Beruflich Dokumente

Kultur Dokumente

Outlook For US Ethane (2012)

Hochgeladen von

CraigUnderwoodOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Outlook For US Ethane (2012)

Hochgeladen von

CraigUnderwoodCopyright:

Verfügbare Formate

Outlook for US Ethane:

Always Climbing a Wall of Worry

Presented to the 2

nd

Platts NGL Conference

Sept 24, 2012

Hilton Houston Post Oak

Peter Fasullo

En*Vantage, Inc

pfasullo@envantageinc.com

2

Throughout its history ethane has posed concerns up

and down the NGL value chain

Introduction

Industry Player Historical Concern

Gas Producers &

Processors

Sufficient ethane extraction

economics to justify investments

in cryogenic plants.

Midstream Cos. Volume risks associated with

handling NGLs with high ethane

contents.

Petrochemical Cos. The long-term availability of

competitively priced ethane.

3

Basic Facts About Ethane

Ethane - most economically sensitive NGL, extraction can

be discretionary, and its price floor is set by natural gas.

Ethane has only one major end use ethylene feedstock.

The incentive to extract ethane is only as good as the

economic viability of the US petrochemical industry.

In the past 40 years, ethane frac spreads and cracking

economics have been materially impacted by:

Gas shortages - Late 1970s/Early 1980s; Early to Mid 2000s

Recessions - Mid 1990s; Late 2008/Early 2009.

Crude price collapses Late 1990s; Q4 2008 to Q1 2009.

4

The Biggest Worry Today

A chronic surplus of ethane will develop due to the drilling of

rich hydrocarbon shale plays.

Many believe ethane supplies will surge overtaking the

petrochemical industrys ability to crack ethane.

Predicting that ethane rejection could be widespread.

So are these concerns justified or are they overblown?

Lets examine the following areas:

Recent history

The factors that will drive ethane supply, demand and pricing.

5

Over the 2007 to 2011 Period

Over 9 BCFD of new

cryogenic processing

capacity was built.

NGL extraction climbed

570 MBPD - 310 MBPD

was ethane.

A global recession,

followed by sluggish

economic growth.

A major build out of

ethylene capacity in the

ME, China and SE Asia.

Incremental NGLs, mainly ethane

efficiently absorbed, except during

the recession in late 08/early 09.

Petchems enhanced ethane

cracking capability to 1.05 MM

BPD, exceeding processors ability

to extract ethane.

US became net exporter of NGLs.

Record NGL (ethane) frac spreads

occurred in 2010/2011.

One negative - NGL takeaway

bottlenecks in Mid-Continent

depressing Conway NGL prices.

6

US ethane prices declined and

frac spreads narrowed:

Ethane extraction up 100 MBPD year

over year to near 1 MM BPD.

Additional volumes would have been

efficiently consumed, but

Ethylene plant turnarounds

dropped ethane demand by 10%.

Lack of winter weather created

a propane surplus.

Conway ethane prices remain

depressed.

Global economic slowdown dropped

US polyethylene exports by ~14%.

What Happened in 1

st

Half of 2012?

Ethane Inventories

climbed to Record

Levels.

Ethane Rejection

mainly in Mid- Cont.

7

Majority of ethylene plant turnarounds completed.

Ethane cracking capability enhanced.

Ethane balances still very sensitive to plant outages.

More balanced Ethane Market for the

Remainder of 2012 and into 2013

US Ethane Inventories

(1000 Bbls)

10,000

15,000

20,000

25,000

30,000

35,000

40,000

J an-

01

J an-

02

J an-

03

J an-

04

J an-

05

J an-

06

J an-

07

J an-

08

J an-

09

J an-

10

J an-

11

J an-

12

Average

Actual Forecast

Ethane Days of Supply of Inventories

0

10

20

30

40

50

60

70

J an-

01

J an-

02

J an-

03

J an-

04

J an-

05

J an-

06

J an-

07

J an-

08

J an-

09

J an-

10

J an-

11

J an-

12

D

a

y

s

-

o

f

-

S

u

p

p

l

y

Average

Actual Forecast

8

The Relative Value of Natural Gas to Crude

Low gas-to-crude ratios combined with high crude prices is

providing a significant BTU price spread between gas and

crude, driving both the supply and demand for US NGLs.

Gas-to-WTI Price Ratio (On a Thermal Basis) vs

the BTU Spread between WTI and Gas

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

YTD

G

a

s

-

t

o

-

C

r

u

d

e

R

a

t

i

o

.

.

.

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

$

p

e

r

M

M

B

T

U

Gas-to-WTI Ratio

BTU Spread Between WTI

and Gas

9

NGL Price Relationships and Frac Spreads

Ethanes floor value, set by gas,

has declined, allowing its market

value to crude to drop to remain

the preferred feedstock.

Heavy NGLs have maintained

their value relative to crude.

Low gas-to-crude ratios and high oil

prices caused record high NGL frac

spreads in 2011.

Ethane frac spreads lower this year.

Heavy NGL frac spreads remain high.

Mt Belvieu NGL Price Relationships to WTI Prices

0%

20%

40%

60%

80%

100%

120%

2006 2007 2008 2009 2010 2011 2012 YTD

Ethane Propane N-Butane I-Butane C5+

NGL Frac Spreads at Mt. Belvieu

($ Per MM Btu)

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

2006 2007 2008 2009 2010 2011 2012 YTD

Ethane

Propane

N-Butane

I-Butane

C5+

10

NGL Uplift Calculation for Typical Shale Play

* Mt. Belvieu NGL prices net of T&F fees of 12/gal.

Ethane

51%

27%

Shale Gas

with 5 gpm

of NGLs

Propane

Butane +

Cryogenic

Processing

Plant

Residue Gas

22%

NGL Barrel Extracted

Sep-2012 NGL uplift $1.75/MM Btu versus $3.25 in Jan-12

Assumes 90% ethane recovery

NGL Uplift for Average Shale Play

(Using Sept 2012 prices for Natural Gas and Mt Belvieu NGLs)

-$0.50

$0.50

$1.50

$2.50

$3.50

$4.50

$5.50

Natural Gas Gas +NGLs

Natural

Gas

C5+

Propane

N-Butane

I-Butane

Ethane

$/MM Btu

$2.73/MM Btu

$1.82

$0.79

$0.58

$0.14

$0.78

$0.37

Uplift w/ ethane extraction $4.48/MM Btu

$1.75

Assumes 32%

shrinkage plus

1% plant fuel

Uplift w/o

ethane frac

spread

$4.11/MM Btu

$1.38

11 11

Rich Hydrocarbon Natural Gas Plays

Rich Plays

NGL

(GPM)

Content*

Avalon/Bone Springs** 4.0 to 7.0

Bakken** 4.0 to 9.0

Barnett 2.5 to 3.5

Cana-Woodford 4.0 to 6.0

Eagle Ford*** 4.0 to 9.0

Granite Wash 4.0 to 6.0

Green River** 3.0 to 5.0

Niobrara** 4.0 to 9.0

Piceance-Uinta 2.5 to 3.5

Green River 2.5 to 3.5

Marcellus/Utica (Rich) 4.0 to 9.0

* gpm gallons of NGLs per 1000 cu. ft.

** Oil Shale Plays

*** Both an Oil and Gas Shale Play

Rich Shale Play Corridors

12

Outlook for Lower 48 State Gas Production

Expect Lower

48 natural gas

production

rising 17% from

2011 to 2020.

Shale gas

production

growth,

offsetting the

decline in the

conventional

gas plays.

Source: EIA and En*Vantage

US Lower 48 Gas Production vs Demand

(Trillion Cubic Feet)

0

5

10

15

20

25

30

2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020

0

5

10

15

20

25

30

Non-associated onshore

Non-associated offshore

Associated w/ oil

Tight Gas

Coal Bed Methane

Shale Gas

Net Imports

Domestic Gas Demand

17%

8%

7%

7%

24%

29%

42%

22%

7%

7%

9%

12%

Source EIA AEO 2012

8%

1%

13

Primary Growth NGL is Ethane

Followed by Propane

Ethane/NGL %: 33%.........37%...................39%....................43%

Source: EIA and En*Vantage

US NGLs Extracted From Gas Processing

(Thousand BPD)

0

100

200

300

400

500

600

700

800

900

1,000

1,100

J an-

90

J an-

92

J an-

94

J an-

96

J an-

98

J an-

00

J an-

02

J an-

04

J an-

06

J an-

08

J an-

10

J an-

12

0

100

200

300

400

500

600

700

800

900

1,000

1,100

Ethane

Propane

Natural Gasoline

I-Butane

N-Butane

Periods of high gas-to-crude ratios

14

New Processing Plants

13 BCFD of new gas

processing capacity

being built by 2015.

40% in the TX Inland

and Gulf Coast

regions.

34% will be built in the

Marcellus/Utica

region.

Probable that another

4.9 BCFD would be

built between 2015

and 2020.

Announced Processing Capacity

(1000 CFD)

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Rockies Bakken TX Inland TX GC Mid-Cont. SE NM Marc/Utica

15

Forecast of US NGL Extraction Capability

Gas processing industrys NGL extraction capability: 2.45 MM

BPD in 2011 to about 3.42 MM BPD by 2020.

Ethane extraction capability: 1.04 MM BPD in 2011 to 1.63

MM BPD by 2020.

Forecast Max NGL Extraction Capability

(1000 BDD)

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Propane, Butanes,

Natural Gasoline

Ethane

Forecast

Ethane forecast

includes 240 MBPD

from Marcellus/Utica

post 2016.

NGL and ethane

supplies from the

M/U region could be

greater, depends on

economics and

logistics.

16

Potential Ethane Extraction in Marcellus/Utica

Potential Marcellus/Utica Ethane Extraction: 390 - 490

MBPD.

Fractionation Capacity to De-Ethanize Ethane ~200 MBPD.

Ethane Takeaway Capability will be 240 MBPD - ATEX (190 MBPD)

and Mariner West (50 MBPD) .

However, Marcellus/Utica ethane has high T&F fees to Mt.

Belvieu of 22/gal to 30/gal or $3.47 to $4 52/mm btu.

Basic question will there be the economic incentive to

bring more Marcellus/Utica ethane to market?

Depends on future ethane demand by the petrochemical industry.

If ethane demand is lacking then what?

Marcellus/Utica ethane gets blended in the gas stream, and/or

Producers have to throttle back rich gas production.

17

Distribution of Ethylene Capacity and Plants

in North America*

Sarnia

Alberta

Midwest

Gulf

Coast

* Excludes Mexico

12.5%

80.0%

3.3%

3.6%

0.6%

4 plants: 8.6 B Lb/Yr

2 plants: 2.3 B Lb/Yr 2 plants: 2.5 B Lb/Yr

1 plants: 0.4 B Lb/Yr

33 plants: 55.2 B Lb/Yr

N. America: 42 Plants: 69.0 Billion Lbs/Yr

% of total N.A.

ethylene capacity

Ethane Cracking Capability

1,2

US 1,050 MBPD (2011)

Alberta 250 MBPD

Sarnia 45 MBPD

Total NA 1295 MBPD

1

Includes refining ethane

2

Assumes 100% operating rate

Source: En*Vantage, Hodson, Industry Contacts

18

Ethane Cracking Can Soar in a

Low Gas-to-Crude Price Environment

Source: En*Vantage, Hodson, Industry Contacts

Since 2008, ethane has been the most preferred petrochemical feedstock,

driving its consumption to record levels ethane cracking above 1 MM BPD

when ethylene industry operates ~ 95% of capacity

-20

-10

0

10

20

30

40

50

J an-04 J an-05 J an-06 J an-07 J an-08 J an-09 J an-10 J an-11 J an-12

Ethylene Feedstock Margins

(Cents per Pound)

Ethane Feedstock Margins

Naphtha Feedstock Margins

Record High Crude Prices

Recession

Crude Price

Collapse

High Gas-to-Crude

Environment

Very Low Gas-to-Crude

Environment

U.S. Ethylene Feedstock Consumption - MBPD

(Jan-00 to April-12)

0

100

200

300

400

500

600

700

800

900

1000

J an-

00

J an-

01

J an-

02

J an-

03

J an-

04

J an-

05

J an-

06

J an-

07

J an-

08

J an-

09

J an-

10

J an-

11

J an-

12

I

n

d

i

v

i

d

u

a

l

F

e

e

d

V

o

l

u

m

e

s

(

M

B

P

D

)

.

.

0

100

200

300

400

500

600

700

800

900

1000

Ethane

Propane

Heavy Feeds

N-Butane

Source: Hodson Reports and

En*Vantage

Hurricanes

High Gas-to-Crude

Ratio Environment

Low Gas-to-Crude

Ratio Environment

Hurricanes

&

Recession

19

US Ethylene Industry Continuing to Enhance

Ethane Capability at Existing Plants

Capability to Crack Ethane at End of 2011 1.055 MM BPD

Ethane cracking capability is expected to increase - furnace conversions,

plant expansions and a plant restart:

Source: En*Vantage, Industry Contacts

Year

End

Increases in C2

Cracking Capability

Cumulative Increase in

C2 Cracking Capability

Total Industry C2

Cracking Capability

(MBPD) (MBPD) (MM BPD)

2012 100 100 1.155

2013 35 135 1.190

2014 85 220 1.275

2015 18 238 1.293

2016 25 263 1.318

Assumes 100% operating rates at plants maximizing ethane as a feed

20

New World-Scale US Ethylene Plants

Announced or Under Consideration

~18.7 billion lbs/yr of new ethylene plant capacity has been announced or

being considered, representing 526 MBPD of ethane cracking capability.

High probability for 4 new plants -- 320 MBPD of ethane cracking capability.

Fair chance that Sasol will build a new plant in Lake Charles.

Foreign petrochemical companies are also doing feasibility studies to build new

ethylene plants in US.

Company Location Est. Cap

B Lb/Yr

Ethane Cracking

Capability (MBPD)

Est. to be

Online

Probability

Formosa Pt Comfort, TX 1.763 53 2016 High

Exxon Baytown, TX 3.300 95 2016 High

Dow Freeport, TX 3.300 77 2017 High

CP Chem Cedar Bayou, TX 3.300 95 2017 High

Sasol Lake Charles, LA 3.300 95 2017 Fair

Shell Western PA 2.600 78 2018 Unknown

Oxy/Mexichem Ingleside, TX 1.102 33 2018 Unknown

Total 18.665 526

21

Lets Not Forget Canada

In total, 90 to 100 MBPD of US Ethane is expected to be

exported to Canada.

Alberta ethane crackers facing a 40 to 80 MBPD ethane

supply shortfall over the next ten years.

Will import 40 to 50 MBPD of ethane from the Bakken Shale through the

proposed Vantage pipeline (late 2013).

Sarnia ethylene plants can crack about 45 MBPD of ethane.

The Mariner West project (mid-2013) will send Marcellus ethane to Sarnia.

Likely that Nova will expand Sarnia ethylene plant.

Kinder Morgan transporting 10 to 15 MBPD of E/P mix to

Nova in Sarnia via their Cochin pipeline.

Sourcing E/P mix from Conway via Enterprises MAPL system.

Only a bridge for Nova until Mariner West is completed.

22

Maximum Demand for US Ethane

Max ability to crack US

ethane is expected to

grow from 1.05 MM

BPD in 2011 to ~ 1.75

MM BPD by 2018.

Enhancements to existing

ethylene plants - 265 MBPD of

ethane cracking capability.

Ethane exports to Canada -

100 MBPD by 2015.

High probability new ethylene

plants - 320 MBPD of ethane

cracking capability by 2017.

Source: En*Vantage, Industry Contacts

Max Cracking Capability for US Ethane

(1000 BPD)

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Low Probability New Plants

Fair Probabilty New Plants

High Probability New Plants

US Ethane Cracked in Canada

Converisons/Expansions/Restarts

Base C2 Cracking Capability

If Sasol builds new ethane cracker, max demand for US ethane

approaches 1.85 MM BPD. If low probability plants are built,

max ethane demand reaches 2 MM BPD by 2019.

23

Max US Ethane Supply Capability vs

Max Ethane Cracking Capability

Through 2013, close

balance between ethane

supply and demand.

From 2014 to 2015

ethane supply overhang is

likely, but can be resolved

by rejecting ethane in the

Marcellus/Utica.

Post 2015, more ethane

needed to support 4 to 7

world-scale ethane

crackers. Incremental

ethane will come from the

Marcellus/Utica.

Source: En*Vantage, Industry Contacts

Max US Ethane Supply vs Max Ethane Cracking Capability

(1000 BPD)

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

2,200

Low Probability New Plants

Moderate Probability New Plants

High Probability New Plants

US Ethane Cracked in Canada

Converisons/Expansions/Restarts

Base C2 Cracking Capability

Max C2 Supply

Additonal C2 Supply from Marcellus

24

Outlook for Ethane Frac Spreads

Source: En*Vantage, Industry Contacts

Ethane Frac Spreads

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0.35

$0.40

$0.45

$0.50

$0.55

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

C

e

n

t

s

P

e

r

G

a

l

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

$8.00

$

P

e

r

M

M

B

T

U

Forecast Actual

Mt Belvieu

Conway

25

In Summary

Expect ethane balances to improve for the remainder of the

year and into 2013 - need the ethylene industry operating at

above 90% of capacity.

Marginal frac spreads for ethane in 2014 and 2015 to

regulate the flow of ethane from the Marcellus/Utica and

keep ethane markets balanced.

Post 2015, full ethane extraction is needed as world-scale

ethylene plants come on line.

Ethane imbalances will occur, but they wont be chronic.

Ethane will always be very susceptible to ethylene industry

swings.

Biggest threats to ethane - a global recession, a collapse in

crude prices, and/or a spike in gas prices.

Das könnte Ihnen auch gefallen

- HJ-March National Voucher Voucher PDFDokument2 SeitenHJ-March National Voucher Voucher PDFCraigUnderwoodNoch keine Bewertungen

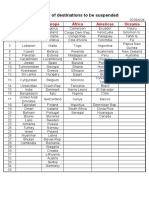

- List of Destinations To Be Suspended: Asia Europe Africa Americas OceaniaDokument1 SeiteList of Destinations To Be Suspended: Asia Europe Africa Americas OceaniaCraigUnderwoodNoch keine Bewertungen

- Appendix BDokument7 SeitenAppendix BCraigUnderwoodNoch keine Bewertungen

- Pressure Relief Valve Engineering HandbookDokument93 SeitenPressure Relief Valve Engineering Handbookakrouti92% (12)

- Improve Control: Level LoopsDokument8 SeitenImprove Control: Level LoopsCraigUnderwoodNoch keine Bewertungen

- Characterisation of CoNiSn Catalyst For Autothermal Reforming of MethaneDokument8 SeitenCharacterisation of CoNiSn Catalyst For Autothermal Reforming of MethaneCraigUnderwoodNoch keine Bewertungen

- PID ControlDokument22 SeitenPID ControlJessica RossNoch keine Bewertungen

- Gold Standard GAMSAT Section 1 2 Mock ExamDokument14 SeitenGold Standard GAMSAT Section 1 2 Mock Examtanbanking22% (9)

- PID ControlDokument22 SeitenPID ControlJessica RossNoch keine Bewertungen

- Process ControlDokument144 SeitenProcess Control14071988100% (1)

- Briefs - Gas Sweetening Using DEADokument8 SeitenBriefs - Gas Sweetening Using DEAMaria PopaNoch keine Bewertungen

- Amine Best Practices GuideDokument63 SeitenAmine Best Practices GuideJerold100% (2)

- A Fresh Look at LNG Process EfficiencyDokument0 SeitenA Fresh Look at LNG Process EfficiencyxinghustNoch keine Bewertungen

- Hydrogen Production From Methane Through Catalytic Partial Oxiation ReactionsDokument11 SeitenHydrogen Production From Methane Through Catalytic Partial Oxiation ReactionsCraigUnderwoodNoch keine Bewertungen

- Briefs - Gas Sweetening Using DEADokument8 SeitenBriefs - Gas Sweetening Using DEAMaria PopaNoch keine Bewertungen

- Process Simulator Effective in De-Ethanizer Tower Revamp - Oil & Gas JournalDokument5 SeitenProcess Simulator Effective in De-Ethanizer Tower Revamp - Oil & Gas JournalCraigUnderwoodNoch keine Bewertungen

- Ogj Jan 2015Dokument35 SeitenOgj Jan 2015CraigUnderwood100% (1)

- LNG c3mr ProcessDokument8 SeitenLNG c3mr ProcessFatih FıratNoch keine Bewertungen

- L1 - Introduction To AlcoaDokument58 SeitenL1 - Introduction To AlcoaCraigUnderwoodNoch keine Bewertungen

- As 1548-2008 - Fine Grained, Weldable Steel Plates For Pressure EquipmentDokument37 SeitenAs 1548-2008 - Fine Grained, Weldable Steel Plates For Pressure EquipmentCraigUnderwoodNoch keine Bewertungen

- HDPE EloallitasaDokument34 SeitenHDPE EloallitasaCraigUnderwood100% (1)

- As 1548-2008 - Fine Grained, Weldable Steel Plates For Pressure EquipmentDokument37 SeitenAs 1548-2008 - Fine Grained, Weldable Steel Plates For Pressure EquipmentCraigUnderwoodNoch keine Bewertungen

- Lecture2 (Petrochemical)Dokument12 SeitenLecture2 (Petrochemical)ToniAndiwijaya100% (1)

- Innovations in LNG TechnologyDokument15 SeitenInnovations in LNG TechnologyCraigUnderwoodNoch keine Bewertungen

- Senior Design PaperDokument109 SeitenSenior Design PaperCraigUnderwoodNoch keine Bewertungen

- Profile On The Production of Low Desnsity Polyethylene (Ldpe)Dokument25 SeitenProfile On The Production of Low Desnsity Polyethylene (Ldpe)CraigUnderwoodNoch keine Bewertungen

- Profile On The Production of Low Desnsity Polyethylene (Ldpe)Dokument25 SeitenProfile On The Production of Low Desnsity Polyethylene (Ldpe)CraigUnderwoodNoch keine Bewertungen

- Senior Design PaperDokument109 SeitenSenior Design PaperCraigUnderwoodNoch keine Bewertungen

- HDPE EloallitasaDokument34 SeitenHDPE EloallitasaCraigUnderwood100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Fact Sheet Wheatstone Project Overview PDFDokument2 SeitenFact Sheet Wheatstone Project Overview PDFsreedar20052185Noch keine Bewertungen

- Odisha Coal job openingsDokument1 SeiteOdisha Coal job openingsSainrupendra DashNoch keine Bewertungen

- PPIS Annual 2022 23 FinalDokument103 SeitenPPIS Annual 2022 23 Finalkamran saleemNoch keine Bewertungen

- Enhanced Oil Recovery: Chemical FloodingDokument5 SeitenEnhanced Oil Recovery: Chemical FloodingTUSHAR CHAUHANNoch keine Bewertungen

- Oil and Gas Dec 2010Dokument32 SeitenOil and Gas Dec 2010sakoboyNoch keine Bewertungen

- Bernstein China's Unconventional Gas RevolutionDokument31 SeitenBernstein China's Unconventional Gas RevolutionDavid FreedmanNoch keine Bewertungen

- LPGDokument19 SeitenLPGAdin HujicNoch keine Bewertungen

- Oil Tank CleaningDokument4 SeitenOil Tank CleaningMituNoch keine Bewertungen

- New oil well drawingsDokument4 SeitenNew oil well drawingsAsaru DeenNoch keine Bewertungen

- IFP2020 Ep en PDFDokument403 SeitenIFP2020 Ep en PDFAshish AmarNoch keine Bewertungen

- Contoh DAFTAR PUSTAKADokument3 SeitenContoh DAFTAR PUSTAKAIbrahim NugrahaNoch keine Bewertungen

- Completion & Workover.Dokument9 SeitenCompletion & Workover.msu6383Noch keine Bewertungen

- Well Completion Functions and ApplicationsDokument112 SeitenWell Completion Functions and Applicationsmissaoui100% (4)

- Helix Experience Jun2009 CPH PDFDokument10 SeitenHelix Experience Jun2009 CPH PDFabhishek kumarNoch keine Bewertungen

- Gas y Petroleo Enero 2017Dokument96 SeitenGas y Petroleo Enero 2017Jose Santos100% (1)

- Argentina oil and gas production by company 2018Dokument3 SeitenArgentina oil and gas production by company 2018Enzo Gabriel RomeroNoch keine Bewertungen

- Company ProfileDokument4 SeitenCompany ProfileAnkit Verma100% (1)

- Badak NGL Company History and LNG ProductionDokument13 SeitenBadak NGL Company History and LNG ProductionMalik AbdurrahmanNoch keine Bewertungen

- 12+ +list+of+availability of Compliant Fuels in SingaporeDokument2 Seiten12+ +list+of+availability of Compliant Fuels in SingaporeArne OlsenNoch keine Bewertungen

- Price Bitumen 16.05.2019Dokument3 SeitenPrice Bitumen 16.05.2019Kartik Kandangkel83% (6)

- Global - LNG - New - Pricing - Ahead - Ernst & YoungDokument20 SeitenGlobal - LNG - New - Pricing - Ahead - Ernst & YoungUJJWALNoch keine Bewertungen

- 1 05 Presentation ExxonMobil Gas Lift ChallengesDokument18 Seiten1 05 Presentation ExxonMobil Gas Lift ChallengesNisar KhanNoch keine Bewertungen

- Oil and Gas Exploration History in KenyaDokument4 SeitenOil and Gas Exploration History in KenyaHoidi Shitakwa ZachariaNoch keine Bewertungen

- LNG in India: Liquefied Natural GasDokument5 SeitenLNG in India: Liquefied Natural GasAman ChoudharyNoch keine Bewertungen

- Sabah - Sarawak Gas Pipeliene Project BackgroundDokument4 SeitenSabah - Sarawak Gas Pipeliene Project BackgroundAnkit Kumar0% (1)

- Market 23Dokument299 SeitenMarket 23Apratim GuhaNoch keine Bewertungen

- Appendix A08: List of China's Conventional Natural Gas PipelinesDokument10 SeitenAppendix A08: List of China's Conventional Natural Gas PipelinesarapublicationNoch keine Bewertungen

- BP Conversion 1Dokument2 SeitenBP Conversion 1Zul AdamNoch keine Bewertungen

- Mock Drill PlanDokument2 SeitenMock Drill Plansanjeet giriNoch keine Bewertungen

- Presented By: Fradika: Mining Engineering Departement of Sriwijaya UniversityDokument51 SeitenPresented By: Fradika: Mining Engineering Departement of Sriwijaya UniversityRizki Munandar AbbasNoch keine Bewertungen