Beruflich Dokumente

Kultur Dokumente

Financial Statement Analysis

Hochgeladen von

Prabath Suranaga MorawakageCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Statement Analysis

Hochgeladen von

Prabath Suranaga MorawakageCopyright:

Verfügbare Formate

describe the roles of financial reporting and financial statement analysis;

describe the roles of the key financial statements (statement of financial position,

statement of comprehensive income, statement of changes in equity, and

statement of cash flows) in evaluating a companys performance and financial

position;

describe the importance of financial statement notes and supplementary

information including disclosures of accounting policies, methods, and estimates

and managements commentary;

describe the objective of audits of financial statements, the types of audit reports,

and the importance of effective internal controls;

identify and explain information sources that analysts use in financial statement

analysis besides annual financial statements and supplementary information;

describe the steps in the financial statement analysis framework.

evaluate a companys past financial performance and explain how a companys

strategy is reflected in past financial performance;

prepare a basic projection of a companys future net income and cash flow;

describe the role of financial statement analysis in assessing the credit quality

of a potential debt investment;

describe the use of financial statement analysis in screening for potential equity

investments;

determine and justify appropriate analyst adjustments to a companys financial

statements to facilitate comparison with another company

Role of Financial Reporting

Provide information about

Performances

Financial Position

Changes in Financial Position

Role of Financial Statement Analysis

Use financial reports combined with other information to

evaluate

past,

current and

potential

performances and financial position of a company for the

purpose of making

Investment

Credit and

Other economic decisions

Concern about the factors that affect the risks to a companys

future performances and financial position

Evaluation an equity investment

Evaluation a merger or acquisition

Evaluation a subsidiary or operating division

Determining the creditworthiness of a company

Extending credit to a customer

Assigning debt rating to a customer

Forecasting future net income and cash flows

Economic

Industrial

Company

Peers

Financial Statements and Supplementary Information

Statement of Financial Position

Statement of Comprehensive Income

Income statement

Other Comprehensive income

Statement of Changes in Equity

Cash flow Statement

Financial Notes and supplementary Schedule

Financial Instruments and associated risks

Commitments and contingencies

Legal proceedings

Related party transactions

Subsequent events

Business acquisitions and disposals

Segmental reporting

Management Discussion and Analysis

Auditors Report

Other sources of information

Proxy statements

Interim Reports

Web sites

Press releases

Forums and conferences

Perodicals

Articulate the purpose and context of Analysis

Collect Input Data

Process Data

Analyzed or interprets the processed data

Develop and communicate conclusions and recommendations

Follow-up

A common size financial statement is a standardized version

of a financial statement in which all entries are presented in

percentages.

A common size financial statement helps to compare entries

in a firms financial statements, even if the firms are not of

equal size.

How to prepare a common size financial statement?

For a common size income statement, divide each entry in the

income statement by the companys sales.

For a common size balance sheet, divide each entry in the balance

sheet by the firms total assets.

FIN3000, Liuren Wu 11

Comparability

Trend

Cross sectional

What happenedWhy

Performances help Road map

Benchmark

Why?

Expected value of a Company

Credit Analysis

Sources of Projection

Company Projections; Relative Valuation, Sensitivity

Company previous FS; acquisition, Start up, volatile industry?

Industry Structure & Outlook

Macro Economic Forecasts

An input to Market based Valuation

Top-down approach

Industry

Company

Common Size

Operational Expenses

Margins

Non recurring Nature

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Model 255 Aerosol Generator (Metone)Dokument20 SeitenModel 255 Aerosol Generator (Metone)Ali RizviNoch keine Bewertungen

- Real Estate Financing: Notes and MortgageDokument15 SeitenReal Estate Financing: Notes and MortgagePrabath Suranaga Morawakage100% (1)

- Anatomy of the pulp cavity กย 2562-1Dokument84 SeitenAnatomy of the pulp cavity กย 2562-1IlincaVasilescuNoch keine Bewertungen

- Emerging Markets and L'Oreal MarketingDokument16 SeitenEmerging Markets and L'Oreal MarketingPrabath Suranaga MorawakageNoch keine Bewertungen

- Financial Econometrics IntroductionDokument13 SeitenFinancial Econometrics IntroductionPrabath Suranaga MorawakageNoch keine Bewertungen

- Capital BudgetingDokument30 SeitenCapital BudgetingPrabath Suranaga Morawakage100% (1)

- Cost of CapitalDokument33 SeitenCost of CapitalPrabath Suranaga Morawakage100% (1)

- Statistics: Basic Concepts, Data Collection and PresentationDokument19 SeitenStatistics: Basic Concepts, Data Collection and PresentationPrabath Suranaga MorawakageNoch keine Bewertungen

- An Introduction To LimitsDokument10 SeitenAn Introduction To LimitsPrabath Suranaga MorawakageNoch keine Bewertungen

- Integrating Processes To Build RelationshipsDokument42 SeitenIntegrating Processes To Build RelationshipsPrabath Suranaga MorawakageNoch keine Bewertungen

- Mechanical Production Engineer Samphhhhhle ResumeDokument2 SeitenMechanical Production Engineer Samphhhhhle ResumeAnirban MazumdarNoch keine Bewertungen

- Prevention of Waterborne DiseasesDokument2 SeitenPrevention of Waterborne DiseasesRixin JamtshoNoch keine Bewertungen

- Review On AlgebraDokument29 SeitenReview On AlgebraGraziela GutierrezNoch keine Bewertungen

- MultiLoadII Mobile Quick Start PDFDokument10 SeitenMultiLoadII Mobile Quick Start PDFAndrés ColmenaresNoch keine Bewertungen

- 20-Admission of PatientDokument3 Seiten20-Admission of Patientakositabon100% (1)

- Radon-222 Exhalation From Danish Building Material PDFDokument63 SeitenRadon-222 Exhalation From Danish Building Material PDFdanpalaciosNoch keine Bewertungen

- Physics Blue Print 1 Class XI Half Yearly 23Dokument1 SeitePhysics Blue Print 1 Class XI Half Yearly 23Nilima Aparajita SahuNoch keine Bewertungen

- Lesson 3 - ReviewerDokument6 SeitenLesson 3 - ReviewerAdrian MarananNoch keine Bewertungen

- Sakui, K., & Cowie, N. (2012) - The Dark Side of Motivation - Teachers' Perspectives On 'Unmotivation'. ELTJ, 66 (2), 205-213.Dokument9 SeitenSakui, K., & Cowie, N. (2012) - The Dark Side of Motivation - Teachers' Perspectives On 'Unmotivation'. ELTJ, 66 (2), 205-213.Robert HutchinsonNoch keine Bewertungen

- Applications SeawaterDokument23 SeitenApplications SeawaterQatar home RentNoch keine Bewertungen

- Sandstorm Absorbent SkyscraperDokument4 SeitenSandstorm Absorbent SkyscraperPardisNoch keine Bewertungen

- Scholastica: Mock 1Dokument14 SeitenScholastica: Mock 1Fatema KhatunNoch keine Bewertungen

- Disassembly Procedures: 1 DELL U2422HB - U2422HXBDokument6 SeitenDisassembly Procedures: 1 DELL U2422HB - U2422HXBIonela CristinaNoch keine Bewertungen

- JIS G 3141: Cold-Reduced Carbon Steel Sheet and StripDokument6 SeitenJIS G 3141: Cold-Reduced Carbon Steel Sheet and StripHari0% (2)

- Speech On Viewing SkillsDokument1 SeiteSpeech On Viewing SkillsMera Largosa ManlaweNoch keine Bewertungen

- Food ResourcesDokument20 SeitenFood ResourceshiranNoch keine Bewertungen

- Export Management EconomicsDokument30 SeitenExport Management EconomicsYash SampatNoch keine Bewertungen

- rp10 PDFDokument77 Seitenrp10 PDFRobson DiasNoch keine Bewertungen

- EqualLogic Release and Support Policy v25Dokument7 SeitenEqualLogic Release and Support Policy v25du2efsNoch keine Bewertungen

- Iguana Joe's Lawsuit - September 11, 2014Dokument14 SeitenIguana Joe's Lawsuit - September 11, 2014cindy_georgeNoch keine Bewertungen

- Acute Appendicitis in Children - Diagnostic Imaging - UpToDateDokument28 SeitenAcute Appendicitis in Children - Diagnostic Imaging - UpToDateHafiz Hari NugrahaNoch keine Bewertungen

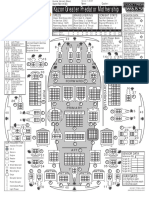

- Kazon Greater Predator MothershipDokument1 SeiteKazon Greater Predator MothershipknavealphaNoch keine Bewertungen

- Cambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022Dokument15 SeitenCambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022ilovefettuccineNoch keine Bewertungen

- The Covenant Taken From The Sons of Adam Is The FitrahDokument10 SeitenThe Covenant Taken From The Sons of Adam Is The FitrahTyler FranklinNoch keine Bewertungen

- Micro Lab Midterm Study GuideDokument15 SeitenMicro Lab Midterm Study GuideYvette Salomé NievesNoch keine Bewertungen

- Canoe Matlab 001Dokument58 SeitenCanoe Matlab 001Coolboy RoadsterNoch keine Bewertungen

- 2014 - A - Levels Actual Grade A Essay by Harvey LeeDokument3 Seiten2014 - A - Levels Actual Grade A Essay by Harvey Leecherylhzy100% (1)

- ASHRAE Journal - Absorption RefrigerationDokument11 SeitenASHRAE Journal - Absorption Refrigerationhonisme0% (1)