Beruflich Dokumente

Kultur Dokumente

Kia Cases

Hochgeladen von

Jonjon BeeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kia Cases

Hochgeladen von

Jonjon BeeCopyright:

Verfügbare Formate

People of the Philippines vs.

Jabinal

FACTS: Jose Jabinal, the accused, kept in his possession, custody and direct

control a revolver with ammunition without frst securing the necessary

permit or license to possess the same. The accused admitted that he was in

possession of such weapon however, he claimed to be entitled to

exoneration because he had an appointment as Secret Agent from the

rovincial !overnor of "atangas and an appointment as #onfdential Agent

from the # rovincial #ommander. The said appointments expressly carried

with them to be authority to possess and carry the frearm in $uestion.

ISSUE: %hether the &acarandang and 'ucero doctrines are applicable in the

present case.

HELD: (es, the &acarandang and 'ucero doctrines are applicable in the

present case. The interpretation upon a law by this #ourt constitutes a part

of the law as of the date that law originally passed, since the #ourt)s

construction merely establishes the contemporaneous legislative intent thus

construed intends to e*ectuate. At the time appellant was found in

possession of the frearm in $uestion and when he arraigned by the trial

court., the doctrine enunciated in &acarandang and 'ucero, under which no

criminal liability is attached to the accused, prevailed.

PERFECTO S. !EER

FACT: +n April ,-./ the #ollector of +nternal 0evenue re$uired &r. Justice

!regorio erfecto to pay income tax upon his salary as member of the #ourt

during the year ,-.1. After paying the amount, he instituted an action in

&anila #ourt of 2irst +nstance contending that the assessment was illegal, his

salary not being taxable for the reason that imposition of taxes thereon

would reduce it in violation of the #onstitution. +t provides in its Article 3+++,

Section - that the members of the Supreme #ourt and all 4udges of inferior

courts 5shall receive such compensation as may be fxed by law, which shall

not be diminished during their continuance in o6ce.

ISSUE: %hether or not the imposition of an income tax upon this salary in

,-.1 amount to a diminution.

HELD: (es, the imposition of the income tax upon the salary of Justice

erfecto amount to a diminution thereof. The prohibition is general, contains

no excepting words, and appears to be directed against all diminution,

whether for one purpose or another. The fathers of the #onstitution intended

to prohibit diminution by taxation as well as otherwise, that they regarded

the independence of the 4udges as of far greater importance than any

revenue that could come from taxing their salaries. Thus, taxing the salary of

a 4udge as a part of his income is a violation of the #onstitution.

E"DE"CIA S. DAID

FACTS: This is a 4oint appeal from the decision of the #ourt of 2irst +nstance in

&anila declaring section ,7 of 0A 8o. 9-: unconstitutional and ordering the

appellant Saturnino ;avid as #ollector of +nternal 0evenue to refund to Justice

astor <ndencia and to Justice 2ernando Jugo the income tax collected on their

salary. %hen the S# held in the erfecto case that 4udicial o6cers exempt from

salary tax because the collection thereof was a decrease or diminution of their

salaries which is prohibited by the #onstitution, the #ongress thereafter

promulgated 0A 8o. 9-:, authori=ing and legali=ing the collection of income tax on

the salaries of 4udicial o6cers.

ISSUE: %hether or not Section ,7 of 0A 9-: is constitutional

HELD: %hen it is clear that a statute transgresses the authority vested in the

legislature by the #onstitution, it is the duly of the courts to declare the act

unconstitutional. Section ,7, 0A 8o. 9-: is a clear example of interpretation or

ascertainment of the meaning of the phrase found in section -, Art. 3+++ of the

#onstitution which refers to the salaries of 4udicial o6cers. This act interpreting the

#onstitution or any part thereof by the 'egislature is an invasion of the well>defned

and established province and 4urisdiction of the Judiciary. The 'egislature may not

legally provide therein that a statue be interpreted in such a way that it may not

violate a #onstitutional prohibition, thus the unconstitutionality of Section ,7 of 0A

8o. 9-:.

"ITAFA" S. CO!!ISSIO"ER OF I"TER"AL REE"UE

FACTS: etitioners, the duly appointed and $ualifed Judges ;avid 8itafan,

%enceslaus olo and &aximo Savellano, Jr. , seek to prohibit and?or

perpetually en4oin respondents., the #ommissioner of +nternal 0evenue and

the 2inancial @6cer of the Supreme #ourt, from making any deduction of

withholding taxes from their salaries. They submit that 5any tax withheld

from their emoluments or compensation as 4udicial o6cers constitutes a

decrease or diminution of their salaries contrary to the provision of Section

,:, Article 3+++ of the ,-A/ #onstitution mandating that 5during their

continuance in o6ce, their salary shall not be decreased.

ISSUE: %hether or not the imposition of taxes in the compensation of

Judicial o6cers is contrary to the ,-A/ #onstitution.

HELD: (es. The clear intent of the #onstitutional #ommission was to delete

the proposed expressed grant of exemption from payment of income tax to

members of the Judiciary, so as to 5give substance to e$uality among the

three branches of !overnmentB. +t was further expressly made clear that the

salaries of members of the Judiciary would be sub4ect to the general income

tax applied to all tax payers. %ith the foregoing pretation, the rulling that

5the imposition of income tax upon the salary of the 4udges is a diminution

thereof, and so violates the #onstitutionB in erfecto vs. &eer, as a6rmed in

<ndencia vs. ;avid must be declared discarded.

PRI!ACIAS S. !U"ICIPALIT# OF URDA"ETA

FACTS: Juan Augusta rimacias was his car within the 4urisdiction of

Crdaneta when a member of Crdaneta)s &unicipal olice asked him to stop.

De was told, upon stopping, that he had violated &unicipal @rdinance 8o. 7,

Series of ,-1.. ;ue to the institution of the criminal case, plainti* rimacias

initiated an action for the annulment of said ordinance

ISSUE: %hether or not &unicipal @rdinance 8o. 7, Series of ,-1. is valid.

HELD: 8o, the ordinance in $uestion is not valid. A local legislative body

intending to control tra6c in public highways is supposed to classify frst,

and then mark them with proper signs, all to be approved by the 'and

Transportation #ommissioner. There is no showing that the marking of the

streets and areas falling under the ordinance was done with the approval of

the 'and Transportation #ommissioner. +t lacks the re$uirement imposed by

the 'and Transportation and Tra6c #ode from 5enacting or enforcing any

ordinance or resolution + conEict with the provisions of this ActB, thus invalid.

TESTATE ESTATE OF FATHER RI$OR S. RI$OR

FACTS: 2ather 0igor, the parish priest of ulilan, "ulacan, left a will

executed and was probated by the #ourt of 2irst +nstance of Tarlac in its order

of ;ecember 9, ,-79. 8amed as devisees in the will were the testators

nearest relatives, his three sisters. +n addition, the will provided that it be

ad4udicated in favor of the legacy purported to be given to the nearest male

relative who shall take the priesthood.

ISSUE: %hether or not the be$uest in $uestion be declared inoperative.

HELD: +n the law of contracts and statutory construction, the primary issue

is the determination of the testatorFs intention which is the law of the case.

%hat is no clear is on how long after the testatorFs death would it be

determined that he had a nephew who would pursue an ecclesiastical

vocation. The S# held that the said be$uest refers to the testatorFs nearest

male relative living at the time of his death and not to any indefnite time

thereafter. G+n order to be capacitated to inherit, the heir, devisee or legatee

must be living at the moment the succession opens, except in case of

representation, when it is properG HArt. ,:I9, #ivil #odeJ. +nasmuch as the

testator was not survived by any nephew who became a priest, the

unavoidable conclusion is that the be$uest in $uestion was ine*ectual or

inoperative. Therefore, the administration of the ricelands by the parish

priest of 3ictoria, as envisaged in the wilt was likewise inoperative.

CO"TE S COA

FACTS: etitioners Avelina ". #onte and 'eticia "oiser>alma were former

employees of the Social Security System HSSSJ who retired from government

service. They availed of compulsory retirement benefts under 0epublic Act

8o. 11:. +n addition, petitioners also claimed benefts granted under SSS

0esolution 8o. 91, series of ,-/, that provides fnancial incentive and

inducement to SSS employees $ualifed to retire to avail of retirement

benefts under 0A 11: as amended, rather than the retirement benefts

under 0A ,1,1 as amended, by giving them 5fnancial assistanceB e$uivalent

in amount to the di*erence between what a retiree would have received

under 0A ,1,1, less what he was entitled to under 0A 11:. Thereafter, #@A

issued a ruling disallowing in audit 5all such claims for fnancial assistance

under SSS 0esolution 8o. 91B for the reason that it results in the increase of

benefts beyond what is allowed under existing retirement laws.

ISSUES:

,. %hether or not public respondent abused its discretion when it

disallowed in audit petitioners) claims for benefts under SSS 0es. 91.

I. %hether or not SSS 0esolution 8o. 91 is valid.

HELD:

1. 8o. The #ommission bears stress that the fnancial assistance

contemplated under SSS 0esolution 8o. 91 is granted to SSS

employees who opt to retire under 0.A. 8o. 11:. +t is clear that

petitioners applied for benefts under 0A 11: only because of the

incentives o*ered by 0es. 91, and that absent such incentives, they

would have without fail availed of 0A ,1,1 instead. The petition is

dismissed for lack of merit, there having been no grave abuse of

discretion on the part of respondent #ommission.

2. 8o. The said fnancial assistance partakes of the nature of a retirement

beneft that has the e*ect of modifying existing retirement laws

particularly 0.A. 8o. 11:. +t is simply beyond dispute that the SSS had

no authority to maintain and implement such retirement plan and in

the guise of rule>making, legislate or amend laws or worse, render

them nugatory. Dence, SSS 0esolution 8o. 91 is hereby illegal, void and

no e*ect.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Posh 1Dokument20 SeitenPosh 1api-347941637Noch keine Bewertungen

- Posh 1Dokument20 SeitenPosh 1api-347941637Noch keine Bewertungen

- Preventing Workplace HarassmentDokument30 SeitenPreventing Workplace HarassmentKapitan BilangNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Year 11 Physics HY 2011Dokument20 SeitenYear 11 Physics HY 2011Larry MaiNoch keine Bewertungen

- 1803 Hector Berlioz - Compositions - AllMusicDokument6 Seiten1803 Hector Berlioz - Compositions - AllMusicYannisVarthisNoch keine Bewertungen

- Bo's Coffee AprmDokument24 SeitenBo's Coffee Aprmalliquemina100% (1)

- American Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsDokument2 SeitenAmerican Wire & Cable Daily Rated Employees Union v. American Wire & Cable Co and Court of AppealsFoxtrot Alpha100% (1)

- Roman Catholic Archbishop of Manila Vs CA, ResyesDokument7 SeitenRoman Catholic Archbishop of Manila Vs CA, ResyesJonjon BeeNoch keine Bewertungen

- Cookery-10 LAS-Q3 Week5Dokument7 SeitenCookery-10 LAS-Q3 Week5Angeline Cortez100% (1)

- Tagalog Vs de GonzalesDokument5 SeitenTagalog Vs de GonzalesJonjon BeeNoch keine Bewertungen

- Shahin CVDokument2 SeitenShahin CVLubainur RahmanNoch keine Bewertungen

- Sexual Harassment PreventionDokument15 SeitenSexual Harassment PreventionNikita KarambelkarNoch keine Bewertungen

- Group 1Dokument31 SeitenGroup 1Jonjon BeeNoch keine Bewertungen

- Definition of Total Sexual Violence and Regional DataDokument30 SeitenDefinition of Total Sexual Violence and Regional Dataanon_567175325Noch keine Bewertungen

- Galia Vs PPDokument12 SeitenGalia Vs PPJanMikhailPanerioNoch keine Bewertungen

- (HRB) Universal Health Coverage BillDokument2 Seiten(HRB) Universal Health Coverage BillSarah Elaiza BuycoNoch keine Bewertungen

- (HRB) Universal Health Coverage BillDokument1 Seite(HRB) Universal Health Coverage BillJonjon BeeNoch keine Bewertungen

- Court of Appeals Affirms Conviction of Three Individuals for Violating the Dangerous Drugs ActDokument13 SeitenCourt of Appeals Affirms Conviction of Three Individuals for Violating the Dangerous Drugs ActFrancis PalabayNoch keine Bewertungen

- Spouses Manuel and Evelyn Tio vs. Bank of The Philippine Islands vs. Goldstar Milling Corporation PDFDokument8 SeitenSpouses Manuel and Evelyn Tio vs. Bank of The Philippine Islands vs. Goldstar Milling Corporation PDFJonjon BeeNoch keine Bewertungen

- Veto Tax AmnestyDokument11 SeitenVeto Tax AmnestyJonjon BeeNoch keine Bewertungen

- Master of Arts in Health Policy Studies - College of Public HealthDokument2 SeitenMaster of Arts in Health Policy Studies - College of Public HealthJonjon BeeNoch keine Bewertungen

- Quinagoran Vs CADokument6 SeitenQuinagoran Vs CAJonjon BeeNoch keine Bewertungen

- Commissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Dokument7 SeitenCommissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Jonjon BeeNoch keine Bewertungen

- DATOS Privados 2019 FinalistsDokument4 SeitenDATOS Privados 2019 FinalistsJonjon BeeNoch keine Bewertungen

- CBK Power Company's Claim for VAT Refund RejectedDokument9 SeitenCBK Power Company's Claim for VAT Refund RejectedJonjon BeeNoch keine Bewertungen

- Flores Vs Sps LindoDokument6 SeitenFlores Vs Sps LindoJonjon BeeNoch keine Bewertungen

- Heirs of Flores Restar Vs Heirs Dolores CichonDokument5 SeitenHeirs of Flores Restar Vs Heirs Dolores CichonJonjon BeeNoch keine Bewertungen

- Commissioner of Internal Revenue vs. The Stanley Works Sales (Phils.), IncorporatedDokument8 SeitenCommissioner of Internal Revenue vs. The Stanley Works Sales (Phils.), IncorporatedJonjon BeeNoch keine Bewertungen

- Nippon Express Vs CIRDokument13 SeitenNippon Express Vs CIRJonjon BeeNoch keine Bewertungen

- Trader's Royal Bank Vs CastañaresDokument6 SeitenTrader's Royal Bank Vs CastañaresJonjon BeeNoch keine Bewertungen

- Team Sual Corporation v. CIRDokument16 SeitenTeam Sual Corporation v. CIRJoyceNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Pilipinas Shell Petroleum CorporationDokument21 SeitenCommissioner of Internal Revenue vs. Pilipinas Shell Petroleum CorporationJonjon BeeNoch keine Bewertungen

- Kepco Ilijan Corp Vs CIR PDFDokument8 SeitenKepco Ilijan Corp Vs CIR PDFJonjon BeeNoch keine Bewertungen

- Pilipinas Total Gas, Inc. vs. CIR Decision Analyzes Tax Refund ProcessDokument24 SeitenPilipinas Total Gas, Inc. vs. CIR Decision Analyzes Tax Refund ProcessJonjon BeeNoch keine Bewertungen

- Western Mindanao Power Corp. vs. CIR Dispute Over VAT RefundDokument7 SeitenWestern Mindanao Power Corp. vs. CIR Dispute Over VAT RefundJonjon BeeNoch keine Bewertungen

- Commissioner of Internal Revenue vs. St. Luke's Medical Center, Inc.Dokument16 SeitenCommissioner of Internal Revenue vs. St. Luke's Medical Center, Inc.Jonjon BeeNoch keine Bewertungen

- M2M RF - RHNDokument3 SeitenM2M RF - RHNNur Nadia Syamira Bt SaaidiNoch keine Bewertungen

- PRI Vs SIP Trunking WPDokument3 SeitenPRI Vs SIP Trunking WPhisham_abdelaleemNoch keine Bewertungen

- History of Philippine Sports PDFDokument48 SeitenHistory of Philippine Sports PDFGerlie SaripaNoch keine Bewertungen

- Cover Letter IkhwanDokument2 SeitenCover Letter IkhwanIkhwan MazlanNoch keine Bewertungen

- Complete BPCL AR 2022 23 - English Final 9fc811Dokument473 SeitenComplete BPCL AR 2022 23 - English Final 9fc811Akanksha GoelNoch keine Bewertungen

- A1. Coordinates System A2. Command Categories: (Exit)Dokument62 SeitenA1. Coordinates System A2. Command Categories: (Exit)Adriano P.PrattiNoch keine Bewertungen

- Grinding and Other Abrasive ProcessesDokument8 SeitenGrinding and Other Abrasive ProcessesQazi Muhammed FayyazNoch keine Bewertungen

- First Preliminary Examination in Tle 8 - Mechanical DraftingDokument6 SeitenFirst Preliminary Examination in Tle 8 - Mechanical DraftingNefritiri BlanceNoch keine Bewertungen

- NetZoom Pro v15 Install GuideDokument81 SeitenNetZoom Pro v15 Install Guidescribd!!Noch keine Bewertungen

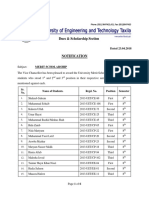

- Dues & Scholarship Section: NotificationDokument6 SeitenDues & Scholarship Section: NotificationMUNEEB WAHEEDNoch keine Bewertungen

- Balochistan Conservation Strategy VDokument388 SeitenBalochistan Conservation Strategy VHãšãñ Trq100% (1)

- Chemistry Sample Paper 2021-22Dokument16 SeitenChemistry Sample Paper 2021-22sarthak MongaNoch keine Bewertungen

- Introduction To Competitor AnalysisDokument18 SeitenIntroduction To Competitor AnalysisSrinivas NandikantiNoch keine Bewertungen

- Learners' Activity Sheets: Homeroom Guidance 7 Quarter 3 - Week 1 My Duties For Myself and For OthersDokument9 SeitenLearners' Activity Sheets: Homeroom Guidance 7 Quarter 3 - Week 1 My Duties For Myself and For OthersEdelyn BuhaweNoch keine Bewertungen

- GravimetryDokument27 SeitenGravimetrykawadechetan356Noch keine Bewertungen

- Intentional Replantation TechniquesDokument8 SeitenIntentional Replantation Techniquessoho1303Noch keine Bewertungen

- Simple Future Vs Future Continuous Vs Future PerfectDokument6 SeitenSimple Future Vs Future Continuous Vs Future PerfectJocelynNoch keine Bewertungen

- Discover books online with Google Book SearchDokument278 SeitenDiscover books online with Google Book Searchazizan4545Noch keine Bewertungen

- Planificación Semanal Maestro de Inglés RAE 2022-2023Dokument2 SeitenPlanificación Semanal Maestro de Inglés RAE 2022-2023vanessabultron8804100% (1)

- Karnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017Dokument14 SeitenKarnataka PUC Board (KSEEB) Chemistry Class 12 Question Paper 2017lohith. sNoch keine Bewertungen

- Mr. Bill: Phone: 086 - 050 - 0379Dokument23 SeitenMr. Bill: Phone: 086 - 050 - 0379teachererika_sjcNoch keine Bewertungen

- 2nd YearDokument5 Seiten2nd YearAnbalagan GNoch keine Bewertungen

- Cell Types: Plant and Animal TissuesDokument40 SeitenCell Types: Plant and Animal TissuesMARY ANN PANGANNoch keine Bewertungen

- Iso 30302 2022Dokument13 SeitenIso 30302 2022Amr Mohamed ElbhrawyNoch keine Bewertungen