Beruflich Dokumente

Kultur Dokumente

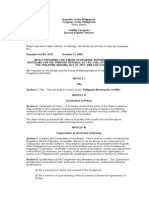

SC Upholds Legality of Senior Citizens 20% As Tax Deductions

Hochgeladen von

Clint M. Maratas0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

76 Ansichten87 SeitenSC decision discussed

Originaltitel

SC Upholds Legality of Senior Citizens 20% as tax deductions

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenSC decision discussed

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

76 Ansichten87 SeitenSC Upholds Legality of Senior Citizens 20% As Tax Deductions

Hochgeladen von

Clint M. MaratasSC decision discussed

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 87

SC upholds legality of senior citizens 20%

discount, tax deduction

December 16, 2013 12:18pm

9 61 4 620

Tags: Supreme Court

The Supreme Court has upheld the constitutionalit o! the 20"percent discount and ta# deduction

scheme !or senior citi$ens imposed on business establishments%

&otin' 13"1, the hi'h court (un)ed !or lac) o! merit a petition !or prohibition !iled b t*o !uneral

companies + ,anila ,emorial -ar), .nc% and /a 0uneraria -a$"Sucat + 1uestionin' the

constitutionalit o! 2epublic 3ct 4432, as amended b 23 9254, that 'ranted senior citi$ens

pri6ile'es%

The rulin' *as *ritten b 3ssociate 7ustice ,ariano del Castillo *ith Senior 3ssociate 7ustice

3ntonio Carpio bein' the lone dissenter% ,ean*hile, 3ssociate 7ustice 3rturo 8rion did not ta)e

part in the 6otin'%

Thirteen o! the 15 SC ma'istrates are senior citi$ens or 60 ears old or older, *hile Chie! 7ustice

,aria /ourdes Sereno is 53 ears old% 3ssociate 7ustice ,ar6ic /eonen *ill turn 51 on

December 29%

.n its rulin', the hi'h court said both the 20"percent discount and the ta# deduction scheme *ere

a 96alid e#ercise o! the police po*er o!the state%9

9There is no intention to sa that price and rate o! return on in6estment control la*s are the

(usti!ication !or the senior citi$en discount la*% :ot at all,9 the (ustices said%

.n its petition, the t*o !uneral homes clari!ied that the *ere contestin' not the le'alit o! the 20"

percent discount !or senior citi$ens but o! the ta# deduction scheme under the Senior Citi$ens

la*, as *ell as the implementin' rules and re'ulations issued b the Department o! Social ;el!are and

De6elopment <DS;D= and the Department o! 0inance <D>0=%

3ccordin' to the petitioners, under the ta# deduction scheme, the pri6ate sectors shoulder 65? o!

the discount because onl 35? o! it is actuall returned b the 'o6ernment to the companies%

The !irms said the ta# deduction and the .22 ran contrar to 3rticle ..., Section 9 o! the 1984

Constitution, *hich states that: 9@pAri6ate propert shall not be ta)en !or public use *ithout (ust

compensation%9

The memorial homes said because o! the ta# deduction scheme, the stateBs constitutional mandate

or dut o! impro6in' the *el!are o! the elderl to the pri6ate sector, in 6iolation o! 3rticle C&, Section 4

and 3rticle C..., Section 11 o! the Constitution%

.n their de!ense, the DS;D and the D>0 said the petitioners !ailed to pro6e that the ta#

deduction scheme *as not 9!air and !ull e1ui6alent o! the loss sustained9 b their companies%

.n its rulin', the SC ruled: 9The (usti!ication !or the senior citi$en discount la* is the plenar po*ers o!

Con'ress% The le'islati6e po*er to re'ulate business establishment is broad and co6ers a *ide arra o! areas

and sub(ects%9

The ma'istrates said: 9.t is *ell *ithin Con'ressB le'islati6e po*ers to re'ulate the pro!its or

incomeD'ross sales o! industries and enterprises, e6en those *ithout !ranchises% 0or *hat are

!ranchises but mere le'islati6e enactmentsE9 Mar Merue!as"#S$, %M& 'e(s

RA 7432, RA 9257, senior citizens - SC: 20% discount for elderly legl !

"edlines, #e$s, %&e '&ili((ine Str ! (&ilstr)co*

see - SC: 20% discount for elderly legal | Headlines, News, The Philiine Star |

hilstar!co"

#$ $ $!

MANILA, Philippines - The Supreme Court (SC) has upheld the legality of the tax

deduction sheme imposed on !usiness esta!lishments under the Senior Citizens

La"#

In a 38-page decision penned by Associate Justice Mariano del Castillo, the SC

held that the 2 percent discount pro!ided under Section " o# $epublic Act %"32,

as a&ended by $A '2(%, is constitutional)

It dismissed the petition filed !y funeral firms Manila Me&orial *ar+ In# and La

$uneraria Pa%-Suat In# &uestioning the sheme and its implementing rules !y the

'epartment of Soial (elfare and 'e)elopment and the ,epart&ent o# -inance#

*A la", "hih has !een in operation for many years and promotes the "elfare of a group

aorded speial onern !y the Constitution, annot and should not !e summarily

in)alidated on a mere allegation that it redues the inome or gross sales of !usiness

esta!lishments,+ read the SC ruling#

,nder the ta- dedution system, pri)ate esta!lishments shoulder ./ perent of the

disount "hile the go)ernment arries 0/ perent#

The petitioners said the sheme )iolates their right to 1ust ompensation under Artile III

of the Constitution#

2eadlines ( Artile M3e ), pagemath4 5, setionmath4 5

3A 6708, 3A 98/6, senior iti%ens - SC4 8:; disount for elderly legal < 2eadlines,

Ne"s, The Philippine Star < philstar#om

see - SC4 8:; disount for elderly legal < 2eadlines, Ne"s, The Philippine Star <

philstar#om

=- - -#

MANILA, Philippines - The Supreme Court (SC) has upheld the legality of the ta-

dedution sheme imposed on !usiness esta!lishments under the Senior Citi%ens La"#

In a 0>-page deision penned !y Assoiate ?ustie Mariano del Castillo, the SC held

that the 8: perent disount pro)ided under Setion 7 of 3epu!li At 6708, as

amended !y 3A 98/6, is onstitutional#

It dismissed the petition filed !y funeral firms Manila Memorial Par@ In# and La

$uneraria Pa%-Suat In# &uestioning the sheme and its implementing rules !y the

'epartment of Soial (elfare and 'e)elopment and the 'epartment of $inane#

*A la", "hih has !een in operation for many years and promotes the "elfare of a group

aorded speial onern !y the Constitution, annot and should not !e summarily

in)alidated on a mere allegation that it redues the inome or gross sales of !usiness

esta!lishments,+ read the SC ruling#

,nder the ta- dedution system, pri)ate esta!lishments shoulder ./ perent of the

disount "hile the go)ernment arries 0/ perent#

The petitioners said the sheme )iolates their right to 1ust ompensation under Artile III

of the Constitution#

2eadlines ( Artile M3e ), pagemath4 5, setionmath4 5

They insisted that the go)ernment should implement ta- redit sheme that "ould

diretly redue ta-es olleted !y the go)ernment on !usinesses granting the 8:-

perent pri)ilege to senior iti%ens#

They added that the sheme )iolates Artile AB Setion 7, and Artile AIII Setion 55 of

the Constitution as it passes to the pri)ate setor the duty of the go)ernment to impro)e

the "elfare of the elderly#

F%2% :o% 145356, December 03, 2013 " ,3:./3 ,G,>2.3/ -32H, .:C% 3:D /3

0I:G232.3 -3J"SIC3T, .:C%, -etitioners, 6% SGC2GT32K >0 TLG

DG-32T,G:T >0 S>C.3/ ;G/032G 3:D DG&G/>-,G:T 3:D TLG

SGC2GT32K >0 TLG DG-32T,G:T >0 0.:3:CG , 2espondent%

)' *&'C

%+#+ 'o+ ,-./.0, 1ece23er 0/, 20,/

M&'45& M)M6#4&5 7, 4'C+ &'1 5& 9:')#& 7&;<S:C&T, 4'C+,

Petitioners, v. S)C#)T&#= 69 T>) 1)7&#TM)'T 69 S6C4&5 ?)59&#)

&'1 1)@)567M)'T &'1 T>) S)C#)T&#= 69 T>) 1)7&#TM)'T 69

94'&'C) , Respondent%

1 ) C 4 S 4 6 '

1)5 C&ST4556, J.:

;hen a part challen'es the constitutionalit o! a la*, the burden o! proo! rests upon

him%

1

8e!ore us is a -etition !or -rohibition

2

under 2ule 65 o! the 2ules o! Court !iled b

petitioners ,anila ,emorial -ar), .nc% and /a 0uneraria -a$"Sucat, .nc%, domestic

corporations en'a'ed in the business o! pro6idin' !uneral and burial ser6ices, a'ainst

public respondents Secretaries o! the Department o! Social ;el!are and De6elopment

<DS;D= and the Department o! 0inance <D>0=%

-etitioners assail the constitutionalit o! Section 4 o! 2epublic 3ct <23= :o% 4432,

3

as

amended b 23 9254,

4

and the implementin' rules and re'ulations issued b the DS;D

and D>0 inso!ar as these allo* business establishments to claim the 20? discount

'i6en to senior citi$ens as a ta# deduction%

Factual Antecedents

>n 3pril 23, 1992, 23 4432 *as passed into la*, 'rantin' senior citi$ens the !ollo*in'

pri6ile'es:

SGCT.>: 4% -ri6ile'es !or the Senior Citi$ens% + The senior citi$ens shall be entitled to

the !ollo*in':

a= the 'rant o! t*ent percent <20?= discount !rom all establishments relati6e to

utili$ation o! transportation ser6ices, hotels and similar lod'in' establishment@sA,

restaurants and recreation centers and purchase o! medicine an*here in the countr:

-ro6ided, That pri6ate establishments ma claim the cost as ta# creditM

b= a minimum o! t*ent percent <20?= discount on admission !ees char'ed b theaters,

cinema houses and concert halls, circuses, carni6als and other similar places o! culture,

leisure, and amusementM

c= e#emption !rom the pament o! indi6idual income ta#es: -ro6ided, That their annual

ta#able income does not e#ceed the propert le6el as determined b the :ational

Gconomic and De6elopment 3uthorit <:GD3= !or that earM

d= e#emption !rom trainin' !ees !or socioeconomic pro'rams underta)en b the >SC3

as part o! its *or)M

e= !ree medical and dental ser6ices in 'o6ernment establishment@sA an*here in the

countr, sub(ect to 'uidelines to be issued b the Department o! Lealth, the Fo6ernment

Ser6ice .nsurance Sstem and the Social Securit SstemM

!= to the e#tent practicable and !easible, the continuance o! the same bene!its and

pri6ile'es 'i6en b the Fo6ernment Ser6ice .nsurance Sstem <FS.S=, Social Securit

Sstem <SSS= and -3F".8.F, as the case ma be, as are en(oed b those in actual

ser6ice%

>n 3u'ust 23, 1993, 2e6enue 2e'ulations <22= :o% 02"94 *as issued to implement 23

4432% Sections 2<i= and 4 o! 22 :o% 02"94 pro6ide:

Sec% 2% DG0.:.T.>:S% + 0or purposes o! these re'ulations:

i% Ta# Credit + re!ers to the amount representin' the 20? discount 'ranted to a 1uali!ied

senior citi$en b all establishments relati6e to their utili$ation o! transportation ser6ices,

hotels and similar lod'in' establishments, restaurants, dru'stores, recreation centers,

theaters, cinema houses, concert halls, circuses, carni6als and other similar places o!

culture, leisure and amusement, *hich discount shall be deducted b the said

establishments !rom their 'ross income !or income ta# purposes and !rom their 'ross

sales !or 6alue"added ta# or other percenta'e ta# purposes%

# # #

Sec% 4% 2GC>2D.:FD8>>HHGG-.:F 2GNI.2G,G:TS 0>2 -2.&3TG

GST38/.SL,G:TS% + -ri6ate establishments, i%e%, transport ser6ices, hotels and

similar lod'in' establishments, restaurants, recreation centers, dru'stores, theaters,

cinema houses, concert halls, circuses, carni6als and other similar places o! culture@,A

leisure and amusement, 'i6in' 20? discounts to 1uali!ied senior citi$ens are re1uired to

)eep separate and accurate record@sA o! sales made to senior citi$ens, *hich shall

include the name, identi!ication number, 'ross salesDreceipts, discounts, dates o!

transactions and in6oice number !or e6er transaction%

The amount o! 20? discount shall be deducted !rom the 'ross income !or income ta#

purposes and !rom 'ross sales o! the business enterprise concerned !or purposes o! the

&3T and other percenta'e ta#es%

.n Commissioner of Internal Revenue v. Central Luzon Drug Corporation,

5

the Court

declared Sections 2<i= and 4 o! 22 :o% 02"94 as erroneous because these contra6ene 23

4432,

6

thus:

23 4432 speci!icall allo*s pri6ate establishments to claim as ta# credit the amount o!

discounts the 'rant% .n turn, the .mplementin' 2ules and 2e'ulations, issued pursuant

thereto, pro6ide the procedures !or its a6ailment% To den such credit, despite the plain

mandate o! the la* and the re'ulations carrin' out that mandate, is inde!ensible%

0irst, the de!inition 'i6en b petitioner is erroneous% .t re!ers to ta# credit as the amount

representin' the 20 percent discount that Oshall be deducted b the said establishments

!rom their 'ross income !or income ta# purposes and !rom their 'ross sales !or 6alue"

added ta# or other percenta'e ta# purposes%P .n ordinar business lan'ua'e, the ta#

credit represents the amount o! such discount% Lo*e6er, the manner b *hich the

discount shall be credited a'ainst ta#es has not been clari!ied b the re6enue re'ulations%

8 ordinar acceptation, a discount is an Oabatement or reduction made !rom the 'ross

amount or 6alue o! anthin'%P To be more precise, it is in business parlance Oa deduction

or lo*erin' o! an amount o! moneMP or Oa reduction !rom the !ull amount or 6alue o!

somethin', especiall a price%P .n business there are man )inds o! discount, the most

common o! *hich is that a!!ectin' the income statement or !inancial report upon *hich

the income ta# is based%

# # #

Sections 2%i and 4 o! 2e6enue 2e'ulations :o% <22= 2"94 de!ine ta# credit as the 20

percent discount deductible !rom 'ross income !or income ta# purposes, or !rom 'ross

sales !or &3T or other percenta'e ta# purposes% .n e!!ect, the ta# credit bene!it under 23

4432 is related to a sales discount% This contri6ed de!inition is improper, considerin'

that the latter has to be deducted !rom 'ross sales in order to compute the 'ross income

in the income statement and cannot be deducted a'ain, e6en !or purposes o! computin'

the income ta#%

;hen the la* sas that the cost o! the discount ma be claimed as a ta# credit, it means

that the amount Q *hen claimed Q shall be treated as a reduction !rom an ta#

liabilit, plain and simple% The option to a6ail o! the ta# credit bene!it depends upon the

e#istence o! a ta# liabilit, but to limit the bene!it to a sales discount Q *hich is not

e6en identical to the discount pri6ile'e that is 'ranted b la* Q does not de!ine it at all

and ser6es no use!ul purpose% The de!inition must, there!ore, be stric)en do*n%

Laws Not Amended

by Regulations

Second, the la* cannot be amended b a mere re'ulation% .n !act, a re'ulation that

Ooperates to create a rule out o! harmon *ith the statute is a mere nullitMP it cannot

pre6ail%

.t is a cardinal rule that courts O*ill and should respect the contemporaneous

construction placed upon a statute b the e#ecuti6e o!!icers *hose dut it is to en!orce it

# # #%P .n the scheme o! (udicial ta# administration, the need !or certaint and

predictabilit in the implementation o! ta# la*s is crucial% >ur ta# authorities !ill in the

details that OCon'ress ma not ha6e the opportunit or competence to pro6ide%P The

re'ulations these authorities issue are relied upon b ta#paers, *ho are certain that

these *ill be !ollo*ed b the courts% Courts, ho*e6er, *ill not uphold these authoritiesR

interpretations *hen clearl absurd, erroneous or improper%

.n the present case, the ta# authorities ha6e 'i6en the term ta# credit in Sections 2%i and

4 o! 22 2"94 a meanin' utterl in contrast to *hat 23 4432 pro6ides% Their

interpretation has muddled # # # the intent o! Con'ress in 'rantin' a mere discount

pri6ile'e, not a sales discount% The administrati6e a'enc issuin' these re'ulations ma

not enlar'e, alter or restrict the pro6isions o! the la* it administersM it cannot en'ra!t

additional re1uirements not contemplated b the le'islature%

.n case o! con!lict, the la* must pre6ail% 3 Ore'ulation adopted pursuant to la* is la*%P

Con6ersel, a re'ulation or an portion thereo! not adopted pursuant to la* is no la*

and has neither the !orce nor the e!!ect o! la*%

4

>n 0ebruar 26, 2004, 23 9254

8

amended certain pro6isions o! 23 4432, to *it:

SGCT.>: 4% -ri6ile'es !or the Senior Citi$ens% + The senior citi$ens shall be entitled to

the !ollo*in':

<a= the 'rant o! t*ent percent <20?= discount !rom all establishments relati6e to the

utili$ation o! ser6ices in hotels and similar lod'in' establishments, restaurants and

recreation centers, and purchase o! medicines in all establishments !or the e#clusi6e use

or en(oment o! senior citi$ens, includin' !uneral and burial ser6ices !or the death o!

senior citi$ensM

# # #

The establishment ma claim the discounts 'ranted under <a=, <!=, <'= and <h= as ta#

deduction based on the net cost o! the 'oods sold or ser6ices rendered: -ro6ided, That

the cost o! the discount shall be allo*ed as deduction !rom 'ross income !or the same

ta#able ear that the discount is 'ranted% -ro6ided, !urther, That the total amount o! the

claimed ta# deduction net o! 6alue added ta# i! applicable, shall be included in their

'ross sales receipts !or ta# purposes and shall be sub(ect to proper documentation and to

the pro6isions o! the :ational .nternal 2e6enue Code, as amended%

To implement the ta# pro6isions o! 23 9254, the Secretar o! 0inance issued 22 :o% 4"

2006, the pertinent pro6ision o! *hich pro6ides:

SGC% 8% 3&3./,G:T 8K GST38/.SL,G:TS >0 S3/GS D.SC>I:TS 3S

DGDICT.>: 02>, F2>SS .:C>,G% + Gstablishments enumerated in subpara'raph

<6= hereunder 'rantin' sales discounts to senior citi$ens on the sale o! 'oods andDor

ser6ices speci!ied thereunder are entitled to deduct the said discount !rom 'ross income

sub(ect to the !ollo*in' conditions:

<1= >nl that portion o! the 'ross sales GCC/IS.&G/K ISGD, C>:SI,GD >2

G:7>KGD 8K TLG SG:.>2 C.T.JG: shall be eli'ible !or the deductible sales

discount%

<2= The 'ross sellin' price and the sales discount ,IST 8G SG-323TG/K

.:D.C3TGD .: TLG >00.C.3/ 2GCG.-T >2 S3/GS .:&>.CG issued b the

establishment !or the sale o! 'oods or ser6ices to the senior citi$en%

<3= >nl the actual amount o! the discount 'ranted or a sales discount not e#ceedin'

20? o! the 'ross sellin' price can be deducted !rom the 'ross income, net o! 6alue

added ta#, i! applicable, !or income ta# purposes, and !rom 'ross sales or 'ross

receipts o! the business enterprise concerned, !or &3T or other percenta'e ta#

purposes%

<4= The discount can onl be allo*ed as deduction !rom 'ross income !or the same

ta#able ear that the discount is 'ranted%

<5= The business establishment 'i6in' sales discounts to 1uali!ied senior citi$ens is

re1uired to )eep separate and accurate record@sA o! sales, *hich shall include the

name o! the senior citi$en, T.:, >SC3 .D, 'ross salesDreceipts, sales discount

'ranted, @dateA o! @transactionA and in6oice number !or e6er sale transaction to

senior citi$en%

<6= >nl the !ollo*in' business establishments *hich 'ranted sales discount to senior

citi$ens on their sale o! 'oods andDor ser6ices ma claim the said discount 'ranted

as deduction !rom 'ross income, namel:

# # #

<i= 0uneral parlors and similar establishments + The bene!iciar or an person *ho

shall shoulder the !uneral and burial e#penses o! the deceased senior citi$en shall

claim the discount, such as cas)et, embalmment, cremation cost and other related

ser6ices !or the senior citi$en upon pament and presentation o! @hisA death

certi!icate%

The DS;D li)e*ise issued its o*n 2ules and 2e'ulations .mplementin' 23 9254, to

*it:

2I/G &.

D.SC>I:TS 3S T3C DGDICT.>: >0 GST38/.SL,G:TS

3rticle 8% Ta# Deduction o! Gstablishments% + The establishment ma claim the

discounts 'ranted under 2ule &, Section 4 + Discounts !or Gstablishments, Section 9,

,edical and Dental Ser6ices in -ri6ate 0acilities and Sections 10 and 11 + 3ir, Sea and

/and Transportation as ta# deduction based on the net cost o! the 'oods sold or ser6ices

rendered% Provided, That the cost o! the discount shall be allo*ed as deduction !rom

'ross income !or the same ta#able ear that the discount is 'rantedM Provided, furter,

That the total amount o! the claimed ta# deduction net o! 6alue added ta# i! applicable,

shall be included in their 'ross sales receipts !or ta# purposes and shall be sub(ect to

proper documentation and to the pro6isions o! the :ational .nternal 2e6enue Code, as

amendedM -ro6ided, !inall, that the implementation o! the ta# deduction shall be sub(ect

to the 2e6enue 2e'ulations to be issued b the 8ureau o! .nternal 2e6enue <8.2= and

appro6ed b the Department o! 0inance <D>0=%

0eelin' a''rie6ed b the ta# deduction scheme, petitioners !iled the present recourse,

prain' that Section 4 o! 23 4432, as amended b 23 9254, and the implementin' rules

and re'ulations issued b the DS;D and the D>0 be declared unconstitutional inso!ar

as these allo* business establishments to claim the 20? discount 'i6en to senior

citi$ens as a ta# deductionM that the DS;D and the D>0 be prohibited !rom en!orcin'

the sameM and that the ta# credit treatment o! the 20? discount under the !ormer Section

4 <a= o! 23 4432 be reinstated%

4ssues

-etitioners raise the !ollo*in' issues:

3%

;LGTLG2 TLG -GT.T.>: -2GSG:TS 3: 3CTI3/ C3SG >2 C>:T2>&G2SK%

8%

;LGTLG2 SGCT.>: 4 >0 2G-I8/.C 3CT :>% 9254 3:D C C C .TS

.,-/G,G:T.:F 2I/GS 3:D 2GFI/3T.>:S, .:S>032 3S TLGK -2>&.DG

TL3T TLG T;G:TK -G2CG:T <20?= D.SC>I:T T> SG:.>2 C.T.JG:S ,3K

8G C/3.,GD 3S 3 T3C DGDICT.>: 8K TLG -2.&3TG GST38/.SL,G:TS,

32G .:&3/.D 3:D I:C>:ST.TIT.>:3/%

9

Petitioners Arguments

-etitioners emphasi$e that the are not 1uestionin' the 20? discount 'ranted to senior

citi$ens but are onl assailin' the constitutionalit o! the ta# deduction scheme

prescribed under 23 9254 and the implementin' rules and re'ulations issued b the

DS;D and the D>0%

10

-etitioners posit that the ta# deduction scheme contra6enes 3rticle ..., Section 9 o! the

Constitution, *hich pro6ides that: O@pAri6ate propert shall not be ta)en !or public use

*ithout (ust compensation%P

11

.n support o! their position, petitioners cite Central Luzon

Drug Corporation,

12

*here it *as ruled that the 20? discount pri6ile'e constitutes

ta)in' o! pri6ate propert !or public use *hich re1uires the pament o! (ust

compensation,

13

and Carlos !uperdrug Corporation v. Department of !o"ial #elfare

and Development,

14

*here it *as ac)no*led'ed that the ta# deduction scheme does not

meet the de!inition o! (ust compensation%

15

-etitioners li)e*ise see) a re6ersal o! the rulin' in Carlos !uperdrug Corporation

16

that

the ta# deduction scheme adopted b the 'o6ernment is (usti!ied b police po*er%

14

The

assert that O@aAlthou'h both police po*er and the po*er o! eminent domain ha6e the

'eneral *el!are !or their ob(ect, there are still traditional distinctions bet*een the t*oP

18

and that Oeminent domain cannot be made less supreme than police po*er%P

19

-etitioners

!urther claim that the le'islature, in amendin' 23 4432, relied on an erroneous

contemporaneous construction that prior pament o! ta#es is re1uired !or ta# credit%

20

-etitioners also contend that the ta# deduction scheme 6iolates 3rticle C&, Section 4

21

and 3rticle C..., Section 11

22

o! the Constitution because it shi!ts the StateRs

constitutional mandate or dut o! impro6in' the *el!are o! the elderl to the pri6ate

sector%

23

Inder the ta# deduction scheme, the pri6ate sector shoulders 65? o! the

discount because onl 35?

24

o! it is actuall returned b the 'o6ernment%

25

Conse1uentl, the implementation o! the ta# deduction scheme prescribed under Section

4 o! 23 9254 a!!ects the businesses o! petitioners%

26

Thus, there e#ists an actual case or

contro6ers o! transcendental importance *hich deser6es (udicious disposition on the

merits b the hi'hest court o! the land%

24

Chan2obles&irtuala*librar

Respondents Arguments

2espondents, on the other hand, 1uestion the !ilin' o! the instant -etition directl *ith

the Supreme Court as this disre'ards the hierarch o! courts%

28

The li)e*ise assert that

there is no (usticiable contro6ers as petitioners !ailed to pro6e that the ta# deduction

treatment is not a O!air and !ull e1ui6alent o! the loss sustainedP b them%

29

3s to the

constitutionalit o! 23 9254 and its implementin' rules and re'ulations, respondents

contend that petitioners !ailed to o6erturn its presumption o! constitutionalit%

30

,ore

important, respondents maintain that the ta# deduction scheme is a le'itimate e#ercise

o! the StateRs police po*er%

31

chanrobles6irtuala*librar

6ur #uling

The -etition lac)s merit%

There exists an actual case or controversy.

;e shall !irst resol6e the procedural issue%

;hen the constitutionalit o! a la* is put in issue, (udicial re6ie* ma be a6ailed o!

onl i! the !ollo*in' re1uisites concur: O<1= the e#istence o! an actual and appropriate

caseM <2= the e#istence o! personal and substantial interest on the part o! the part raisin'

the @1uestion o! constitutionalitAM <3= recourse to (udicial re6ie* is made at the earliest

opportunitM and <4= the @1uestion o! constitutionalitA is the lis mota o! the case%P

32

.n this case, petitioners are challen'in' the constitutionalit o! the ta# deduction scheme

pro6ided in 23 9254 and the implementin' rules and re'ulations issued b the DS;D

and the D>0% 2espondents, ho*e6er, oppose the -etition on the 'round that there is no

actual case or contro6ers% ;e do not a'ree *ith respondents%

3n actual case or contro6ers e#ists *hen there is Oa con!lict o! le'al ri'htsP or Oan

assertion o! opposite le'al claims susceptible o! (udicial resolution%P

33

The -etition must

there!ore sho* that Othe 'o6ernmental act bein' challen'ed has a direct ad6erse e!!ect

on the indi6idual challen'in' it%P

34

.n this case, the ta# deduction scheme challen'ed b

petitioners has a direct ad6erse e!!ect on them% Thus, it cannot be denied that there e#ists

an actual case or contro6ers%

The validity of the 20 senior citi!en discount and tax deduction scheme under RA

"2#$% as an exercise of police po&er of the 'tate% has already (een settled in )arlos

'uperdrug )orporation.

-etitioners posit that the resolution o! this case lies in the determination o! *hether the

le'all mandated 20? senior citi$en discount is an e#ercise o! police po*er or eminent

domain% .! it is police po*er, no (ust compensation is *arranted% 8ut i! it is eminent

domain, the ta# deduction scheme is unconstitutional because it is not a peso !or peso

reimbursement o! the 20? discount 'i6en to senior citi$ens% Thus, it constitutes ta)in'

o! pri6ate propert *ithout pament o! (ust compensation%

3t the outset, *e note that this 1uestion has been settled in Carlos !uperdrug

Corporation%

35

.n that case, *e ruled:

-etitioners assert that Section 4<a= o! the la* is unconstitutional because it constitutes

depri6ation o! pri6ate propert% Compellin' dru'store o*ners and establishments to

'rant the discount *ill result in a loss o! pro!it and capital because 1= dru'stores impose

a mar)"up o! onl 5? to 10? on branded medicinesM and 2= the la* !ailed to pro6ide a

scheme *hereb dru'stores *ill be (ustl compensated !or the discount%

G#aminin' petitionersR ar'uments, it is apparent that *hat petitioners are ultimatel

1uestionin' is the 6alidit o! the ta# deduction scheme as a reimbursement mechanism

!or the t*ent percent <20?= discount that the e#tend to senior citi$ens%

8ased on the a!ore"stated D>0 >pinion, the ta# deduction scheme does not !ull

reimburse petitioners !or the discount pri6ile'e accorded to senior citi$ens% This is

because the discount is treated as a deduction, a ta#"deductible e#pense that is

subtracted !rom the 'ross income and results in a lo*er ta#able income% Stated

other*ise, it is an amount that is allo*ed b la* to reduce the income prior to the

application o! the ta# rate to compute the amount o! ta# *hich is due% 8ein' a ta#

deduction, the discount does not reduce ta#es o*ed on a peso !or peso basis but merel

o!!ers a !ractional reduction in ta#es o*ed%

Theoreticall, the treatment o! the discount as a deduction reduces the net income o! the

pri6ate establishments concerned% The discounts 'i6en *ould ha6e entered the co!!ers

and !ormed part o! the 'ross sales o! the pri6ate establishments, *ere it not !or 2%3% :o%

9254%

The permanent reduction in their total re6enues is a !orced subsid correspondin' to the

ta)in' o! pri6ate propert !or public use or bene!it% This constitutes compensable ta)in'

!or *hich petitioners *ould ordinaril become entitled to a (ust compensation%

7ust compensation is de!ined as the !ull and !air e1ui6alent o! the propert ta)en !rom its

o*ner b the e#propriator% The measure is not the ta)erRs 'ain but the o*nerRs loss% The

*ord Aust is used to intensi! the meanin' o! the *ord co2pensation, and to con6e the

idea that the e1ui6alent to be rendered !or the propert to be ta)en shall be real,

substantial, !ull and ample%

3 ta# deduction does not o!!er !ull reimbursement o! the senior citi$en discount% 3s

such, it *ould not meet the de!inition o! (ust compensation%

La6in' said that, this raises the 1uestion o! *hether the State, in promotin' the health

and *el!are o! a special 'roup o! citi$ens, can impose upon pri6ate establishments the

burden o! partl subsidi$in' a 'o6ernment pro'ram%

The Court belie6es so%

The Senior Citi$ens 3ct *as enacted primaril to ma#imi$e the contribution o! senior

citi$ens to nation"buildin', and to 'rant bene!its and pri6ile'es to them !or their

impro6ement and *ell"bein' as the State considers them an inte'ral part o! our societ%

The priorit 'i6en to senior citi$ens !inds its basis in the Constitution as set !orth in the

la* itsel!% Thus, the 3ct pro6ides:

SGC% 2% 2epublic 3ct :o% 4432 is hereb amended to read as !ollo*s:

SGCT.>: 1% De"laration of Poli"ies and $b%e"tives% Q -ursuant to 3rticle C&, Section

4 o! the Constitution, it is the dut o! the !amil to ta)e care o! its elderl members

*hile the State ma desi'n pro'rams o! social securit !or them% .n addition to this,

Section 10 in the Declaration o! -rinciples and State -olicies pro6ides: OThe State shall

pro6ide social (ustice in all phases o! national de6elopment%P 0urther, 3rticle C...,

Section 11, pro6ides: OThe State shall adopt an inte'rated and comprehensi6e approach

to health de6elopment *hich shall endea6or to ma)e essential 'oods, health and other

social ser6ices a6ailable to all the people at a!!ordable cost% There shall be priorit !or

the needs o! the underpri6ile'ed sic), elderl, disabled, *omen and children%P

Consonant *ith these constitutional principles the !ollo*in' are the declared policies o!

this 3ct:

S S S

<!= To recognize the i2portant role of the priBate sector in the i2proBe2ent of the

(elfare of senior citizens and to actiBely see their partnership+

To implement the abo6e polic, the la* 'rants a t*ent percent discount to senior

citi$ens !or medical and dental ser6ices, and dia'nostic and laborator !eesM admission

!ees char'ed b theaters, concert halls, circuses, carni6als, and other similar places o!

culture, leisure and amusementM !ares !or domestic land, air and sea tra6elM utili$ation o!

ser6ices in hotels and similar lod'in' establishments, restaurants and recreation centersM

and purchases o! medicines !or the e#clusi6e use or en(oment o! senior citi$ens% 3s a

!orm o! reimbursement, the la* pro6ides that business establishments e#tendin' the

t*ent percent discount to senior citi$ens ma claim the discount as a ta# deduction%

The la* is a le'itimate e#ercise o! police po*er *hich, similar to the po*er o! eminent

domain, has 'eneral *el!are !or its ob(ect% -olice po*er is not capable o! an e#act

de!inition, but has been purposel 6eiled in 'eneral terms to underscore its

comprehensi6eness to meet all e#i'encies and pro6ide enou'h room !or an e!!icient and

!le#ible response to conditions and circumstances, thus assurin' the 'reatest bene!its%

3ccordin'l, it has been described as Othe most essential, insistent and the least

limitable o! po*ers, e#tendin' as it does to all the 'reat public needs%P .t is O@tAhe po*er

6ested in the le'islature b the constitution to ma)e, ordain, and establish all manner o!

*holesome and reasonable la*s, statutes, and ordinances, either *ith penalties or

*ithout, not repu'nant to the constitution, as the shall (ud'e to be !or the 'ood and

*el!are o! the common*ealth, and o! the sub(ects o! the same%P

0or this reason, *hen the conditions so demand as determined b the le'islature,

propert ri'hts must bo* to the primac o! police po*er because propert ri'hts, thou'h

sheltered b due process, must ield to 'eneral *el!are%

-olice po*er as an attribute to promote the common 'ood *ould be diluted

considerabl i! on the mere plea o! petitioners that the *ill su!!er loss o! earnin's and

capital, the 1uestioned pro6ision is in6alidated% ,oreo6er, in the absence o! e6idence

demonstratin' the alle'ed con!iscator e!!ect o! the pro6ision in 1uestion, there is no

basis !or its nulli!ication in 6ie* o! the presumption o! 6alidit *hich e6er la* has in

its !a6or%

Fi6en these, it is incorrect !or petitioners to insist that the 'rant o! the senior citi$en

discount is undul oppressi6e to their business, because petitioners ha6e not ta)en time

to calculate correctl and come up *ith a !inancial report, so that the ha6e not been

able to sho* properl *hether or not the ta# deduction scheme reall *or)s 'reatl to

their disad6anta'e%

.n treatin' the discount as a ta# deduction, petitioners insist that the *ill incur losses

because, re!errin' to the D>0 >pinion, !or e6er -1%00 senior citi$en discount that

petitioners *ould 'i6e, -0%68 *ill be shouldered b them as onl -0%32 *ill be re!unded

b the 'o6ernment b *a o! a ta# deduction%

To illustrate this point, petitioner Carlos Super Dru' cited the anti"hpertensi6e

maintenance dru' Norvas" as an e#ample% 3ccordin' to the latter, it ac1uires Norvas"

!rom the distributors at -34%54 per tablet, and retails it at -39%60 <or at a mar'in o! 5?=%

.! it 'rants a 20? discount to senior citi$ens or an amount e1ui6alent to -4%92, then it

*ould ha6e to sell Norvas" at -31%68 *hich translates to a loss !rom capital o! -5%89 per

tablet% G6en i! the 'o6ernment *ill allo* a ta# deduction, onl -2%53 per tablet *ill be

re!unded and not the !ull amount o! the discount *hich is -4%92% .n short, onl 32? o!

the 20? discount *ill be reimbursed to the dru'stores%

-etitionersR computation is !la*ed% 0or purposes o! reimbursement, the la* states that

the cost o! the discount shall be deducted !rom 'ross income, the amount o! income

deri6ed !rom all sources be!ore deductin' allo*able e#penses, *hich *ill result in net

income% Lere, petitioners tried to sho* a loss on a per transaction basis, *hich should

not be the case% 3n income statement, sho*in' an accountin' o! petitionersR sales,

e#penses, and net pro!it <or loss= !or a 'i6en period could ha6e accuratel re!lected the

e!!ect o! the discount on their income% 3bsent an !inancial statement, petitioners cannot

substantiate their claim that the *ill be operatin' at a loss should the 'i6e the

discount% .n addition, the computation *as erroneousl based on the assumption that

their customers consisted *holl o! senior citi$ens% /astl, the 32? ta# rate is to be

imposed on income, not on the amount o! the discount%

0urthermore, it is un!air !or petitioners to critici$e the la* because the cannot raise the

prices o! their medicines 'i6en the cutthroat nature o! the plaers in the industr% .t is a

business decision on the part o! petitioners to pe' the mar)"up at 5?% Sellin' the

medicines belo* ac1uisition cost, as alle'ed b petitioners, is merel a result o! this

decision% .nasmuch as pricin' is a propert ri'ht, petitioners cannot reproach the la* !or

bein' oppressi6e, simpl because the cannot a!!ord to raise their prices !or !ear o!

losin' their customers to competition%

The Court is not obli6ious o! the retail side o! the pharmaceutical industr and the

competiti6e pricin' component o! the business% ;hile the Constitution protects propert

ri'hts, petitioners must accept the realities o! business and the State, in the e#ercise o!

police po*er, can inter6ene in the operations o! a business *hich ma result in an

impairment o! propert ri'hts in the process%

,oreo6er, the ri'ht to propert has a social dimension% ;hile 3rticle C... o! the

Constitution pro6ides the precept !or the protection o! propert, 6arious la*s and

(urisprudence, particularl on a'rarian re!orm and the re'ulation o! contracts and public

utilities, continuousl ser6e as # # # reminder@sA that the ri'ht to propert can be

relin1uished upon the command o! the State !or the promotion o! public 'ood%

Indeniabl, the success o! the senior citi$ens pro'ram rests lar'el on the support

imparted b petitioners and the other pri6ate establishments concerned% This bein' the

case, the means emploed in in6o)in' the acti6e participation o! the pri6ate sector, in

order to achie6e the purpose or ob(ecti6e o! the la*, is reasonabl and directl related%

;ithout su!!icient proo! that Section 4 <a= o! 2%3% :o% 9254 is arbitrar, and that the

continued implementation o! the same *ould be unconscionabl detrimental to

petitioners, the Court *ill re!rain !rom 1uashin' a le'islati6e act%

36

<8old in the ori'inalM

underline supplied=

;e, thus, !ound that the 20? discount as *ell as the ta# deduction scheme is a 6alid

e#ercise o! the police po*er o! the State%

*o compelling reason has (een proffered to overturn% modify or a(andon the ruling

in )arlos 'uperdrug )orporation.

-etitioners ar'ue that *e ha6e pre6iousl ruled in Central Luzon Drug Corporation

34

that the 20? discount is an e#ercise o! the po*er o! eminent domain, thus, re1uirin' the

pament o! (ust compensation% The ur'e us to re"e#amine our rulin' in Carlos

!uperdrug Corporation

38

*hich alle'edl re6ersed the rulin' in Central Luzon Drug

Corporation%

39

The also point out that Carlos !uperdrug Corporation

40

reco'ni$ed that

the ta# deduction scheme under the assailed la* does not pro6ide !or su!!icient (ust

compensation%

;e a'ree *ith petitionersR obser6ation that there are statements in Central Luzon Drug

Corporation

41

des"ribing the 20? discount as an e#ercise o! the po*er o! eminent

domain, viz%:

@TAhe pri6ile'e en(oed b senior citi$ens does not come dire"tly !rom the State, but

rather !rom the pri6ate establishments concerned% 3ccordin'l, the ta& "redit bene!it

'ranted to these establishments can 3e dee2ed as their %ust "ompensation !or pri6ate

propert ta)en b the State !or public use%

The concept o! publi" use is no lon'er con!ined to the traditional notion o! use by te

publi", but held snonmous *ith publi" interest, publi" benefit, publi" welfare, and

publi" "onvenien"e% The discount pri6ile'e to *hich our senior citi$ens are entitled is

actuall a bene!it en(oed b the 'eneral public to *hich these citi$ens belon'% The

discounts 'i6en *ould ha6e entered the co!!ers and !ormed part o! the gross sales o! the

pri6ate establishments concerned, *ere it not !or 23 4432% The permanent reduction in

their total re6enues is a !orced subsid correspondin' to the ta)in' o! pri6ate propert

!or publi" use or benefit%

3s a result o! the 20 percent discount imposed b 23 4432, respondent becomes

entitled to a %ust "ompensation% This term re!ers not onl to the issuance o! a ta& "redit

certi!icate indicatin' the correct amount o! the discounts 'i6en, but also to the

promptness in its release% G1ui6alent to the pament o! propert ta)en b the State, such

issuance Q *hen not done *ithin a reasonable time !rom the 'rant o! the discounts Q

cannot be considered as %ust "ompensation% .n e!!ect, respondent is made to su!!er the

conse1uences o! bein' immediatel depri6ed o! its re6enues *hile a*aitin' actual

receipt, throu'h the certi!icate, o! the e1ui6alent amount it needs to cope *ith the

reduction in its re6enues%

8esides, the ta#ation po*er can also be used as an implement !or the e#ercise o! the

po*er o! eminent domain% Ta# measures are but Oen!orced contributions e#acted on pain

o! penal sanctionsP and Oclearl imposed !or a publi" purpose%P .n recent ears, the

po*er to ta# has indeed become a most e!!ecti6e tool to reali$e social (ustice, publi"

welfare, and the e1uitable distribution o! *ealth%

;hile it is a declared commitment under Section 1 o! 23 4432, social (ustice Ocannot be

in6o)ed to trample on the ri'hts o! propert o*ners *ho under our Constitution and

la*s are also entitled to protection% The social (ustice consecrated in our @CAonstitution

@isA not intended to ta)e a*a ri'hts !rom a person and 'i6e them to another *ho is not

entitled thereto%P 0or this reason, a (ust compensation !or income that is ta)en a*a

!rom respondent becomes necessar% .t is in the ta& "redit that our le'islators !ind

support to reali$e social (ustice, and no administrati6e bod can alter that !act%

To put it di!!erentl, a pri6ate establishment that merel brea)s e6en Q *ithout the

discounts et Q *ill surel start to incur losses because o! such discounts% The same

e!!ect is e#pected i! its mar)"up is less than 20 percent, and i! all its sales come !rom

retail purchases b senior citi$ens% 3side !rom the obser6ation *e ha6e alread raised

earlier, it *ill also be 'rossl un!air to an establishment i! the discounts *ill be treated

merel as deductions !rom either its gross in"ome or its gross sales% >peratin' at a loss

throu'h no !ault o! its o*n, it *ill reali$e that the ta& "redit limitation under 22 2"94 is

inutile, i! not improper% ;orse, pro!it"'eneratin' businesses *ill be put in a better

position i! the a6ail themsel6es o! ta# credits denied those that are losin', because no

ta#es are due !rom the latter%

42

<.talics in the ori'inalM emphasis supplied=

The abo6e *as partl incorporated in our rulin' in Carlos !uperdrug Corporation

43

*hen *e stated preliminarily thatQ

-etitioners assert that Section 4<a= o! the la* is unconstitutional because it constitutes

depri6ation o! pri6ate propert% Compellin' dru'store o*ners and establishments to

'rant the discount *ill result in a loss o! pro!it and capital because 1= dru'stores impose

a mar)"up o! onl 5? to 10? on branded medicinesM and 2= the la* !ailed to pro6ide a

scheme *hereb dru'stores *ill be (ustl compensated !or the discount%

G#aminin' petitionersR ar'uments, it is apparent that *hat petitioners are ultimatel

1uestionin' is the 6alidit o! the ta# deduction scheme as a reimbursement mechanism

!or the t*ent percent <20?= discount that the e#tend to senior citi$ens%

8ased on the a!ore"stated D>0 >pinion, the ta# deduction scheme does not !ull

reimburse petitioners !or the discount pri6ile'e accorded to senior citi$ens% This is

because the discount is treated as a deduction, a ta#"deductible e#pense that is

subtracted !rom the 'ross income and results in a lo*er ta#able income% Stated

other*ise, it is an amount that is allo*ed b la* to reduce the income prior to the

application o! the ta# rate to compute the amount o! ta# *hich is due% 8ein' a ta#

deduction, the discount does not reduce ta#es o*ed on a peso !or peso basis but merel

o!!ers a !ractional reduction in ta#es o*ed%

Theoreticall, the treatment o! the discount as a deduction reduces the net income o! the

pri6ate establishments concerned% The discounts 'i6en *ould ha6e entered the co!!ers

and !ormed part o! the 'ross sales o! the pri6ate establishments, *ere it not !or 2%3% :o%

9254%

The permanent reduction in their total re6enues is a !orced subsid correspondin' to the

ta)in' o! pri6ate propert !or public use or bene!it% This constitutes compensable ta)in'

!or *hich petitioners *ould ordinaril become entitled to a (ust compensation%

7ust compensation is de!ined as the !ull and !air e1ui6alent o! the propert ta)en !rom its

o*ner b the e#propriator% The measure is not the ta)erRs 'ain but the o*nerRs loss% The

*ord Aust is used to intensi! the meanin' o! the *ord co2pensation, and to con6e the

idea that the e1ui6alent to be rendered !or the propert to be ta)en shall be real,

substantial, !ull and ample%

3 ta# deduction does not o!!er !ull reimbursement o! the senior citi$en discount% 3s

such, it *ould not meet the de!inition o! (ust compensation%

La6in' said that, this raises the 1uestion o! *hether the State, in promotin' the health

and *el!are o! a special 'roup o! citi$ens, can impose upon pri6ate establishments the

burden o! partl subsidi$in' a 'o6ernment pro'ram%

The Court belie6es so%

44

This, not*ithstandin', *e *ent on to rule in Carlos !uperdrug Corporation

45

that the

20? discount and ta# deduction scheme is a 6alid e#ercise o! the police po*er o! the

State%

The present case, thus, a!!ords an opportunit !or us to clari! the abo6e"1uoted

statements in Central Luzon Drug Corporation

46

and Carlos !uperdrug Corporation%

44

0irst, *e note that the abo6e"1uoted dis1uisition on eminent domain in Central Luzon

Drug Corporation

48

is obiter dicta and, thus, not bindin' precedent% 3s stated earlier, in

Central Luzon Drug Corporation,

49

*e ruled that the 8.2 acted ultra vires *hen it

e!!ecti6el treated the 20? discount as a ta# deduction, under Sections 2%i and 4 o! 22

:o% 2"94, despite the clear *ordin' o! the pre6ious la* that the same should be treated

as a ta# credit% ;e *ere, there!ore, not con!ronted in that case *ith the issue as to

*hether the 20? discount is an e#ercise o! police po*er or eminent domain%

Second, althou'h *e ad6erted to Central Luzon Drug Corporation

50

in our rulin' in

Carlos !uperdrug Corporation,

51

this re!erred onl to preliminar matters% 3 !air

readin' o! Carlos !uperdrug Corporation

52

*ould sho* that *e cate'oricall ruled

therein that the 20? discount is a 6alid e#ercise o! police po*er% Thus, e6en i! the

current la*, throu'h its ta# deduction scheme <*hich abandoned the ta# credit scheme

under the pre6ious la*=, does not pro6ide !or a peso !or peso reimbursement o! the 20?

discount 'i6en b pri6ate establishments, no constitutional in!irmit obtains because,

bein' a 6alid e#ercise o! police po*er, pament o! (ust compensation is not *arranted%

;e ha6e care!ull re6ie*ed the basis o! our rulin' in Carlos !uperdrug Corporation

53

and *e !ind no co'ent reason to o6erturn, modi! or abandon it% ;e also note that

petitionersR ar'uments are a mere reiteration o! those raised and resol6ed in Carlos

!uperdrug Corporation%

54

Thus, *e sustain Carlos !uperdrug Corporation%

55

:onetheless, *e deem it proper, in *hat !ollo*s, to ampli! our e#planation in Carlos

!uperdrug Corporation

56

as to *h the 20? discount is a 6alid e#ercise o! police po*er

and *h it ma not, under te spe"ifi" "ir"umstan"es of tis "ase, be considered as an

e#ercise o! the po*er o! eminent domain contrar to the obiter in Central Luzon Drug

Corporation%

54

Chan2obles&irtuala*librar

Police po&er versus eminent domain.

-olice po*er is the inherent po*er o! the State to re'ulate or to restrain the use o!

libert and propert !or public *el!are%

58

The onl limitation is that the restriction

imposed should be reasonable, not oppressi6e%

59

.n other *ords, to be a 6alid e#ercise o!

police po*er, it must ha6e a la*!ul sub(ect or ob(ecti6e and a la*!ul method o!

accomplishin' the 'oal%

60

Inder the police po*er o! the State, Opropert ri'hts o!

indi6iduals ma be sub(ected to restraints and burdens in order to !ul!ill the ob(ecti6es o!

the 'o6ernment%P

61

The State Oma inter!ere *ith personal libert, propert, la*!ul

businesses and occupations to promote the 'eneral *el!are @as lon' asA the inter!erence

@isA reasonable and not arbitrar%P

62

Gminent domain, on the other hand, is the inherent

po*er o! the State to ta)e or appropriate pri6ate propert !or public use%

63

The

Constitution, ho*e6er, re1uires that pri6ate propert shall not be ta)en *ithout due

process o! la* and the pament o! (ust compensation%

64

Traditional distinctions e#ist bet*een police po*er and eminent domain%

.n the e#ercise o! police po*er, a propert ri'ht is impaired b re'ulation,

65

or the use o!

propert is merel prohibited, re'ulated or restricted

66

to promote public *el!are% .n

such cases, there is no compensable ta)in', hence, pament o! (ust compensation is not

re1uired% G#amples o! these re'ulations are propert condemned !or bein' no#ious or

intended !or no#ious purposes <e%'%, a buildin' on the 6er'e o! collapse to be demolished

!or public sa!et, or obscene materials to be destroed in the interest o! public morals=

64

as *ell as $onin' ordinances prohibitin' the use o! propert !or purposes in(urious to the

health, morals or sa!et o! the communit <e%'%, di6idin' a citRs territor into residential

and industrial areas=%

68

.t has, thus, been obser6ed that, in the e#ercise o! police po*er

<as distin'uished !rom eminent domain=, althou'h the re'ulation a!!ects the ri'ht o!

o*nership, none o! the bundle o! ri'hts *hich constitute o*nership is appropriated !or

use b or !or the bene!it o! the public%

69

>n the other hand, in the e#ercise o! the po*er o! eminent domain, propert interests

are appropriated and applied to some public purpose *hich necessitates the pament o!

(ust compensation there!or% :ormall, the title to and possession o! the propert are

trans!erred to the e#propriatin' authorit% G#amples include the ac1uisition o! lands !or

the construction o! public hi'h*as as *ell as a'ricultural lands ac1uired b the

'o6ernment under the a'rarian re!orm la* !or redistribution to 1uali!ied !armer

bene!iciaries% Lo*e6er, it is a settled rule that the ac1uisition o! title or total destruction

o! the propert is not essential !or Ota)in'P under the po*er o! eminent domain to be

present%

40

G#amples o! these include establishment o! easements such as *here the land

o*ner is perpetuall depri6ed o! his proprietar ri'hts because o! the ha$ards posed b

electric transmission lines constructed abo6e his propert

41

or the compelled

interconnection o! the telephone sstem bet*een the 'o6ernment and a pri6ate

compan%

42

.n these cases, althou'h the pri6ate propert o*ner is not di6ested o!

o*nership or possession, pament o! (ust compensation is *arranted because o! the

burden placed on the propert !or the use or bene!it o! the public%

The 20 senior citi!en discount is an exercise of police po&er.

.t ma not al*as be eas to determine *hether a challen'ed 'o6ernmental act is an

e#ercise o! police po*er or eminent domain% The 6er nature o! police po*er as elastic

and responsi6e to 6arious social conditions

43

as *ell as the e6ol6in' meanin' and scope

o! public use

44

and (ust compensation

45

in eminent domain e6inces that these are not

static concepts% 8ecause o! the e#i'encies o! rapidl chan'in' times, Con'ress ma be

compelled to adopt or e#periment *ith di!!erent measures to promote the 'eneral

*el!are *hich ma not !all s1uarel *ithin the traditionall reco'ni$ed cate'ories o!

police po*er and eminent domain% The (udicious approach, there!ore, is to loo) at the

nature and e!!ects o! the challen'ed 'o6ernmental act and decide, on the basis thereo!,

*hether the act is the e#ercise o! police po*er or eminent domain% Thus, *e no* loo) at

the nature and e!!ects o! the 20? discount to determine i! it constitutes an e#ercise o!

police po*er or eminent domain%

The 20? discount is intended to impro6e the *el!are o! senior citi$ens *ho, at their a'e,

are less li)el to be 'ain!ull emploed, more prone to illnesses and other disabilities,

and, thus, in need o! subsid in purchasin' basic commodities% .t ma not be amiss to

mention also that the discount ser6es to honor senior citi$ens *ho presumabl spent the

producti6e ears o! their li6es on contributin' to the de6elopment and pro'ress o! the

nation% This distinct cultural 0ilipino practice o! honorin' the elderl is an inte'ral part

o! this la*%

3s to its nature and e!!ects, the 20? discount is a re'ulation a!!ectin' the abilit o!

pri6ate establishments to price their products and ser6ices relati6e to a special class o!

indi6iduals, senior citi$ens, !or *hich the Constitution a!!ords pre!erential concern%

46

.n

turn, this a!!ects the amount o! pro!its or incomeD'ross sales that a pri6ate establishment

can deri6e !rom senior citi$ens% .n other *ords, the sub(ect re'ulation a!!ects the pricin',

and, hence, the pro!itabilit o! a pri6ate establishment% Lo*e6er, it does not purport to

appropriate or burden speci!ic properties, used in the operation or conduct o! the

business o! pri6ate establishments, !or the use or bene!it o! the public, or senior citi$ens

!or that matter, but merel re'ulates the pricin' o! 'oods and ser6ices relati6e to, and the

amount o! pro!its or incomeD'ross sales that such pri6ate establishments ma deri6e

!rom, senior citi$ens%

The sub(ect re'ulation ma be said to be similar to, but *ith substantial distinctions

!rom, price control or rate o! return on in6estment control la*s *hich are traditionall

re'arded as police po*er measures%

44

These la*s 'enerall re'ulate public utilities or

industriesDenterprises imbued *ith public interest in order to protect consumers !rom

e#orbitant or unreasonable pricin' as *ell as temper corporate 'reed b controllin' the

rate o! return on in6estment o! these corporations considerin' that the ha6e a

monopol o6er the 'oods or ser6ices that the pro6ide to the 'eneral public% The sub(ect

re'ulation di!!ers there!rom in that <1= the discount does not pre6ent the establishments

!rom ad(ustin' the le6el o! prices o! their 'oods and ser6ices, and <2= the discount does

not appl to all customers o! a 'i6en establishment but onl to the class o! senior

citi$ens% :onetheless, to the de'ree material to the resolution o! this case, the 20?

discount ma be properl 6ie*ed as belon'in' to the cate'or o! price re'ulator

measures *hich a!!ect the pro!itabilit o! establishments sub(ected thereto%

>n its !ace, there!ore, the sub(ect re'ulation is a police po*er measure%

The obiter in Central Luzon Drug Corporation,

48

ho*e6er, describes the 20? discount

as an e#ercise o! the po*er o! eminent domain and the ta# credit, under the pre6ious

la*, e1ui6alent to the amount o! discount 'i6en as the (ust compensation there!or% The

reason is that <1= the discount *ould ha6e !ormed part o! the 'ross sales o! the

establishment *ere it not !or the la* prescribin' the 20? discount, and <2= the

permanent reduction in total re6enues is a !orced subsid correspondin' to the ta)in' o!

pri6ate propert !or public use or bene!it%

The !la* in this reasonin' is in its premise% .t presupposes that the sub(ect re'ulation,

*hich impacts the pricin' and, hence, the pro!itabilit o! a pri6ate establishment,

automati"ally amounts to a depri6ation o! propert *ithout due process o! la*% .! this

*ere so, then all price and rate o! return on in6estment control la*s *ould ha6e to be

in6alidated because the impact, at some le6el, the re'ulated establishmentRs pro!its or

incomeD'ross sales, et there is no pro6ision !or pament o! (ust compensation% .t *ould

also mean that 'o6ernment cannot set price or rate o! return on in6estment limits, *hich

reduce the pro!its or incomeD'ross sales o! pri6ate establishments, i! no (ust

compensation is paid e6en i! the measure is not con!iscator% The obiter is, thus, at odds

*ith the settled doctrine that the State can emplo police po*er measures to re'ulate the

pricin' o! 'oods and ser6ices, and, hence, the pro!itabilit o! business establishments in

order to pursue le'itimate State ob(ecti6es !or the common 'ood, pro6ided that the

re'ulation does not 'o too !ar as to amount to Ota)in'%P

49

.n City of 'anila v. Laguio, (r.,

80

*e reco'ni$ed thatQ

# # # a ta)in' also could be !ound i! 'o6ernment re'ulation o! the use o! propert *ent

Otoo !ar%P ;hen re'ulation reaches a certain ma'nitude, in most i! not in all cases there

must be an e#ercise o! eminent domain and compensation to support the act% ;hile

propert ma be re'ulated to a certain e#tent, i! re'ulation 'oes too !ar it *ill be

reco'ni$ed as a ta)in'%

:o !ormula or rule can be de6ised to ans*er the 1uestions o! *hat is too !ar and *hen

re'ulation becomes a ta)in'% .n 'aon, 7ustice Lolmes reco'ni$ed that it *as Oa

1uestion o! de'ree and there!ore cannot be disposed o! b 'eneral propositions%P >n

man other occasions as *ell, the I%S% Supreme Court has said that the issue o! *hen

re'ulation constitutes a ta)in' is a matter o! considerin' the !acts in each case% The

Court as)s *hether (ustice and !airness re1uire that the economic loss caused b public

action must be compensated b the 'o6ernment and thus borne b the public as a *hole,

or *hether the loss should remain concentrated on those !e* persons sub(ect to the

public action%

81

The impact or e!!ect o! a re'ulation, such as the one under consideration, must, thus, be

determined on a case"to"case basis% ;hether that line bet*een permissible re'ulation

under police po*er and Ota)in'P under eminent domain has been crossed must, under

the speci!ic circumstances o! this case, be sub(ect to proo! and the one assailin' the

constitutionalit o! the re'ulation carries the hea6 burden o! pro6in' that the measure

is unreasonable, oppressi6e or con!iscator% The time"honored rule is that the burden o!

pro6in' the unconstitutionalit o! a la* rests upon the one assailin' it and Othe burden

becomes hea6ier *hen police po*er is at issue%P

82

Chan2obles&irtuala*librar

The 20 senior citi!en discount has not (een sho&n to (e unreasona(le% oppressive

or confiscatory.

.n Alalayan v. National Power Corporation,

83

petitioners, *ho *ere !ranchise holders o!

electric plants, challen'ed the 6alidit o! a la* limitin' their allo*able net pro!its to no

more than 12? per annum o! their in6estments plus t*o"month operatin' e#penses% .n

re(ectin' their plea, *e ruled that, in an earlier case, it *as !ound that 12? is a

reasonable rate o! return and that petitioners !ailed to pro6e that the a!oresaid rate is

con!iscator in 6ie* o! the presumption o! constitutionalit%

84

;e adopted a similar line o! reasonin' in Carlos !uperdrug Corporation

85

*hen *e

ruled that petitioners therein !ailed to pro6e that the 20? discount is arbitrar,

oppressi6e or con!iscator% ;e noted that no e6idence, such as a !inancial report , to

establish the impact o! the 20? discount on the o6erall pro!itabilit o! petitioners *as

presented in order to sho* that the *ould be operatin' at a loss due to the sub(ect

re'ulation or that the continued implementation o! the la* *ould be unconscionabl

detrimental to the business operations o! petitioners% .n the case at bar, petitioners

proceeded *ith a hpothetical computation o! the alle'ed loss that the *ill su!!er

similar to *hat the petitioners in Carlos !uperdrug Corporation

86

did% -etitioners *ent

directl to this Court *ithout !irst establishin' the !actual bases o! their claims% Lence,

the present recourse must, li)e*ise, !ail%

8ecause all la*s en(o the presumption o! constitutionalit, courts *ill uphold a la*Rs

6alidit i! an set o! !acts ma be concei6ed to sustain it%

84

>n its !ace, *e !ind that there

are at least t*o concei6able bases to sustain the sub(ect re'ulationRs 6alidit absent clear

and con6incin' proo! that it is unreasonable, oppressi6e or con!iscator% Con'ress ma

ha6e le'itimatel concluded that business establishments ha6e the capacit to absorb a

decrease in pro!its or incomeD'ross sales due to the 20? discount *ithout substantiall

a!!ectin' the reasonable rate o! return on their in6estments considerin' <1= not all

customers o! a business establishment are senior citi$ens and <2= the le6el o! its pro!it

mar'ins on 'oods and ser6ices o!!ered to the 'eneral public% Concurrentl, Con'ress

ma ha6e, li)e*ise, le'itimatel concluded that the establishments, *hich *ill be

re1uired to e#tend the 20? discount, ha6e the capacit to re6ise their pricin' strate' so

that *hate6er reduction in pro!its or incomeD'ross sales that the ma sustain because o!

sales to senior citi$ens, can be recouped throu'h hi'her mar)"ups or !rom other products

not sub(ect o! discounts% 3s a result, the discounts resultin' !rom sales to senior citi$ens

*ill not be con!iscator or undul oppressi6e%

.n sum, *e sustain our rulin' in Carlos !uperdrug Corporation

88

that the 20? senior

citi$en discount and ta# deduction scheme are 6alid e#ercises o! police po*er o! the

State absent a clear sho*in' that it is arbitrar, oppressi6e or con!iscator%

)onclusion

.n closin', *e note that petitioners hpothesi$e, consistent *ith our pre6ious

ratiocinations, that the discount *ill !orce establishments to raise their prices in order to

compensate !or its impact on o6erall pro!its or incomeD'ross sales% The 'eneral public,

or those not belon'in' to the senior citi$en class, are, thus, made to e!!ecti6el shoulder

the subsid !or senior citi$ens% This, in petitionersR 6ie*, is un!air%

3s alread mentioned, Con'ress ma be reasonabl assumed to ha6e !oreseen this

e6entualit% 8ut, more importantl, this 'oes into the *isdom, e!!icac and e#pedienc

o! the sub(ect la* *hich is not proper !or (udicial re6ie*% .n a *a, this la* pursues its

social e1uit ob(ecti6e in a non"traditional manner unli)e past and e#istin' direct

subsid pro'rams o! the 'o6ernment !or the poor and mar'inali$ed sectors o! our

societ% &eril, Con'ress must be 'i6en su!!icient lee*a in !ormulatin' *el!are

le'islations 'i6en the enormous challen'es that the 'o6ernment !aces relati6e to, amon'

others, resource ade1uac and administrati6e capabilit in implementin' social re!orm

measures *hich aim to protect and uphold the interests o! those most 6ulnerable in our

societ% .n the process, the indi6idual, *ho en(os the ri'hts, bene!its and pri6ile'es o!

li6in' in a democratic polit, must bear his share in supportin' measures intended !or

the common 'ood% This is onl !air%

.n !ine, *ithout the re1uisite sho*in' o! a clear and une1ui6ocal breach o! the

Constitution, the 6alidit o! the assailed la* must be sustained%

Refutation of the +issent

The main points o! 7ustice CarpioRs Dissent ma be summari$ed as !ollo*s: <1= the

discussion on eminent domain in Central Luzon Drug Corporation

89

is not obiter di"taM

<2= allo*able ta)in', in police po*er, is limited to propert that is destroed or placed

outside the commerce o! man !or public *el!areM <3= the amount o! mandator discount

is pri6ate propert *ithin the ambit o! 3rticle ..., Section 9

90

o! the ConstitutionM and <4=

the permanent reduction in a pri6ate establishmentRs total re6enue, arisin' !rom the

mandator discount, is a ta)in' o! pri6ate propert !or public use or bene!it, hence, an

e#ercise o! the po*er o! eminent domain re1uirin' the pament o! (ust compensation%

.

;e maintain that the discussion on eminent domain in Central Luzon Drug

Corporation

91

is obiter di"ta%

3s pre6iousl discussed, in Central Luzon Drug Corporation,

92

the 8.2, pursuant to

Sections 2%i and 4 o! 22 :o% 2"94, treated the senior citi$en discount in the pre6ious

la*, 23 4432, as a ta# deduction instead o! a ta# credit despite the clear pro6ision in

that la* *hich stated +

SGCT.>: 4% Privileges for te !enior Citizens% + The senior citi$ens shall be entitled to

the !ollo*in':

a= The 'rant o! t*ent percent <20?= discount !rom all establishments relati6e to

utili$ation o! transportation ser6ices, hotels and similar lod'in' establishment,

restaurants and recreation centers and purchase o! medicines an*here in the countr:

-ro6ided, That pri6ate establishments ma claim the cost as tax creditM <)mpasis

supplied=

Thus, the Court ruled that the sub(ect re6enue re'ulation 6iolated the la*, viz:

The 20 percent discount re1uired b the la* to be 'i6en to senior citi$ens is a ta# credit,

not merel a ta# deduction !rom the 'ross income or 'ross sale o! the establishment

concerned% 3 ta# credit is used b a pri6ate establishment onl a!ter the ta# has been

computedM a ta# deduction, be!ore the ta# is computed% 23 4432 unconditionall 'rants

a ta# credit to all co6ered entities% Thus, the pro6isions o! the re6enue re'ulation that

*ithdra* or modi! such 'rant are 6oid% 8asic is the rule that administrati6e re'ulations

cannot amend or re6o)e the la*%

93

3s can be readil seen, the discussion on eminent domain *as not ne"essary in order to

arri6e at this conclusion% 3ll that *as needed *as to point out that the re6enue

re'ulation contra6ened the la* *hich it sou'ht to implement% 3nd, precisel, this *as

done in Central Luzon Drug Corporation

94

b comparin' the *ordin' o! the pre6ious

la* 6is"T"6is the re6enue re'ulationM emploin' the rules o! statutor constructionM and

applin' the settled principle that a re'ulation cannot amend the la* it see)s to

implement%

3 close readin' o! Central Luzon Drug Corporation

95

*ould sho* that the Court went

on to state that the ta# credit Ocan be deemedP as (ust compensation onl to e#plain wy

the pre6ious la* pro6ides !or a ta# credit instead o! a ta# deduction% The Court surmised

that the ta# credit *as a !orm o! (ust compensation 'i6en to the establishments co6ered

b the 20? discount% Lo*e6er, the reason *h the pre6ious la* pro6ided !or a ta#

credit and not a ta# deduction *as not ne"essary to resol6e the issue as to *hether the

re6enue re'ulation contra6enes the la*% Lence, the discussion on eminent domain is

obiter di"ta%

3 court, in resol6in' cases be!ore it, ma loo) into the possible purposes or reasons that

impelled the enactment o! a particular statute or le'al pro6ision% Lo*e6er, statements

made relati6e thereto are not al*as necessar in resol6in' the actual contro6ersies

presented be!ore it% This *as the case in Central Luzon Drug Corporation

96

resultin' in

that un!ortunate statement that the ta# credit Ocan be deemedP as (ust compensation%

This, in turn, led to the erroneous conclusion, b deducti6e reasonin', that the 20?

discount is an e#ercise o! the po*er o! eminent domain% The Dissent essentiall adopts

this theor and reasonin' *hich, as *ill be sho*n belo*, is contrar to settled principles

in police po*er and eminent domain analsis%

..

The Dissent discusses at len'th the doctrine on Ota)in'P in police po*er *hich occurs

*hen pri6ate propert is destroed or placed outside the commerce o! man% .ndeed,

there is a *hole class o! police po*er measures *hich (usti! the destruction o! pri6ate

propert in order to preser6e public health, morals, sa!et or *el!are% 3s earlier

mentioned, these *ould include a buildin' on the 6er'e o! collapse or con!iscated

obscene materials as *ell as those mentioned b the Dissent *ith re'ard to propert

used in 6iolatin' a criminal statute or one *hich constitutes a nuisance% .n such cases,

no compensation is re1uired%

Lo*e6er, it is e1uall true that there is another class o! police po*er measures *hich do

not in6ol6e the destruction o! pri6ate propert but merel re'ulate its use% The minimum

*a'e la*, $onin' ordinances, price control la*s, la*s re'ulatin' the operation o! motels

and hotels, la*s limitin' the *or)in' hours to ei'ht, and the li)e *ould !all under this

cate'or% The e#amples cited b the Dissent, li)e*ise, !all under this cate'or: 3rticle

154 o! the /abor Code, Sections 19 and 18 o! the Social Securit /a*, and Section 4 o!

the -a'".8.F 0und /a*% These la*s merel re'ulate or, to use the term o! the Dissent,

burden the conduct o! the a!!airs o! business establishments% .n such cases, pament o!

(ust compensation is not re1uired because the !all *ithin the sphere o! permissible

police po*er measures% The senior citi$en discount la* !alls under this latter cate'or%

...

The Dissent proceeds !rom the theor that the permanent reduction o! pro!its or

incomeD'ross sales, due to the 20? discount, is a Ota)in'P o! pri6ate propert !or public

purpose *ithout pament o! (ust compensation%

3t the outset, it must be emphasi$ed that petitioners neBer presented any eBidence to

establish that the *ere !orced to su!!er enormous losses or operate at a loss due to the

e!!ects o! the assailed la*% The came directl to this Court and pro6ided a hpothetical

computation o! the loss the *ould alle'edl su!!er due to the operation o! the assailed

la*% The central premise o! the DissentRs ar'ument that the 20? discount results in a

permanent reduction in pro!its or incomeD'ross sales, or !orces a business establishment

to operate at a loss is, thus, (holly unsupported b competent e6idence% To be sure, the

Court can in6alidate a la* *hich, on its !ace, is arbitrar, oppressi6e or con!iscator%

94

8ut this is not the case here%

.n the case at bar, e6idence is indispensable be!ore a determination o! a constitutional

6iolation can be made because o! the !ollo*in' reasons%

0irst, the assailed la*, b imposin' the senior citi$en discount, does not ta)e an o! the

properties used b a business establishment li)e, sa, the land on *hich a manu!acturin'

plant is constructed or the e1uipment bein' used to produce 'oods or ser6ices%

Second, rather than ta)in' speci!ic properties o! a business establishment, the senior

citi$en discount la* merely regulates the prices o! the 'oods or ser6ices bein' sold to

senior citi$ens b mandatin' a 20? discount% Thus, i! a product is sold at -10%00 to the

'eneral public, then it shall be sold at -8%00 <i.e., -10%00 less 20?= to senior citi$ens%

:ote that the la* does not impose at *hat spe"ifi" price the product shall be sold, onl

that a 20? discount shall be 'i6en to senior citi$ens based on the price set b the

business establishment% 3 business establishment is, thus, !ree to ad(ust the prices o! the

'oods or ser6ices it pro6ides to the 'eneral public% 3ccordin'l, it can increase the price

o! the abo6e product to -20%00 but is re1uired to sell it at -16%00 <i.e., -20%00 less 20?=

to senior citi$ens%

Third, because the la* impacts the prices o! the 'oods or ser6ices o! a particular

establishment relati6e to its sales to senior citi$ens, its pro!its or incomeD'ross sales are

a!!ected% The e#tent o! the impact *ould, ho*e6er, depend on the pro!it mar'in o! the

business establishment on a particular 'ood or ser6ice% .! a product costs -5%00 to

produce and is sold at -10%00, then the pro!it

98

is -5%00

99

or a pro!it mar'in

100

o! 50?%

101

Inder the assailed la*, the a!oresaid product *ould ha6e to be sold at -8%00 to senior

citi$ens et the business *ould still earn -3%00

102

or a 30?

103

pro!it mar'in% >n the other

hand, i! the product costs -9%00 to produce and is re1uired to be sold at -8%00 to senior

citi$ens, then the business *ould e#perience a loss o! -1%00%

104

8ut note that since not all

customers o! a business establishment are senior citi$ens, the business establishment

ma continue to earn -1%00 !rom non"senior citi$ens *hich, in turn, can o!!set an loss

arisin' !rom sales to senior citi$ens%

0ourth, *hen the la* imposes the 20? discount in !a6or o! senior citi$ens, it does not

pre6ent the business establishment !rom re6isin' its pricin' strate'% 8 re6isin' its

pricin' strate', a business establishment can recoup an reduction o! pro!its or

incomeD'ross sales *hich *ould other*ise arise !rom the 'i6in' o! the 20? discount%

To illustrate, suppose 3 has t*o customers: C, a senior citi$en, and K, a non"senior

citi$en% -rior to the la*, 3 sells his products at -10%00 a piece to C and K resultin' in

incomeD'ross sales o! -20%00 <-10%00 U -10%00=% ;ith the passa'e o! the la*, 3 must

no* sell his product to C at -8%00 <i%e%, -10%00 less 20?= so that his incomeD'ross sales

*ould be -18%00 <-8%00 U -10%00= or lo*er b -2%00% To pre6ent this !rom happenin', 3

decides to increase the price o! his products to -11%11 per piece% Thus, he sells his

product to C at -8%89 <i%e%, -11%11 less 20?= and to K at -11%11% 3s a result, his

incomeD'ross sales *ould still be -20%00

105

<-8%89 U -11%11=% The capacit, then, o!

business establishments to re6ise their pricin' strate' ma)es it possible !or them not to

su!!er an reduction in pro!its or incomeD'ross sales, or, in the alternati6e, miti'ate the

reduction o! their pro!its or incomeD'ross sales e6en a!ter the passa'e o! the la*% .n

other *ords, business establishments ha6e the capacit to ad(ust their prices so that the

ma remain pro!itable e6en under the operation o! the assailed la*%

The Dissent, ho*e6er, states that +

The e#planation b the ma(orit that pri6ate establishments can al*as increase their

prices to reco6er the mandator discount *ill onl encoura'e pri6ate establishments to

ad(ust their prices up*ards to the pre(udice o! customers *ho do not en(o the 20?

discount% .t *as li)e*ise su''ested that i! a compan increases its prices, despite the

application o! the 20? discount, the establishment becomes more pro!itable than it *as

be!ore the implementation o! 2%3% 4432% Such an economic (usti!ication is sel!"

de!eatin', !or more consumers *ill su!!er !rom the price increase than *ill bene!it !rom

the 20? discount% G6en then, such abilit to increase prices cannot le'all 6alidate a

6iolation o! the eminent domain clause%

106

8ut, i! it is possible that the business establishment, b ad(ustin' its prices, *ill su!!er

no reduction in its pro!its or incomeD'ross sales <or su!!er some reduction but continue

to operate pro!itabl= despite 'i6in' the discount, *hat *ould be the basis to stri)e

do*n the la*E .! it is possible that the business establishment, b ad(ustin' its prices,

*ill not be undul burdened, ho* can there be a !indin' that the assailed la* is an

unconstitutional e#ercise o! police po*er or eminent domainE

That there ma be a burden placed on business establishments or the consumin' public