Beruflich Dokumente

Kultur Dokumente

Printed DBM Fs Eng Dec 5 Last To Public

Hochgeladen von

sodbayargOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Printed DBM Fs Eng Dec 5 Last To Public

Hochgeladen von

sodbayargCopyright:

Verfügbare Formate

Development Bank of Mongolia

International Financial Reporting Standards

Interim Financial Statements and

Independent Auditors Report

30 June 2013

Contents

INDEPENDENT AUDITORS REPORT

INTERIM FINANCIAL STATEMENTS

Interim Statement of Financial Position ......................................................................................................... 1

Interim Statement of Comprehensive Income............................................................................................... 2

Interim Statement of Changes in Equity........................................................................................................ 3

Interim Statement of Cash Flows ............................................................................................................. 4

Notes to the Interim Financial Statements

1. CORPORATE INFORMATION AND OPERATING ENVIRONMENT 8

2. FINANCIAL REPORTING FRAMEWORK AND BASIS FOR PREPARATION AND 9

PRESENTATION

3. SIGNIFICANT ACCOUNTING POLICIES 13

4. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION 21

UNCERTAINTY

5. APPLICATION OF NEW AND REIVISED INTERNATIONAL FINANCIAL 22

REPORTING STANDARDS

6. CASH AND CASH EQUIVALENTS 26

7. BANK DEPOSITS 27

8. LOAN AND ADVANCES 28

9. OTHER ASSETS 32

10. PROPERTY AND EQUIPMENT 33

11. INTANGIBLES ASSETS 34

12. CUSTOMER ACCOUNTS AND OTHER LIABILITIES 35

13. BONDS 35

14. BORROWINGS 36

15. RELATED PARTY TRANSACTIONS 36

16. CONTRIBUTED CAPITAL 38

17. INTEREST INCOME 39

18. INTEREST EXPENSE 39

19. FOREIGN EXCHANGE LOSSES LESS GAINS 40

20. ADMINISTRATIVE AND OTHER OPERATING EXPENSES 40

21. INCOME TAXES 40

22. FINANCIAL RISK MANAGEMENT 42

23. PRESENTATION OF FINANCIAL INSTRUMENTS BY MEASUREMENT CATEGORY 55

24. FAIR VALUES OF FINANCIAL ASSETS AND LIABILITIES 56

25. COMMITMENTS AND CONTINGENCIES 60

26. SEGMENT REPORTING 61

27. POST BALANCE SHEET EVENTS 62

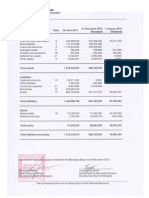

Development Bank of Mongolia

Interim Statement of Financial Position

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

Development Bank of Mongolia

Interim Statement of Comprehensive Income

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

4

Development Bank of Mongolia

Interim Statement of Comprehensive Income

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

5

In thousands of Mongolian

Tugriks

Note 30 June 2013

(Restated)

1 January 2012

(Restated)

Assets

Cash and cash equivalents 6 245,896,656 216,468,206 75,817,745

Bank deposits 7 137,243,869 168,924,490 -

Loans and advances 8 1,110,543,393 493,555,967 -

Intangible assets 11 798,248 726,688 811,286

Property and equipment 10 375,355 234,558 182,563

Deferred tax assets 21 8,132,651 5,940,360 44,933

Other assets 9 15,352,501 2,285,515 3,667

Total assets 1,518,342,673 888,135,784 76,860,194

Liabilities

Customer accounts 12 38,011,542 6,960 -

Other liabilities 1,202,933 505,688 1,139,593

Income tax payables 21 6,943,985 3,313,560 -

Borrowings 14 433,553,076 - -

Bonds 13 964,184,602 817,317,727 26,622,791

Total liabilities 1,443,896,138 821,143,935 27,762,384

Equity

Share capital 16 73,300,000 73,300,000 49,700,000

Retained earnings 1,146,535 (6,308,151) (602,190)

Total equity 74,446,535 66,991,849 49,097,810

Total liabilities and equity 1,518,342,673 888,135,784 76,860,194

Development Bank of Mongolia

Interim Statement of Comprehensive Income

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

6

Approved for issue and signed on behalf of the Executive management on 8 November 2013.

Munkhbat Nanjid Tuyachimeg Sevjid

Chief Executive Officer Acting Head of Accounting Division

Development Bank of Mongolia Development Bank of Mongolia

In thousands of Mongolian Tugriks Note

1 January 2013

to 30 June 2013

1 January 2012

to 30 June 2012

Interest income 17 40,580,655 600,573

Interest expense 18 (27,655,733) (406,668)

Net interest income 12,924,922 193,905

Net interest income after provision for loan

impairment 12,924,922 193,905

Gains less losses from trading in foreign currencies 770,852 -

Foreign exchange gains less losses 19 (1,966,848) (2,500,419)

Administrative and other operating expenses 20 (2,149,512) (755,243)

Profit/(loss) before tax 9,579,414 (3,061,757)

Income tax (expenses)/benefit 21 (2,124,726) 829,757

Profit/(loss) for the period 7,454,688 (2,232,000)

Total comprehensive income/(loss) for the period 7,454,688 (2,232,000)

Development Bank of Mongolia

Interim Statement of Changes in Equity

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

In thousands of Mongolian Tugriks

Note Share capital

Retained

earnings

Total equity

Balance at 1 January 2012 16 49,700,000 (602,190) 49,097,810

Loss for the period - (2,232,000) (2,232,000)

Total comprehensive loss - (2,232,000) (2,232,000)

Balance at 30 June 2012 16 49,700,000 (2,834,190) 46,865,810

Balance at 1 January 2013 16 73,300,000 (6,308,151) 66,991,849

Profit for the period - 7,454,688 7,454,688

Total comprehensive income - 7,454,688 7,454,688

Balance at 30 June 2013 16 73,300,000 1,146,535 74,446,535

Development Bank of Mongolia

Interim Statement of Cash Flows

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

8

In thousands of Mongolian Tugriks

1 January 2013

to 30 June 2013

1 January 2012

to 30 June 2012

Cash flows from operating activities

Profit / (loss) before tax 9,579,414 (3,061,757)

Adjustments to:

Depreciation, amortization 84,927 75,207

Interest income (40,580,655) (600,573)

Interest expense on borrowings 27,655,733 406,668

FX (gain)/loss -Unrealized 1,638,772 186,086

Other non-cash operating expenses 233,569 114,775

Cash flows from operating activities before changes in

operating assets and liabilities (1,388,240) (2,879,594)

Net (increase)/decrease in loans and advances to customers (616,987,426) (27,225,665)

Net (increase)/decrease in other financial assets 30,917,488 (26,133,092)

Net increase/ (decrease) in other financial liabilities

38,701,826 (1,138,514)

Net cash (used in)/from operating activities before tax

and interest received and paid

(548,756,352) (57,376,865)

Income taxes paid (686,593) -

Interest received 22,014,073 391,657

Interest paid on borrowings (24,357,996) (738,049)

Net cash (used in)/from operating activities (551,786,868) (57,723,257)

Development Bank of Mongolia

Interim Statement of Cash Flows

Period ended 30 J une 2013

The accompanying notes are an integral part of these financial statements.

9

In thousands of Mongolian Tugriks

1 January 2013

to 30 June 2013

1 January 2012

to 30 June 2012

Net cash (used in)/from operating activities (551,786,868) (57,723,257)

Cash flows from investing activities

Purchase of property, plant, equipment and intangible assets (297,283) (110,026)

Net cash used in investing activities (297,283) (110,026)

Cash flows from financing activities

Proceeds from borrowings 433,553,076

-

Proceeds from bonds 147,045,342 769,007,622

Net cash from/(used in) financing activities 580,598,418 769,007,622

Effect of exchange rate changes on cash and cash

equivalents 914,183 6,200,770

Net (decrease)/increase in cash and cash equivalents 29,428,450 717,375,109

Cash and cash equivalents at the beginning of the period 216,468,206 75,817,745

Cash and cash equivalents at the end of the period 245,896,656 793,192,854

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

10

1. CORPORATE INFORMATION AND OPERATING ENVIRONMENT

The Development Bank of Mongolia ('the Bank') is a Government-owned, policy-oriented statutory

financial institution established on 25 March, 2011 pursuant to Resolution No. 195 dated 20 July 2010

by the Government of Mongolia and under the Development Bank Law passed by Parliament on 10

February 2011. The Bank has been registered as a limited liability company with the Legal Entity

Registration Office of the General Authority for State Registration since 25 March 2011 and is the

only policy bank in Mongolia. The Bank conducts its business under the direct supervision of the

Cabinet, which is the highest institution of Government administration in Mongolia and the Ministry of

Economic Development, and is regulated, principally, by the Development Bank Law. The Bank

commenced operations in May 2011.

The Government of Mongolia is the Bank's sole shareholder. In May and December 2011, the

Government contributed MNT 16.7 billion and MNT 33.0 billion, respectively, in cash to the Bank's

capital. In 2012, the Government contributed a further MNT 23.6 billion and as at 30 June 2013, the

Bank's share capital was 73.3 billion. The Government has contributed a further MNT 10.0 billion,

MNT 5.0 billion and MNT 35.0 billion in July, August and September 2013, respectively, to the Banks

capital.

In accordance with Article 21.1 of the Development Bank Law, Parliament determines the source of

equity financing the Government can provide to the Bank and determines the limits of loan

guarantees to be provided by the Government. The Bank is not subject to the rules and regulations

issued by the Bank of Mongolia in relation to commercial banks. The Bank's policy is to maintain a

strong capital base so as to maintain investor, creditor and market confidence and to sustain future

development of the business.

Until July 2013, the executive management of the Bank had been carried out by a joint team from the

Bank and the Korean Development Bank. In July 2013, the Management Agreement with the Korean

Development Bank was changed to the Advisory Agreement, and the Bank is managed solely by

Mongolian nationals appointed by the Government. The Bank had an average of 63 employees

during the period ended 30 June 2013 (2012: 43). The Bank's principal place of business is: Max

Tower Building 2-3

rd

floor, Juulchin Street 4/4 Ulaanbaatar 15170, Mongolia.

These financial statements are presented in Mongolian Tugriks (MNT), unless otherwise stated.

These interim financial statements were approved for issue by the Executive mement of Directorsof

the Bank on 8 November 2013.

Operating Environment of the Bank

Mongolia displays many characteristics of an emerging market including relatively high inflation and

interest rates. After recording steady growth in 2010 and 2011, the Mongolian economy has shown

signs of a slowdown in 2012 that continued to 2013 due to declining global commodities prices,

concerns over slowing growth in China and changes to the Mongolian foreign investment law which

have slowed inbound foreign investment into the country.

The tax and customs legislation in Mongolia is subject to varying interpretations. The future economic

performance of Mongolia is tied to the continuing demand from China and continuing high global

prices for commodities as well as dependent upon the effectiveness of economic, financial and

monetary measures undertaken by the Government together with tax, legal regulatory and political

developments.

The international sovereign debt crisis, stock market volatility and other risks could have a negative

effect on the Mongolian financial and corporate sector.

Management is unable to predict all developments, which could have an impact on the Mongolian

economy, and consequently what effect, if any, they could have on the future financial position of the

Bank. Management believes it is taking all the necessary measures to support the sustainability and

development of the Banks business.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

11

2. FINANCIAL REPORTING FRAMEWORK AND BASIS FOR PREPARATION AND

PRESENTATION

Statement of Compliance

The interim financial statements of the Bank have been prepared in accordance International

Financial Reporting Standards (IFRS), which includes all applicable IFRS, International Accounting

Standards (IAS), and interpretations issued by the International Financial Reporting Interpretations

Committee (IFRIC) and Standing Interpretations Committee (SIC).

Basis of Preparation and Presentation

These interim financial statements have been prepared in accordance with International

Accounting Standard No. 34 Interim Financial Reporting, under the historical cost convention, as

modified by the initial recognition of financial instruments based on fair value. The principal

accounting policies applied in the preparation of these financial statements are set out below.

These policies have been consistently applied to all the periods presented, unless otherwise

stated.

Functional Currency

These financial statements are presented in Mongolian tugriks ('MNT') the currency of the primary

economic environment in which the Bank operates and the Banks functional currency.

Amendments of the financial statements after issue.

The Banks management has the power to amend the financial statements after issue.

Restatements

The following retrospective restatements have been made in these financial statements:

Accrued Interest Receivable and Accrued Interest Payable. Accrued Interest Receivable and

Accrued Interest Payable were previously reported as separate line items in the Statement of

Financial Position for the year ended 31 December 2012, while they are integral to

measurement of the related assets and liabilities at amortized cost according to the Banks

accounting policies. They have therefore been reclassified within Loans and advances, Bank

Deposits, Cash and cash equivalents and Long Term Debt in these financial statements.

Accrued Interest receivables on bank deposits of MNT 2,350 million as at 31 December 2012

has been restated to Bank Deposits in the amount of MNT 1,872 million and to Cash and cash

equivalents in the amount of MNT 478 million. Accrued Interest receivables on loans and

advances of MNT 6,771 million as at 31 December 2012 has been restated to Loans and

advances. Accrued Interest receivables on bank deposits of MNT 108 million as at 1 January

2012 has been restated to Bank Deposits. Accrued Interest payables on bonds of MNT 12,896

million as at 31 December 2012 has been restated to Bonds. Accrued Interest payables on

bonds of MNT 102 million as at 1 January 2012 has been restated to Bonds. This restatement

has no impact on the Statement of Comprehensive Income while its impact on the Statement of

Financial Position as of 31 December 2012 is presented below.

Unearned Income and Non-Interest income. Management has reconsidered the accounting for

Unearned Income previously reported within Accounts and Other Liabilities and Non-interest

income which represented loan origination fees. These two items were presented as separate

line items in the Statement of Financial Position and the Statement of Comprehensive Income,

respectively, for the year ended 31 December 2012. They are reported within Loans and

advances and Interest Income in these financial statements. Other liabilities and Loans and

advances have been reduced by MNT 590 million. This restatements impact on the Statement

of Comprehensive Income and on the Statement of Financial Position as of 31 December 2012

is presented below.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

12

2. FINANCIAL REPORTING FRAMEWORK AND BASIS FOR PREPARATION AND

PRESENTATION (CONTINUED)

Restatements (continued)

Deposits from Borrowers. Management has reconsidered the accounting for Deposits from

Borrowers previously shown within Accounts and Other Liabilities. These amounts

represented conditional loan commitments. This was presented as a separate line in the

Statement of Financial Position for the year ended 31 December 2012. Following a

reassessment of the nature of this deposit amounting to MNT 2,330 million has now been

presented off balance sheet as undrawn commitments with the corresponding amount

removed from Loans and Advances. This restatement has no impact on the Statement of

Comprehensive Income while its impact on the Statement of Financial Position as of 31

December 2012 is presented below.

Previously recorded Interest Income: In 2013, the management performed a detailed analysis

of nature of certain transactions with the Government and their accounting treatment in

accordance with IFRS. As a result of this analysis, management concluded that cash

contributions received from the Government in the amount of MNT 23,957 million in 2012

(MNT 13 billion in the first half of the year) represents Government support with regard to the

guarantee issued by the Ministry of Finance and the Banks repayment of notes issued under

Euro Medium Term Notes Programme, and therefore meet definition of government grant

under IAS 20. As a result, related amount is recognised as a reduction in the related Interest

Expense in these financial statements. Related amount was recognised as interest income in

IFRS financial statements for year ended 31 December 2012. This restatement has no impact

on the Statement of Financial Position as of 31 December 2012, while its impact on the

Statement of Comprehensive Income as of 31 December 2012 is presented below.

Change in Deferred Tax Rate: In 2013, the management performed a detailed analysis of its

deferred tax calculation and its future tax rate. As a result of this analysis and on the basis of

forecasts management concluded that the Bank will incur tax at a rate of 25%. The Bank had

previously used 10% to calculate deferred tax. The related deferred tax asset and income tax

expense for 2012 have been restated in these financial statements. Related amount of MNT

2,475 million was recognised in Deferred tax assets on the Statement of Financial Position

as of 31 December 2012 and in Income tax expense on the Statement of Comprehensive

Income as of 31 December 2012. This restatements impact on the Statement of

Comprehensive Income and on the Statement of Financial Position as of 31 December 2012

is presented below.

Recognition of income tax charge: In 2013, the management performed a detailed analysis of

its current income tax return for 2012. As a result of this analysis management concluded that

the Bank will incur a current tax charge of MNT 3,314 million for the year ending 31 December

2012. This amount has been recognised within Income tax payables and Income tax

expenses. This restatements impact on the Statement of Comprehensive Income and on the

Statement of Financial Position as of 31 December 2012 is presented below.

Bank Deposits. Management has reconsidered the presentation of Bank Deposits amounting

to MNT 9,000 million as at 1 January 2012 which represented cash. As a result of this

analysis management concluded that this amount should be restated to Cash and cash

equivalents. This restatement has been reflected in the 1 January 2012 Statement of

Financial Position comparatives shown on page 3.

Reclassifications

Operating expenses. In 2013, the management performed a detailed analysis of its

presentation of operating expenses. As a result of this analysis management concluded that

Operating Expenses should be split to show Foreign exchange translation gain less loss

and Foreign exchange trading gain less loss separately on the Statement of Comprehensive

Income. Of MNT 5,771 million reclassified from Operating Expenses MNT 5,767 million was

reclassified to FX translation gain less losses and MNT 4 million was reclassified to FX

trading gain. This reclassification has no impact on the Statement of Financial

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

13

In thousands of Mongolian

Tugriks

Year ended

31 December 2012

(as previously

reported

Restatements Note

Year ended

31 December 2012

(restated)

Assets

Cash and cash equivalents 215,990,270 477,936 6 216,468,206

Bank deposits 167,052,000 1,872,490 7 168,924,490

Loans and advances 489,704,568 3,851,399 8 493,555,967

Accrued interest receivables 9,121,272 (9,121,272) 8 -

Intangible assets 726,688 - 11 726,688

Property and equipment 234,558 - 10 234,558

Deferred tax assets 3,465,282 2,475,078 21 5,940,360

Other assets 2,285,515 - 9 2,285,515

Total assets 888,580,153 444,369 - 888,135,784

Liabilities

Other liabilities 3,425,135 (2,919,447) 505,688

Customer accounts 6,960 - 12 6,960

Income tax payables - 3,313,560 21 3,313,560

Accrued interest payables 12,896,260 (12,896,260) 13 -

Bonds 804,421,467 12,896,260 13 817,317,727

Total liabilities 820,749,822 394,113 821,143,935

Equity

Share capital 73,300,000 - 16 73,300,000

Retained earnings (5,469,669) (838,482) (6,308,151)

Total equity 67,830,331 (838,482) 66,991,849

Total liabilities and equity 888,580,153 (444,369) 888,135,784

2. FINANCIAL REPORTING FRAMEWORK AND BASIS FOR PREPARATION AND

PRESENTATION (CONTINUED)

Reclassifications (continued)

Position as of 31 December 2012, while its impact on the Statement of Comprehensive

Income as of 31 December 2012 is shown below.

Other Assets and Foreign exchange gain less losses. In 2013, the management performed a

detailed analysis of nature of certain transactions with the Government and their accounting

treatment in accordance with IFRS. As a result of this analysis, management concluded that

receivables due from the Ministry of Finance, presented within Other Assets, in the amount

of MNT 2,168,468 thousand meets the definition of a government grant under IAS 20. The

grant amount is recognised in the related expense to which the grant relates to namely the

Foreign exchange gain less losses in these financial statements. This was previously treated

as an embedded derivative and recorded within Operating Expenses in the 31 December

2012 financial statements. This reclassification has no impact on the Statement of Financial

Position as of 31 December 2012, and no impact on the Statement of Comprehensive Income

as of 31 December 2012.

The reclassifications have no impact on the Statement of Financial Position. The impact of the above

restatements on the Statement of Financial Position as of 31 December 2012 is presented below.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

14

In thousands of Mongolian Tugriks

Year ended

31 December

2012

(as previously

reported

Restatements

Reclassific

ation

Note

Year ended

31 December

2012

(adjusted)

Interest income 36,787,338 (23,909,064) - 17 12,878,274

Interest expense (37,652,609) 23,957,121 - 18 (13,695,488)

Net interest income (865,271) 48,057 - (817,214)

Non-interest income 48,057 (48,057) -

Operating expenses (7,470,614) - 5,767,295 20 (1,703,319)

Foreign exchange trading gains less losses - - 4,060 4,060

Foreign exchange gains less losses

- - (5,771,355) 19 (5,771,355)

Profit before tax (8,287,828) (48,057) - (8,287,828)

Income tax expense 3,420,349 (838,482) - 21 2,581,867

Profit for the year (4,867,479) (838,482) - (5,705,962)

Total comprehensive income for the

year (4,867,479) (838,482) - (5,705,962)

2. FINANCIAL REPORTING FRAMEWORK AND BASIS FOR PREPARATION AND

PRESENTATOIN (CONTINUED)

The impact of the above reclassification and restatements on the Statement of Comprehensive

Income as of 31 December 2012 is presented below.

The period 1 January 2012 to 30 June 2012 has never previously been audited, published or made

publically available. As such the figures for this period are not restated.

The abovementioned restatements and reclassifications were reflected in the Banks Statement of

cash flows in these financial statements. Management concluded that detailed disclosures of the

effect of restatements, reclassifications or other improvements on each financial statement line item

of the statement of cash flows are not necessary, given that the only impact is an increase of MNT 9

billion to the cash and cash equivalents opening balance as at 1 January 2012 and a corresponding

impact on the Net (increase)/decrease in other financial assets line.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

15

3. SIGNIFICANT ACCOUNTING POLICIES

Financial instruments - key measurement terms. Depending on their classification financial

instruments are carried at fair value or amortised cost as described below.

Fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability

in an orderly transaction between market participants at the measurement date. The best evidence of

fair value is price in an active market. An active market is one in which transactions for the asset or

liability take place with sufficient frequency and volume to provide pricing information on an ongoing

basis. Fair value of financial instruments traded in an active market is measured as the product of the

quoted price for the individual asset or liability and the quantity held by the entity. This is the case

even if a markets normal daily trading volume is not sufficient to absorb the quantity held and placing

orders to sell the position in a single transaction might affect the quoted price.

A portfolio of financial derivatives or other financial assets and liabilities that are not traded in an

active market is measured at the fair value of a group of financial assets and financial liabilities on the

basis of the price that would be received to sell a net long position (i.e. an asset) for a particular risk

exposure or paid to transfer a net short position (i.e. a liability) for a particular risk exposure in an

orderly transaction between market participants at the measurement date. This is applicable for

assets carried at fair value on a recurring basis if the Group: (a) manages the group of financial

assets and financial liabilities on the basis of the entitys net exposure to a particular market risk (or

risks) or to the credit risk of a particular counterparty in accordance with the entitys documented risk

management or investment strategy; (b) it provides information on that basis about the group of

assets and liabilities to the entitys key management personnel; and (c) the market risks, including

duration of the entitys exposure to a particular market risk (or risks) arising from the financial assets

and financial liabilities is substantially the same.

Valuation techniques such as discounted cash flow models or models based on recent arms length

transactions or consideration of financial data of the investees are used to measure fair value of

certain financial instruments for which external market pricing information is not available. Fair value

measurements are analysed by level in the fair value hierarchy as follows: (i) level one are

measurements at quoted prices (unadjusted) in active markets for identical assets or liabilities, (ii)

level two measurements are valuations techniques with all material inputs observable for the asset or

liability, either directly (that is, as prices) or indirectly (that is, derived from prices), and (iii) level three

measurements are valuations not based on solely observable market data (that is, the measurement

requires significant unobservable inputs). Transfers between levels of the fair value hierarchy are

deemed to have occurred at the end of the reporting period.

Transaction costs. Transaction costs are incremental costs that are directly attributable to the

acquisition, issue or disposal of a financial instrument. An incremental cost is one that would not have

been incurred if the transaction had not taken place. Transaction costs include fees and commissions

paid to agents (including employees acting as selling agents), advisors, brokers and dealers, levies

by regulatory agencies and securities exchanges, and transfer taxes and duties. Transaction costs do

not include debt premiums or discounts, financing costs or internal administrative or holding costs.

Amortised cost. Amortised cost is the amount at which the financial instrument was recognised at

initial recognition less any principal repayments, plus accrued interest, and for financial assets less

any write-down for incurred impairment losses. Accrued interest includes amortisation of transaction

costs deferred at initial recognition and of any premium or discount to maturity amount using the

effective interest method. Accrued interest income and accrued interest expense, including both

accrued coupon and amortised discount or premium (including fees deferred at origination, if any),

are not presented separately and are included in the carrying values of related items in the statement

of financial position.

The effective interest method. The effective interest method is a method of allocating interest

income or interest expense over the relevant period, so as to achieve a constant periodic rate of

interest (effective interest rate) on the carrying amount. The effective interest rate is the rate that

exactly discounts estimated future cash payments or receipts (excluding future credit losses) through

the expected life of the financial instrument or a shorter period, if appropriate, to the net carrying

amount of the financial instrument. The effective interest rate discounts cash flows of variable interest

instruments to the next interest reprising date, except for the premium or discount which reflects the

credit spread over the floating rate specified in the instrument, or other variables that are not reset to

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

16

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Market rates. Such premiums or discounts are amortised over the whole expected life of the

instrument. The present value calculation includes all fees paid or received between parties to the

contract that are an integral part of the effective interest rate

Initial recognition of financial instruments. Trading securities, derivatives and other financial

instruments at fair value through profit or loss are initially recorded at fair value. All other financial

instruments are initially recorded at fair value plus transaction costs. Fair value at initial recognition is

best evidenced by the transaction price. A gain or loss on initial recognition is only recorded if there is

a difference between fair value and transaction price which can be evidenced by other observable

current market transactions in the same instrument or by a valuation technique whose inputs include

only data from observable markets.

All purchases and sales of financial assets that require delivery within the time frame established by

regulation or market convention (regular way purchases and sales) are recorded at trade date,

which is the date on which the Bank commits to deliver a financial asset. All other purchases are

recognised when the entity becomes a party to the contractual provisions of the instrument.

Derecognition of financial assets. The Bank derecognises financial assets when (a) the assets are

redeemed or the rights to cash flows from the assets otherwise expired or (b) the Bank has

transferred the rights to the cash flows from the financial assets or entered into a qualifying pass-

through arrangement while (i) also transferring substantially all risks and rewards of ownership of the

assets or (ii) neither transferring nor retaining substantially all risks and rewards of ownership, but not

retaining control. Control is retained if the counterparty does not have the practical ability to sell the

asset in its entirety to an unrelated third party without needing to impose restrictions on the sale.

Cash and cash equivalents. Cash and cash equivalents are items which are readily convertible to

known amounts of cash and which are subject to an insignificant risk of changes in value. Cash and

cash equivalents include all interbank placements with original maturities of less than 90 days. Funds

restricted for a period of more than 90 days on origination are excluded from cash and cash

equivalents. Cash and cash equivalents are carried at amortised cost.

Loans and advances to customers. Loans and advances to customers are recorded when the

Bank advances money to purchase or originate an unquoted non-derivative receivable from a

customer due on fixed or determinable dates, and has no intention of trading the receivable. Loans

and advances to customers are carried at amortised cost.

Bank Deposits. Bank deposit are recorded when the Bank advances money to counterparty banks

with no intention of trading the resulting unquoted non-derivative receivable due on fixed or

determinable dates. Amounts due from other banks are carried at amortised cost.

Impairment of financial assets carried at amortised cost. Impairment losses are recognised in

profit or loss for the year when incurred as a result of one or more events (loss events) that occurred

after the initial recognition of the financial asset and which have an impact on the amount or timing of

the estimated future cash flows of the financial asset or group of financial assets that can be reliably

estimated.

The following other principal criteria are also used to determine whether there is objective evidence

that an impairment loss has occurred:

- any instalment is overdue and the late payment cannot be attributed to a delay caused by the

settlement systems;

- the borrower experiences a significant financial difficulty as evidenced by the borrowers

financial information that the Bank obtains;

- the borrower considers bankruptcy or a financial reorganisation;

- there is an adverse change in the payment status of the borrower as a result of changes in

the national or local economic conditions that impact the borrower; or

- the value of collateral significantly decreases as a result of deteriorating market conditions.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

17

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Future cash flows in a group of financial assets that are collectively evaluated for impairment, are

estimated on the basis of the contractual cash flows of the assets and the experience of management

in respect of the extent to which amounts will become overdue as a result of past loss events and the

success of recovery of overdue amounts. Past experience is adjusted on the basis of current

observable data to reflect the effects of current conditions that did not affect past periods, and to

remove the effects of past conditions that do not exist currently.

If the terms of an impaired financial asset held at amortised cost are renegotiated or otherwise

modified because of financial difficulties of the borrower or issuer, impairment is measured using the

original effective interest rate before the modification of terms. The renegotiated asset is then

derecognized and a new asset is recognized at its fair value only if the risks and rewards of the asset

substantially changed. This is normally evidenced by a substantial difference between the present

values of the original cash flows and the new expected cash flows.

Impairment losses are always recognised through an allowance account to write down the assets

carrying amount to the present value of expected cash flows (which exclude future credit losses that

have not been incurred) discounted at the original effective interest rate of the asset. The calculation

of the present value of the estimated future cash flows of a collateralised financial asset reflects the

cash flows that may result from foreclosure less costs for obtaining and selling the collateral, whether

or not foreclosure is probable. Allowances are made against the carrying amount of loans and

advances that are identified as being potentially impaired, based on regular reviews of outstanding

balances, to reduce these loans and advances to their recoverable amount in accordance with

Regulations on Asset Classification and provisioning approved by the Executive director of

Development Bank of Mongolia.

If, in a subsequent period, the amount of the impairment loss decreases and the decrease can be

related objectively to an event occurring after the impairment was recognised (such as an

improvement in the debtors credit rating), the previously recognised impairment loss is reversed by

adjusting the allowance account through profit or loss for the year.

Uncollectible assets are written off against the related impairment loss provision after all the

necessary procedures to recover the asset have been completed and the amount of the loss has

been determined. Subsequent recoveries of amounts previously written off are credited to impairment

loss account in profit or loss for the year.

Prepayments. Prepayments represent expenses not yet incurred but already paid in cash.

Prepayments are initially recorded as assets and measured at the amount of cash paid.

Subsequently, these are charged to profit or loss as they are consumed in operations or expire with

the passage of time.

Property and Equipment. Property and equipment are initially measured at cost. At the end of each

reporting period, property and equipment are measured at cost less any subsequent accumulated

depreciation, amortization and impairment losses. Cost includes expenditure that is directly

attributable to the acquisition of the asset.

Purchased software that is integral to the functionality of the related equipment is capitalized as

part of that equipment.

When an item of property and equipment is acquired in an exchange for non-monetary asset/s, or a

combination of monetary and non-monetary assets, the cost of that item is measured at fair value

unless:

- the exchange transaction lacks commercial substance; or

- the fair value of neither the asset received nor the asset given up is reliably measurable.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

18

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Costs of minor repairs and maintenance are expensed when incurred. Costs of replacing major

parts or components of premises and equipment items are capitalised, and the replaced part is

retired.

Depreciation is computed on the straight-line method, based on the estimated useful lives of the

assets as follows:

- IT Equipment 3 years

- Furniture and fixture 10 years

- Vehicles 10 years

Derecognition of property and equipment. An item of property and equipment is derecognized

upon disposal or when no future economic benefits are expected to arise from the continued use of

the asset. Gain or loss arising on the disposal or retirement of an asset is determined as the

difference between the sales proceeds and the carrying amount of the asset and is recognized in

profit or loss.

Intangible Assets. Intangible assets that are acquired by the Bank with finite useful lives are initially

measured at cost. At the end of each reporting period items of intangible assets acquired are

measured at cost less accumulated amortization and accumulated impairment losses. Cost includes

purchase price, including import duties and non-refundable purchase taxes, after deducting trade

discounts and rebates and any directly attributable cost of preparing the intangible asset for its

intended use.

Subsequent expenditure is capitalized only when it increases the future economic benefits embodied

in the specific asset to which it relates. All other expenditure, including expenditure on internally

generated goodwill and brands, is recognized in profit or loss as incurred.

Amortization for intangible asset with finite useful life is calculated over the cost of the asset, or other

amount substituted for cost, less its residual value.

Amortization is recognized in profit or loss on a straight-line basis over the estimated useful lives of

intangible assets from the date that they are available for use, since this most closely reflects the

expected pattern of consumption of the future economic benefits embodied in the asset. The

estimated useful lives are as follows:

Software 10 years

Derecognition of intangible assets. An intangible asset is derecognized on disposal, or when no

future economic benefits are expected from use or disposal. Gains or losses arising from

derecognition of an intangible asset are measured as the difference between the net disposal

proceeds and the carrying amount of the asset and are recognized in profit or loss when the asset is

derecognized.

Impairment of Tangible and Intangible Assets. At the end of each reporting period management

assesses whether there is any indication of impairment of premises and equipment or intangible

assets. If any such indication exists, management estimates the recoverable amount, which is

determined as the higher of an assets fair value less costs to sell and its value in use. The carrying

amount is reduced to the recoverable amount and the impairment loss is recognised in profit or loss

for the year. An impairment loss recognised for an asset in prior years is reversed if there has been a

change in the estimates used to determine the assets value in use or fair value less costs to sell.

Customer accounts. Customer accounts are non-derivative liabilities to individuals, state or corporate

customers and are carried at amortised cost.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

19

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Bonds and Borrowings. Debt securities representing bonds issued are stated at amortised cost. If

the Bank purchases its own debt securities in issue, they are removed from the statement of financial

position and the difference between the carrying amount of the liability and the consideration paid is

included in gains arising from retirement of debt.

Ordinary shares. As at 30 June 2013, the Government of Mongolia had paid in capital contributions

to the Bank, but no share certificates had been issued.

Income tax. Interim period income tax expense is accrued using the effective tax rate that would be

applicable to expected total annual earnings, that is, the estimated weighted average annual effective

income tax rate applied to the pre-tax income of the interim period.

Deferred income tax. Deferred income tax is provided using the balance sheet liability method for

tax loss carry forwards and temporary differences arising between the tax bases of assets and

liabilities and their carrying amounts for financial reporting purposes. In accordance with the initial

recognition exemption, deferred taxes are not recorded for temporary differences on initial recognition

of an asset or a liability in a transaction other than a business combination if the transaction, when

initially recorded, affects neither accounting nor taxable profit. Deferred tax balances are measured at

tax rates enacted or substantively enacted at the end of the reporting period, which are expected to

apply to the period when the temporary differences will reverse or the tax loss carry forwards will be

utilised.

Deferred tax assets for deductible temporary differences and tax loss carry forwards are recorded

only to the extent that it is probable that future taxable profit will be available against which the

deductions can be utilised.

Provisions, Contingent Liabilities and Contingent Assets

Provisions. Provisions are recognized when the Bank has a present obligation, either legal or

constructive, as a result of a past event, it is probable that the Bank will be required to settle the

obligation through an outflow of resources embodying economic benefits, and the amount of the

obligation can be estimated reliably.

The amount of the provision recognized is the best estimate of the consideration required to settle the

present obligation at the end of each reporting period, taking into account the risks and uncertainties

surrounding the obligation. A provision is measured using the cash flows estimated to settle the

present obligation; its carrying amount is the present value of those cash flows.

When some or all of the economic benefits required to settle a provision are expected to be

recovered from a third party, the receivable is recognized as an asset if it is virtually certain that

reimbursement will be received and the amount of the receivable can be measured reliably.

Provisions are reviewed at the end of each reporting period and adjusted to reflect the current best

estimate.

If it is no longer probable that a transfer of economic benefits will be required to settle the obligation,

the provision is reversed.

Contingent Liabilities and Assets. Contingent liabilities and assets are not recognized because

their existence will be confirmed only by the occurrence or non-occurrence of one or more uncertain

future events not wholly within the control of the entity.

Contingent liabilities are disclosed, unless the possibility of an outflow of resources embodying

economic benefits is remote.

Contingent assets are disclosed only an inflow of economic benefits is probable.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

20

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Credit related commitments. From time to time, the Bank enters into credit related commitments,

including letters of credit and financial guarantees. Financial guarantees represent irrevocable

assurances to make payments in the event that a customer cannot meet its obligations to third parties

and carry the same credit risk as loans. Financial guarantees and commitments to provide a loan are

initially recognized at their fair value, which is normally evidenced by the amount of fees received.

This amount is amortized on a straight line basis over the life of the commitment, except for

commitments to originate loans if it is probable that the Bank will enter into a specific lending

arrangement and does not expect to sell the resulting loan shortly after origination; such loan

commitment fees are deferred and included in the carrying value of the loan on initial recognition. At

the end of each reporting period, the commitments are measured at the higher of (i) the remaining

unamortized balance of the amount at initial recognition and (ii) the best estimate of expenditure

required to settle the commitment at the end of each reporting period. In cases where the fees are

charged periodically in respect of an outstanding commitment, they are recognized as revenue on a

time proportion basis over the respective commitment period.

Employee Benefits

Short-term benefits. The Bank recognizes a liability net of amounts already paid and an expense for

services rendered by employees during the reporting period. A liability is also recognized for the

amount expected to be paid under short-term cash bonus or profit sharing plans if the Bank has a

present legal or constructive obligation to pay this amount as a result of past service provided by the

employee, and the obligation can be estimated reliably.

Short-term employee benefit obligations are measured on an undiscounted basis and are expensed

as the related service is provided.

Long-term benefits. The Bank has provided funding to a 3

rd

party bank in order for it to give its

Employees cheaper mortgage and salary loans. The cost of this scheme has initially been booked as

a prepayment and will be expensed through the statement of comprehensive income over the life-

time of the loan scheme.

Post-employment benefits. The Bank does not have any pension arrangements separate from the

state pension system of Mongolia, which requires current contributions by the employer calculated

as a percentage of current gross salary payments; such expense is charged to the statement of

comprehensive incomes in the period the related salaries and wages are payable.

Offsetting. Financial assets and liabilities are offset and the net amount reported in the statement of

financial position only when there is a legally enforceable right to offset the recognised amounts, and

there is an intention to either settle on a net basis, or to realise the asset and settle the liability

simultaneously.

Income and expense recognition. Interest income and expense are recorded for all debt instruments on

an accrual basis using the effective interest method. This method defers, as part of interest income or

expense, all fees paid or received between the parties to the contract that are an integral part of the

effective interest rate, transaction costs and all other premiums or discounts.

Fees integral to the effective interest rate include origination fees received or paid by the entity

relating to the creation or acquisition of a financial asset or issuance of a financial liability, for example

fees for evaluating creditworthiness, evaluating and recording guarantees or collateral, negotiating

the terms of the instrument and for processing transaction documents. Commitment fees received by

the Bank to originate loans at market interest rates are integral to the effective interest rate if it is

probable that the Bank will enter into a specific lending arrangement and does not expect to sell the

resulting loan shortly after origination. The Bank does not designate loan commitments as financial

liabilities at fair value through profit or loss.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

21

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

When loans and other debt instruments become doubtful of collection, they are written down to the

present value of expected cash inflows and interest income is thereafter recorded for the unwinding of the

present value discount based on the assets effective interest rate which was used to measure the

impairment loss.

All other fees, commissions and other income and expense items are generally recorded on an

accrual basis by reference to completion of the specific transaction assessed on the basis of the

actual service provided as a proportion of the total services to be provided.

Commissions and fees arising from negotiating, or participating in the negotiation of a transaction for

a third party, such as the acquisition of loans, shares or other securities or the purchase or sale of

businesses, and which are earned on execution of the underlying transaction, are recorded on its

completion.

Government Grants. Grants from the government are recognised at their fair value, where there is a

reasonable assurance that the grant will be received, and the Bank will comply with all attached

conditions. Government grants relating to costs are deferred, and recognised in the Statement of

Comprehensive Income over the period necessary to match them with the costs they are intended to

compensate. The Bank has opted to recognise its Government Grants as a reduction of the related

expense. If part, or all, of a grant becomes repayable to the government, the repayment is first matched

against any remaining deferred income set up for that grant. If this is insufficient, the remainder is

expensed immediately.

Foreign Currency

Foreign currency transactions. Transactions in currencies other than the MNT are recorded at the

rates of exchange prevailing on the dates of the transactions. At the end of each reporting period,

monetary assets and liabilities that are denominated in foreign currencies are retranslated at the rates

prevailing at the end of the reporting period. Non-monetary assets and liabilities carried at fair value

that are denominated in foreign currencies are translated at the rates prevailing at the date the fair

value was determined. Gains and losses arising on retranslation are included in profit or loss for the

year. Non-monetary assets and liabilities that are measured in terms of historical cost in a foreign

currency are not retranslated.

Related Party Transactions

A related party transaction is a transfer of resources, services or obligations between the Bank and a

related party, regardless of whether a price is charged.

A person or a close member of that person

s family is related to the Bank if that person:

has control or joint control over the Bank or

has significant influence over the Bank or

is a member of the key management personnel of the Bank or of a parent of the

Bank

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

22

3. SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

An entity is related to the Bank if any of the following conditions apply:

the entity and the Bank are members of the same group which means that each

parent, subsidiary and fellow subsidiary is related to the others;

one entity is an associate or joint venture of the other entity or an associate or joint

venture of a member of a group of which the other entity is a member;

both entities are joint ventures of the same third party;

one entity is a joint venture of a third entity and the other entity is an associate of

the third entity;

the entity is a post-employment benefit plan for the benefit of employees of either

the Bank or an entity related to the Bank;

the entity is controlled or jointly controlled by a person who is a related party as

identified above; and

A person that has control or joint control over the reporting entity has significant

influence over the entity or is a member of the key management personnel of the

entity or of a parent of the entity.

Due to the nature of the Bank and its role as a policy bank almost all loans and transactions are with

related parties. The Bank applies the exemption allowed under IAS 24.25.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

23

4. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY

In the application of the Bank's accounting policies, management is required to make judgments,

estimates and assumptions about the carrying amounts of assets and liabilities that are not readily

apparent from other sources. The estimates and associated assumptions are based on the historical

experience and other factors that are considered to be relevant. Actual results may differ from these

estimates. The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions

to accounting estimates are recognized in the period in which the estimate is revised if the revision

affects only that period or in the period of the revision and future periods if the revision affects both

current and future periods.

Key Sources of Estimation Uncertainty. The following are the key assumptions concerning the

future and other key sources of estimation uncertainty at the end of each reporting period that have a

significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within

the next financial year.

Determining the carrying value of employee prepayments. Management has concluded that

deposit to State bank of MNT 1 billion receives interest rate below market rate. Based on available

information on comparable transactions, management made judgment that the policy rate of the

Bank of Mongolia of 10.5% p.a. represents reasonable approximation of market interest rate on

MNT funding. As a result, related prepayment was recognized at its fair value at initial recognition

of MNT 776,352 thousand. The loss on initial recognition (i.e. the difference between nominal

value of this deposit and its fair value) represents salary prepayments in accordance with IFRS

requirements. Management has concluded that it is appropriate to recognize the cost of the

scheme over the lifetime of the deposit. Refer to Note 9 for details.

Determining the level of loan loss provisioning. The purpose of the Bank is to provide financing to

development projects in the Mongolia. As a result, the projects are often of a social infrastructure

nature and may not have a clearly defined stand-alone profit-oriented cash flow sufficient to

demonstrate a long-term ability to repay the development loan. However, for substantially all loans a

guarantee is provided by the State, and this is considered when assessing whether there is a risk of

loss on any particular loan. Management does not believe any loan impairment assessment is

required on loans where guarantees have been received from the Government. No collective loan

loss provision calculation is performed by the Bank as management assess that given the structure of

the loan portfolio and the guarantees received from Government any loss given default LGD on

loans would be zero. Given the close involvement of the Government, the Bank and the underlying

projects the Bank finances, management assess that there are no losses incurred but not reported

affecting the Bank. The level of Government guarantees and other collateral guarantees is disclosed

in Note 8. Any changes in the assessment of recoverability of guarantees would impact the profit or

loss of the Bank.

Determining the treatment of Government Grant Schemes. Management has concluded that it is

a recipient of two grant schemes described in Note 18 and Note 19 in the periods 1 January 2012 to

30 June 2012 and 1 January 2013 to 30 June 2013 amounting to MNT 13 billion and MNT 12.3 billion

respectively. Determining whether the transaction falls within the scope of IAS 20 requires

judgement. The definition of government grants includes transfers to an entity, subject to certain

conditions placed on the operating activities of the entity. However, it excludes government

assistance on which cannot be distinguished from normal trading transactions of the entity and

transactions which constitute "government participation in the ownership of the entity". Management

have concluded that the two schemes fall within the scope of IAS 20. Management have also

concluded that the receivable due from Government at each reporting date was reasonably assured

to be received.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

24

4. CRITICAL ACCOUNTING JUDGEMENTS AND KEY SOURCES OF ESTIMATION

UNCERTAINTY (CONTINUED)

Initial recognition of borrowings and loans at below market rates. During the first half 2013, the

Bank has obtained financing directly from the Government of Mongolia. These funds are

denominated in MNT and obtained at an interest rate of 4.9%, which is lower than rates at which the

Bank could source the funds from other lenders at Mongolian market. Based on available information

on comparable transactions, management made judgment that the policy rate of the Bank of

Mongolia represents the best approximation of market interest rate on MNT funding for banks

(10.5%). As a result of such financing, the Bank is able to advance funds to target customers as

determined by the Government, at advantageous rates of approximately 8% p.a. The Bank has little

or no discretionary rights in determining interest rates on issued loans should it continue to wish

receiving cheap financing from the Government. Management has considered whether gains or

losses should arise on initial recognition of such instruments. Managements judgement is that these

funds and the related lending are at market rates and no initial recognition gains or losses should

arise. In making this judgement management also considers that these instruments are a separate

market segment (i.e. the Bank operates in a separate principal market).

Deferred income tax asset recognition. The recognised deferred tax asset represents income

taxes recoverable through future deductions from taxable profits, and is recorded in the statement of

financial position. Deferred income tax assets are recorded to the extent that realisation of the related

tax benefit is probable. The future taxable profits and the amount of tax benefits that are probable in

the future are based on a medium term business plan prepared by management and extrapolated

results thereafter. The business plan is based on management expectations that are believed to be

reasonable under the circumstances taking into account the Banks actual profitability during 2013.

Management has concluded that it will be able to recover its deferred tax asset including tax losses

and is likely to incur tax at the rate of 25%.

5. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING

STANDARDS

The following new standards and interpretations became effective for the Group from 1 January 2013:

IFRS 10 Consolidated Financial Statements (issued in May 2011 and effective for annual

periods beginning on or after 1 J anuary 2013) replaces all of the guidance on control and

consolidation in IAS 27 Consolidated and separate financial statements and SIC-12 Consolidation -

special purpose entities. IFRS 10 changes the definition of control so that the same criteria are

applied to all entities to determine control. This definition is supported by extensive application

guidance. The Standard did not have any material impact on the Banks financial statements.

IFRS 11 Joint Arrangements (issued in May 2011 and effective for annual periods beginning

on or after 1 J anuary 2013) replaces IAS 31 Interests in Joint Ventures and SIC-13 Jointly

Controlled EntitiesNon-Monetary Contributions by Ventures. Changes in the definitions have

reduced the number of types of joint arrangements to two: joint operations and joint ventures. The

existing policy choice of proportionate consolidation for jointly controlled entities has been eliminated.

Equity accounting is mandatory for participants in joint ventures. The Standard did not have any

material impact on the Banks financial statements.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

25

5. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING

STANDARDS (CONTINUED)

IFRS 12 Disclosure of Interests in Other Entities (issued in May 2011 and effective for

annual periods beginning on or after 1 J anuary 2013) applies to entities that have an interest in a

subsidiary, a joint arrangement, an associate or an unconsolidated structured entity. It replaces the

disclosure requirements previously found in IAS 28 Investments in associates. IFRS 12 requires

entities to disclose information that helps financial statement readers to evaluate the nature, risks and

financial effects associated with the entitys interests in subsidiaries, associates, joint arrangements

and unconsolidated structured entities. To meet these objectives, the new standard requires

disclosures in a number of areas, including significant judgments and assumptions made in

determining whether an entity controls, jointly controls, or significantly influences its interests in other

entities, extended disclosures on share of non-controlling interests in group activities and cash flows,

summarized financial information of subsidiaries with material non-controlling interests, and detailed

disclosures of interests in unconsolidated structured entities. The Standard did not have any material

impact on the Banks financial statements.

IFRS 13 Fair Value Measurement (issued in May 2011 and effective for annual periods

beginning on or after 1 J anuary 2013) improved consistency and reduced complexity by providing

a revised definition of fair value, and a single source of fair value measurement and disclosure

requirements for use across IFRSs The Standard did not have any material impact on the Banks

financial statements.

IAS 27 Separate Financial Statements (revised in May 2011 and effective for annual periods

beginning on or after 1 J anuary 2013) was changed and its objective is now to prescribe the

accounting and disclosure requirements for investments in subsidiaries, joint ventures and

associates when an entity prepares separate financial statements. The guidance on control and

consolidated financial statements was replaced by IFRS 10 Consolidated Financial Statements. The

Standard did not have any material impact on the Banks financial statements.

IAS 28 Investments in Associates and Joint Ventures (revised in May 2011 and effective for

annual periods beginning on or after 1 J anuary 2013). The amendment of IAS 28 resulted

from the Boards project on joint ventures. When discussing that project, the Board decided to

incorporate the accounting for joint ventures using the equity method into IAS 28 because this

method is applicable to both joint ventures and associates. With this exception, other guidance

remained unchanged. The Standard did not have any material impact on the Banks financial

statements.

Amendments to IAS 1 Presentation of Financial Statements (issued in June 2011, effective for annual

periods beginning on or after 1 J uly 2013) changed the disclosure of items presented in other

comprehensive income. The amendments require entities to separate items presented in other

comprehensive income into two groups, based on whether or not they may be reclassified to profit or

loss in the future. The suggested title used by IAS 1 has changed to statement of profit or loss and

other comprehensive income. The amended standard resulted in changed presentation of financial

statements, but did not have any impact on measurement of transactions and balances.

Amended IAS 19 Employee Benefits (issued in June 2011, effective for periods beginning on or after 1

J anuary 2013) makes significant changes to the recognition and measurement of defined benefit

pension expense and termination benefits, and to the disclosures for all employee benefits. The

standard requires recognition of all changes in the net defined benefit liability (asset) when they

occur, as follows: (i) service cost and net interest in profit or loss; and (ii) remeasurements in other

comprehensive income. The Standard did not have any material impact on the Banks financial

statements.

Disclosures - Offsetting Financial Assets and Financial Liabilities - Amendments to IFRS 7

(issued in December 2011 and effective for annual periods beginning on or after 1 J anuary

2013). The amendment requires disclosures that enable users of an entitys financial statements to

evaluate the effect or potential effect of netting arrangements, including rights of set-off. The

Standard did not have any material impact on the Banks financial statements.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

26

5. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING

STANDARDS (CONTINUED)

Improvements to International Financial Reporting Standards (issued in May 2012 and

effective for annual periods beginning 1 J anuary 2013). The improvements consist of changes to

five standards. IFRS 1 was amended to (i) clarify that an entity that resumes preparing its IFRS

financial statements may either repeatedly apply IFRS 1 or apply all IFRSs retrospectively as if it had

never stopped applying them, and (ii) to add an exemption from applying IAS 23 Borrowing costs,

retrospectively by first-time adopters. IAS 1 was amended to clarify that explanatory notes are not

required to support the third balance sheet presented at the beginning of the preceding period when it

is provided because it was materially impacted by a retrospective restatement, changes in accounting

policies or reclassifications for presentation purposes, while explanatory notes will be required when

an entity voluntarily decides to provide additional comparative statements. IAS 16 was amended to

clarify that servicing equipment that is used for more than one period is classified as property, plant

and equipment rather than inventory. IAS 32 was amended to clarify that certain tax consequences

of distributions to owners should be accounted for in the income statement as was always required

by IAS 12. IAS 34 was amended to bring its requirements in line with IFRS 8. IAS 34 now requires

disclosure of a measure of total assets and liabilities for an operating segment only if such

information is regularly provided to chief operating decision maker and there has been a material

change in those measures since the last annual financial statements. The Standard did not have any

material impact on the Banks financial statements.

Transition Guidance Amendments to IFRS 10, IFRS 11 and IFRS 12 (issued in June 2012

and effective for annual periods beginning 1 J anuary 2013). The amendments clarify the

transition guidance in IFRS 10 Consolidated Financial Statements. Entities adopting IFRS 10

should assess control at the first day of the annual period in which IFRS 10 is adopted, and if the

consolidation conclusion under IFRS 10 differs from IAS 27 and SIC 12, the immediately preceding

comparative period (that is, year 2012) is restated, unless impracticable. The amendments also

provide additional transition relief in IFRS 10, IFRS 11 Joint Arrangements and IFRS 12 Disclosure

of Interests in Other Entities, by limiting the requirement to provide adjusted comparative information

only for the immediately preceding comparative period. Further, the amendments remove the

requirement to present comparative information for disclosures related to unconsolidated structured

entities for periods before IFRS 12 is first applied. The Standard did not have any material impact on

the Banks financial statements.

Other revised standards and interpretations: IFRIC 20 Stripping Costs in the Production Phase of

a Surface Mine, considers when and how to account for the benefits arising from the stripping

activity in mining industry. The interpretation did not have an impact on the Groups financial

statements. Amendments to IFRS 1 First-time adoption of International Financial Reporting

Standards - Government Loans, which were issued in March 2012 and are effective for annual

periods beginning 1 January 2013, give first-time adopters of IFRSs relief from full retrospective

application of accounting requirements for loans from government at below market rates. The

amendment is not relevant to the Group.

New Accounting Pronouncements

Certain new standards and interpretations have been issued that are mandatory for the annual periods

beginning on or after 1 January 2014 or later, and which the Group has not early adopted.

IFRS 9 Financial Instruments Part 1: Classification and Measurement. IFRS 9, issued in

November 2009, replaces those parts of IAS 39 relating to the classification and measurement of

financial assets. IFRS 9 was further amended in October 2010 to address the classification and

measurement of financial liabilities and in December 2011 to (i) change its effective date to annual

periods beginning on or after 1 January 2015 and (ii) to add transition disclosures. Key features of the

standard are as follows:

Financial assets are required to be classified into two measurement categories: those to be

measured subsequently at fair value, and those to be measured subsequently at amortised cost.

The decision is to be made at initial recognition. The classification depends on the entitys

business model for managing its financial instruments and the contractual cash flow

characteristics of the instrument.

Development Bank of Mongolia

Notes to the Interim Financial Statement 30 J une 2013

(Expressed in thousands of Mongolian tugriks unless otherwise stated)

27

5. APPLICATION OF NEW AND REVISED INTERNATIONAL FINANCIAL REPORTING

STANDARDS (CONTINUED)

An instrument is subsequently measured at amortised cost only if it is a debt instrument and both

(i) the objective of the entitys business model is to hold the asset to collect the contractual cash

flows, and (ii) the assets contractual cash flows represent payments of principal and interest only

(that is, it has only basic loan features). All other debt instruments are to be measured at fair

value through profit or loss.

All equity instruments are to be measured subsequently at fair value. Equity instruments that are

held for trading will be measured at fair value through profit or loss. For all other equity

investments, an irrevocable election can be made at initial recognition, to recognise unrealised

and realised fair value gains and losses through other comprehensive income rather than profit

or loss. There is to be no recycling of fair value gains and losses to profit or loss. This election

may be made on an instrument-by-instrument basis. Dividends are to be presented in profit or

loss, as long as they represent a return on investment.