Beruflich Dokumente

Kultur Dokumente

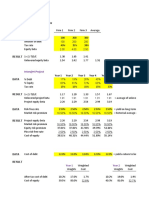

FNCE Cheat Sheet Midterm 1

Hochgeladen von

carmenng19900 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

176 Ansichten1 SeiteReference sheet for FNCE 100 midtem

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenReference sheet for FNCE 100 midtem

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

176 Ansichten1 SeiteFNCE Cheat Sheet Midterm 1

Hochgeladen von

carmenng1990Reference sheet for FNCE 100 midtem

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Interest rate risk= up when years up, coupon rate down

Simple annuity: PV=C((1/r)-(1/r(1+r)^t)

Continuous compounding: rannual=ln(1+rcontinuous)

Annual yield =((1+ R/# periods per year)

# of periods year

) - 1

Non-annual payment amount:(1+R)

#payments peryear

= (1+r)

Solve for R, then simple annuity using R, solve for C

Payoff remainder of loan= PV of remaining payments

Valuing Share with non-annual dividend payment: Find PV of

each payment, Po= PV(1+r)

time units remaining in year

+ PV(1+r)

time units

Discount Factor= 1/ (1+rt)

t

, use to solve for annual yield

Strategy=Buy underpriced bond Z, offset future flows with other bonds W, X and Y

Annunity PV= C((1/r)-(1/r(1+r)

t

))

Growing Annuity=C(1/(r-g) (1+g)

t

/(r-g)(1+r)

t

)

Growing annuity when r=g = (C)(T)/(1+r)

Constant Perpetuity PV = C/r

Growing Perp PV=C/(r-g)

Delayed Perp PV= C/ r(1+r)

t

Continuous annuity: 1) Solve for continuous perpetuity,

2)discount PV for # years in time frame, use annual r, 1-2=value

of continuous annuity. 1+r=e

r annual, continuous

Valuing share: 1)Stream of annual end year

payments=perpetuity. Find PV. 2)Stream of mid year payments.

PV=(PV end year)(1+rannual, # pay periods in year)

Gordon growth model: Po=Div1/(r-g) when g constant

Future value= C(1+r/#periods per

year)

#periods to maturity

FV=C(1+R)

#periods to maturity

FV=C (PV simple annuity)(discount factor)

NPV=C0 + C1/(1+r1)= C0 + Ct / (1+ rt)

t

Po/EPS1= 1/r + NPVGO/EPS1

NPV=(INVt(ROE-r))/r

G= (k)(ROE)

INV=(EPSt)(k)

DIVt=EPSt(1-k)

Divt= EPSt(1-k) g=(k)(ROE) Po=EPS1/r + NPVGO

NPVt= INVt(ROE-r) / r DIVt=EPSt - INVt

Expected Return= r = DIV1/Po + g

Annual yield=ra,1 (1+ra,1)=(1+ra,m/m)

m

= (1+R)

m

rannual rate, compunded annually=rannual rate, compound other=rnon-annual

Bond Price=C/(1+r1) + C/(1+r2)

2

+ FV/(1+r2)

2

Yield to maturity: Price=C(1/(1+r) + 1/(1+r)

2

) + FV/(1+r)

2

Yield to Maturity: Price=(Face value)(DFt) where

Price=(DFt)(Face value), DFt= 1/(1+r)

t

*Solving for r as one value, instead of using different rs*

Bond Price=(C)(DF1)+C(DF2)+FV(DF2)

Discount Factor=1/(1+rt)

t

Future rate (f): (1+r1)(1+f2,1)=(1+r3)

3

(1+fi,t)=((1+ri,t)

t+i

/ (1+rt)

t

)

1/i

*where i=# of years term lasts, t=#years in future*

Low Price to earnings ratio=valuehigh=growth

k=1-(Div1/EPS1)

EPSt= EPSt-c(1+gEPSt)

C

R= ra,m / m ra, continuous= ln (1+r)

(1+r)=(1+ra,m/m)

m

= (1+R)

m

To solve for continuous flow of C, PV=C/ra, continuous

Solve for quarterly payments for flow C, PV=Cquarter/R

Ra,continuous=ln(1+ra,1) e

r a, continuous

=(1+ra,1)

PV of stream continuously compounded for t years=

Cannual(1/ra,continuous 1/(ra,cont.)(1+r)

t

)

Effective annual rate=(1+r/m)

m

1 when r=annual %

Das könnte Ihnen auch gefallen

- Chapter 5 - Time Value of Money Multiple Choice QuestionsDokument36 SeitenChapter 5 - Time Value of Money Multiple Choice QuestionsJeffrey Mak82% (39)

- Macroeconomics FINAL Cheat SheetDokument1 SeiteMacroeconomics FINAL Cheat Sheetcarmenng1990Noch keine Bewertungen

- FINA1221 Formula SheetDokument2 SeitenFINA1221 Formula SheetTjia Hwei ChewNoch keine Bewertungen

- Ex09 2 SolDokument9 SeitenEx09 2 SolToonz NetworkNoch keine Bewertungen

- Corporate Finance SyllabusDokument2 SeitenCorporate Finance SyllabusaNoch keine Bewertungen

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDokument4 SeitenDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Noch keine Bewertungen

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDokument6 SeitenFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNoch keine Bewertungen

- Formula Sheet-Coporate FinanceDokument3 SeitenFormula Sheet-Coporate FinanceWH JeepNoch keine Bewertungen

- Chapter 13Dokument11 SeitenChapter 13Hương LýNoch keine Bewertungen

- Capital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachDokument4 SeitenCapital Budgeting Evaluation Criteria Exercise Guide - NPV, IRR, Replacement Chain ApproachAnshuman AggarwalNoch keine Bewertungen

- Module 4 Practice QuizDokument2 SeitenModule 4 Practice QuizAlecNoch keine Bewertungen

- Assignment 2Dokument1 SeiteAssignment 2Sumbal JameelNoch keine Bewertungen

- Ch04 Tool KitDokument80 SeitenCh04 Tool KitAdamNoch keine Bewertungen

- Isom 2700 Cheat Sheet - 1Dokument2 SeitenIsom 2700 Cheat Sheet - 1Jiny LeeNoch keine Bewertungen

- Fin Cheat SheetDokument3 SeitenFin Cheat SheetChristina RomanoNoch keine Bewertungen

- 3 - Cost Volume Profit AnalysisDokument1 Seite3 - Cost Volume Profit AnalysisPattraniteNoch keine Bewertungen

- Risk Management and Basel II: Bank Alfalah LimitedDokument72 SeitenRisk Management and Basel II: Bank Alfalah LimitedtanhaitanhaNoch keine Bewertungen

- Understanding portfolio risk and returnDokument6 SeitenUnderstanding portfolio risk and returnAchal ChandNoch keine Bewertungen

- Formula Sheet FIMDokument4 SeitenFormula Sheet FIMYNoch keine Bewertungen

- Engineering formulas guide for financial analysisDokument4 SeitenEngineering formulas guide for financial analysisJeff JabeNoch keine Bewertungen

- Multimedia Learning BibliographyDokument2 SeitenMultimedia Learning BibliographyMichael Sturgeon, Ph.D.100% (1)

- FMV Cheat SheetDokument1 SeiteFMV Cheat SheetAyushi SharmaNoch keine Bewertungen

- Comparable Companies: Inter@rt ProjectDokument9 SeitenComparable Companies: Inter@rt ProjectVincenzo AlterioNoch keine Bewertungen

- Time Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaDokument18 SeitenTime Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaSaurabh ChawlaNoch keine Bewertungen

- General Annuities and Equivalent Rates ExplainedDokument22 SeitenGeneral Annuities and Equivalent Rates ExplainedFrancisco, Ashley Dominique V.Noch keine Bewertungen

- Statistical Foundation For Analytics-Module 1Dokument18 SeitenStatistical Foundation For Analytics-Module 1VikramAditya RattanNoch keine Bewertungen

- Practice MidtermDokument8 SeitenPractice MidtermghaniaNoch keine Bewertungen

- Chapter 03Dokument80 SeitenChapter 03raiNoch keine Bewertungen

- Operating Ratio + Operating Profit Ratio 1Dokument6 SeitenOperating Ratio + Operating Profit Ratio 1Prakash ReddyNoch keine Bewertungen

- Chap 1Dokument22 SeitenChap 1Zara Sikander33% (3)

- Regression Model and Its ApplicationsDokument30 SeitenRegression Model and Its ApplicationsShuyu Jia100% (1)

- Valuation of BondsDokument27 SeitenValuation of BondsAbhinav Rajverma100% (1)

- Evaluating Project Risks & Capital RationingDokument53 SeitenEvaluating Project Risks & Capital RationingShoniqua JohnsonNoch keine Bewertungen

- Merton PD ModelDokument6 SeitenMerton PD Modelapi-223061586Noch keine Bewertungen

- Finance Interview QuestionDokument41 SeitenFinance Interview QuestionshuklashishNoch keine Bewertungen

- Case 1Dokument2 SeitenCase 1Chiks JpegNoch keine Bewertungen

- Review of Structured Programming in CDokument64 SeitenReview of Structured Programming in CSahil AhujaNoch keine Bewertungen

- CompilationLecLab VB 2010 .NET JRUDokument116 SeitenCompilationLecLab VB 2010 .NET JRUEl YangNoch keine Bewertungen

- Visual Programming 1: - Exam Preparation: With MCQS, Pracs, Questions and SolutionsDokument27 SeitenVisual Programming 1: - Exam Preparation: With MCQS, Pracs, Questions and SolutionsChikoNoch keine Bewertungen

- Homework Chapter 8Dokument4 SeitenHomework Chapter 8Husainy KamalNoch keine Bewertungen

- Cost and Management Accounting MMS Second SemesterDokument5 SeitenCost and Management Accounting MMS Second SemesterTilottama KokateNoch keine Bewertungen

- Calculate WACC for SCS CoDokument11 SeitenCalculate WACC for SCS CoHusnina FakhiraNoch keine Bewertungen

- Calibrate Hull-White ModelDokument43 SeitenCalibrate Hull-White ModelLeo LiuNoch keine Bewertungen

- Valuation of SecuritiesDokument71 SeitenValuation of Securitieskuruvillaj2217Noch keine Bewertungen

- PowerPoint Presentation PythonDokument17 SeitenPowerPoint Presentation PythongovindNoch keine Bewertungen

- INFS2621 - OverviewDokument6 SeitenINFS2621 - OverviewAther AhmedNoch keine Bewertungen

- Ooad Lab Final Manual1Dokument232 SeitenOoad Lab Final Manual1dina27nov100% (4)

- Chuong 1 Introduction 2013 SDokument82 SeitenChuong 1 Introduction 2013 Samericus_smile7474Noch keine Bewertungen

- 4 6032630305691534636 PDFDokument254 Seiten4 6032630305691534636 PDFDennisNoch keine Bewertungen

- Mock Midterm 2019-1Dokument8 SeitenMock Midterm 2019-1xsnoweyxNoch keine Bewertungen

- Unit - 7 - Depreciation & Income TaxesDokument43 SeitenUnit - 7 - Depreciation & Income TaxesAadeem NyaichyaiNoch keine Bewertungen

- Entity Relationship Model PDFDokument37 SeitenEntity Relationship Model PDFDivansh Sood100% (2)

- Ch. 18 Exercises On Equity ValuationDokument3 SeitenCh. 18 Exercises On Equity Valuationclyon1547100% (1)

- Excel Financial Modelling Guide: Basic Tools in BriefDokument5 SeitenExcel Financial Modelling Guide: Basic Tools in Briefnikita bajpaiNoch keine Bewertungen

- Object Oriented SAD-3 Requirement ElicitationDokument50 SeitenObject Oriented SAD-3 Requirement ElicitationBiruk BelaynehNoch keine Bewertungen

- Finance QuestionsDokument10 SeitenFinance QuestionsAkash ChauhanNoch keine Bewertungen

- Chapter 04 - Acturial PrinciplesDokument15 SeitenChapter 04 - Acturial PrinciplesAmit Kumar Jha100% (1)

- Monte Carlo SimulationDokument22 SeitenMonte Carlo SimulationWillinton GutierrezNoch keine Bewertungen

- Performance AttributionDokument7 SeitenPerformance AttributiondomomwambiNoch keine Bewertungen

- ICFAI Question PaperDokument22 SeitenICFAI Question PaperS ChettiarNoch keine Bewertungen

- Database System Concepts and ArchitectureDokument52 SeitenDatabase System Concepts and ArchitectureAsfand Yar Jutt100% (2)

- Structured programming Complete Self-Assessment GuideVon EverandStructured programming Complete Self-Assessment GuideNoch keine Bewertungen

- Concept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023Von EverandConcept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023Noch keine Bewertungen

- MKTG 101 NotesDokument25 SeitenMKTG 101 Notescarmenng1990Noch keine Bewertungen

- Pract Exam 1-BDokument17 SeitenPract Exam 1-Bcarmenng1990Noch keine Bewertungen

- C 6677 4625720632156061899Dokument5 SeitenC 6677 4625720632156061899someguy1987Noch keine Bewertungen

- Accounting 102 Recitation Session 01 NotesDokument4 SeitenAccounting 102 Recitation Session 01 Notescarmenng1990Noch keine Bewertungen

- Session 05Dokument15 SeitenSession 05carmenng1990Noch keine Bewertungen

- Forrest GumpDokument4 SeitenForrest Gumpcarmenng19900% (1)

- Session 04 - CVPDokument20 SeitenSession 04 - CVPcarmenng1990Noch keine Bewertungen

- Final Study GuideDokument55 SeitenFinal Study Guidecarmenng1990Noch keine Bewertungen

- LG 101 Final Study GuideDokument12 SeitenLG 101 Final Study Guidecarmenng1990Noch keine Bewertungen

- Wharton Investment Course SyllabusDokument10 SeitenWharton Investment Course Syllabuscarmenng1990Noch keine Bewertungen

- Finance Lecture Slides SEC01 Coursera UpdateDokument8 SeitenFinance Lecture Slides SEC01 Coursera UpdateArmando LeónNoch keine Bewertungen

- Finance CoughCough CaseDokument2 SeitenFinance CoughCough Casecarmenng1990Noch keine Bewertungen

- Lecture 3 Discounting and Compounding Printout FinalDokument28 SeitenLecture 3 Discounting and Compounding Printout Finalcamisetas_abercrombiNoch keine Bewertungen

- Corporate Finance Practice Questions MidDokument9 SeitenCorporate Finance Practice Questions MidFrasat IqbalNoch keine Bewertungen

- Time Value of MoneyDokument26 SeitenTime Value of Moneynicko marceloNoch keine Bewertungen

- Topic 1-PV, FV, Annunities, Perpetuities - No SolutionsDokument47 SeitenTopic 1-PV, FV, Annunities, Perpetuities - No SolutionsJorge Alberto HerreraNoch keine Bewertungen

- 08 Valuation of Stocks and BondsDokument43 Seiten08 Valuation of Stocks and BondsRaviPratapGond100% (1)

- IPPTChap 002Dokument32 SeitenIPPTChap 002ufuk uyanNoch keine Bewertungen

- 10 Pdfsam EDITED UOL FM Topic 9 PostedDokument85 Seiten10 Pdfsam EDITED UOL FM Topic 9 PostedEmily TanNoch keine Bewertungen

- The Time Value of MoneyDokument24 SeitenThe Time Value of Moneysaliljain2001Noch keine Bewertungen

- Calculus Derivation of Perpetuity Formula: NotationDokument4 SeitenCalculus Derivation of Perpetuity Formula: NotationAndrijaCrepuljaNoch keine Bewertungen

- Final Exam Cover Formulas COMM 308 JMSBDokument4 SeitenFinal Exam Cover Formulas COMM 308 JMSBmeilleurlNoch keine Bewertungen

- Chapter 3 - Concept Questions and ExercisesDokument3 SeitenChapter 3 - Concept Questions and ExercisesPhương Nguyễn ThuNoch keine Bewertungen

- Chapter 5 Time Value of Money Multiple Choice Questions PDFDokument36 SeitenChapter 5 Time Value of Money Multiple Choice Questions PDFImran Zulfiqar100% (3)

- Brea ch05 BMM 7e SGDokument91 SeitenBrea ch05 BMM 7e SGAshish BhallaNoch keine Bewertungen

- Chapter 8 Stock ValuationDokument35 SeitenChapter 8 Stock ValuationHamza KhalidNoch keine Bewertungen

- FM Module 1-Lesson 3Dokument13 SeitenFM Module 1-Lesson 3John Kenneth FiguerraNoch keine Bewertungen

- Fundamentals of Corporate Finance: Time Value of Money: Valuing Cash Flow StreamsDokument56 SeitenFundamentals of Corporate Finance: Time Value of Money: Valuing Cash Flow StreamsQinghua XiaNoch keine Bewertungen

- Exam 1 Learning ObjectivesDokument4 SeitenExam 1 Learning ObjectivesYingfanNoch keine Bewertungen

- 01 Value and Capital Budgeting SlidesDokument164 Seiten01 Value and Capital Budgeting SlidesFernandoNoch keine Bewertungen

- Corporate Finance: Laurence Booth - W. Sean ClearyDokument136 SeitenCorporate Finance: Laurence Booth - W. Sean Clearyatif41Noch keine Bewertungen

- Engineering Economy: Annuity Due, Deferred Annuity and PerpetuityDokument8 SeitenEngineering Economy: Annuity Due, Deferred Annuity and PerpetuityHENRICK IGLENoch keine Bewertungen

- 04 Time Value of MoneyDokument45 Seiten04 Time Value of MoneyGladys Dumag80% (5)

- Fm-Module II Word Document - Anjitha Jyothish Uvais PDFDokument17 SeitenFm-Module II Word Document - Anjitha Jyothish Uvais PDFMuhammed HuvaisNoch keine Bewertungen

- Lesson 1-Simple and General AnnuitiesDokument23 SeitenLesson 1-Simple and General AnnuitiesClifford Estrellado100% (1)

- HW 3 SolutionsDokument4 SeitenHW 3 SolutionsJohn SmithNoch keine Bewertungen

- CHAPTER 6 Module Financial ManagementDokument23 SeitenCHAPTER 6 Module Financial Managementgiezel francoNoch keine Bewertungen

- FIN2704 Week 3 Zoom Lecture SlidesDokument23 SeitenFIN2704 Week 3 Zoom Lecture SlidesZenyuiNoch keine Bewertungen