Beruflich Dokumente

Kultur Dokumente

Quarterly Update: First Half 2014 Results

Hochgeladen von

sapigagah0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten4 SeitenQUARTERLY UPDATE FIRST HALF 2014 RESULTS Debts and Cash Debts Composition Consolidated Statements of Financial Position In Billion Rupiah 2013 1H 14 Total Current Assets 32,464. 38,588. Cash and Cash Equivalents 13,666. 14,346.

Originalbeschreibung:

Originaltitel

Indf Web 1h 2014

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenQUARTERLY UPDATE FIRST HALF 2014 RESULTS Debts and Cash Debts Composition Consolidated Statements of Financial Position In Billion Rupiah 2013 1H 14 Total Current Assets 32,464. 38,588. Cash and Cash Equivalents 13,666. 14,346.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten4 SeitenQuarterly Update: First Half 2014 Results

Hochgeladen von

sapigagahQUARTERLY UPDATE FIRST HALF 2014 RESULTS Debts and Cash Debts Composition Consolidated Statements of Financial Position In Billion Rupiah 2013 1H 14 Total Current Assets 32,464. 38,588. Cash and Cash Equivalents 13,666. 14,346.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

QUARTERLY UPDATE

FIRST HALF 2014 RESULTS

Debts & Cash

Debts Composition

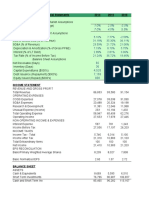

Consolidated Statements of Financial Position

In Billion Rupiah 2013 1H 14

Total Current Assets 32,464.5 38,588.8

Cash & Cash Equivalents 13,666.2 14,346.5

Accounts Receivable - Net 4,959.4 5,558.9

Inventories - Net 8,160.5 10,121.8

Other Current Assets 5,678.3 8,561.7

Total Non Current Assets 45,628.3 47,663.5

Plantations, Property, Plant & Equipment - Net 30,887.3 32,437.5

Other Non-Current Assets 14,741.0 15,226.0

Total Assets 78,092.8 86,252.3

Total Current Liabilities 19,471.3 23,599.5

Short-term Loans, Trust Receipts & Current

Maturities of Long-term Loans 12,031.8 12,711.8

Trade & Other Current Liabilities 7,439.5 10,887.7

Total Non Current Liabilities 20,248.5 23,036.5

Long-term Loans 15,324.3 18,021.2

Other Non-Current Liabilities 4,924.1 5,015.3

Total Liabilities 39,719.8 46,636.0

Total Equity 38,373.1 39,616.4

Ending Exchange Rate to USD 12,189 11,969

Rp Bn

Foreign

Currency

Rp Equiv

(Bn)

Total Rp

Bn

Short-term Debts 4,806.1 660.5 7,905.7 12,711.8

Short-term Debts & Trust Receipts 3,346.2 636.0 7,612.8 10,959.1

Current Portion of Long-term Debts 1,459.9 24.5 292.8 1,752.7

Long-term Debts 8,193.6 821.1 9,827.6 18,021.2

Bank Loans 4,210.0 818.2 9,793.5 14,003.5

Bonds 3,983.6 - - 3,983.6

Liability for Purchases of Fixed Assets - 2.9 34.2 34.2

Liability for Purchases of Fixed Assets - - -

Total Debts 12,999.8 1,481.6 17,733.2 30,733.0

Cash and Cash Equivalents 9,171.1 432.4 5,175.4 14,346.5

QUARTERLY UPDATE

FIRST HALF 2014 RESULTS

85%

15% Domestic

Overseas

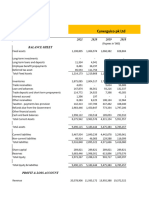

Consolidated Statements of Income Financial & Operating Ratios

Sales Mix Overseas

US$441.8 mn

1) Attributable to equity holders of the parent entity

2) Returns represents total return including non-controlling interests

3) Based on trailing numerator for 1H14 figure

4) EBIT as numerator

* Restated

In Billion Rupiah 1H13 1H 14 Growth

Net Sales 26,932.9 34,066.1 26.5%

Cost of Goods Sold 20,468.7 24,704.7 20.7%

Gross Profit 6,464.3 9,361.4 44.8%

Selling and Distribution Expenses (2,233.9) (3,063.2) 37.1%

General and Administrative Expenses (1,468.2) (2,043.4) 39.2%

Other operating income 349.9 316.0 -9.7%

Other operating expenses (184.3) (179.7) -2.5%

Income From Operations (EBIT) 2,927.8 4,391.1 50.0%

EBITDA 3,890.3 5,575.5 43.3%

Finance income 265.1 507.8 91.6%

Finance expenses (598.3) (825.1) 37.9%

Share in net income (loss) of associates 99.2 (73.9) -174.5%

Income Before Income Tax 2,693.8 3,999.9 48.5%

Income Tax Expense - Net (625.0) (1,014.5) 62.3%

Income before pro forma adjustment 2,068.8 2,985.4 44.3%

Pro forma adjustment (1.1) - -100.0%

Income for the year 2,067.7 2,985.4 44.4%

Equity holders of the parent entity 1,703.4 2,289.2 34.4%

Non-controlling interests 364.4 696.2 91.1%

Core Profit

1)

1,774.0 2,246.9 26.7%

Gross Profit Margin 24.0% 27.5%

EBIT Margin 10.9% 12.9%

EBITDA Margin 14.4% 16.4%

Net Income Margin

1)

6.3% 6.7%

Avg. Exchange Rate 9,750 11,751

*

2013 1H 14

Profitability Ratio

ROA

2) 3)

5.0% 5.7%

ROE

2) 3)

9.4% 11.7%

ROCE

2) 3) 4)

11.7% 13.3%

Liquidity Ratio

Current Ratio

1.67 1.64

Debt Ratio

Gross Gearing (incl. Trust Receipt)

0.71 0.78

Gross Gearing (excl. Trust Receipt)

0.61 0.66

Net Gearing (incl. Trust Receipt)

0.27 0.26

Net Gearing (excl. Trust Receipt)

0.16 0.14

Interest Coverage

3)

7.9 7.4

Earnings Per Share

1)

285 261

Share Price

6,600 6,700

Market Cap. (Rp. Bn)

57,951 58,829

Price / Book Value

2.45 2.41

Price / EPS

3)

23.14 19.03

Enterprise Value (Rp Bn)

82,967 90,437

Enterprise Value / EBITDA Multiple

3)

9.43 8.63

QUARTERLY UPDATE

FIRST HALF 2014 RESULTS

Segment Contribution

Segment Performance

EBIT

3)

1)

1) EBIT per segment: Before elimination and unallocated expenses

2) After elimination

3) After elimination and before unallocated expenses

* Restated

Sales

2)

*

* *

Sales (Rp Billion)

1H13 1H 14

External

Inter

Segment

Total External

Inter

Segment

Total 1H13 1H 14

Consumer Branded Products 12,101.2 53.0 12,154.2 14,991.5 51.3 15,042.9 12.8% 10.8%

Bogasari 7,138.4 1,904.1 9,042.5 8,172.3 2,046.5 10,218.7 9.0% 8.1%

Agribusiness 5,545.3 879.4 6,424.7 5,851.2 1,105.1 6,956.3 4.8% 15.7%

Distribution 2,148.0 - 2,148.0 2,468.5 - 2,468.5 3.6% 4.1%

Cultivation and Processed

Vegetables - - - 2,582.5 3.5 2,586.0 - 23.6%

Sub Total 26,932.9 2,836.5 29,769.4 34,066.1 3,206.4 37,272.5

Elimination - (2,836.5) (2,836.5) - (3,206.4) (3,206.4)

Unallocated Income (Expenses)

Total 26,932.9 - 26,932.9 34,066.1 - 34,066.1 10.9% 12.9%

Segment

EBIT Margin

1)

*

*

QUARTERLY UPDATE

FIRST HALF 2014 RESULTS

For further information, please contact:

Consolidated Statements of Cash Flows

INVESTOR RELATIONS DIVISION

Werianty Setiawan +62 21 5795 8822 Ext. 1215 E-mail: werianty@indofood.co.id

Clara Suraya +62 21 5795 8822 Ext. 1109 E-mail: clara.suraya@icbp.indofood.co.id

Cash & Cash Equivalents at Beginning & Ending after taking into account overdraft

** Restated

**

**

In Billion Rupiah 1H13 1H 14

Net Cash Flow from Operating Activities 2,177.0 3,953.7

Net Cash Flow from Investing Activities (5,246.9) (5,947.7)

Proceeds from sale of fixed assets and other non-current assets 62.7 18.8

Additions to fixed assets and plantations (2,409.4) (2,435.5)

Addition to intangible assets - (367.8)

Advance for purchases of Fixed assets (302.2) (274.2)

Acquisition of Subsidiaries, net of cash acquired (330.0) (35.0)

Investments in associates (2,267.9) (94.2)

Investments in time deposits - (2,651.6)

Capitalized future cane crop expenditures - (108.3)

Net Cash Flow from Financing Activities 2,920.0 2,908.1

Proceeds in short term bank loans 2,653.1 3,681.6

Proceeds from issuance of Rupiah Bonds VII - Net - 1,989.5

Proceeds from long term bank loans 1,459.3 1,370.8

Capital contribution from non-controlling interests 51.1 147.5

Proceeds from Advance for Subcription from non-controlling interests - 19.6

Payment of short term bank loans (872.4) (1,877.5)

Payment of Rupiah Bond V - (1,610.0)

Payment of long term bank loan (360.2) (585.8)

Purchase of treasury stock by a subsidiary - (166.3)

Investment in convertible notes - (57.0)

Payments of cash dividends by subsidiaries to non controlling interest (9.5) (4.4)

Payment of liability for purchases of fixed assets (1.4) -

Net Effects of Changes in Exchange Rates on Cash & Cash Equivalents 100.8 (113.6)

Net Increase (Decrease) in Cash & Cash Equivalents (49.1) 800.5

Cash & Cash Equivalents at Beginning of Period * 13,217.6 13,518.7

Cash & Cash Equivalents at End of Period * 13,168.6 14,319.3

**

Das könnte Ihnen auch gefallen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Income Statement and Balance Sheet AnalysisDokument10 SeitenIncome Statement and Balance Sheet AnalysisKi KiNoch keine Bewertungen

- Ratio Analysis of Engro Vs NestleDokument24 SeitenRatio Analysis of Engro Vs NestleMuhammad SalmanNoch keine Bewertungen

- Accounts AssignDokument9 SeitenAccounts AssigngauravdangeNoch keine Bewertungen

- FSA ProjectDokument59 SeitenFSA ProjectIslam AbdelshafyNoch keine Bewertungen

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDokument2 SeitenInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNoch keine Bewertungen

- INDIGO Cash FlowsDokument9 SeitenINDIGO Cash FlowsAyush SarawagiNoch keine Bewertungen

- Comman Size Analysis of Income StatementDokument11 SeitenComman Size Analysis of Income Statement4 7Noch keine Bewertungen

- In RM Million Unless Otherwise Stated: 2018 MfrsDokument4 SeitenIn RM Million Unless Otherwise Stated: 2018 MfrsTikah ZaiNoch keine Bewertungen

- Horizontal and VerticalDokument16 SeitenHorizontal and VerticalFadzir AmirNoch keine Bewertungen

- PV OIl Financial Spreadsheet AnalysisDokument32 SeitenPV OIl Financial Spreadsheet AnalysisNguyễn Minh ThànhNoch keine Bewertungen

- Assignment On Ratio Analysis of Tata Motors For 2007 and 2008Dokument8 SeitenAssignment On Ratio Analysis of Tata Motors For 2007 and 2008Chetan AgrawalNoch keine Bewertungen

- (A) Nature of Business of Cepatwawasan Group BerhadDokument16 Seiten(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNoch keine Bewertungen

- Ratio Analysis of TATA MOTORSDokument8 SeitenRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- 02 06 BeginDokument6 Seiten02 06 BeginnehaNoch keine Bewertungen

- 02 04 EndDokument6 Seiten02 04 EndnehaNoch keine Bewertungen

- CocaCola and PepsiCo-2Dokument23 SeitenCocaCola and PepsiCo-2Aditi KathinNoch keine Bewertungen

- Managerial-Finance-Project Orascom Report FinalDokument63 SeitenManagerial-Finance-Project Orascom Report FinalAmira OkashaNoch keine Bewertungen

- Year-to-Date Revenues and Income Analysis for Period Ending Dec 2010Dokument35 SeitenYear-to-Date Revenues and Income Analysis for Period Ending Dec 2010Kalenga CyrilleNoch keine Bewertungen

- Case 3Dokument53 SeitenCase 3ShirazeeNoch keine Bewertungen

- Financial Statement Analysis UnsolvedDokument3 SeitenFinancial Statement Analysis Unsolvedavani singhNoch keine Bewertungen

- 5 EstadosDokument15 Seiten5 EstadosHenryRuizNoch keine Bewertungen

- Financial Accounting AssignmentDokument14 SeitenFinancial Accounting AssignmentPoojith KumarNoch keine Bewertungen

- Donam Corporate FinanceDokument9 SeitenDonam Corporate FinanceMAGOMU DAN DAVIDNoch keine Bewertungen

- It Sept 13 Web EngDokument15 SeitenIt Sept 13 Web EngcoccobillerNoch keine Bewertungen

- Tesla 2018 Production ForecastDokument61 SeitenTesla 2018 Production ForecastAYUSH SHARMANoch keine Bewertungen

- Financial Statement PertaminaDokument10 SeitenFinancial Statement PertaminaAgnes Grace Florence SimanjuntakNoch keine Bewertungen

- System LimitedDokument11 SeitenSystem LimitedNabeel AhmadNoch keine Bewertungen

- Accounting Presentation (Beximco Pharma)Dokument18 SeitenAccounting Presentation (Beximco Pharma)asifonikNoch keine Bewertungen

- Assignment: Topic: Financial Statement Analysis of National Bank of PakistanDokument28 SeitenAssignment: Topic: Financial Statement Analysis of National Bank of PakistanSadaf AliNoch keine Bewertungen

- Asian PaintsDokument38 SeitenAsian PaintsKartikai MehtaNoch keine Bewertungen

- DG Khan Cement Financial StatementsDokument8 SeitenDG Khan Cement Financial StatementsAsad BumbiaNoch keine Bewertungen

- Philippine Seven Corporation and SubsidiariesDokument4 SeitenPhilippine Seven Corporation and Subsidiariesgirlie ValdezNoch keine Bewertungen

- Pacific Grove Spice CompanyDokument3 SeitenPacific Grove Spice CompanyLaura JavelaNoch keine Bewertungen

- Tesla Inc ModelDokument57 SeitenTesla Inc ModelRachel GreeneNoch keine Bewertungen

- BUY Bank of India: Performance HighlightsDokument12 SeitenBUY Bank of India: Performance Highlightsashish10mca9394Noch keine Bewertungen

- Prospective Analysis - FinalDokument7 SeitenProspective Analysis - FinalMAYANK JAINNoch keine Bewertungen

- PIOC Data For Corporate ValuationDokument6 SeitenPIOC Data For Corporate ValuationMuhammad Ali SamarNoch keine Bewertungen

- Finance For Non-Finance: Ratios AppleDokument12 SeitenFinance For Non-Finance: Ratios AppleAvinash GanesanNoch keine Bewertungen

- Apollo Tyres ProjectDokument10 SeitenApollo Tyres ProjectChetanNoch keine Bewertungen

- Ratio Modeling & Pymamid of Ratios - CompleteDokument28 SeitenRatio Modeling & Pymamid of Ratios - CompleteShreya ChakrabortyNoch keine Bewertungen

- BF1 Package Ratios ForecastingDokument16 SeitenBF1 Package Ratios ForecastingBilal Javed JafraniNoch keine Bewertungen

- Tesla Income Statement and Financial Ratios 2016Dokument5 SeitenTesla Income Statement and Financial Ratios 2016Mary JoyNoch keine Bewertungen

- Walmart Valuation ModelDokument179 SeitenWalmart Valuation ModelHiếu Nguyễn Minh HoàngNoch keine Bewertungen

- Prospective Analysis - FinalDokument7 SeitenProspective Analysis - Finalsanjana jainNoch keine Bewertungen

- Kohinoor Chemical Company LTD.: Horizontal AnalysisDokument19 SeitenKohinoor Chemical Company LTD.: Horizontal AnalysisShehreen ArnaNoch keine Bewertungen

- TeslaDokument5 SeitenTeslaRajib ChatterjeeNoch keine Bewertungen

- Annual Report - Attock CementDokument10 SeitenAnnual Report - Attock CementAbdul BasitNoch keine Bewertungen

- Balance Sheet - Assets: Period EndingDokument3 SeitenBalance Sheet - Assets: Period Endingvenu54Noch keine Bewertungen

- M Saeed 20-26 ProjectDokument30 SeitenM Saeed 20-26 ProjectMohammed Saeed 20-26Noch keine Bewertungen

- HYUNDAI Motors Balance SheetDokument4 SeitenHYUNDAI Motors Balance Sheetsarmistha guduliNoch keine Bewertungen

- ABS CBN CorporationDokument16 SeitenABS CBN CorporationAlyssa BeatriceNoch keine Bewertungen

- RIL Financial Statement Analysis (CIA-1BDokument10 SeitenRIL Financial Statement Analysis (CIA-1Bprince chaudharyNoch keine Bewertungen

- Awasr Oman and Partners SAOC - FS 2020 EnglishDokument42 SeitenAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91Noch keine Bewertungen

- Prospective Analysis 2Dokument7 SeitenProspective Analysis 2MAYANK JAINNoch keine Bewertungen

- Business Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BDokument7 SeitenBusiness Valuation: Shriyan Gattani REGISTER NO. 1720233 5 Bba BShriyan GattaniNoch keine Bewertungen

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Dokument32 Seiten4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNoch keine Bewertungen

- Analysis of Statement of Profit or LossDokument4 SeitenAnalysis of Statement of Profit or LossShehzad QureshiNoch keine Bewertungen

- Facebook IPO Case Study: Group Project - Investment BankingDokument18 SeitenFacebook IPO Case Study: Group Project - Investment BankingLakshmi SrinivasanNoch keine Bewertungen

- Elara Securities - Eicher MotorsDokument10 SeitenElara Securities - Eicher MotorsMehul PanjuaniNoch keine Bewertungen

- Understand Unit Linked Insurance PlansDokument43 SeitenUnderstand Unit Linked Insurance PlansPriyanka PadhiNoch keine Bewertungen

- BHP vs. Rio TintoDokument54 SeitenBHP vs. Rio Tintoeholmes80100% (2)

- Head Master: Rupees Fifty Five Thousand Five Hundred and Eighty Three OnlyDokument10 SeitenHead Master: Rupees Fifty Five Thousand Five Hundred and Eighty Three Onlyvijay kumarNoch keine Bewertungen

- Derivative 2-1Dokument9 SeitenDerivative 2-1Abhijeet Gupta 1513Noch keine Bewertungen

- Merchant BankingDokument29 SeitenMerchant BankingramrattangNoch keine Bewertungen

- Consultancy Projects NormsDokument3 SeitenConsultancy Projects NormsArnab BanerjeeNoch keine Bewertungen

- What Is IFRSDokument5 SeitenWhat Is IFRSRR Triani ANoch keine Bewertungen

- BibliographyDokument5 SeitenBibliographyKen PimenteroNoch keine Bewertungen

- Temple Trust DeedDokument6 SeitenTemple Trust Deedjm67% (3)

- Far 610 Group Project 1: InstructionsDokument6 SeitenFar 610 Group Project 1: InstructionsSiti Rafidah DaudNoch keine Bewertungen

- 0452 s10 QP 21Dokument20 Seiten0452 s10 QP 21Mwavi Chris KachaleNoch keine Bewertungen

- Sharpe's Ratio - A Powerful Tool for Portfolio EvaluationDokument12 SeitenSharpe's Ratio - A Powerful Tool for Portfolio EvaluationVaidyanathan RavichandranNoch keine Bewertungen

- Primary Dealer System - A Comparative StudyDokument5 SeitenPrimary Dealer System - A Comparative Studyprateek.karaNoch keine Bewertungen

- BIS CDO Rating MethodologyDokument31 SeitenBIS CDO Rating Methodologystarfish555Noch keine Bewertungen

- Certificate of Increase of CsDokument3 SeitenCertificate of Increase of CsAnthonette Beriso JacoboNoch keine Bewertungen

- Religare Mutual FundDokument73 SeitenReligare Mutual FundpopNoch keine Bewertungen

- RBI Master Directions 2024 On CP, NCDDokument18 SeitenRBI Master Directions 2024 On CP, NCDParasjkohli6659Noch keine Bewertungen

- Tech TP PrudenceDokument6 SeitenTech TP PrudenceAgus WijayaNoch keine Bewertungen

- The Philippine American Life and General Insurance Company vs. The Secretary of Finance and The CIRDokument10 SeitenThe Philippine American Life and General Insurance Company vs. The Secretary of Finance and The CIRKennethQueRaymundoNoch keine Bewertungen

- JPM Vietnam Equity Strat 2019-12-11 PDFDokument34 SeitenJPM Vietnam Equity Strat 2019-12-11 PDFNguyễn Thanh Phong0% (1)

- College of Computer Studies: Entrepreneurial MindDokument2 SeitenCollege of Computer Studies: Entrepreneurial MindJE TCNoch keine Bewertungen

- Brenda Dickenson v. Michael Petit, Etc., 728 F.2d 23, 1st Cir. (1984)Dokument4 SeitenBrenda Dickenson v. Michael Petit, Etc., 728 F.2d 23, 1st Cir. (1984)Scribd Government DocsNoch keine Bewertungen

- Cfap 1 Aafr PK PDFDokument312 SeitenCfap 1 Aafr PK PDFMuhammad ShehzadNoch keine Bewertungen

- NavitasDokument16 SeitenNavitaswikoliawensNoch keine Bewertungen

- Eric Woon Kim ThakDokument2 SeitenEric Woon Kim Thakeric woonNoch keine Bewertungen

- Holder in Due CourseDokument5 SeitenHolder in Due CourseSarada Nag100% (2)

- Idx 1st Quarter 2018 PDFDokument144 SeitenIdx 1st Quarter 2018 PDFSyna AlfarizyNoch keine Bewertungen

- Flutterwave - The African Unicorn Built On QuicksandDokument47 SeitenFlutterwave - The African Unicorn Built On QuicksandJakrokNoch keine Bewertungen