Beruflich Dokumente

Kultur Dokumente

Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111

Hochgeladen von

Sally MillerOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111

Hochgeladen von

Sally MillerCopyright:

Verfügbare Formate

HORNGREN'S ACCOUNTING - Tenth Edition

1.

2.

3.

4.

Identify the three categories of the accounting equation and list at least four

accounts associated with each category.

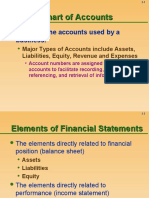

What is the purpose of the chart of accounts? Explain the numbering typically

associated with the accounts.

What does a ledger show? Whats the difference between a ledger and the chart

of accounts?

Accounting uses a double-entry system. Explain what this sentence means.

Chapter 2: Recording Business Transactions Page 1 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

5.

6.

7.

8.

9. What are source documents? Provide examples of source documents that a

business might use.

When are credits increases? When are credits decreases?

Identify which types of accounts have a normal debit balance and which types

of accounts have a normal credit balance.

What is a T-account? On which side is the debit? On which side is the credit?

Where does the account name go on a T-account?

When are debits increases? When are debits decreases?

Chapter 2: Recording Business Transactions Page 2 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

10.

11.

12.

Where are transactions initially recorded?

Explain the five steps in journalizing and posting transactions.

What are the four parts of a journal entry?

Chapter 2: Recording Business Transactions Page 3 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

13.

14.

15.

16.

What is involved in the posting process?

What is the purpose of the trial balance?

What is the difference between the trial balance and the balance sheet?

If total debits equal total credits on the trial balance, is the trial balance error-free?

Explain your answer.

Chapter 2: Recording Business Transactions Page 4 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

17. What is the calculation for the debt ratio? Explain what the debt ratio evaluates.

Chapter 2: Recording Business Transactions Page 5 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-1

Identify each account as an asset (A), liability (L), or equity (E).

Solution:

a.

b.

c.

d.

e.

f.

g.

h.

i

j.

Chapter 2: Recording Business Transactions Page 6 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-2

Solution:

a.

b.

c.

d.

e.

f.

g.

h.

i

j.

For each account, identify whether the changes would be recorded as a debit (DR)

or credit (CR).

Chapter 2: Recording Business Transactions Page 7 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-3

For each account, identify whether the normal balance is a debit (DR) or credit (CR).

Solution:

a.

b.

c.

d.

e.

f.

g.

h.

i

j.

Chapter 2: Recording Business Transactions Page 8 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-4

Solution:

Date Debit Credit

Journalize the transactions of Ned Brown, M.D. Include an explanation with

each entry.

Accounts and Explanation

Chapter 2: Recording Business Transactions Page 9 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-5

Solution:

Date Debit Credit

Journalize the transactions of Texas Sales Consultants. Include an

explanation with each journal entry.

Accounts and Explanation

Chapter 2: Recording Business Transactions Page 10 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-6

Calculate the Accounts Payable balance.

Solution:

Accounts Payable

Chapter 2: Recording Business Transactions Page 11 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-7

Requirements

1.

2.

Solution:

Requirement 1

Debit Credit

Requirement 2

Office Supllies

Cash Accounts Payable

Journalize the transactions of Kenneth Dolkart Optical Dispensary. Include

an explanation with each journal entry.

Open the following accounts (use T-account format): Cash (Beginning

Balance of $14,000), Office Supplies, and Accounts Payable. Post the

journal entries from Requirement 1 to the accounts and compute the

balance in each account.

Accounts and Explanation Date

Chapter 2: Recording Business Transactions Page 12 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-8

Prepare the trial balance of Oakland Floor Coverings at December 31, 2014.

Solution:

Debit Credit

OAKLAND FLOOR COVERINGS

Trial Balance

December 31, 2014

Account Title Balance

Chapter 2: Recording Business Transactions Page 13 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

S2-9

What is Professional Carpet Cares debt ratio as of October 31?

Solution:

Chapter 2: Recording Business Transactions Page 14 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-10

Match the accounting terms with the corresponding definitions.

Solution:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Chapter 2: Recording Business Transactions Page 15 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-11

Solution:

Expenses

Equity

Create a chart of accounts for Richard Autobody Shop using the standard system.

Assets

Liabilities

Revenues

Chapter 2: Recording Business Transactions Page 16 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-12

Requirements

1. Identify each account as asset (A), liability (L), or equity (E).

2. Identify whether the account is increased with a debit (DR) or credit (CR).

3. Identify whether the normal balance is a debit (DR) or credit (CR).

Solution:

Requirement 1 Requirement 2 Requirement 3

Account Name

a. Interest Revenue

b. Accounts Payable

c. Chapman, Capital

d. Office Supplies

e. Advertising Expense

f. Unearned Revenue

g. Prepaid Rent

h. Utilities Expense

i. Chapman, Withdrawals

j. Service Revenue

Normal Balance

with Debit/Credit

Increase with

Debit/Credit

Type of Account

Chapter 2: Recording Business Transactions Page 17 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-13

Solution:

a.

b.

c.

e.

f.

g.

h.

i.

j.

k.

l.

m.

n.

o.

p.

q.

r.

Insert the missing information into the accounting equation. Signify increases as

Incr. and decreases as Decr.

Chapter 2: Recording Business Transactions Page 18 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-14

For each transaction, identify a possible source document.

Solution:

a.

b.

c.

Chapter 2: Recording Business Transactions Page 19 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-15

Solution:

a.

b.

c.

d.

e.

f.

g.

As the manager of Mighty Fine Mexican Restaurant, you must deal with a

variety

Chapter 2: Recording Business Transactions Page 20 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-16

Solution:

Date Debit Credit

Journalize the transactions of London Engineering. Include an

explanation with each journal entry.

Accounts and Explanation

Chapter 2: Recording Business Transactions Page 21 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Chapter 2: Recording Business Transactions Page 22 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-17

Requirements

1. Open the following T-accounts for London Engineering: Cash; Accounts

Receivable; Office Supplies; Equipment; Accounts Payable; Notes Payable;

London, Capital; London, Withdrawals; Service Revenue; Utilities Expense.

2.

3. Compute the July 31 balance for each account.

Solution:

Requirements 1, 2, and 3

Office Supplies London, Capital

Post the journal entries to the T-accounts. Also transfer the dates to the T-accounts.

Cash Accounts Payable

Accounts Receivable Notes Payable

Chapter 2: Recording Business Transactions Page 23 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Service Revenue Utilities Expense

Equipment London, Withdrawals

Chapter 2: Recording Business Transactions Page 24 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-18

Solution:

Date Debit Credit

Journalize the transactions of Ward Technology Solutions. Include an

explanation with each journal entry.

Accounts and Explanation

Chapter 2: Recording Business Transactions Page 25 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-19

Requirements

1. Open four-column accounts using the following account numbers: Cash, 110;

Accounts Receivable, 120; Office Supplies, 130; Prepaid Advertising, 140;

Building, 150; Land, 160; Accounts Payable, 210; Unearned Revenue, 220; Ward,

Capital, 310; Service Revenue, 410; Rent Expense, 510; Salaries Expense, 520.

2.

Solution:

Requirement 2

Debit Credit

Post the journal entries to the four-column accounts and determine the

balance in the account after each transaction. Assume that the journal

entries were recorded on page 10 of the journal. Make sure to complete the

Post. Ref. columns in the journal and ledger.

Accounts and Explanation Date

Chapter 2: Recording Business Transactions Page 26 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Debit Credit

Requirements 1 and 2

Debit Credit

Post.

Ref. Debit Credit

Balance

Item Date

Account No. 110

Date Accounts and Explanation

CASH

Chapter 2: Recording Business Transactions Page 27 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

PREPAID ADVERTISING

Debit Credit

BUILDING

Debit Credit

LAND

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

Account No. 210

Account No. 160

Credit

Balance

Date

Credit

Balance

Date Item

Post.

Ref. Debit

Post.

Ref. Debit Item

Debit

Account No. 150

Credit

Balance

Date Item

Post.

Ref.

Account No. 140

Credit

Balance

Date Item

Post.

Ref. Debit

Credit

Balance

Date Item

Post.

Ref. Debit

Account No. 130

Item

Account No. 120

Post.

Ref. Debit Credit

Balance

Date

Chapter 2: Recording Business Transactions Page 28 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

UNEARNED REVENUE

Debit Credit

WARD, CAPITAL

Debit Credit

SERVICE REVENUE

Debit Credit

RENT EXPENSE

Debit Credit

SALARIES EXPENSE

Debit Credit

Account No. 510

Credit

Balance Post.

Ref. Debit Date Item

Balance

Credit Date Item

Account No. 520

Account No. 220

Post.

Ref. Debit

Post.

Ref. Debit

Date

Post.

Ref. Debit

Credit

Balance

Date Item

Item

Account No. 410

Credit

Balance

Account No. 310

Credit

Balance

Date Item

Post.

Ref. Debit

Chapter 2: Recording Business Transactions Page 29 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-20

Solution:

1.

2.

3.

4.

5.

6.

7.

8.

9.

The first nine transactions of North-West Airplane Repair have been posted to

the T-accounts. Provide an explanation for each of the nine transactions.

Chapter 2: Recording Business Transactions Page 30 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-21

Solution:

Date Debit Credit

Posting

Ref. Accounts and Explanation

Prepare the journal entries that served as the sources for the five

transactions. Include an explanation for each entry.

Chapter 2: Recording Business Transactions Page 31 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-22

Prepare Atkins trial balance as of August 31, 2015.

Solution:

Debit Credit

Balance Account Name

ATKINS MOVING COMPANY

Trial Balance

August 31, 2015

Chapter 2: Recording Business Transactions Page 32 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-23

Prepare McDonald Farm Equipment Repairs trial balance as of May 31, 2015.

Solution:

Debit Credit

MCDONALD FARM EQUIPMENT REPAIR

Trial Balance

May 31, 2015

Account Name Balance

Chapter 2: Recording Business Transactions Page 33 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-24

Requirements

1. Open the following four-column accounts of Teresa Parker, CPA: Cash, 110;

Accounts Receivable, 120; Office Supplies, 130; Office Furniture, 140; Accounts

Payable, 210; Utilities Payable, 220; Parker, Capital, 310; Parker, Withdrawals,

320; Service Revenue, 410; Salaries Expense, 510; Rent Expense, 520; Utilities

Expense, 530.

2.

3. Prepare the trial balance as of June 30, 2015.

Solution:

Requirement 2

Debit Credit

Journalize the transactions and then post the journal entries to

the four-column accounts. Keep a running balance in each

account. Assume the journal entries are recorded on page 10 of

Posting

Ref. Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 34 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 1 & 2

Debit Credit

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

OFFICE FURNITURE

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

UTILITIES PAYABLE

Debit Credit

Account No. 220

Post.

Ref.

Balance

Date Item Debit

Credit

Account No. 210

Post.

Ref.

Balance

Date

Credit

Post.

Ref.

Item Debit

Balance

Balance

Item

Account No. 140

Credit

Account No. 130

Post.

Ref.

Date

Balance

Date Item Debit Credit

Credit

Credit

Debit

Post.

Ref. Date Item

Post.

Ref.

Date

Item Debit

CASH

Account No. 120

Debit

Account No. 110

Balance

Chapter 2: Recording Business Transactions Page 35 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

PARKER, CAPITAL

Debit Credit

SERVICE REVENUE

Debit Credit

SALARIES EXPENSE

Debit Credit

RENT EXPENSE

Debit Credit

UTILITIES EXPENSE

Debit Credit

Balance

Date Item Credit

Account No. 520

Post.

Ref.

Balance

Date Item Credit

Account No. 410

Post.

Ref.

Balance

Date Item Debit

Account No. 510

Account No. 310

Post.

Ref.

Balance

Date Item Debit

Debit

Credit

Post.

Ref.

Item

Account No. 530

Post.

Ref. Debit Credit

Balance

Date

Debit

Credit

Chapter 2: Recording Business Transactions Page 36 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 3

Debit Credit

TERESA PARKER, CPA

Acct. No. Account Name

Trial Balance

June 30, 2015

Chapter 2: Recording Business Transactions Page 37 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-25

Requirements

1.

2.

Solution:

Requirements 1 and 2

a.

b.

c.

d.

e.

For each of these errors, state whether total debits equal total credits on the

trial

Identify each account that has an incorrect balance, and the amount and

direction of the error (such as Accounts Receivable $500 too high).

Debits equal Credits,

Yes or No Accounts Amount High or Low

Chapter 2: Recording Business Transactions Page 38 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-26

Solution:

Debit Credit

November 30, 2015

Account Name

Prepare the corrected trial balance as of November 30, 2015. Assume all amounts

are correct and all accounts have normal balances.

METRO PAINTING SPECIALISTS

Trial Balance

Balance

Chapter 2: Recording Business Transactions Page 39 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-27

Solution:

Debit Credit

Explanation:

a.

b.

c.

d.

Prepare the corrected trial balance as of May 31, 2015, complete with a heading;

journal entries are not required.

Balance

METRO PAINTING SPECIALISTS

Trial Balance

May 31, 2015

Account Name

Chapter 2: Recording Business Transactions Page 40 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

E2-28

Calculate the debt ratio for John Hill, M.D.

Solution:

Assets:

Liabilities:

Chapter 2: Recording Business Transactions Page 41 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-29A

Requirements

1. Journalize each transaction. Explanations are not required.

2.

3. Prepare the trial balance of Vernon Yung, M.D. as of July 31, 2015.

Solution:

Requirement 1

Post the journal entries to the T-accounts, using transaction dates as

posting references in the ledger accounts. Label the balance of each

Posting

Ref. Date Accounts and Explanation Debit Credit

Chapter 2: Recording Business Transactions Page 42 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 2

Accounts Receivable Advertising Payable

Cash Accounts Payable

Unearned Revenue

Notes Payable

Office Supplies

Yung, Capital

Land Yung, Withdrawals

Chapter 2: Recording Business Transactions Page 43 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 3

Debit Credit

Service Revenue Utilities Expense

Salaries Expense Rent Expense

VERNON YUNG, MD

Trial Balance

July 31, 2015

Account Title Balance

Chapter 2: Recording Business Transactions Page 44 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-30A

Requirements

1. Record each transaction in the journal using the following account titles: Cash;

Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Land;

Accounts Payable; Utilities Payable; Unearned Revenue; Stewart, Capital;

Stewart, Withdrawals; Service Revenue; Salaries Expense; Rent Expense;

Utilities Expense. Explanations are not required.

2.

3.

4. Prepare the trial balance of Doris Stewart, Designer, as of September 30, 2015.

Solution:

Requirement 1

Date Accounts and Explanation Debit

Open a T-account for each of the accounts.

Post the journal entries to the T-accounts, using transaction dates as posting

references in the ledger accounts. Label the balance of each account Bal.

Posting

Ref. Credit

Chapter 2: Recording Business Transactions Page 45 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Posting

Ref. Debit Credit Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 46 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

Cash Accounts Payable

Utilities Payable

Accounts Receivable Unearned Revenue

Office Supplies Capital

Prepaid Insurance Stewart, Withdrawals

Chapter 2: Recording Business Transactions Page 47 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Salaries Expense Rent Expense

Land Service Revenue

Furniture Utilities Expense

Chapter 2: Recording Business Transactions Page 48 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

DORIS STEWART, DESIGNER

Trial Balance

September 30, 2015.

Account Title Balance

Chapter 2: Recording Business Transactions Page 49 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-31A

Requirements

1. Record each transaction in the journal, using the following account titles: Cash;

Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Building;

Land; Accounts Payable; Utilities Payable; Notes Payable; Moore, Capital;

Moore, Withdrawals; Service Revenue; Salaries Expense; Rent Expense; and

Utilities Expense. Explanations are not required.

2. Open the following four-column accounts including account numbers:

Cash, 101; Accounts Receivable, 111; Office Supplies, 121; Prepaid

Insurance, 131; Furniture, 141; Building, 151; Land, 161; Accounts

Payable, 201; Utilities Payable, 211; Notes Payable, 221; Moore, Capital, 301;

Moore, Withdrawals, 311; Service Revenue, 411; Salaries Expense, 511;

Rent Expense, 521; and Utilities Expense, 531.

3.

4. Prepare the trial balance of Trevor Moore, Attorney, at January 31, 2015.

Solution:

Requirement 1 and 3

Date Accounts and Explanation

Post the journal entries to four-column accounts in the ledger using dates,

account numbers, journal references, and posting references. Assume the journal

entries were recorded on page 1 of the journal.

Posting

Ref. Credit Debit

Chapter 2: Recording Business Transactions Page 50 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Debit Credit

Posting

Ref. Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 51 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

CASH Account No. 101

Debit Credit

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

PREPAID INSURANCE

Debit Credit

FURNITURE

Debit Credit

Post.

Ref. Debit Credit

Balance

Date Item

Account No. 131

Account No. 141

Date Item

Balance

Date Item Debit

Post.

Ref.

Account No. 121

Debit Credit

Balance Post.

Ref.

Credit

Account No. 111

Post.

Ref. Debit Credit

Balance

Date Item

Post.

Ref. Debit Credit

Balance

Date Item

Chapter 2: Recording Business Transactions Page 52 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

BUILDING

Debit Credit

LAND

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

UTILITIES PAYABLE

Debit Credit

NOTES PAYABLE

Debit Credit

MOORE, CAPITAL

Debit Credit

MOORE, WITHDRAWALS

Debit Credit

Balance

Date Item

Post.

Ref. Debit

Account No. 311

Credit

Balance

Date Item

Post.

Ref.

Credit

Debit

Item

Account No. 301

Post.

Ref. Debit Credit

Balance

Date Item

Account No. 221

Account No. 211

Post.

Ref. Debit Credit

Balance

Date

Account No. 161

Post.

Ref. Debit

Account No. 201

Post.

Ref. Debit Credit

Balance

Date Item

Credit

Balance

Account No. 151

Post.

Ref. Debit Credit

Balance

Date

Date Item

Item

Chapter 2: Recording Business Transactions Page 53 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

SERVICE REVENUE

Debit Credit

SALARIES EXPENSE

Debit Credit

RENT EXPENSE

Debit Credit

UTILITIES EXPENSE

Debit Credit

Balance

Date Item

Item

Debit Credit

Post.

Ref.

Credit

Balance

Date

Item

Account No. 531

Account No. 521

Post.

Ref. Debit

Account No. 511

Post.

Ref. Debit Credit

Balance

Date

Balance Post.

Ref. Debit

Account No. 411

Credit Date Item

Chapter 2: Recording Business Transactions Page 54 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

TREVOR MOORE, ATTORNEY

Trial Balance

January 31, 2015

Account Title Balance

Chapter 2: Recording Business Transactions Page 55 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-32A

Requirements

1. Record the February transactions in the journal.

2.

3.

4. Prepare the trial balance of Sam Mitchell, CPA, at February 28, 2015.

Solution:

Requirement 1

Open the four-column ledger accounts listed in the trial balance, together with

their balances as of January 31.

Post the journal entries to four-column accounts in the ledger using dates, account

numbers, journal references, and posting references. Assume the journal

entries were recorded on page 5 of the journal.

Posting

Ref. Credit Date Accounts and Explanation Debit

Chapter 2: Recording Business Transactions Page 56 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Credit Date Accounts and Explanation

Posting

Ref. Debit

Chapter 2: Recording Business Transactions Page 57 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

CASH Account No. 11

Debit Credit

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

FURNITURE

Debit Credit

AUTOMOBILE

Debit Credit

Account No. 15

Post.

Ref. Debit Credit

Balance

Date Item

Date Item

Post.

Ref.

Item

Debit Credit

Balance

Account No. 14

Account No. 13

Post.

Ref.

Account No. 12

Post.

Ref. Debit Credit Item

Debit

Balance

Credit Date

Balance

Date

Balance

Date Item

Post.

Ref. Debit Credit

Chapter 2: Recording Business Transactions Page 58 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

LAND

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

UNEARNED REVENUE

Debit Credit

MITCHELL, CAPITAL

Debit Credit

MITCHELL, WITHDRAWALS

Debit Credit

SERVICE REVENUE

Debit Credit Debit Credit

Balance

Date Item

Account No. 41

Post.

Ref.

Balance

Date Item

Item

Post.

Ref.

Account No. 32

Post.

Ref. Debit Credit

Balance

Date Item

Account No. 31

Account No. 22

Post.

Ref. Debit

Debit Credit

Credit

Balance

Date

Account No. 21

Post.

Ref. Debit Credit

Balance

Account No. 16

Post.

Ref. Debit Credit

Balance

Date Item

Date Item

Chapter 2: Recording Business Transactions Page 59 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

SALARIES EXPENSE

Debit Credit

RENT EXPENSE

Debit Credit

Post.

Ref. Debit Credit

Account No. 52

Balance

Date Item

Post.

Ref. Debit Credit

Account No. 51

Balance

Date Item

Chapter 2: Recording Business Transactions Page 60 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

SAM MITCHELL, CPA

Trial Balance

February 28, 2015

Account Title Balance

Chapter 2: Recording Business Transactions Page 61 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-33A

Solution:

Debit Credit

Prepare the corrected trial balance as of August 31, 2015. Journal entries are

not required.

Account Title

August 31, 2015

Balance

SMART TOTS CHILD CARE

Trial Balance

Chapter 2: Recording Business Transactions Page 62 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-34A

Solution:

Debit Credit

Prepare the corrected trial balance at February 28, 2015. Journal entries are not

required.

Account Title

February 28, 2015

Balance

TREASURE HUNT EXPLORATION COMPANY

Trial Balance

Chapter 2: Recording Business Transactions Page 63 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-35A

Requirements

1. Prepare the income statement for the month ended July 31, 2015.

2.

3. Prepare the balance sheet as of July 31, 2015.

4. Calculate the debt ratio as of July 31, 2015.

Solution:

Requirement 1

Prepare the statement of owners equity for the month ended July 31, 2015.

The beginning balance of capital was $0 and the owner contributed $23,150

during the month.

SHARON SILVER, REGISTERED DIETICIAN

Income Statement

Month Ended July 31, 2015

Chapter 2: Recording Business Transactions Page 64 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 2

Requirements 3

Requirements 4

Owner's Equity

SHARON SILVER, REGISTERED DIETICIAN

Balance Sheet

July 31, 2015

Assets Liabilities

SHARON SILVER, REGISTERED DIETICIAN

Statement of Owner's Equity

Month Ended July 31, 2015

Chapter 2: Recording Business Transactions Page 65 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-36B

Requirements

1. Journalize each transaction. Explanations are not required.

2.

3. Prepare the trial balance of Vince Rockford, M.D. as of March 31, 2015.

Solution:

Requirement 1

Debit Credit

Post the journal entries to the T-accounts, using transaction dates as posting

references

Posting

Ref. Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 66 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 2

Cash Accounts Payable

Accounts Receivable Advertising Payable

Office Supplies

Rockford, Capital Notes Payable

Land Rockford, Withdrawals

Unearned Revenue

Chapter 2: Recording Business Transactions Page 67 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Advertising Expense

Utilities Expense

Salaries Expense Rent Expense

Service Revenue

Chapter 2: Recording Business Transactions Page 68 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 3

Debit Credit

Balance

VINCE ROCKFORD, MD

Trial Balance

March 31, 2015

Account Title

Chapter 2: Recording Business Transactions Page 69 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-37B

Requirements

1. Record each transaction in the journal using the following account titles: Cash;

Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Land;

Accounts Payable; Utilities Payable; Unearned Revenue; Nelson, Capital;

Nelson, Withdrawals; Service Revenue; Salaries Expense; Rent Expense; Utilities

Expense. Explanations are not required.

2.

3.

4. Prepare the trial balance of Beth Nelson, Designer, as of November 30, 2015.

Solution:

Requirement 1

Open a T-account for each of the accounts.

Post the journal entries to the T-accounts, using transaction dates as posting

references in the ledger accounts. Label the balance of each account Bal.

Debit Credit

Posting

Ref. Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 70 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Posting

Ref. Debit Credit Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 71 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

Prepaid Insurance Nelson, Withdrawals

Cash Accounts Payable

Accounts Receivable Unearned Revenue

Utilities Payable

Office Supplies Nelson, Capital

Chapter 2: Recording Business Transactions Page 72 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Salaries Expense

Utilities Expense

Rent Expense

Furniture

Land Service Revenue

Chapter 2: Recording Business Transactions Page 73 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

November 30, 2015

Account Title Balance

Trial Balance

BETH NELSON, DESIGNER

Chapter 2: Recording Business Transactions Page 74 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-38B

Requirements

1. Record each transaction in the journal, using the following account titles: Cash;

Accounts Receivable; Office Supplies; Prepaid Insurance; Furniture; Building;

Land; Accounts Payable; Utilities Payable; Notes Payable; Perez, Capital; Perez,

Withdrawals; Service Revenue; Salaries Expense; Rent Expense; and Utilities

Expense. Explanations are not required.

2. Open the following four-column accounts including account numbers:

Cash, 101; Accounts Receivable, 111; Office Supplies, 121; Prepaid

Insurance, 131; Furniture, 141; Building, 151; Land, 161; Accounts

Payable, 201; Utilities Payable, 211; Notes Payable, 221; Perez, Capital, 301;

Perez, Withdrawals, 311; Service Revenue, 411; Salaries Expense, 511;

Rent Expense, 521; and Utilities Expense, 531.

3.

4. Prepare the trial balance of Vince Perez, Attorney, at April 30, 2015.

Solution:

Requirement 1 and 3

Post the journal entries to four-column accounts in the ledger using dates,

account numbers, journal references, and posting references. Assume the journal

entries were recorded on page 1 of the journal.

Debit Credit

Posting

Ref. Date Accounts and Explanation

Chapter 2: Recording Business Transactions Page 75 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Accounts and Explanation

Posting

Ref. Debit Credit Date

Chapter 2: Recording Business Transactions Page 76 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

CASH Account No. 101

Debit Credit

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

PREPAID INSURANCE

Debit Credit

FURNITURE

Debit Credit

Debit

Balance

Date Item Credit Debit

Post.

Ref.

Post.

Ref. Date Item Debit Credit

Balance

Post.

Ref. Credit

Balance

Account No. 141

Item Credit

Balance

Debit

Post.

Ref.

Account No. 121

Date

Post.

Ref. Date Item

Account No. 111

Date Item

Balance

Account No. 131

Debit Credit

Chapter 2: Recording Business Transactions Page 77 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

BUILDING

Debit Credit

LAND

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

UTILITIES PAYABLE

Debit Credit

NOTES PAYABLE

Debit Credit

PEREZ, CAPITAL

Debit Credit

PEREZ, WITHDRAWALS

Debit Credit

Account No. 311

Post.

Ref. Debit Credit

Balance

Date Item

Balance

Date Item

Account No. 301

Post.

Ref. Debit Credit

Post.

Ref. Debit

Account No. 221

Post.

Ref. Debit Credit

Balance

Date Item

Date Item

Account No. 201

Post.

Ref. Debit Credit

Date Item

Balance

Account No. 211

Credit

Balance

Balance

Debit Credit Date

Account No. 151

Account No. 161

Item

Credit

Balance

Date Item

Post.

Ref. Debit

Post.

Ref.

Chapter 2: Recording Business Transactions Page 78 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

SERVICE REVENUE

Debit Credit

SALARIES EXPENSE

Debit Credit

RENT EXPENSE

Debit Credit

UTILITIES EXPENSE

Debit Credit Date

Item

Account No. 531

Balance

Date Item

Item

Post.

Ref. Debit Credit

Balance

Balance

Date

Credit

Account No. 521

Debit Credit

Post.

Ref.

Account No. 511

Post.

Ref. Debit Credit

Post.

Ref. Debit

Balance

Date Item

Account No. 411

Chapter 2: Recording Business Transactions Page 79 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

April 30, 2015

Account Title Balance

Trial Balance

VINCE PEREZ, ATTORNEY

Chapter 2: Recording Business Transactions Page 80 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-39B

Requirements

1. Record the April transactions in the journal.

2.

3.

4. Prepare the trial balance of John Hilton, CPA, at April 30, 2015.

Solution:

Requirement 1

Posting

Ref. Date Accounts and Explanation

Post the journal entries to four-column accounts in the ledger, using dates, account

numbers, journal references, and posting references. Assume the journal

entries were recorded on page 5 of the journal.

Debit Credit

Open the four-column ledger accounts listed in the trial balance, together with

their balances as of March 31.

Chapter 2: Recording Business Transactions Page 81 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Credit Date Accounts and Explanation

Posting

Ref. Debit

Chapter 2: Recording Business Transactions Page 82 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

CASH Account No. 11

Debit Credit

ACCOUNTS RECEIVABLE

Debit Credit

OFFICE SUPPLIES

Debit Credit

FURNITURE

Debit Credit

Account No. 12

Item Credit

Debit

Balance

Credit

Balance

Account No. 13

Post.

Ref.

Post.

Ref. Debit

Balance

Credit

Balance

Account No. 14

Date Item

Post.

Ref. Debit Item

Date

Date Item Credit Debit

Post.

Ref.

Date

Chapter 2: Recording Business Transactions Page 83 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

AUTOMOBILE

Debit Credit

LAND

Debit Credit

ACCOUNTS PAYABLE

Debit Credit

UNEARNED REVENUE

Debit Credit

HILTON, CAPITAL

Debit Credit

HILTON, WITHDRAWALS

Debit Credit

Credit

Post.

Ref. Item Debit Date

Date Item

Account No. 15

Account No. 16

Credit

Balance Post.

Ref. Debit

Balance

Credit

Balance

Credit

Balance

Date Item

Post.

Ref. Debit

Balance

Account No. 31

Account No. 21

Date

Post.

Ref. Debit Credit

Debit Credit

Balance

Item

Date Item

Account No. 22

Post.

Ref. Debit

Account No. 32

Post.

Ref. Date Item

Chapter 2: Recording Business Transactions Page 84 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

SERVICE REVENUE

Debit Credit

SALARIES EXPENSE

Debit Credit

RENT EXPENSE

Debit Credit

Account No. 41

Credit

Balance

Date Item

Post.

Ref. Debit

Account No. 51

Credit

Balance

Date Item

Post.

Ref. Debit

Item

Account No. 52

Post.

Ref. Debit Credit

Balance

Date

Chapter 2: Recording Business Transactions Page 85 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Debit Credit

JOHN HILTON, CPA

Trial Balance

April 30, 2015

Account Title Balance

Chapter 2: Recording Business Transactions Page 86 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-40B

Solution:

Debit Credit

Account Title Balance

Prepare the corrected trial balance as of May 31, 2015. Journal entries

are not required.

BUILDING BLOCKS CHILD CARE

Trial Balance

May 31, 2015

Chapter 2: Recording Business Transactions Page 87 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-41B

Solution:

Debit Credit

Account Name Balance

Prepare the corrected trial balance at July 31, 2015. Journal entries

are not required.

OCEAN DIVERS EXPLORATION COMPANY

Trial Balance

July 31, 2015

Chapter 2: Recording Business Transactions Page 88 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-42B

Requirements

1. Prepare the income statement for the month ended July 31, 2015.

2.

3. Prepare the balance sheet as of July 31, 2015.

4. Calculate the debt ratio as of July 31, 2015.

Solution:

Requirement 1

Prepare the statement of owners equity for the month ended July 31, 2015.

The beginning balance of capital was $0 and the owner contributed $21,700

during the month.

SHERMANA PETERS, REGISTERED DIETICIAN

Income Statement

Month Ended July 31, 2015

Chapter 2: Recording Business Transactions Page 89 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 2

Requirements 3

Requirements 4

SHERMANA PETERS, REGISTERED DIETICIAN

Statement of Owner's Equity

Month Ended July 31, 2015

Assets Liabilities

SHERMANA PETERS, REGISTERED DIETICIAN

Balance Sheet

July 31, 2015

Owner's Equity

Chapter 2: Recording Business Transactions Page 90 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-43

Requirements

1. Journalize the transactions.

2. Open a T-account for each of the accounts.

3.

4. Prepare a trial balance as of December 31, 2014.

5.

6.

7. Prepare the balance sheet as of December 31, 2014.

8. Calculate the debt ratio for Davis Consulting.

Post the journal entries to the T-accounts and calculate account balances.

Formal posting references are not required.

Prepare the income statement for Davis Consulting for the month ended

December 31, 2014.

Prepare the statement of owners equity for the month ended December 31,

2014.

Chapter 2: Recording Business Transactions Page 91 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Solution:

Requirement 1

Date Accounts and Explanation Debit Credit

Posting

Ref.

Chapter 2: Recording Business Transactions Page 92 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

Furniture

Davis, Withdrawals

Service Revenue

Equipment

Cash

Office Supplies

Accounts Payable

Unearned Revenue

Davis, Capital

Accounts Receivable

Chapter 2: Recording Business Transactions Page 93 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Account Title

Debit Credit

DAVIS CONSULTING

Trial Balance

December 31, 2014

Balance

Utilities Expense Rent Expense

Chapter 2: Recording Business Transactions Page 94 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 5

Requirement 6

Month Ended December 31, 2014

Income Statement

Statement of Owner's Equity

Month Ended December 31, 2014

DAVIS CONSULTING

DAVIS CONSULTING

Chapter 2: Recording Business Transactions Page 95 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 7

Requirement 8

Owner's Equity

Assets Liabilities

Month Ended December 31, 2014

Balance Sheet

DAVIS CONSULTING

Chapter 2: Recording Business Transactions Page 96 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

P2-44

Requirements

1. Journalize the transactions.

2. Open a T-account for each account.

3.

4. Prepare a trial balance as of November 30, 2015.

Solution:

Requirement 1

Post the journal entries to the T-accounts and calculate account balances.

Formal posting references are not required.

Posting

Ref. Date Accounts and Explanation Debit Credit

Chapter 2: Recording Business Transactions Page 97 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirements 2 and 3

Unearned Revenue Accounts Receivable

Accounts Payable Cash

Accounts and Explanation

Posting

Ref. Debit Credit Date

Chapter 2: Recording Business Transactions Page 98 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Salaries Expense Truck

Prepaid Rent

Service Revenue

Hudson, Withdrawals

Equipment

Prepaid Insurance

Hudson, Capital

Cleaning Supplies Notes Payable

Chapter 2: Recording Business Transactions Page 99 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Account Title

Debit Credit

Balance

SHINE KING CLEANING

Advertising Expense Utilities Expense

Trial Balance

November 30, 2015

Chapter 2: Recording Business Transactions Page 100 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Decision Case 2-1

Requirements

1. Open the following T-accounts: Cash; Accounts Receivable; Office Supplies;

Accounts Payable; McChesney, Capital; Service Revenue; Salaries Expense; Rent

Expense; and Advertising Expense.

2.

3. Prepare a trial balance at June 30, 2016.

4.

Solution:

Requirements 1 and 2

McChesney, Capital Accounts Receivable

Office Supplies Service Revenue

Post the transactions directly to the accounts without using a journal. Record

each transaction by letter. Calculate account balances.

Compute the amount of net income or net loss for this first month of operations.

Would you recommend that McChesney continue in business?

Cash Accounts Payable

Chapter 2: Recording Business Transactions Page 101 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 3

A-PLUS TRAVEL PLANNERS

June 30, 2016

Trial Balance

Salaries Expense Rent Expense

Advertising Expense

Chapter 2: Recording Business Transactions Page 102 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Requirement 4

Chapter 2: Recording Business Transactions Page 103 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Decision Case 2-2

Requirements

1.

2.

Solution:

Requirement 1

Requirement 2

Explain the advantages of double-entry bookkeeping instead of recording

transactions in terms of the accounting equation to a friend who is opening a used

When you deposit money in your bank account, the bank credits your account.

Is the bank misusing the word credit in this context? Why does the bank use the

term credit to refer to your deposit, instead of debit?

Chapter 2: Recording Business Transactions Page 104 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Ethical Issue 2-1

Solution:

What is the ethical issue in this situation, if any? State why you approve or

disapprove of Hensons management of Better Days Aheads funds.

Chapter 2: Recording Business Transactions Page 105 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Fraud Case 2-1

Requirements

1.

2. Who gained and who lost as a result of these actions?

Solution:

Requirement 1

Requirement 2

How did the change in the journal entries affect the net income of the

company at year-end?

Chapter 2: Recording Business Transactions Page 106 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Financial Statement Case 2-1

Requirement

1. Calculate the debt ratio for Starbucks Corporation as of October 2, 2011.

2.

Solution:

Requirement 1

Requirement 2

How did the debt ratio for Starbucks Corporation compare to the debt ratio for Green

Mountain Coffee Roasters, Inc.? Discuss.

Chapter 2: Recording Business Transactions Page 107 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Team Project 2-1

Requirements

1. Obtain a copy of the business chart of accounts.

2. Prepare the companys financial statements for the most recent month, quarter,

or year.

Solution:

Chapter 2: Recording Business Transactions Page 108 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Chapter 2: Recording Business Transactions Page 109 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Chapter 2: Recording Business Transactions Page 110 of 111

HORNGREN'S ACCOUNTING - Tenth Edition

Communication Activity 2-1

Solution:

In 35 words or fewer, explain the difference between a debit and a credit, and

explain what the normal balance of the six account types is.

Chapter 2: Recording Business Transactions Page 111 of 111

Das könnte Ihnen auch gefallen

- Fundamental Accounting Principles Volume Canadian 15th Edition by Larson Jensen Dieckmann ISBN Solution ManualDokument8 SeitenFundamental Accounting Principles Volume Canadian 15th Edition by Larson Jensen Dieckmann ISBN Solution Manualstephen100% (26)

- Accounting PrincipleDokument817 SeitenAccounting PrincipleMassawe Michael Baraka100% (9)

- FINANCIAL ACCOUNTING IFRS EDITION SLIDES ch02Dokument51 SeitenFINANCIAL ACCOUNTING IFRS EDITION SLIDES ch02salmanyz6100% (2)

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresVon EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNoch keine Bewertungen

- Application AccountingDokument39 SeitenApplication Accountingramatarak100% (4)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDokument109 SeitenHorngrens Accounting 12th Edition Nobles Solutions ManualAnnGregoryDDSytidk100% (16)

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyVon EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNoch keine Bewertungen

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNoch keine Bewertungen

- Funds Management (FI-FM) V1Dokument22 SeitenFunds Management (FI-FM) V1Tushar KohinkarNoch keine Bewertungen

- Test BankDokument26 SeitenTest BankMonica BuscatoNoch keine Bewertungen

- 203 Cat Generalbrochure Topnotch NEWDokument16 Seiten203 Cat Generalbrochure Topnotch NEWjhienellNoch keine Bewertungen

- Enhanced SK Pederasyon Orientation and Elections FDokument77 SeitenEnhanced SK Pederasyon Orientation and Elections FTonyReyes0% (1)

- Journalizing: Information Sheet 1.3-1Dokument29 SeitenJournalizing: Information Sheet 1.3-1Marilyn GNoch keine Bewertungen

- Module 7 Topic 1 Posting To The LedgerDokument7 SeitenModule 7 Topic 1 Posting To The LedgerMary GraceNoch keine Bewertungen

- ICARE - AFAR - PreWeek - Batch 4Dokument14 SeitenICARE - AFAR - PreWeek - Batch 4john paulNoch keine Bewertungen

- Nobles Horngrenacct11 Ch02 Working PaperDokument118 SeitenNobles Horngrenacct11 Ch02 Working PaperHengNoch keine Bewertungen

- AccountingDokument37 SeitenAccountingGeetanjali ChawlaNoch keine Bewertungen

- Chapter 2 The Recording ProcessDokument37 SeitenChapter 2 The Recording ProcesszayaanoNoch keine Bewertungen

- CH 2 Recording ProcessDokument36 SeitenCH 2 Recording Processapi-248607804Noch keine Bewertungen

- Lecture 4Dokument45 SeitenLecture 4Mohamed Salah El DinNoch keine Bewertungen

- Chapter 2Dokument36 SeitenChapter 2Nazifa AfrozeNoch keine Bewertungen

- Ch11 - Current Liabilities and Payroll AccountingDokument52 SeitenCh11 - Current Liabilities and Payroll AccountingPrincess Trisha Joy Uy100% (1)

- Chapter Two Part of The Accounting System: An Account Is ADokument48 SeitenChapter Two Part of The Accounting System: An Account Is Akidest mesfinNoch keine Bewertungen

- Chapter 2Dokument46 SeitenChapter 2FernandoMamahitNoch keine Bewertungen

- CH 2 Accounting 2Dokument45 SeitenCH 2 Accounting 2EmadNoch keine Bewertungen

- ch02 AccountingDokument46 Seitench02 AccountingAl Imran100% (1)

- CH.2 Part IDokument35 SeitenCH.2 Part IthomasNoch keine Bewertungen

- Chapter 7Dokument53 SeitenChapter 7api-358995037100% (1)

- INFORMATION SHEET 1 Entrep 4thDokument22 SeitenINFORMATION SHEET 1 Entrep 4thAndrea Mae CenizalNoch keine Bewertungen

- IllustrationDokument3 SeitenIllustrationFantayNoch keine Bewertungen

- Fa - Chapter - 2 The Recording ProcessDokument16 SeitenFa - Chapter - 2 The Recording ProcessfuriousTaherNoch keine Bewertungen

- ACCOUNTING IWeek 2Dr. E. Esra BİLGİÇChapter 2 Recording ProcessDokument46 SeitenACCOUNTING IWeek 2Dr. E. Esra BİLGİÇChapter 2 Recording ProcessSaad BianouniNoch keine Bewertungen

- Understanding Assets and LiabilitiesDokument17 SeitenUnderstanding Assets and LiabilitiesLaten CruxyNoch keine Bewertungen

- Test Bank For Accounting Principles Volume 1 7th Canadian EditionDokument37 SeitenTest Bank For Accounting Principles Volume 1 7th Canadian Editiondupuisheavenz100% (16)

- Accounting Chapter 2Dokument56 SeitenAccounting Chapter 2hnhNoch keine Bewertungen

- Abm 1 Midterm Marlowne Brialle T. GalaponDokument9 SeitenAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponNoch keine Bewertungen

- Accounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeDokument61 SeitenAccounting Information System: Uaa - Acct 201 Principles of Financial Accounting Dr. Fred BarbeeArchana KotturNoch keine Bewertungen

- They Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Dokument91 SeitenThey Use That Information To Make Important Decisions.: Chapter 1: Accouting and The Business Environment Page 1 of 91Joshe Dela Cruz100% (1)

- The Recording Process: Accounting Principles, Ninth EditionDokument43 SeitenThe Recording Process: Accounting Principles, Ninth EditionindahmuliasariNoch keine Bewertungen

- BSCM-CHAPTER-V-Analyzing-Recording-Business-Transactions-of-a-Service-BusinessDokument7 SeitenBSCM-CHAPTER-V-Analyzing-Recording-Business-Transactions-of-a-Service-BusinessJoe Lander CariagaNoch keine Bewertungen

- Entrepreneurship: Chart of Accounts/ JournalizingDokument8 SeitenEntrepreneurship: Chart of Accounts/ JournalizingSeigfred SeverinoNoch keine Bewertungen

- Accounting Principles Gmeet 2Dokument26 SeitenAccounting Principles Gmeet 2Nur ika PratiwiNoch keine Bewertungen

- ObjectivesDokument27 SeitenObjectivesHazel GumaponNoch keine Bewertungen

- Accounting 3Dokument3 SeitenAccounting 3Isabella CatincoNoch keine Bewertungen

- Accounting Final RufDokument9 SeitenAccounting Final RufSyed HoqueNoch keine Bewertungen

- Chapter 2 - Analyzing TransactionDokument100 SeitenChapter 2 - Analyzing TransactionAzriel100% (1)

- Recoding of Transactions Part I: Short Answer Type QuestionsDokument36 SeitenRecoding of Transactions Part I: Short Answer Type QuestionsMehul AgarwalNoch keine Bewertungen

- 2.recording ProcessDokument30 Seiten2.recording Processwpar815Noch keine Bewertungen

- The Accounting CycleDokument98 SeitenThe Accounting CycleEhsan Sarparah100% (2)

- Accounting Principles 13th Edition Weygandt Solutions Manual Full Chapter PDFDokument67 SeitenAccounting Principles 13th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (15)

- Chapter 1Dokument5 SeitenChapter 1palash khannaNoch keine Bewertungen

- OL Accounting P1Dokument181 SeitenOL Accounting P1Luqman KhanNoch keine Bewertungen

- Week 2Dokument44 SeitenWeek 2Rick SimmsNoch keine Bewertungen

- Analyzing Transactions & Recording Journal EntriesDokument41 SeitenAnalyzing Transactions & Recording Journal Entrieskhoo zitingNoch keine Bewertungen

- Chapter 4 Books of Accounts and Double Entry SystemDokument61 SeitenChapter 4 Books of Accounts and Double Entry SystemMonica BuscatoNoch keine Bewertungen

- ACCA F3 Course OverviewDokument58 SeitenACCA F3 Course OverviewHannan SalimNoch keine Bewertungen

- Ccounting Principles, 6eDokument75 SeitenCcounting Principles, 6eWilmarie Crespo ChevalierNoch keine Bewertungen

- Mba Faaunit - IIDokument15 SeitenMba Faaunit - IINaresh GuduruNoch keine Bewertungen

- Recording transactions efficientlyDokument22 SeitenRecording transactions efficientlyshashi sinhaNoch keine Bewertungen

- Chapter 3the Accounting CycleDokument10 SeitenChapter 3the Accounting CycleonakhogxamsheNoch keine Bewertungen

- Investing and Financing Decisions and The Accounting SystemDokument33 SeitenInvesting and Financing Decisions and The Accounting SystemrorysuxdixNoch keine Bewertungen

- Chart of Accounts and Financial StatementsDokument36 SeitenChart of Accounts and Financial StatementsAllen CarlNoch keine Bewertungen

- Trial Balance SummaryDokument14 SeitenTrial Balance SummarybharathdevareddyNoch keine Bewertungen

- Workbook Intro Acc 2 Even 2017 - 2018Dokument39 SeitenWorkbook Intro Acc 2 Even 2017 - 2018GressZidaneNoch keine Bewertungen

- Business Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationVon EverandBusiness Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationNoch keine Bewertungen

- Subverting 4.4Dokument2 SeitenSubverting 4.4Sally MillerNoch keine Bewertungen

- Education ReformDokument4 SeitenEducation ReformSally MillerNoch keine Bewertungen

- HelloDokument1 SeiteHelloSally MillerNoch keine Bewertungen

- Calendar To Help Students With AccountabilityDokument1 SeiteCalendar To Help Students With AccountabilitySally MillerNoch keine Bewertungen

- Love Enterprises Year-End Trial BalanceDokument8 SeitenLove Enterprises Year-End Trial BalanceSheen CaválidaNoch keine Bewertungen

- Practical Accounting 1 Conrado Valix Free Download PDFDokument3 SeitenPractical Accounting 1 Conrado Valix Free Download PDFAnalie Mendez0% (2)

- Pengaruh Kompetensi Dan Independensi TerDokument20 SeitenPengaruh Kompetensi Dan Independensi TersaridNoch keine Bewertungen

- BDO Unibank Vol2 2014Dokument184 SeitenBDO Unibank Vol2 2014Dark ShadowNoch keine Bewertungen

- The Accounting CycleDokument98 SeitenThe Accounting CycleEhsan Sarparah100% (2)

- MSO Chapter 8 & 9 ObjDokument22 SeitenMSO Chapter 8 & 9 ObjsantaNoch keine Bewertungen

- True/False: Chapter 13-Statement of Cash FlowsDokument10 SeitenTrue/False: Chapter 13-Statement of Cash FlowsmilahrztaNoch keine Bewertungen

- Future and Option TurnoverDokument4 SeitenFuture and Option TurnoverROHIT GUPTANoch keine Bewertungen

- Bharathiar University UG Exam Time Table April 2019 B.Com ITDokument26 SeitenBharathiar University UG Exam Time Table April 2019 B.Com ITപേരില്ലോക്കെ എന്തിരിക്കുന്നുNoch keine Bewertungen

- Chapter 2 Activity 2Dokument4 SeitenChapter 2 Activity 2youssefwessa1771Noch keine Bewertungen

- Financial HeadDokument217 SeitenFinancial HeadManmohan TripathiNoch keine Bewertungen

- Cash and Cash Equivalents Reconciliation ProblemsDokument50 SeitenCash and Cash Equivalents Reconciliation ProblemsAnne EstrellaNoch keine Bewertungen

- Resume BungaranDokument2 SeitenResume BungaranAdanbungaran PangribNoch keine Bewertungen

- FY 2008 SMGR Semen+Indonesia (Persero) TBKDokument89 SeitenFY 2008 SMGR Semen+Indonesia (Persero) TBKRiki Ariyadi 2002110906Noch keine Bewertungen

- SAP - FI - Basics ConceptsDokument37 SeitenSAP - FI - Basics Conceptsarjunasahu1986Noch keine Bewertungen

- Accounting For InventoriesDokument65 SeitenAccounting For InventoriesRalph Ernest HulguinNoch keine Bewertungen

- Radiance Group LTD 2010 Annual ReportDokument92 SeitenRadiance Group LTD 2010 Annual ReportWeR1 Consultants Pte LtdNoch keine Bewertungen

- S4HANA2022 Availability Dependencies en XXDokument76 SeitenS4HANA2022 Availability Dependencies en XXKiran JadhavNoch keine Bewertungen

- Corporate Governance Irregularities in Kenya's Financial MarketsDokument26 SeitenCorporate Governance Irregularities in Kenya's Financial MarketsJudy Wairimu100% (1)

- ACCA Ethic ModuleDokument2 SeitenACCA Ethic ModuleĐỗ Tuấn Hải100% (1)

- Intermediate Accounting Kieso 15th Edition Test BankDokument13 SeitenIntermediate Accounting Kieso 15th Edition Test BankWillis Sanchez100% (35)

- Sagar Cement - Financial STMT AnalysisDokument79 SeitenSagar Cement - Financial STMT AnalysisRamesh AnkathiNoch keine Bewertungen

- KanchanDokument84 SeitenKanchanJyoti KumariNoch keine Bewertungen

- Pengaruh Konsentrasi Kepemilikan Institusional Dan Leverage Terhadap Manajemen Laba, Nilai Pemegang Saham Serta Cost of Equity CapitalDokument45 SeitenPengaruh Konsentrasi Kepemilikan Institusional Dan Leverage Terhadap Manajemen Laba, Nilai Pemegang Saham Serta Cost of Equity CapitalJeffri LiandaNoch keine Bewertungen