Beruflich Dokumente

Kultur Dokumente

2014 Outlook Health Care

Hochgeladen von

rahulverma90 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten8 Seitenyou can get to know about the health industry

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenyou can get to know about the health industry

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten8 Seiten2014 Outlook Health Care

Hochgeladen von

rahulverma9you can get to know about the health industry

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

Corporates

www.indiaratings.co.in 31 January 2014

Health Care

2014 Outlook: Health Care

Earning Drivers Intact, Capex to Continue

Outlook Report

Favourable Earning Dynamics: India Ratings & Research (Ind-Ra) has a stable outlook on

the health care sector and all its rated sector companies for FY15. Growth in the sector will

continue to be driven by the wide gap between demand and supply in health care services.

Key drivers for demand are increasing lifestyle-related health problems, the sectors immunity

to economic cycles, improving health insurance penetration, increasing awareness and

disposable income. The sectors growth is also likely to be boosted by continuing government

initiatives and increasing medical tourism in the country.

Capacity Addition to Continue: In view of the strong demand drivers, the industry is attracting

investments towards health services (hospital beds) and allied industries such as medical

technologies, diagnostics, etc. Ind-Ra believes a majority of the investments in FY15 will

continue to come from the private sector.

Long Break-even Periods, Pressure on Profitability: Revenue of most health care players

will grow 10%-15% yoy in FY15 due to continuous expansion in the bed capacity. However, the

overall profitability of the sector might be affected by a long break-even period of new capex

and high manpower costs. Ind-Ra believes credit profiles, especially of the standalone

hospitals with recent bed additions, are likely to be stressed in FY15. However, larger players

with multiple hospitals leading to higher economies of scale would be better placed.

Regulatory Benefits: The government has made important contribution to incentivise the

investments in the sector through its insurance schemes, encouraging investments in public

private partnership and also qualifying hospitals (including medical colleges, paramedical

training institutes and diagnostics centres) for infrastructure lending.

These initiatives are likely to positively impact the occupancy levels and could also mean better

lending terms in the form of concessional interest rates, longer moratorium and maturity aiding

in the capex plans of health care players. The initiatives could also enhance the credit profiles

of entities, especially in the initial years of the capex when optimum utilisation is yet to be

achieved.

New Business Models: The investments by large private sector entities in the health care

industry were primarily restricted to high-cost, multi-specialty tertiary care facilities. Increasing

competitive intensity and high real estate costs involved in the Tier I cities have shifted the

investors focus towards relatively lower cost, underpenetrated Tier II and Tier III cities and also

towards asset-light, less capital intensive business models. Ind-Ra believes certain business

models such as single specialty, hub-and-spoke, health mall and day care/ambulatory services

centres will attract investors in FY15.

What Could Change the Outlook

Consolidation of Operations: Continuous capex in the last few years has led to a rise in

borrowings for many players, impacting their credit profiles. Consolidation of operations leading

to improved credit profile will be a positive for the sector. Timely completion of the planned

expansion along with attaining optimum occupancy rates will also lead to a positive outlook

revision for both the sector and companies.

Sector Outlook

STABLE

Rating Outlook

STABLE

Favourable demand supply gap

Boost from regulatory benefits

Increasing health insurance penetration

Analysts

Mukul Pathak

+91 11 4356 7241

mukul.pathak@indiaratings.co.in

Avinash Lodha

+91 44 4340 1722

avinash.lodha@indiaratings.co.in

Tejas Savani

+91 44 4340 1725

tejas.savani@indiaratings.co.in

Salil Garg

+91 11 4356 7244

salil.garg@indiaratings.co.in

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

2

Reducing the gap between the demand and supply of doctors and medical staff will also be a

long-term positive for the sector.

Debt-led Expansions, Commissioning Delays: Continuous debt-led capex, coupled with

delays in commissioning of facilities and stressed profitability due to low occupancy could affect

the outlook negatively.

Key Issues

Capex At the Crossroads

Driven by increasing urbanisation, which has brought in affordability and awareness, the sector

has seen increased spending and substantial investments over the past decade. Investments

have been towards increasing hospital bed capacity, medical devices, and medical education

to produce more doctors and paramedical staff. However, despite these investments, the

Indian health care statistics do not compare well with those of similar economies.

Figure 2

Key Health Care Statistics

Per 10,000

Hospital

beds

General government expenditure on

health as a percentage of total

expenditure on health

Total expenditure on health

as a percentage of gross

domestic product

Russian Federation 97.0 59.7 6.2

UK 30.0 82.7 9.3

US 30.0 45.9 17.9

China 39.0 55.9 5.2

Brazil 23.0 45.7 8.9

India 9.0 31.0 3.9

World Median Average 27.0 60.8 6.5

Source: WHO - World Health Statistics

To achieve the government of Indias goal of 20.0 beds per 10,000 people by 2020, Ind-Ra

estimates 1.5 million beds will have to be added requiring multi-billion dollar investments.

Based on capex announcements by the industry players, FY15 would be the year of peak

capacity additions since FY11.

Figure 3

Though the government spending on health care has been increasing, most of the investments

in FY15 will come from the private sector. Ind-Ra believes as companies continue with capex

plans, borrowings will increase over the short to medium term leading to increased financial

leverage.

0

3,000

6,000

9,000

12,000

15,000

18,000

0

30

60

90

120

150

180

FY11 FY12 FY13 FY14 FY15 FY16

Investment (LHS) Bed capacity addition (RHS) Projected (RHS)

Capacity Expansion in Indian Health Care

(INRbn)

Source: CMIE

(Beds)

Figure 1

Applicable Criteria

Corporate Rating Methodology

(September 2012)

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

3

Emergence of low-cost models Tier II cities promising geographies

Health care companies are now opting for low-cost models in Tier II cities due to the high

competition and heavy capex they face in Tier I cities. Ind-Ra believes low-cost delivery models

in Tier II and Tier III cities would be the targeted avenues for capacity additions in FY15. Low-

cost models including single specialty centers requiring smaller area and hence lower

investment, asset light models such as hospitals on lease rental model which reduces the

expenditure on real estate, hub and spoke model where a large hospital (with multi -speciality

facilities) in a bigger city acts as the hub to the smaller hospitals (spokes) and day

care/ambulatory centres are emerging as preferred investment models for investors.

The agency believes established entities having a large network of hospitals with higher

economies of scales and strong operating cash flows coupled with better refinancing

capabilities will be better placed compared with smaller, standalone hospitals. However, the

companies will have to time their investments strategically to protect their credit profiles.

Stress on Profitability Continuous Capex and High Manpower Costs

Major health care players have grown in the last decade both organically and inorganically

without taking break in the capex cycle to consolidate the growth. Long break-even period for

the hospitals coupled with shortage of doctors and paramedical staff has led to high operating

costs impacting the profitability of the companies. The average manpower cost for large

corporate chains has been in the range of 30%-35% since FY11.

Based on the World Health Organizations estimates, India has 6.5 doctors per 10,000 people

against the world median of 14.2. There have been investments over the last two decades to

increase medical colleges in the country. The government had also recently announced an

addition of 10,000 seats in state and central government medical colleges. However, Ind-Ra

does not expect the demand supply dynamics to improve in the short to medium term leading

to continued stress on profitability in FY15 for many players.

Large players such as Fortis Healthcare Limited and Max Healthcare Institute Limited, which

have continuously enhanced their bed capacity are facing volatile margins and credit profile as

not all of the facilities have started to yield.

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

4

Figure 4 Figure 5

Among Ind-Ra rated health care entities, Manipal Health Enterprises (IND A-'/Stable) plans to

acquire existing fully operational hospitals and/or expand its capacities. The capex is planned

to be funded by a mix of debt and equity which would lead to credit metrics deterioration over

FY14 and FY15.

Healthcare Global Enterprises Limited (IND BBB/Stable) plans to set up 16 centres in India

and two in Uganda over the next 15 months, to be funded by a mix of debt and equity. This is

likely to deteriorate the companys credit metrics during the expansion phase.

Regency Hospital Limited (IND BBB-/Stable) completed expansion in 1HFY13. The credit

profile of the company started to improve from 2HFY13 and is likely to improve further.

Medical Tourism A growth opportunity

As health care related costs soar high and waiting time for surgeries lengthen in the developed

parts of the world, medical tourism is increasing in developing markets such as India. The

countrys state-of-the-art facilities offering super speciality surgical procedures at attractive

costs are placed well to capitalise on this opportunity. Based on the estimates of The

Associated Chambers of Commerce and Industry of India (ASSOCHAM), the medical tourism

industry in India is likely to grow 25% yoy and reach INR120bn by 2015.

Ind-Ra expects established players in larger cities with better connectivity to reap the most of

this opportunity.

Health Insurance Penetration Growing But Still a Long Way to Go

The growth in the health care sector in mature, developed markets is driven by strong

insurance penetration while Indias health care spending still depends, to a large extent, on out-

of-pocket expenses with insurance contributing only around 20%-25% expenses.

Also, per capita expenditure on health in India is the lowest among the comparable emerging

economies. This is a major deterrent in the sectors growth. However, with the increasing

insurance penetration in the country, especially in the Tier II and Tier III cities, health care

spending is likely to be boosted.

0

2

4

6

8

FY10 FY11 FY12 FY13 FY14P FY15P

Regency Hospital Limited

Manipal Health Enterprises Limited

Yashoda Super Speciality Hospital

Mittal Hospitals Limited

Healthcare Global Enterprises Limited

Leverage Trend for Ind-Ra Rated

Companies

Source: Companies, Ind-Ra

Leverage (x)

-20

-10

0

10

20

30

40

FY10 FY11 FY12 FY13 FY14P FY15P

Regency Hospital Limited

Manipal Health Enterprises Limited

Yashoda Super Speciality Hospital

Mittal Hospitals Limited

Alchemist Hospitals Limited

Healthcare Global Enterprises Limited

Profitability Pattern for Ind-Ra Rated

Companies

Source: Companies, Ind-Ra

EBITDA margin (x)

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

5

Figure 6 Figure 7

Based on the World Banks estimates, about half of Indias population will be covered under

some form of health insurance by end-2015 with government sponsored health insurance

schemes playing an important role.

Private Equity (PE) Interest across the Value Chain

PE players have been bullish on the Indian health care sector with investments being made

across the value chain in multi-speciality hospitals, single speciality clinics, diagnostics and

pathology labs and medical devices. This is primarily due to the sectors strong growth potential

along with its immunity to the economic slowdown.

The growth of the health care industry has to be parallel with that of the allied industries such

as diagnostics, pathology and medical devices. With increasing lifestyle-related health issues

and health insurance penetration, diagnostics and pathology services are becoming important

contributors to revenue and profitability of hospitals. This protects the credit profiles in the wake

of large investments in adding bed capacity and medical equipment to some extent.

Also, with the increasing focus of health care players on the asset-light, low-cost models in Tier

II cities, the reliance on imports of medical devices has to come down to reduce costs. This,

along with the availability of engineering talent and increasing domestic demand, could attract

higher investments from multinational equipment manufacturers and PE investors.

Figure 8

Select Private Equity Deals

Investor Investee

Deal Value

(INRm) Month Sector

Asian Healthcare Fund Forus INR500m Jan 14 Medical devices

India Value Fund, Trivitron Healthcare INR1,500m Dec 13 Medical devices

Carlyle Global Health Limited INR9500m Dec 13 Hospital

Sequoia Capital Cloudnine INR1,000m Oct 13 Maternity and infant

care

Orbi Med Surya Child Care INR540m Sep 13 Paediatric hospital

TPG Growth Sutures India INR1,500m Sep 13 Medical Consumables

West Bridge Capital Partners Dr Lal Path Labs INR2160m Feb 13 Diagnostics

Goldmann Sachs BPL Medical Technologies INR1,100m May 13 Medical devices

Fidelity Growth Partners Trivitron Healthcare INR4,000m Oct 12 Medical devices

Government of Singapore

Investment Corporation (GIC)

Vasan Health Care Pvt Ltd INR5,500m Mar 12 Single Speciality

Clinics

Advent International Care Hospital INR5,500m Apr 12 Hospitals

Source: Media reports

0

200

400

600

800

1,000

1,200

1,400

Brazil China India Russia South

Africa

Per capital health expenditure

Per Capita Total Expenditure on

Health (PPP int USD)

(USD)

Source: WHO

0

30

60

90

120

150

0

30

60

90

120

150

2006 2007 2008 2009 2010 2011

Health insurance premiums (LHS)

Per capital health expenditure (RHS)

Increase in Health Insurance

Premiums and Per Capita

Expenditure on Health

(INRbn)

Source: WHO, Insurance Regulatory Development

Authority

(PPP Int. USD)

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

6

2013 Review

Manipal Health Enterprises Private Limited (MHEL, IND A-'/Stable)

Ind-Ra assigned MEHL an IND A-' Long-Term Issuer Rating reflecting the companys over 26

years of operational track record and established brand of hospitals. The ratings also reflect the

companys strong founders, backing of PE money for funding expansion and financial flexibility

underpinned by a long debt repayment schedule. MHEL runs an asset-light hospital chain. It

has 11 leased and four managed hospitals with a total of 4,400 beds.

Yashoda Super Speciality Hospitals (Yashoda, IND BBB+/Stable)

Ind-Ra affirmed Yashoda to reflect its robust credit profile, continued high revenue growth and

stable profitability margins coupled with positive cash flows over FY10-FY13. Yashoda runs a

tertiary care hospital started in 1990. Specialties practiced at Yashoda include oncology,

cardiology & cardiothoracic surgery and orthopaedics & joint replacements. It is part of the

Yashoda Group which operates three facilities with a total capacity of 1,196 beds (including

Yashoda).

Healthcare Global Enterprises Limited (HCGE, IND BBB/Stable)

Ind-Ra assigned HCGE and HCGEs subsidiaries, Healthcare Global Vijay Oncology Private

Limited and Healthcare Medi-Surge Hospitals Private Limited, a IND BBB rating reflecting their

established brand in the field of cancer treatment and strong PE investor backing. HCGEs pan-

India presence through its 27 centres and the 30 years of experience of its founder in the field

of oncology also support the rating. This, along with its policy of partnering with established

oncology practitioners for new locations ensuring an existing pool of patients and consequently,

a short break-even period are credit positives.

Regency Hospital Limited (RHL, IND BBB-'/Stable)

Ind-Ra assigned RHL an IND BBB-' Long-Term Issuer Rating reflecting its continuous growth

in revenue and stable operating profitability due to high occupancy rates in its two hospitals.

The ratings are also supported by RHLs established market position in Kanpur.

Alchemist Hospitals (AHL, IND BB-'/Stable)

Ind-Ra upgraded AHLs ratings to reflect its improved capital structure due to an equity infusion

of INR1,000m from the Alchemist Group in FY13 coupled with its better operational

performance. The improved operational performance resulted from the companys increased

focus on speciality services. AHL is part of the Alchemist Group and operates two 100-bed

multi-speciality hospitals in Gurgaon and Panchkula.

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

7

Appendix

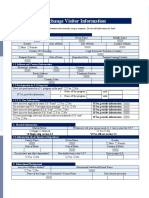

Figure 9

Issuer Ratings

Issuer

Rating/Outlook/RW

(Current)

Rating/Outlook/RW

(2012)

Manipal Health Enterprises Limited IND A-/Stable n.a.

Yashoda Super Speciality Hospital IND BBB+/Stable IND BBB+/Stable

Alchemist Hospitals Limited IND BB-/Stable IND B+/Stable

Mittal Hospitals Limited IND BB-/Stable IND BB-/Stable

Healthcare Global Enterprises Limited IND BBB/Stable n.a.

Regency Hospital Limited IND BBB-/Stable n.a.

SSGR Hospital and Research Center Pvt. Ltd. IND B/Stable n.a.

Source: Ind-Ra

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Corporates

2014 Outlook: Health Care

January 2014

8

ALL CREDIT RATINGS ASSIGNED BY INDIA RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS

AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS

LINK: HTTP://WWW.INDIARATINGS.CO.IN/UNDERSTANDINGCREDITRATINGS.JSP IN ADDITION,

RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE

AGENCY'S PUBLIC WEBSITE WWW.INDIARATINGS.CO.IN. PUBLISHED RATINGS, CRITERIA, AND

METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. INDIA RATINGS CODE OF

CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE,

AND OTHER RELEVANT POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE CODE

OF CONDUCT SECTION OF THIS SITE.

Copyright 2014 by Fitch, Inc., Fitch Ratings Ltd. and its subsidiaries. One State Street Plaza, NY, NY 10004.Telephone: 1-800-753-4824,

(212) 908-0500. Fax: (212) 480-4435. Reproduction or retransmission in whole or in part is prohibited except by permission. All rights

reserved. In issuing and maintaining its ratings, India Ratings & Research (India Ratings) relies on factual information it receives from issuers

and underwriters and from other sources India Ratings believes to be credible. India Ratings conducts a reasonable investigation of the factual

information relied upon by it in accordance with its ratings methodology, and obtains reasonable verification of that information from

independent sources, to the extent such sources are available for a given security or in a given jurisdiction. The manner of India Ratings

factual investigation and the scope of the third-party verification it obtains will vary depending on the nature of the rated security and its issuer,

the requirements and practices in the jurisdiction in which the rated security is offered and sold and/or the issuer is located, the availability and

nature of relevant public information, access to the management of the issuer and its advisers, the availability of pre-existing third-party

verifications such as audit reports, agreed-upon procedures letters, appraisals, actuarial reports, engineering reports, legal opinions and other

reports provided by third parties, the availability of independent and competent third-party verification sources with respect to the particular

security or in the particular jurisdiction of the issuer, and a variety of other factors. Users of India Ratings ratings should understand that

neither an enhanced factual investigation nor any third-party verification can ensure that all of the information India Ratings relies on in

connection with a rating will be accurate and complete. Ultimately, the issuer and its advisers are responsible for the accuracy of the

information they provide to India Ratings and to the market in offering documents and other reports. In issuing its ratings India Ratings must

rely on the work of experts, including independent auditors with respect to financial statements and attorneys with respect t o legal and tax

matters. Further, ratings are inherently forward-looking and embody assumptions and predictions about future events that by their nature

cannot be verified as facts. As a result, despite any verification of current facts, ratings can be affected by future events or conditions that were

not anticipated at the time a rating was issued or affirmed.

The information in this report is provided "as is" without any representation or warranty of any kind. A rating provided by I ndia Ratings is an

opinion as to the creditworthiness of a security. This opinion is based on established criteria and methodologies that India Ratings is

continuously evaluating and updating. Therefore, ratings are the collective work product of India Ratings and no individual, or group of

individuals, is solely responsible for a rating. The rating does not address the risk of loss due to risks other than credit risk, unless such risk is

specifically mentioned. India Ratings is not engaged in the offer or sale of any security. All India Ratings reports have shared authorship.

Individuals identified in a India ratings report were involved in, but are not solely responsible for, the opinions stated therein. The individuals

are named for contact purposes only. A report providing a rating by India Ratings is neither a prospectus nor a substi tute for the information

assembled, verified and presented to investors by the issuer and its agents in connection with the sale of the securities. Ratings may be

changed or withdrawn at any time for any reason in the sole discretion of India Ratings. India Ratings does not provide investment advice of

any sort. Ratings are not a recommendation to buy, sell, or hold any security. Ratings do not comment on the adequacy of market price, the

suitability of any security for a particular investor, or the tax-exempt nature or taxability of payments made in respect to any security. India

Ratings receives fees from issuers, insurers, guarantors, other obligors, and underwriters for rating securities. The assignment, publication, or

dissemination of a rating by India Ratings shall not constitute a consent by India Ratings to use its name as an expert in connection with any

registration statement filed under the United States securities laws, the Financial Services and Markets Act of 2000 of the United Kingdom, or

the securities laws of any particular jurisdiction including India. Due to the relative efficiency of electronic publishing and distribution, India

Ratings research may be available to electronic subscribers up to three days earlier than to print subscribers.

The ratings above were solicited by, or on behalf of, the issuer, and therefore, India

Ratings has been compensated for the provision of the ratings.

EMISPDF in-iimidrchand from 14.139.224.146 on 2014-09-24 20:29:25 BST. DownloadPDF.

Downloaded by in-iimidrchand from 14.139.224.146 at 2014-09-24 20:29:25 BST. EMIS. Unauthorized Distribution Prohibited.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Module 10 Air Legislation EssayDokument3 SeitenModule 10 Air Legislation EssayKeith Roche100% (1)

- Gaccept3 20160810 145923695Dokument2 SeitenGaccept3 20160810 145923695Laxman RamesNoch keine Bewertungen

- ENGLISH For The GLOBALIZED CLASSROOM SeriesDokument7 SeitenENGLISH For The GLOBALIZED CLASSROOM SeriesCentienne Bateman100% (1)

- NQF03 Guide To NQS 130902Dokument200 SeitenNQF03 Guide To NQS 130902Adam BorthwickNoch keine Bewertungen

- Docket No. AO 12-025 WD - Nathan and Jenny Chartier, Abigails Bakery HILITEDDokument4 SeitenDocket No. AO 12-025 WD - Nathan and Jenny Chartier, Abigails Bakery HILITEDAudra ToopNoch keine Bewertungen

- Basic Principle of Health Care EthicsDokument2 SeitenBasic Principle of Health Care EthicsNURSETOPNOTCHERNoch keine Bewertungen

- Budgeting Process WashingtonDokument12 SeitenBudgeting Process WashingtonFangxue ZhengNoch keine Bewertungen

- NSTPDokument8 SeitenNSTPGino GalanoNoch keine Bewertungen

- Engleski - Šalić 1Dokument19 SeitenEngleski - Šalić 1Leonarda PavićNoch keine Bewertungen

- ECC For Academic PurposesDokument6 SeitenECC For Academic Purposesvia christineNoch keine Bewertungen

- Department of Budget and ManagementDokument3 SeitenDepartment of Budget and ManagementChariz Eniceo HermocillaNoch keine Bewertungen

- Frank Field LetterDokument3 SeitenFrank Field LetterLeonInclusionCarterNoch keine Bewertungen

- Nestle Cocoa Child LabourDokument4 SeitenNestle Cocoa Child LabourJulius Paulo ValerosNoch keine Bewertungen

- The Story of Martha Laura Granados - The Immigration Prostitute - DOB 11/14/1966Dokument4 SeitenThe Story of Martha Laura Granados - The Immigration Prostitute - DOB 11/14/1966Martha Laura Granados DOB 11/14/1966Noch keine Bewertungen

- Exchange Visitor InformationDokument3 SeitenExchange Visitor InformationPrathamesh ParabNoch keine Bewertungen

- Samriddhi MissionDokument20 SeitenSamriddhi MissionKumud ShankarNoch keine Bewertungen

- Memorandum To Benard Berelson 1969-EUGENISME PREUVEDokument1 SeiteMemorandum To Benard Berelson 1969-EUGENISME PREUVEcruxsacraNoch keine Bewertungen

- World Health OrganizationDokument17 SeitenWorld Health OrganizationRichi SinghNoch keine Bewertungen

- Current Affairs Pocket PDF - September 2020 by AffairsCloud PDFDokument97 SeitenCurrent Affairs Pocket PDF - September 2020 by AffairsCloud PDFNandkishor PalNoch keine Bewertungen

- Division of Camarines SurDokument1 SeiteDivision of Camarines SurkachirikoNoch keine Bewertungen

- List of College Teaching MBBS - MCI India 2Dokument10 SeitenList of College Teaching MBBS - MCI India 2Nipun JainNoch keine Bewertungen

- ONC Draft Nationwide Interoperability Roadmap PDFDokument166 SeitenONC Draft Nationwide Interoperability Roadmap PDFiggybauNoch keine Bewertungen

- As 1319-1994 Safety Signs For The Occupational EnvironmentDokument8 SeitenAs 1319-1994 Safety Signs For The Occupational EnvironmentSAI Global - APAC0% (2)

- Video Commissioning AgreementDokument10 SeitenVideo Commissioning AgreementRadenko IvanovicNoch keine Bewertungen

- Code of Ethics For NursesDokument11 SeitenCode of Ethics For NursesPaul Andrew TugahanNoch keine Bewertungen

- Most Frequently Asked Questions About OSHA: When Was OSHA Created?Dokument2 SeitenMost Frequently Asked Questions About OSHA: When Was OSHA Created?Mohammed YasserNoch keine Bewertungen

- 09 Chapter 2hhjDokument36 Seiten09 Chapter 2hhjRizzy PopNoch keine Bewertungen

- EDPM SBA 2014 RevisedDokument20 SeitenEDPM SBA 2014 RevisedSayyid Muhammad Aqeed Aabidi100% (2)

- Ten Golden Rules For Successful Safe Ship ManagementDokument2 SeitenTen Golden Rules For Successful Safe Ship Managementislima100% (1)

- North Carolina House Budget PlanDokument639 SeitenNorth Carolina House Budget PlanSteven DoyleNoch keine Bewertungen