Beruflich Dokumente

Kultur Dokumente

StratoSync Business Plan

Hochgeladen von

Simon GeorgeCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

StratoSync Business Plan

Hochgeladen von

Simon GeorgeCopyright:

Verfügbare Formate

C o n f i d e n t i a l

StratoSync, Inc

Business Plan

StratoSync, Inc Business Plan Table of Contents

StratoSync, Inc 2008

TABLE OF CONTENTS

Confidentiality / Nondisclosure Agreement .................................................................................................... i

Executive Summary................................................................................................................................ 40

I. Industry Analysis .................................................................................................................................. 1

II. Business Concept ................................................................................................................................ 5

Mission Statement ...................................................................................................................................... 5

Business Goals ............................................................................................................................................ 6

Value Proposition ....................................................................................................................................... 7

Business Models ......................................................................................................................................... 9

Products and Services ................................................................................................................................... 11

III. Market Analysis ............................................................................................................................... 18

Pricing Strategy ..................................................................................................................................... 22

Promotion Plan ..................................................................................................................................... 23

Distribution Plan .................................................................................................................................. 23

Demand Forecast ................................................................................................................................... 23

IV. Competitor Analysis ........................................................................................................................ 24

Direct Competitors ................................................................................................................................. 24

Indirect Competitors .............................................................................................................................. 25

Future Competitors ................................................................................................................................ 26

Competitive Strategies ............................................................................................................................ 27

StratoSync, Inc Business Plan Table of Contents

StratoSync, Inc 2008

V. Operations ......................................................................................................................................... 28

Business Location ................................................................................................................................... 28

Operating Facilities and Equipment ....................................................................................................... 28

Production and Operating Procedures ..................................................................................................... 28

Purchasing Procedures ............................................................................................................................ 29

Inventory Management Procedures .......................................................................................................... 29

Quality Control Procedures .................................................................................................................... 29

Customer Service Procedures ................................................................................................................... 30

Organization Structure .......................................................................................................................... 31

Management Plan ................................................................................................................................. 31

Internal Salaries .................................................................................................................................... 31

Respective Candidates ............................................................................................................................ 32

Development ............................................................................................................................................ 33

Product Development ............................................................................................................................. 33

Product Firmware Development ............................................................................................................. 33

User Software Development .................................................................................................................... 33

Website Development ............................................................................................................................. 33

Domain Names ..................................................................................................................................... 33

VI. Financial Statements ....................................................................................................................... 34

Cash Flow Statements ............................................................................................................................ 34

Income and Expense Statement ............................................................................................................... 36

Financial Ratios .................................................................................................................................... 39

StratoSync, Inc Business Plan I. Industry Analysis

Confidential 1 StratoSync, Inc 2008

Industry Analysis

Martin Gartner, Director of Wireless Intelligence, a mobile industry information provider,

announced, "The cellular industry took 20 years to reach 1 billion connections, three years to reach

2 billion connections and is on target to reach its third billion in a period of just over two years. In

less than one year, his prediction was exceeded by 300 million.

Given the fresh company model, to compare StratoSync Inc with one industry would be

lax to say the least as the company presents a new Industry model. Call it, the device synergy

industry, and StratoSync plans to be the exclusive company in that market. Sounds ambitious, huh?

Well StratoSync puts it together pretty well. Yahoo! Finance would categorize StratoSync under

networking & communication devices. Not as catchy, I know, but as a first time start-up

entrepreneur, Im learning that its the small sacrifices, like these, that count.

With both feet in the networking & communication devices industry, StratoSync walks in

the Information Technology sector. Taking this position, StratoSync is a footstep away from the

following industries: data storage services, electronic payment services, and internet music

distribution. These are the auxiliary industries involved in StratoSyncs capitalization of what has

become to be known as the placeshifting industry, with the companys focal revenue generated

through the sales of network and communication devices.

To shed some light on a relatively new industry, the placeshifting industry was made evident

by San Mateo, CA based company Sling Media Inc with the 2005 release of a device that allows a

user to stream programming from their television set-top boxes to a mobile computer over an

Internet connection, hence the term placeshifting. Todays technology does not limit the type of

data to be shifted if that medium is in digital form, a concept that StratoSync capitalizes on.

StratoSync, Inc Business Plan I. Industry Analysis

Confidential 2 StratoSync, Inc 2008

As proposed by a Morgan Stanley report in December 2006

1

, Sling Media sold 100,000+

Slingbox units in the first six months of shipment in 2005. Sling Media was later sold to the

owners of Dish Network, EchoStar, for $380 Million in Q3 of 2007.

Due to the recent birth of the placeshifting industry, there is still much that is untapped.

There is yet to be a company that has created a digital-based placeshifting device, as opposed to the

analog technology that the Slingbox uses wherein the placeshifting is that of an analog signal (e.g.,

A/V out for Cable TV). The first company that utilizes digital technology on a placeshifting device,

and does it right, holds the potential of unlocking a myriad of convenient uses, products, services,

and consequently, the complimentary revenue. This would allow a company to tap into the

placeshifting industry in ways that current analog-based technology can not, allowing for embedded

support of auxiliary markets, including internet music distribution, data storage services, and

electronic payment services. This is what StratoSync puts together so well.

As mentioned in the introduction, the Director of Wireless Intelligence, Martin Gartner,

announced that it took 20 years for the mobile industry to reach 1 billion connections, three years to

reach 2 billion connections, and estimated that it would take just over two years to reach the third

billion. In a period of less than one year, his quota exceeded by 300 Million, with the number of

active mobile phone subscriptions totaling 3.3 Billion, according to research firm Informa

2

. Take the

worlds population and cut that in half. The bigger piece represents the number of mobile phones in

use, and in essence, the addressable market for StratoSync, Inc.

Revenue that was spent by mobile users on non-voice mobile data services was $102.3 billion

in 2005, $28.4 Billion for Q1 of 2006, with expected revenue of $189 Billion by 2009, according to

research firm Informa

3

. This represents that a growing number of users are uniformly turning to

their mobile phones for external uses such as music downloads, data services, and media

subscriptions.

John Kennedy, Chairman and CEO of the IFPI, a company that represents the recording

industry worldwide, announced "Revenues [for digital music downloads] for 2006 doubled to about

1

http://www.morganstanley.com/views/perspectives/files/Global_Internet_Trends_121906_FINAL.pdf

2

http://investing.reuters.co.uk/news/articleinvesting.aspx?type=media&storyID=nL29172095

3

http://www.unstrung.com/document.asp?doc_id=99866&WT.svl=wire1_1

StratoSync, Inc Business Plan I. Industry Analysis

Confidential 3 StratoSync, Inc 2008

$2 billion and by 2010 we expect at least one quarter of all music sales worldwide to be digital.

With this and the previously mentioned statistics of mobile phone data use in mind, a worldwide

demand for a mobile solution for accessing purchased media is only a matter of time. This is a

prospect of the mobility effect, and StratoSync is the cure.

Current data storage solutions do not offer much support for mobility or efficient pricing

models. As proposed in a Wall Street Journal article

4

, Pioneer Google Inc has announced that its

preparing a service that would enable users to store data from their personal hard drives on its

computers. A data storage service that incorporates mobile access, a service that StratoSync plans to

supply, can be the finishing touch that binds all the products and services that counteract the

demands of the mobility effect.

There are other likelihoods in relation to the mobility effect and here is a statistic to help

prove my point. By 1996, US consumers had 1.4 billion credit cards

5

, with the average American

carrying 4 credit cards

6

. 12 years later, technology advances, credit card usage continues to grow, we

land a go-kart on Mars, but not much changed in the means we pay for things. Research and analysis

firm, IDTechEx, proposes that the RFID market will rise from $2.8 Billion in 2006 to $12.4 Billion

in 2010

7

. RFID, an acronym for radio frequency identification, is used predominately by delivery

services and drug companies to ID items such as medicines and packages. RFID is used by other

companies to ID books, livestock, tires, ticketing, baggage, secure documents including passports

and visas and much more. What the previously stated statistics do not anticipate is the use of RFID

in mobile phones. The idea of RFID use in mobile phones started circulating in 2005, but never

really caught on as the demand was evanescent. Based on a service that StratoSync will implement,

putting the two (RFID and mobile devices) together, and creating a convenient and safe passport for

a users credit card accounts could be desirable and potentially quite profitable. In 1998, a company

called PayPal Inc was formed with an attempt to create a safer alternative to e-commerce, allowing

a user to upload their credit card or bank account information to an online account. In 2002,

4

Google Plans Service To Users Data, The Wall Street Journal, November 27, 2007; Page B1

5

Credit Card, The Columbia Encyclopedia, Sixth Edition, 2007

6

http://articles.moneycentral.msn.com/Banking/CreditCardSmarts/1In7AmericansCarries10CreditCards.aspx

7

http://www.idtechex.com/products/en/articles/00000409.asp

StratoSync, Inc Business Plan I. Industry Analysis

Confidential 4 StratoSync, Inc 2008

auctioneer EBay Inc acquired PayPal Inc for $1.5 Billion to permanently embed the PayPal

service into its own model. Placing the mobile RFID payment passport in every day uses yields an

unlimited stream of profitability.

As its nice to compare StratoSync alongside with these incredibly successful mentioned

companies, its not very practical due to the unique style of StratoSyncs infiltration of these auxiliary

industries using placeshifting technology, which is explained in-depth in this Plan. The whole

motto behind StratoSync is why get it there if its already right here with me, literally, in the

form of a phone, computer, or any electronic linked to the same infrastructure.

Just Rock & Roll.

The motto behind my drive.

-Simon George

Founder, StratoSync.

StratoSync, Inc Business Plan II. Business Concept

Confidential 5 StratoSync, Inc 2008

Mission Statement

StratoSyncs exclusive objective is to enhance a users life experience by bringing any desired

information under the sky directly to them, specifically personal data, in the most efficient, cost

effective and convenient access.

Desired information includes music, work and important documents, recreational

documents, owned content, movies, data not possessed, accounts, and communication with others.

User access includes electronic devices that are used persistently in life, including computers, mobile

phones, vehicle dashboards, televisions, and public domains.

StratoSync, Inc Business Plan II. Business Concept

Confidential 6 StratoSync, Inc 2008

Business Goals

Assemble a non-provisional patent of the ready technology through an intellectual property

firm, to keep StratoSyncs infrastructure and delivery system exclusive and unique.

Establish a partnership with all major distributors worldwide including electronic retailers,

supercenters, mobile phone providers, and miscellaneous boutiques.

Distribute the retail product worldwide.

Provide exceptional online and phone support for users who will ultimately influence the

amount of companys growth.

Promote the company and brand to potential customers and companies.

License the product protocols to external companies in expanding the synergy infrastructure,

as the larger the license portfolio, the higher the market value held by StratoSync.

Implement auxiliary services

Create new products and enhanced editions of current hardware.

StratoSync, Inc Business Plan II. Business Concept

Confidential 7 StratoSync, Inc 2008

Value Proposition

Essentially, StratoSyncs value comes centrally from its products application abilities.

Additionally, value comes from its means of bringing devices together. Currently, solutions that will

allow a user to administer the applications that StratoSyncs products and patented technology will

do are non-existent.

The companys feature product, the uCast, acts as the central tool that allows StratoSync to

make the seamless sew of all the auxiliary services possible. Its main feature allows a user to dock an

iPod and deliver its content away from a users home to any supported electronic inside the

infrastructure, where at release will consist of mobile phones and internet-connected computers.

StratoSyncs patent will allow the company to keep its technology, style of delivery, and quality

control unique and state-of-the-art.

Currently, price efficient and (or) mobile-exclusive data storage solutions are non-existent.

StratoSync integrates data storage solutions using uDisk, a mobile-exclusive data storage solution

with price plans that allow efficiency for the most contrasting persons, and a method of access that

you cannot put a price on and much more administrative than available solutions, deeming use of

service logical.

StratoSync provides the most price efficient and innovative internet music store structure

available to anybody. Period. Utilizing music copyright laws, StratoSync will offer free uDisk access

of purchased content along with a CD album or a novelty vinyl (if available) with paid shipping for

the price of a single album- an unmatched level of value to any music shopper, mobile or stationary,

and a level of integrity that has not been seen in the music business since before the dot-com era, as

StratoSync, Inc Business Plan II. Business Concept

Confidential 8 StratoSync, Inc 2008

uDisk limits playback to its supported devices while simultaneously offering music that you can not

only hear, but touch.

Through uWallet, StratoSync will introduce a technology that will allow a user to do things

with their mobile devices that they have never done before. It consolidates bank and credit cards

information onto a encrypted uCast at home and sends the users information to their mobile phone

at the time of transaction. Airplane itineraries and club memberships will also be supported by

uWallet. The competitive advantage over future imitators is that the security and organization

uWallet delivers can only be reproduced with an additional user-owned device, a feature that will be

included free of charge in StratoSyncs feature product, the uCast, which has an estimated retail price

of $99.90.

If you cant fly, run;

if you cant run, walk;

if you cant walk, crawl;

but by all means, keep moving.

-Dr. Martin Luther King, Jr

StratoSync, Inc Business Plan II. Business Concept

Confidential 9 StratoSync, Inc 2008

Business Models

Internal

Product Licensing. The selling of a product usually involves the transfer of usage rights to the buyer, in

accordance with a terms of user agreement, with ownership rights remaining with the manufacturer.

StratoSync plans to allocate an equal amount of resources and time on growing a license portfolio.

To extend the level of convenience available to a user, licensing various StratoSync protocols for use

by for other companies and their products in accordance with quality control and hardware

requirements, will consequently raise the value of StratoSync, its products, and its services. The value

proposition revolves around extending support of product abilities, and a revenue model based on

market demand.

Transaction Broker. A transaction broker generally provides a third party payment mechanism for buyers

and sellers to settle a transaction. As a future external model, StratoSyncs objective role in this internal

model is to create a market demand through customer and third-party company awareness. The

value proposition of uWallet lies in its requirement of the retail product, uCast (increase of Sales),

and a revenue model based on market awareness.

The following is a snapshot taken from the uCast packaging showing one avenue

that StratoSync will use in creating a market demand for third-party application.

StratoSync, Inc Business Plan II. Business Concept

Confidential 10 StratoSync, Inc 2008

_

External

Product Manufacturer. A product manufacturer generally manufactures one or more products and ships

them amongst the retail distributors that will sell the product. StratoSync intends to manufacture and

ship its feature product to major product distributors worldwide including electronic retail chains,

membership warehouses, supercenters, and mobile phone retail centers, where the product may be

purchased in-store or online through the respective vendor. StratoSync revolves its value proposition

around the products price-efficiency, patented abilities, and unique delivery, with a revenue model

based on customer growth. A direct-to-consumer distribution may not be necessary, as it will aid in

maintaining product exclusivity through the respective vendors.

Bit Merchant. A bit vendor, or bit merchant, deals strictly in digital products and services in its purest

form and conducts both sales and distribution over the web. StratoSync will be a virtual merchant of

both digital media and leaser of e-space through mobile phones, computers, and any other devices

hosting StratoSyncs software or protocol. StratoSync bases its value proposition on its unique

delivery of content and competitive pricing, with a revenue model generally based on user-quantity

and user-growth.

StratoSync, Inc Business Plan II. Business Concept

Confidential 11 StratoSync, Inc 2008

Products and Services

uCast

The uCast is the feature product of StratoSync. The device allows a user to dock their

iPod and deliver the iPods content to a persons mobile phone, computer, or any other supported

device in the infrastructure. The uCast also supports connectivity for other devices in a users home

for information retrieval. Its other attractive feature is the Aura. It displays the current electricity

rate on the uCast as a color-changing light in the front of the unit, by simply entering a zip code at

setup. The Aura can host other fluctuating info including brokerage stock portfolios and weather

forecasts as there are 3 lights in total. Some users may, and will, buy this product just for its aura.

StratoSync, Inc Business Plan II. Business Concept

Confidential 12 StratoSync, Inc 2008

The iPod, as well as any other uSatellite supported devices connected to a wireless router,

can be accessed by uCast. At the time of release, in-home supported devices will be limited to their

docked iPod, a user will be able to access uCast through a downloaded software, and access clients

will include mobile phones and internet connected computers.

As time passes, the implementation of StratoSync protocols into other companies products

of other companies will allow users to access multiple home-based devices on multiple remote

devices, as a result, engaging a user in applications that were once not possible and turning the uCast

into the central link of all their life-essential devices.

Packaging

MSRP $99.90

Estimated production cost including packaging: less than $30.

StratoSync, Inc Business Plan II. Business Concept

Confidential 13 StratoSync, Inc 2008

uDisk

Through uCasts software, uSatellite (free to download via internet), StratoSync will offer a

data storage solution, uDisk, which offers consumers an ultra-flexible price plan to store and access

files on any device hosting the uSatellite software or built-in protocol, including mobile devices,

computers, a vehicle dashboard- any device that chooses to host the uSatellite protocol. The uDisk

service can be used for personal or business purposes alike as it will host a meticulous yet practical

automatic organization system. The ultra-flexible price plan allows StratoSync to cater user

requirements to the most contrasting of customers (i.e. casual use, aggressive use, small storage, large

storage). Also, 1 GB will be free to everybody with the support of Googles AdWords.

$7 / 1GB storage / no expiration

$1 / 1GB storage / 30 days

Picture Source: Courtesy of Apple Inc and Microsoft Inc

Edited by Simon George

Picture Sou SS

Edited tt by Si

StratoSync, Inc Business Plan II. Business Concept

Confidential 14 StratoSync, Inc 2008

uSatellite Music Store

Wherever there is there is the music store. The free uSatellite software incorporates an

innovative and highly competitive pricing model. All downloads purchased through uSatellite will be

uploaded onto their uDisk account free of charge, allocating an independent space for purchased

media without allocating purchased uDisk storage space. Utilizing a loophole in music copyright

laws as a bonus, StratoSync will give any user the choice of two purchase options when purchasing

all of the songs in an album:

a) 9.99 for an album, a DRM-free (copy protection-free) download, and instant uDisk

access, wherever it may be, or

b) 12.99 for an album, a DRM (copy protected) download, instant uDisk access, and a

choice of the physical CD or vinyl record (if available) plus $3 for shipping

a worthy amount of value for any music lover. More information is available upon request.

99 songs.

uDisk storage and access with purchase.

Physical album for $15 shipped with uDisk support.

Drawing by Simon George

StratoSync, Inc Business Plan II. Business Concept

Confidential 15 StratoSync, Inc 2008

uVid

On any device that the uSatellite protocol is built-in, there is uVid. Through uVid,

StratoSync introduces a long-awaited video conferencing solution that makes video conferencing

available, worldwide, regardless of the service provider or line type (hard or wireless). When a

uSatellite user dials the digits of another person whose phone is uSatellite supported, the receiving

end is prompted with a choice of answering the call in video, or in the traditional audio-only

method, with the incoming callers live video feed displayed on the receiving end until the call is

accepted (or denied, for that matter). Along with home and office-grade telephones, screen / camera

attachments will be made by StratoSync for connecting between an existing phone and phone line.

Included in supported and licensed devices.

$ - TBD by service providers; airtime usage is likely.

S

i

m

u

l

a

t

i

o

n

.

\

Picture Source: Courtesy of Apple Inc, Samsung Electronics Inc, and Giles Keyte Photography Edited by Simon George

StratoSync, Inc Business Plan II. Business Concept

Confidential 16 StratoSync, Inc 2008

uWallet

The pattern continues: wherever there is a built-in uSatellite protocol, there is uWallet, an

account management solution that allows a user securely store bank and credit card accounts onto

their uCast at home with 128-bit encryption. In return, a user can use any uSatellite-supported

public ATM to make cash withdrawals, and use their mobile devices in payment transactions such as

check stands and other point-of-sale places. Additionally, uWallet can be used in the organization of

funds and transactions, as most credit and bank account transactions may pend for days before it

posts onto an account, leaving the user more susceptible to overdraft fees, a $17.1 billion revenue

stream for banks and credit unions in 2006 according to the NY Times and a 15% annual cost for

me, personally. Though cell phone manufacturers have yet to catch up with RFID enabled devices,

the uCast comes shipped with uWallet compatibility.

$ or % - TBD, if any.

Requires a uCast.

Information is 128-bit encrypted on the uCast, which

conveniently is already protected by a users 128-bit

encrypted home internet connection.

Drawing by Simon George

Simulation.

Photo Source:

Courtesy of ViVOtech Inc,

Nokia Coporation Inc.

Edited by Simon George

StratoSync, Inc Business Plan II. Business Concept

Confidential 17 StratoSync, Inc 2008

uContacts

As all uSatellite supported phones will have uVid support, they will have uContacts support.

uContacts simply saves all contacts on a uSatellite-supported phone to a uSatellite account. So when

a user changes phones or carriers, their contacts will port along with them.

uDrive

Wherever the conveniences of uSatellite take you, uDrive extends them to a vehicle

dashboard. Using a new type of Bluetooth technology, a user will be able to listen to a home-docked

iPod over a vehicle sound system and use the steering wheel mounted buttons for controls. All that is

required is a uSatellite-supported phone and a uDrive-supported vehicle is required.

You may have noticed the reoccurring theme thus far: all that StratoSync really does is bring

things together. So, the iPod, the music store, uDisk, and uWallet are accessible through uSatellite,

not to mention the connecting video-communication technology of uVid, and the convenience of

uContacts and uDrive. What else can we do? Because our mission is to deliver lifes important and

joyous information onto as many devices as possible (including vehicle dashboards), we figured we

might as well add Pandora Radio to our business model. Pandora Radio is a radio experience unlike

another. This free service is owned by, and utilizes the Music Genome Project, which analyzes

music on over 400 characteristics. This allows a user to enter the name of song or artists they like

and automatically begin playing music in that same style. If it plays a song a user doesnt like, the

thumbs-down option immediately changes tracks and never plays that song again.

This is not an official part of StratoSyncs business plan and for good reason. Though we see

this happening, the details have not been worked with Pandora as they may already be working on a

vehicle playback solution that will give commuters the opportunity to listen to a new form of a non-

corporate radio. We dont think the team at Pandora will be against working together in extending

this enjoyable service to vehicle dashboards and many other device that uSatellite supports.

StratoSync, Inc Business Plan II. Business Concept

Confidential 18 StratoSync, Inc 2008

Success, failure, its all an illusion.

Its about getting out there, and do what you do best:

make the world a better place.

-Elizabeth Berkley

Actress, Dancer.

StratoSync, Inc Business Plan III. Market Analysis

Confidential 19 StratoSync, Inc 2008

Market Analysis

Potential Market: The total number of people who could buy from a business.

3.3 billion mobile phone subscribers.

Addressable Market: The group of individuals in the potential market who are likely to have an interest

in what a business has to offer.

Due to the nature range and nature of StratoSyncs products and service, all 3.3 Billion of the

potential market is addressable.

Target Market: The group, or groups, of individuals in the addressable market that is likely to buy from a

business.

The opportune individual would be subscriber to a home broadband internet service, a mobile

phone service with broadband speeds (major providers), and an owner of an iPod, as these are the

requirements to take full advantage of the uCast and all of StratoSyncs services.

Market Share: The individuals in the target market who can be expected to make a purchase from a

business.

At release, it is expected that only those knowing of the products abilities and ease of use, such as

tech-savvied individuals or retail employees, will be expected to purchase the product. Once the non-

broadband addressable market is aware of the products capabilities and uses of the uCast (that is

why we have Best Buy and Circuit City) but do not have the requirements, they may feel inspired to

purchase the required subscriptions or make the necessary upgrades in order to take advantage of

StratoSyncs products and services, and as a result, making them part of the target market.

StratoSync, Inc Business Plan III. Market Analysis

Confidential 20 StratoSync, Inc 2008

Mobile Phone

Subscribers

(in billions)

One Year

Change

World

Penetration

(per capita)

Users with

Broadband*

(in millions)

One Year

Change

World

Broadband

Penetration

(per capita)

2003 1.14 + 14.00 % 18.10 % 99.6 + 165.60 % 1.57 %

2004 1.45 + 27.19 % 22.75 % 180.8 + 81.53 % 2.84 %

2005 2.14 + 47.59 % 33.18 % 285.7 + 58.02 % 4.43 %

2006 2.70 + 26.17 % 41.38 % 422.3 + 47.81 % 6.47 %

2007 3.30 + 22.22 % 49.68 % 699.8 + 58.67 % 9.91 %

References: FCC, Reuters, US Census Bureau, Wireless Intelligence

*high-end 3G or 4G networks; target market for StratoSync

Supplemental Information: Even with a high penetration rate, the numbers show stability in

user growth. With 4G technologies being launched by Verizon, Sprint and Google this year

1

, the

growth in broadband mobile subscriptions should be piercingly substantial.

iPod Units*

(in Millions)

One Year

Change

World

Penetration

(per capita)

US

Penetration

(per capita)

2003 2.046 + 335.32 % 2.10 % n/a

2004 10.309 + 403.86 % 2.13 % n/a

2005 42.269 + 310.02 % 2.29 % 11%**

2006 88.701 + 109.85 % 2.95 % 20%**

2007 141.386 + 59.37 % 4.31% 28%**

References: Apple Inc, US Census Bureau **WSJ Online

*target market for StratoSync Inc

Supplemental Information: The statistics show the iPods growth is stable. Richard Siklos,

editor-at-large for CNN, reports that Apple holds more than a 70% market share for portable music

players

2

.

1

source: the companies.

2

http://money.cnn.com/2007/10/08/technology/ipod_siklos.fortune/index.htm

StratoSync, Inc Business Plan III. Market Analysis

Confidential 21 StratoSync, Inc 2008

Internet

Users

(in millions)

One Year

Change

World

Penetration

(per capita)

Users with

Broadband*

(in millions)

One Year

Change

World

Broadband

Penetration

(per capita)

2003 723 + 16.61 % 11.48 % 101 n/a 1.60 %

2004 850 + 17.57 % 13.34 % 167 + 65.35 % 2.62 %

2005 975 + 14.71 % 15.12 % 233 + 39.52 % 3.61 %

2006 1,120 + 14.87 % 17.16 % 295 + 26.01 % 4.52 %

2007 1,319 + 15.98 % 19.68 % 305 + 13.56 % 5.07 %

References: Morgan Stanley Research, US Census Bureau

*target market for Stratosync Inc

Graph Supplement Broadband internet makes up for 72% of total internet connections in

the United States, with 53% of all US households having a broadband internet connection

3

.

According to the same source, as of June 2007, 68% of all households with annual incomes over

$50K have broadband and 39% of all households with annual incomes under $50K have

broadband. Internet providers are becoming more competitive, and with services starting at $14.99

per month. As more products are requiring a broadband internet connection and as broadband

becomes more affordable the penetration rate should increase appropriately. According to research

firm Neilson, US broadband penetration was 87.49% in January 2008, and is expected to break

90% by mid-2008.

StratoSync Fact Though some variables may influence a company to tailor a product service,

StratoSyncs target market is not limited to sex, gender, ethnicity or occupation as these products

and services are universal and have various pricing options.

Target Age 13-75

Target Total Household Income 30K to Infinity

3

Online News network: Giga Omni Media. http://gigaom.com/2007/06/07/53-of-us-homes-have-broadband

StratoSync, Inc Business Plan III. Market Analysis

Confidential 22 StratoSync, Inc 2008

Pricing Strategy

uCast

The retail estimate price is $99.90 for the device. (Cost-Plus Pricing = over 300%)

There will be no price skimming at release or in the future.

StratoSyncs strategy is to have its pricing to be as distinct as the products themselves.

Future plans to release a premium edition with wireless connectivity and connectivity for USB

storage device. (subject to change)

uSatellite Music Store

Innovative pricing- 99 songs. CD or Vinyl for $15 shipped with uDisk playback.

In the future, sales of other media will include movies and TV shows.

uDisk

Competitive pricing: $1 / GB / 30 days or $7 / GB /no expiration.

As mentioned before, StratoSyncs strategy is to have price plans for all its subsidiaries as unique

and distinct as the products themselves.

uWallet

Price is TBD, if any, as it requires the purchase of a uCast.

Free uSatellite software

Penetration pricing: An easy-interfaced software is available to download for all broadband mobile

users. The software will give a user access to the iPod when docked on the uCast as well as uDisk,

uWallet, and the music store. For a user to access any one service, all services will be available for a

users disposal. For example, in the case of a user who does not own a uCast, when accessing the

uDisk service from the main menu, the main menu will be visible as the following: No iPod,

Music Store, uDisk, uWallet, Settings, and Help. In the case the user is a uCast owner

and had named their iPod TedPod when they first bought it, the main menu would be visible as

the following: TedPod, Music Store, uDisk, uWallet, Settings, and Help. This easy setup

heightens the level of convenience available to a user, and equally important, also makes it more

likely for a customer of any one service to become a customer of another. In a sense, uSatellite

becomes like an iTunes to mobile users.

StratoSync, Inc Business Plan III. Market Analysis

Confidential 23 StratoSync, Inc 2008

Promotion Plan

The product itself: Though its been said, many times by many companies, the packaging of

the uCast, by itself, will provide the most awareness to

Potential Customers

And 3

rd

party Companies.

How the package is presented, specifically an iPod dock with a music symbol, which is also the

company logo, and an empty outline of the iPod stating Your iPod Here should spark the curious

Toms and Tammys to pick up and read the package, and as a result, finding out the products

capabilities. What is presented on the package, specifically about the products future capabilities,

will generate a degree of market demand for these proposed abilities including in-car dashboard

playback / control and built-in phone playback. This will raise interest from the 3

rd

party companies

to integrate support of the product to make these applications possible to their customers and future

consumers. TV and media advertising would be selective as their sole objective would be for buzz,

or customer awareness.

Distribution Plan

uSatellite software (free to download by all mobile phone users)

Electronic retail distributors

Supercenters (i.e., Wal-Mart)

Major mobile phone providers

o This is significant because most mobile phone providers do not carry products other than

their mobile phones and accessories, hence a product of this sort would be very distinct and

stand out significantly.

Membership warehouses (targeted 5USD decrease in wholesale cost; 10USD in retail)

Demand Forecast

Estimated to sell over 500Thousand uCast units within the first year, based in comparison to

Sling Medias product, price, sales figures, and the nature of the uCast, as well as other factors.

Estimated to sell a minimum of 1Million songs within the first year of service release, due greatly

to the innovative pricing structure (uDisk access + Album).

Due to a flexible price plan that is suitable for business and consumer users alike, the uDisk

service is expected to reach an exponential growth (no estimate in sales).

A constant growth in all StratoSync services is expected due to the free software and the distinct

pricing strategy of having the purchase of one product support the purchase of another.

StratoSync, Inc. Business Plan IV. Competitor Analysis

Confidential 24 StratoSync, Inc 2008

Competitor Analysis

StratoSync doesnt have an absolute monopoly on life essential products and services.

The level of competition is revealed in this section.

Direct Competitors

a) There are no direct competitors for

1) a device that enables a user to listen to their docked iPod over a internet connected

mobile device or computer,

2) a data storage solution exclusive for mobile use, or

3) a point-of-transaction solution exclusive for mobile devices.

b) Music stores available through major mobile phone providers: Most mobile service providers

offer mobile phone playback and one PC download for purchased content.

1) US: Sprint / Nextel, Verizon, AT&T

2) Worldwide: China Mobile, China Unicom, Telefnica Mviles, Orange, and

TeleNor .

StratoSync Advantage Using an organized, clean, and easy-to-use software, user content is

automatically uploaded to uDisk, creating user-access from any of their electronic devices

inside the infrastructure, with a choice of PC download or a physical album.

In order to penetrate this market, StratoSync proposed a business model that embeds itself within

the carriers own music store. In doing so, the carrier receives the greater portion of referred sales

profit (approximately 55%) by giving the shopper the second option of purchasing the physical CD

StratoSync, Inc. Business Plan IV. Competitor Analysis

Confidential 25 StratoSync, Inc 2008

with free uDisk support for 14.99USD with free shipping (retail for all of the music industry is

12.99USD for new titles and 3USD to cover shipping margin). This model leaves the carriers music

store intact, while providing a non-labored profit and giving shoppers more options. As for the

carriers independent business model and music store, uDisk support can be included for a nominal

contractual fee of approximately 5% of direct profits, a fee mostly to cover operational costs, but

more importantly, for building a relationship based on longevity as mobile carriers will play a major

role in manufacturing uSatellite-supported handsets and extending uDrive support to vehicles.

Indirect Competitors

a) Orb Networks: This free service allows a users computer stored media on to be played on a

mobile phone, PDA or another personal computer with an Internet connection. The service

requires viewing of advertisements and a users home computer to be powered on and

connected to the internet at all times.

b) Apple Inc: Users can currently download songs and other mediums through an internet-

connected computer or an iPhone using a WiFi connection. The iTunes store accounts for

more than 70% of music downloads worldwide.

c) Amazon.com: In the beginning of 2008, Amazon.com became the first major distributor of

non-protected MP3 songs and albums, and remains the leader in distribution of this media.

d) Current data storage service providers: Users can upload documents, media, and other files to

these services and access them at a later time from another computer. Some will allow a user

to edit files online.

1) Omnidrive.com, Box.net, Xdrive/AOL, Mozy, and IBackup

StratoSync Advantage None carry built-in support for mobile devices, nor the convenient

infrastructure that StratoSync will carry around its patented product.

StratoSync, Inc. Business Plan IV. Competitor Analysis

Confidential 26 StratoSync, Inc 2008

Future Competitors

a) Sling Media Inc: Though Sling Media took the TV route with its EchoStar acquisition in

2007, they may feel inspired to add another avenue of revenue as a result of StratoSyncs

models.

b) Apple Inc: It is my personal prediction that is only a matter of time before Apple Inc

implements exclusive support of its music store on mobile devices, and might improve on an

infrastructure to download directly to large-capacity devices, such as the iPhone or iPod.

StratoSync Advantage No storage device can meet the non-metered comfort of uDisk, with

purchases from the uSatellite Music Store.

c) Google Inc: According to a Wall Street Journal article, Google plans to offer a free and paid

service that allows files to be easily searchable through a search box and accessible directly

from Windows this year.

StratoSync Advantage StratoSync plans to extend file-access even further by taking them to

mobile devices and making them applicable real life situations. In rhetoric to Google,

StratoSync will implement an automated organization folder system that directs uDisk files

to behave like other files on your computer. A free uSatellite player will be available as a web

browser add-on.

StratoSync, Inc. Business Plan IV. Competitor Analysis

Confidential 27 StratoSync, Inc 2008

d) Current data storage service providers: These providers may implement dedicated mobile

support and solutions as a response to StratoSyncs data storage service.

1) Omnidrive.com, Box.net, Xdrive/AOL, Mozy, and IBackup

StratoSync Fact The patents that StratoSync will hold will play a large role in what these companies

will be allowed to implement and will not be allowed to implement, and incoherently, the main

reason for an expedited capitalization of StratoSync. If synergy is desired by an external company,

license purchases are available with hardware requirement and quality control guidelines.

Competitive Strategies

Cost Leader: StratoSync will be a low-cost producer of exclusive goods at low prices.

A Different Company: StratoSync will use its product abilities, ease of application, and

image to distinguish itself in the market place.

Innovator: New ways of commerce have been introduced through StratoSync that will

influence the nature of multiple industries.

Seed of Opportunity: As it is its intention, StratoSync puts itself in a position with its

products and services that will allow birth of other products and services.

Ally: Third-party expansion will increase market value for StratoSync and its allied

companies. Partnerships with prospective production and distribution companies will aid

StratoSync in being price effective and time efficient.

Clock-Basher: StratoSync will utilize users time in ways that other competitors arent,

utilizing user-friendly navigation, on-demand customer service, and efficient order-to-

delivery strategies.

StratoSync, Inc. Business Plan V. Operations

Confidential 28 StratoSync, Inc 2008

Operations

The inputs, processes, procedures, and activities required to create what the business will sell.

Business Location

As an IT company, the central operating facility will be based out of the San Francisco Bay

Area in California, also known as Silicon Valley. This includes storage of servers, IT support

technicians, and a call center. Assembly and distribution depots are located externally as part of an

efficient order-to-delivery strategy. More information is available upon request.

Operating Facilities and Equipment

The operation facility consists of a 2000-3000 ft

2

commercial space, office furniture suitable

for nine, 9 computers, 2 printers, an internal network and communication system, a central

customer storage server and an entry-level vehicle for company use. More information is available

upon request.

Production and Operating Procedures

The day-to-day operating procedure at StratoSync will be a continuous and evolving

customer service and product support. This includes keeping retailers stocked with product,

continuous support to new devices, and troubleshooting customers in need of assistance. More

information is available upon request.

StratoSync, Inc. Business Plan V. Operations

Confidential 29 StratoSync, Inc 2008

Purchasing Procedures

Raw materials and components will be purchased from multiple manufacturers and sent to

the assembler. The product assembler also packages, stores, and ships the finished product from their

distribution depot to e retail distribution warehouses worldwide as part of an evolved order-to-

delivery strategy, where as being cost effective and having a reduced cycle time is the objective.

Inventory Management Procedures

StratoSync will receive daily updates from the assembler / warehouse depot on the status of

in-progress and completed inventory ready for shipment. StratoSync will also receive inventory

updates on a daily basis from retail distribution warehouses worldwide. Product will be shipped

accordingly. More information is available upon request.

Quality Control Procedures

Quality control requirements and procedures will be set in manufacturing and shipping to

ensure product quality and consistency. When licensing protocols, such as uVid for video

communication, or built-in support of uSatellite for allowing third-parties companies to

communicate the uCast, hardware requirements and quality control guidelines will also be set. More

information is available upon request.

StratoSync, Inc. Business Plan V. Operations

Confidential 30 StratoSync, Inc 2008

Customer Service Procedures

Customer service and experience will be the elements that StratoSync will give much of its

resources and attention to. A users mobile phone will be the opportune vessel for product support.

Announcements and polls will appear on the startup of the free downloaded software to help

determine our customers experience and expectations. In addition to aiding in service enhancement,

a comment box will also be readily available for the opinioned customer.

When a customer opens their uCast package, they are greeted with a petite booklet labeled

Read Me. This includes installation instructions and other useful information. Located inside the

booklets sleeve is a business card that lists the users unique product code and the companys web

directory including Product Support. As the user enters the first part of installation on their mobile

device, they are prompted with a choice of guidance in either video or text.

To minimize or eliminate waiting time for a user to receive a uCast, the alternate element

that StratoSync will allocate its resources and attention to will be to keep retail distribution

warehouses appropriately stocked.

To measure and guarantee efficiency of customer service operations, StratoSync will utilize

communication through the software, as previously mentioned, as well as hold a seasonal meeting

for customer relations. RSVP will include customers, programmers and field related personnel.

StratoSync is helping customers serve themselves by using the online avenue as the suggested

method of support, with phone contact exposed as a last resort. A user can access the Product

Support web directory either on the internet or by scrolling down to the Help option on the main

menu of the uSatellite software, as almost all inquiries will be due to lack of simple product or

service knowledge.

The personal and unique style in which StratoSyncs delivers customer service will give it a

competitive advantage over future imitators.

More information is available upon request.

StratoSync, Inc. Business Plan V. Operations

Confidential 31 StratoSync, Inc 2008

Organization Structure

StratoSync will be formed as an elected corporation with a number of company shares listed

in the Articles of Incorporation. An appropriate number of shares will be distributed to the capital

investing individual(s) or company and to the founder of StratoSync, Simon George.

Management Plan

As founder, Simon George will play a central role in the establishment and operation of

StratoSync. Responsibilities include the orchestration of inventory placement, troubleshooting

technical issues, and active creation of company direction. The companys management structure

shall remain elastic for the first year of operation. Simon George will be replaced by a qualified CEO

as StratoSync gains momentum. More information is available upon request.

Internal Salaries Embryonic Structure. Year 1 of Operation.

Chief Executive Officer

64K, plus company benefits

IT Technicians (accumulative of 3 full-time technicians or 120 hours/week)

58K, plus company benefits

Lead Customer Service Agent (full-time)

34K, plus company benefits

Customer Service Agents (accumulative of 7 full-time agents or 280 hours/week)

31K, plus company benefits

Administration (full-time)

29K, plus company benefits

StratoSync, Inc. Business Plan V. Operations

Confidential 32 StratoSync, Inc 2008

Respective Candidates

CEO: a leader with well-rounded experience, an IT background, with an intricate knowledge

of business management and the financial management.

IT Tech/Server Manager: a leading, well rounded IT technician for server management with

intricate knowledge of website management, and program writing.

IT Tech/Lead Programmer: a leading, well rounded IT technician for writing programs with

intricate knowledge of server management, and website management.

IT Tech/Web Master: a leading, well rounded IT technician for website management with

intricate knowledge of programming and server management.

Lead Customer Service Agent: a well spoken and friendly customer service representative, for

customer troubleshooting and technical support, and to lead other agents.

Customer Service Agents: well spoken and friendly customer service representatives for

customer troubleshooting and technical support.

Raw Material and Component Manufacturers: house the required material(s) and

component(s), in abundance, and at low price.

Product Manufacturer: A price-efficient assembler that is accompanied by a distribution

depot and accommodates technical assembly requirements.

StratoSync, Inc. Business Plan V. Operations

Confidential 33 StratoSync, Inc 2008

Development

Product Development

Partnering development: A development firm will be hired to collaborate in building the

feature product alongside Simon George. More information is available upon request.

Product Firmware Development

Partnering development: A firm will develop the hardwares firmware (the software on the

uCast hardware) with collaboration of StratoSync employees. Management and further maintenance

of the firmware will be carried out internally. More information is available upon request.

User Software Development

Partnering development: StratoSync employees will work alongside Simon George and a

hired firm during development of the user software. Further development will be carried out

internally. More information is available upon request.

Website Development

Partnering development: A web firm will develop and design websites during the

development phase. Maintenance and further maintenance will be carried out internally. More

information is available upon request.

Domain Names

StratoSync.com

uSatellite.com

uCast.com

uDisk.com

uWallet.com

uVid.com

uDrive.com

uContacts.com

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 34 StratoSync, Inc 2008

Financial Statements

The resources and flows that will be required to carry out the business plan.

Total Capital Required: 3,126,771 USD

Stratosync, Inc.

Cash Flow Statement

Year 1

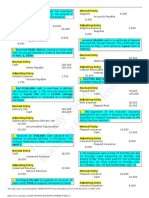

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total Year 1

INFLOW

Gross Receipts on Sales - - 0 0

Dividend and Interest Incom TBD TBD TBD TBD

Invested Capital (est.) - 0 0

TOTAL FUNDS IN $0 $0 $0 $0 $0

OUTFLOW

Cost of Goods Produced - 0 0 550,000

Sales, General, and Administr 232,213 53,283 55,008 127,020

Buildings and Equipment 27,600 4,500 4,500 78,000

Other Expenses 20,000 63,000 103,000 129,000

Corporate Taxes - - 0 0

TOTAL FUNDS OUT $279,813 $120,783 $162,508 $884,020 $1,447,124

Net Cash Flow -$279,813 ($120,783) ($162,508) ($884,020) -$1,447,124

Plus: Beginning Cash Balance -279,813 -400,596 -563,104

Ending Cash Balance -$279,813 -$400,596 -$563,104 -$1,447,124

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 35 StratoSync, Inc 2008

Stratosync, Inc.

Cash Flow Statement

Year 2

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total Year 2

INFLOW

Gross Receipts on Sales $2,625,000 $15,750,000 $15,750,000 $35,730,000

Dividend and Interest Income TBD TBD TBD TBD

Invested Capital - - -

TOTAL FUNDS IN 2,625,000 $ $15,750,000 15,750,000 $ 35,730,000 $ 69,855,000 $

OUTFLOW

Cost of Goods Produced $4,075,000 $5,625,000 $5,625,000 $10,950,000

Sales, General, and Administratio $149,647 $352,835 $280,042 $528,096

Buildings and Equipment 45,000 0 162,500 0

Other Expenses $35,000 $0 $0 $100,000

Corporate Taxes

TOTAL FUNDS OUT 4,304,647 $ 5,977,835 $ 6,067,542 $ 11,578,096 $ 27,928,120 $

Net Cash Flow (1,679,647) $ 9,772,165 $ 9,682,458 $ 24,151,904 $ 41,926,880 $

Plus: Beginning Cash Balance 673,184 (1,006,463) 8,765,702 18,448,160

Ending Cash Balance (1,006,463) $ 8,765,702 $ 18,448,160 $ 42,600,064 $

At first glance it may be difficult to understand how the venture capital can generate such large

numbers in short time. This is an exclusive result of the turnaround procedure, wherein the net

profits are recycled into the expense accounts of the component manufactures, assembler and

distribution warehouse, reproducing a multiplied number of product in the first months as a result.

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 36 StratoSync, Inc 2008

Stratosync, Inc

Income and Expense Statement

Year 1

INCOME Q1 Q2 Q3 Q4 Year 1 Total

Gross Receipts on Sales

uCast - - 0 0 0

uDrive - - 0 0 0

uSatellite Music Store - - - - -

Other Products and Services - - - - -

Dividend and Interest Income - - - - -

TOTAL INCOME $0 $0 $0 $0 $0

EXPENSES

Cost of Goods

Raw materials and supplies - 0 0 375,000 375,000

Facilities - 0 0 175,000 175,000

Total Cost of Goods - $0 $0 $550,000 $550,000

General Operation & Admin

Salaries and wages 32,664 41,247 42,747 54,496 171,154

Taxes and 'load' @ 15% 4,899 6,186 6,411 8,174 25,670

Rent and lease expenses 0 0 0 10,500 10,500

Utilities 0 0 0 2,000 2,000

Insurance (business and health) 0 0 0 3,800 3,800

Office Furniture & Supplies 7,400 3,600 3,600 32,400 47,000

Advertising 0 0 0 0 TBD

Vehicle expenses 1,650 1,650 1,650 2,450 7,400

Accounting and Legal services 185,600 600 600 13,200 200,000

Total Sales, General, & Admin $232,213 $53,283 $55,008 $127,020 $467,524

Buildings and Equipment

Building renovations 0 0 0 18,000 18,000

Office Equipment 2,000 4,500 4,500 25,500 36,500

Computers 10,000 0 0 34,500 44,500

Vehicles 15,600 0 0 0 15,600

Total Buildings & Equip $27,600 $4,500 $4,500 $78,000 $114,600

Other Expenses

New product development 20,000 53,000 73,000 104,000 250,000

User Software Development 0 10,000 5,000 10,000 25,000

Web Acquisition & Development 0 0 25,000 15,000 40,000

Other legal costs

Total Other Expenses $20,000 $63,000 $103,000 $129,000 $315,000

TOTAL OPERATING EXPENSES $279,813 $120,783 $162,508 $884,020 $1,447,124

Operating Profit Before Taxes ($279,813) ($120,783) ($162,508) ($884,020) ($1,447,124)

Less: corporate taxes @ 40% - - - - -

NET PROFIT (279,813) (120,783) (162,508) (884,020) (1,447,124)

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 37 StratoSync, Inc 2008

Stratosync, Inc

Income and Expense Statement

Year 2

INCOME Q1 Q2 Q3 Q4 Year 2 Total

Gross Receipts on Sales

uCast 2,475,000 14,850,000 14,850,000 26,730,000 58,905,000

uDisk 150,000 900,000 900,000 2,000,000 3,950,000

uSatelite Music Store 7,000,000 7,000,000

Other Products and Services 0

Dividend and Interest Income 0

TOTAL INCOME $2,625,000 $15,750,000 $15,750,000 $35,730,000 $69,855,000

EXPENSES

Cost of Goods

Raw materials and supplies 1,125,000 1,125,000 1,125,000 2,100,000 5,475,000

Facilities 2,950,000 4,500,000 4,500,000 8,850,000 20,800,000

Total Cost of Goods $4,075,000 $5,625,000 $5,625,000 $10,950,000 $26,275,000

General Operation & Admin

Salaries and wages 83,997 160,248 180,254 235,257 659,756

Taxes and 'load' @ 15% 12,600 24,037 27,038 35,289 98,964

Rent and lease expenses 15,000 15,000 15,000 15,000 60,000

Utilities 8,000 12,000 15,000 18,600 53,600

Insurance (bus & health) 8,900 11,100 12,300 17,100 49,400

Office Furniture & Supplies 0

Advertising

Vehicle expenses 1,650 1,650 1,650 1,650 6,600

Accounting and Legal services 19,500 128,800 28,800 205,200 382,300

Total Sales, General, & Admin $149,647 $352,835 $280,042 $528,096 $1,310,620

Buildings and Equipment

Building renovations

Office Equipment & Computers 45,000 0 162,500 0 207,500

Vehicles - - 0 0 0

Total Buildings & Equip $45,000 $0 $162,500 $0 $207,500

Other Expenses

New product development 35,000 0 0 100,000 135,000

User Software Development - - 0 0 0

Web Acquisition & Development - - 0 0 0

Other legal costs - - 0 0 0

Total Other Expenses $35,000 $0 $0 $100,000 $135,000

TOTAL OPERATING EXPENSE $4,304,647 $5,977,835 $6,067,542 $11,578,096 $27,928,120

Operating Profit Before Taxes -1,679,647 $9,772,165 $9,682,458 $24,151,904 $41,926,880

Less: corporate taxes @ 40% - $3,908,866 $3,872,983 $9,660,762 $16,770,752

NET PROFIT (1,679,647) $5,863,299 $5,809,475 $14,491,142 $25,156,128

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 38 StratoSync, Inc 2008

Stratosync, Inc

Income and Expense Statement

Year 1 - Year 3

Year 1 End Year 2 End Year 3 End

INCOME

Gross Receipts on Sales

uCast $0 $58,905,000 $87,500,000

uDisk $0 $3,950,000 $15,200,000

uSatellite Music Store $0 $7,000,000 $45,500,000

Other Products and Services $0 $0 $40,000,000

Dividend and Interest Income $0 $0 $0

TOTAL INCOME $0 $69,855,000 $188,200,000

EXPENSES

Cost of Goods

Raw materials and supplies $375,000 $5,475,000 $4,995,000

Facilities $175,000 $20,800,000 $27,625,000

Total Cost of Goods $550,000 $26,275,000 $32,620,000

General Operation and Administration

Salaries and wages (including taxes) $171,154 $659,756 $1,142,688

Taxes and 'load' @ 15% $25,670 $98,964 $171,403

Rent and lease expenses $10,500 $60,000 $60,000

Utilities $2,000 $53,600 $145,500

Insurance (business and health) $3,800 $49,400 $119,200

Web site hosting (Internal) $0 $0 $0

Office Furniture & Supplies $47,000 $0 $0

Vehicle expenses $7,400 $6,600 $6,000

Accounting and Legal services $200,000 $382,300 $79,200

Total Sales, General, & Admin $467,524 $1,310,620 $1,723,991

Buildings and Equipment

Building renovations $18,000 $0 $0

Office Equipment $36,500 $207,500 272,500

Computers $44,500 $0 $0

Vehicles $15,600 $0 46,040

Total Buildings and Equipment $114,600 $207,500 $318,540

Other Expenses

New product development $250,000 $135,000 $0

Web site acquisition and developme $25,000 $0 $0

Other legal costs $15,000 $0 $68,000

(including patents and incorporation)

Total Other Expenses $290,000 $135,000 $68,000

TOTAL OPERATING EXPENSES $1,422,124 $27,928,120 $34,730,531

Operating Profit Before Taxes ($1,447,124) $41,926,880 $153,469,469

Less: corporate taxes @ 40% - $16,770,752 $61,387,788

NET PROFIT (1,447,124) $25,156,128 $92,081,681

StratoSync, Inc Business Plan VI. Financial Statements

Confidential 39 StratoSync, Inc 2008

Ratios

Beginning with Year Two.

Return On Investment: net profit to total assets

1000% or 10:1

Return On Equity: net profit to equity (3-year average)

145% or 14:10

Net Profit Margin: net profit to gross revenue on sales

60.6% or 6:10

Debt To Equity: long-term liabilities to owners equity

0% or 0:0

StratoSync, Inc Business Plan Executive Summary

Confidential 40 StratoSync, Inc 2008

Executive Summary

The inspiration to start StratoSync came in the form of a NYC subway ride in June 2007.

Since then, what was once an idea for a product has turned into a money making infrastructure of

products and services to make peoples lives easier- an iTunes for mobile phones- a Google for

mobile users. StratoSyncs objective is to make life more enjoyable by conveniently bringing all

desired information under the sky directly to a user using innovative technology.

StratoSync expects to accomplish this mission by using its highlight product, the uCast. All

the products and services that StratoSync will deliver will revolve around this product. Its main

feature enables user-access to their home-docked iPod on any supported electronic on the

infrastructure, where at the time of release includes mobile phones and internet-connected

computers. Future-supported electronics include vehicle dashboards, television sets, and many other

mediums. Also in the future, those users who wish to listen to artists they do not have, a music store

will be available to their disposal, working in conjunction with StratoSyncs mobile data storage

solution, uDrive.

The majority of company revenue will come from product manufacturing and distribution

to various retailers including major electronic retailers and mobile phone providers. For the first year,

StratoSync will not incorporate these extra services, as concentrating on market penetration is a key

objective. Another reason for this decision is not to compete with mobile phone providers music

services, as they will play a key element in product distribution and market demand. To expand

connectivity to other devices, and consequently enhancing the level of convenience available to a

user, StratoSync will take up product licensing as an internal business model. When StratoSync

licenses support to third-party companies and their respective products so they can communicate

with the uCast, hardware requirements and quality control guidelines will be in place.

StratoSync, Inc Business Plan Executive Summary

Confidential 41 StratoSync, Inc 2008

The target market for StratoSync and its products and services include mobile phone

subscribers with broadband network speeds, home broadband internet subscribers, and owners of the

iPod. Currently there more than 500 million broadband mobile subscribers, more than 300 million

broadband internet subscribers, and over 120 million iPod owners.

StratoSync is at a slight disadvantage as far as selling media over a mobile medium. Apple

Inc has over 70% market share of digital music downloads and most major providers of mobile

phone service have music stores built in. In response, StratoSyncs competitive advantage includes an

innovative pricing strategy and a patented method of delivery that revolves around its free software.

Essentially, the value of StratoSync comes from its product abilities, specifically remote

access of the iPod. Noteworthy, bringing a mobile-exclusive data storage service to the market will

help gain reputability to StratoSyncs mission statement and open doors for other companies. Also

the introduction of mobile payment transaction solution, uWallet, will help raise the value of

StratoSync on a customer level as well as on a market level.

The goals of the company include the following: assembly of a production-ready prototype

of the uCast, submission of a non-provisional patent through a legal firm, establishing partnerships

with major retailers worldwide, and establishing an operation facility with a customer support call

center. Secondary goals include growing the license portfolio that extends uCast capabilities to other

devices, implementing the auxiliary services into the company infrastructure, and create new

products and services.

The purpose of this plan is to propose the capitalization of StratoSync Inc and seek funding

for the development of its feature product, the uCast.

Required Capital: 3.12 Million USD

Recommended Capital: 3.12 to 5 Million USD

for additional padding and selective marketing.

Das könnte Ihnen auch gefallen

- The Only Absolute Way Left For Little Guy To Get Rich On InternetDokument47 SeitenThe Only Absolute Way Left For Little Guy To Get Rich On Internetcash365Noch keine Bewertungen

- Software Startup - Business PlanDokument32 SeitenSoftware Startup - Business Planadoniscal100% (2)

- HDFC Bank Credit Card ChargesDokument12 SeitenHDFC Bank Credit Card ChargesKumar RockyNoch keine Bewertungen

- TRACS 17 Technology, Media, Telecom PrimerDokument133 SeitenTRACS 17 Technology, Media, Telecom Primermattdough100% (2)

- Use Iot To Advance Railway Predictive Maintenance WhitepaperDokument28 SeitenUse Iot To Advance Railway Predictive Maintenance Whitepaperdwi hananto bayu aji100% (1)

- International Botnet and Iot Security GuideDokument57 SeitenInternational Botnet and Iot Security GuidestrokenfilledNoch keine Bewertungen

- Booking.com confirmation for stay at The LaLiT Golf & Spa Resort GoaDokument2 SeitenBooking.com confirmation for stay at The LaLiT Golf & Spa Resort GoaNitin GuptaNoch keine Bewertungen

- Blinkist Know Yourself Know Your Money by Rachel CruzeDokument14 SeitenBlinkist Know Yourself Know Your Money by Rachel CruzeAisyah SumariNoch keine Bewertungen

- Digital Transformation in Freight TransportDokument24 SeitenDigital Transformation in Freight TransportAhsan AfzalNoch keine Bewertungen

- AI White Paper PDFDokument20 SeitenAI White Paper PDFUsman GhaniNoch keine Bewertungen

- Adjusting Entries FarDokument2 SeitenAdjusting Entries FarKylha BalmoriNoch keine Bewertungen

- Ielts7.guru Task 2 Writing Sample Pack v1.1 PDFDokument44 SeitenIelts7.guru Task 2 Writing Sample Pack v1.1 PDFHardik Jani88% (8)

- Telematics: Gear Shift in The Automotive IndustryDokument10 SeitenTelematics: Gear Shift in The Automotive IndustryDeepak DuggadNoch keine Bewertungen

- Business Plan for a 3D Digital Marketplace and NFT PlatformDokument37 SeitenBusiness Plan for a 3D Digital Marketplace and NFT PlatformRicco BenNoch keine Bewertungen

- Digital Transformation in Freight TransportDokument26 SeitenDigital Transformation in Freight TransportfahdNoch keine Bewertungen

- MSC Digital LeadershipDokument13 SeitenMSC Digital LeadershipAlina khan100% (1)

- DCK-datacenter Strategies PDFDokument26 SeitenDCK-datacenter Strategies PDFtkphamy2k9273Noch keine Bewertungen

- Hype Cycle For Unified Communications and Collaboration - Gartner 2018Dokument60 SeitenHype Cycle For Unified Communications and Collaboration - Gartner 2018Resham Siddiqui100% (1)

- Data & Analytics Maturity Model & Business ImpactDokument28 SeitenData & Analytics Maturity Model & Business Impactlana_wiajya100% (1)

- Digital Transformation in IndustryDokument35 SeitenDigital Transformation in IndustrySatyaveer Rhythem PalNoch keine Bewertungen

- Data-Driven Business Models in Connected Cars, Mobility Services & BeyondDokument58 SeitenData-Driven Business Models in Connected Cars, Mobility Services & BeyondHadi SedaghatNoch keine Bewertungen

- SKY Cable Statement BreakdownDokument2 SeitenSKY Cable Statement BreakdownAidel AndrewNoch keine Bewertungen

- WhatsApp Pay: A Concise Guide to Features and RisksDokument5 SeitenWhatsApp Pay: A Concise Guide to Features and RisksSabya BaliarsinghNoch keine Bewertungen

- MuleSoft Digital Transformation BlueprintDokument30 SeitenMuleSoft Digital Transformation BlueprintxalibeutNoch keine Bewertungen

- Business Plan On HandicraftDokument31 SeitenBusiness Plan On Handicraftbiplob100% (1)

- CMDokument23 SeitenCMlakshita pabuwalNoch keine Bewertungen

- Digital Asset & Commodity ExchangeDokument39 SeitenDigital Asset & Commodity ExchangeJun JunNoch keine Bewertungen

- Cloud Computing Policy 2020Dokument31 SeitenCloud Computing Policy 2020Saint ClarksonNoch keine Bewertungen

- Research PaperDokument20 SeitenResearch PaperJakia Sultana BrishtiNoch keine Bewertungen

- Hype Cycle For It Outsourcin 205037Dokument94 SeitenHype Cycle For It Outsourcin 205037sant_shivNoch keine Bewertungen

- Hitachi Sunway Expands to Brazil with IT SolutionsDokument25 SeitenHitachi Sunway Expands to Brazil with IT Solutionsacex00Noch keine Bewertungen

- OR152481Dokument9 SeitenOR152481Ramneek JainNoch keine Bewertungen

- GXChain WhitePaper v3.0 ENDokument42 SeitenGXChain WhitePaper v3.0 ENRZW RNoch keine Bewertungen

- OSMOTECH ICT Business Plan SummaryDokument17 SeitenOSMOTECH ICT Business Plan SummaryTlholohelo HatlaneNoch keine Bewertungen

- Student ID 000000 Last Name Business Capstone Business Plan Version Page 1Dokument24 SeitenStudent ID 000000 Last Name Business Capstone Business Plan Version Page 1frankieNoch keine Bewertungen

- Information Technology & Information System: Cource Constructor Prepared byDokument13 SeitenInformation Technology & Information System: Cource Constructor Prepared byfahmida afrozNoch keine Bewertungen

- Well Referenced Assignment Example 1Dokument21 SeitenWell Referenced Assignment Example 1vortex.vista007Noch keine Bewertungen

- Bbe A1.2Dokument15 SeitenBbe A1.2Nguyen Ba DuyNoch keine Bewertungen

- Fast Sample IT Business Plan SummaryDokument30 SeitenFast Sample IT Business Plan SummaryRimsha ShahidNoch keine Bewertungen

- Digital Business Marketplace Catalyst - Whitepaper V1.1 PDFDokument60 SeitenDigital Business Marketplace Catalyst - Whitepaper V1.1 PDFTestNoch keine Bewertungen

- Business Plan April 24, 2007: Muhammad Raza Michael Vachette Thomas Deslandres Kendall Chuang Shawn LanktonDokument23 SeitenBusiness Plan April 24, 2007: Muhammad Raza Michael Vachette Thomas Deslandres Kendall Chuang Shawn LanktonellehuNoch keine Bewertungen

- BIS2018 Report 3000 WordsDokument18 SeitenBIS2018 Report 3000 WordsNadia RiazNoch keine Bewertungen

- Building IoT’s Trust Anchor with TaraxaDokument22 SeitenBuilding IoT’s Trust Anchor with TaraxabubanjNoch keine Bewertungen