Beruflich Dokumente

Kultur Dokumente

Warwick Growth 12342012

Hochgeladen von

Daniel Lee Eisenberg JacobsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Warwick Growth 12342012

Hochgeladen von

Daniel Lee Eisenberg JacobsCopyright:

Verfügbare Formate

1

Growth Lectures 1 + 2: The Solow Growth Model and Beyond

Peter Sinclair

University of Warwick Masters Macroeconomics: October 24, 2012

A: The Solow Model (QJE 1956)

2 equilibrium concepts: steady state growth (SSG) and balanced growth (BG).

SSG: all relevant variables are stationary in level or rate of change.

BG: variables that grow, grow at a common rate.

Like any equilibrium concept in economics, SSG and BG prompt 4 questions:

a. existence? [is there an equilibrium?]

b. Uniqueness? [if it exists, is there just one?]

c. Stability? [does a chance divergence establish forces restoring it?]

d. Optimality [does it maximize welfare?]?

The assumptions of the simplest version of Solows model are:

1. population grows at n, exogenous and positive

2. savings (or, equivalently, investment) share of income is s, exogenous and positive

3. production function, y=f(k), has constant returns to scale, is twice differentiable with f>0>f,

and capital-output ratio, v, able to take on any positive value (y and k are output per head and

capital per head).

4. no depreciation

5. no technological progress

6. perfect competition (including marginal product factor pricing, full price flexibility and

information, and market clearance).

The implication of these assumptions is that existence, uniqueness and stability (but not optimality) are

guaranteed.

Reasoning: the growth rate of capital is, by definition, INVESTMENT/CAPITAL, which may be

written s/v. BG requires this to equal n. From 3, there exists some value of k at which v=s/n.

Geometrically, n/s is the gradient of a ray from the origin depicting the average product of capital in

balanced growth: this proves existence. Since the idea that f(k) could be zero at some positive k makes

it possible that n/s could be so steep as to exceed the highest possible value of 1/v , f(0)=0, so that

f>0>f bars multiple equilibria: equilibrium is unique. Stability is assured since, if k is below (above)

its BG value, the average product of capital is above (below) n/s, so the capital labour ratio is rising

(falling). More on optimality below.

Consider now the balanced growth equilibrium (BGE) effects of a rise in n or fall in s. The ray with

gradient n/s must steepen. So it will cut f(k) to the south west of the old BGE. So we infer at once that

y, and k must fall. From concavity, v must fall, too, while the real interest rate (equals the marginal

product of capital from assns 4 and 6, which is the gradient of the tangent to f(k)) must rise. The real

wage rate falls ( . 0 ) ( ' ' ) ( ' ' ) ( ' ) ( ' / )} ( ' ) ( { / k kf k kf k f k f dk k kf k f d dk dw )

The profit share of national income is subject to conflicting forces: a higher rate of profit, but less

capital per head. The first effect dominates the second if , the elasticity of substitution between

capital and labour in the production function is less than unity; they cancel if the production function is

Cobb Douglas, where 1; and the profit share falls if 1, so that capital and labour are

substitutes rather than complements. A mnemonic for the impact of n on r: the late 1960s / early

1970s slogan, Women in labour keep capital in power.

In all these cases, faster population growth is similar to a fall in the savings ratio. Here are two

variables for which this is not true: the growth rate of output (call it g), and consumption per head. IN

BGE, g=n. This means that faster population growth must imply faster long run output growth (one for

one), but that a change in the savings ratio has no effect on the long run growth rate of output. Higher

s raises the long run level of output per head, but the growth rate of capital gradually slips back, as v

rises, to equal n in the long run.

Consumption per head, c, equals nk k f ) ( in BGE. Differentiating this with respect to k gives

n k f ) ( ' . So c reaches a maximum where the growth rate and the real interest rate are equal.

2

(Prove it is a maximum by showing that ). 0 ' ' /

2 2

f dk c d This is the GOLDEN RULE. But it

is only by chance, with n and s given, that BGE satisfies this. Hence the answer to the optimality

question is, generally NO. The Golden Rule condition n k f ) ( ' implies that the savings ratio

should equal the profit share of income in BGE (proof: multiply both by v).

The Golden Rule is straightforward and illuminating. But it has drawbacks. One is that it does not

prescribe a path towards the best BGE if you are at an inferior BGE. (By contrast, Ramsey does do

this). Further, it cannot properly handle extensions, such as to exhaustible natural resources or

technological progress, the first of which will tend to make c drift downwards over time, and the

second, upwards.

Technology trends can be incorporated provided technical progress is Harrod-neutral (equivalently,

labour augmenting). So if Y, K and N are aggregate output, capital and labour, the production function

is written Y=Y(K,BN) where B advances at a given, constant rate (say x). Since returns to scale are

constant, we may write (using the same notation as in the Ramsey model) )) (

~

( ) (

~

t k f t y ; in a BGE,

) (

~

t k is stationary, and the relevant geometry of a BGE requires that 1/v = (n+x)/s. Faster technical

progress raises the rate of profit and reduces the long run value of capital per human efficiency unit,

k

~

. The BGE growth rate of output is now n+x, and both output per head, and consumption per head,

climb at x.

There are numerous other possible extensions to Solows model (eg, additional sectors for example

for capital goods; an endogenous savings ratio, displaying sensitivity to n, or factor shares of national

income, or to the real interest rate). It is a very powerful and versatile model. One controversial

aspect is that it cannot incorporate short-run Keynesian problems, such as may arise from price

rigidities and either deficient or excessive aggregate demand: it simply assumes such problems away,

invoking assumption 6.

A more serious criticism, perhaps, is that the savings ratio is not derived from optimization conditions.

It is just imposed. Responding to that criticism is simple switch to the Ramsey model (1928). But a

still more powerful criticism is that is not a model of long run growth at all. Solows model is really a

set of relationships explaining how y, k, v, r, w, c and so on vary with the fundamental parameters n, s

and x. Long run growth, n+x, is simply exogenous, and unexplained. To rectify this, we need to

explore models of ENDOGENOUS GROWTH.

We shall consider 5 such models:

a. endogenous population growth

b. exhaustible natural resources (oil)

c. training (Lucas JME 1988)

d. externalities (Romer JPE 1986)

e. invention (Romer JPE 1990)

Endogenous population growth: invoke Malthuss argument that population tends to expand (contract)

when the real wage exceeds (falls short of) subsistence level. Write n=n(w), where as before w=f(k)-

kf(k), the real wage rate. Malthus would predict n>0; let us assume this (but imagine the effect is

small). Now consider the impact of a (permanently) higher savings ratio. The Solow model showed

that the BGE value of the real wage rate must climb, in response to the additional capital per head. If n

were to rise as a result of this, we would find that the BGE growth rate of output went up. Note the

contrast with the standard Solow model, where it remained unchanged. (Note too that, if this

Malthusian relationship is strong enough, we might imperil the existence, or uniqueness, or stability of

BGE). Evidence from the 19

th

and earlier centuries supports Malthus; but recent decades, especially in

rich countries, much less so. Indeed ds dn/ may be taken as broadly negative for much of the 20

th

century, chiefly because of the labour market opportunity cost effects of bearing children for married

women, plus direct child rearing costs. If Malthusian effects hold at low and high w, but anti-

Malthusian effects at intermediate ones, note that n/s curve could be at first convex, then concave,

possibly intersecting f(k) three times.

3

Later lectures will explore c, d and e; Part B of this lecture looks at b. B: Growth with an

Exhaustible Natural Resource

Peter Sinclair, University of Warwick, Growth lectures 3 and 4

October 25, 2012

Let aggregate production of final output be described by the Cobb

Douglas production function:

1

) ( )) ( ) ( ( ) ( ) ( t E t N t B t TK t Q (1)

where E(t) denotes inputs of oil, extracted at that date. (Note that the sum

of the 3 exponents is unity implying that competitive factor rewards add

up to the value of final output; each of the 3 exponents is strictly

positive). So if S(t) is the stock of unextracted oil at date t, ) (t E ) (t S

and let us define the proportionate rate of extraction,

) ( / ) ( ) ( / ) ( ) ( t S t S t S t E t x . B(t) advances at rate b, and N(t) at rate n.

There is perfect competition, the savings share of income is s and, as

again in Solow, no depreciation.

So r(t) = ) ( / ) ( t K t Q . (2)

Differentiating this last equation totally with respect to time implies

. / ) ( ) (

) ( / ) ( ) (

) (

) (

) ( t sr t Q t K t sQ t Q t K t Q t r (3)

Equation (3) is a law of motion for the real rate of interest, which we can

relate to the other key dynamic variable, x(t), a little below.

We now invoke the HOTELLING RULE (Hotelling, JPE 1931) to

explore the dynamics of the price of oil, call it P(t). Assume that oil

exporters are neutral to risk, perfectly competitive, not subject to tax, and

free of any extraction costs. These assumptions imply that the price of

oil should be expected to rise at the real rate of interest. Given foresight,

and shocks apart, actual and expected paths of oil prices should coincide,

so:

) ( ) (

t r t P . (4)

Perfect competition among final output producers implies

4

) ( / ) ( ) 1 ( ) ( t E t Q t P (5)

Note that E should normally be falling over time (and must be in a steady

state), and also that Q will presumably be rising so the price of oil

should exhibit an upward trend over time.

So that, from (4) and (5) and the definition of x(t), we have

). ( ) ( ) (

) ( t x t x t Q t r (6)

Next, it helps to eliminate the growth rate of final output, ) (

t Q . From (1),

we have

) ( ) (

)( 1 ( ) ( ) ( )) ( ) ( )( 1 ( ) ( ) (

) (

t r t Q n b t sr t x t x n b t K t Q

using (6) and (2). Simplifying:

] 1 )[ ( ) ( ) )( (

s t r n b t Q . (7)

BY SUBSTITUTING (7) INTO (3) AND (6) WE CAN NOW FIND 2

KEY LAWS OF MOTION, for the extraction and interest rates, in terms

of these variables alone:

] / 1 )[ ( ) ( ) )( ( s t r n b t r (8)

) 1 )( ( ) ( ) )( ( ) )( ( s t r n b t x t x . (9)

(8) says that the stationarity locus for r is independent of x and always

attracts r (a standard feature of Solow-type and many Ramsey-type

models). In other words, the long run real interest rate is determined by

the production function characteristics, plus the parameters b, n and s.

The savings ratio tends to lower r; b and n to raise it. So r is stable the

dynamics of r are stabilizing. Diagram 1 refers.

(9) says that the stationarity locus for x is linear in r and x, which are

related positively. Intuition: higher r implies, from Hotelling, faster rate

of ascent of the price of oil, and therefore faster extraction. The

dynamics of x are unstable. Diagram 2 refers.

Putting (8) and (9) together, into Diagram 3, shows a steady state at point

E, where the 2 stationarity loci intersect and that there is a unique

5

saddle path towards E from either side. Given foresight, and knowledge

of the model and information about the parameters, agents should be able

to plot the evolution of r and x.

At point E, the steady state, the long run values of r and x (and also the

growth of final output) will be:

s

n b

g A s n b x A n b r

) 1 (

1

; ) / 1 )( ( ; ) ( , where

. / 1

1

s A

Many points of interest are apparent. One is that the (long run) growth

rate now INCREASES with s, the savings ratio. Reason: over time it

raises capital, reduces the rate of interest, and implies slower oil

extraction and therefore higher SUSTAINABLE growth. Note that the

faster oil is extracted, the faster oil inputs into production will decline,

and the slower output growth must be (eventually, at least). (Note too

that if the role of fossil fuels in production were to disappear suddenly,

1 would vanish, and g would be the sum of population growth and

labour augmenting technical progress). Another is that sensible results

require the profit share to exceed the savings ratio (otherwise we get a

nonsensical, negative solution for extraction).

The most interesting feature of all, perhaps, is how we can now use the

model to try to understand the dynamics of oil prices. An unexpected

permanent rise in the savings ratio would flatten the stationarity locus for

x, and push the stationarity locus for r leftwards, with the combined long

run effect of lowering both r and x. The saddle path to the new long run

equilibrium would show x slipping very slightly, and r slipping faster.

Diagram 4 illustrates. So the impact effect would be a big fall in x.

Counterpart: a big jump in the spot price of oil (which would

thenceforward increase more slowly). Similar consequences would

ensue from unanticipated permanent falls in (or reduced expectations of

future values of) b or n. (1970s? 2003-2006?). And falls in expected s

would have the opposite effect (mid 1980s? mid 09). As would the end

of traditional communism , adding large population, but little extra useful

capital, to the prospective advanced trading worlds endowments (late

1980s, early 1990s?). And although oil is currently (around US$83) far

below its July 2008 peak of US$ 143 per barrel, it has risen sharply over

this year so far, and now stands(in US$ at least) at well above its levels

of 3 or more years ago.

6

The decline in real interest rates in the period since the early 2000s is

startling. And it is noticeable that the period from late 2002 to late 2007

witnessed rises not just in oil prices, but in the prices of many other

assets, such as real estate (most economies), gold, equities, and copper,

as well as (rather more mutedly) in indexed bonds. Demography may

be partly responsible for this. Falling fertility (particularly in China,

Japan, Germany, Italy, Russia, Spain, and most of eastern Europe) has

coincided with increased life expectation (especially in most of Asia and

Europe). The Blanchard (1985) model of annuities and random mortality,

which excludes intergenerational altruism, generates the result that steady

state real interest is reduced by reductions in both fertility and mortality

hazard.

(If you want to read more on macro models with oil, you might like to

consult applications to global warming in Sinclair Manchester School

1992 or in a Ramsey framework - Oxford Economic Papers 1994.)

Krautkraemer (JEL 98) is sceptical about Hotelling curves; Lee et al

(Journal of Environmental Economics and Management 2006) is one of

several recent papers to present arguments or pieces of evidence that take

a more favourable view of them.

Das könnte Ihnen auch gefallen

- Beta Anomaly An Ex-Ante Tail RiskDokument104 SeitenBeta Anomaly An Ex-Ante Tail RiskDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Why The Euro Will Rival The Dollar PDFDokument25 SeitenWhy The Euro Will Rival The Dollar PDFDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Claudia Jones Nuclear TestingDokument25 SeitenClaudia Jones Nuclear TestingDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Continuity Change State of Process of Task ofDokument1 SeiteContinuity Change State of Process of Task ofDaniel Lee Eisenberg JacobsNoch keine Bewertungen

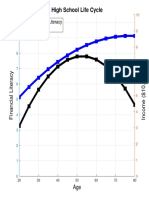

- High School Life Cycle: Financial Literacy IncomeDokument1 SeiteHigh School Life Cycle: Financial Literacy IncomeDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Theophilus Capital Against: Fisk Labor1Dokument9 SeitenTheophilus Capital Against: Fisk Labor1Daniel Lee Eisenberg Jacobs100% (1)

- Conference Group For Central European History of The American Historical AssociationDokument9 SeitenConference Group For Central European History of The American Historical AssociationDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Individualization of Robo-AdviceDokument8 SeitenIndividualization of Robo-AdviceDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Karl Kautsky Republic and Social Democra PDFDokument4 SeitenKarl Kautsky Republic and Social Democra PDFDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Borel Sets PDFDokument181 SeitenBorel Sets PDFDaniel Lee Eisenberg Jacobs100% (1)

- Cover FERCDokument1 SeiteCover FERCDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- 1st International: Djacobs November 2020Dokument5 Seiten1st International: Djacobs November 2020Daniel Lee Eisenberg JacobsNoch keine Bewertungen

- Gpebook PDFDokument332 SeitenGpebook PDFDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- The Saving Behavior of Public Vocational High School Students of Business and Management Program in Semarang SitiDokument8 SeitenThe Saving Behavior of Public Vocational High School Students of Business and Management Program in Semarang SitiDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Bank Loan Loss ProvisioningDokument17 SeitenBank Loan Loss ProvisioningDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Necessary and Sufficient Conditions For Dynamic OptimizationDokument18 SeitenNecessary and Sufficient Conditions For Dynamic OptimizationDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Teach-In: Government of The People, by The People, For The PeopleDokument24 SeitenTeach-In: Government of The People, by The People, For The PeopleDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Simple BeamerDokument25 SeitenSimple BeamerDaniel Lee Eisenberg JacobsNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Catalog Man 1Dokument116 SeitenCatalog Man 1Petrov AndreiNoch keine Bewertungen

- Manual Elspec SPG 4420Dokument303 SeitenManual Elspec SPG 4420Bairon Alvira ManiosNoch keine Bewertungen

- Biopsy: Assessment Diagnosis Planning Intervention Rationale EvaluationDokument5 SeitenBiopsy: Assessment Diagnosis Planning Intervention Rationale EvaluationDan HizonNoch keine Bewertungen

- Definition of Logistics ManagementDokument4 SeitenDefinition of Logistics ManagementzamaneNoch keine Bewertungen

- Dragons and Winged SerpentsDokument5 SeitenDragons and Winged SerpentsYuna Raven100% (1)

- Academic Program Required Recommended Academic Program Required RecommendedDokument1 SeiteAcademic Program Required Recommended Academic Program Required Recommendedonur scribdNoch keine Bewertungen

- Grand Vitara 2005Dokument35 SeitenGrand Vitara 2005PattyaaNoch keine Bewertungen

- An Infallible JusticeDokument7 SeitenAn Infallible JusticeMani Gopal DasNoch keine Bewertungen

- Wind Load CompututationsDokument31 SeitenWind Load Compututationskim suarezNoch keine Bewertungen

- The Coffee Shop Easy Reading - 152542Dokument1 SeiteThe Coffee Shop Easy Reading - 152542Fc MakmurNoch keine Bewertungen

- DA-42 Performance Calculator v2.3.1Dokument23 SeitenDA-42 Performance Calculator v2.3.1DodgeHemi1Noch keine Bewertungen

- Iron FistDokument2 SeitenIron FistVictor PileggiNoch keine Bewertungen

- 5 Kingdoms of OrganismsDokument13 Seiten5 Kingdoms of OrganismsChoirul Anam100% (2)

- Content For Essay and Paragraph Writing On Maritime HistoryDokument15 SeitenContent For Essay and Paragraph Writing On Maritime HistoryRaju KumarNoch keine Bewertungen

- Cad, CamDokument16 SeitenCad, CamRakhi Mol BVNoch keine Bewertungen

- 020 Basketball CourtDokument4 Seiten020 Basketball CourtMohamad TaufiqNoch keine Bewertungen

- Our Lady of Fatima University: College of Business & AccountancyDokument17 SeitenOur Lady of Fatima University: College of Business & AccountancyCLARIN GERALDNoch keine Bewertungen

- 7 Stages of NafsDokument7 Seiten7 Stages of NafsLilyNoch keine Bewertungen

- TRL Explanations - 1Dokument4 SeitenTRL Explanations - 1Ana DulceNoch keine Bewertungen

- Catalogue Mp200Dokument33 SeitenCatalogue Mp200Adrian TudorNoch keine Bewertungen

- Time Series - Practical ExercisesDokument9 SeitenTime Series - Practical ExercisesJobayer Islam TunanNoch keine Bewertungen

- Pre-Test First QTR 2022-2023Dokument3 SeitenPre-Test First QTR 2022-2023anna marie mangulabnanNoch keine Bewertungen

- Journal Homepage: - : IntroductionDokument9 SeitenJournal Homepage: - : IntroductionIJAR JOURNALNoch keine Bewertungen

- Construction Companies in AlbaniaDokument17 SeitenConstruction Companies in AlbaniaPacific HRNoch keine Bewertungen

- Barium Chloride 2h2o LRG MsdsDokument3 SeitenBarium Chloride 2h2o LRG MsdsAnas GiselNoch keine Bewertungen

- OKM 54MP FlyerDokument1 SeiteOKM 54MP FlyerJohnsonNoch keine Bewertungen

- Load ScheduleDokument8 SeitenLoad SchedulemerebookNoch keine Bewertungen

- Danh M C AHTN 2017 - HS Code 2017 PDFDokument564 SeitenDanh M C AHTN 2017 - HS Code 2017 PDFBao Ngoc Nguyen100% (1)

- A Practical Approach To Classical YogaDokument39 SeitenA Practical Approach To Classical Yogaabhilasha_yadav_1Noch keine Bewertungen

- Pastor O. I. Kirk, SR D.D LIFE Celebration BookDokument63 SeitenPastor O. I. Kirk, SR D.D LIFE Celebration Booklindakirk1100% (1)