Beruflich Dokumente

Kultur Dokumente

The Money: Financial

Hochgeladen von

krjulu0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

40 Ansichten1 Seitemju

Originaltitel

07_07_2014_114_7afb3628ce3767b54adfc9c45d134e7b

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmju

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

40 Ansichten1 SeiteThe Money: Financial

Hochgeladen von

krjulumju

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

The content on this page is courtesy Centre for Investment Education and Learning (CIEL).

Contributions by Girija Gadre and Arti Bhargava.

1

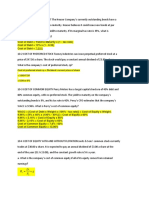

Base rate,

determined by a

bank as per RBI

guidelines, is the

minimum rate below

which a bank is not

permitted to lend to

its customers.

2

Base rate linked

pricing system for

loans and advances

was started on July 1,

2010. It replaced the

Bank Prime Lending

Rate (BPLR). Earlier,

banks could lend

below the BPLR.

3

Since a bank cannot

offer loans at rates

lower than the base

rate to any of its

customers, it makes

it easy for borrowers

to compare and

choose a lender.

4

Lending rates may

include customer

specific charges

and be higer than

the base rate. Rates

vary according to

type of loan,

borrower, security,

and amount.

5

Base rate has to be

reviewed and

notified at least

once in a quarter. It

can be modified by

the banks Board

or its Asset

Liability Manage-

ment Committee.

THE MONEY QUESTION

Can those with limited income and no savings history become successful investors?

Points to note

Securities Transaction Tax paid can be

downloaded in a consolidated format

and is reflected in Form 26AS.

If tax has been deducted but not paid

by the deductor to the government,

Traces enables identifying and com-

plaining about such discrepancy.

Internet banking accounts can be

linked to Traces to enable logging in

and reconciling taxes paid.

Paper

Work

Using TRACES

Traces (TDS Reconciliation Analysis and

Correction Enabling System) is an online

facility provided by the Income Tax Depart-

ment at www.tdscpc.gov.in. The objective

of this facility is to enable both payers and

deductors of TDS to view taxes paid online,

reconcile them for purposes of filing returns

and seeking refunds.

SMART THINGS TO KNOW: Base Rate

Downloads

Form 16/16A can be downloaded from

Traces, which is an acceptable proof of

taxes deducted at source. Annual tax

statement (Form 26AS) can also be

downloaded to show all taxes paid

including advance taxes and self-

assessment.

Registration

Individual tax payers who like to view

taxes deducted on their incomes have

to first register by providing details of

their PAN, email, and mobile numbers

and create on online account with a

username and password. The system

then generates an email for activating

the account.

Facilities

Users can view all transactions where

taxes have been deducted at source,

including salaries. Tax that has been

collected on behalf of the taxpayer,

including advance taxes paid and self-

assessment taxes deposited can be

viewed by logging in.

AIR

The Tax Information Network main-

tained by the government requires

specified entities to file details of

specific transactions as an Annual

Information Report (AIR). These

include transactions in cash, property,

shares, bonds, mutual funds and cred-

it cards. Taxpayers can view and

download the AIR pertaining to their

PAN from Traces.

A

mit perhaps belongs to the class of

investors that thinks that unless

they have a large amount of mon-

ey, they may not be able to build

meaningful assets. He might also

have resigned to the fact that his income is just

about adequate for his needs, leaving less to

save. It is never late to start saving and invest-

ing. There are three things he can do:

The first thing is to see how much of his in-

come is used for expenses that are absolutely

unavoidable. Mandatory expenses include

monthly groceries, electricity and utility bills,

childrens school fee, and such things that he

knows his family cannot do without. Whatever

remains of his income, after these mandatory

expenses have been met, is his savings poten-

tial. Amit should take the time to see what this

number is and target saving a good portion of

this amount instead of resigning to a per-

ceived inability to save.

The second thing to do is to save first and

spend later. Just as his PF and tax is deducted

even before the salary is available for spending,

he should set up some systematic investments

that are made as soon as his salary is credited to

his bank account. The amount can be as small as

`5,000, but it will add up to a nice sum over a

period of time.

The third thing to do is to define a few finan-

cial goals. Without a specific requirement in

mind, Amit may not be able to find the motiva-

tion to cut back on expenses and seriously try to

save and invest. If the goals are important

enough, such as his childrens education or his

own retirement, Amit will stop before spending

and begin to save.

Everyone needs financial planning. The abil-

ity to face any future need with confidence

comes only when part of the current income is

set aside and invested. Amit should take the first

steps, and as he sees the build-up of his wealth,

he will be motivated to do more.

Amit Pal is a middle-aged, mar-

ried, salaried man with two teen-

age children. Except for the house

he lives in, Amit does not have

much by way of assets. He worries

if it is too late to start and whether

he can inculcate the saving habit

at all.

14

Financial Planning The Economic Times Wealth, July 7-July 13, 2014

Das könnte Ihnen auch gefallen

- Á≥Ôë˛Ö-Fõ Bmê¸-Δêˇ¤-◊Ó˝Ƒê˝$ ºyä˛: ±Δêˇ-ͲBá‹$¢Àfá≥#¢Mê¸$ΔêˇÖvê¸Öì‹ßê˛ ÖDokument1 SeiteÁ≥Ôë˛Ö-Fõ Bmê¸-Δêˇ¤-◊Ó˝Ƒê˝$ ºyä˛: ±Δêˇ-ͲBá‹$¢Àfá≥#¢Mê¸$ΔêˇÖvê¸Öì‹ßê˛ ÖkrjuluNoch keine Bewertungen

- Jyothy SpecialDokument1 SeiteJyothy SpecialkrjuluNoch keine Bewertungen

- Stock Qty Invest Amt Last Price Prev Close High/Lows Gain Latest Price Date Intraday 52 Week Today's Overall ValueDokument5 SeitenStock Qty Invest Amt Last Price Prev Close High/Lows Gain Latest Price Date Intraday 52 Week Today's Overall ValuekrjuluNoch keine Bewertungen

- Reads: Ask The MentorDokument1 SeiteReads: Ask The MentorkrjuluNoch keine Bewertungen

- ¢√Úø'-Éπ-™Éà ´Ææ'H†O Ççí∫X ´Uéãh-Éπ-®Ω-Ù-©†' °Æj-Ϊߪ'Ç Îëêæ Ñ Qj (-Éπ™ Ñ ¢√®Ωç Éìeo †' Øë®Ω'A-Èπ◊Çü∆Ç. Öü∆-£Æ«-®Ω-Ù© ≤Ƒߪ'Çûó °Æô'D °Æçîª'-Èπ◊E, Oöàe Ææçü¿-®Ós¥-*-Ûªçí¬ V°Æßá÷-Tü∆Lç!Dokument1 Seite¢√Úø'-Éπ-™Éà ´Ææ'H†O Ççí∫X ´Uéãh-Éπ-®Ω-Ù-©†' °Æj-Ϊߪ'Ç Îëêæ Ñ Qj (-Éπ™ Ñ ¢√®Ωç Éìeo †' Øë®Ω'A-Èπ◊Çü∆Ç. Öü∆-£Æ«-®Ω-Ù© ≤Ƒߪ'Çûó °Æô'D °Æçîª'-Èπ◊E, Oöàe Ææçü¿-®Ós¥-*-Ûªçí¬ V°Æßá÷-Tü∆Lç!krjuluNoch keine Bewertungen

- The Times of India, Mumbai Wednesday, September 3, 2014Dokument1 SeiteThe Times of India, Mumbai Wednesday, September 3, 2014krjuluNoch keine Bewertungen

- Ææ'N'vû Ƒ® N - Ƒ® Ƒ® N - Ƒ® - C Ææ'N'vû Ƒ® N - Ƒ® - CDokument1 SeiteÆæ'N'vû Ƒ® N - Ƒ® Ƒ® N - Ƒ® - C Ææ'N'vû Ƒ® N - Ƒ® - CkrjuluNoch keine Bewertungen

- "Mýs Í' ) L º™Èl$-Mýs$Ë$... : Ñfä Æ$Ðéyýl Mýs-Çù Ë Mýsìz° Çüóæý Êæš Ìz Éæý $×Æ .. I Ýl$Výs$Æý $ Mýs Îë ºíDokument16 Seiten"Mýs Í' ) L º™Èl$-Mýs$Ë$... : Ñfä Æ$Ðéyýl Mýs-Çù Ë Mýsìz° Çüóæý Êæš Ìz Éæý $×Æ .. I Ýl$Výs$Æý $ Mýs Îë ºíkrjuluNoch keine Bewertungen

- Appear For An Exam: Window DressingDokument3 SeitenAppear For An Exam: Window DressingkrjuluNoch keine Bewertungen

- Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç!Dokument1 SeiteÆæ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç! Ææ Æ Ü¿ß ' E Ë-Ü¿ Ç!krjuluNoch keine Bewertungen

- Reads: Ask The MentorDokument1 SeiteReads: Ask The MentorkrjuluNoch keine Bewertungen

- 03 09 2014 023Dokument1 Seite03 09 2014 023krjuluNoch keine Bewertungen

- 03 09 2014 019Dokument1 Seite03 09 2014 019krjuluNoch keine Bewertungen

- The Times of India, Mumbai Wednesday, September 3, 2014Dokument1 SeiteThe Times of India, Mumbai Wednesday, September 3, 2014krjuluNoch keine Bewertungen

- 09 07 2014 018Dokument1 Seite09 07 2014 018krjuluNoch keine Bewertungen

- Salaries:: "It's Vital To Always Anticipate The Opponent's Response"Dokument1 SeiteSalaries:: "It's Vital To Always Anticipate The Opponent's Response"krjuluNoch keine Bewertungen

- 09 07 2014 018Dokument1 Seite09 07 2014 018krjuluNoch keine Bewertungen

- Salaries:: "It's Vital To Always Anticipate The Opponent's Response"Dokument1 SeiteSalaries:: "It's Vital To Always Anticipate The Opponent's Response"krjuluNoch keine Bewertungen

- 10 07 2014 017Dokument1 Seite10 07 2014 017krjuluNoch keine Bewertungen

- 10 07 2014 020Dokument1 Seite10 07 2014 020krjuluNoch keine Bewertungen

- Goals Within Reach With Higher Equity Exposure: FinancesDokument1 SeiteGoals Within Reach With Higher Equity Exposure: FinanceskrjuluNoch keine Bewertungen

- 10 07 2014 020Dokument1 Seite10 07 2014 020krjuluNoch keine Bewertungen

- Deposits: Loans &Dokument1 SeiteDeposits: Loans &krjuluNoch keine Bewertungen

- Due Diligence When Buying From a First-Time DeveloperDokument1 SeiteDue Diligence When Buying From a First-Time DeveloperkrjuluNoch keine Bewertungen

- Review: PreviewDokument1 SeiteReview: PreviewkrjuluNoch keine Bewertungen

- 07 07 2014 130 PDFDokument1 Seite07 07 2014 130 PDFkrjuluNoch keine Bewertungen

- The Money: FinancialDokument1 SeiteThe Money: FinancialkrjuluNoch keine Bewertungen

- Due Diligence When Buying From a First-Time DeveloperDokument1 SeiteDue Diligence When Buying From a First-Time DeveloperkrjuluNoch keine Bewertungen

- Alternative Investment Returns Monitor: InvestmentsDokument1 SeiteAlternative Investment Returns Monitor: InvestmentskrjuluNoch keine Bewertungen

- Experts Answer Personal Finance QueriesDokument1 SeiteExperts Answer Personal Finance QuerieskrjuluNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingDokument107 SeitenBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonNoch keine Bewertungen

- Branch and Unit BankingDokument1 SeiteBranch and Unit BankingSheetal Thomas100% (1)

- Financing Your Business in OmanDokument12 SeitenFinancing Your Business in OmanAsadulla KhanNoch keine Bewertungen

- Bonus Assignment 1Dokument4 SeitenBonus Assignment 1Zain Zulfiqar100% (2)

- Paperco Case Study on Capital Investment Tax BenefitsDokument6 SeitenPaperco Case Study on Capital Investment Tax BenefitsJan Joseph Mejia Tayzon0% (1)

- Co Operative BanksDokument13 SeitenCo Operative Banksamyncharaniya100% (4)

- Tom Lives On An Island and Has 20 Coconut TreesDokument1 SeiteTom Lives On An Island and Has 20 Coconut Treestrilocksp SinghNoch keine Bewertungen

- BBG Adj HighlightsDokument1 SeiteBBG Adj HighlightsMaria Pia Rivas LozadaNoch keine Bewertungen

- IDBI Bank's Executive Summary and ProfileDokument41 SeitenIDBI Bank's Executive Summary and Profilesee2vickyNoch keine Bewertungen

- Marking Scheme 2020Dokument5 SeitenMarking Scheme 2020Joanna GarciaNoch keine Bewertungen

- E PaymentDokument14 SeitenE PaymentNeeraj PrajapatiNoch keine Bewertungen

- EF3320 Group ProjectDokument8 SeitenEF3320 Group ProjectJohnny LamNoch keine Bewertungen

- EMBA1Dokument7 SeitenEMBA1lfz15855102061Noch keine Bewertungen

- LeverageDokument64 SeitenLeveragePRECIOUSNoch keine Bewertungen

- The Cash BookDokument22 SeitenThe Cash Bookrdeepak99Noch keine Bewertungen

- Bengal Money Lenders Act, 1940 PDFDokument27 SeitenBengal Money Lenders Act, 1940 PDFSutirtha BanerjeeNoch keine Bewertungen

- AmazonRestrictedProductsList PDFDokument44 SeitenAmazonRestrictedProductsList PDFnitishhdesaiNoch keine Bewertungen

- ABRISH Final NEWDokument40 SeitenABRISH Final NEWGetachew AliNoch keine Bewertungen

- Inter IKEA Holding B.V. Annual Report FY18 Financial StatementsDokument4 SeitenInter IKEA Holding B.V. Annual Report FY18 Financial StatementsaretaNoch keine Bewertungen

- Franklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Dokument45 SeitenFranklin India Ultra Short Bond Fund - (No. of Segregated Portfolio in The Scheme - 1) - (Under Winding Up) $$$Ghanshyam Kumar PandeyNoch keine Bewertungen

- IB - Sessions Private EquityDokument4 SeitenIB - Sessions Private EquityDivya Jain50% (2)

- Lecture Course Week 2Dokument61 SeitenLecture Course Week 2juanpablooriolNoch keine Bewertungen

- Investment Slide 1Dokument17 SeitenInvestment Slide 1ashoggg0% (1)

- Financial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualDokument46 SeitenFinancial Accounting With International Financial Reporting Standards 4th Edition Weygandt Solutions ManualJordanChristianqryox100% (14)

- PDIC Law Additional NotesDokument6 SeitenPDIC Law Additional NotesBay Ariel Sto TomasNoch keine Bewertungen

- Ebook College Accounting Chapters 1 15 22Nd Edition Heintz Test Bank Full Chapter PDFDokument60 SeitenEbook College Accounting Chapters 1 15 22Nd Edition Heintz Test Bank Full Chapter PDFconvive.unsadden.hgp2100% (12)

- Trial Memorandum Plaintiff SAMPLEDokument10 SeitenTrial Memorandum Plaintiff SAMPLEHannah Escudero100% (3)

- Final accounts of sole traderDokument32 SeitenFinal accounts of sole tradervickramravi16Noch keine Bewertungen

- Nirmal Bang On CCL Products - Upside of 20%Dokument7 SeitenNirmal Bang On CCL Products - Upside of 20%Alok DashNoch keine Bewertungen

- Ipr & Technology Bulletin Technology and Electronic Payment System in IndiaDokument7 SeitenIpr & Technology Bulletin Technology and Electronic Payment System in IndiaVivek DubeyNoch keine Bewertungen