)

- Elements of ValuationsDokument14 SeitenElements of ValuationsnamitNoch keine Bewertungen

- Bridge Leases Contract, Property, & StatusDokument17 SeitenBridge Leases Contract, Property, & StatusAaron Goh100% (1)

- Duffy v. Central R. Co. of NJ, 268 U.S. 55 (1925)Dokument4 SeitenDuffy v. Central R. Co. of NJ, 268 U.S. 55 (1925)Scribd Government DocsNoch keine Bewertungen

- As 19 LeasesDokument13 SeitenAs 19 LeasesSubrat NandaNoch keine Bewertungen

- Royalty AccountsDokument30 SeitenRoyalty AccountsKavinraj R S0% (1)

- House Designs, SAC, 1925Dokument47 SeitenHouse Designs, SAC, 1925House Histories100% (4)

- Commercial LeasesDokument6 SeitenCommercial LeasesJana PastierikováNoch keine Bewertungen

- Elements of Valuations: Professional PracticeDokument14 SeitenElements of Valuations: Professional PracticeShah ZainNoch keine Bewertungen

- Pondicherry Cultivating Tenants Payment of Fair Rent Act 1970Dokument17 SeitenPondicherry Cultivating Tenants Payment of Fair Rent Act 1970Latest Laws TeamNoch keine Bewertungen

- Accounting Lesson 17 - Royalty AccountsDokument38 SeitenAccounting Lesson 17 - Royalty AccountsRameshKumarMurali79% (19)

- Economics of Public Issues 19th Edition Miller Solutions Manual 1Dokument35 SeitenEconomics of Public Issues 19th Edition Miller Solutions Manual 1paulhansenkifydcpaqr100% (19)

- Montgomery Ward & Co., Incorporated v. Collins Estate, Inc., 268 F.2d 830, 4th Cir. (1959)Dokument11 SeitenMontgomery Ward & Co., Incorporated v. Collins Estate, Inc., 268 F.2d 830, 4th Cir. (1959)Scribd Government DocsNoch keine Bewertungen

- Midler Court Realty, Inc. v. Commissioner of Internal Revenue, 521 F.2d 767, 3rd Cir. (1975)Dokument7 SeitenMidler Court Realty, Inc. v. Commissioner of Internal Revenue, 521 F.2d 767, 3rd Cir. (1975)Scribd Government DocsNoch keine Bewertungen

- Welsh Homes, Incorporated, and v. Commissioner of Internal Revenue, And, 279 F.2d 391, 4th Cir. (1960)Dokument6 SeitenWelsh Homes, Incorporated, and v. Commissioner of Internal Revenue, And, 279 F.2d 391, 4th Cir. (1960)Scribd Government DocsNoch keine Bewertungen

- Glossary of Real Estate TermsDokument5 SeitenGlossary of Real Estate Termsskkarim90Noch keine Bewertungen

- Lecture 6 Investment MethodDokument65 SeitenLecture 6 Investment Methodhani nazirahNoch keine Bewertungen

- Leases Business Properties by O. S. Lair W Ross Campbell Co Los AngelesDokument8 SeitenLeases Business Properties by O. S. Lair W Ross Campbell Co Los Angelesreal-estate-historyNoch keine Bewertungen

- An Inquiry into the Nature and Progress of Rent, and the Principles by Which It is RegulatedVon EverandAn Inquiry into the Nature and Progress of Rent, and the Principles by Which It is RegulatedNoch keine Bewertungen

- Lease Hold Covenant: Hampton School Law Unit 2 - Property LawDokument27 SeitenLease Hold Covenant: Hampton School Law Unit 2 - Property LawchelsiaNoch keine Bewertungen

- Module 10 Lease & LicenceDokument42 SeitenModule 10 Lease & LicenceSamkiti JainNoch keine Bewertungen

- Elements of ValuationsDokument16 SeitenElements of ValuationsShah ZainNoch keine Bewertungen

- Info For TenantsDokument11 SeitenInfo For Tenantsnex342Noch keine Bewertungen

- The Landlord and Tenant OrdinanceDokument16 SeitenThe Landlord and Tenant Ordinanceandy john channelNoch keine Bewertungen

- Seattle Tenant LawsDokument15 SeitenSeattle Tenant LawsyunushabibNoch keine Bewertungen

- Palmer v. Connecticut Railway & Lighting Co., 311 U.S. 544 (1941)Dokument14 SeitenPalmer v. Connecticut Railway & Lighting Co., 311 U.S. 544 (1941)Scribd Government DocsNoch keine Bewertungen

- Kleinfelder Company Has Decided To Lease Its New Office BuildingDokument1 SeiteKleinfelder Company Has Decided To Lease Its New Office BuildingM Bilal SaleemNoch keine Bewertungen

- 5 Amigo vs. Teves, 96 Phil. 252 (1954)Dokument5 Seiten5 Amigo vs. Teves, 96 Phil. 252 (1954)arctikmarkNoch keine Bewertungen

- Quit Rents ActDokument16 SeitenQuit Rents Actanon-443515100% (1)

- Ankit Thakur Assistant Professor Civil EngineeringDokument53 SeitenAnkit Thakur Assistant Professor Civil EngineeringAditiNoch keine Bewertungen

- LEASE (Intro To Law)Dokument11 SeitenLEASE (Intro To Law)moonriverNoch keine Bewertungen

- Dilapidation Survey 2-2Dokument16 SeitenDilapidation Survey 2-2NUR FATINAH BINTI ZOLKIFLI 5ENoch keine Bewertungen

- Valuation & Costing 70817Dokument137 SeitenValuation & Costing 70817Asawaree SuryawanshiNoch keine Bewertungen

- Fair RentDokument19 SeitenFair RentProf. Vandana Tiwari SrivastavaNoch keine Bewertungen

- PROPERTYDokument9 SeitenPROPERTYAbdullah Jawad MalikNoch keine Bewertungen

- ValuationDokument74 SeitenValuationFarhan KhanNoch keine Bewertungen

- CH 7Dokument4 SeitenCH 7Elsie GutierrezNoch keine Bewertungen

- Phase 3 - Sample Exam SetDokument28 SeitenPhase 3 - Sample Exam SetaliNoch keine Bewertungen

- Sale Leaseback & MortgageDokument30 SeitenSale Leaseback & MortgageshivpreetsandhuNoch keine Bewertungen

- Pitts Slip Marina Lease Agreement PDFDokument30 SeitenPitts Slip Marina Lease Agreement PDFAnonymous ZRsuuxNcCNoch keine Bewertungen

- 48 RACELIS Vs SPOUSES JAVIERDokument25 Seiten48 RACELIS Vs SPOUSES JAVIERLuelle PacquingNoch keine Bewertungen

- Should Land in The USSR Be Rented or Sold?Dokument8 SeitenShould Land in The USSR Be Rented or Sold?api-142090127Noch keine Bewertungen

- Valuation 2018Dokument27 SeitenValuation 2018sunkapakalgouthamiNoch keine Bewertungen

- Leasehold Estates in Land - Additional HandoutDokument3 SeitenLeasehold Estates in Land - Additional HandoutEmanuela Alexandra SavinNoch keine Bewertungen

- Analysis Criteria 2Dokument4 SeitenAnalysis Criteria 2torchbarsNoch keine Bewertungen

- Basic Appraisal For Real Estate BrokerDokument7 SeitenBasic Appraisal For Real Estate BrokerJosue Sandigan Biolon SecorinNoch keine Bewertungen

- Business Deductions For Rent and Lease Payments: AmortizedDokument6 SeitenBusiness Deductions For Rent and Lease Payments: AmortizedHosty PuffNoch keine Bewertungen

- Principles of Property ValuationDokument8 SeitenPrinciples of Property ValuationcivilsadiqNoch keine Bewertungen

- Lease AccountingDokument10 SeitenLease AccountingabrehamNoch keine Bewertungen

- Royalty AccountDokument21 SeitenRoyalty AccountLokesh Sharma100% (2)

- Equatorial Realty Development Vs Mayfair TheaterDokument7 SeitenEquatorial Realty Development Vs Mayfair TheaterGlenn Robin FedillagaNoch keine Bewertungen

- Tax Unit 1-2 - 25Dokument1 SeiteTax Unit 1-2 - 25joy BoseNoch keine Bewertungen

- Prospekt BGF PDFDokument150 SeitenProspekt BGF PDFreacharunkNoch keine Bewertungen

- Prospekt BGF PDFDokument150 SeitenProspekt BGF PDFreacharunkNoch keine Bewertungen

- Prospekt BGF PDFDokument150 SeitenProspekt BGF PDFreacharunkNoch keine Bewertungen

- Prospekt BGF PDFDokument150 SeitenProspekt BGF PDFreacharunkNoch keine Bewertungen

- Supplement To The Prospectuses and Summary Prospectuses For Investor Shares and Admiral™SharesDokument65 SeitenSupplement To The Prospectuses and Summary Prospectuses For Investor Shares and Admiral™SharesreacharunkNoch keine Bewertungen

- Supplement To The Prospectuses and Summary Prospectuses For Investor Shares and Admiral™SharesDokument65 SeitenSupplement To The Prospectuses and Summary Prospectuses For Investor Shares and Admiral™SharesreacharunkNoch keine Bewertungen

- General Terms and Conditions of The Pzu NNW (Personal Accident Insurance Pzu Edukacja InsuranceDokument19 SeitenGeneral Terms and Conditions of The Pzu NNW (Personal Accident Insurance Pzu Edukacja InsurancereacharunkNoch keine Bewertungen

- En (1460)Dokument1 SeiteEn (1460)reacharunkNoch keine Bewertungen

- En (1454)Dokument1 SeiteEn (1454)reacharunkNoch keine Bewertungen

- NameDokument2 SeitenNamereacharunkNoch keine Bewertungen

- En (1463)Dokument1 SeiteEn (1463)reacharunkNoch keine Bewertungen

- En (1464)Dokument1 SeiteEn (1464)reacharunkNoch keine Bewertungen

- Emergency Response Quick Guide MY: 2014Dokument2 SeitenEmergency Response Quick Guide MY: 2014reacharunkNoch keine Bewertungen

- En (1462)Dokument1 SeiteEn (1462)reacharunkNoch keine Bewertungen

- En (1461)Dokument1 SeiteEn (1461)reacharunkNoch keine Bewertungen

- En (1458)Dokument1 SeiteEn (1458)reacharunkNoch keine Bewertungen

- En (1459)Dokument1 SeiteEn (1459)reacharunkNoch keine Bewertungen

- En (1455)Dokument1 SeiteEn (1455)reacharunkNoch keine Bewertungen

- En (1457)Dokument1 SeiteEn (1457)reacharunkNoch keine Bewertungen

- En (1451)Dokument1 SeiteEn (1451)reacharunkNoch keine Bewertungen

- En (1453)Dokument1 SeiteEn (1453)reacharunkNoch keine Bewertungen

- En (1456)Dokument1 SeiteEn (1456)reacharunkNoch keine Bewertungen

- En (1452)Dokument1 SeiteEn (1452)reacharunkNoch keine Bewertungen

- En (1389)Dokument1 SeiteEn (1389)reacharunkNoch keine Bewertungen

- En (1388)Dokument1 SeiteEn (1388)reacharunkNoch keine Bewertungen

- Mate The: (Fig. - VrouldDokument1 SeiteMate The: (Fig. - VrouldreacharunkNoch keine Bewertungen

- En (1450)Dokument1 SeiteEn (1450)reacharunkNoch keine Bewertungen

- And Rome.: in Front of The Prostyle Existed atDokument1 SeiteAnd Rome.: in Front of The Prostyle Existed atreacharunkNoch keine Bewertungen

- En (1390)Dokument1 SeiteEn (1390)reacharunkNoch keine Bewertungen

- En (1387)Dokument1 SeiteEn (1387)reacharunkNoch keine Bewertungen

- 91 Paculdo Vs RegaladoDokument2 Seiten91 Paculdo Vs RegaladoMichael John Duavit Congress OfficeNoch keine Bewertungen

- Philippine Deposit Insurance Corporation Act (RA 3591)Dokument22 SeitenPhilippine Deposit Insurance Corporation Act (RA 3591)BellaDJNoch keine Bewertungen

- Phil Town Rule1Dokument18 SeitenPhil Town Rule1Rajiv Mahajan88% (8)

- 1st Activity in ACCA104Dokument11 Seiten1st Activity in ACCA104John Rey BonitNoch keine Bewertungen

- Business Math Profit or LossDokument1 SeiteBusiness Math Profit or LossAnonymous DmjG6o100% (2)

- Analysis of Financial StatementDokument47 SeitenAnalysis of Financial StatementViransh Coaching ClassesNoch keine Bewertungen

- Effect of Micro-Finance On PovertyDokument18 SeitenEffect of Micro-Finance On PovertyKarim KhaledNoch keine Bewertungen

- Data Analytics NotesDokument8 SeitenData Analytics NotesRamesh Safare100% (2)

- Case StudyDokument19 SeitenCase Studynida100% (3)

- Consolidated FS MCDokument2 SeitenConsolidated FS MCRyan Prado AndayaNoch keine Bewertungen

- This Study Resource WasDokument2 SeitenThis Study Resource WasJamaica DavidNoch keine Bewertungen

- What Does The Word BIBLE Mean Rev 1Dokument1 SeiteWhat Does The Word BIBLE Mean Rev 1Kurozato CandyNoch keine Bewertungen

- Digest The Philippine Sugar Estates Development Co vs. POizatDokument1 SeiteDigest The Philippine Sugar Estates Development Co vs. POizatJureeBonifacioMudanzaNoch keine Bewertungen

- ProposalDokument12 SeitenProposalapil subediNoch keine Bewertungen

- Morning Star Report 20190906085421Dokument1 SeiteMorning Star Report 20190906085421ChankyaNoch keine Bewertungen

- Consolidated Statement: DepositsDokument6 SeitenConsolidated Statement: DepositsVivekNoch keine Bewertungen

- Tata Steel Key Financial Ratios, Tata Steel Financial Statement & AccountsDokument3 SeitenTata Steel Key Financial Ratios, Tata Steel Financial Statement & Accountsmohan chouriwarNoch keine Bewertungen

- اعادة التامينDokument23 Seitenاعادة التامينfaiza elabidNoch keine Bewertungen

- Choice Multiple Questions - Docx.u1conflictDokument4 SeitenChoice Multiple Questions - Docx.u1conflictAbdulaziz S.mNoch keine Bewertungen

- Company Profile: Tullow Oil PLCDokument8 SeitenCompany Profile: Tullow Oil PLCXolani Radebe RadebeNoch keine Bewertungen

- Our Lady of The Pillar College-San Manuel IncDokument5 SeitenOur Lady of The Pillar College-San Manuel Incrosalyn mauricioNoch keine Bewertungen

- Institutions and Corporate Capital Structure in The MENA RegionDokument32 SeitenInstitutions and Corporate Capital Structure in The MENA RegionMissaoui IbtissemNoch keine Bewertungen

- 23Dokument2 Seiten23Heaven HeartNoch keine Bewertungen

- Summit BankDokument12 SeitenSummit BankMian Muhammad HaseebNoch keine Bewertungen

- UEFA Stadium Design Guidelines PDFDokument160 SeitenUEFA Stadium Design Guidelines PDFAbdullah Hasan100% (1)

- Cwa Jun 2013 Tax SolnDokument15 SeitenCwa Jun 2013 Tax Solnbiju_0147Noch keine Bewertungen

- KOTAK BANK ProjectDokument76 SeitenKOTAK BANK ProjectNancy PatelNoch keine Bewertungen

- 2 - Chapter 1 - Banking Operations OverviewDokument29 Seiten2 - Chapter 1 - Banking Operations OverviewNgô KhánhNoch keine Bewertungen

- Auditing Mcom 2Dokument49 SeitenAuditing Mcom 2BhavyaNoch keine Bewertungen

- MODULE 7 BudgetingDokument6 SeitenMODULE 7 BudgetingKatrina Peralta FabianNoch keine Bewertungen