Beruflich Dokumente

Kultur Dokumente

Hampden County Physician Associates Bankruptcy Papers

Hochgeladen von

Jim Kinney0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8K Ansichten24 SeitenInformation on salary

Originaltitel

Hampden County Physician Associates Bankruptcy papers

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenInformation on salary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8K Ansichten24 SeitenHampden County Physician Associates Bankruptcy Papers

Hochgeladen von

Jim KinneyInformation on salary

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 24

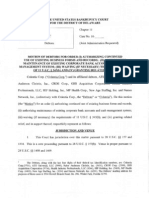

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF MASSACHUSETTS

Chapter 11, No. 14-

HAMPDEN COUNTY PHYSICIAN

ASSOCIATES, LLC

Debtor

MOTION TO AUTHORIZE DEBTOR TO PAY PRE-PETITION WAGES

AND RELATED EXPENSES AND FOR OTHER RELIEF

To the HONORABLE HENRY J. BOROFF, Bankruptcy Judge:

Now comes HAMPDEN COUNTY PHYSICIAN ASSOCIATES, LLC

("Debtor"), the Debtor in the above-captioned matter, and it

does hereby move this Court for the entry of an Order, pursuant

to 11 U.S.C. 105 and 363, authorizing, but not directing, the

Debtor to pay pre-petition wages, salaries and other related

obligations and to continue to use the Debtor's existing payroll

account for the purpose of the relief requested herein. In

support of this Motion, the Debtor submits the Declaration of

Lisa A. Patenaude, CPA in Support of Chapter 11 Petition and

First Day Motions filed contemporaneously herewith and

represents as follows:

JURISDICTION

1. This Court has jurisdiction over this Motion pursuant

to 28 U.S.C. 157 and 1334. This is a core matter within the

meaning of 28 U.S.C. 157(b). Venue in this District is proper

pursuant to 28 U.S.C. 1408 and 1409.

1

30961

BACKGROUND

2. On October 2, 2014 ("Petition Date"), the Debtor filed

a Voluntary Petition under the provisions of Chapter 11 of the

United States Bankruptcy Code ("Bankruptcy Code") with the

United States Bankruptcy Court for the District of Massachusetts

("Bankruptcy Court") .

3. Pursuant to the provisions of 1107 and 1108 of the

Bankruptcy Code, the Debtor has continued to operate its

business and manage its business affairs as a Debtor-in-

Possession. No Trustee or Examiner has been requested or

appointed.

4. The Debtor is a multi-specialist physician group

engaged in the practice of medicine in Western Massachusetts.

Its approximately sixty-eight (68) healthcare providers serve

about 55,000 patients. The business enterprise employs a total

of approximately 300 individuals, including the Debtor's twenty-

seven (27) members, and operates fourteen (14) offices primarily

located throughout Hampden County, Massachusetts. In addition,

the Debtor and its staff serve patients at local hospitals,

skilled-nursing facilities, and long-term care facilities. The

Debtor operates its own laboratory, sleep disorder center, and

urgent care center.

5. The filing of the Debtor's bankruptcy case was

precipitated by a series of events that resulted in a decrease

in revenue and increase in certain expenses. Over the course of

approximately the last two years, several healthcare providers

have retired or departed from the Debtor for a variety of

2

reasons. During this same period of time, the Debtor attempted

to expand its practice by leasing new office space, purchasing

new equipment, converting all medical records to a secure

electronic medium, and attempting to recruit new healthcare

providers.

RELIEF REQUESTED

6. The Debtor seeks authority to pay and to honor certain

outstanding pre-petition claims that were owed to the Debtor's

employees as of the Petition Date. Additionally, the Debtor

seeks authority to pay and to honor certain administrative

expenses due in connection with the payment of said employee-

related claims.

7. The Debtor's standard payroll procedure is to pay its

employees through a professional payroll service by direct

deposit or check. Employees are paid on a bi-weekly basis and

are paid approximately one (1) week in arrears.

8. The Debtor estimates that, as of the Petition Date,

the aggregate amount of accrued, unpaid wages and salaries due

to the Debtor's employees, exclusive of deductions and

exclusions, is approximately $288,326.48 ("Pre-Petition Wages").

A detailed itemization of the estimated Pre-Petition Wages owed

to the employees is annexed hereto as Exhibit "A".

9. The Debtor requests the entry of an Order authorizing

the Debtor to pay Pre-Petition Wages in an amount not to exceed

$12,475.00 per employee in the ordinary course of business.

10. The Debtor is required by law to do the following:

(1) to withhold from an employee's wages and salaries amounts

3

related to, among other things, federal and state income taxes

and Social Security and Medicare taxes for remittance to the

appropriate taxing authority ("Withholdings"); and (2) to pay

Social Security, Medicare, and unemployment insurance taxes

related to each employee's wages and salaries ("Payroll Taxes").

11. The Debtor also deducts certain amounts from its

employees' paychecks on account of (1) garnishments for domestic

support obligations; (2) pre-tax contributions to health and

dependent care flexible spending accounts; (3) mandatory and

voluntary retirement account contributions; (4) charitable

contributions; (5) other pre-tax and after-tax deductions

payable related to certain employee benefits ("Deductions").

12. The Debtor says that the Deductions and Withholdings

may constitute trust funds that are not property of the Debtor's

Bankruptcy Estate. Further, the Debtor says that the relevant

taxing authorities would hold a priority claim pursuant to

507(a) (8) of the Bankruptcy Code for the Withholdings and

Payroll Taxes.

13. The Debtor seeks the entry of an Order authorizing the

Debtor to pay Withholdings, Payroll Taxes, and Deductions in the

ordinary course of its business.

14. In the ordinary course of its business, the Debtor

uses the services of Paychex, a third-party administrator, for

the payment of compensation and benefits to employees

("Administrative Costs"). The services provided by Paychex

ensure that the Debtor's obligations with respect to employees

continue to be administered in the most cost-efficient manner

and comply with all applicable laws.

4

15. The Debtor seeks entry of an Order authorizing the

Debtor to pay Administrative Costs in the ordinary course of its

business.

16. In the ordinary course of its business, the Debtor

maintains a payroll account with TO Bank, N.A. ("Payroll

Account") .

17. The Debtor seeks the entry of an Order authorizing the

Debtor to: (i) continue to utilize the Payroll Account to honor

any outstanding pre-petition payroll checks or wires; and (ii)

to pay Pre-Petition Wages, Withholdings, Payroll Taxes,

Deductions, and Administrative Costs, as may be authorized by

the Court pursuant to this Motion.

BASIS FOR RELIEF REQUESTED

18. Section 105(a) of the Bankruptcy Code provides that

the "court may issue any order . . . that is necessary or

appropriate to carry out the provisions of this title." 11

U.S.C. 105(a). Section 105(a) facilitates "the implementation

of other Bankruptcy Code provisions," and provides a "bankruptcy

court with broad authority to exercise its equitable powers."

Ameriquest Mortgage Co. v. Nosek (In re Nosek), 544 F.3d 34, 43

(1st Cir. 2008).

19. Section 363(b) of the Bankruptcy Code provides that

the debtor-in-possession, after notice and hearing, may use

property of the bankruptcy estate for payments outside of the

ordinary course of its business. 11 U.S.C. 363 (b) (1).

20. Rule 6003 of the Federal Rules of Bankruptcy Procedure

expressly states that a Bankruptcy Court may authorize the

5

Debtor to use property of a bankruptcy estate to "pay all or

part of a claim that arose before the filing of the petition."

Fed. R. Bankr. P. 6003.

21. "The fundamental purpose of reorganization is to

prevent a debtor from going into liquidation, with an attendant

job loss." NLRB v. Bildisco & Bildisco, 465 U.S. 513, 528

(1984).

22. Payment of Pre-Petition Employee Wages and Benefits is

necessary to enable the Debtor to retain employees, to provide

an incentive for the Debtor's employees to continue to provide

quality services to the Debtor's patients, to preserve employee

morale during the administration of this bankruptcy case, to

avoid the substantial negative economic impact on the employees,

and to maintain the continuity of the Debtor's business

operations.

23. The Debtor says that payment of the Pre-Petition

Employee Wages and Benefits is essential to its successful

reorganization. Further, the Debtor says that failure to pay

such claims will likely result in substantial and irreparable

harm to the Debtor's approximately three hundred (300)

employees.

24. Pursuant to 105(a) and 363(b) of the Bankruptcy

Code and Rule 6003 of the Federal Rules of Bankruptcy Procedure,

this Court has the authority to grant the relief requested

herein.

25. Several courts in this District have granted relief

similar to the relief requested in this Motion. See e.g., New

England Soup Factory, LTD, Case No. 14-10871 (Bankr. D. Mass.

6

2014) [Docket No. 24]; In re Northern Berkshire Healthcare,

Inc., Case No. 11-31114 (Bankr. D. Mass. 2011) [Docket No. 43];

In re SW Boston Hotel Venture LLC, Case No. 10-14535 (Bankr. D.

Mass. 2010) [Docket No. 39]; In re Erving Industries, Inc., Case

No. 09-30623 (Bankr. D. Mass. 2009) [Docket No. 39].

26. The proposed payment of Pre-Petition Employee Wages

and Benefits would be entitled to priority treatment under

507(a) of the Bankruptcy Code. Therefore, general unsecured

creditors are not prejudiced if the relief requested herein is

granted.

27. Notwithstanding anything in this Motion to the

contrary, any payment made pursuant to an Order entered by this

Court related to this Motion shall neither (i) make such

obligations administrative expenses of the Estate entitled to

priority status under 503 or 507 of the Bankruptcy Code, nor

(ii) constitute approval by this Court of any employee plan or

program, including bonus plans subject to 503(c) or any other

section of the Bankruptcy Code.

28. Nothing in this Motion should be construed as a

request for authorization to assume or reject any executory

contract between the Debtor and any party with respect to any

Pre-Petition Employee Wages and Benefits.

29. Based upon the foregoing, the Debtor submits that the

relief requested herein is necessary, appropriate, and is in the

best interests of the Debtor's Bankruptcy Estate.

WAIVER

30. Because the relief requested herein is necessary to

7

avoid immediate and irreparable harm, to the extent required for

the immediate implementation of the relief requested herein, the

Debtor seeks a waiver of Rules 6003(b), 6004(a) and 6004(h) of

the Federal Rules of Bankruptcy Procedure.

NOTICE

32. Notice of this Motion has been served on the following

parties: ( i) TD Bank; ( ii) Peter Shrair, Esq., Cooley Shrair,

P. C., counsel to TD Bank; (iii) SPHS; ( i v) Edward Green, Esq.,

Foley & Lardner, LLP, counsel to SPHS; (v) the tax authorities;

(vi) the largest twenty (20) unsecured creditors; (vii) all

creditors having requested notice pursuant to Rule 2002; and

(viii) the Office of the United States Trustee.

WHEREFORE, the Debtor respectfully requests the entry of an

Order, in substantially the form as the proposed Order filed

herewith, granting the relief requested in this Motion and

providing such other and further relief as the Court may deem

just and proper.

Dated: October 2, 2014

HAMPDEN COUNTY PHYSICIAN

ASSOCIATES, LLC

By: /s/ Joseph B. Collins

JOSEPH B. COLLINS, ESQ.

(BBO No. 092660)

HENRY E. GEBERTH, JR., ESQ.

(BBO No. 187940)

ANDREA M. O'CONNOR, ESQ.

(BBO No. 67 9540)

For HENDEL & COLLINS, P.C.

101 State Street

Springfield, MA 01103

Tel. (413) 734-6411

jcollins@hendelcollins.com

8

hgeberth@hendelcollins.com

aoconnor@hendelcollins.com

9

Employee

,-----

ABERT, JULIE

AKEMON, PAMELA

f-----

ALEEM, TAZEEM

ANICETO, MARGARIDA

AUSTIN, ANN

BABINEAU, HAYLEY

BAKOWSKI, MARGARET

BALDWIN, STACIE

BALLAN, DAVID

BARNETT, MICHELLE

BARZILAI, KATHRYN

BATCHELOR, AMANDA

BAYUK, JONATHAN

BEARSE, COURTNEY

BELDEN, KADY JEAN

BELL, ANDREA

BENEITONE, ROGER

BENOIT, TRICIA

BERMAN, ARI

BISCOE, JAMES

BLACKBURN-KIERKLA,

BLACKMAN, DEEGEE

BLAIS, MARY

BORGES, ANGELA

BORHOT, HASSEN

BOSCHER, MARY

BOWEN, SALLY

BOWERS, APRIL

BRANDON, CHRISTINA

BROOKS, DIANE

BROWNE, DENISE

BRZEZICKI, JOSEPH

BUCKBERG, MIRIAM

BUCKNOR, KIMBERLY

BURKE, CHRISTINE

-

BURTON, PARIS

BYRD, NAQUIA

CALCASOLA, CHARLES

--

jCANINI, LESLIE

--

Exhibit "A"

MELISSA

-

CARLO

I

Estimated Wages

9/28-10/2

--

1,269.88

483.30

3,024.00

461.26

494.72

392.54

681.04

1,423.08

1,478.66

2,883.60

923.08

429.46

18,880.80

1,430.77

563.65

616.88

3,088.40

568.32

0.00

806.34

1,538.46

794.96

511.36

359.23

1,538.46

0.00

471.96

1,521.23

279.19

508.62

580.98

615.66

2,338.46

2,923.08

611.71

--

433.08

177.22

236.88

394.90

-

,CAOUETTE, BRITTANY 431.84

1

CARDINALE, ERIN 804.22

-

CARRATURO, DOMINIC 197.62

-

CASSESSE, MELISSA 463.58

CEBULA, ELIZABETH 1,461.54

CHAGANTI, UMA 2,846.16

CHARPENTIER, KATHY 1,307.69

CHAUHAN, KIRAN 3,242.80

CHISHOLM, WILLIAM 279.75

CICHON, JOANNA 3,921.60

CLARK, CHRISTINA 439.83

CLEVELAND, RONALD 300.62

COACHE, SARA 402.60

COLLINS, BRIDGET 509.14

COSENZI, KATHLEEN 479.58

COTE, JENNIFER 579.24

CRUZ, ANAIDA 432.76

CRUZ, MARIBEL 368.84

CRUZ-MALDONADO, MARYLYN 470.09

CUADRA, HUGO 789.60

CURTO, ANTHONY 693.15

CYR, MICHELLE 415.32

DANIO, ANNETTE 601.86

DASILVA, MARIE 562.88

DAVIDSON, DEBORAH 96.00

DELEON, DEBRA 609.88

DELGADO, JANNETTE 483.18

DELISA, REBECCA 1,230.77

DELORGE, CAROL ANN 485.20

DINIS, CHRISTINA 1,551.54

DOBRONSKI, BARBARA 417.56

DODGE, LORI 503.16

DOGAN, EBRU 415.98

DRENNAN, PETER J 2,530.40

ERFAN, FARHAN A 530.34

FAGNANT, DIANE 849.70

FELICIANO, LUZ 475.52

FELTNER, KARYN 414.60

FELTON, CORI 558.83

FIGUEIREDO, SILVIA 505.48

FLAGG, DOROTHY 465.08

FLATHERS, DIANE 438.00

FLORES, NELIDA 673.11

FORREST-PINETTE, ERIN

I

467.52

~ . --

-- -- ---- -

FOURNIER, KATHLEEN ' 466.38

- --

FRANCO, THOMAS

I

1,253.85

- ---

GABRYEL, STORMY DAWN 468.16

GAMBLE, LAURA 434.43

GARRETT, JACKIE 2,692.31

GEARY, NANCY 477.27

GEBO, CAROL 81.66

GIFFUNE, JENNIFER

!

477.62

GIOIELLA, LAURA 856.40

GOLDMAN,

r-----

MARC 6,410.00

GONCALVES, JENNY 0.00

GUADELOUPE, TAKEYSHA 497.34

GUYETTE, ANN L 265.08

HALL, ELIZABETH 0.00

HANGASKY, SUZANNE 1,169.23

HANLON, CARISSA 423.02

HART, MEGAN 416.94

HASTINGS, JOY 0.00

HAWK, CAROL 168.08

HAYWARD JR, WILLIAM 273.90

HELIE, AMANDA 272.71

HERNANDEZ, SUEHAY 462.47

HIGGINS, JEANNE 2,513.20

HINE, SELINA 415.74

HIXON, JENNIFER 0.00

HNITECKI, JADWIGA 431.83

HOLLINGSWORTH, ROBIN 0.00

HOUGH, BARBARA 797.27

HOUSE, ELIZA VETA 1,538.46

HOWE, DANIELE 510.53

HOYT, KAREN 3,149.60

HUFF, CARI 480.30

HUFNAGEL, TORI 219.80

HUNT, JUDITH 248.50

HUTCHINSON, GAIL 570.88

INGILIZOVA, MARINELA 2,692.31

JACOBSON, GARY 3,790.40

JACQUE, ANNE 156.74

JEFFERY, ANGELINE 77.16

JENCO, ASHLEY 405.50

JENKINS, BRIE 608.00

JOHNSON, DIANE 1,169.23

JONES, ELIZABETH 317.75

.JQNES, KAITLIN 416.23

-

JORDAN, PATRICIA 804.04

JOSEPHSON, RUTH 81.20

!------

JURCZYK, KIMBERLY 1,561.84

KAT I BAH, KRISTIN 831.87

r---

KAZI, FAHIM 7,056.00

KELLIHER, NANCY 815.03

KHANNA, ASHA 460.01

KILLIPS, LISA 0 00 I

KING, ARTHUR 3,086.00

KRUPCZAK, DAVID 285.84

IKUPPUSWAMY, RAMACHANDRAN 3,157.60

LABOY, MARILYN 43.77

LAFLAMME, LINDA 704.26

LAMARRE, JENNIFER 1,017.69

LAMICA, THERESA 488.22

LOBODA, YELENA 0.00

LOPEZ HERNANDEZ, MAYRA 161.73

LOPEZ, EILEEN 413.09

LUKASZCZYK, WIOLETTA 613.38

LYONS, KAYLA 425.36

LYONS, SHELDON 4,698.00

MADDEN, PATRICK 1,337.69

MADDEN, VIKTORIA 1,699.97

MAGGIO, CRISTA 1,430.77

MAIA, PAMELA 467.64

MALDONADO, SABRINA 0.00

MARTIN, JEANINE 2,615.38

MARTIN, QIANA 276.37

MARVICI, CATHERINE 520.19

MATIN, SHAUKAT 2,675.20

MAURER, CARLA 1,292.31

MAZZAFERRO, RONNA-MARIE 0.00

MCAULIFFE, MARIE 570.22

MCDOUGALL, DAVID 4,648.80

MCLOYD, HAYWOOD 424.16

METZ, STEPHEN 154.00

MILBIER, HEIDI 1,346.08

MILLER, TANYA 723.27

MORETTI, CATHERINE 1,538.46

MORRISON, PAMELA 511.45

MUDAWWAR, FRED 10,462.40

NAJEEBI, SHAMIM

I

9,320.00

I

,NATHANSON, IRA 1,956.80

wROCKI, KATHLEEN 4 5 l O ~ j

I NELSON' KAREN

---- -----T

4 91. 64

---

rc9WAK, MAGDALENA

---

1,423.08

--

OCHAB, IWONA 428.48

I

10GOLEY, ALAN 1,239.68

I10' GOWAN, RYAN 0.00

~ O L E S ELIZAB-ETH 784.08

482.43 ,ORTIZ, TRACY

OTERO, LINETTE 428.60

OWENS, CALVIN 399.24

PANEK, JENNIFER 514.41

PATENAUDE, LISA 3,692.31

PATTERSON, LUCY 0.00

PISKOROWSKI, MALGORZATA 1,000.00

PITTS, JACQUELINE 464.00

POEHLER, MELANIE 149.72

PRATT, NICOLE 476.18

PSZCZOLA, BETH 514.40

RADZICKI, MARK 3,996.40

RAGOONANAN, LINCOLN 568.25

RAHMAN, MOHAMMAD 0.00

RAMOS, BERNICE 334.46

RATCLIFFE, MELISSA 0.00

RAY, KAREN 372.95

RAY, SUBRATA 1,508.80

REGADAS, ALMIRA 538.49

REHM, JULIE 776.96

REID, KATHLEEN 0.00

RIGGINS, MARISOL 472.36

RIGGIO, SANDRA 435.51

ROBACK, KATHARINE 1,430.77

ROBBINS, DEBORAH 687.80

ROBERTSON, DAVID 5,710.40

RODRIGUES, JESSICA 1,230.77

RODRIGUEZ, JESSETTE 499.64

RODRIGUEZ, SUSANA 0.00

ROMERO, NIXILU 434.44

ROSADO, ROSEMARY 220.70

ROSENBERG, NAOMI 2,538.46

RYHAL, LARISA 415.40

RYTER, EDWARD 2,490.40

SALDANA, GLORIMAR 428.06

SALVADOR, MARIA 851.63

---

SAMPSON-PHELAN, LISA 581.48

SANTOS-NORTON, ANA PAULA

; 423.39

-- -- . -- -

SAVAGE, MONIQ=U __ E __________ ~ 4 ~ 1 . 3 2 1

SCHMIDT, AMY 488.09

f----------'--------------------- ------- ---- ~ ---- -- --+-------- --j

SEDELOW, DANIEL 490.28:

-- ~ -

SEIBOLD, KARA 4 61. 61

SERRANO, JEANNAVICE 400.00

--

SICKINGER, ANDREA 1,138.46

- -

. S IMUL YNAS, KELLY 823.54

!SIROIS, RENEE 1,045.66

SMITH, ROBIN

I

360.90

SMITH, TERYL 1,846.16

SOBEY, ANTHONY 1,439.60

SOUSA, SUSANA 546.58

ST GERMAIN, SYLVIA 495.05

ST PIERRE, STEPHEN 279.96

ST. AMOUR, ASHLEY 536.50

STEINBERG, GERALD 6,200.00

STELZER, DEBORAH 1,043.48

STUCENSKI, NATALIE 71.72

SUCHECKI, ROBERT 1,305.28

SULLIVAN, ANDREA 456.20

THOMPSON, KIMBERLY 649.28

TIRADO, BEATRIZ 403.98

TKACZEK, TINA 1,939.08

TOMESTIC, ROBIN 455.35

TORRES, DEMARIS 338.67

TORRES, JAZMIN 414.82

TORRES, NORMA 468.18

TRAHAN, YORN 498.02

TROMBLEY, WAYNE 1,046.16

TRUSTY, SHANNON 709.28

VALENTIN, CAROL IN 432.00

VALENTINE, SONIA 1,461.54

VAN STEE, VANESSA 6,162.00

VELAZQUEZ, MILDRED 91.65

VICTOR, ROSA 0.00

VINCI, DEBORAH 535.01

VOZNYUK, YULIYA 404.38

WALLACE, KATHLEEN 515.08

WANCKO, MAGGIE 549.55

WEBSTER, LAURIE 562.16

WETHERELL, AMANDA 428.48

WHITE, ROSEMARIE 582.48

WHITMAN, STACEY 706.27

--

WIESE, ROXANNE 406.18

-

WILLEY-VYCE, TAMMY 250.191

- -.

WILLIAMS, CHERI 804.04

-

WOJCIK, JAN 2,645.60

-

WOODIS,

KATHERINE 464.96

WOODS, ELIZABETH i 1,164.80

YANNI, PHILIP

I

1,410.88

ZARBA, NICOLE

1,384.621

ZUCCO, KATHRYN 522.86

Grand Total 288,326.48

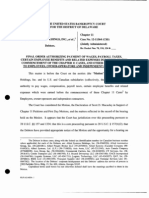

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF MASSACHUSETTS

Chapter 11, No. 14-

HAMPDEN COUNTY PHYSICIAN

ASSOCIATES, LLC

Debtor

ORDER ON MOTION TO AUTHORIZE DEBTOR TO PAY

PRE-PETITION WAGES AND RELATED EXPENSES AND FOR OTHER RELIEF

Upon the Motion to Authorize Debtor to Pay Pre-Petition

Wages and Related Expenses and Other Relief ("Motion") of HAMPDEN

COUNTY PHYSICIAN ASSOCIATES, LLC ("Debtor"), the Debtor in the

above-captioned case, after notice and hearing, and for good

cause shown, it is hereby

ORDERED that the Motion is GRANTED; and it is further

ORDERED that the Debtor is authorized, but not directed, in

its sole discretion, to pay pre-petition wages in an amount not

to exceed $12,475.00 per employee and certain related expenses

including withholdings, payroll taxes, deductions, and

administrative costs as they may become due on or after the

Petition Date; and it is further

ORDERED that the Debtor is authorized to continue to utilize

its payroll account held at TD Bank, N.A. to honor any

outstanding pre-petition payroll checks, wires, or electronic

payments and to pay any pre-petition payments approved by this

Court in this Order; and it is further

1

ORDERED that the Debtor is authorized to take all actions

necessary to implement the relief granted in this Order; and it

is further

ORDERED that, notwithstanding the relief granted in this

Order and any actions taken pursuant to such relief, nothing in

this Order shall be deemed: (i) an admission as to the validity

of any claim against the Debtor; (ii) a waiver of the Debtor's

right to dispute any claim on any grounds; (iii) a promise or

requirement to pay any claim; (iv) an assumption or adoption of

any agreement, contract, or policy; or (v) a waiver of the

Debtor's rights under the Bankruptcy Code or any other applicable

law; and it is further

ORDERED that the relief requested in the Motion is necessary

to avoid immediate and irreparable harm to the Debtor and,

notwithstanding any applicable Federal Rules of Bankruptcy

Procedure, the terms and conditions of this Order shall be

immediately effective and enforceable upon its entry; and it is

further

ORDERED that notice of the Motion as provided therein shall

be deemed good and sufficient notice of such Motion and the

requirements of Rule 6004(a) of the Federal Rules of Bankruptcy

Procedure are waived; and it is further

2

ORDERED that this Court shall retain jurisdiction to hear

and determine all matters arising from or related to the

implementation and enforcement of this Order.

Dated:

HONORABLE HENRY J. BOROFF

United States Bankruptcy Judge

3

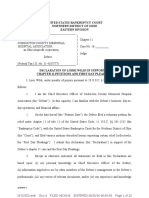

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF MASSACHUSETTS

In re

HAMPDEN COUNTY PHYSICIAN

ASSOCIATES, LLC

Debtor

Chapter 11, No. 14-

CERTIFICATE OF SERVICE

I, JOSEPH B. COLLINS, of the law firm of HENDEL & COLLINS,

P.C., 101 State Street, Springfield, Massachusetts do hereby

certify that I caused a copy of the attached Motion to be served

upon each of the parties listed on the attached Exhibit "A" on

the 2nd day of October, 2014.

Dated: October 2, 2014

Is/ Joseph B. Collins

JOSEPH B. COLLINS, ESQ.

(BBO No. 092660)

For HENDEL & COLLINS, P.C.

101 State Street

Springfield, MA 01103

Tel. (413) 734-6411

jcollins@hendelcollins.com

1

Exhibit A

Lisa A. Patenaude, CPA

HAMPDEN COUNTY PHYSICIAN ASSOCIATES, LLC

354 Birnie Avenue

Springfield, MA 01107

Richard T. King, Esq.

OFFICE OF THE U.S. TRUSTEE

446 Main Street, 14

th

Floor

Worcester, MA 01608

Edward J. Green, Esq.

FOLEY & LARDER, LLP

99 High Street, 20

th

Floor

Boston, MA 02110

Peter W. Shrair, Esq.

COOLEY SHRAIR, P.C.

1380 Main Street, Suite 500

Springfield, MA 01103

INTERNAL REVENUE SERVICE

Attn: Bankruptcy Unit

P.O. Box 7346

Philadelphia, PA 19101

INTERNAL REVENUE SERVICE

Attn: Bankruptcy Unit

P.O. Box 9112

Boston, MA 02203-9112

MASSACHUSETTS DEPARTMENT OF REVENUE

Attn: Bankruptcy Unit

P.O. Box 9564

Boston, MA 02114-9564

Alan H. Einhorn, Esq.

FOLEY & LARDER, LLP

111 Huntington Avenue, Suite 2600

Boston, MA 02199-7610

Mr. Daniel P. Moen

SISTERS OF PROVIDENCE HEATLH SYSTEM, INC.

271 Carew Street

Springfield, MA 01104

Exhibit A

Mr. Thomas Robert

SISTERS OF PROVIDENCE HEALTH SYSTEM, INC.

271 Carew Street

Springfield, MA 01104

Bradford R. Martin, Jr., Esq.

MORRISON MAHONEY, LLP

1500 Main Street, Suite 2400

Springfield, MA 01115

TD BANK, NATIONAL ASSOCIATION

2035 Limestone Road

Wilmington, DE 19808

CONNECTICUT PHYSICIANS SERVICES

207 Main Street

Hartford, CT 06106

CAREW CHESTNUT PARTNERS, LLC

P.O. Box 180

West Springfield, MA 01090

ALLSCRIPTS HEALTHCARE, LLC

24630 Network Place

Chicago, IL 60673-1246

MERCY INTERNAL MEDICINE SERVICES

Attn: Susan Higgins

1221 Main Street, #108

Holyoke, MA 01040

CONVERGENT

9501 Post Office Park

Wilbraham, MA 01095

SPYGLASS

2001 Crocker Road, Suite 200

Westlake, OH 44145

PSS WORLD MEDICAL, INC.

3 Walpole Park South Drive, Unit 11

Walpole, MA 02081

BCHP PARTNERS, LLC

P.O. Box 180

West Springfield, MA 01089

Exhibit A

ALK-ABELLO PHARMACEUTICALS, INC.

7806 Solutions Center

Chicago, IL 60677-7806

KLONDIKE INVESTMENT GROUP, LLC

c/o Colebrook Management

1441 Main Street

Springfield, MA 01103

SYSTEM COORDINATED SERVICES, INC.

c/o Sisters of Providence

1233 Main Street

Holyoke, MA 01040

LYON OFFICES, LLC

P.O. Box 180

West Springfield, MA 01090

PRIORITY HEALTHCARE DISTRIBUTION, INC.

d/b/a CuraScript Specialty

P.O. Box 533307

Charlotte, NC 28290-3307

HILLSIDE DEVELOPMENT CORP.

267 Hillside Road

Southwick, MA 01077-9685

80 CONGRESS STREET, LLC

P.O. Box 2342

South Burlington, VT 05407

VERIZON BUSINESS

P.O. Box 660794

Dallas, TX 75266-0794

BECKMAN COULTER, INC.

Dept. CH 10164

Palatine, IL 60055-0164

SAREMI, LLP

2073 Roosevelt Avenue

Springfield, MA 01104

MICHAEL B. GUARCO, SR.

7 Bayberry Drive

East Granby, CT 06026

Exhibit A

WB MASON

P.O. Box 981101

Boston, MA 02298-1101

Das könnte Ihnen auch gefallen

- Et Al.Dokument19 SeitenEt Al.Chapter 11 DocketsNoch keine Bewertungen

- Proposed Attorneys For The Debtor and Debtor-in-PossessionDokument11 SeitenProposed Attorneys For The Debtor and Debtor-in-PossessionoldhillbillyNoch keine Bewertungen

- Proposed Attorneys For The Debtor and Debtor-in-PossessionDokument15 SeitenProposed Attorneys For The Debtor and Debtor-in-Possessionjballauer2139Noch keine Bewertungen

- Order (I) Authorizing Prepetition Wage, Salary and Benefit Payments (Ii) Authorizing Employee Benefit Programs and Directing All Banks To Honor Related Prepetition ChecksDokument4 SeitenOrder (I) Authorizing Prepetition Wage, Salary and Benefit Payments (Ii) Authorizing Employee Benefit Programs and Directing All Banks To Honor Related Prepetition ChecksChapter 11 DocketsNoch keine Bewertungen

- Et Al./: (II) (III)Dokument15 SeitenEt Al./: (II) (III)Chapter 11 DocketsNoch keine Bewertungen

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayDokument15 SeitenDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayChapter 11 DocketsNoch keine Bewertungen

- Re: Docket Nos. 5, 37Dokument25 SeitenRe: Docket Nos. 5, 37Chapter 11 DocketsNoch keine Bewertungen

- Et SeqDokument9 SeitenEt SeqChapter 11 DocketsNoch keine Bewertungen

- Debtors Motion for Interim and Final Orders Pursuant to Bankruptcy Code Sections 105, 363(b), 507(a), 541, 1107(a) and 1108, Authorizing, But Not Directing, the Debtor, Inter Alia, to Pay Prepetition Wages, Compensation, and Employee Benefits filed by Scott Eric Ratner on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Exhibit A - Proposed Interim Order# (2) Exhibit B - Proposed Final Order)Dokument22 SeitenDebtors Motion for Interim and Final Orders Pursuant to Bankruptcy Code Sections 105, 363(b), 507(a), 541, 1107(a) and 1108, Authorizing, But Not Directing, the Debtor, Inter Alia, to Pay Prepetition Wages, Compensation, and Employee Benefits filed by Scott Eric Ratner on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Exhibit A - Proposed Interim Order# (2) Exhibit B - Proposed Final Order)Chapter 11 DocketsNoch keine Bewertungen

- 10000005755Dokument5 Seiten10000005755Chapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument24 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument8 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- 11 Affidavit of Martin McGahan, Chief Restructuring OfficerDokument45 Seiten11 Affidavit of Martin McGahan, Chief Restructuring OfficerDentist The MenaceNoch keine Bewertungen

- Hearing Date: T.B.A Hearing Time: T.B.A.: Professional Fees ExpensesDokument64 SeitenHearing Date: T.B.A Hearing Time: T.B.A.: Professional Fees ExpensesChapter 11 DocketsNoch keine Bewertungen

- ResCap KERP OpinionDokument22 SeitenResCap KERP OpinionChapter 11 DocketsNoch keine Bewertungen

- Declaration of Daniell. Fitchett in Support of Chapter 11Dokument21 SeitenDeclaration of Daniell. Fitchett in Support of Chapter 11Chapter 11 DocketsNoch keine Bewertungen

- Unpublished United States Court of Appeals For The Fourth CircuitDokument11 SeitenUnpublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNoch keine Bewertungen

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Dokument19 SeitenThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNoch keine Bewertungen

- HEARING DATE: June 7, 2011 HEARING TIME: 2:00 P.M.: Professional Fees ExpensesDokument8 SeitenHEARING DATE: June 7, 2011 HEARING TIME: 2:00 P.M.: Professional Fees ExpensesChapter 11 DocketsNoch keine Bewertungen

- #119916 V1 - Mti NotcredappempwcDokument6 Seiten#119916 V1 - Mti NotcredappempwcChapter 11 DocketsNoch keine Bewertungen

- Fox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Dokument11 SeitenFox Rothschild LLP Yann Geron 100 Park Avenue, Suite 1500 New York, New York 10017 (212) 878-7900Chapter 11 DocketsNoch keine Bewertungen

- Et At./: RLF16087186v.lDokument29 SeitenEt At./: RLF16087186v.lChapter 11 DocketsNoch keine Bewertungen

- Et AlDokument19 SeitenEt AlChapter 11 DocketsNoch keine Bewertungen

- Larga V RanadaDokument4 SeitenLarga V RanadaAxl Jon RachoNoch keine Bewertungen

- Et Al./: (LL) (Ill)Dokument32 SeitenEt Al./: (LL) (Ill)Chapter 11 DocketsNoch keine Bewertungen

- Re: Docket Nos. 78, 110, 124Dokument4 SeitenRe: Docket Nos. 78, 110, 124Chapter 11 DocketsNoch keine Bewertungen

- Declaration From CEODokument22 SeitenDeclaration From CEOMNCOOhioNoch keine Bewertungen

- Fria PDFDokument4 SeitenFria PDFTinny Flores-LlorenNoch keine Bewertungen

- 10000000736Dokument94 Seiten10000000736Chapter 11 DocketsNoch keine Bewertungen

- Coca-Cola Bottlers Inc. vs. Sta. Rosa Plant Employees UnionDokument6 SeitenCoca-Cola Bottlers Inc. vs. Sta. Rosa Plant Employees UnionJohanna Mae L. AutidaNoch keine Bewertungen

- In Re:) : Debtors.)Dokument25 SeitenIn Re:) : Debtors.)Chapter 11 DocketsNoch keine Bewertungen

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsDokument16 SeitenMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaNoch keine Bewertungen

- FTL 108944881v2Dokument5 SeitenFTL 108944881v2Chapter 11 DocketsNoch keine Bewertungen

- United States v. Energy Resources Co., 495 U.S. 545 (1990)Dokument6 SeitenUnited States v. Energy Resources Co., 495 U.S. 545 (1990)Scribd Government DocsNoch keine Bewertungen

- James Edward Bent v. Commissioner of Internal Revenue, 835 F.2d 67, 3rd Cir. (1988)Dokument6 SeitenJames Edward Bent v. Commissioner of Internal Revenue, 835 F.2d 67, 3rd Cir. (1988)Scribd Government DocsNoch keine Bewertungen

- W. J. Usery, JR., Secretary of Labor, United States Department of Labor v. First National Bank of Arizona, A National Banking Association, 586 F.2d 107, 1st Cir. (1978)Dokument7 SeitenW. J. Usery, JR., Secretary of Labor, United States Department of Labor v. First National Bank of Arizona, A National Banking Association, 586 F.2d 107, 1st Cir. (1978)Scribd Government DocsNoch keine Bewertungen

- G.R. No. 152456Dokument5 SeitenG.R. No. 152456GWYNETH RICHELLE LIMNoch keine Bewertungen

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Dokument10 SeitenCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsNoch keine Bewertungen

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDokument3 SeitenCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNoch keine Bewertungen

- In The Matter of A & B Heating & Air Conditioning, Debtor. United States of America v. A & B Heating & Air Conditioning, Inc., 823 F.2d 462, 11th Cir. (1987)Dokument7 SeitenIn The Matter of A & B Heating & Air Conditioning, Debtor. United States of America v. A & B Heating & Air Conditioning, Inc., 823 F.2d 462, 11th Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- 1 CSC Vs DBMDokument6 Seiten1 CSC Vs DBMkimmyNoch keine Bewertungen

- United States Court of Appeals, Eleventh CircuitDokument13 SeitenUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNoch keine Bewertungen

- 12-12553-jmp Doc 12Dokument3 Seiten12-12553-jmp Doc 12oldhillbillyNoch keine Bewertungen

- Pryce Corporation v. China Banking CorporationDokument2 SeitenPryce Corporation v. China Banking CorporationAaron AristonNoch keine Bewertungen

- 1 Equitable Bank V SadacDokument33 Seiten1 Equitable Bank V SadacCharm Divina LascotaNoch keine Bewertungen

- United States Court of Appeals, Eighth CircuitDokument6 SeitenUnited States Court of Appeals, Eighth CircuitScribd Government DocsNoch keine Bewertungen

- Module 2 - Financial Rehabilitation and Insolvency Act - RA No. 101422Dokument99 SeitenModule 2 - Financial Rehabilitation and Insolvency Act - RA No. 101422gabbi gaileNoch keine Bewertungen

- United States Court of Appeals, Fourth CircuitDokument15 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- 10000021183Dokument9 Seiten10000021183Chapter 11 DocketsNoch keine Bewertungen

- FRIA REVIEWER Petition For RehabilitationDokument65 SeitenFRIA REVIEWER Petition For RehabilitationSao DirectorNoch keine Bewertungen

- G.R. No. 158791 - Civil Service Commission v. Department of Budget andDokument22 SeitenG.R. No. 158791 - Civil Service Commission v. Department of Budget andMae ReyesNoch keine Bewertungen

- 10000006242Dokument31 Seiten10000006242Chapter 11 DocketsNoch keine Bewertungen

- United States Court of Appeals, Fourth CircuitDokument9 SeitenUnited States Court of Appeals, Fourth CircuitScribd Government DocsNoch keine Bewertungen

- Pension Gratuity Management Center vs. AAA (Full Text, Word Version)Dokument9 SeitenPension Gratuity Management Center vs. AAA (Full Text, Word Version)Emir MendozaNoch keine Bewertungen

- Boyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Dokument3 SeitenBoyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Chapter 11 DocketsNoch keine Bewertungen

- Lorenzo Tangga An v. Philippine Transmarine CarriersDokument4 SeitenLorenzo Tangga An v. Philippine Transmarine CarriersMike HamedNoch keine Bewertungen

- Broadview EE MotionDokument40 SeitenBroadview EE MotionChapter 11 DocketsNoch keine Bewertungen

- CasesDokument139 SeitenCasesSpidermanNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationVon EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNoch keine Bewertungen

- Massachusetts To Help Homeowners With Crumbling FoundationsDokument8 SeitenMassachusetts To Help Homeowners With Crumbling FoundationsJim KinneyNoch keine Bewertungen

- 2020 MassTrails Grant AwardsDokument9 Seiten2020 MassTrails Grant AwardsJim KinneyNoch keine Bewertungen

- Hotel JessDokument2 SeitenHotel JessJim KinneyNoch keine Bewertungen

- MBTA Procurement For 80 Bi-Level Commuter Rial CarsDokument16 SeitenMBTA Procurement For 80 Bi-Level Commuter Rial CarsJim KinneyNoch keine Bewertungen

- USDA Responses To Senator Richard Blumenthal Re Beulah and KarenDokument3 SeitenUSDA Responses To Senator Richard Blumenthal Re Beulah and KarenJim KinneyNoch keine Bewertungen

- Amtrak Valley Flyer ScheduleDokument1 SeiteAmtrak Valley Flyer ScheduleJim Kinney100% (1)

- JD Byrider JudgmentDokument8 SeitenJD Byrider JudgmentJim KinneyNoch keine Bewertungen

- Enfield Square Mall Deed DocumentDokument14 SeitenEnfield Square Mall Deed DocumentJim KinneyNoch keine Bewertungen

- American Outdoor Brands Report To Shareholders On Gun SafetyDokument26 SeitenAmerican Outdoor Brands Report To Shareholders On Gun SafetyJim KinneyNoch keine Bewertungen

- Acute Hospital Health System Financial Performance Report - 2019Dokument32 SeitenAcute Hospital Health System Financial Performance Report - 2019Jim KinneyNoch keine Bewertungen

- March 19 Presentation Final 3 19 19 PDFDokument72 SeitenMarch 19 Presentation Final 3 19 19 PDFJim KinneyNoch keine Bewertungen

- Victims' Suit Against Bill Cosby Stays Alive As Comedian Serves Prison Sentence in PennsylvaniaDokument2 SeitenVictims' Suit Against Bill Cosby Stays Alive As Comedian Serves Prison Sentence in PennsylvaniaJim KinneyNoch keine Bewertungen

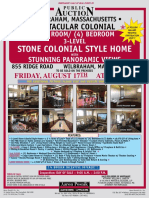

- Wilbraham AuctionDokument2 SeitenWilbraham AuctionJim KinneyNoch keine Bewertungen

- CISA 2018 Farm Products GuideDokument92 SeitenCISA 2018 Farm Products GuideJim KinneyNoch keine Bewertungen

- Applied Golf Solar Project at Hickory Ridge in AmherstDokument118 SeitenApplied Golf Solar Project at Hickory Ridge in AmherstJim KinneyNoch keine Bewertungen

- MassMutual Puts Enfield Campus On The MarketDokument14 SeitenMassMutual Puts Enfield Campus On The MarketJim KinneyNoch keine Bewertungen

- Public Response To Interstate 91 PlansDokument26 SeitenPublic Response To Interstate 91 PlansJim KinneyNoch keine Bewertungen

- CTRAIL ScheduleDokument2 SeitenCTRAIL ScheduleJim Kinney100% (1)

- Springfield Default Letter To SilverBrickDokument3 SeitenSpringfield Default Letter To SilverBrickJim KinneyNoch keine Bewertungen

- Social Security Cola Facts 2019Dokument2 SeitenSocial Security Cola Facts 2019Jim KinneyNoch keine Bewertungen

- Interstate 91 Meeting PresentationDokument35 SeitenInterstate 91 Meeting PresentationJim KinneyNoch keine Bewertungen

- Auction at 274-276 High StreetDokument2 SeitenAuction at 274-276 High StreetJim KinneyNoch keine Bewertungen

- New Valley Bank & Trust Public Co. FileDokument91 SeitenNew Valley Bank & Trust Public Co. FileJim KinneyNoch keine Bewertungen

- Hartford Springfield Line ScheduleDokument2 SeitenHartford Springfield Line ScheduleJim KinneyNoch keine Bewertungen

- Saratoga Race Course MapDokument1 SeiteSaratoga Race Course MapJim KinneyNoch keine Bewertungen

- Perils & Pitfalls of ChangeDokument2 SeitenPerils & Pitfalls of ChangeSiddhi Kochar100% (1)

- 360 Degree FeedbackDokument16 Seiten360 Degree Feedbackmoanabianca6885Noch keine Bewertungen

- A Study On Employee Morale at Natraj Oil Mill (P) LTD, MaduraiDokument6 SeitenA Study On Employee Morale at Natraj Oil Mill (P) LTD, MaduraiRaja MadhanNoch keine Bewertungen

- A Study On Quality of Work Life Among The Employees of A Leading Pharmaceuticals Limited Company of Vadodara DistrictDokument9 SeitenA Study On Quality of Work Life Among The Employees of A Leading Pharmaceuticals Limited Company of Vadodara DistrictAnjuhoney AnjuNoch keine Bewertungen

- Saudi Labour Law SummaryDokument4 SeitenSaudi Labour Law SummaryRaja Adnan LiaqatNoch keine Bewertungen

- Mayank Raj - LP - Practice - MostFrequentDigit - 1609843153072Dokument3 SeitenMayank Raj - LP - Practice - MostFrequentDigit - 1609843153072mayankNoch keine Bewertungen

- Compensation MangementDokument164 SeitenCompensation Mangementbobli tripathyNoch keine Bewertungen

- 20Dokument4 Seiten20Vikas ChopraNoch keine Bewertungen

- Clarence F. Lear, III v. City of Cape May (Cape May)Dokument11 SeitenClarence F. Lear, III v. City of Cape May (Cape May)opracrusadesNoch keine Bewertungen

- Performance Budgeting: Management by ObjectiveDokument7 SeitenPerformance Budgeting: Management by ObjectiveDoxMamamiaNoch keine Bewertungen

- Vendor ComplianceDokument42 SeitenVendor ComplianceRavi KiranNoch keine Bewertungen

- Food Safety Culture Plan 2021Dokument1 SeiteFood Safety Culture Plan 2021Nurul Fikri100% (1)

- 2014 Tax TablesDokument1 Seite2014 Tax Tableszimbo2Noch keine Bewertungen

- CareerDokument15 SeitenCareerapi-545873389Noch keine Bewertungen

- Contract of Service (Fel Bake ShopDokument2 SeitenContract of Service (Fel Bake ShopFlordeliza CoroNoch keine Bewertungen

- Test Bank Labour Relations 3rd Edition SolutionDokument9 SeitenTest Bank Labour Relations 3rd Edition SolutionRichard1Lauritsen67% (3)

- 1 Course-Syllabus GS MNGT-204Dokument10 Seiten1 Course-Syllabus GS MNGT-204Jhay SevillaNoch keine Bewertungen

- Application For LeaveDokument64 SeitenApplication For LeaveMr. Yoso GamingNoch keine Bewertungen

- Drug Free Workplace PolicyDokument11 SeitenDrug Free Workplace PolicyAlfieNoch keine Bewertungen

- 11-Workplace Communication SkillsDokument4 Seiten11-Workplace Communication SkillsS.m. ChandrashekarNoch keine Bewertungen

- Motivating Change: Motivating Self and OthersDokument58 SeitenMotivating Change: Motivating Self and Othersyatin rajputNoch keine Bewertungen

- Employee EngagementDokument24 SeitenEmployee Engagementarabsar100% (1)

- Peñaranda Vs BagangaDokument1 SeitePeñaranda Vs BagangachugamiNoch keine Bewertungen

- Running Head: Union Organizing Process Paper 1Dokument8 SeitenRunning Head: Union Organizing Process Paper 1felamendoNoch keine Bewertungen

- Time & Attendance - Self & ManagerDokument38 SeitenTime & Attendance - Self & ManagerKrishnaKanth PagadalaNoch keine Bewertungen

- Designing Work Organizations: Organization Design of Techno Electronics LimitedDokument15 SeitenDesigning Work Organizations: Organization Design of Techno Electronics LimitedchetanNoch keine Bewertungen

- HRM Performance ManagementDokument13 SeitenHRM Performance ManagementRishabh VijayNoch keine Bewertungen

- Case 1Dokument2 SeitenCase 1Clintjames De PazNoch keine Bewertungen

- Survey of Child Labour in Slums of HyderabadDokument126 SeitenSurvey of Child Labour in Slums of HyderabadMahesh JawaleNoch keine Bewertungen