Beruflich Dokumente

Kultur Dokumente

Top-End Progressivity and Federal Tax Preferences in Canada

Hochgeladen von

Institute for Research on Public Policy (IRPP)Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Top-End Progressivity and Federal Tax Preferences in Canada

Hochgeladen von

Institute for Research on Public Policy (IRPP)Copyright:

Verfügbare Formate

!"#$%&' )*"+*,--./.

01 2&' 3,',*24

!25 )*,6,*,&7,- .& 82&2'29 %-:;20,-

6*"; ),*-"&24 <&7";, !25 =202

8rlan Murphy, SLausucs Canada

Mlke veall, McMasLer unlverslLy

Mlchael Wolfson, unlverslLy of Cuawa

)*,#2*,' 6"* 0>, <?))$8@A?B 7"&6,*,&7,

<&,CD24.01 .& 82&2'29 =*./.&+ 3"*7,-E FD07";,- 2&' )"4.71

FG2H2E 3,I*D2*1 JK$JLE JMNK

All oplnlons expressed are Lhose of Lhe auLhors (oral presenLauon: veall).

1hanks Lo !ullen ulcalre, Pung ham, Mohammad Mashlur 8ahman and ?ue

xlng for excellenL research asslsLance and SSP8C for nanclal supporL.

1

Starting Point :

Much of Lhe lncrease ln lncome lnequallLy ln

Lhe lasL years ls due Lo a surge ln Lhe lncome

share of Lhe Lop 1, Lop 0.1 and Lop 0.01

2

0

2

4

6

8

10

12

14

16

18

20

1

9

2

0

1

9

2

3

1

9

3

0

1

9

3

3

1

9

4

0

1

9

4

3

1

9

3

0

1

9

3

3

1

9

6

0

1

9

6

3

1

9

7

0

1

9

7

3

1

9

8

0

1

9

8

3

1

9

9

0

1

9

9

3

2

0

0

0

2

0

0

3

2

0

1

0

<&7";, @>2*, "6 0>, !"# NOE 82&2'2E NPJM$JMNM

1he surge

3

Motivation (1) :

1. Pow whaL Lhe uepL. of llnance calls Lax

expendlLures" (Lax credlLs, deducuons,

preferences) beneL Lop 1, Lop 0.1, Lop

0.01

2. u.S.: Pang, nunn, 1oder and Wllllams

(2012) and 8rown, Cale and Looney (2012)

4

Motivation (2) :

3. Chrls 8agan, !"#$% '() *'+" #("+(%, leb. 11, 2014-

. 1he Canadlan lncome Lax sysLem ls repleLe wlLh

bllllons of dollars of 'Lax expendlLures' .Whlle some

of Lhese are senslble, many oLhers needlessly

compllcaLe Lhe lncome Lax sysLem and lncrease Lhe

growlng percepuon of unfalrness. l challenge Lhe

governmenL Lo commlL Lo ellmlnaung $2-bllllon Lo

$3-bllllon of Lax expendlLures each year for Lhe nexL

Lhree years. Cnce achleved, Lhe sLage would be seL

for a small overall reducuon ln Lax raLes."

3

Motivation (3) :

ln conslderlng a Lax expendlLure, overall/Lop-end

progresslvlLy ls one of Lhe facLors LhaL mauers as

well as

AdmlnlsLrauve ease

Lconomlc emclency: overall, purpose of

measure, gov'L revenue

8elaLed work: ueparLmenL of llnance (2011):

Clnl j wlLh Lax credlLs and ^ wlLh deducuons

does noL look aL lndlvldual Lax preferences

6

What we do :

Slmple and rough, 2011

use LonglLudlnal AdmlnlsLrauve uaLabase (3 mllllon

records, aggregaLes): Canada 8evenue Agency

publlshed daLa used as a check

AllocaLe beneL of Lax expendlLures (from uepL. of

llnance 2012 for 2011) across lncome caLegorles

lncome = all lndlvldual ler currenL lncome, lncludlng k

galns, gov'L Lransfers

MeLhod: ad[usL usage by declle (and Lop 1, 0.1,

0.01) for:

nonrefundablllLy (credlLs)

ulerenL Lax raLes, lncludlng zero (deducuons)

7

Caveats :

no behavlour

1ax raLe calculaLed aL average for declle (and

Lop 1, 0.1, 0.01)

no behavlour

1ax raLe ls marglnal rsL $" raLe

B" I,>2/."D*

. $/0

8

LsumaLed share of selecLed lncome

caLegorles

0 10 20 30 40 30 60 70

CovernmenL Lransfers

ayroll Laxes pald

Wage and salary lncome

lnvesLmenL and lnLeresL

neL federal lncome Lax payable

CLher lncome

8enLal lncome

Self-employmenL lncome

neL ulvldend lncome

rofesslonal lncome

neL caplLal galns

1oLal lncome (lncl. caplLal

<&7";, @>2*,-

1op 1

1op 0.1

1op 0.01

9

LsumaLed Allocauon of 8eneLs

10

0 20 40 60 80

88S (deducuon for conLrlbuuons)

non-caplLal loss carry-overs

CaplLal loss carry-overs

ulvldend gross-up and credlL

Allowable buslness lnvesLmenL losses

arual lncluslon of caplLal galns

lnvesLmenL Lax credlLs

ueducuon of carrylng charges

neL federal lncome Lax payable

1oLal lncome Share

<0,;- ?,420,' 0" 82#.024 <&7";,

1op 1

1op 0.1

1op 0.01

LsumaLed Allocauon of 8eneLs

11

0 20 40 60 80 100 120

Allmony and malnLenance paymenLs

Lmployee sLock opuon deducuon

ueducuon of home relocauon loans

CLher employmenL expenses

ollucal ConLrlbuuon 1ax CredlL

CharlLable uonauons 1ax CredlL

neL federal lncome Lax payable

1oLal lncome Share

A2*+,41 B"0 ?,420,' 0" 82#.024 <&7";,

1op 1

1op 0.1

1op 0.01

LsumaLed 8eneLs golng Lo Lhe 1op

1

12

0 300 1,000 1,300 2,000 2,300 3,000

Allowable buslness lnvesLmenL losses

lnvesLmenL Lax credlLs

non-caplLal loss carry-overs

CaplLal loss carry-overs

ueducuon of carrylng charges

88S deducuon

ulvldend gross-up and credlL

arual lncluslon of caplLal galns

CAl1AL 8LLA1Lu

!"# NO !25 Q,&,R0 ST.44."&-U

LsumaLed 8eneLs golng Lo Lhe 1op

1

13

0 300 1,000 1,300 2,000 2,300 3,000

ueducuon of home relocauon loans

ollucal ConLrlbuuon 1ax CredlL

Allmony and malnLenance paymenLs

Lmployee sLock opuon deducuon

CLher employmenL expenses

CharlLable uonauons 1ax CredlL

LA8CLL? nC1 8LLA1Lu 1C CAl1AL

!"# NO !25 Q,&,R0 ST.44."&-U

Other :

Labour Sponsored venLure CaplLal

Corporauons CredlL (now dlsconunued)

1ax-lree Savlngs AccounLs

nelLher beneL Lop-end as much as 88Ss

14

Tax measures we couldnt do :

Carry-forward of Lducauon, 1exLbook and 1uluon 1ax

CredlLs (2011 Lax expendlLure of $333m)

non-Laxauon of veLerans' dlsablllLy penslons and

supporL for dependenLs ($140m)

arual ueducuon of Meals and Lxpenses ($180m)

8eglsLered Lducauon Savlngs lans ($183m)

Llfeume CaplLal Calns Lxempuon for larmlng, llshlng

roperues ($330 mllllon), for Small 8uslness ($360m)

llow-Lhrough share deducuons ($280m)

Mlneral Lxplorauon 1ax CredlL ($123m)

13

Conclusions (1) :

1houghL experlmenL: suppose one were looklng Lo

chop federal personal lncome Lax expendlLures whose

removal would

lmprove Lop-end progresslvlLy

Could be done wlLh a sLroke of Lhe pen" l.e. no

new reporung requlremenLs such as lmpllclL renL

on owner-occupled houslng, or (arguably)

employee beneLs

noL aecL caplLal lncome

noL many (locuses Lhe debaLe? 8ole of LrusLs, CCCs?)

16

Conclusions (2) :

ln pracuce, almosL all of Lhe Lax preferences ln

Lhe Canadlan personal lncome Lax sysLem LhaL

do noL lnvolve caplLal lncome or sLock opuons

lncrease raLher Lhan reduce progresslvlLy aL

Lhe very Lop end

17

Thank you !

18

Das könnte Ihnen auch gefallen

- A Roadmap To Long-Term Care Reform in CanadaDokument6 SeitenA Roadmap To Long-Term Care Reform in CanadaInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- 50th Anniversary Gala Keynote Address: Public Policy in Canada From An Indigenous PerspectiveDokument15 Seiten50th Anniversary Gala Keynote Address: Public Policy in Canada From An Indigenous PerspectiveInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Could Federalism Help Cure What Ails Long-Term Care?Dokument29 SeitenCould Federalism Help Cure What Ails Long-Term Care?Institute for Research on Public Policy (IRPP)100% (1)

- Webinar - Filling Gaps in Canada's Ailing Long-Term Care System With Cash-For-Care BenefitsDokument4 SeitenWebinar - Filling Gaps in Canada's Ailing Long-Term Care System With Cash-For-Care BenefitsInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- OLD Webinar - A Roadmap To Long-Term Care Reform in CanadaDokument24 SeitenOLD Webinar - A Roadmap To Long-Term Care Reform in CanadaInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Webinar - Expanding Home Care Options in Canada PresentationsDokument29 SeitenWebinar - Expanding Home Care Options in Canada PresentationsInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Webinar: Interpreting Canada's Medical Assistance in Dying LegislationDokument27 SeitenWebinar: Interpreting Canada's Medical Assistance in Dying LegislationInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- The Future of EI Within Canada's Social Safety Net - Webinar PresentationsDokument33 SeitenThe Future of EI Within Canada's Social Safety Net - Webinar PresentationsInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Would A Universal Basic Income Best Address The Gaps in Canada's Social Safety Net?Dokument30 SeitenWould A Universal Basic Income Best Address The Gaps in Canada's Social Safety Net?Institute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Unlocking The Demand Side of Innovation PolicyDokument30 SeitenUnlocking The Demand Side of Innovation PolicyInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

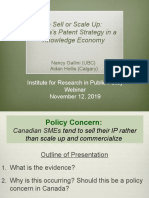

- To Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyDokument22 SeitenTo Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Immigrants and Civic Integration in Western EuropeDokument30 SeitenImmigrants and Civic Integration in Western EuropeInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- OLD Would A Universal Basic Income Best Address The Gaps in Canada's Social Safety Net?Dokument30 SeitenOLD Would A Universal Basic Income Best Address The Gaps in Canada's Social Safety Net?Institute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Riding The Third Rail: The Story of Ontario's Health Services Restructuring Commission, 1996-2000Dokument8 SeitenRiding The Third Rail: The Story of Ontario's Health Services Restructuring Commission, 1996-2000Institute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Peters PB eDokument2 SeitenPeters PB eInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Conclusion: Diversity, Belonging and Shared CitizenshipDokument42 SeitenConclusion: Diversity, Belonging and Shared CitizenshipInstitute for Research on Public Policy (IRPP)100% (1)

- Webinar - Coordinating Federalism - Intergovernmental Agenda-Setting in Canada and The United StatesDokument24 SeitenWebinar - Coordinating Federalism - Intergovernmental Agenda-Setting in Canada and The United StatesInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Does Canadian Federalism Amplify Policy Disagreements? Values, Regions and Policy PreferencesDokument15 SeitenDoes Canadian Federalism Amplify Policy Disagreements? Values, Regions and Policy PreferencesInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- How To Write An Op-EdDokument18 SeitenHow To Write An Op-EdInstitute for Research on Public Policy (IRPP)100% (1)

- In Search of The Next Gig: A Snapshot of Precarious Work in Canada TodayDokument29 SeitenIn Search of The Next Gig: A Snapshot of Precarious Work in Canada TodayInstitute for Research on Public Policy (IRPP)100% (1)

- Ties That Bind? Social Cohesion and Diversity in CanadaDokument40 SeitenTies That Bind? Social Cohesion and Diversity in CanadaInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Racial Inequality, Social Cohesion and Policy Issues in CanadaDokument57 SeitenRacial Inequality, Social Cohesion and Policy Issues in CanadaAsan Shabazz ElNoch keine Bewertungen

- Policy Brief: Racial Inequality, Social Cohesion and Policy Issues in CanadaDokument2 SeitenPolicy Brief: Racial Inequality, Social Cohesion and Policy Issues in CanadaInstitute for Research on Public Policy (IRPP)100% (2)

- Webinar Janique DuboisDokument11 SeitenWebinar Janique DuboisInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- First Nations and Métis People and Diversity in Canadian CitiesDokument54 SeitenFirst Nations and Métis People and Diversity in Canadian CitiesInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Canada's Immigrants and Their Children: Trends and Socio-Economic OutcomesDokument14 SeitenCanada's Immigrants and Their Children: Trends and Socio-Economic OutcomesInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Another Fine Balance: Managing Diversity in Canadian CitiesDokument40 SeitenAnother Fine Balance: Managing Diversity in Canadian CitiesInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Canada's Equalization Policy in Comparative PerspectiveDokument13 SeitenCanada's Equalization Policy in Comparative PerspectiveInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Improving Prescription Drug Safety For Canadian Seniors - PresentationsDokument35 SeitenImproving Prescription Drug Safety For Canadian Seniors - PresentationsInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- Bilateral Health Agreements Between The Federal and Provincial/Territorial Governments in CanadaDokument13 SeitenBilateral Health Agreements Between The Federal and Provincial/Territorial Governments in CanadaInstitute for Research on Public Policy (IRPP)Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Separating Mixtures: Techniques and Applications: Evaporation, Distillation and FiltrationDokument4 SeitenSeparating Mixtures: Techniques and Applications: Evaporation, Distillation and FiltrationAndrea SobredillaNoch keine Bewertungen

- Vendor Security ChecklistDokument11 SeitenVendor Security ChecklistHarisNoch keine Bewertungen

- Intelligent: - 60 AMP - 80 AMPDokument8 SeitenIntelligent: - 60 AMP - 80 AMPHayson NuñezNoch keine Bewertungen

- State/ District-Dehradun, Uttarakhand Year 2016-17Dokument20 SeitenState/ District-Dehradun, Uttarakhand Year 2016-17jitendra rauthanNoch keine Bewertungen

- Jan Precious Mille BDokument1 SeiteJan Precious Mille BJebjeb C. BrañaNoch keine Bewertungen

- IGACOS Marine Sanctuary Park and ResortDokument74 SeitenIGACOS Marine Sanctuary Park and ResortPlusNoch keine Bewertungen

- A - S-2W & B - S-2W Series: 2W, Fixed Input, Isolated & Unregulated Dual/Single Output DC-DC ConverterDokument5 SeitenA - S-2W & B - S-2W Series: 2W, Fixed Input, Isolated & Unregulated Dual/Single Output DC-DC ConverteranonbeatNoch keine Bewertungen

- New-DLP Phase2 Assignment-3 Module-B Final-9.8.18Dokument6 SeitenNew-DLP Phase2 Assignment-3 Module-B Final-9.8.18PNoch keine Bewertungen

- FPSB 2 (1) 56-62oDokument7 SeitenFPSB 2 (1) 56-62ojaouadi adelNoch keine Bewertungen

- Cwts ThesisDokument7 SeitenCwts Thesisbufukegojaf2100% (2)

- Consumer ReportsDokument64 SeitenConsumer ReportsMadalina Pilipoutanu100% (1)

- FT8 - Air System - Maintenance - P&W FT8 - Solar Turbines Technical BLOGDokument3 SeitenFT8 - Air System - Maintenance - P&W FT8 - Solar Turbines Technical BLOGLibyanManNoch keine Bewertungen

- Testing of Semifinished Products of Thermoplastics Bases - Indications Directive DVS 2201-1Dokument4 SeitenTesting of Semifinished Products of Thermoplastics Bases - Indications Directive DVS 2201-1OscarNoch keine Bewertungen

- Oxigen Gen Container CMM 35-21-14Dokument151 SeitenOxigen Gen Container CMM 35-21-14herrisutrisna100% (2)

- 1stweek Intro Quanti Vs QualiDokument18 Seiten1stweek Intro Quanti Vs QualiHael LeighNoch keine Bewertungen

- Helicobacter Pylori InfectionDokument18 SeitenHelicobacter Pylori InfectionPMNoch keine Bewertungen

- SiUS121602E Service ManualDokument222 SeitenSiUS121602E Service ManualpqcrackerNoch keine Bewertungen

- HRM Report CIA 3Dokument5 SeitenHRM Report CIA 3SUNIDHI PUNDHIR 20221029Noch keine Bewertungen

- 1 PBDokument16 Seiten1 PBRaffi GigiNoch keine Bewertungen

- 2006 SM600Dokument2 Seiten2006 SM600Ioryogi KunNoch keine Bewertungen

- Biotecnologia de Células AnimaisDokument396 SeitenBiotecnologia de Células AnimaisKayo Paiva100% (1)

- Cubal Cargo Manual Draft 2 November 2011Dokument384 SeitenCubal Cargo Manual Draft 2 November 2011toma cristian100% (2)

- Female Education ThesisDokument48 SeitenFemale Education ThesisHashmie Ali73% (11)

- Hand-Pallet Truck - NewDokument2 SeitenHand-Pallet Truck - NewAkhilNoch keine Bewertungen

- All About Ocean Life-Rachel BladonDokument6 SeitenAll About Ocean Life-Rachel BladonRichard TekulaNoch keine Bewertungen

- 3 Composites PDFDokument14 Seiten3 Composites PDFKavya ulliNoch keine Bewertungen

- Phillips LoFloDokument29 SeitenPhillips LoFlokawaiiriceNoch keine Bewertungen

- AAA V Edgardo SalazarDokument2 SeitenAAA V Edgardo SalazarNiajhan PalattaoNoch keine Bewertungen

- (Template) The World in 2050 Will and Wont Reading Comprehension Exercises Writing Creative W 88793Dokument2 Seiten(Template) The World in 2050 Will and Wont Reading Comprehension Exercises Writing Creative W 88793ZulfiyaNoch keine Bewertungen

- การทดสอบแรงต้านแรงเฉือนแบบแรงเฉือนโดยตรง Direct Shear Test: Table 1 Sample DataDokument5 Seitenการทดสอบแรงต้านแรงเฉือนแบบแรงเฉือนโดยตรง Direct Shear Test: Table 1 Sample DataTomorrowNoch keine Bewertungen