Beruflich Dokumente

Kultur Dokumente

HW Assignment 2 4

Hochgeladen von

phi_maniacsOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HW Assignment 2 4

Hochgeladen von

phi_maniacsCopyright:

Verfügbare Formate

4.

value:

25.00 points

HW ASSIGNMENT-2 instructions | help

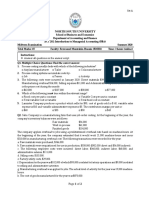

Ravsten Company uses a job-order costing system.

The company applies overhead cost to jobs on the basis of machine-hours. For the current year, the

company estimated that it would work 38,000 machine-hours and incur $165,300 in manufacturing overhead

cost. The following transactions occurred during the year:

a. Raw materials requisitioned for use in production, $192,000 (75% direct and 25% indirect).

b. The following costs were incurred for employee services:

Direct labor $ 162,000

Indirect labor $ 20,000

Sales commissions $ 12,000

Administrative salaries $ 27,000

c. Heat, power, and water costs incurred in the factory, $44,000.

d. Insurance costs, $12,000 (85% relates to factory operations, and 15% relates to selling and

administrative activities).

e. Advertising costs incurred, $52,000.

f. Depreciation recorded for the year, $62,000 (80% relates to factory operations, and 20% relates to

selling and administrative activities).

g. The company used 42,000 machine-hours during the year.

h. Goods that cost $482,000 to manufacture according to their job cost sheets were transferred to the

finished goods warehouse.

i. Sales for the year totaled $704,000. The total cost to manufacture these goods according to their job

cost sheets was $477,000.

Required:

1. Determine the underapplied or overapplied overhead for the year. (Round your intermediate

calculations to two decimal places.)

$ Overhead overapplied 10,900

2.

Prepare an income statement for the year. (Hint: No calculations are required to determine the cost of

goods sold before any adjustment for underapplied or overapplied overhead.) (Round your

intermediate calculations to two decimal places.)

Waila Fitri Sudharyanto

FI019-Managerial Accounting-14T2: MA2-

Management

$

$

Ravsten Company

Income Statement

For the Year Ended December 31

Sales 704,000

Cost of goods sold 466,100

Gross margin 237,900

Selling and administrative expenses 105,200

Net operating income 132,700

ref erences

2014 McGraw-Hill Education. All rights reserved.

success...

Das könnte Ihnen auch gefallen

- Finals SolutionsDokument9 SeitenFinals Solutionsi_dreambig100% (3)

- ACT 202 AssignmentDokument3 SeitenACT 202 AssignmentFahim AnjumNoch keine Bewertungen

- ACT202 Midterm ExamDokument2 SeitenACT202 Midterm ExamSalahuddin BadhonNoch keine Bewertungen

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDokument18 SeitenAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- MASDokument10 SeitenMASMelvin TalaveraNoch keine Bewertungen

- Day 06Dokument8 SeitenDay 06Cy PenalosaNoch keine Bewertungen

- KTQTDokument3 SeitenKTQTTrần Nguyễn Tuệ MinhNoch keine Bewertungen

- BA 7000 Study Guide 1Dokument11 SeitenBA 7000 Study Guide 1ekachristinerebecaNoch keine Bewertungen

- QS05 - Class Exercises SolutionDokument3 SeitenQS05 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- Mas ReviewDokument4 SeitenMas ReviewCarl AngeloNoch keine Bewertungen

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Dokument2 Seiten3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Chapter 24Dokument28 SeitenChapter 24Shahaleel Alboridi0% (2)

- Managerial Accounting Practice Problems2 PDFDokument9 SeitenManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- 8508 QuestionsDokument3 Seiten8508 QuestionsHassan MalikNoch keine Bewertungen

- 203 Practice WTR 2013 PDFDokument22 Seiten203 Practice WTR 2013 PDFKarim IsmailNoch keine Bewertungen

- Management Accounting Midterm Test (Time: 60') Name: Student ID: Class: - Part 1: Multiple Choice QuestionsDokument5 SeitenManagement Accounting Midterm Test (Time: 60') Name: Student ID: Class: - Part 1: Multiple Choice QuestionsSơn HoàngNoch keine Bewertungen

- Job Costing and Overhead ER PDFDokument16 SeitenJob Costing and Overhead ER PDFShaira VillaflorNoch keine Bewertungen

- CH 10Dokument5 SeitenCH 10ghsoub7770% (1)

- CH 22 Exercises ProblemsDokument3 SeitenCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Manufacturing Costs Lecture Version 2 STUDENT VERSIONDokument15 SeitenManufacturing Costs Lecture Version 2 STUDENT VERSIONLampel Louise LlandaNoch keine Bewertungen

- Zkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSDokument34 SeitenZkhokhar - 1336 - 3711 - 1 - CHAPTER 04 - JOB-ORDER COSTING - PROBLEMSnabeel nabiNoch keine Bewertungen

- LEVEL 2 Online Quiz - Questions SET ADokument8 SeitenLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNoch keine Bewertungen

- AkbiDokument37 SeitenAkbiCenxi TVNoch keine Bewertungen

- Final Exam AkmenlanDokument12 SeitenFinal Exam AkmenlanThomas DelongeNoch keine Bewertungen

- IPE 481 - Term Final Question - January 2020Dokument6 SeitenIPE 481 - Term Final Question - January 2020Shaumik RahmanNoch keine Bewertungen

- Sample MidTerm MC With AnswersDokument5 SeitenSample MidTerm MC With Answersharristamhk100% (1)

- Managerial Accounting - WS4 Connect Homework GradedDokument9 SeitenManagerial Accounting - WS4 Connect Homework GradedJason HamiltonNoch keine Bewertungen

- Mas Preweek Hndouts Batch 92Dokument26 SeitenMas Preweek Hndouts Batch 92Mark Anthony CasupangNoch keine Bewertungen

- Sample Questions Part 2 - Feb08 (Web)Dokument15 SeitenSample Questions Part 2 - Feb08 (Web)AccountingLegal AccountingLegalNoch keine Bewertungen

- Ma1 Specimen j14Dokument17 SeitenMa1 Specimen j14Shohin100% (1)

- Cup-Management Advisory ServicesDokument7 SeitenCup-Management Advisory ServicesJerauld BucolNoch keine Bewertungen

- Santiago City, Philippines: College of Accountancy and Business Administration Cost Accounting Quiz # 1Dokument1 SeiteSantiago City, Philippines: College of Accountancy and Business Administration Cost Accounting Quiz # 1Vel JuneNoch keine Bewertungen

- Cost AccumulationDokument5 SeitenCost AccumulationAccounting Files0% (1)

- Practice Problem Job CostingDokument4 SeitenPractice Problem Job CostingDonna Zandueta-TumalaNoch keine Bewertungen

- Managerial AccountingDokument1 SeiteManagerial Accountingacuna.alexNoch keine Bewertungen

- Act Exam 1Dokument14 SeitenAct Exam 1aman_nsu100% (1)

- Dorji GyeltshenDokument7 SeitenDorji Gyeltshenyeshey460Noch keine Bewertungen

- Saa Group Cat TT7 Mock 2011 PDFDokument16 SeitenSaa Group Cat TT7 Mock 2011 PDFAngie NguyenNoch keine Bewertungen

- Tutorial Questions For Week 2Dokument4 SeitenTutorial Questions For Week 2MANPREETNoch keine Bewertungen

- Final ExamDokument12 SeitenFinal ExamKang JoonNoch keine Bewertungen

- 3 Cost Volume Profit AnalysisDokument9 Seiten3 Cost Volume Profit AnalysisNancy MendozaNoch keine Bewertungen

- Managerial Accounting Trial Essay Questions - V3Dokument2 SeitenManagerial Accounting Trial Essay Questions - V3Nhật Nam BùiNoch keine Bewertungen

- Questions For ExamDokument9 SeitenQuestions For ExamjojoinnitNoch keine Bewertungen

- G4 ZAKARIA - Job Order Costing SystemDokument6 SeitenG4 ZAKARIA - Job Order Costing SystemZakaria HasaneenNoch keine Bewertungen

- AFAR TestDokument6 SeitenAFAR TestJtm PasigNoch keine Bewertungen

- Class Handout - Job Costing Session - 2and3-2Dokument4 SeitenClass Handout - Job Costing Session - 2and3-2Ritwik MahajanNoch keine Bewertungen

- FinalexamDokument12 SeitenFinalexamJoshua GibsonNoch keine Bewertungen

- Assignment CH 2Dokument30 SeitenAssignment CH 2Svetlana50% (2)

- Accounting QuestionDokument8 SeitenAccounting QuestionMusa D Acid100% (1)

- Tutorial 1Dokument5 SeitenTutorial 1FEI FEINoch keine Bewertungen

- Unit 3 COST Accounting CycleDokument6 SeitenUnit 3 COST Accounting CycleJaizer TimbrezaNoch keine Bewertungen

- Chapter 01 - Managerial Accounting and Cost ConceptsDokument14 SeitenChapter 01 - Managerial Accounting and Cost ConceptsHardly Dare GonzalesNoch keine Bewertungen

- 202E03Dokument29 Seiten202E03Ariz Joelee ArthaNoch keine Bewertungen

- Quiz 1 - Chapt 19-20-21Dokument7 SeitenQuiz 1 - Chapt 19-20-21Giovanna CastilloNoch keine Bewertungen

- Exam 1 - VI SolutionsDokument9 SeitenExam 1 - VI SolutionsZyraNoch keine Bewertungen

- Remodelers' Cost of Doing Business Study, 2020 EditionVon EverandRemodelers' Cost of Doing Business Study, 2020 EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNoch keine Bewertungen

- Remodelers Cost of Doing Business Study, 2023 EditionVon EverandRemodelers Cost of Doing Business Study, 2023 EditionNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNoch keine Bewertungen

- Netflix Case AnalysisDokument10 SeitenNetflix Case Analysisphi_maniacsNoch keine Bewertungen

- Case Study Ford PintoDokument13 SeitenCase Study Ford Pintophi_maniacsNoch keine Bewertungen

- Student Study Guide: Web Development FundamentalsDokument63 SeitenStudent Study Guide: Web Development FundamentalsIvan KalinichenkoNoch keine Bewertungen

- List PrintDokument1 SeiteList Printphi_maniacsNoch keine Bewertungen

- QuizDokument1 SeiteQuizphi_maniacsNoch keine Bewertungen

- Student Study Guide: Web Development FundamentalsDokument63 SeitenStudent Study Guide: Web Development FundamentalsIvan KalinichenkoNoch keine Bewertungen

- Mini Camera User ManualDokument4 SeitenMini Camera User ManualAndronikus Marintan NapitupuluNoch keine Bewertungen

- Value BubbleDokument82 SeitenValue Bubblephi_maniacsNoch keine Bewertungen

- Exam 98-363Dokument3 SeitenExam 98-363phi_maniacsNoch keine Bewertungen