Beruflich Dokumente

Kultur Dokumente

A Study On Human Resource Accounting Methods and Practices in India

Hochgeladen von

debasispahi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten8 SeitenHuman resource is one of the most important back office operations of any organization or business. Companies must learn to recognize and appreciate the value of their employees. Solid management team in what sets a company apart with venture capitalists.

Originalbeschreibung:

Originaltitel

11

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenHuman resource is one of the most important back office operations of any organization or business. Companies must learn to recognize and appreciate the value of their employees. Solid management team in what sets a company apart with venture capitalists.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten8 SeitenA Study On Human Resource Accounting Methods and Practices in India

Hochgeladen von

debasispahiHuman resource is one of the most important back office operations of any organization or business. Companies must learn to recognize and appreciate the value of their employees. Solid management team in what sets a company apart with venture capitalists.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

95

A STUDY ON HUMAN RESOURCE ACCOUNTING METHODS AND

PRACTICES IN INDIA

DASARI.PANDURANGARAO*; DR.S.CHAND BASHA**;

DEVARAPALLI.RAJASEKHAR***

*ASSISTANT PROFESSOR,

DEPARTMENT OF MBA,

ST.ANNS ENGINEERING COLLEGE,

CHIRALA, ANDHRA PRADESH, INDIA

**PROFESSOR & HOD-MBA

ST.ANNS ENGINEERING COLLEGE,

CHIRALA, ANDHRA PRADESH, INDIA

***RESERCH SCHOLOR,

DEPARTMENT OF COMMERCE AND BUSINESS ADMINISTRATION

ACHARAYA NAGARJUNA UNIVERSITY, GUNTUR

______________________________________________________________________________

ABSTRACT

It is highly complicated in the todays market find well knowledge, coached, and highly

motivated people. Human resource is one of the most important back office operations of any

organization or business. Their skills, creativity, ability human cannot be replaced by machines.

We can lose efficiency in work if no qualitative people. At all levels and areas of the business or

firm human efficiency is required with machine efficiency. Human can work without machine

but machine cant. Hence, industry like advertising and direct marketing for instance human

talent is more valuable among other else. No machine can ever come up with a unique

advertising idea without the human input. Thus companies must learn to recognize and

appreciate the value of their employees. It is worth and capital investments. That is why firms

also need to search people those are on capital investment along with capital (money) while

many entrepreneurs are focused on securing capital they have to make sure they have the right

management team and employer in place if they want to attract investor create value and

maximum wealth. Solid management team in what sets a company apart with venture capitalists.

The article highlights the significance of Human resource valuation and methods to measures

human assets value. The article describes views of the authors and finds out the organizations

those have tried to implement human resource accounting. The article depicts the advantages of

human resource valuation.

KEYWORDS: Human resources accounting, human resource valuation, cost, model,

investment.

______________________________________________________________________________

Introduction

All the processes of the organization are operated by human resource, hence valuation of this

resource is very necessary and information about the valuation should be given to the investors,

the management and others through financial statements. Human resource accounting is basically

an information system that tells management what changes are occurring over time to the human

resources of the business. In the early 1990s industries were recognized the value and importance

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

96

of human assets. When service sector started major contribution to a countrys economy the

significance of human assets got prominence. Knowledge sectors like Information Technology

(IT), Banking, Teleservices and others the intangible asset especially humans contributed highly

to the building of shareholder value. Intellectual power of employees only major input to these

sectors. The critical success factor for any knowledge based company is its skilled and

intellectual work force.

Real assets will not appreciate much as businesses get commoditized; Innovation and

Intellectual power are going to be the key to the future (Mohandas Pai, CFO, INFOSYS).

Employees are the most valuable resources of comparison in the services (software, Banking,

Management Consultancy, etc) sectors. Like all other resources the company the employees

possess value because of providing future services (Samarat Gupta, MIS Manager, DSQ

Software Ltd). Human resource accounting is an attempt to identify and report investment made

in resources of the organization that are not presently accounted for under conventional

accounting practice "(woddruff). There is an almost universal belief among business executives,

investment managers and other stakeholders that consistent human capital metrics would be

valuable. Moreover, investors would take human capital data into consideration if it could be

provided on a reliable basis that would enable intelligent comparison (scott-jackson et al.,

2006)1. Flamholtz (1979) describes the HRA paradigm in terms of the psycho-technical

systems (PTS) approach to organizational measurement. According to the PTS approach, the

two functions of measurement are: 1) process functions in the process of measurement and 2)

numerical information from the numbers themselves.

Whereas one role of Human resource

Accounting (HRA) is to provide numerical measures, an even more important role is the

measurement process itself1.

Prof. Sidney Davidson defines human resource accounting as a

term used to describe a variety of proposals that seek to report and emphasize the importance of

human resources-Knowledgeable, trained and loyal employees-in a companys earnings process

and total assets. American Accounting Association defines it as a process of identifying and

measuring data about human resources and communicating this information to interested

parties. E.Flamholtz says it is the measurement of the cost and value of people for the

organization.

Origin of Human Resource Accounting

Recognizing human being as asset as old one. Form the observation of Indian History, it is

evident that Emperor Akbar gave importance to the nine jewels. Freedom fighters in India like

Shri Motilal Nehru, Mahatma Gandhi, Sardar Vallabh Bhai patel, PanditjawaharLal Nehru

cannot be removed from the historical pages of freedom movement of India. In spite of the

uncountable sacrifices forgone by the above individuals, no one make efforts to allocate any

monetary values to such individuals in the Balance sheet of India.

The suitable work was started to determine the cost and value of human beings by behavioral

scientists from 1960 onwards. The experts in this field were Shultz (1960), William Pyle(1967),

Flam Holtz(1973), Kenneth Sinclare (1978) and Dr Roa (1983), etc who contributed appropriate

methodology and correct methods for finding out the value of the employee to the organization.

World demand of Human Resource Accounting

It is fact that the 21

st

century is era of Human demand, countries those have labor quality ruling

the world with dominant technology. Countries like china and Japan forerunners in technology

advancement, is all result of work force performance. Hence whole world realized that human

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

97

resource is the real investment into business ventures that should only catch and stick the success

waves. It can be say that INFOSYIS, Bharat heavy Electrical Ltd (BHEL), DR.REDDY`S and

Steel Authority of India Ltd (SAIL) are ever profit generators because recognized value of

quality of labor and ordered peak priority so as company`s yields ripped fruits with assistance of

ripped force (quality employees) and can stand against any business storm and cope up

effectively.

Human Resource Accounting Practicing Companies In India

Even though, many benefits have contributed by HRA, yet its development and application in

different industries has not been encouraging. Because Indian companies act 1956, does not

provide any scope for showing any information about human resources in financial statement.

Due to the development of business and industries, some of the Indian companies, both public

and private, value their human resources and report this information in their annual report. The

companies, who are presently reporting human assets valuation, include:

1. Bharat heavy Electrical Ltd (BHEL).

2. Steel Authority of India Ltd (SAIL).

3. Oil and Natural Gas Commissioning (ONGC).

4. Oil India Ltd

5. Project and Equipment corporation of India.(PEC).

6. Engineers India limited

7. Mineral and Metal trading Corporation of India.(MMTC).

8. Electrical India Ltd.

9. Hindustan Shipyard Ltd.

10. Cement corporation of India. (CCI).

11. Infosys Technologies Ltd.

12. Tata Engineering and Locomotive Works

13. Southern Petrochemicals Industries Corporation Ltd SPIC).

14. Associated Cement Company Ltd ACC).

15. National Thermal Power Corporation Ltd (NTPC).

Human Resource Valuation Approaches followed by companies in India

Human resources have been given much priority in the present service sector since identifies

importance. In order to quantify the talent, skills and knowledge of employees or workforce

various models were suggested. Some of the models to valuation of Human Resources are:

Historical Cost Method

This method was developed by William C.Pyle and adopted in 1969 by R.G.Barry Corporation, a

leisure footwear company in Columbus, Ohio, USA. Historical cost method calculates actual

cost incurred on recruiting, selecting, hiring and training and development of human resource

(HR) which is equal to the value of workforce. The economic value of HR increases overtime

and they gain experience. However, according to this model, the capital cost of HR decreases

through amortization.

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

98

Replacement Cost Model

According to this model the value of employee is estimated as the cost of replacement with a

new employee of equivalent ability and efficiency. There are two costs, individual replacement

cost and positional replacement cost in this model. Cost of recruiting, selecting, training and

development and familiarization cost are account in individual replacement cost. When a

employee present position to another or leave the organization cost of moving, vacancy carrying

and other relevant costs reflect in individual replacement cost. Positional replacement cost refers

to the cost of filling different position in an organization and this model is highly subjective in

nature.

Opportunity Cost Model

Opportunity cost is the maximum alternative earning that is earning if the productive capacity or

asset is put to some alternative use. Quantifying HR value is difficult under this method. Because

alternative use of HR within the organization is restricted and at the same time the use may not

be identifiable in the real industrial environment.

Stochastic Rewards Model

Stochastic Rewards Model was developed by Eric G.Flamholtz. This model identified some

major variables that are help to determine the value of an individual to the organization. He

determined the movement of employees from one organization to another as Stochastic Process.

Eric G.Flamholtz suggested different approaches to assess the value of HR of the company in

this model. In order to quantify human resource value the period any employee work in the

organization, role of employee and value of present position are determined and discounted

expedited service rewards.

To be precise an employee value is the product of individual conditional value and the profit that

the individual offers to the organization in his/her service life. The conditional value comprises

of productivity, transferability and promotability, skills and activation levels are also the

determinants of an individuals conditional value.

Flamholtz has measured the expected realizable value of an individual as

Where E (RV) =expected realizable value

R

t

=Value derived by an organization in each possible sate

P (R

t

) =Probability that the organization will have R

t

t= time

n= state of exit

r= discount rate

i = 1,2,3

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

99

Sk.chakra borty Model

Sk. Chakraborty of Indian institute of management Calcutta was the first Indian to attempt at

valuation of resources. This model was similar to historical cost model, he noticed the cost of

recruiting ,learning, selection, training and development of each employee should considered for

acquisition cost method of valuation and be treated as different revenue expenditure, this is

subject to gradual written off.

The balance, not the written off amount, should be shown separately in the balance sheet under

the head of investment. To derive the present value of HR average feature tenure of employment

of employee`s and average future salary should discounted at an appropriate rate, it is shown as

investment in the asset side of balance sheet which is to be added to the capital employed in the

liability side.

separate valuation can be made for managerial and non- managerial employee the discount

calculate the present value should take as expected average after tax return on capital employed,

taken from the conventional balance sheet. The chakraborty model basically considered a

combination of acquisition method and present value.

Where

V= Value of a category of employee

N=Number of employees

AS= average annual pay

K= after tax return on capital employed

i=1, 2, 3n years (average tenure of employed

Lev and Schwartz compensation model

This model developed in 1971 by Lev and Schwartz for valuing human resources. Lev and

Schwartz model is popular for calculating the value of HR used by public sector like SAIL and

BHEL. It is based future earnings of an employee till his retirement. According to the model

value of human assets is estimated for a person at a given age which is the present value of his

remaining future earning from his employment and this represented by the following.

Where

V

r

= value of an individual or r years old

I(t)= the individuals annual earnings up to retirements age

T= retirement age

r= discount rate specific to the person

t= active year of service

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

100

The model categorized whole work force in the various homogenous groups such as unskilled

,semi-skilled, technical staff, managerial staff and so on and also into different age groups. By

using the formula calculated average earnings for different classes and age groups and present

value of HR.

Lev & Schwartz also recommended the use of cost of capital of the organizations for the purpose

of discounting the future earnings of the employees to arrive at the present value. They

recognized individual employees economic value to the organization.

Human Resource Valuation by INFOSYS

A fundamental dichotomy in accounting practices is between human and non-human capital is

considered as assets and reported in the financial statement, whereas human capital is mostly

ignored by accountants.. The definition of wealth as a source of income inevitably leads to the

recognition of human capital as one of the several forms of wealth such as money, securities and

physical capital. As standard practice, Infosys reports the value of its employees using the Lev &

Schwartz model. We have developed a new model quantify this value, in partnership with GIST

Advisory this year.

The INFOSYS GIST-HCX model is base o a present value calculation of the increase I future

earnings of employees during their employment at Infosys. Unlike conventional model, it also

accounts for the impact of attrition on our human capital value, and therefore also quantifies the

value of the positive human capital externality being generated by Infosys. Human capital

Externality refers to the benefit derived by society when employees whose human capital value

is enhanced du to training and employee development at Infosys, leave the company. The model

discounts future earnings at an appropriate discount rate, and utilizes a long-run inflation rate

consistent with the Reserve Bank of Indias target for inflation expectations.

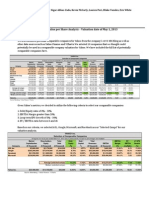

In Rs. Crore unless stated otherwise

Source: Annual Reports of Infosys 2011-12

2012 2011 Annual Change

Employees (no.)

Software professionals 1,41,788 1,23,811 14.52%

Support 8,206 7,009 17.08%

Total 1,49,994 1,30,820 14.66%

Value of human resources

Software professionals 1,15,900 89,507 29.49%

Support 9,817 8,640 13.62%

Total 1,25,717 98,147 28.09%

Value of human capital externality

Software professionals 6,182 4,702 31.48%

Support 649 563 15.28%

Total 6,831 5,265 29.17%

Total value of human resource capital and

human capital externality

1,32,548 1,03,412 28.17%

Ratio

Value of human capital per Employee 0.84 0.75 12.00%

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

101

According to this report the worth of each Infosys employee in 2011 is 75 lakhs and as per 2012

it is 84 lakhs.

Five benefits of HRA

Human resource accounting helps in knowing whether human asset is being built up in the

business or not. An executive may show good result in producing well, and so on but he might

not have built the human resources properly. A good manager keeps the morale of his

subordinates high so that they contribute the maximum in achieving the organizational

objectives.

Benefits of HRA

Cost of developing human resources: HRA will give the cost of developing human resources

in the business. This will enable the management to ascertain the cost of labor turnover also.

Proper investment: It can be seen whether the business has made proper investment in human

resources in terms of money or not. If the investment is in excess, efforts should be made to

control it.

Planning and executing personal policies: It will help the management in planning and

executing personal policies. The management also makes use of its help in taking decisions

regarding transfers, promotions, training, retirement and retrenchment of human resources.

Improving employee efficiency: It helps in improving the efficiency of employees. The

employees come to know of the cost incurred on them and the return given by them in the form

of output, and so on, which will motivate them to increase their worth.

Calculate Return on Investment (ROI): The return on investment can realistically be

calculated only when the investment on human resources also is taken into account. The ROI is

may be good because there is an investment on human beings.

International Journal of Social Science & Interdisciplinary Research__________________________________ ISSN 2277 3630

IJSSIR, Vol. 2 (4), APRIL (2013)

Online available at indianresearchjournals.com

102

Conclusion

Overall, even valuing human resources appear to be important to Indian organizations, most

organizations do not value their human resources and plans to implement valuation of human

resources are at a very early stage. Despite the interest in valuation there will be little or

moderate progress in the area over the next five to ten years. In order to show greater progress,

more needs to be done at both the theoretical and practical level. More search into valuation

methods and models, and the practical implication of these, is needed together with the

engagement of both human resource and accounting professionals in the debate on valuation and

its implementation in practice.

Bibliography:

Baker & McKenzie (2010).Australian Master Human Resources guide.CCH Australia

Limited. Macquarie University. Graduate School of Management : 51

Bullen L, Clayton State, University, Kel-Ann Eyler Journal of International Business and

Cultural Studies, Human resource accounting and international developments:

implications for measurement of human capital. Maria, Wesleyan College p. 4

Tyagi CL, Madhu Tyagi (2003).Financial And Management Accounting. Atlantic

Publishers and Distributers.New Delhi:441

Palanivelu VR (2007).Accounting for management.Lakshmi publishing (p) Limited. New

Delhi:399-403

Porwal L S (2007). Accounting Theory. Tata McGraw-Hill. New Delhi.3e: 478 - 491

Singh YK and Rawat HS (2006) .Human Resource Management.A.P.H .Publishing

Corporation. New Delhi:181-182

Kamal Gosh Ray (2010).Mergers and Acquisitions. prentice -Hall of India private

limited, New Delhi:203-210

Infosys annual financial statement 2011-12

Jelsy joseph, Kuppapally (2008).Accounting for Managers. Prentice-Hall of India Private

Limited. New Delhi: 596

Journal of Accounting Review.Jaipur.Volume II.1991.

Das könnte Ihnen auch gefallen

- Human Capital Investment For Better Business PerformanceVon EverandHuman Capital Investment For Better Business PerformanceNoch keine Bewertungen

- Human Resource Accounting at Infosys-A Case Study: January 2010Dokument19 SeitenHuman Resource Accounting at Infosys-A Case Study: January 2010Nishit AsherNoch keine Bewertungen

- Human Resource Accounting:: InvestmentsDokument4 SeitenHuman Resource Accounting:: InvestmentsRuchi GargNoch keine Bewertungen

- Human ResourceDokument8 SeitenHuman ResourceMS ArunimaNoch keine Bewertungen

- It's High-Time To Come To Terms With HCM - The Superset of HRM!Dokument13 SeitenIt's High-Time To Come To Terms With HCM - The Superset of HRM!prjpublicationsNoch keine Bewertungen

- HRA in InfosysDokument17 SeitenHRA in Infosysअंजनी श्रीवास्तवNoch keine Bewertungen

- Study of Human Resource Accounting Practices: April 2018Dokument4 SeitenStudy of Human Resource Accounting Practices: April 2018Priyanka YadavNoch keine Bewertungen

- Human Resource AccountingDokument4 SeitenHuman Resource AccountingAtul SinghNoch keine Bewertungen

- Dbim HraDokument3 SeitenDbim HraAlif ShaikhNoch keine Bewertungen

- Assignment: Resource Management-Valuation of Human Resources - Methodologies and PracticesDokument7 SeitenAssignment: Resource Management-Valuation of Human Resources - Methodologies and PracticespriyankaNoch keine Bewertungen

- Hra at Infosys PDFDokument7 SeitenHra at Infosys PDFankitkmr25Noch keine Bewertungen

- Chapters of Specialization - InfosysDokument65 SeitenChapters of Specialization - InfosysShubham JadhavNoch keine Bewertungen

- Asian Journal of Management ResearchDokument8 SeitenAsian Journal of Management Researcharun1974Noch keine Bewertungen

- HR Accounting PDFDokument10 SeitenHR Accounting PDFGaith BsharatNoch keine Bewertungen

- Hra Infosys CaseDokument4 SeitenHra Infosys CaseNish PawarNoch keine Bewertungen

- Human Resource Valuation in Infosys: Employees (No.)Dokument4 SeitenHuman Resource Valuation in Infosys: Employees (No.)Hitesh ShahNoch keine Bewertungen

- Human Resource AccountingDokument20 SeitenHuman Resource AccountingISHFAQ ASHRAFNoch keine Bewertungen

- Research Paper On Human Resource AccountingDokument4 SeitenResearch Paper On Human Resource Accountingsvfziasif100% (1)

- Assignment HRADokument22 SeitenAssignment HRACHIRAG V VYASNoch keine Bewertungen

- Human Resources Accounting Concepts Objectives Models and CriticismDokument10 SeitenHuman Resources Accounting Concepts Objectives Models and Criticismpavan kumarNoch keine Bewertungen

- Importance of Human Resource Accounting in The Era of Economic RecessionDokument2 SeitenImportance of Human Resource Accounting in The Era of Economic RecessionHitesh ShahNoch keine Bewertungen

- 45 HRA - Practices - by - Indian - Companies - The - Case - of - HPCL - by - CMA - Dr. - Sudipta - GhoshDokument15 Seiten45 HRA - Practices - by - Indian - Companies - The - Case - of - HPCL - by - CMA - Dr. - Sudipta - GhoshArpana KumariNoch keine Bewertungen

- Assignment: Resource Management-Valuation of Human Resources - Methodologies and PracticesDokument11 SeitenAssignment: Resource Management-Valuation of Human Resources - Methodologies and PracticespriyankaNoch keine Bewertungen

- Abstract:: Human Resource Accounting Practices in Infosys Technologies Ltd-A Case StudyDokument11 SeitenAbstract:: Human Resource Accounting Practices in Infosys Technologies Ltd-A Case StudyqweasdcxzNoch keine Bewertungen

- Hra Valuation Methods PDFDokument35 SeitenHra Valuation Methods PDFJayashree UNoch keine Bewertungen

- Human Resources Accounting in Infosys: Ms. Gaganjit KaurDokument5 SeitenHuman Resources Accounting in Infosys: Ms. Gaganjit KaurHitesh ShahNoch keine Bewertungen

- Volume+14+Issue+1 91 112Dokument22 SeitenVolume+14+Issue+1 91 112Sucheta SahaNoch keine Bewertungen

- HR AccountingDokument9 SeitenHR AccountingjayasreesriNoch keine Bewertungen

- Human Resource Management Aspect in Leather Industry in BangladeshDokument7 SeitenHuman Resource Management Aspect in Leather Industry in BangladeshSub 1Noch keine Bewertungen

- Running Head: Human Resource Accounting 1Dokument6 SeitenRunning Head: Human Resource Accounting 1Irynn RynnNoch keine Bewertungen

- Human Resource AccountingDokument47 SeitenHuman Resource AccountingYash VoraNoch keine Bewertungen

- A Study On Holland'S Personality Types and Employment Realities-An Empirical EvidenceDokument65 SeitenA Study On Holland'S Personality Types and Employment Realities-An Empirical EvidenceayalewtesfawNoch keine Bewertungen

- Krupanidhi School of Mangamentpage 1Dokument20 SeitenKrupanidhi School of Mangamentpage 1DarshanPrimeNoch keine Bewertungen

- Casestudy HPCLDokument5 SeitenCasestudy HPCLSantoshi SravanyaNoch keine Bewertungen

- Human Resource AccountingDokument31 SeitenHuman Resource AccountingmnjbashNoch keine Bewertungen

- Human Resource Accounting: Practical Challenges in Recognition, Measurement, Accounting Treatment Procedure and A Possible Way OutDokument6 SeitenHuman Resource Accounting: Practical Challenges in Recognition, Measurement, Accounting Treatment Procedure and A Possible Way OutJkNoch keine Bewertungen

- Human Resource Information System and Its Impact oDokument9 SeitenHuman Resource Information System and Its Impact ojitendra kumarNoch keine Bewertungen

- 218 16104717uuuuDokument12 Seiten218 16104717uuuuAbdelhak BenaoudaNoch keine Bewertungen

- Human Resource Accounting Practices by Selected CompaniesDokument13 SeitenHuman Resource Accounting Practices by Selected CompaniesYagnesh Dalvadi100% (4)

- HumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)Dokument6 SeitenHumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)bablooNoch keine Bewertungen

- Human Resource AccountingDokument14 SeitenHuman Resource AccountingSmart SivaNoch keine Bewertungen

- Human Resource Accounting: Brief History and Popular ModelsDokument4 SeitenHuman Resource Accounting: Brief History and Popular ModelsSaeful AzisNoch keine Bewertungen

- Human Resource AccountingDokument240 SeitenHuman Resource AccountingSasirekha84% (19)

- Human Resource Accounting in India: An Overview: Dr. Brajesh Kumar TiwariDokument5 SeitenHuman Resource Accounting in India: An Overview: Dr. Brajesh Kumar TiwarinehaNoch keine Bewertungen

- Performance Impact of Intellectual Capital: A Study of Indian It SectorDokument9 SeitenPerformance Impact of Intellectual Capital: A Study of Indian It SectorShazia HassanNoch keine Bewertungen

- A Case Study On Human Resource Accounting in InfosysDokument3 SeitenA Case Study On Human Resource Accounting in InfosysAnchal Jain100% (2)

- Human Resource Accounting-A New DimensionDokument18 SeitenHuman Resource Accounting-A New Dimensionhossein100% (2)

- Human Resources - Ijhrmr - HR Best Practices For - JeevarekaDokument8 SeitenHuman Resources - Ijhrmr - HR Best Practices For - JeevarekaTJPRC PublicationsNoch keine Bewertungen

- 1504594675quadrant1 Module37Dokument17 Seiten1504594675quadrant1 Module37jajamea tabatNoch keine Bewertungen

- Emerging HR Management Trends in India ADokument9 SeitenEmerging HR Management Trends in India Avanshika sharmaNoch keine Bewertungen

- Achieving Excellence in Human Resources Management: An Assessment of Human Resource FunctionsVon EverandAchieving Excellence in Human Resources Management: An Assessment of Human Resource FunctionsBewertung: 3 von 5 Sternen3/5 (1)

- Human Capital Frameworks: How To Build A Strong OrganizationVon EverandHuman Capital Frameworks: How To Build A Strong OrganizationNoch keine Bewertungen

- Digital HR: A Guide to Technology-Enabled Human ResourcesVon EverandDigital HR: A Guide to Technology-Enabled Human ResourcesBewertung: 5 von 5 Sternen5/5 (3)

- Delivering on the Promise: How to Attract, Manage, and Retain Human CapitalVon EverandDelivering on the Promise: How to Attract, Manage, and Retain Human CapitalBewertung: 5 von 5 Sternen5/5 (1)

- Human Resource Management in the Knowledge Economy: New Challenges, New Roles, New CapabilitiesVon EverandHuman Resource Management in the Knowledge Economy: New Challenges, New Roles, New CapabilitiesBewertung: 3 von 5 Sternen3/5 (5)

- Organizational Behavior: A Case Study of Reliance Industries Limited: Organizational BehaviourVon EverandOrganizational Behavior: A Case Study of Reliance Industries Limited: Organizational BehaviourNoch keine Bewertungen

- Organizational Behavior: A Case Study of Tata Consultancy Services: Organizational BehaviourVon EverandOrganizational Behavior: A Case Study of Tata Consultancy Services: Organizational BehaviourNoch keine Bewertungen

- AI-Driven HR: Innovations in Employee Experience and Talent AcquisitionVon EverandAI-Driven HR: Innovations in Employee Experience and Talent AcquisitionNoch keine Bewertungen

- A Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiaDokument9 SeitenA Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiadebasispahiNoch keine Bewertungen

- EAA NoticeDokument1 SeiteEAA NoticedebasispahiNoch keine Bewertungen

- Chap 010Dokument17 SeitenChap 010debasispahiNoch keine Bewertungen

- Dimensions Economic: Nation State Global GovernanceDokument1 SeiteDimensions Economic: Nation State Global GovernancedebasispahiNoch keine Bewertungen

- Chap 003Dokument17 SeitenChap 003debasispahiNoch keine Bewertungen

- CSR of BricsDokument2 SeitenCSR of BricsdebasispahiNoch keine Bewertungen

- The Main Features of Advertise Are As UnderDokument5 SeitenThe Main Features of Advertise Are As UnderdebasispahiNoch keine Bewertungen

- A Brief On MncsDokument102 SeitenA Brief On MncsAjit Pal Singh HarnalNoch keine Bewertungen

- Financial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredDokument34 SeitenFinancial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredKoketso Mogwe100% (1)

- Intermediate Accounting 2 First Grading ExaminationDokument18 SeitenIntermediate Accounting 2 First Grading ExaminationJEFFERSON CUTE60% (15)

- Time Value of MoneyDokument52 SeitenTime Value of Moneykichloo4anwar4ul4haqNoch keine Bewertungen

- Far410 Tutorial Chapter 4Dokument2 SeitenFar410 Tutorial Chapter 4syuhadahNoch keine Bewertungen

- Quiz 2 Problem 1Dokument2 SeitenQuiz 2 Problem 1Jerah Marie PepitoNoch keine Bewertungen

- International Financial Reporting Standard 3Dokument27 SeitenInternational Financial Reporting Standard 3Platonic100% (21)

- Unit 15 Final ExamDokument5 SeitenUnit 15 Final ExamTakuriNoch keine Bewertungen

- Lecture Note On Project AppraisalDokument36 SeitenLecture Note On Project Appraisalmatiwos samuel100% (3)

- FSM Revision Notes June 2021Dokument267 SeitenFSM Revision Notes June 2021jacob michelNoch keine Bewertungen

- IMPAIRMENT OF ASSET Acctg 211Dokument30 SeitenIMPAIRMENT OF ASSET Acctg 211LumongtadJoanMaeNoch keine Bewertungen

- Interest Rate Risk I (CH 8)Dokument13 SeitenInterest Rate Risk I (CH 8)Mahbub TalukderNoch keine Bewertungen

- CTS CCP L0 BFS DumpsDokument28 SeitenCTS CCP L0 BFS Dumpssamrat18850% (8)

- Simple Discount InterestDokument16 SeitenSimple Discount InterestVivian100% (2)

- Chapter 19 - Financial Asset at Amortized Cost PDFDokument21 SeitenChapter 19 - Financial Asset at Amortized Cost PDFTurksNoch keine Bewertungen

- Far NosolnDokument11 SeitenFar NosolnStela Marie CarandangNoch keine Bewertungen

- Yahoo! Inc. Valuation ProjectDokument8 SeitenYahoo! Inc. Valuation ProjectNigar_AbbasNoch keine Bewertungen

- Bill Gross Investment Outlook Apr - 05Dokument4 SeitenBill Gross Investment Outlook Apr - 05Brian McMorrisNoch keine Bewertungen

- Class 8 Maths Exemplar Book ChapterDokument16 SeitenClass 8 Maths Exemplar Book ChapterPulkitNoch keine Bewertungen

- Chapter 5 Introduction To Valuation The Time Value of MoneyDokument35 SeitenChapter 5 Introduction To Valuation The Time Value of MoneyMuhammed Zakir HossainNoch keine Bewertungen

- Commercial MathematicsDokument10 SeitenCommercial MathematicsFaiz KhanNoch keine Bewertungen

- Mock 3 FARDokument10 SeitenMock 3 FARRodelLaborNoch keine Bewertungen

- Jmse 09 00459Dokument24 SeitenJmse 09 00459qw BastiaNoch keine Bewertungen

- Bird in Hand Theory by GordonDokument10 SeitenBird in Hand Theory by Gordonarchaudhry130Noch keine Bewertungen

- Polytechnic University of The Philippines College of AccountancyDokument11 SeitenPolytechnic University of The Philippines College of AccountancyRonel CacheroNoch keine Bewertungen

- Valuation of Bonds: SA Sem 3Dokument48 SeitenValuation of Bonds: SA Sem 3anindya_kunduNoch keine Bewertungen

- Case Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by BrunerDokument12 SeitenCase Solutions For Case Studies in Finance Managing For Corporate Value Creation 6th Edition by Brunerbiwithse7en0% (1)

- Topic 3 - Money - Time Relationships and EquivalenceDokument50 SeitenTopic 3 - Money - Time Relationships and EquivalenceMc John PobleteNoch keine Bewertungen

- Tally Ledger Under Group ListDokument5 SeitenTally Ledger Under Group Listvenu gopalNoch keine Bewertungen

- Risk and Refinement in Capital BudgetingDokument51 SeitenRisk and Refinement in Capital BudgetingRitesh Lashkery0% (1)

- Compound Financial InstrumentsDokument3 SeitenCompound Financial Instrumentskevior2Noch keine Bewertungen