Beruflich Dokumente

Kultur Dokumente

Platts SBB Steel Daily

Hochgeladen von

dxkarthikOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Platts SBB Steel Daily

Hochgeladen von

dxkarthikCopyright:

Verfügbare Formate

www.platts.

com

SBB STEEL MARKETS DAILY

COVERING THE RAW MATERIALS INPUTS TO STEELMAKING

Volume 7 / Issue 135 / July 16, 2013

[STEEL ]

www.twitter.com/PlattsSBBSteel

Today in raw materials

Iron ore market

Iron ore prices edge up as mills

restock, doubts emerge 3

Coking coal market

Australian miners make aggressive

coal offers into EU 4

Scrap market

Ukraines scrap price steady, seen

rising in Aug on exports 7

Exchanges

Volume and prices recede in

iron ore swaps market 7

Ferroalloys market

Manganese ore soft, buyers hold

back from purchasing 8

Other News

Glencore Xstrata to halt Queensland

magnetite output 8

Marketplace

11

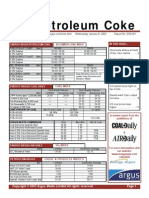

Platts raw material assessments, July 16

Close/Midpoint Change % Chg

IODEX Iron ore fines 62% Fe ($/dmt)

CFR North China 128.75-129.75 129.25 0.25 0.19

Please see Platts complete iron price/netbacks table, p.3

Coking coal, premium low vol ($/mt)

FOB Australia 129.50 129.50 0.50 0.39

CFR China 142.50 142.50 0.50 0.35

Please see full metallurgical coal price/freight table, p.4

Ferrous scrap ($/mt)

HMS FOB Rotterdam 334.00-338.00 336.00 0.00 0.00

A3, FOB Black Sea 332.00-338.00 335.00 0.00 0.00

HMS CFR Turkey 364.00-368.00 366.00 0.00 0.00

Ferrous scrap ($/lt)

Shredded del Midwest US 390.00-395.00 392.50 0.00 0.00

Shredded del dock East Coast 290.00-300.00 295.00 0.00 0.00

HMS del dock East Coast 280.00-290.00 285.00 0.00 0.00

TSI raw material indices, July 16

Frequency Change % Chg

Iron ore fines 62% Fe

Chinese imports (CFR North China port), $/dmt 129.00 Daily 2.10 1.65

Please see TSIs complete iron ore price table, p.2

Ferrous scrap

HMS 1&2 80:20, Turkish imports (CFR port), $/mt 364.00 Daily 0.00 0.00

Shredded, US domestic (del Midwest mill)*, $/lt 384.00 Weekly (Fri) 4.00 1.05

Shredded, Indian imports (CFR port)*, $/mt 372.00 Weekly (Fri) 4.00 1.09

* Latest index July 12

MelbourneRio Tinto could potentially

extract additional iron ore capacity from its

existing Western Australian mines rather than

developing more expensive greenfield pro-

jects, which would likely delay planned expan-

sion there to 360 million mt/year.

The Anglo-Australian miner said Tuesday work

was under way to expand port, rail and power

infrastructure in the Pilbara to handle 360 million

mt/year, but noted a number of options for mine

capacity growth were under evaluation.

Rios board has yet to sign off on the addi-

tional 70 million mt/year of capacity required to

reach 360 million mt/year and is expected to

make a decision by the end of this year. Some

of the miners large shareholders have been

putting pressure on Chief Executive Sam Walsh

to delay the expansion, given the weaker longer-

term outlook for iron ore and slowing Chinese

economy. Were keeping our options open, a

Rio spokesman said.

Rio Tinto could slow Pilbara expansion

The potential for a more phased expan-

sion had been flagged by some analysts,

including JP Morgan, who said in a July 10

research note that Rio will likely reach 360

million mt/year in 2019 rather than in 2015

as originally planned. This suggests the mar-

ket is overestimating Rios iron ore supply

over the next five years, JP Morgan said.

The delay would also support the views of

those analysts who believe the iron ore mar-

ket will stay stronger for longer, on the basis

that new supply will not come online in the

expected timeframe.

Rio said it remained on track to reach annu-

alized production capacity of 290 million mt/

year in Western Australia in the September

quarter, from around 237 million mt/year cur-

rently. This is despite heavy rain in the Pilbara

in June and a conveyor belt breakage in May

that resulted in one of the shiploaders at Cape

Iron ore market

Iron ore prices firm, views

mixed on uptrend duration

SingaporeSeaborne iron ore prices

continued to rise Tuesday on limited supply

of mainstream cargoes and stronger offers.

Demand for mainstream material remained

good and there was little on offer, leading sev-

eral participants to believe the uptick would

last for a few days as end-users were willing to

pay higher prices to restock. There are mills

who would pay high prices for mainstream ore

cargoes, as there is a very evident shortage of

mainstream material available both in the

seaborne and port stock markets, a source at

a state-owned Chinese trading house said.

Sentiment is quite positive and there looks to

be more room for improvement to both iron ore

and steel prices.

(continued on page 2) (continued on page 2)

SBB STEEL MARKETS DAILY JULY 16, 2013

2

Copyright 2013 McGraw Hill Financial

TSI DAILY IRON ORE PRICE INDICES

TSIs indices reflect average daily iron ore spot prices. Full price histories are available to TSI

subscribers on its website. Details of TSIs methodology and product specifications, together with

general information about TSI and its full range of steel indices and subscription services, can also be

found on its website: www.thesteelindex.com

To reach Platts

E-mail:support@platts.com

North America

Tel:800-PLATTS-8 (toll-free)

+1-212-904-3070 (direct)

Latin America

Tel:+54-11-4121-4810

Europe & Middle East

Tel:+44-20-7176-6111

Asia Pacific

Tel:+65-6530-6430

SBB Steel Markets Daily is published daily by Platts, a division of McGraw Hill

Financial. Registered office Two Penn Plaza, 25th Floor, New York, NY 10121-

2298

Officers of the Corporation: Harold McGraw III, Chairman, President and Chief

Executive Officer; Kenneth Vittor, Executive Vice President and General Counsel;

Jack F. Callahan Jr., Executive Vice President and Chief Financial Officer;

Elizabeth OMelia, Senior Vice President, Treasury Operations.

Prices, indexes, assessments and other price information published herein are

based on material collected from actual market participants. Platts makes no

warranties, express or implied, as to the accuracy, adequacy or completeness

of the data and other information set forth in this publication (data) or as to

the merchantability or fitness for a particular use of the data. Platts assumes no

liability in connection with any partys use of the data. Corporate policy prohibits

editorial personnel from holding any financial interest in companies they cover

and from disclosing information prior to the publication date of an issue.

Copyright 2013 by Platts, McGraw Hill Financial

Permission is granted for those registered with the Copyright Clearance Center

(CCC) to photocopy material herein for internal reference or personal use only,

provided that appropriate payment is made to the CCC, 222 Rosewood Drive,

Danvers, MA 01923, phone (978) 750-8400. Reproduction in any other form,

or for any other purpose, is forbidden without express permission of McGraw

Hill Financial. For article reprints contact: The YGS Group, phone +1-717-505-

9701 x105. Text-only archives available on Dialog File 624, Data Star, Factiva,

LexisNexis, and Westlaw. Platts is a trademark of McGraw Hill Financial.

London:

Managing Editor

Colin Richardson(+44 151 228

1081)

Senior Managing Editor, Markets

Annalisa Jeffries(+44 207 176

6204)

Team Leader,

raw materials

Hector Forster(+44 207 176

6285)

Markets Editors

Ciaran Roe(+44 207 176 6346);

David Braid(+44 207 176 7611);

Jitendra Gill

Pittsburgh:

Americas Managing Editor

Christopher Davis(+1 412 431

0398)

Markets Editors

Nicholas Tolomeo(+1 412 246

1577); Estelle Tran

Singapore:

Senior Managing Editor

Russ McCulloch(+65 6227 7811)

Managing Editor,

raw materials

Keith Tan(+65 6530 6557)

Team leader,

raw materials

Julien Hall(+65 6530 6538)

Asian markets editors

Melvin Yeo(+65 6530 6517);

Celestyn Wong(+65-6530-6442);

Helena Sheng; Edwin Yeo;

Hongmei Li; Anna Low; Anitha

Krishnan

Managing Editor

Paul Bartholomew, Australia(+61

410 400 156)

Associate Editorial Director,

Metals EMEA

Andy Blamey(+44 207 176 6189)

Editorial Director, Metals Pricing

and Market Engagement

Karen McBeth(+1 202 383 2110)

Editorial Director

Joe Innace(+1 212 904 3484)

Manager, Advertisement Sales

Kacey Comstock

Volume 7 / Issue 135 / July 16, 2013

Vice President, Editorial

Dan Tanz

Platts President

Larry Neal

ISSN:

Advertising

Tel: +1-720-548-5508

All rights reserved. No portion of this publication may be photocopied, repro-

duced, retransmitted, put into a computer system or otherwise redistributed

without prior authorization from Platts.

1935-7354

General Manager, Metals

Andrew Goodwin

SBB STEEL MARKETS DAILY

TSI daily iron ore indices, July 16

$/dmt Change % Chg Low* High*

62% Fe fines, 3.5% Al, CFR Tianjin port 129.00 2.10 1.65 86.70 158.90

58% Fe fines, 3.5% Al, CFR Tianjin port 118.90 1.00 0.85 79.30 146.60

62% Fe fines, 2% Al, CFR Qingdao port 130.10 2.10 1.64 88.50 160.00

63.5/63% Fe fines, 3.5% Al, CFR Qingdao port 131.50 2.10 1.62 88.90 161.70

* Past 12 months

Per 1% Fe differentials, $/dmt

$/dmt Change

Range: 61-64% Fe 2.25 0.00

Range: 56-59% Fe 3.00 0.00

FOB netback per route / basis TSI 62% Fe, 3.5% Al fines

Origin Vessel Type FOB ($/dmt) Change % Chg

W.Australia Capesize 121.24 2.12 1.78

India Supramax 114.90 2.10 1.86

Brazil Capesize 108.53 2.10 1.97

Rolling Averages, $/dmt

5-day Monthly Quarterly

62% Fe fines, 3.5% Al, CFR Tianjin port 126.36 123.23 123.23

58% Fe fines, 3.5% Al, CFR Tianjin port 116.82 114.29 114.29

62% Fe fines, 2% Al, CFR Qingdao port 127.46 124.30 124.30

63.5/63% Fe fines, 3.5% Al, CFR Qingdao port 128.86 125.71 125.71

One Singapore-based trader said

mills were maintaining high capacity utili-

zation given the recent improvement in

steel, thus needed to buy. Some of my

mill customers have been asking the

major miners to increase their term allo-

cations of iron ore for the month of

August because steel is doing very well,

the trader said. There are some mills

Rio Tinto could slow Pilbara

expansion

... from page 1

Lambert port being sidelined for almost

three weeks. Rio operates 14 iron ore mines

in Western Australia, some 12 of which can

contribute to the Pilbara Blend product.

Rio produced 66 million mt of iron ore

from its global operations in April-June, up

7% on the same period a year earlier and up

8% on the January-March quarter, but

shipped just 61.3 million mt due to the

Pilbara disruptions. Total production in

January-June was 127.2 million mt, up 6%

on the first half of 2012, with shipments of

118.6 million mt 4% higher than the same

period last year. Rio expects to produce 265

million mt of iron ore in calendar 2013.

Meanwhile, Rio produced 1.9 million

mt of hard coking coal in April-May, down

5% on the same period in 2012, but up

15% on the previous quarter. It produced

7.1 million mt of semi-soft and thermal

coal in the quarter, up 23% on last year

and up 17% on January-March.

Paul Bartholomew

Iron ore market

...from page 1

SBB STEEL MARKETS DAILY JULY 16, 2013

3

Copyright 2013 McGraw Hill Financial

PLATTS DAILY IRON ORE PRICE ASSESSMENTS

Platts daily iron ore assessments, July 16

$/dmt Midpoint Change % Chg

IODEX 62% Fe CFR North China 128.75-129.75 129.25 0.25 0.19

63.5/63% Fe CFR North China 130.00-131.00 130.50 0.25 0.19

65% Fe CFR North China 136.00-137.00 136.50 0.25 0.18

58% Fe* CFR North China 114.50-115.50 115.00 0.25 0.22

52% Fe CFR North China 88.00-89.00 88.50 0.25 0.28

*Al = 4.0% max

Per 1% Fe differential (Range 60-63.5% Fe), $/dmt

$/dmt Change

Range 60-63.5% Fe 2.20 0.00

Platts weekly iron ore lump premium spot assessment, July 10

$/dmtu Midpoint Change

Spot lump premium assessment 0.1350-0.1450 0.1400 NA

FOB netbacks per route / basis IODEX 62% Fe

Route Vessel Type Freight rate ($/wmt) Moisture (%) IODEX ($/dmt)

Australia Capesize 7.60 8.03 120.99

India West Panamax 12.00 8.11 116.19

India West Handymax 14.00 8.11 114.01

India East Handymax* 15.00 8.00 112.95

Brazil Capesize 20.50 9.00 106.72

South Africa Capesize 13.50 3.00 115.33

* Typical two-port co-loadings from Haldia and Paradip

Freight differentials to major import ports, $/wmt

From Qingdao on a Free Out basis

To North China: Caofeidian, Tianjin & Xingang 0.30

To East China: Beilun -0.30

To South China: Zhanjiang & Fangcheng -0.80

Rolling monthly average, $/dmt

IODEX 62% Fe 123.88

IODEX 62% Fe CFR North China OTC swaps assessment, July 16

switch

IODEX 62% $/dmt Change % Chg TSI 62

Aug 13 126.750 -0.500 -0.39 0.500

Sep 13 123.750 -0.500 -0.40 0.500

Oct 13 122.750 -0.750 -0.61 0.500

Q4 2013 121.500 0.000 0.00 0.500

Q1 2014 121.500 0.000 0.00 0.500

Q2 2014 116.500 0.000 0.00 0.500

Calendar 2014 115.500 0.500 0.43 0.500

Detailed methodology and specifications are found here: www.platts.com/IM.Platts.Content/

MethodologyReferences/MethodologySpecs/ironore.pdf

that are ramping up their crude steel pro-

duction levels because steel demand is

doing well, and mills have a need to buy

more iron ore for steelmaking.

A Hunan-based steelmaker said there

was a definite need for Chinese mills to

replenish iron ore and many were looking

for spot cargoes.

However, some believed mill inquiries

were beginning to slow given the quick

increase in ore prices, which they said had

outpaced steel. There needed to be more

balance between the steel and iron ore

markets, which could lead to a weakening

in the latter, they said.

Mixed market sentiment was evi-

dent in the rebar futures market with

the most active January rebar futures

contract in Shanghai trading Yuan 16

higher from Monday at Yuan 3,677/mt

($596/mt), while settling Yuan 5/mt

lower at Yuan 3,670/mt. The spot price

of square billet in Tangshan was down

Yuan 10/mt from Monday at Yuan

3,120/mt ex-stock, according to a

Shandong-based mill source.

Melvin Yeo

and Celestyn Wong

Iron ore prices edge up as

mills restock, doubts emerge

SingaporeSpot prices of seaborne

iron ore edged higher Tuesday as some

mills were still seeking material, but there

was growing skepticism over whether

steel fundamentals supported a continued

uptrend. Platts assessed the 62% Fe Iron

Ore Index up 25 cents at $129.25/dry mt

CFR North China.

Many sources noted resilience in buy-

ing appetite as Chinese mills were still

replenishing stocks after destocking in

late May/June when the market view on

steel prices was bearish. You do not

see the mills scrambling for cargoes

today, but spot supply is limited and you

are not able to buy a PB cargo with a

price tag of $128/dmt, said a

Shandong-based mill source.

However, some mills were heard to

be retreating from the spot market

because they were not confident cur-

rent steel prices were able to support

iron ore. There are at least three mills

who approached me for seaborne iron

ore yesterday, but not a single one

wanted to buy iron ore from me today,

said a Hebei trader source. The mills

told me that in comparison to steel,

ore prices are too expensive, and they

are not confident that the price of iron

ore will be supported.

Another Jiangsu-based mill source,

who also saw demand for iron ore

weakening, said a price correction was

inevitable as prices needed to come off

some dollars before mills would be

comfortable to buy. When the price of

iron ore is hovering near $130/dmt

level you need more than positive senti-

ment to motivate the mills to buy iron

ore, said a Singapore-based trader. It

doesnt help much when steel prices

are not moving up much these days

and that explained why buyers are put-

ting on hold their spot purchases.

SBB STEEL MARKETS DAILY JULY 16, 2013

4

Copyright 2013 McGraw Hill Financial

Platts daily metallurgical coal assessments, July 16

Asia-Pacific coking coal ($/mt)

FOB CFR CFR Change

Australia China India Australia China India

HCC Peak Downs Region 131.00 144.00 147.50 +0.50 +0.50 +0.50

Premium Low Vol 129.50 142.50 146.00 +0.50 +0.50 +0.50

HCC 64 Mid Vol 117.00 130.00 133.50 +2.00 +2.00 +2.00

Low Vol PCI 105.50 118.50 122.00 +0.50 +0.50 +0.50

Low Vol 12 Ash PCI 95.50 108.50 112.00 0.00 0.00 0.00

Semi Soft 88.50 101.50 105.00 0.00 0.00 0.00

Met Coke - - 250.00 - - -1.00

North China prompt port stock prices

Ex-stock Jingtang CFR Jingtang

(Yuan/mt, incl VAT) equivalent ($/mt)**

Premium Low Vol* 1070.00 143.52

HCC 64 Mid Vol* 965.00 128.96

*weekly (assessed July 12), 20-day delivery from date.

**ex-stock price, net of VAT and port charges.

Atlantic coking coal ($/mt)

FOB US

East Coast Change VM Ash S

Low Vol HCC 132.00 0.00 19% 8% 0.80%

High Vol A 127.00 0.00 32% 7% 0.85%

High Vol B 115.00 0.00 34% 8% 0.95%

Detailed methodology and specifications are found here:

http://platts.com/IM.Platts.Content/MethodologyReferences/MethodologySpecs/metcoalmethod.pdf

Dry bulk freight assessments

Route Vessel Class Freight rate ($/mt) Moisture (%)

Australia-China Panamax 13.00 9.50

Australia-India Panamax 16.50 9.50

USEC-China Panamax 35.00 8.00

USEC-India Panamax 34.00 8.00

USEC-Rotterdam Panamax 12.90 8.00

USEC-Brazil Panamax 15.00 8.00

East Australia: basis Hay Point port. USEC: basis Hampton Roads. See methodology for further details.

HCC assessed specifications

CSR VM Ash S P TM Fluidity

Premium Low Vol 71% 21.5% 9.3% 0.50% 0.045% 9.7% 500

HCC Peak Downs Region 74% 20.7% 10.5% 0.60% 0.030% 9.5% 400

HCC 64 Mid Vol 64% 25.5% 9.0% 0.60% 0.050% 9.5% 1,700

Penalties & Premia: Differentials ($/mt)

Within % of Premium Low Vol FOB Net value

Min-Max Australia assessment price ($/mt)

Per 1% CSR 60-71% 0.50% 0.65

Per 1% VM (air dried) 18-27% 0.50% 0.65

Per 1% TM (as received) 8-11% 1.00% 1.30

Per 1% Ash (air dried) 7-10.5% 1.25% 1.62

Per 0.1%S (air dried) 0.3-1% 1.00% 1.30

The assessed price of HCC Peak Downs originates with Platts and is based on price information

for a range of HCCs with a CSR> 67% normalized to the standard of HCC Peak Downs (CSR 74%).

Peak Downs is a registered trade mark of BM Alliance Coal Operations Pty Limited BMA. This price

assessment is not affiliated with or sponsored by BMA in any way.

Source: Platts

There were few spot bids and offers,

but most market participants said the

repeatable price of 61% Fe Australian

Pilbara fines was in the $128-128.50/dmt

CFR China range, up from $128/dmt CFR

China the day before.

Sources said a Newman 90,000 mt

cargo was sold on a 62% Fe basis on glob-

alOre, at $128.50/dmt for delivery in

August. There were no details on either the

buyer or seller of this cargo.

Elsewhere, Australian miner BHP

Billiton was heard to be inviting bids pri-

vately for 63.5% Fe Australian Newman

lump Tuesday, according to traders who

received the invitation to bid. The

90,000 mt shipment will load over July

26-August 4.

Two traders, one based in Shanghai

and the other in Hong Kong, said there

was healthy demand for lump cargoes

now as there was a shortage of domestic

pellet cargoes in the market. Weve

been seeing stronger demand for pellet

from mills in the past two weeks and

there isnt much supply available, so this

will drive up the buying appetite for lump

cargoes, the trader in Hong Kong said.

Lump and pellet cargoes are mutual sub-

stitutes, with the latter processed in a

plant from concentrate material.

Melvin Yeo

and Celestyn Wong

with Annalisa Jeffries in London

Coking coal market

Australian miners make

aggressive coal offers into EU

LondonEuropean mills are seeing

some offers closer to their expecta-

tions from Australian producers follow-

ing recent low-priced deals from the US

into Brazil.

One European mill source said he

was offered this week a low-volatile

blend from Australia at $130/mt for

material with 19-21% volatile matter

(VM), 100-120 fluidity, reflectance of

1.35, vitrinite at 72.5 and CSR at 58-60.

He described the offer as aggressive

and said costs are currently more impor-

tant than 3 or 4 CSR points, with mills

running at below full capacity.

He said the Australian offer was

lower than anything he has seen from

the US. He had seen one US offer of low-

vol coal in the low $130s/mt FOB US,

which with freight to Hamburg of around

$15-16 would result in around $150/mt

delivery into Europe.

The offer for Australian low-vol blend at

$130/mt was below the deals seen from

the US last week for straight run coals at

SBB STEEL MARKETS DAILY JULY 16, 2013

5

Copyright 2013 McGraw Hill Financial

Metallurgical Coke 62% CSR

$/mt Change % Chg

CFR India 250.00 -1.00 -0.40

FOB North China* 231.00 -5.00 -2.12

Yuan/mt

DDP North China* 1330.00 0.00 0.00

*weekly

SBB-SMD raw materials reference prices

$/mt Change % Chg

Coke and coal

Charcoal - Brazil domestic 222.81 0.00 0.00

Iron

SGX 62% Fe Iron Ore cash-settled swaps (dry mt) - front month 126.08 10.14 8.04

Iron ore concentrate 66% Fe wet - China domestic 145.01 4.07 2.89

Atlantic Basin iron ore pellets* FOB Basis (cents/dmtu) 200.61 -16.45 -8.20

Pig iron - FOB - Black sea export 382.50 2.50 0.65

Pig iron - FOB Ponta da Madeira - Brazil export 385.00 -2.50 -0.65

Pig iron - Hebei - China domestic 411.40 -8.15 -1.94

HBI - Venezuela export 275.00 -12.50 -4.55

*Reflects estimated monthly price term contract delivery

SBB-SMD ferrous scrap reference prices

Price Change % Chg

Scrap, Europe/Turkey ($/mt)

OA (plate & structural) - UK domestic, delivered 314.38 0.00 0.00

Shredded - delivered - N. Europe domestic, delivered 344.99 -4.90 -1.40

Shredded - delivered - S. Europe domestic, delivered 339.79 -6.44 -1.86

Scrap, Asia* ($/mt)

H2 - del Okayama - Tokyo Steel purchase price, at works gate 313.38 -10.11 -3.13

H2 - del Utsunomiya - Tokyo Steel purchase price, at works gate 323.49 -5.05 -1.54

Heavy - Shanghai - China domestic 379.18 0.00 0.00

HMS 1/2 80:20 CFR - East Asia import (WEEKLY) 365.00 0.00 0.00

Shindachi Bara - del Okayama -

Tokyo Steel purchase (list) price 333.60 -10.11 -2.94

Shindachi Bara - del Utsunomiya -

Tokyo Steel purchase (list) price 343.71 -5.05 -1.45

Shredded scrap A (auto) - del Okayama -

Tokyo Steel purchase (list) price 321.47 -10.11 -3.05

Shredded scrap A (auto) - del Utsunomiya -

Tokyo Steel purchase (list) price 331.57 -5.05 -1.50

Scrap, Americas ($/lt)

#1 Busheling - N. America domestic, del, Midwest US 415.00 0.00 0.00

HMS 1/2 - N. America domestic, del Midwest US 347.50 0.00 0.00

Plate & Structural - N. America domestic, del Midwest US 377.50 0.00 0.00

($/mt)

HMS 1/2 - Brazil S.E. domestic 210.53 0.00 0.00

*Monthly unless otherwise noted

$131/mt FOB USEC. However, the offer

from Australia is for a blended coal, indi-

cating that coking prices are relatively sta-

ble in the Atlantic.

Platts assessed US low-vol hard coking

coal flat at $132/mt FOB USEC Tuesday.

US high-vol A remained at $127/mt FOB

USEC and high-vol B also remained at

$115/mt FOB USEC.

However, suppliers were becoming

more competitive. One trader said he had

July deals all in place, with prices around

the levels of $132/mt FOB USEC for low-

vol and high-vol B at around $115/mt FOB

USEC. He also said he was talking with the

Australians and said they had a very good

grasp of the current market and that he

had seen competitive offers.

Canadian producers also understood

realities now, despite saying they are

close to costs, he said, adding I dont

think theyre making money, but if they are

covering costs they should be happy.

Elsewhere, a source at another

European mill said although prices were

quite low, it was not enough to bring them

back into the spot market. He had room

for maybe an extra 50,000-100,000 mt

but this was an option within his contract

deals. He believed the coking coal market

would remain flat this year and was unlike-

ly to fall further.

David Braid

Spot met coal rangebound

as traders take positions

SingaporeSpot coking coal prices

in Asia were assessed slightly higher

Tuesday, though the market was yet to see

any sustained upward movement after an

extended period of price stability.

Premium hard coking coals coals

(HCCs) gained 50 cents on the day, to

$142.50/mt CFR China and $129.50/mt

FOB Australia.

Higher offers were heard for prestig-

ious Australian brands with low-volatile

matter, typically in the $147-148/mt CFR

China range, up from $145-148/mt last

week. Perhaps in reaction to these higher

offers, price opinions from large Chinese

steelmakers were also observed to have

risen marginally.

Meanwhile, premium mid-vol HCCs

were seen tradeable at a wider-than-

usual discount to premium low-vols,

with firm offers heard around $139/mt

CFR China for August loadings. The

spread was reportedly causing Chinese

mills to shun higher-priced low-vol. Big

mills are refusing premium low-vol

because of the high price, a Beijing

trader said.

There was some market talk of a spot

deal done in the northeast Asian market

for premium mid-vol HCC last week. It was

understood to be a Panamax cargo and its

offer price reported earlier was around

$127/mt FOB Australia.

Meanwhile, second-tier HCC was

assessed $2/mt higher on the day, revers-

ing a $1.50/mt drop Monday. There was a

lack of consensus on this market seg-

ment, where recent volatility could be a

reflection of the wider tradeable range cur-

rently prevailing.

SBB STEEL MARKETS DAILY JULY 16, 2013

6

Copyright 2013 McGraw Hill Financial

6

Steel Mill Economics: Global Spreads, July 16, 2013

Change % change

China Flat Steel Spread (CFSS using IODEX)* 302.81 $/mt -1.77 -0.58

China Flat Steel Spread (CFSS using TSI)* 303.21 $/mt -4.73 -1.54

China Long Steel Spread (CLSS using IODEX) 279.31 $/mt -3.38 -1.20

China Long Steel Spread (CLSS using TSI) 279.71 $/mt -6.34 -2.22

China Hot Metal Spread (CHMS using IODEX)* 291.06 $/mt -2.58 -0.88

China Hot Metal Spread (CHMS using TSI)* 291.46 $/mt -5.54 -1.86

China Coking Margin (CCM)** 365.00 RMB/mt 0.00 0.00

China Billet-Rebar Spread (CBRS) 320.00 RMB/mt 0.00 0.00

Turkey Scrap-Rebar Spread (TSRS: Platts) 217.00 $/mt 1.00 0.46

Turkey Scrap-Rebar Spread (TSRS: TSI) 219.00 $/mt 1.00 0.46

Turkey Scrap-Black Sea Billet Spread (TSBS: Platts) 142.00 $/mt 0.00 0.00

Turkey Scrap-Black Sea Billet Spread (TSBS: TSI) 144.00 $/mt 0.00 0.00

US Scrap-HRC Spread (US SHRC) 294.58 $/st 0.00 0.00

US Scrap-HRC Futures Spread (US SHRCF) 284.58 $/st 0.00 0.00

US Scrap-Rebar Spread (US SRS) 279.58 $/st 0.00 0.00

*Weekly, assessed on Mondays. **Weekly, assessed on Fridays.

For spreads calculation and assessment methodology, please go to:

http://platts.com/IM.Platts.Content/MethodologyReferences/MethodologySpecs/steel.pdf

Several traders expressed interest

in purchasing typical Rangals with

60-63% coke strength after reaction

(CSR) at $115-116/mt FOB Australia,

or $125-130/mt CFR China, even for a

Panamax-size cargo, contradicting

claims from two sell-side sources

Monday they would happily sell at

$125-127/mt CFR.

Most sources described the market as

steady, and all agreed there was only very

little room for prices to drop further.

Meanwhile, three end-users from

north China expressed a cautious atti-

tude toward current prices, suggesting

any price rebound cannot last for long

and [has] little [leeway]. Highlighting a

pick-up in trader activity, out of 15

reported hard coking coal and PCI trans-

actions concluded last week, nine were

sold to traders.

With regards to domestic coking coal

prices, a Tangshan-based coke plant said

he thought Chinese miners had become

more determined in negotiations with

mills since steel prices had picked up.

On metallurgical coke, several mar-

ket participants were said to be prepar-

ing documents for a coke procurement

tender floated by a west Indian mill last

week. The tender called for 40,000 mt

of blast furnace coke with specifica-

tions of 62/60% CSR for August load-

News in Brief

The direct reduced iron (DRI) plant to be built by Austrian steel-

maker Voestalpine in the US will be the worlds largest when it is

completed in 2015. Plantmaker Siemens, which Voestalpine has contracted

to build the facility in Texas together with Midrex Technologies, confirmed

Tuesday the plant will be the largest single module of this type worldwide.

The plant has a design capacity of 2 million mt/year of hot briquetted iron

(HBI), which will be produced from iron ore pellets using natural gas as the

reducing agent. Voestalpine will use half the HBI for its own steelmaking opera-

tions and plans to sell the remainder.

Nikopol Ferroalloy Plant (NFP), Ukraines biggest ferroalloy smelter,

saw June output fall 0.3% month on month to 33,600 mt, producers

association UkrFa said Tuesday. NFP produced 32,700 mt of silicomanga-

nese and 900 mt of ferromanganese. Junes total output was down 45.1% year on

year, UkrFa said. NFP produced 250,300 mt of ferroalloys in the first half of the

year, down 20.7%. That was made up of 228,800 mt of silicomanganese, down

12.5%, and 21,500 mt of ferromanganese, down 60.4%. NFP, one of the worlds

biggest producers of ferromanganese and silicomanganese, is capable of produc-

ing about 1.2 million mt/year of ferroalloy. In 2012 NFP produced 657,800 mt of

ferroalloy, down 14.6%.

AIM-listed South Africa-focused miner and developer Ironveld has

upgraded the iron ore resource at its Lapon properties in South Africa,

it said in a statement. The company is developing a pig iron project on the

northern limb of the Bushveld minerals complex in Limpopo, South Africa, for

which these mines will provide the feedstock. According to the statement, the

company has doubled its tonnage in the Indicated category to 27.26 million mt at

a cut off (minimum grade) of 20% Fe. The ore in the Measured category is now at

1.58 million mt, also at 20% Fe cut-off. Also, the deposits main magnetite layer

has seen a grade increase from 46.7% to 48% Fe. The total mineral resource now

sits at 32 million mt at 20% Fe cut-off and there is sufficient recoverable iron

ore in situ to produce [its previously declared figure of] 1 million mt of pig iron/

year for 25 years, the company said. The company joined Londons Alternative

Investment Market (AIM) in July last year.

In the face of a declining metallurgical coal prices, US miner Alpha

Natural Resources announced layoffs at various mining operations in

West Virginia as well as the idling of its Pocahontas met coal mine. The

mine is operated by White Buck Coal Co. Generally speaking, met coal is in an over-

supply situation right now, a company spokesperson told Platts. And prices for the

mid-vol spec that Pocahontas produces, have dropped considerably.

TENDER NOTICE

Get more visibility for your Tender

Notice and reach a broad market of

global metals suppliers and end users.

Advertise your Tender Notice in

Platts Steel Markets Daily.

+44 20 7176 7638 | neil_roberts@platts.com

SBB STEEL MARKETS DAILY JULY 16, 2013

7

Copyright 2013 McGraw Hill Financial

Platts steel industry assessments, July 16

Close/Midpoint Change % Chg

Asia

Hot-rolled coil $/mt

FOB Shanghai* 505.00-515.00 510.00 7.50 1.49

Reinforcing bar $/mt

FOB China* 500.00-505.00 502.50 5.00 1.01

* Assessed July 11, 2013

Europe

Hot-rolled coil Eur/mt

Ex-works, Ruhr 415.00-420.00 417.50 0.00 0.00

CIF Antwerp 425.00-431.00 428.00 0.00 0.00

DDP NW Europe (Accessible to SBB Briefing subscribers at sbb.com)

$/mt

FOB Black Sea 505.00-515.00 510.00 0.00 0.00

Plate Eur/mt

Ex-works, Ruhr 495.00-505.00 500.00 0.00 0.00

CIF Antwerp 425.00-435.00 430.00 0.00 0.00

Reinforcing bar Eur/mt

Ex-works, NW Eur 450.00-455.00 452.50 0.50 0.11

$/mt

FOB basis Turkey 580.00-586.00 583.00 1.00 0.17

Billet $/mt

FOB Black Sea 508.00 508.00 0.00 0.00

North America

Hot-rolled coil $/st

Ex-works, Indiana 640.00-650.00 645.00 0.00 0.00

CIF, Houston 580.00-600.00 590.00 0.00 0.00

Plate $/st

Ex-works, US SE 680.00-700.00 690.00 0.00 0.00

CIF, Houston 640.00-660.00 650.00 0.00 0.00

Reinforcing bar $/st

Ex-works, US SE 620.00-640.00 630.00 0.00 0.00

CIF, Houston 535.00-540.00 537.50 0.00 0.00

Europe and US cold-rolled coil assessments, July 16

Eur/mt Close/Midpoint Change % Chg

Ex-works, Ruhr 515.00-520.00 517.50 0.00 0.00

CIF Antwerp 495.00-502.00 498.50 0.00 0.00

DDP NW Europe (Accessible to SBB Briefing subscribers at sbb.com)

$/mt

FOB Black Sea 580.00-590.00 585.00 0.00 0.00

$/st

Ex-works, Indiana 740.00-750.00 745.00 0.00 0.00

CIF, Houston 620.00-640.00 630.00 0.00 0.00

ing. There was also talk of a coke pro-

curement tender in Brazil for 40-100

mm sized coke with 66/64% CSR for

August laycan. The volume requested

was 50,000 mt.

Helena Sheng

with Julien Hall

and Edwin Yeo

Scrap market

Ukraines scrap price steady,

seen rising in Aug on exports

LondonDomestic scrap prices in

Ukraine remain unchanged Tuesday

from two weeks earlier, but several trad-

ers said the resumption of exports may

result in a Hryvnia 200-250/mt or 10%

price increase in August.

Scrap continued to sell for Hryvnia

2,050-2,150/mt ($251-263) ex-yard for

A3 grade (HMS I/II 80/20). At the same

time, port buyers were paying Hryvnia

2,200/mt for A3, merchants in eastern

Ukraine said.

As soon as exports resumed this

month, it affected scrap flow. It was direct-

ed overseas to the detriment of steelworks

in close proximity to ports particularly

Kryviy Rih, Ilyich and Zaporizhstal, a mer-

chant said.

Deliveries to Ukrainian mills fell from

nearly 110,000 mt/week in mid-June to

90,000 mt/week in mid-July, which cov-

ers only 80% of the mills combined

scrap needs.

Although mills have sufficient

stocks, roughly 270,000 mt in all, their

suppliers are running out of stock,

meaning shipments to mills can only

fall unless the mills raise bids, accord-

ing to Kiev-based industry analysts

UkrPromZovnishEkspertiza.

Katya Bouckley

Exchanges

Volume and prices recede

in iron ore swaps market

LiverpoolThe iron ore swaps mar-

ket was quieter again Tuesday as a

lack of activity in the physical market

and growing concern over the longev-

ity of recent increases saw prices

soften marginally throughout the curve.

The Singapore Exchange cleared just

444,000 mt of swaps.

Jul y traded at $126.50/dry mt

and $126.25/dmt, whi l e August

pri nted down from $126.50/dmt to

$126/dmt duri ng Asi an tradi ng.

September was done at $124.25/

dmt, $124/dmt and $123/dmt,

whi l e Q4 pri nted at $120/dmt. The

August- September ti mespread, whi ch

had been the focus of much l i qui di ty

over the past two days, traded at

$2.50/dmt, after tradi ng at $2.50-

3/dmt Monday.

Prices were down around 25 cents-

$1/dmt across the curve from the pre-

vious session. Brokers said liquidity

had thinned and one quipped that peo-

ple should sell the curve, given high

steel production relative to sales in

China. He said iron ore swaps have felt

overvalued compared to the physical

market for some time.

SBB STEEL MARKETS DAILY JULY 16, 2013

8

Copyright 2013 McGraw Hill Financial

The Steel Indexs 62% Fe CFR North

China reference price rose $2.10/dmt

to $129/dmt on the back of limited

supply of mainstream material. Platts

62% Fe Iron Ore Index, however, crept

up just 25 cents as some sources

doubted the longevity of increases

given lagging steel fundamentals.

European steel and scrap contracts

were quiet, but a US hot-rolled coil trade

was done for the 2014 calendar year at

$610/short ton, at 500 st/month, bro-

kers said.

Colin Richardson

Ferroalloys market

Manganese ore soft, buyers

hold back from purchasing

LondonManganese ore prices

moved down Tuesday, with sources

reporting weak buying activity and

softer offers from suppliers. Platts

assessed its 44% manganese ore price

at $5.51/dry mt unit, two cents lower

from the previous day.

A Chinese trader said Gabon ore

was being offered at $5.40/dmtu CIF

China and that market sentiment was

weak, but he thought manganese ore

prices were near the bottom and could

not fall further.

A trader selling into China said pric-

es had softened over the week and he

was hearing Gabon ore being offered

below $5.40/dmtu. He said sellers

reporting high offer levels in May and

June were not able to sell ore without

discounting. Chinese prices are all

coming down even though some people

are still talking high prices. They can-

not sell at these prices, the trader

said. The Chinese dont need ore and

they are not looking to buy very much.

A Chinese purchasing source said she

had also seen soft prices for manganese

ore. However, she was not yet in the mar-

ket to import.

Jitendra Gill

and Clement Kwok

Molybdenum oxide prices

stable, pressure remains: trade

LondonMolybdenum oxide prices

took a breather from the losses seen over

the past seven days and were unchanged

at $9.30-9.40/lb Tuesday.

Theres no change in prices, it seems

to be holding a little bit now, one produc-

er said. He said the market was nervous

as people were not expecting prices to fall

as quickly as they did from the $10/lb

mark seen six days ago.

A Europe-based trader said: Bids are

lower today at $9.20/lb but nobody wants

to buy anyway. They dont want to get their

finger burnt.

He said prices were under pressure

because of poor sentiment and declines

would not stop until consumers return to

the market. It cant stabilize because

there are no deals, he said.

A source reported a deal at $9.30/lb

CIF Busan. Sources agreed buying sig-

nals were not yet seen from China. We

may see resistance if Chinese decide to

come in and start to buy and this will

help stabilize prices, a European con-

sumer source said.

A second Europe-based trader said

the market was lacking activity. Anyone

who wants to put a bid on it now is going

to go lower.

Jitendra Gill

Other News

Glencore Xstrata to halt

Queensland magnetite output

MelbourneGlencore Xstrata will

stop producing magnetite concentrate

at its Ernest Henry Mining operation in

Platts proposes to assess Australia-China Capesize coal freight

Platts is seeking feedback on a proposal to enhance its suite of metallurgical coal

freight assessments by adding a new daily assessment for spot Capesize cargoes.

The assessment would reflect cargoes of 140,000 mt loading 7-45 days forward from

the day of assessment, between Hay Point, eastern Australia and Qingdao, north China.

The assessment would reflect well approved modern tonnage only, not exceeding

10 years of age. Platts invites feedback about this proposal by July 29, please con-

tact: julien.hall@platts.com, and copy cokingcoal@platts.com

Platts clarifies freight netback for metallurgical coal FOB Australia

Platts clarifies its procedures for calculating freight netbacks for metallurgical coal

assessments on an FOB Australia basis. When deals, bids/offers are observed to

be illiquid, inconsistent and non-repeatable, spot price bids/offers or trades in key

consumer markets basis CFR China, India, Europe, Japan or South Korea Taiwan may

be netted back to FOB Australia. Freight netbacks from China will be calculated using

assessed Panamax spot freight rates for dry bulk carriers on the day of assessment,

while from other regions, the prevailing vessel size on the given route will be used.

Platts clarifies standard specifications for Asia coal & coke assessments

Platts clarifies its standard specifications by adding new quality parameters for several Asian metallurgical coal and coke assess-

ments. Standard vitrinite percentage will be 71% for HCC Peak Downs Region (FOB Australia, CFR India and CFR China), 65% for

Premium Low Vol (FOB Australia, CFR India and CFR China), and 55% for HCC 64 Mid Vol (FOB Australia, CFR India and CFR China).

Total Moisture (as received) will be 10% for Low Vol PCI (FOB Australia, CFR India and CFR China), and 10% for Low Vol 12 Ash

PCI (FOB Australia, CFR India and CFR China).

Standard Hardgrove Grindability Index (or HGI) will be 80 for Low Vol 12 Ash PCI (FOB Australia, CFR India and CFR China).

Crucible Swelling Number (or CSN) will be 1 for Low Vol 12 Ash PCI (FOB Australia, CFR India and CFR China). Maximum fluidity will

be 200 dial divisions per minute (or ddpm) for Semi Soft (FOB Australia, CFR India and CFR China). Standard sulfur (air-dried basis)

will be 0.65% for Met Coke (CFR East India, DDP North China and FOB North China).

Platts clarifies loading ports considered for metallurgical coal FOB Australia

Platts clarifies the ports considered in its metallurgical coal FOB Australia assessments. These include Dalrymple Bay, Hay Point,

Gladstone and Abbot Point; and in New South Wales: Newcastle and Port Kembla. Freight rates for hard coking coal from any of

these ports are normalized to Hay Point port for assessment purposes. For PCI and Semi Soft assessments, freight rates from any

of these ports are normalized to Dalrymple Bay.

SBB STEEL MARKETS DAILY JULY 16, 2013

9

Copyright 2013 McGraw Hill Financial

Queensland, Australia, from mid-August

due to weaker iron ore prices and high

logistics costs making exports uneconom-

ic, the company said late Monday.

The Switzerland-based commodity group

said a 30% drop in iron ore prices over the

past two years and higher costs for produc-

tion and transportation have eroded margins,

prompting the decision to suspend magnet-

ite output. The magnetite has to be trans-

ported some 780 km by rail from Ernest

Henry mine, east of Mount Isa, to a port

facility at Townsville for export to China.

Parts of the magnetite circuit at Ernest

Henry will be placed on care and mainte-

nance, with the regrinding circuit reconfig-

ured to produce copper concentrate.

Exports of magnetite concentrate start-

ed from Ernest Henry in 2011 and produc-

tion capacity had been ramping up towards

an ultimate target of 1.2 million mt/year of

magnetite concentrate. An Ernest Henry

Mining spokeswoman said the mine pro-

duced about 500,000 mt of magnetite

concentrate in 2012. Our magnetite con-

centrate went predominantly to the

Chinese market, with a very small amount

for domestic use, she told Platts.

The mine had been earmarked for clo-

sure in 2012. But in late 2009, the com-

pany decided to invest US$542 million to

extend the life of the mine until 2024. This

followed a feasibility study into construct-

ing a magnetite processing facility and

building full-scale underground mining oper-

ations at Ernest Henry.

Last month, Glencore-Xstrata said it

would cut 450 jobs from its Newlands and

Oaky Creek coal mines in Queensland, cit-

ing weaker coal prices and the high

Australian dollar.

Paul Bartholomew

S&P downgrades NWR on

lower coal prices

LondonCentral European coal and coke

producer New World Resources (NWR) has

been given a lower credit rating by Standard &

Poors on the back of the negative coal price

outlook for 2013-2014 and uncertainty related

to NWRs ability to limit negative cashflow, S&P

stated in a press release.

According to S&P like Platts, part of

McGraw Hill Financial the business risk

represented by the Amsterdam-based NWR

has slipped from weak to vulnerable

(from B to B-) reflecting its high cost profile

and need to downscale its operations. At

the same time NWRs liquidity was termed

less than adequate from adequate.

The downgrade is also based on the newly

adjusted coal price assumptions by S&P for

2013-2014, to $140-150/mt from previous

level of $150-160/mt. This results in NWR

generating more negative free cash flow in the

second half of 2013 and 2014 than we previ-

ously assumed, S&P explained.

The agency also made clear that further

downgrading is possible in the coming quar-

ters if coal prices keep softening, and NWR

fails to fully meet its cost-cutting targets and

sell its 800,000 mt/year coke facility OKK

Koksovny in the Ostrava region of the Czech

Republic. The miner was in talks with poten-

tial buyers, it said earlier this month.

NWR was also planning to divest its

Czech Paskov mine but recently said the

sale was unlikely to materialize and other

scenarios were under evaluation including

a potential temporary or permanent shut-

down of the mine.

Wojtek Laskowski

Equatorial to apply for Congo

mining license immediately

MelbourneAustralias Equatorial

Resources has completed the scoping

study for its Mayoko-Moussondji iron ore

Steel headlines

Chinese HRC export prices rise, Korean buyers hold off

Korean buyers of Chinese hot-rolled coil are holding back on bookings amid a

surge in Chinese export prices and persisting weak demand in Korea. Recent export

offer prices from major Chinese mills to Korean buyers were at $540-545/mt CFR for

SS400B 3mm thick HRC, up $20/mt or more compared with prices late last month,

Platts was told Monday.

For more steel news, please visit: www.sbb.com

Marcegaglia raises sheet, plate prices by around Eur30/mt

Keystone raises wire rod prices $15/st for August shipments

Shanghai HDG market sees modest price increase

Turkish flats prices firm with improving market sentiment

Legal battle over UK hot strip mill to be settled in 2014

HRC level at $640-650/st

CRC stays at $740-750/st

Severstal, USS dissolve Double Eagle galvanizing JV

US sheet pricing steady, import concerns linger

Southern European HR coil price up; US price rise continues - TSI

Indias Sail dispatches first switch rail consignment

Taiwan rebar makers lift prices on better demand, scrap rise

Northern Chinas rebar price still rising on better sentiment

Vietnams sales of longs for first-half 2013 rise by 1.5%

Rebar mini-mill in southwest Russia may start up by August

New Russian bar mill aims to start rolling before year-end

Nucor: Long product prices unchanged until further notice

Fullacero sole distributor of Deacero rebar in Chile

Ezz Steel raises rebar exports to fund raw materials imports

Chinese company to complete new Iranian steelworks

Jordanian re-roller seeks investor to help in restructuring

Low demand, over-capacity depress OCTG sales for Tianda

Seamless pipe prices stable in eastern China

US to conduct full sunset reviews of rectangular P&T

Saudi pipemaker secures $67 million OCTG supply contract

Chinese stainless export prices show signs of stabilizing

Turkish stainless coil import prices steady in July

Carpenter gets new leader for distribution businesses

Chinas GDP growth betters target, achieving 7.6% for H1

Special Report: Chinas auto output dips again in June

Chinas crude steel output dips in June, up 4.6% on year

Klckner not expected to break even this year

Tata Steel made operating loss of GPB354 million in EU in 2012/13

Mexicos industrial output flat in May

US steel industry capability utilization at 78%: AISI

Special Report: Colombia steelworkers to fight outsourcing

Brazils crude steel production falls 6% on month in June

Egypts Misr Ataqa approves debt payments for Suez DRI plant

Egypt mills operating despite social unrest, but market slow

Saudi state spending reduction to hit infrastructure growth

Qatars $200 billion construction boom to kick off in 2014

SBB STEEL MARKETS DAILY JULY 16, 2013

10

Copyright 2013 McGraw Hill Financial

Australia lump premium contract price settlements with China mills

$/dmtu

Q2 2013 0.1350-0.1450

Lump premiums vary from company to company, depending on when agreements are reached, brands,

volumes, and whether they are negotiated as a package with other products like fines. Platts has been

reporting on the settlements in the form of news articles, and is publishing them more regularly for

easier access by subscribers. The published lump premium represents what Platts understands most

Chinese mills have agreed to. Premiums that are settled under known, special circumstances, would be

reported about in news articles, but would be excluded from the published premium. For further details,

see http://www.platts.com/MethodologyAndSpecifications/Metals.

Platts steel assessments currency and unit comparisons, July 16

Prior assessment

Eur/mt $/mt $/st $/CWT $/mt $ change % change

Hot-rolled coil

Ex-works, Ruhr* 417.50*** 548.80 497.87 24.90 544.38 4.42 0.81%

FOB Black Sea* 387.98 510.00*** 462.67 23.14 510.00 0.00 0.00%

CIF Antwerp* 428.00*** 562.61 510.40 25.53 558.07 4.54 0.81%

Ex-works, Indiana** 540.27 710.98 645.00*** 32.25 710.98 0.00 0.00%

CIF, US Gulf states, basis Houston** 494.20 650.35 590.00*** 29.50 650.35 0.00 0.00%

Cold-rolled coil

Ex-works, Ruhr* 517.50*** 680.25 617.13 30.86 674.77 5.48 0.81%

FOB Black Sea* 445.04 585.00*** 530.71 26.54 585.00 0.00 0.00%

CIF Antwerp* 498.50*** 655.28 594.47 29.73 649.99 5.29 0.81%

Ex-works, Indiana** 624.04 821.21 745.00*** 37.25 821.21 0.00 0.00%

CIF, US Gulf states, basis Houston** 527.71 694.44 630.00*** 31.50 694.44 0.00 0.00%

Plate

Ex-works, Ruhr* 500.00*** 657.25 596.26 29.82 651.95 5.30 0.81%

CIF Antwerp* 430.00*** 565.24 512.78 25.65 560.68 4.56 0.81%

Ex-works, US Southeast** 577.97 760.58 690.00*** 34.50 760.58 0.00 0.00%

CIF, US Gulf states, basis Houston** 544.46 716.49 650.00*** 32.50 716.49 0.00 0.00%

Reinforcing bar

Ex-works, Northwest Europe* 452.50*** 594.81 539.61 26.99 589.36 5.45 0.92%

East Mediterranean, basis Turkey* 443.51 583.00*** 528.90 26.45 582.00 1.00 0.17%

Ex-works, US Southeast** 527.71 694.44 630.00*** 31.50 694.44 0.00 0.00%

CIF, US Gulf states, basis Houston** 450.23 592.48 537.50*** 26.88 592.48 0.00 0.00%

*LN 16:30 Eur/$ ex rate = 1.3145; **NY 16:30 $/Eur ex rate = 0.7599. ***the primary assessments and have not been converted

project in the Republic of Congo and plans

to apply for a mining license immediate-

ly, the company said Tuesday.

The scoping study has identified an

immediate pathway to a 2 million mt/

year hematite mining operation producing

a premium product transported by the

existing railway and port facilities,

Equatorials Managing Director John

Wellborn said in a statement.

The Perth-based company plans to pro-

duce a Mayoko premium fines iron ore of

grading 64.1% Fe from the project at a rate

of 500,000 mt/year during stage 1, ramping

up to 2 million mt/year within 18 months.

Initial capex required for first produc-

tion has been estimated at $114 million

with total capital costs to achieve the 2

million mt/year rate estimated at $231

million. Operating cash costs for the mine

are expected to average $41/mt FOB

Pointe-Noire over the life of the mine,

which is expected to be 23 years.

Equatorial plans to reduce some of the

costs for Mayoko-Moussondji through part-

nership opportunities in rail and port infra-

structure with Exxaro Resources, whose

project Mayoko-Lekoumo is adjacent

to Equatorials.

Equatorial said Tuesday it expects ini-

tial production from its mine to start 15

months from when investment decisions

have been satisfied.

Marnie Hobson

Asia

Posco scraps Karnataka plan,

some point to ore supply

SingaporeSouth Koreas Posco has

abandoned plans to build a 6 million mt/

year integrated steelworks in the south

Indian state of Karnataka and agreed with

the state government to stop work on the

project, it said Tuesday.

In a disclosure to the Korea Stock

Exchange, Posco cited delays in gaining

approvals to mine along with persisting

problems with land acquisitions. It had

signed a Memorandum of Understanding

with Karnataka in June 2010.

There was not much expectation of

success in this project [from the planning

stage], a source from Posco told Platts.

For its own political purposes, the state

government had initially intended to lure

several steelmakers, he added. Political

uncertainty in the state was also a major

reason behind the companys decision,

he added.

Meanwhile, Posco has been struggling

with a much delayed 8 million mt/year pro-

ject in eastern Indias Odisha, he noted,

adding that there has been some progress

with that project though at a slow pace.

Poscos decision is hardly surprising,

a Mumbai-based analyst said. Even exist-

ing [steel] mills in Karnataka dont know

where they will source iron ore for the next

few years or even decades. It just doesnt

make sense to pump in more investments

there, he said.

Most other Indian steelmakers have

SBB STEEL MARKETS DAILY JULY 16, 2013

11

Copyright 2013 McGraw Hill Financial

Marketplace

Iron ore: 63.5% Fe Australian Newman lump BHP Billiton heard inviting bids pri-

vately for 90,000 mt, loading July 26-August 4, according to traders who received

the invitation to bid

Iron ore: freight Shanghai-based trader heard Capesize freight from W. Australia

to Qingdao fixed at $7.60/wmt

Iron ore: freight Shanghai-based trader indicated Capesize freight from W.

Australia to Beilun at $7.30/wmt

Iron ore: freight Shanghai-based trader heard Capesize freight from Brazil to

Qingdao fixed at $20.40-20.50/wmt

Iron ore: freight Shanghai-based trader heard Capesize freight from S. Africa to

Qingdao fixed at $13.50/wmt

Iron ore: freight Shanghai-based trader heard Capesize freight differential from

Qingdao to Beilun at $0.30/wmt

Iron ore: spot lump premium Hong Kong-based trader estimated tradeable value

at IODEX +$0.16/dmtu

Met coal, freight: Hong Kong trader estimated Panamax DBCT to Jingtang at $12-13/mt

Met coal, HCC: Hong Kong trader would consider buying Jellinbah Lake Vermont at

$115-116/mt FOB Australia

Met coal, PCI: Hong Kong trader would consider buying Yancoal Yarrabee 12% ash

at $110/mt CFR China

(This is a sample of trade and market information gathered by Platts editors as they

assessed the daily , coking coal, steel, scrap and freight prices. They were first pub-

lished on Platts Metals Alert earlier in the day as part of the market-testing process with

market participants. For more related information about that process and our realtime

news and price services, please request a trial to Platts Metals Alert or learn more

about the product offering by visiting http //www.platts.com/Products/metalsalert)

also put their plans for setting up integrat-

ed steelworks in Karnataka on hold until

there is more clarity on the iron ore mining

scenario in the state. No investor in their

right mind will dream of setting up a steel

plant in India now unless they have captive

iron ore mines under their belt first, a

Mumbai-based mill official said.

Anitha Krishnan

and Hera Oh

Chinese mills conflicted on

scrap price development

SingaporeMajor mills from eastern

China expressed caution in changing

their scrap purchasing prices at a regu-

lar gathering of important consumers

in northern Chinas Tianjin on Friday,

July 12. Heavy scrap over 6mm was

assessed by Platts at Yuan 2,320/mt

($377/mt) delivered including VAT on a

delivered basis on Friday, stable week

on week as market participants held con-

flicting views on the market.

The meeting of 8-10 steelmakers plus

other participants was hosted by Tianjin

Pipe Group Corporation, Chinas third larg-

est consumer of ferrous scrap. The next

meeting is due to be held at Zenith Steel

in Jiangsu in early August.

Baosteel said some mills at the

event believed prices should go up in

July following prices of finished steel.

Platts assessed 18-25mm HRB400

rebar in Shanghai at Yuan 3,415/mt

Friday, up from Yuan 3,210/mt on July

1, an increase of Yuan 205/mt during

two weeks.

However, Baosteel was not sure the

increase was sustainable in July and

August and other mills also argued that

the price increase was temporary. It there-

fore did not want to increase its scrap buy-

ing prices, especially since it had ample

and relatively cheap hot metal supply.

Baosteel believed scrap prices would be

stable in July.

As to the long-term, Baosteel believed

the price trend would likely depend on gov-

ernment policies in areas such as urbani-

zation or high-speed rail projects. But stim-

ulus on the scale seen in 2009, when

Yuan 4 trillion was injected into the econo-

my, was very unlikely, it affirmed.

Shagang was also uncertain about

the price trend going forward. Meanwhile,

Nanjing Iron & Steel Corporation believed

scrap prices might be stable or drop

slightly. Blast furnaces are expensive to

stop and it is easier to keep producing

steel from hot metal and reduce scrap

use, it noted.

One independent Beijing analyst

believed scrap prices would increase fol-

lowing the uptick of iron ore and finished

steel prices, furthermore, smaller mills

have raised their scrap purchasing prices

because they could make profits and plan

to keep production high.

Bryan Gao

Analysis

Take-or-pay deals supporting

Australian coal output

LiverpoolOnly 4 million mt of

Australian coal production will close this

year, despite 32 million mt currently being

produced at negative margins, Wood

Mackenzie said in a release Tuesday.

The decision to continue production

instead of shutting it down can mainly be

attributed to transport and port contracts

in Australia, otherwise known as take-or-

pay contracts, WoodMac said. Take-or-

pay means miners pay for capacity regard-

less of the tons they ship.

WoodMac said just over 1% of

Australias coal exports in 2013 (4 million

mt) is at risk of closure based on hard cok-

ing coal prices of $171/mt and thermal

coal prices of $92/mt. This is not a sig-

nificant volume of output; however the

amount at risk increases significantly

under a lower price scenario, the compa-

ny said. Platts assessed premium hard

coking coal at $142.50/mt CFR China

Tuesday, or $129.50/mt FOB Australia.

If average HCC prices fall to $122/mt,

however, WoodMac said 13% of Australias

coal exports in 2013 (45 million mt) will be

at risk of closure. At that price 204 million

mt of production will be suffering negative

margins, the company said.

There have only been two mine clo-

sures so far in 2013 compared to seven

in 2012, said Viktor Tanevski, coal cost

analyst at Wood Mackenzie. Despite the

low coal price environment and current

margin squeeze, take-or-pay contracts

are incentivising coal producers to

increase rather than reduce production,

even if additional production is generat-

ing negative cash margins.

The impact of weak met coal prices on

margins, at a time of high costs, has

forced some companies in Australia to

mothball mines or consider asset sales.

Earlier this year Anglo American said it

would place its Aquila mine in the Bowen

Basin on care and maintenance from July

30. It has also been suggested that Rio

Tinto would sell 29% of its 80% stake in

Coal & Allied, as well as stakes in two

thermal coal mines.

Last month Sydney-based CLSA ana-

lyst Dylan Kelly told Platts Australian min-

ers were struggling to reduce costs on

an operational basis and were seeing

record cost levels. Around half of all

open-cut mines in Australia are believed

to be selling coal below their production

costs, he said.

Colin Richardson

Das könnte Ihnen auch gefallen

- Iron Ore PrimerDokument301 SeitenIron Ore Primeruser121821100% (1)

- Fco (Full Corporate Offer) For Type B Thermal Coal Fob ModalityDokument3 SeitenFco (Full Corporate Offer) For Type B Thermal Coal Fob ModalityJuliana Iru100% (1)

- Ict 20230727Dokument20 SeitenIct 20230727arsya chairunnisaNoch keine Bewertungen

- Wirtgen Surface MinerDokument29 SeitenWirtgen Surface MinerRodrigo Sabino100% (1)

- Rao Minerals PDFDokument348 SeitenRao Minerals PDFOppie ChelyNoch keine Bewertungen

- Sample 27001 QRODokument1 SeiteSample 27001 QROYogesh PrajapatiNoch keine Bewertungen

- FonikaDokument9 SeitenFonikashirleysimone53Noch keine Bewertungen

- 450F HsdviDokument2 Seiten450F HsdviJoJo kNoch keine Bewertungen

- Procedure Standard and Refainery PDFDokument31 SeitenProcedure Standard and Refainery PDFFELICIALOHNoch keine Bewertungen

- Platts 2020 Outlook Report PDFDokument21 SeitenPlatts 2020 Outlook Report PDFKamal ShayedNoch keine Bewertungen

- British Petroleum Terms and ConditionDokument4 SeitenBritish Petroleum Terms and Conditionkarthikeyan mpNoch keine Bewertungen

- Itp Iof 62 Ex-MinesDokument2 SeitenItp Iof 62 Ex-MinesPSNYCNoch keine Bewertungen

- Project Report On Vizag Steel Plant Distribution ChannelDokument94 SeitenProject Report On Vizag Steel Plant Distribution ChannelOm Prakash78% (9)

- Iron Ore: Demand EstimationDokument12 SeitenIron Ore: Demand Estimationmaverick1911Noch keine Bewertungen

- 0325 Jet Fuel Aand A1Dokument10 Seiten0325 Jet Fuel Aand A1VidyasenNoch keine Bewertungen

- Views - Could Greenflation Stall The Electric Vehicle RevolutionDokument5 SeitenViews - Could Greenflation Stall The Electric Vehicle RevolutionQuyet Doan TienNoch keine Bewertungen

- Distribution Networks in Vizag Steel PlantDokument61 SeitenDistribution Networks in Vizag Steel Plantnaveen kumarNoch keine Bewertungen

- LOI For Iron OreDokument1 SeiteLOI For Iron Ore최호준Noch keine Bewertungen

- Production Sharing Contracts Regulatory FrameworkDokument5 SeitenProduction Sharing Contracts Regulatory FrameworkHarshit KhareNoch keine Bewertungen

- Sco Full PDFDokument1 SeiteSco Full PDFFrianata ZrNoch keine Bewertungen

- PETROL COKE - Specifications: (Low Sulphur)Dokument1 SeitePETROL COKE - Specifications: (Low Sulphur)Pedro Secol PanzelliNoch keine Bewertungen

- Energy Petroleum CokeDokument9 SeitenEnergy Petroleum Cokesoumyarm942Noch keine Bewertungen

- UntitledDokument2 SeitenUntitledGray ShadowNoch keine Bewertungen

- Product Information: Date: Friday, 17 February 2023 Reference Product Product Price (BBL) InspectionDokument3 SeitenProduct Information: Date: Friday, 17 February 2023 Reference Product Product Price (BBL) InspectionibregyptNoch keine Bewertungen

- Pet CokeDokument12 SeitenPet Cokezementhead100% (1)

- Draft Contract GLIIT-BMI GAR 5500-5300Dokument12 SeitenDraft Contract GLIIT-BMI GAR 5500-5300Julian Nico100% (1)

- UntitledDokument11 SeitenUntitledrian putraNoch keine Bewertungen

- Coal Trader International: Thermal Coal Sellers Seek Alternative Markets Amid Bearish China DemandDokument12 SeitenCoal Trader International: Thermal Coal Sellers Seek Alternative Markets Amid Bearish China Demandibad rehmanNoch keine Bewertungen

- FCO Zakamura 70'000 TM FOB PDFDokument20 SeitenFCO Zakamura 70'000 TM FOB PDFOmar MagañaNoch keine Bewertungen

- Petros Transacting Procedures Petroleum Coke.Dokument3 SeitenPetros Transacting Procedures Petroleum Coke.Harold DiamondNoch keine Bewertungen

- Working Document of The NPC Global OilDokument82 SeitenWorking Document of The NPC Global Oilmahendranauto5Noch keine Bewertungen

- Coal Specifications and Pricing - Indonesian Coal - IMIDokument1 SeiteCoal Specifications and Pricing - Indonesian Coal - IMIPSNYCNoch keine Bewertungen

- Loi 2Dokument2 SeitenLoi 2Ruddy SetiawanNoch keine Bewertungen

- Loi 63-61Dokument2 SeitenLoi 63-61arbi82Noch keine Bewertungen

- Specification Steam Coal IndonesiaDokument2 SeitenSpecification Steam Coal IndonesiaUdino Towero0% (1)

- Ict 20200123Dokument17 SeitenIct 20200123Hendri FahrizaNoch keine Bewertungen

- FCO (Full Corporate Offer) : Calorific 5800 - 5500 Kcal/Kg (Crushed)Dokument4 SeitenFCO (Full Corporate Offer) : Calorific 5800 - 5500 Kcal/Kg (Crushed)zmahfudzNoch keine Bewertungen

- Iron Ore Sales and Purchase Contract: Date XX March 2021Dokument10 SeitenIron Ore Sales and Purchase Contract: Date XX March 2021Note BuriNoch keine Bewertungen

- Price List Jun23 AgrocooperDokument2 SeitenPrice List Jun23 Agrocooper4Ever Comissária de DespachosNoch keine Bewertungen

- Chemical Composition Copper PDFDokument4 SeitenChemical Composition Copper PDFtoppfartNoch keine Bewertungen

- Soft Corporate Offer (Sco) Aluminum Ingots A7Dokument4 SeitenSoft Corporate Offer (Sco) Aluminum Ingots A7Trindra PaulNoch keine Bewertungen

- ZUL - Steam Coal - Loi - 29th Aug 2017Dokument4 SeitenZUL - Steam Coal - Loi - 29th Aug 2017Chandan JstNoch keine Bewertungen

- Jet Fuel A1 Fob HoustonDokument2 SeitenJet Fuel A1 Fob HoustonLTPN (Jet Fuel A1)Noch keine Bewertungen

- Draft r1 Spa Nar5500 (Lj 莲嘉) 第一次修订Dokument14 SeitenDraft r1 Spa Nar5500 (Lj 莲嘉) 第一次修订Stevy SelaNoch keine Bewertungen

- Soft Offer Basmati Rice-Pakistan-May10Dokument3 SeitenSoft Offer Basmati Rice-Pakistan-May10davidarcosfuentesNoch keine Bewertungen

- Products Price List and ProceduresDokument4 SeitenProducts Price List and ProceduresmanugeorgeNoch keine Bewertungen

- Shipping TermsDokument4 SeitenShipping TermsJaviTron74Noch keine Bewertungen

- 1) ICPO-THMC-A&H GLOBAL - (Chicken Paws)Dokument8 Seiten1) ICPO-THMC-A&H GLOBAL - (Chicken Paws)Seara FerminoNoch keine Bewertungen

- Loi - Used Rails - A.u.-FtDokument2 SeitenLoi - Used Rails - A.u.-FtTrindra Paul100% (1)

- Mazut-100 Specification (Russia Origin)Dokument1 SeiteMazut-100 Specification (Russia Origin)Tariq B ShamsiNoch keine Bewertungen

- Geology and Mineral Investment Opportunities in South Sudan: Dr. Andu Ezbon Adde MAY 2013Dokument39 SeitenGeology and Mineral Investment Opportunities in South Sudan: Dr. Andu Ezbon Adde MAY 2013Jalo Max100% (1)

- Coal Trader International 02-06-2023Dokument14 SeitenCoal Trader International 02-06-2023kahoutgNoch keine Bewertungen

- Euro Gas DailyDokument8 SeitenEuro Gas DailyJose DenizNoch keine Bewertungen

- Experimental Learning Phase 1 Presentation: Production of Sodium CarbonateDokument47 SeitenExperimental Learning Phase 1 Presentation: Production of Sodium CarbonatespidyNoch keine Bewertungen

- Basrah MediumDokument3 SeitenBasrah MediumOmar SaaedNoch keine Bewertungen

- JENNETGDokument10 SeitenJENNETGsoegi08Noch keine Bewertungen

- Spa - TMK at Venus - GCV (Arb) 4200 - 4000Dokument25 SeitenSpa - TMK at Venus - GCV (Arb) 4200 - 4000Abimanyu SutanegaraNoch keine Bewertungen

- 11-SPA-draft - , Kks-Buyer 2020Dokument9 Seiten11-SPA-draft - , Kks-Buyer 2020fajarNoch keine Bewertungen

- Draft - C0419120154-Tdlsv-Ift Pt. Mandiangin Batubara Mv. Apex PDFDokument10 SeitenDraft - C0419120154-Tdlsv-Ift Pt. Mandiangin Batubara Mv. Apex PDFRIO THRIVENI JAMBINoch keine Bewertungen

- Fob Procedure 2%PB UpfrontDokument4 SeitenFob Procedure 2%PB UpfrontfemiNoch keine Bewertungen

- Delivery Contract Parboiled Rice No. XXXXXXXX of January 2ND, 2021Dokument12 SeitenDelivery Contract Parboiled Rice No. XXXXXXXX of January 2ND, 2021Chandan JstNoch keine Bewertungen

- FC Offer - Fintrade LLC EfineryDokument6 SeitenFC Offer - Fintrade LLC EfineryВиктор ВладимировичNoch keine Bewertungen

- Soft Offer Wheat-May10Dokument4 SeitenSoft Offer Wheat-May10davidarcosfuentesNoch keine Bewertungen

- Iron Ore AnalysisDokument69 SeitenIron Ore Analysisd_bapanaNoch keine Bewertungen

- Country Paper: MongoliaDokument4 SeitenCountry Paper: MongoliaADBI Events100% (1)

- NMDC Annual Report 2010-11Dokument212 SeitenNMDC Annual Report 2010-11Hrishikesh DargeNoch keine Bewertungen

- Mayon Steel Company Profile BrouchureDokument2 SeitenMayon Steel Company Profile Brouchurerbk.tendersNoch keine Bewertungen

- NIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Dokument41 SeitenNIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Jaswanth SunkaraNoch keine Bewertungen

- Inventory ManagementDokument122 SeitenInventory ManagementSahil Goutham100% (1)

- Research Proposal For BiotechnologyDokument1 SeiteResearch Proposal For BiotechnologyParthasarathy VelusamyNoch keine Bewertungen

- TISCO - The World's Most Cost-Effective Steel Plant: Background NoteDokument6 SeitenTISCO - The World's Most Cost-Effective Steel Plant: Background NoteManoj MaxNoch keine Bewertungen

- MEE 511 (Metallurgy)Dokument21 SeitenMEE 511 (Metallurgy)Gabriel UdokangNoch keine Bewertungen

- Densitate Diferite MaterialeDokument8 SeitenDensitate Diferite MaterialeDana ElenaNoch keine Bewertungen

- 1405Dokument19 Seiten1405Neeraj Agrawal100% (1)

- Numerical Analysis Blast Furnace PDFDokument9 SeitenNumerical Analysis Blast Furnace PDFLTE002Noch keine Bewertungen

- Geology of BanswaraDokument24 SeitenGeology of Banswarakanwaljeetsingh05Noch keine Bewertungen

- Development and Use of Mill Scale Briquettes in BOF: Ironmaking & SteelmakingDokument7 SeitenDevelopment and Use of Mill Scale Briquettes in BOF: Ironmaking & SteelmakingSrikanth SrikantiNoch keine Bewertungen

- Utilization of Steel Plant Wastes by Agglomeration: A Review - Ela Jha and S. K. DuttaDokument8 SeitenUtilization of Steel Plant Wastes by Agglomeration: A Review - Ela Jha and S. K. DuttaAtika syafawiNoch keine Bewertungen

- Application of Superconducting High Gradient Magnetic Separation Technology On Silica Extraction From Iron Ore BeneDokument7 SeitenApplication of Superconducting High Gradient Magnetic Separation Technology On Silica Extraction From Iron Ore BeneLuanna MouraNoch keine Bewertungen

- 1 Ex AutomatedDokument7 Seiten1 Ex Automatedsandu_cimbrescuNoch keine Bewertungen

- Eliwana Iron Ore Mine Project: Environmental Review DocumentDokument527 SeitenEliwana Iron Ore Mine Project: Environmental Review Documentsrinu441Noch keine Bewertungen

- Bankable-Projects in Uganda - 2021-2022Dokument99 SeitenBankable-Projects in Uganda - 2021-2022Kaleb TibebeNoch keine Bewertungen

- IRON ORE AssignmentDokument3 SeitenIRON ORE AssignmentFaheem WassanNoch keine Bewertungen

- Base Metal LeachingDokument4 SeitenBase Metal LeachingRa kannanNoch keine Bewertungen

- X Reserves Resources 201112Dokument50 SeitenX Reserves Resources 201112Eun Young MNoch keine Bewertungen

- LC News Thursday, 12th January 2012Dokument29 SeitenLC News Thursday, 12th January 2012pigheadponceNoch keine Bewertungen

- Wharfage ChargesDokument4 SeitenWharfage ChargessyedalimechNoch keine Bewertungen

- 1 Week Plant VisitDokument27 Seiten1 Week Plant VisitAshish JaiswalNoch keine Bewertungen

- State Wise Mineral DistributionDokument16 SeitenState Wise Mineral DistributionThomas FennNoch keine Bewertungen

- Report On Steel Industries in IndiaDokument20 SeitenReport On Steel Industries in IndianikhilmohananNoch keine Bewertungen