Beruflich Dokumente

Kultur Dokumente

GBO

Hochgeladen von

habib_aaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GBO

Hochgeladen von

habib_aaCopyright:

Verfügbare Formate

1

JOB DESCRIPTION

Job Title Banking Services

Officer / Senior

Banking Services Office

Job Holder (Name)

Reports to

(Title)

SBSM / BSM Reports to (Name)

Branch/Depart

ment

A. JOB PURPOSE (Why does the job exist?)

Provisioning of Hassle free / complaint free service to Banks clients.

B. PRINCIPAL ACCOUNTABILITIES (What end results are expected to be achieved and

why?)

(1)

Customer Services

Ensures error free and timely services to the customers to enhance the Banks image

and increase customer base.

(2)

Account Opening / Scrutiny

Helps customer in filling the AOF / CP.

Scrutinizes AOF documents and verifies customers address and phone number.

(3)

Know Your Customer

Get KYC formalities completed to ensure that account opened in accordance with rules

and regulations set by Bank & SBP.

(4)

Issue Cheque Book , ATM, and Locker

Issue cheque books & ATM Cards to customers for giving facility of withdrawing amount

from his/her account and issue lockers for safe custody of their assets.

(4)

Clearing

Input inward and outward clearing transactions.

Liaise with NIFT / clearing hub for settlement of transaction.

Ensure balancing of clearing suspense heads.

(5)

Statement of Account

Deliver SOA to customers to keep update them about their transactions as and when

required by the customer

(6)

Handle Fixed Deposit (TDR)

Issue, encash, mature, rollover, pre-mature fixed deposits of customers. Ensure to have

full knowledge about of the deposit mobilization products.

(7)

Regulatory Compliance

Ensures compliance with all SBP/ other regulatory requirement/ guidelines, banks

policies & procedures/ standard instructions to maintain Banks system and control

standards and avoid any risks or losses to the bank & audit objections.

(8)

Remittances

Issue / encash / cancel PO / DD / ABC / CDR/ ARTC and Processing of all advices /

vouchers. Ensure balancing of all payable heads are balanced. Ensure that stock of

instrument is balanced.

2

(9)

Fund Transfer

Handle fund transfer request for local and online customer.

posting of Salaries

(10)

Internal Control

Ensures that acceptable levels of internal control are maintained in order to comply

with internal procedures, Banks Standard Instruction and SBP Regulations.

11)

Record Maintenance

Maintains proper record of all the relevant documents to issue balance to customers as

per request.

(12)

Issue Reminder

Ensure to send letter for collection of undelivered cheque book and ATM card.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Modular Heavy Duty Truck TransmissionDokument6 SeitenModular Heavy Duty Truck Transmissionphucdc095041Noch keine Bewertungen

- CKRE Lab (CHC 304) Manual - 16 May 22Dokument66 SeitenCKRE Lab (CHC 304) Manual - 16 May 22Varun pandeyNoch keine Bewertungen

- Configuring Hyper-V: This Lab Contains The Following Exercises and ActivitiesDokument9 SeitenConfiguring Hyper-V: This Lab Contains The Following Exercises and ActivitiesMD4733566Noch keine Bewertungen

- Lesson Exemplar Math 7Dokument6 SeitenLesson Exemplar Math 7Pablo Jimenea100% (2)

- 61annual Report 2010-11 EngDokument237 Seiten61annual Report 2010-11 Engsoap_bendNoch keine Bewertungen

- Ad For Guru Ned'S Enlightenment Masterclass 1 of 33Dokument33 SeitenAd For Guru Ned'S Enlightenment Masterclass 1 of 33ElliuggNoch keine Bewertungen

- Design of Footing R1Dokument8 SeitenDesign of Footing R1URVESHKUMAR PATELNoch keine Bewertungen

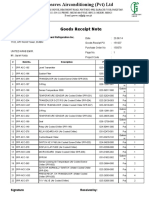

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDokument4 SeitenGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanNoch keine Bewertungen

- Changing Sentences in The Simple Present Tense Into PassiveDokument4 SeitenChanging Sentences in The Simple Present Tense Into PassiveBernadette NarteNoch keine Bewertungen

- 4 PDFDokument81 Seiten4 PDFMohammad K. NassouraNoch keine Bewertungen

- Biosynthesis and Characterization of Silica Nanoparticles From RiceDokument10 SeitenBiosynthesis and Characterization of Silica Nanoparticles From Riceanon_432216275Noch keine Bewertungen

- Scope and Sequence 2020 2021...Dokument91 SeitenScope and Sequence 2020 2021...Ngọc Viễn NguyễnNoch keine Bewertungen

- CNC Milling ReportDokument15 SeitenCNC Milling ReportStarscream Aisyah78% (37)

- How To Install 64 Bits IDES On 32 Bits OSDokument1 SeiteHow To Install 64 Bits IDES On 32 Bits OSMuhammad JaveedNoch keine Bewertungen

- Cross Border Data Transfer Consent Form - DecemberDokument3 SeitenCross Border Data Transfer Consent Form - DecemberFIDELIS MUSEMBINoch keine Bewertungen

- Number CardsDokument21 SeitenNumber CardsCachipún Lab CreativoNoch keine Bewertungen

- Tecsun Pl310et PDFDokument30 SeitenTecsun Pl310et PDFAxel BodemannNoch keine Bewertungen

- Unit 7 ActivitiesDokument8 SeitenUnit 7 ActivitiesleongeladoNoch keine Bewertungen

- Handbook On National Spectrum Management 2015Dokument333 SeitenHandbook On National Spectrum Management 2015Marisela AlvarezNoch keine Bewertungen

- SDOF SystemsDokument87 SeitenSDOF SystemsAhmet TükenNoch keine Bewertungen

- Conflict Management A Practical Guide To Developing Negotiation Strategies Barbara A Budjac Corvette Full ChapterDokument67 SeitenConflict Management A Practical Guide To Developing Negotiation Strategies Barbara A Budjac Corvette Full Chapternatalie.schoonmaker930100% (5)

- World English 2ed 1 WorkbookDokument80 SeitenWorld English 2ed 1 WorkbookMatheus EdneiNoch keine Bewertungen

- Emcee Script For Recognition DayDokument3 SeitenEmcee Script For Recognition DayRomeo Jr. LaguardiaNoch keine Bewertungen

- HCH - 15 04 004Dokument5 SeitenHCH - 15 04 004NarvaxisNoch keine Bewertungen

- SAP Solution Manager - CHARM - Retrofit - Change Request Management Enhanced RetrofitDokument61 SeitenSAP Solution Manager - CHARM - Retrofit - Change Request Management Enhanced RetrofitARPITA BISWASNoch keine Bewertungen

- CE-23113-SP-902-R01-00 Asset SpecificationDokument14 SeitenCE-23113-SP-902-R01-00 Asset SpecificationСветлана ФайберNoch keine Bewertungen

- 2011 Frequency AllocationsDokument1 Seite2011 Frequency Allocationsculeros1Noch keine Bewertungen

- Practicewith Argument Athletesas ActivistsDokument30 SeitenPracticewith Argument Athletesas ActivistsRob BrantNoch keine Bewertungen

- 1st Unseen Passage For Class 5 in EnglishDokument7 Seiten1st Unseen Passage For Class 5 in EnglishVibhav SinghNoch keine Bewertungen

- Most Dangerous City - Mainstreet/Postmedia PollDokument35 SeitenMost Dangerous City - Mainstreet/Postmedia PollTessa VanderhartNoch keine Bewertungen