Beruflich Dokumente

Kultur Dokumente

Harshit Manaktala (23) Soundararajan.R (59) Ananya Pratap Singh Ragini Anand Tushar

Hochgeladen von

Ananya Pratap Singh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

225 Ansichten14 SeitenThis document appears to be a certificate for a project submitted by a group of students to their professor at Symbiosis Law School in India. It includes an introduction, acknowledgements, and index sections. The introduction provides a high-level overview of capital markets, including that they help channel funds from savers to institutions and consist of primary and secondary markets. It also outlines some of the key roles and importance of capital markets in India, such as mobilizing savings, raising long-term capital, promoting industrial growth, and providing a ready market.

Originalbeschreibung:

Capital Market

Originaltitel

Capital Market

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document appears to be a certificate for a project submitted by a group of students to their professor at Symbiosis Law School in India. It includes an introduction, acknowledgements, and index sections. The introduction provides a high-level overview of capital markets, including that they help channel funds from savers to institutions and consist of primary and secondary markets. It also outlines some of the key roles and importance of capital markets in India, such as mobilizing savings, raising long-term capital, promoting industrial growth, and providing a ready market.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

225 Ansichten14 SeitenHarshit Manaktala (23) Soundararajan.R (59) Ananya Pratap Singh Ragini Anand Tushar

Hochgeladen von

Ananya Pratap SinghThis document appears to be a certificate for a project submitted by a group of students to their professor at Symbiosis Law School in India. It includes an introduction, acknowledgements, and index sections. The introduction provides a high-level overview of capital markets, including that they help channel funds from savers to institutions and consist of primary and secondary markets. It also outlines some of the key roles and importance of capital markets in India, such as mobilizing savings, raising long-term capital, promoting industrial growth, and providing a ready market.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 14

Submitted by

Harshit Manaktala (23)

Soundararajan.R (59)

Ananya Pratap Singh

Ragini Anand

Tushar

Division C Class BBA.LLB

September, 2013

Under the guidance of

Prof. Sandeep Bhatia

Faculty in-charge

Symbiosis Law School, NOIDA

Symbiosis International University, Pune.

C E R T I F I C A T E

The project entitled submitted to the Symbiosis Law School,

NOIDA for Financial Management and Corporate Governance as part of

internal assessment is based on my original work carried out under the guidance

of Prof. Sandeep from July to October. The research work has not been

submitted elsewhere for award of any degree. The material borrowed from other

sources and incorporated in the thesis has been duly acknowledged.

We understand that we our self could be held responsible and accountable for

plagiarism, if any, detected later on.

Signature of the candidate

Date: 29-09-2013

A C K N O W L E D G E M E N T S

We would like to express our special thanks of gratitude to Prof. Sandeep

Bhatia who gave me the golden opportunity to do this wonderful project on the

topic , in Finance Management and Corporate Governance

which also helped me in doing a lot of Research and We came to know about

so many new things.

Secondly We would also like to thank our friends who helped us a lot in

completing this project within the prescribed time.

Signature

I N D E X

Introduction

Capital market is a market where buyers and sellers engage in trade of financial securities

like bonds, stocks, etc. The buying/selling is undertaken by participants such as individuals

and institutions. Capital markets help channelize surplus funds from savers to institutions

which then invest them into productive use. Generally, this market trades mostly in long-term

securities.

Capital market consists of primary markets and secondary markets. Primary markets deal

with trade of new issues of stocks and other securities, whereas secondary market deals with

the exchange of existing or previously-issued securities. Another important division in the

capital market is made on the basis of the nature of security traded, i.e. stock market and bond

market.

There are two types of capital markets

1. Primary market

The primary market is that part of the capital markets that deals with the issuance of new

securities. Companies, governments or public sector institutions can obtain

funding through the sale of a new stock or bond issue. This is typically done through a

syndicate of securities dealers. The process of selling new issues to investors is called

underwriting. In the case of a new stock issue, this sale is an initial public offering (IPO).

Dealers earn a commission that is built into the price of the security offering, though it can be

found in the prospectus.

Features of primary markets are:

1. This is the market for new long term equity capital. The primary market is the market

where the securities are sold for the first time. Therefore it is also called the new issue

market (NIM).

2. In a primary issue, the securities are issued by the company directly to investors.

3. The company receives the money and issues new security certificates to the investors.

4. Primary issues are used by companies for the purpose of setting up new business or

for expanding or modernizing the existing business.

5. The primary market performs the crucial function of facilitating capital formation in

the economy.

6. The new issue market does not include certain other sources of new long term

external finance, such as loans from financial institutions. Borrowers in the new issue

market may be raising capital for converting private capital into public capital; this is

known as going public.

7. The financial assets sold can only be redeemed by the original holder.

Methods of issuing securities in the primary market are:

Initial public offering;

Rights issue (for existing companies);

Preferential issue.

Initial public offering

2. Secondary market

The secondary market, also known as the aftermarket, is the financial market where

previously issued securities and financial instruments such as stock, bonds, options, and

futures are bought and sold. The term secondary market is also used to refer to the market

for any used goods or assets, or an alternative use for an existing product or asset where the

customer base is the second market (for example, corn has been traditionally used primarily

for food production and feedstock, but a second- or third- market has developed for use in

ethanol production). Another commonly referred to usage of secondary market term is to

refer to loans which are sold by a mortgage bank to investors such as Fannie Mae and Freddie

Mac.

With primary issuances of securities or financial instruments, or the primary market,

investors purchase these securities directly from issuers such as corporations issuing shares in

an IPO or private placement, or directly from the federal government in the case of treasuries.

After the initial issuance, investors can purchase from other investors in the secondary

market.

The secondary market for a variety of assets can vary from loans to stocks, from fragmented

to centralized, and from illiquid to very liquid. The major stock exchanges are the most

visible example of liquid secondary markets in this case, for stocks of publicly traded

companies. Exchanges such as the New York Stock Exchange, Nasdaq and the American

Stock Exchange provide a centralized, liquid secondary market for the investors who own

stocks that trade on those exchanges. Most bonds and structured products trade over the

counter, or by phoning the bond desk of ones broker-dealer. Loans sometimes trade online

using a Loan Exchange.

Features of secondary market are-

(1) It Creates Liquidity:

The most important feature of the secondary market is to create liquidity in securities.

Liquidity means immediate conversion of securities into cash. This job is performed by the

secondary market.

(2) It Comes after Primary Market:

Any new security cannot be sold for the first time in the secondary market. New securities are

first sold in the primary market and thereafter comes the turn of the secondary market.

(3) It has a Particular Place:

The secondary market has a particular place which is called Stock Exchange. However, it

must be noted that it is not essential that all the buying and selling of securities will be done

only through stock exchange.

Two individuals can buy or sell them mutually. This will also be called a transaction of the

secondary market. Generally, most of the transactions are made through the medium of stock

exchange.

(4) It Encourages New Investment:

The rates of shares and other securities often fluctuate in the share market. Many new

investors enter this market to exploit this situation. This leads to an increase in investment in

the industrial sector of the country.

ROLE AND IMPORTANCE OF CAPITAL MARKET IN INDIA

Capital market has a crucial significance to capital formation. For a speedy economic

development adequate capital formation is necessary. The significance of capital market in

economic development is explained below :-

1. Mobilisation Of Savings And Acceleration Of Capital Formation -

In developing countries like India the importance of capital market is self evident. In this

market, various types of securities help in mobilising savings from various sectors of

population. The twin features of reasonable return and liquidity in stock exchange are definite

incentives to the people to invest in securities. This accelerates the capital formation in the

country.

2. Raising Long - Term Capital -

The existence of a stock exchange enables companies to raise permanent capital. The

investors cannot commit their funds for a permanent period but companies require funds

permanently. The stock exchange resolves this dash of interests by offering an opportunity to

investors to buy or sell their securities, while permanent capital with the company remains

unaffected.

3. Promotion Of Industrial Growth -

The stock exchange is a central market through which resources are transferred to the

industrial sector of the economy. The existence of such an institution encourages people to

invest in productive channels. Thus it stimulates industrial growth and economic

development of the country by mobilising funds for investment in the corporate securities.

4. Ready And Continuous Market -

The stock exchange provides a central convenient place where buyers and sellers can easily

purchase and sell securities. Easy marketability makes investment in securities more liquid as

compared to other assets.

5. Technical Assistance -

An important shortage faced by entrepreneurs in developing countries is technical assistance.

By offering advisory services relating to preparation of feasibility reports, identifying growth

potential and training entrepreneurs in project management, the financial intermediaries in

capital market play an important role.

6. Reliable Guide To Performance -

The capital market serves as a reliable guide to the performance and financial position of

corporates, and thereby promotes efficiency.

7. Proper Channelization Of Funds -

The prevailing market price of a security and relative yield are the guiding factors for the

people to channelize their funds in a particular company. This ensures effective utilisation of

funds in the public interest.

8. Provision Of Variety Of Services -

The financial institutions functioning in the capital market provide a variety of services such

as grant of long term and medium term loans to entrepreneurs, provision of underwriting

facilities, assistance in promotion of companies, participation in equity capital, giving expert

advice etc.

9. Development Of Backward Areas -

Capital Markets provide funds for projects in backward areas. This facilitates economic

development of backward areas. Long term funds are also provided for development projects

in backward and rural areas.

10. Foreign Capital -

Capital markets makes possible to generate foreign capital. Indian firms are able to generate

capital funds from overseas markets by way of bonds and other securities. Government has

liberalised Foreign Direct Investment (FDI) in the country. This not only brings in foreign

capital but also foreign technology which is important for economic development of the

country.

11. Easy Liquidity -

With the help of secondary market investors can sell off their holdings and convert them into

liquid cash. Commercial banks also allow investors to withdraw their deposits, as and when

they are in need of funds.

12. Revival Of Sick Units -

The Commercial and Financial Institutions provide timely financial assistance to viable sick

units to overcome their industrial sickness. To help the weak units to overcome their financial

industrial sickness banks and FIs may write off a part of their loan.

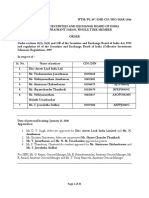

STOCK ANALYSIS OF LEADING COMPANIES

Nestle India

Rate of return on investments

If I had purchased 100 shares of Nestle India at Rs. 4100 each, on 01-01-2012 and had sold

them for Rs. 4990 per share on 01-01-2013

1

, the rate of return on my investment would have

been-

Net proceeds/ cost price, i.e.

[(4990-4100) / 4100] X 100= 21.71%

Earning per share

Earning per share in 2012 = (Net Profit- Preference dividend)/ No. of shares in issue

i.e. EPS= (106793-0) / 964.16 (in lakhs)

= Rs. 110.76

1

As provided on moneycontrol.com

NTPC

Rate of return on investment

If I had purchased 100 shares of NTPC on 1-1-2012 for Rs. 160 each and sold them for Rs.

157 per share on 1-1-2013, the rate of return on my investment would have been

[(157-160) / 160] X 100 = -1.87 %

Earning per share

EPS in 2012 = 981466 / 82454.64 (in lakhs)

= Rs. 11.90

PVR

Rate of return on investment

If I had purchased 100 shares of PVR on 01-01-2012 for Rs. 132 per share and had sold them

for Rs. 285 on 01-01-2013, the rate of return on my investment would be

[(285-132) / 132] X 100 = 115.91%

Earning per share

EPS in 2012 = 2528/ 259.03 (in lakhs)

= Rs. 9.76

ONGC

Rate of return on investment

If I had purchased 100 shares of ONGC on 1-1-2012 for Rs. 259 and had sold them for Rs.

270 on 1-1-2013, the rate of return on my investment would have been

[(270-259) / 259] X 100 = 4.25%

Earning per share

EPS in 2012 = 2842891 / 85554.90 (in lakhs)

= Rs. 33.23

TVS MOTOR COMPANY

Rate of Return on Investment

If I had purchased 100 shares of Rs. 52.50 each on 1-1-2012 and had sold them for Rs. 42.50

on 1-1-2013, the rate of return on my investment would have been

[(42.50 52.50) / 52.50] X 100 = - 19.05%

Earning per share

EPS in 2012 = 19898 / 4750.87 (in lakhs)

= Rs. 4.19

Reliance Industries

Rate of return on investment

If I had purchased 100 shares of Reliance Industries for Rs. 713 each on 1-1-2012 and had sold them

for Rs. 845each on 1-1-2013, the rate of return on my investment would have been-

[(845-713) / 713] X 100 = 18.51%

Earning per share

EPS in 2012 = 2088600 / 29363.09 (in lakhs)

= Rs. 71.13

B I B L I O G R A P H Y

1. Last seen on 20

th

September 2013 at http://www.yourarticlelibrary.com

2. Last retrieved on 23

rd

September 2013 at study-material4u.in

Das könnte Ihnen auch gefallen

- Notice of Acceptance TemplateDokument17 SeitenNotice of Acceptance TemplateEl Zargermone86% (7)

- Citadel 2001Dokument9 SeitenCitadel 2001mbt923Noch keine Bewertungen

- Notice: (To Recover Money (Legal Debts) )Dokument9 SeitenNotice: (To Recover Money (Legal Debts) )Ananya Pratap SinghNoch keine Bewertungen

- Money Market Concept, MeaningDokument4 SeitenMoney Market Concept, MeaningAbhishek ChauhanNoch keine Bewertungen

- Unit 10 Financial MarketsDokument9 SeitenUnit 10 Financial MarketsDURGESH MANI MISHRA PNoch keine Bewertungen

- FISD Tables & CodesDokument64 SeitenFISD Tables & CodesmfrastadNoch keine Bewertungen

- Bombay Stamp Act, 1958 Schedule I PDFDokument23 SeitenBombay Stamp Act, 1958 Schedule I PDFtejasj171484Noch keine Bewertungen

- Capital Market V/s Money MarketDokument23 SeitenCapital Market V/s Money Marketsaurabh kumarNoch keine Bewertungen

- Project of Company Law by A.P. SinghDokument16 SeitenProject of Company Law by A.P. SinghAnanya Pratap SinghNoch keine Bewertungen

- Money Market in India: A Project Report ONDokument35 SeitenMoney Market in India: A Project Report ONLovely SharmaNoch keine Bewertungen

- Demat Services of Karvy Stock Broking LTDDokument99 SeitenDemat Services of Karvy Stock Broking LTDSharn Gill100% (1)

- Project On Derivative MarketDokument124 SeitenProject On Derivative MarketArvind MahandhwalNoch keine Bewertungen

- Security Analysis and PortFolio Management Case StudyDokument4 SeitenSecurity Analysis and PortFolio Management Case StudyCT Sunilkumar50% (2)

- Depository System in IndiaDokument10 SeitenDepository System in Indiababloorabidwolverine100% (2)

- Efficiency of Depository SystemDokument71 SeitenEfficiency of Depository SystemdayaghelaniNoch keine Bewertungen

- Evolution of The Indian Financial SectorDokument18 SeitenEvolution of The Indian Financial SectorVikash JontyNoch keine Bewertungen

- Stock Market and Indian EconomyDokument62 SeitenStock Market and Indian Economyswapnilr85Noch keine Bewertungen

- Psda 1 CSR Activities For Companies Submitted By-Siddhi Khanna Submitted To - DR Richa Sharma ENROLLMENT NO - A0102321018 Sec - A Mba HR 2021-2023Dokument10 SeitenPsda 1 CSR Activities For Companies Submitted By-Siddhi Khanna Submitted To - DR Richa Sharma ENROLLMENT NO - A0102321018 Sec - A Mba HR 2021-2023Vaishnavi SomaniNoch keine Bewertungen

- A Study of Currency Derivatives in IndiaDokument5 SeitenA Study of Currency Derivatives in IndiaNikunj Bafna100% (1)

- Project Report: " To Analyse The Investment Behavior ofDokument43 SeitenProject Report: " To Analyse The Investment Behavior ofAnnu BallanNoch keine Bewertungen

- MR BrownDokument13 SeitenMR Brownmithun3790Noch keine Bewertungen

- Chapter No 1 IntroductionDokument33 SeitenChapter No 1 Introductionpooja shandilyaNoch keine Bewertungen

- A Study On International BankingDokument36 SeitenA Study On International Bankinganilpeddamalli0% (1)

- Innovative Financial ServicesDokument9 SeitenInnovative Financial ServicesShubham GuptaNoch keine Bewertungen

- Ifim Unit 1 - NotesDokument17 SeitenIfim Unit 1 - NotesJyot DhamiNoch keine Bewertungen

- Study of Derivatives: (Infosys LTD)Dokument66 SeitenStudy of Derivatives: (Infosys LTD)yash daraNoch keine Bewertungen

- FdI in Banking Sector in IndiaDokument38 SeitenFdI in Banking Sector in IndiaSumedhAmaneNoch keine Bewertungen

- A Study On Stock Market Volatility Pattern of BSE and NSE in IndiaDokument4 SeitenA Study On Stock Market Volatility Pattern of BSE and NSE in IndiaEditor IJTSRDNoch keine Bewertungen

- Role of Merchant Banker in WordDokument23 SeitenRole of Merchant Banker in WordchandranilNoch keine Bewertungen

- Abstract On Formation of SebiDokument2 SeitenAbstract On Formation of Sebireshmi duttaNoch keine Bewertungen

- Capital Market Project1Dokument99 SeitenCapital Market Project1Gary GaryNoch keine Bewertungen

- A Study On Impact of Financial Crisis On Indian Mutual FundsDokument86 SeitenA Study On Impact of Financial Crisis On Indian Mutual FundsTania MajumderNoch keine Bewertungen

- Project On Derivative Market With EquityDokument100 SeitenProject On Derivative Market With EquityNoorul AmbeyaNoch keine Bewertungen

- Unit I - Indian Financial Syaytem: An Overview: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Dokument51 SeitenUnit I - Indian Financial Syaytem: An Overview: Dnyansagar Arts and Commerce College, Balewadi, Pune - 45Nithin RajuNoch keine Bewertungen

- A Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionDokument88 SeitenA Comprehensive Study On Sebi Guidelines Regarding Investor ProtectionMohammad Ejaz AhmedNoch keine Bewertungen

- A Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDDokument15 SeitenA Summer Internship Project Report On A Study of Online Trading in Indian Stock Market at Mudrabiz LTDRupali BoradeNoch keine Bewertungen

- What Is Equity MarketDokument2 SeitenWhat Is Equity MarketVinod AroraNoch keine Bewertungen

- Banking Sector Reforms in IndiaDokument8 SeitenBanking Sector Reforms in IndiaJashan Singh GillNoch keine Bewertungen

- Mouni (Equity Analysis)Dokument22 SeitenMouni (Equity Analysis)arjunmba119624Noch keine Bewertungen

- Investment Pattern of Investors On Different Products Introduction EXECUTIVE SUMMARY An Investment Refers To The Commitment of Funds at PresentDokument33 SeitenInvestment Pattern of Investors On Different Products Introduction EXECUTIVE SUMMARY An Investment Refers To The Commitment of Funds at Presentnehag24Noch keine Bewertungen

- Mutual Fund: An Attractive Investment OptionDokument117 SeitenMutual Fund: An Attractive Investment OptionMohammad FaizanNoch keine Bewertungen

- Role of Credit Rating Agencies in IndiaDokument14 SeitenRole of Credit Rating Agencies in IndiaPriyaranjan SinghNoch keine Bewertungen

- Unit 2 Financial System and Its ComponenetsDokument54 SeitenUnit 2 Financial System and Its Componenetsaishwarya raikar100% (1)

- Indian Capital MarketDokument35 SeitenIndian Capital MarketVivek Rai100% (1)

- International Trade and Finance (Derivatives)Dokument52 SeitenInternational Trade and Finance (Derivatives)NikhilChainani100% (1)

- Mutual Fund Project LLM2Dokument122 SeitenMutual Fund Project LLM2Adv Moumita Dey BhuwalkaNoch keine Bewertungen

- Azeem Complete Thesis Imran AzeemDokument68 SeitenAzeem Complete Thesis Imran AzeemImran Hassan100% (1)

- Prit PPT ProjectDokument16 SeitenPrit PPT ProjectpriteshNoch keine Bewertungen

- Mutual FundDokument170 SeitenMutual FundPatel UrveshNoch keine Bewertungen

- SynopsisDokument7 SeitenSynopsisPreetpal Singh VirkNoch keine Bewertungen

- A Project On Capital Market: Submitted To: Punjab Technical University, JalandharDokument95 SeitenA Project On Capital Market: Submitted To: Punjab Technical University, JalandharSourav ChoudharyNoch keine Bewertungen

- Ion of Mutual Funds With Other Investment OptionsDokument76 SeitenIon of Mutual Funds With Other Investment OptionsDiiivya100% (1)

- Recent Trend in New Issue MarketDokument14 SeitenRecent Trend in New Issue MarketAbhi SinhaNoch keine Bewertungen

- A Study On The Effectiveness of Tax Saving As A Selling Tool or Life Insurance Investment StrategyDokument6 SeitenA Study On The Effectiveness of Tax Saving As A Selling Tool or Life Insurance Investment StrategyVaishnavi ShenoyNoch keine Bewertungen

- NABARDDokument25 SeitenNABARDAmit KumarNoch keine Bewertungen

- Chapter-1: Introduction To Mutual FundsDokument37 SeitenChapter-1: Introduction To Mutual Fundsrajesh nagaNoch keine Bewertungen

- Vidyalankar Marg, Wadala (East) Mumbai 400037.: Synopsis of The Project For The Subject AreaDokument7 SeitenVidyalankar Marg, Wadala (East) Mumbai 400037.: Synopsis of The Project For The Subject AreaYaash ChogleNoch keine Bewertungen

- Dissertation Report CSRDokument47 SeitenDissertation Report CSRtrishlaNoch keine Bewertungen

- Sharekhan Satisfaction LevelDokument116 SeitenSharekhan Satisfaction LevelamericaspaydayloansNoch keine Bewertungen

- Amity Business School: Dissertation Weekly Progress Report For The Week 01Dokument2 SeitenAmity Business School: Dissertation Weekly Progress Report For The Week 01Aakanksha JainNoch keine Bewertungen

- Corporate Finance ProjectDokument14 SeitenCorporate Finance ProjectAspiring StudentNoch keine Bewertungen

- National Stock ExchangeDokument11 SeitenNational Stock ExchangeKaustubh PatelNoch keine Bewertungen

- Mergers & AcquisitionsDokument123 SeitenMergers & Acquisitionssmh9662Noch keine Bewertungen

- The Four Walls: Live Like the Wind, Free, Without HindrancesVon EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesBewertung: 5 von 5 Sternen5/5 (1)

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorVon EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNoch keine Bewertungen

- Sca195372022 GJHC240636132022 1 28092022Dokument28 SeitenSca195372022 GJHC240636132022 1 28092022Ananya Pratap SinghNoch keine Bewertungen

- UOI V EraDokument21 SeitenUOI V EraAnanya Pratap SinghNoch keine Bewertungen

- Note On SettiNote On Setting Up A Renewable Energy Projectng Up A Renewable Energy Project EditedDokument9 SeitenNote On SettiNote On Setting Up A Renewable Energy Projectng Up A Renewable Energy Project EditedAnanya Pratap SinghNoch keine Bewertungen

- Interpretation of Data: 2. Significance of The ProjectDokument4 SeitenInterpretation of Data: 2. Significance of The ProjectAnanya Pratap SinghNoch keine Bewertungen

- Project Report of ContractDokument19 SeitenProject Report of ContractAnanya Pratap Singh100% (1)

- A. Ecomate Holdings Berhad - Draft Prospectus (Without Price)Dokument305 SeitenA. Ecomate Holdings Berhad - Draft Prospectus (Without Price)JoNoch keine Bewertungen

- Epayments 149Dokument11 SeitenEpayments 149Hassan Murtaza QaziNoch keine Bewertungen

- Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDokument12 SeitenMatriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentrekerttanaNoch keine Bewertungen

- State Bank & National Bank McqsDokument26 SeitenState Bank & National Bank McqsNazim Shahzad100% (1)

- Capital Market in India and Identification of IndexDokument17 SeitenCapital Market in India and Identification of Indexmahesh19689Noch keine Bewertungen

- JobsOhio Bond Deal CircularDokument253 SeitenJobsOhio Bond Deal CircularJosephNoch keine Bewertungen

- Balucan InAcc Week 3Dokument14 SeitenBalucan InAcc Week 3Luigi Enderez BalucanNoch keine Bewertungen

- FIN619 Project VUDokument84 SeitenFIN619 Project VUsunny_fzNoch keine Bewertungen

- Chapter 16 - Foreign Exchange MarketsDokument19 SeitenChapter 16 - Foreign Exchange MarketsLevi Emmanuel Veloso BravoNoch keine Bewertungen

- Rates 104 - Debt Instruments 1Dokument42 SeitenRates 104 - Debt Instruments 1ssj7cjqq2dNoch keine Bewertungen

- Order in The Matter of Disc Assets Lead India LTDDokument25 SeitenOrder in The Matter of Disc Assets Lead India LTDShyam SunderNoch keine Bewertungen

- Determining Margin Levels Using Risk Modelling: Alexander Argiriou Argiriou@kth - Se October 12, 2009Dokument47 SeitenDetermining Margin Levels Using Risk Modelling: Alexander Argiriou Argiriou@kth - Se October 12, 2009samreportNoch keine Bewertungen

- Investment Management: UNIT-2 Securities MarketsDokument10 SeitenInvestment Management: UNIT-2 Securities MarketsChand BashaNoch keine Bewertungen

- Glossary For Capital IQDokument26 SeitenGlossary For Capital IQHimanshu RanjanNoch keine Bewertungen

- Summer Internship Report (Nitin)Dokument28 SeitenSummer Internship Report (Nitin)Viswajit100% (1)

- Internship Report ANURAG NewDokument32 SeitenInternship Report ANURAG NewMusic LoverNoch keine Bewertungen

- SARFAESI Act PDFDokument36 SeitenSARFAESI Act PDFvarshneyankit1100% (5)

- Members and ShareholdersDokument2 SeitenMembers and Shareholdersimad0% (2)

- Ms8-Set C Midterm - With AnswersDokument5 SeitenMs8-Set C Midterm - With AnswersOscar Bocayes Jr.Noch keine Bewertungen

- Financial MNGT 2022Dokument85 SeitenFinancial MNGT 2022Beky AbrahamNoch keine Bewertungen

- Insurance - EDELDokument146 SeitenInsurance - EDELSaeed JafferyNoch keine Bewertungen

- Accounting Textbook Solutions - 63Dokument19 SeitenAccounting Textbook Solutions - 63acc-expertNoch keine Bewertungen

- LKAS 34-Interim Financial ReportingDokument19 SeitenLKAS 34-Interim Financial ReportingAmaya AmarasingheNoch keine Bewertungen

- The Organization of The Fi Nancial Industry: Lead inDokument5 SeitenThe Organization of The Fi Nancial Industry: Lead indorotak89Noch keine Bewertungen

- Final Project TybmsDokument57 SeitenFinal Project TybmsAnkit Chaurasiya50% (2)