Beruflich Dokumente

Kultur Dokumente

Impact of Foreign Direct Investment On Unemployment in Nigeria

Hochgeladen von

gentleken100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

188 Ansichten6 SeitenForeign direct investment in Nigeria, project topics, research materials, download project topics

Originaltitel

Impact of Foreign Direct Investment on Unemployment in Nigeria

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenForeign direct investment in Nigeria, project topics, research materials, download project topics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

188 Ansichten6 SeitenImpact of Foreign Direct Investment On Unemployment in Nigeria

Hochgeladen von

gentlekenForeign direct investment in Nigeria, project topics, research materials, download project topics

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

i

IMPACT OF FOREIGN DIRECT INVESTMENT ON

UNEMPLOYMENT IN NIGERIA (1980-2007)

BY

www.projects.page4.me

(08034883821 08188988835)

TABLE OF CONTENT

Title i

Certification ii

Dedication iii

Acknowledgement iv

Abstract viii

Chapters

CHAPTER ONE: INTRODUCTION

1.1 Background to the Study 1

1.2 Statement of the Problem 4

1.3 Significance of the Study 5

1.4 Objectives of the Study 7

1.5 Hypotheses of the Study 7

1.6 Scope and Methodology 8

1.7 Limitation of the Study 9

ii

CHAPTER TWO: LITERATURE REVIEW

2.1 Foreign Direct Investments: Conceptual Issues 10

2.2 Determinants of Foreign Direct Investments Flows 13

2.3 Trend in Foreign Direct Investment Flows in Nigeria 19

2.4 Unemployments Conceptual Issues 22

2.5 Determinants of Unemployment 26

2.6 Trend in Unemployment in Nigeria 32

2.7 Foreign Direct Investment and Unemployment:

Theory and Evidence. 34

CHAPTER THREE: THEORETICAL FRAMEWORK

3.1 Sources of Data and Method of Analyses 37

3.2 Model Specification 37

CHAPTER FOUR: EMPIRICAL ANALYSES

4.1 Presentation of Empirical Results 41

4.2 Discussion of Empirical Results 42

CHAPTER FIVE: SUMMARY, RECOMMEDATION AND

CONCLUSION

5.1 Summary of Findings 46

5.2 Recommendations 47

5.3 Conclusions 49

Bibliography 51

Appendix

iii

ABSTRACT

This study investigated the Impact of foreign direct investment on

unemployment in Nigeria from the period 1980 to 2007.

The study was carried out empirically using the Ordinary Least Squares

method of regression analysis; alongside other statistical tests.

Empirical results obtained revealed that government expenditure is a

poor determinant of unemployment, while foreign direct investment

inflow is the most germane determinant of unemployment in Nigeria.

Hence to reduce the spat of unemployment in Nigeria, policy emphases

should be centered on attracting greater inflows of foreign direct

investment.

4

CHAPTER ONE

INTRODUCTION

1.1 BACKGROUND TO THE STUDY

The world economy is growing on the strength of globalization.

One of the most salient features of globalization drive is the conscious

encouragement of cross-border investments, especially by trans-

national corporations and firms. Thus many countries and continents

(especially developing) now see the attraction of foreign direct

investment as an important element in their strategy for economic

development, essentially because it is seen as an amalgamation of

capital, technology, marketing and management (Sjoholm, 1999).

Foreign direct investment is an investment made to acquire a

lasting management interest in a business enterprise operating in a

country other than that of the investor, defined according to residency

(World Bank, 1996). Such investments may take the form of either

Greenfield investment (also called mortar and brick investments)

or merger and acquisition which entails the acquisition of existing

interest rather than new investment.

In corporate governance, ownership of at least 10% of the

ordinary shares or voting stock is the criterion for the existence of a

direct investment relationship, while ownership of less than 10% is

5

recorded as portfolio investment. Furthermore, foreign direct

investment comprises not only mergers and acquisitions and new

investments, but also reinvested earnings and loans and similar

capital flows or transfers between parent companies and their

affiliates. It has been posited that a countrys inward foreign direct

investment position is made up of the hosted foreign direct investment

projects, while outward foreign direct investment comprises those

investment projects owned abroad.

One of the strongest strengths of foreign direct investment arises

from the positive externalities if generates from the positive

externalities it generates from forward and backward linkages or

through industrial acceleration as being currently experienced in the

South and East Asia. This is evident because it is less volatile and

resilient to perturbations in the economy.

Africa is in dire need of foreign direct inflows owing to its

acknowledged advantages. Hence one of the pillars on which the New

partnership for Africas Development (NEPAD) was launched, was to

increase the available capital inflows through a combination of

reforms, resource mobilization and a conducive environment for

foreign direct investment (funke and Nsouli, 2003).

Finally, in Nigeria the level of foreign direct investment attracted

overtime is mediocre (Asiedu, 2003),as compared with her resource

6

base, potential need; especially in limiting unemployment growth rate,

, and in relation to the policy framework initiated in the past.

TO GET THE COMPLETE PROJECT (Chapter 1-5)

Kindly make payment to the accounts below.

After payment, call or text us the project topic you paid for

08034883821 08188988835

Email: gentlekenny@gmail.com

Website: www.projects.page4.me

A/C NAME: KRUKRU KENOBI

A/C NO: 23-1111-9816

AMOUNT: N3,500

NIGERIA

A/C NAME: KRUKRU KENOBI

A/C NO: 00-3806-7700

AMOUNT: N3,500

NIGERIA

Das könnte Ihnen auch gefallen

- Marketing Research As A Tool For Increased ProfitabilityDokument8 SeitenMarketing Research As A Tool For Increased ProfitabilitygentlekenNoch keine Bewertungen

- The Influence of Western Television Programmes On The Cultural Values of Nigeria YouthsDokument8 SeitenThe Influence of Western Television Programmes On The Cultural Values of Nigeria YouthsgentlekenNoch keine Bewertungen

- The Impact of Management Incentive Policies On WorkerDokument11 SeitenThe Impact of Management Incentive Policies On WorkergentlekenNoch keine Bewertungen

- The Impact of Microfinance Banks On Employment Generation in NigeriaDokument10 SeitenThe Impact of Microfinance Banks On Employment Generation in NigeriagentlekenNoch keine Bewertungen

- Federal Character Principle and Its Implication On Manpower UtilizationDokument5 SeitenFederal Character Principle and Its Implication On Manpower Utilizationgentleken100% (1)

- Human Resource Management in The Hotel and Catering IndustryDokument8 SeitenHuman Resource Management in The Hotel and Catering Industrygentleken100% (1)

- Effectiveness of Crime Control Measures in NigeriaDokument12 SeitenEffectiveness of Crime Control Measures in NigeriagentlekenNoch keine Bewertungen

- Design and Implementation of A University Online Clearance SystemDokument6 SeitenDesign and Implementation of A University Online Clearance Systemgentleken33% (3)

- Community Relations & Its Role in Corporate ImageDokument13 SeitenCommunity Relations & Its Role in Corporate ImagegentlekenNoch keine Bewertungen

- Budget& Budgetary ControlDokument8 SeitenBudget& Budgetary ControlgentlekenNoch keine Bewertungen

- Credit Management and The Incidence of Bad Debt in NigeriaDokument5 SeitenCredit Management and The Incidence of Bad Debt in NigeriagentlekenNoch keine Bewertungen

- An Appraisal of Accounting System in The Public SectorDokument7 SeitenAn Appraisal of Accounting System in The Public SectorgentlekenNoch keine Bewertungen

- WWW Projects Page4 MeDokument13 SeitenWWW Projects Page4 MegentlekenNoch keine Bewertungen

- Project Topics & MaterialsDokument28 SeitenProject Topics & MaterialsgentlekenNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Vol 1 CLUP (2013-2022)Dokument188 SeitenVol 1 CLUP (2013-2022)Kristine PiaNoch keine Bewertungen

- CRPC MergedDokument121 SeitenCRPC MergedNishal KiniNoch keine Bewertungen

- Ande Ande LumutDokument2 SeitenAnde Ande Lumutalissatri salsabilaNoch keine Bewertungen

- Lebogang Mononyane CV 2023Dokument3 SeitenLebogang Mononyane CV 2023Mono MollyNoch keine Bewertungen

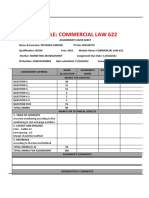

- Claw 622 2022Dokument24 SeitenClaw 622 2022Priyanka GirdariNoch keine Bewertungen

- Kartilla NG Katipuna ReportDokument43 SeitenKartilla NG Katipuna ReportJanine Salanio67% (3)

- OPEN For Business Magazine June/July 2017Dokument24 SeitenOPEN For Business Magazine June/July 2017Eugene Area Chamber of Commerce CommunicationsNoch keine Bewertungen

- Eir SampleDokument1 SeiteEir SampleRayrc Pvt LtdNoch keine Bewertungen

- 10 Biggest LiesDokument12 Seiten10 Biggest LiesJose RenteriaNoch keine Bewertungen

- Bases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 FactsDokument1 SeiteBases Conversion and Development Authority vs. Commission On Audit G.R. No. 178160, 26 February 2009 Factsaudrich carlo agustinNoch keine Bewertungen

- Sample Motion To Strike For Unlawful Detainer (Eviction) in CaliforniaDokument5 SeitenSample Motion To Strike For Unlawful Detainer (Eviction) in CaliforniaStan Burman91% (11)

- Kinds of Sentences - Positives.Dokument20 SeitenKinds of Sentences - Positives.Vamsi KrishnaNoch keine Bewertungen

- Republic V Tanyag-San JoseDokument14 SeitenRepublic V Tanyag-San Joseyannie11Noch keine Bewertungen

- ColumbusDokument2 SeitenColumbusAbraham Morales MorenoNoch keine Bewertungen

- AEF3 Files1-5 ProgTestBDokument6 SeitenAEF3 Files1-5 ProgTestBnayra100% (1)

- Chinese Erotic Art by Michel BeurdeleyDokument236 SeitenChinese Erotic Art by Michel BeurdeleyKina Suki100% (1)

- Our Official Guidelines For The Online Quiz Bee Is HereDokument3 SeitenOur Official Guidelines For The Online Quiz Bee Is HereAguinaldo Geroy JohnNoch keine Bewertungen

- Zambia National Holdings Limtied and United National Independence Party (Unip) v. The Attorney-General (1994) S.J. 22 (S.C.) SupreDokument12 SeitenZambia National Holdings Limtied and United National Independence Party (Unip) v. The Attorney-General (1994) S.J. 22 (S.C.) SupreNkumbu kaluweNoch keine Bewertungen

- Aditya DecertationDokument44 SeitenAditya DecertationAditya PandeyNoch keine Bewertungen

- Unit 10 Observation Method: StructureDokument14 SeitenUnit 10 Observation Method: StructuregeofetcherNoch keine Bewertungen

- Supreme Court Judgment On Family Settlement Deed As Piece of Corroborative EvidenceDokument32 SeitenSupreme Court Judgment On Family Settlement Deed As Piece of Corroborative EvidenceLatest Laws Team100% (1)

- A Deal Making Strategy For New CEOsDokument4 SeitenA Deal Making Strategy For New CEOsTirtha DasNoch keine Bewertungen

- Project Proposal - Tanya BhatnagarDokument9 SeitenProject Proposal - Tanya BhatnagarTanya BhatnagarNoch keine Bewertungen

- List of Districts of West BengalDokument9 SeitenList of Districts of West BengalDebika SenNoch keine Bewertungen

- Chapter 11 Summary: Cultural Influence On Consumer BehaviourDokument1 SeiteChapter 11 Summary: Cultural Influence On Consumer BehaviourdebojyotiNoch keine Bewertungen

- The Purple JarDokument4 SeitenThe Purple JarAndrada Matei0% (1)

- School Form 10 SF10 Learner Permanent Academic Record JHS Data Elements DescriptionDokument3 SeitenSchool Form 10 SF10 Learner Permanent Academic Record JHS Data Elements DescriptionJun Rey LincunaNoch keine Bewertungen

- Pakistan The Factories Act, 1934: CHAPTER I - PreliminaryDokument56 SeitenPakistan The Factories Act, 1934: CHAPTER I - Preliminarydanni1Noch keine Bewertungen

- Power of The Subconscious MindDokument200 SeitenPower of The Subconscious Mindapi-26248282100% (2)

- Sub Contract Agreement TabukDokument7 SeitenSub Contract Agreement TabukHanabishi RekkaNoch keine Bewertungen