Beruflich Dokumente

Kultur Dokumente

Hca14 SM FM

Hochgeladen von

Sam NgOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hca14 SM FM

Hochgeladen von

Sam NgCopyright:

Verfügbare Formate

Solutions Manual

COST

ACCOUNTIN

G

Solutions Manual

Upper Saddle River, NJ 07458

This work is protected by United States copyright laws and is provided

solely for the use of instructors in teaching their courses and assessing

2012 Pearson Education, Inc. Publishing as Prentice Hall

COST

ACCOUNTIN

G

Fourteenth Edition

Charles T. Horngren

Srikant M. Datar

Madhav Rajan

student learning. Dissemination or sale of any part of this work (including

on the World Wide Web) will destroy the integrity of the work and is not

permitted. The work and materials from it should never be made available

to students ecept by instructors using the accompanying tet in their

classes. !ll recipients of this work are epected to abide by these

restrictions and to honor the intended pedagogical purposes and the needs

of other instructors who rely on these materials.

Acquisition Editor: Stephanie Wall

Editorial Project Manager: Christina Rumbaugh

Editorial Assistant: Brian Reilly

Project Manager, Production: Lynne Breitfeller

Operations Specialist: Natacha Moore

Printer/Binder: OPM Digital Print Services

Cover Printer: OPM Digital Print Services

Credits and acknowledgments borrowed from other sources and reproduced, with permission, in this

textbook appear on appropriate page within text.

______________________________________________________________________________________

Copyright 2012 by Pearson Education, Inc., Upper Saddle River, New Jersey, 07458.

Pearson Prentice Hall. All rights reserved. Printed in the United States of America. This publication is

protected by Copyright and permission should be obtained from the publisher prior to any prohibited

reproduction, storage in a retrieval system, or transmission in any form or by any means, electronic,

mechanical, photocopying, recording, or likewise. For information regarding permission(s), write to: Rights

and Permissions Department.

Pearson Prentice Hall is a trademark of Pearson Education, Inc.

Pearson is a registered trademark of Pearson plc

Prentice Hall is a registered trademark of Pearson Education, Inc.

Pearson Education Ltd., London Pearson Education North Asia, Ltd., Hong Kong

Pearson Education Singapore, Pte. Ltd Pearson Educacin de Mexico, S.A. de C.V.

Pearson Education, Canada, Inc. Pearson Education Malaysia, Pte. Ltd

Pearson EducationJapan Pearson Education Upper Saddle River, New Jersey

Pearson Education Australia PTY, Limited

10 9 8 7 6 5 4 3 2 1

ISBN-13: 978-0-13-210921-5

ISBN 10: 0-13-210921-2

TABLE OF CONTENTS

Preface v

Supplements Available for Fourteenth Edition ix

Alternative Suggested Chapter Sequences xiii

Categorization of Assignment Material xvii

Presentation of Solutions xxxi

Major Changes in ext for the Fourteenth Edition xxxiii

Changes in Assignment Material for the Fourteenth Edition xxxvii

Chapter Solutions

! he Manager and Management Accounting !"!

# An $ntroduction to Cost erms and Purposes #"!

% Cost"&olume"Profit Anal'sis %"!

( )ob Costing ("!

* Activit'"+ased Costing and Activit'"+ased Management *"!

, Master +udget and -esponsibilit' Accounting ,"!

. Flexible +udgets/ 0irect"Cost &ariances/ and Management Control ."!

1 Flexible +udgets/ 2verhead Cost &ariances/ and Management Control 1"!

3 $nventor' Costing and Capacit' Anal'sis 3"!

!4 0etermining 5o6 Costs +ehave !4"!

!! 0ecision Ma7ing and -elevant $nformation !!"!

!# Pricing 0ecisions and Cost Management !#"!

!% Strateg'/ +alanced Scorecard/ and Strategic Profitabilit' Anal'sis !%"!

!( Cost Allocation/ Customer"Profitabilit' Anal'sis/ and Sales"&ariance Anal'sis !("!

!* Allocation of Support"0epartment Costs/ Common Costs/ and -evenues !*"!

!, Cost Allocation8 )oint Products and +'products !,"!

!. Process Costing !."!

!1 Spoilage/ -e6or7/ and Scrap !1"!

!3 +alanced Scorecard8 9ualit'/ ime/ and the heor' of Constraints !3"!

#4 $nventor' Management/ )ust"in"ime/ and Simplified Costing Methods #4"!

#! Capital +udgeting and Cost Anal'sis #!"!

## Management Control S'stems/ ransfer Pricing/ and Multinational Considerations ##"!

#% Performance Measurement/ Compensation/ and Multinational Considerations #%"!

v

vi

PREFACE

he 7e's to the success of a course in cost accounting are the assignment and discussion of

provocative problem material: he gathering of high"qualit' assignment material has been a

crucial phase of this boo7;s preparation < not a painful afterthought:

Please revie6 the preface in the text in conjunction 6ith examining the suggestions in this

Solutions Manual: Please also read all the front matter of this manual:

Anna )ensen/ +arbara 0urham/ Anna )ensen and Shalin Shah assisted us greatl' 6ith

contributing/ critiquing/ and chec7ing of the problems and their solutions: =e than7 them for

their man' 6onderful contributions:

=e deepl' appreciate the tremendous support of Caroline -oop/ Aim>e 5amel/ and Shalin Shah:

heir abilit' to cheerfull' respond to the man' challenges made our tas7s much more

manageable: =e further appreciate the technical support for data anal'sis provided b' 0e?ett

@a6:

=e are than7ful to Stephanie =all and Christina -umbaugh at Prentice"5all for providing

continual support in preparing this Solutions Manual:

C5A-@ES : 52-AB-EA

S-$CAA M: 0AA-

MA05A& &: -A)AA

vii

viii

SUPPLEMENTS AVALABLE FOR T!E FOURTEENT! E"TON

A complete pac7age of supplements is available to assist students and instructors in using

Cost Accounting: A Managerial Emphasis

M#A$$%&'(i')La*+ for 5orngren Cost Accounting !(e

M'Accounting@ab is an online home6or7 and assessment tool/ designed to help students

practice cost accounting problems and concepts/ and give their instructors feedbac7 on their

performance: $t lets cost accounting professors assign a home6or7 deliverable that is

automaticall' graded/ but that also serves as a tutorial experience for students:

+ased on Pearson;s MathD@ platform that has graded over millions of assignments/

M'Accounting@ab provides a strong/ reliable platform 6ith a roc7 solid performance histor': o

learn more visit ,,,-.#a$$%&'(i')la*-$%.:

F%r '/(r&$(%r/

'/(r&$(%r Re/%&r$e Ce'(er 0RC1

hese pass6ord"protected resources are accessible from ,,,-pear/%'2i)2ered-$%. for Cost

Accounting/ !(

th

ed: -esources $nclude8

$nstructor;s Manual

est $tem File

est Ben E9EA computerized test item file:

Solutions Manual

$mage @ibrar'EAccess to most of the images and illustrations featured in the text:

Excel @abs and their solutions: Also included are the Excel files of the figures and tables

in the text:

Complete Po6erPoint Presentations

AE= Po6erPoint slides of full'"6or7ed"out solutions for selected problems:

Support for +lac7board and =ebC courses

'/(r&$(%r3/ Ma'&al

+' Sheila 5and'

F #4!# G 4"!%"#!43#(". G 2nline

Chapter b' chapter manual offers helpful classroom suggestions and teaching tips

Te/( (e. File

F #4!# G 4"!%"#!43##"4 G 2nline

his collection of tests for each chapter offers an arra' of questions ranging from eas' to

difficult: An electronic version of these questions is also available: he Test Item File no6

supports Association to Advance Collegiate Schools of +usiness HAACS+I $nternational

Accreditation:

ix

S%l&(i%'/ Ma'&al

F #4!# G 4"!%"#!43#!"# G Paper

his manual contains the full' 6or7ed"out and accurac'"chec7ed solutions for ever' question/

exercise and problem in the text:

P%,er P%i'( Pre/e'(a(i%'/

F #4!# G 4"!%"#!433."# G 2nline

Chapter b' chapter presentations that provide 'ou 6ith a slide sho6 read' for classroom use: Jse

the slides as the' are/ or edit them to meet 'our classroom needs:

F%r S(&de'(/

S(&de'( S(&d# 4&ide

b' )ohn C: 5arris

F #4!# G 4"!%"#!43#4"( G Paper

his chapter"b'"chapter learning aid effectivel' helps students learn cost accounting and get the

maximum benefit from their stud' time: Each chapter provides a Chapter 2vervie6 and -evie6/

a Featured Exercise that covers all of the most important chapter material/ and -evie6 9uestions

and Exercises 6ith Solutions that best test the students; understanding of the material:

S(&de'( S%l&(i%'/ Ma'&al

F #4!# G 4"!%"#!43!3"4 G Paper

his manual contains the full' 6or7ed"out and accurac'"chec7ed solutions for selected end"of"

chapter problems in the text:

E5$el Ma'&al 6%r C%/( A$$%&'(i')

+' @aurie +urne' and Michelle Matherl'

F #4!# G 4"!%"#!43!1# G Paper

his brief supplement is aligned to bring students up to speed 6ith using Excel in this course:

S(&de'( "%,'l%ad Pa)e 777 !%r')re'

URL+ ,,,-pear/%'2i)2ered-$%.82%r')re'

2ur Companion =ebsite provides students 6ith chapter learning objectives and chapter b'

chapter self"stud' quizzes:

""" F%r S(&de'(/+ Excel templates for selected and <of"chapter exercises and problems

Hmar7ed 6ith an iconI are available online: hese templates allo6 students to complete

selected exercises and problems using Excel: he Focus is on having students use Excel

to understand and appl' chapter content: his Excel"based learning is completel'

optionalK therefore/ students ma' choose to solve these exercises and problems manuall':

he Excel @abs can be found on the $nstructor;s -esource Center H$-CI:

x

ALTERNATVE SU44ESTE" C!APTER SE9UENCES

he Preface to Cost Accounting noted that our aim in organizing the material 6as to present a

modular/ flexible organization that permits a course to be custom tailored: his section presents

six possible sequences for a first course in cost accounting: For each of these six sequences/ 6e

also present the sequence of a second course that 6ould result in coverage of man' or all of the

topics in Cost Accounting: 2utlines $<& all include Chapters ! to 3 in var'ing orders of

sequence: 2utline &$ has a strong Halmost exclusiveI focus on the decision ma7ing role of cost

accounting:

=e anal'zed the sequences of chapters assigned b' man' users of the !%th edition: Although

man' instructors tended to follo6 the sequence in the text/ other instructors tailored sequences to

fit their particular desires: hese tailored sequences varied considerabl': +' far the most popular

departure 6as to assign the chapter on process costing HChapter !.I immediatel' after the

coverage of job costing HChapter (I and activit'"based costing HChapter *I: he next most

popular departure 6as to assign Chapter !4 after Chapter # or %: All the accompan'ing

alternative assignment schedules have an optional provision to facilitate tailoring a course:

2bviousl'/ instructors should alter an' suggested sequence to suit their preferences:

2J@$AE $8 his basic course provides a balance of topics bet6een the major purposes of cost

accounting8

!: Calculating the cost of products/ services/ and other cost objects:

#: 2btaining information for planning and control and performance evaluation:

%: Anal'zing relevant information for ma7ing decisions:

Finishing the first course 6ith Chapters !! and !# means that topics 6ith less procedural

emphasis are highlighted in the last 6ee7s of the courseK these t6o chapters also introduce topics

covered in more detail in a second course: Some instructors ma' assign Chapter !4 6ithout using

the Appendix on L-egression Anal'sis/M preferring to dela' use of the Appendix until the second

course Hespeciall' if man' students have not been exposed to regression anal'sis at the time of

the basic courseI:

2J@$AE $$8 his basic course covers the same chapters as 2utline $/ but assigns Chapter !4

H0etermining 5o6 Costs +ehavesI immediatel' after Chapter % HCost &olume"Profit Anal'sisI:

$t also assigns the ne6 Chapter !% on Strateg'/ +alanced Scorecard/ and Strategic Profitabilit'

Anal'sis: his first part of the Second Course emphasizes cost management and performance

evaluation before covering the six chapters H!(<#4I on cost allocation and other aspects of

costing s'stems:

2J@$AE $$$8 After covering Chapters ! to 3 and !! in the basic course/ this sequence finishes

6ith a chapter on strategic issues HChapter !%I and t6o chapters on cost allocation topics

HChapters !( and !*I: Some instructors vie6 it as important that students ta7ing onl' one cost

accounting course become a6are of ho6 pervasive cost allocation issues are in practice:

2J@$AE $&8 his basic course is similar to 2utline $$ 6ith one 7e' exceptionK Chapter !.

HProcess CostingI is covered immediatel' after Chapter *: Man' instructors prefer to cover job

costing and process costing in sequence so that their differences are highlighted:

xi

2J@$AE &8 his basic course emphasizes technical cost accounting topics more than the other

five outlines: Chapters !. and !1/ extend Chapters ( and *K covering (/ */ !./ and !1/ as a single

section of the course provides students 6ith a solid understanding of product costing alternatives:

2J@$AE &$8 his basic course is adopted b' instructors 6ho 6ish to put most emphasis on the

decision ma7ing and performance evaluation aspects of cost accounting: Finishing the basic

course 6ith Chapters ## and #% means that behavioral issues are highlighted in the final 6ee7s of

the course:

xii

OUTLNE OUTLNE OUTLNE

+AS$C

C2J-SE C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/

! H!I ! H!I ! H!I

# H#I # H#I # H#I

% H#I % H#I % H#I

( H%I !4 H#I ( H%I

* H%I ( H%I * H%I

, H#I * H%I , H#I

. H#I , H#I . H#I

1 H#I . H#I 1 H#I

3 H#I 1 H#I 3 H#I

!4 H#I 3 H#I !! H#I

!! H#I !! H#I !% H#I

!# H#I !# H#I !( H#I

!% H#I !* H#I

ests H%I ests H%I ests H%I

2ptional H(I 2ptional H#I 2ptional H#I

%# %# %#

SEC2A0

C2J-SE C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/

!% H%I #! H%I !4 H#I

!( H#I ## H#I !# H#I

!* H#I #% H#I #! H%I

!, H#I !( H%I !* H#I

!. H#I !* H#I !. H%I

!1 H#I !, H#I !1 H#I

!3 H#I !. H%I !3 H#I

#4 H#I !1 H#I #4 H%I

#! H#I !3 H#I ## H#I

## H#I #4 H#I #% H#I

#% H#I

ests H%I ests H%I ests H%I

2ptional H,I 2ptional H,I 2ptional H,I

%# %# %#

xiii

OUTLNE V OUTLNE V OUTLNE V

+AS$C

C2J-SE C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/

! H!I ! H!I ! H!I

# H#I # H#I # H#I

% H#I % H#I % H#I

!4 H#I ( H%I !4 H#I

( H#I * H%I ( H#I

* H#I !. H%I * H#I

!. H#I !1 H#I , H#I

, H#I , H%I !! H#I

. H#I . H#I !# H#I

1 H#I 1 H#I !% H%I

3 H#I 3 H#I ## H#I

!! H#I #% H#I

!# H#I

ests H%I ests H%I ests H%I

2ptional H(I 2ptional H(I 2ptional H*I

%# %# %#

SEC2A0

C2J-SE C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/ C2ap(er

N&.*er %6

Se//i%'/

!% H%I !4 H#I . H#I

#! H%I !! H#I 1 H#I

## H#I !# H#I 3 H#I

#% H#I !% H%I !. H%I

!( H%I #! H%I !1 H#I

!* H#I !( H#I !3 H#I

!, H#I !* H#I #4 H#I

!1 H#I !, H#I #! H%I

!3 H#I !3 H#I !( H#I

#4 H#I #4 H#I !* H#I

## H#I !, H#I

#% H#I

ests H%I ests H%I ests H%I

2ptional H,I 2ptional H%I 2ptional H*I

%# %# %#

xiv

CATE4OR:ATON OF ASS4NMENT MATERAL

he assignment material in the fourteenth edition has been developed to offer instructors a broad

range of options in developing a challenging and interesting course: he follo6ing exhibits assist

instructors in selecting assignment material:

Exhibits P"l and P"# sho6 assignment material that is based on serviceNnonprofit/ merchandising

Hretail/ 6holesale or distributionI sectors of the econom': =hile much assignment in the

fourteenth edition is based in the manufacturing sector/ Exhibits P"l and P"# provide man'

examples for instructors to either select assignment material from a broad range of sectors or

indeed to concentrate on sectors outside manufacturing:

!: SE-&$CE AA0 A2AP-2F$ SEC2-S8 $ncludes such settings as accounting firms/

la6 firms/ advertising agencies/ ban7 and finance companies/ lodging companies/

transportation companies/ and government agencies:

#: ME-C5AA0$S$AB SEC2-S8 $ncludes such settings as distributors/ 6holesalers/ and

retailers:

here is gro6ing demand from instructors for assignment material in three specific areasE

ethics/ global or international/ and modern cost management: Exhibits P"% to P"* sho6

assignment material in the fourteenth edition on these three topics:

%: E5$CS: he second"last problem of man' chapters incorporates an ethical issue facing a

management accountant or a manager: Examples include pressure for coo7ing the boo7s/

concealing of unfavorable information/ and conflicts of interest bet6een management

incentives and compan' value: Man' of these problems require students to consider the

OStandards of Ethical Conduct for Practitioners of Management Accounting and Financial

ManagementO on p:!, of the text:

(: B@2+A@N$AE-AA$2AA@ 0$MEAS$2AS: $ncluded assignment material based

outside the Jnited States or problems pertaining to companies 6ith operations in more

than one countr':

*: M20E-A C2S MAAABEMEA F-2A$E- $0EAS: $ncludes assignment material

that an instructor can use to highlight areas such as customer focus/ 7e' success factors/

balanced scorecard/ total value"chain anal'sis/ strategic anal'sis of operating income/ )$/

and continuous improvement: Assignment material related to activit'"based costing

HA+CI/ activit'"based management HA+MI/ and cost drivers is found in man' chapters:

xv

E;!BT P7<

ASS4NMENT MATERAL FROM SERVCE AN" NOT7FOR7PROFT SECTORS

C2ap(er N&.*er C%'(e5(

! !"## 5ouse"painting serviceK five"step decision"ma7ing process

!"#( $nternet compan'K planning and control

!"%4 Publishing compan'K ethicsK end"of"'ear actions

!"%! Shipping compan'K ethical challenges

# #"!1 Classification of costs/ mar7eting research

#"#! Phone contractK fixed and variable costs

#"#( Publishing compan'K value chain/ cost drivers

#"#, otal costs and unit costs of student entertainment

% %"!1 ravel agenc'K C&P anal'sis

%"## -estaurantK C&P anal'sis

%"#3 Music Societ'K C&P anal'sis

%"%% ourismK C&P anal'sis

%"%( 0a'careK C&P anal'sis/ target operating income

%"(4 Printing compan'K brea7evenK alternative cost structures/ uncertaint'/

sensitivit'

%"(! Computer retailerK C&P/ alternative cost structures

%"(. Museum of artK gross margin/ contribution margin

( ("!1 -esidential constructionK job costing/ normal/ actual

("#! Consulting firm/ job costing

("#( Jniversit' pressK job costing/ journal entries

("#1 Canadian accounting firmK actual/ normal and variation from normal

costing

("#3 Architecture firmK actual/ normal/ and variation from normal costing

("%# @a6 firmK job costing

("%% @a6 firmK job costing

("%3 PrintingK allocation and proration of overhead

("(! +oo7 signing agenc'K job costing

* *"!. esting labsK activit'"based costing/ cost hierarch'

*"!1 Professional services firmK alternative allocation bases

*"## Printing compan'K activit'"based costing

*"#. Custom framingK activit'"based costing

*"#1 +an7ingK activit'"based costing/ product costing/ cross"subsidization

*"#3 @a6 firmK job costing/ single direct" and indirect"cost categories

*"%4 @a6 firmK job costing/ multiple direct" and single indirect"cost

categories

*"%! @a6 firmK job costing/ multiple direct" and indirect"cost categories

*"%% -adiolog' centerK department/ activit'"cost rates

*"%( 0ance studio/ childcare/ fitnessK activit'"based costing and management

*"%. 5ealth careK activit'"based costing s'stem

xvi

E;!BT P7< 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

, ,"!, Environmental testingK sales budget

,"(4 5air salonK human aspects of budgeting

. ."%! Car detailingK variance anal'sis

1 1"#( Food deliver' serviceK overhead variances

1"%, Publishing compan'K activit'"based costing

1"(4 Pet food inspectionK non"financial variances

3 3"%! Jniversit' pressK metrics to minimize inventor' buildups

3"%3 5ospital chainK cost allocation/ do6n6ard demand spiral

3"(4 5ospital chainK cost allocation/ responsibilit' accounting/ ethics

!4 !4"!. Car rental contractsK variable"/ fixed" and mixed"cost functions

!4"#4 Car 6ashK account anal'sis method

!4"#! -estaurantK account anal'sis method

!4"#% ravel servicesK estimating a cost function/ high"lo6 method

!4"#( Customer"service costsK estimating a cost function/ high"lo6 method

!4"#* Consulting servicesK linear cost approximation

!4"#. Catering compan'K regression anal'sis

!4"%# Produce clubK high"lo6 method/ regression anal'sis

!4"%% -estaurantK sales and advertising/ high"lo6 method/ regression anal'sis

!! !!"#( 5ospitalK relevant costs/ decision on closing surger' centers

!!"#, Printing pressK choosing customers

!!"#. Auto 6ash compan'K relevance of equipment costs

!# !#"!3 ool repair shopK value"added/ nonvalue"added costs

!#"#4 ArchitectsK target operating income/ value"added costs

!#"#% 5otel managementK cost"plus target return on investment pricing

!#"#. 5otelK price discrimination

!#"%! -epair servicesK cost"plus/ time and materials/ ethics

!#"%# emp labor agenc'K cost"plus and mar7et"based pricing

!#"%% esting labsK cost"plus and mar7et"based pricing

!#"%% esting labsK cost"plus and mar7et"based pricing

!#"%* AirlineK price discrimination

!#"%, Art framingK preparing a bid/ pricing/ ethics

!% !%"#, Consulting firmK strateg'/ balanced scorecard

!%"#. Consulting firmK strategic anal'sis of operating income

!%"#1 Consulting firmK anal'sis of gro6th/ price"recover'/ and productivit'

components

!%"#3 Consulting firmK identif'ing and managing unused capacit'

xvii

E;!BT P7< 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

!( !("!, 5ospitalsK cost allocation

!("!1 5otelK cost allocation to divisions

!("#! -epair serviceK customer profitabilit'

!("#% Sports teamK variance anal'sis/ multiple products

!("%1 $nterior designK customer"cost hierarch' and profitabilit' anal'sis

!* !*"!3 Management consultingK direct and step"do6n support department cost

allocation

!*"#4 Management consultingK reciprocal method support department cost

allocation

!*"#% Allocation of common living costs

!*"#( Consulting servicesK allocation of common travel costs

!*"#3 Jniversit'K fixed cost allocation

!*"%* 5otelK revenue allocation/ bundled products

!. !."%1 Publishing compan'K transferred"in costs/ 6eighted"average method

!."%3 Publishing compan'K transferred"in costs/ F$F2 method

!3 !3"#! Conference centerK qualit' improvement/ relevant costs and revenues

!3"## Jniversit'K 6aiting time

!3"#% Jniversit'K 6aiting time/ relevant costs/ student satisfaction

!3"%4 5ealthcare groupK patient satisfaction/ 6aiting time/ compensation

!3"%. Pizza deliver'K qualit' improvement/ Pareto diagram/ cause"and"effect

diagram

#! #!"!1 5ospitalK capital budgeting methods/ no income taxes

#!"!3 5ospitalK capital budgeting methods/ income taxes

#!"## Construction compan'K pa'bac7 and AP& methods/ no income taxes

#!"#( +a7er'K ne6 equipment purchase/ income taxes

#!"%( Fitness centerK recognizing cash flo6s for capital investment projects/

AP&/ income taxes

## ##"!, heme par7sK management control s'stems/ balanced scorecard

#% #%"!. Educational servicesK 0uPont method

#%"#3 -estaurantsK -2$/ measurement alternatives for performance measures

#%"%# Media groupK -2$/ -$/ 0uPont method/ investment decisions/ balanced

scorecard

#%"%% Media groupK division managersP compensation/ levers of control

#%"%( +an7K compensation/ balanced scorecard/ compensation

#%"%. 5ealth spasK -$/ E&A/ measurement alternatives/ goal congruence

xviii

E;!BT P7=

ASS4NMENT MATERAL FROM MERC!AN"SN4 SECTORS

C2ap(er N&.*er C%'(e5(

# #"!3 Classification of costs/ merchandising sector

#"#3 0epartment storeK cost of goods purchased/ cost of goods sold/ and

income statement

#"%4 -etail outlet storeK cost of goods sold and income statement

% %"!3 0oughnut retailingK C&P

%"#! Car dealerK C&P anal'sis

%"#% +oo7 publisherK C&P and sensitivit' anal'sis

%"#* -ug dealerK space rental terms/ operating leverage

%"#1 +agel shopK sales mixK C&P

%"%4 MenPs clothing retailerK contribution margin/ decision ma7ing

%"%# -etailK uncertaint'/ expected costs

%"%1 Shoe storeK sales commissions/ C&P anal'sis

%"%3 Shoe storeK sales commissions/ C&P anal'sis

%"(, @uggage carrier retailerK sales mix/ C&P

* *"#( Supermar7etK A+C/ product"line profitabilit'

*"#* Furniture 6holesalerK A+C/ customer profitabilit'

*"%* Pharmaceuticals distributorK A+C

*"(! +oo7storeK activit'"based costing and management

, ,"#( Supermar7et chainK activit'"based budgeting

,"#* Supermar7et chainK activit'"based budgeting/ 7aizen budgeting

,"#. &ideo game distributorK cash flo6 anal'sis

,"%. =holesalerK cash budgeting

!4 !4"(4 0epartment store chainK cost drivers/ A+C/ simple regression anal'sis

!4"(! 0epartment store chainK cost drivers/ A+C/ multiple regression anal'sis

!4"(# Clothing storeK matching time periods/ regression/ ethics

!! !!"## Food storeK relevant costs/ contribution margin/ product emphasis

!!"#* Convenience storesK relevant costs/ closing and opening stores

!# !#"#! 0istributorK target prices/ target costs/ A+C

!% !%"!1 "shirts distributorK strateg'/ balanced scorecard

!%"!3 "shirts distributorK strategic anal'sis of operating income

!%"#4 "shirts distributorK anal'sis of gro6th/ price"recover'/

and productivit' components

!%"#! "shirts distributorK identif'ing and managing unused capacit'

!%"%3 Clothing retailerK strategic anal'sis of operating income

xix

E;!BT P7= 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

!( !("#4 Electronics distributorK customer profitabilit'/ customer"cost hierarch'

!("## Pharmaceutical distributorK customer profitabilit'

!("#( =ine glass retailerK variance anal'sis/ multiple products

!("%4 +ottled 6ater distributorK customer profitabilit'

!("%( Belato storesK variance anal'sis/ multiple products

!* !*"#! 2nline boo7 retailerK direct and step"do6n support department cost

allocation

!*"## 2nline boo7 retailerK reciprocal method support department cost

allocation

!*"#* Fragrance retailerK revenue allocation

!*"#, Auto salesK allocation of common costs

!*"#. 0epartment storeK single"rate/ dual"rate and practical capacit' allocation

!*"%% Computer hard6are salesK revenue allocation

#4 #4"!, Sporting goods retailerK E29

#4"!. Sporting goods retailerK E29/ effect of parameter changes

#4"!1 extile retailerK E29

#4"#, @inen retailerK effect of different order quantities/ E29/

#4"#3 2nline computer retailerK E29/ performance evaluation

#! #!"!. 5ard6are storesK capital budgeting methods/ no income taxes

#!"%, Food retailerK AP&/ inflation/ income taxes

#!"%. Food franchiseK AP&/ internal rate of return/ sensitivit' anal'sis

#% #%"## Automobile retailerK -2$/ -$/ E&A

#%"#, Car batter' salesK ris7 sharing/ incentives/ benchmar7ing/ multiple tas7s

xx

E;!BT P7>

ASS4NMENT MATERAL ON ET!CS

C2ap(er N&.*er C%'(e5(

! !"#% 0ivision performance

!"#1 Pharmaceutical compan'/ budgeting

!"#3 End"of"'ear actions

!"%4 End"of"'ear actions

!"%! Blobal compan'/ end"of"'ear actions

# #"(! Cost classification

% %"(1 Environmental costs/ C&P anal'sis

( ("(4 )ob costing/ contracting/ cost reimbursement

* *"(4 ElectronicsK A+C/ implementation/ ethics

, ,"%3 ManufacturerK slac7/ ethics

. ."(! 0rum manufacturerK variances/ standard"setting/ benchmar7ing/ ethics

1 1"(# 2verhead variances/ ethics

3 3"(4 5ospital chainK cost allocation/ responsibilit' accounting/ ethics

!4 !4"(# Clothing storeK matching time periods/ regression/ ethics

!! !!"(! 0ropping a customer/ activit'"based costing/ ethics

!# !#"%! -epair servicesK cost"plus/ time and materials/ ethics

!#"%, Art framingK preparing a bid/ pricing/ ethics

!% !%"%% Electronic component manufacturerK ethics

!( !("%3 =riting smaller ordersK customer profitabilit' and ethics

!3 !3"!1 Car seatsK costs of qualit'/ ethics

!3"%1 Auto parts manufacturerK ethics and qualit'

#4 #4"%, Container manufacturerK )$ production/ relevant benefits/ relevant

costs/ ethics

## ##"%* @uggage manufacturerK transfer pricing/ goal congruence/ ethics

#% #%"%* SemiconductorsK managerPs performance evaluation/ ethics

#%"%, Picture frame moldingK levers of control/ ethics

xxv

E;!BT P74

ASS4NMENT MATERAL ?T! 4LOBALOR NTERNATONAL SETTN4

C2ap(er N&.*er C%'(e5(

! !"%! Contract bidding/ ethical and cultural issues

% %"!1 ravel agenc'/ C&P anal'sis

%"#, $nternational cost structure differences/ C&P anal'sis

( ("#1 Canadian accounting firmK actual/ normal and variation from normal

costing

, ,"## )apanese motorc'cle manufacturerK revenues/ production and purchases

budgets

1 1"#% elecommunications compan'K manufacturing overhead/ standard"costing

s'stem

!! !!"%4 $nternational outsourcingK relevant costs/ exchange rates

#! #!"#, Clothing manufacturerK selling a plant/ income taxes

#!"#3 Fragrance manufacturerK 0CF/ sensitivit' anal'sis/ no income taxes

## ##"!3 Multinational computer compan'K transfer pricing/ global income"tax

minimization

##"#4 Canadian lumber compan'K transfer"pricing methods/ goal congruence

##"#% elecommunications equipment/ global mar7etingK multinational transfer

pricing/ global tax minimization

##"#( elecommunications equipment/ global mar7etingK multinational transfer

pricing/ goal congruence

##"%# $ndustrial diamondsK multinational transfer pricing/ global tax

minimization

##"%% Component manufacturerK multinational transfer pricing/ taxation/ goal

congruence

#% #%"#( Manufacturing/ J:S: and Aor6a'K multinational performance

measurement/ -2$/ -$

##"%4 Manufacturing/ J:S: and FranceK multinational performance

measurement/ -2$/ -$

#%"%! Multinational firm/ J:S:/ Berman'/ and Ae6 QealandK performance

measurement/ -2$/ -$/ cost of capital/ taxes

xxvi

E;!BT P75

ASS4NMENT MATERAL USN4 MO"ERN COST MANA4EMENT FRONTER "EAS

C2ap(er N&.*er C%'(e5(

! !"!, Computer compan'K value chain/ cost classification

!"!. Pharmaceutical compan'K value chain/ cost classification

!"!1 Fast food restaurantK value chain/ cost classification

!"!3 Ce' success factors

!"#* Ma7ing strategic decisions

# #"#( Publishing compan'K value chain/ cost drivers

* *"!, Cost hierarch' at manufacturer

*"!. esting labsK A+C/ cost hierarch'

*"!3 Automotive productsK plant6ide/ department/ A+C costing

*"#4 rophies and plaques manufacturerK plant6ide/ department/ A+C

costing

*"#! Calculator manufacturerK A+C/ process costing

*"## Printing compan'K activit'"based costing

*"#% 0oor manufacturerK activit'"based costing

*"#( Supermar7etK A+C/ product"line profitabilit'

*"#* Furniture 6holesalerK A+C/ customer profitabilit'

*"#, Food processingK A+C/ area cost"driver rates/ product cross"

subsidization

*"#. Custom framingK activit'"based costing

*"#1 +an7ingK A+C/ product costing/ cross"subsidization

*"%4 @a6 firmK job costing/ multiple direct" and single indirect"cost

categories

*"%! @a6 firmK job costing/ multiple direct" and indirect"cost categories

*"%# roph' manufacturingK plant6ide/ department/ activit'"cost rates

*"%% -adiolog' centerK department/ activit'"cost rates

*"%( 0ance studio/ childcare/ fitnessK activit'"based costing and management

*"%* Pharmaceuticals distributorK A+C

*"%, +ag manufacturerK activit'"based costing and management

*"%. 5ealth careK A+C s'stem

*"%1 Sports manufacturerK unused capacit'/ activit'"based costing and

management

*"%3 Machining shopK A+C

*"(4 ElectronicsK A+C/ implementation/ ethics

*"(! +oo7storeK activit'"based costing and management

, ,"#( Supermar7et chainK activit'"based budgeting

,"#* Supermar7et chainK activit'"based budgeting/ 7aizen budgeting

,"#3 "shirt manufacturerK 7aizen approach

,"%# Purchasing agentK responsibilit' accounting

,"%% @uggage manufacturerK activit'"based budgeting

,"%1 Plastic accessories manufacturerK activit'"based budgeting

,"(! Foot6ear manufacturerK activit'"based budgeting

xxvii

E;!BT P75 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

. ."#* @amp manufacturerK continuous improvement

."%# Sunglass frameNlens manufacturerK responsibilit' issues

."%1 E'eglass lens manufacturerK use of variances for benchmar7ing

."(! 0rum manufacturerK variances/ standard"setting/ benchmar7ing/ ethics

."(# Electronics manufacturerK variances/ standards/ negotiations

1 1"%* Shoe manufacturerK activit'"based costing/ batch"level variance anal'sis

1"%, Publishing compan'K activit'"based costing/ batch"level variance

anal'sis

1"%. )e6elr' ma7erK relationship bet6een production"volume and sales"

volume variance anal'sis

1"(! Cloth shopping bag ma7erK relationship bet6een production"volume and

sales"volume variance anal'sis

3 3"!. Auto compan'K throughput costing

3"!3 Electronics manufacturerK throughput costing

3"#* Capacit' management/ denominator"level capacit' concepts

3"#, Motorc'cle manufacturerK alternative denominator"level capacities

3"%! extboo7 publisherK metrics to minimize inventor' buildups

3"%( 0enominator"level choices/ changes in inventor' levels/ effect on

operating income

3"%, Electronics manufacturerK do6n6ard demand spiral

3"%3 5ospital meal serviceK cost allocation/ do6n6ard demand spiral

3"(4 5ospital meal serviceK cost allocation/ responsibilit' accounting/ ethics

!4 !4"%( ManufacturingK cost drivers/ A+C/ simple regression anal'sis

!4"%1 ManufacturingK cost drivers/ A+C/ simple regression anal'sis

!4"%3 ManufacturingK cost drivers/ A+C/ multiple regression anal'sis

!4"(4 0epartment store chainK cost drivers/ A+C/ simple regression anal'sis

!4"(! 0epartment store chainK cost drivers/ A+C/ multiple regression anal'sis

!! !!"!3 Special order/ activit'"based costing

!!"#4 Ma7e versus bu'/ activit'"based costing

!!"#, PrintersK customer profitabilit' anal'sis

!!"%, ManufacturingK A+C/ ma7e versus bu'

!!"(! Customer profitabilit'/ activit'"based costing/ ethics

!# !#"!3 ool repair shopK value"added/ nonvalue"added costs

!#"#4 ArchitectsK target operating income/ value"added costs

!#"#! 0istributorK target prices/ target costs/ A+C

!#"## Medical instrumentsK target costs/ effect of product"design changes on

product costs

!#"#% 5otel managementK cost"plus target return on investment pricing

!#"#( ManufacturerK cost"plus/ target pricing

!#"#* o' manufacturerK life"c'cle product costing

!#"#. 5otelK price discrimination

xxviii

E;!BT P75 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

!#"#1 ManufacturerK target pricing

!#"#3 ElectronicsK target prices/ target costs/ value engineering/ cost

incurrence/ loc7ed"in costs/ A+C

!#"%4 Cand' manufacturerK target return on investment pricing

!#"%# emp labor agenc'K cost"plus and mar7et"based pricing

!#"%% esting labsK cost"plus/ activit'"based costing/ mar7et"based pricing

!#"%( $ndustrial site cleanupK life"c'cle costing

!#"%* AirlineK price discrimination

!#"%. ManufacturingK target prices/ target costs/ loc7ed"in costs/ value

engineering

!% !%"!, +alanced scorecard

!%"!. Anal'sis of gro6th/ price"recover' and productivit' components

!%"!1 MerchandisingK strateg'/ balanced scorecard

!%"!3 MerchandisingK strategic anal'sis of operating income

!%"#4 MerchandisingK anal'sis of gro6th/ price"recover'/ and productivit'

components

!%"#! MerchandisingK identif'ing and managing unused capacit'

!%"## ManufacturingK strateg'/ balanced scorecard

!%"#% ManufacturingK strategic anal'sis of operating income

!%"#( ManufacturingK anal'sis of gro6th/ price"recover' and productivit'

components

!%"#* ManufacturingK identif'ing and managing unused capacit'

!%"#, Consulting firmK strateg'/ balanced scorecard

!%"#. Consulting firmK strategic anal'sis of operating income

!%"#1 Consulting firmK anal'sis of gro6th/ price"recover'/ and productivit'

components

!%"#3 Consulting firmK identif'ing and managing unused capacit'

!%"%4 ManufacturingK strateg'/ balanced scorecard

!%"%! ManufacturingK strategic anal'sis of operating income

!%"%# ManufacturingK anal'sis of gro6th/ price"recover'/ and productivit'

components

!%"%% ManufacturingK identif'ing and managing unused capacit'

!%"%( +alanced scorecard

!%"%* Petroleum compan'K balanced scorecard

!%"%, @aser printersK balanced scorecard

!%"%. ManufacturingK partial productivit' measurement

!%"%1 ManufacturingK total factor productivit'

!%"%3 Clothing retailerK strategic anal'sis of operating income

!( !("#4 Electronics distributionK customer profitabilit'/ customer"cost hierarch'

!("#! -epair serviceK customer profitabilit'

!("## Pharmaceutical distributorK customer profitabilit'

!("#3 )e6elr' manufacturerK customer profitabilit'

!("%4 +ottled 6ater distributorK customer profitabilit'

!("%! Manufacturing compan'K customer profitabilit' anal'sis

xxix

E;!BT P75 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

!("%1 $nterior designK customer"cost hierarch'/ customer profitabilit'

!("%3 =riting smaller ordersK customer"cost hierarch'/ profitabilit' and ethics

!3 !3"!, Cell phone equipmentK costs of qualit'

!3"!. Car seatsK costs of qualit'

!3"!1 Car seatsK costs"of"qualit'/ ethics

!3"!3 Cell phonesK nonfinancial measures of qualit' and time

!3"#4 Printing pressesK qualit' improvements/ relevant costs and relevant

revenues

!3"#! Conference center/ qualit' improvement/ relevant costs and relevant

revenues

!3"## Jniversit'K 6aiting time

!3"#% Jniversit'K 6aiting time/ relevant costs/ student satisfaction

!3"#( ManufacturerK nonfinancial measures of qualit'/ manufacturing c'cle

efficienc'

!3"#* Filing cabinetsK theor' of constraints/ throughput margin/ relevant costs

!3"#, Filing cabinetsK theor' of constraints/ throughput margin/ qualit'

!3"#. &alve manufacturingK qualit' improvement/ relevant costs/ and relevant

revenues

!3"#1 Plastic productsK qualit' improvement/ relevant costs/ and relevant

revenues

!3"#3 Cereal manufacturerK statistical qualit' control

!3"%4 5ealthcare groupK 6aiting time/ patient satisfaction/ compensation

!3"%! Plastic productsK 6aiting times/ manufacturing lead times

!3"%# Plastic productsK 6aiting times/ relevant revenues/ and relevant costs

!3"%% =ire harnessesK manufacturing c'cle times/ relevant revenues/ and

relevant costs

!3"%( Electronic testing equipmentK theor' of constraints/ throughput margin/

relevant costs

!3"%* Pharmaceutical manufacturerK theor' of constraints/ throughput margin/

qualit'/ relevant costs

!3"%, o' manufacturerK theor' of constraints/ sensitivit' anal'sis

!3"%. Pizza deliver'K qualit' improvement/ Pareto diagram/ cause"and"effect

diagram

!3"%1 Auto parts manufacturerK qualit' and ethics

!3"%3 extile printingK qualit' improvementK theor' of constraints

#4 #4"#! Car manufacturerK )$/ balanced scorecard

#4"## 5ard6are compan'K )$ production/ relevant benefits/ relevant costs

#4"#% Computer assembl'K bac7flush costing and )$ production

#4"#( Computer assembl'K bac7flush costing/ t6o trigger points/ materials

purchase and sale

#4"#* Computer assembl'K bac7flush costing/ t6o trigger points/ completion of

production and sale

#4"#1 Music pla'ersK E29/ )$ production

#4"%4 Automotive supplier/ )$ purchasing/ relevant benefits/ relevant cost

xxx

E;!BT P75 0C%'(i'&ed1

C2ap(er N&.*er C%'(e5(

#4"%! Computer manufacturerK supplier evaluation/ costs of qualit'/ timel'

deliveries

#4"%# Electrical goodsK bac7flush costing and )$ production

#4"%% Electrical goodsK bac7flush/ t6o trigger points/ materials purchase and

sale

#4"%( Electrical goodsK bac7flush/ t6o trigger points/ completion of production

and sale

#4"%* Securit' devicesK lean accounting

#4"%, Container manufacturerK )$ production/ relevant benefits/ relevant

costs/ ethics:

## ##"!, heme par7sK management control s'stems/ balanced scorecard

##"!1 Supermar7et chainK decentralization/ goal congruence/ responsibilit'

centers

#% #%"## Automotive retailerK -2$/ -$/ E&A

#%"#( Manufacturing/ J:S: and Aor6a'K multinational performance

measurement/ -2$/ -$

#%"#* Fashion product manufacturerK -2$/ -$/ E&A/ performance evaluation

#%"#, AutomotiveK ris7 sharing/ incentives/ benchmar7ing/ multiple tas7s

#%"#. 0oorbell manufacturingK -$/ E&A/ adjusted operating income

#%"%4 Manufacturing/ J:S: and FranceK multinational performance

measurement/ -2$/ -$

#%"%! Multinational firm/ J:S:/ Berman'/ and Ae6 QealandK multinational

performance measurement/ -2$/ -$/ cost of capital/ taxes

#%"%# Media groupK -2$/ -$/ 0uPont method/ investment decisions/ balanced

scorecard

#%"%% Media groupK division managersP compensation/ levers of control

#%"%( +an7K business unit compensation/ balanced scorecard

#%"%, Picture frame moldingK levers of control/ ethics

#%"%. 5ealth spasK -$/ E&A/ measurement alternatives/ goal congruence

xxxi

xxxii

PRESENTATON OF SOLUTONS

T2i/ edi(i%' i/ a$$%.pa'ied *# a Student Solutions Manual, ,2i$2 i/ availa*le 6%r /ale (%

/(&de'(/- T2e Manual pr%vide/ ,%r@ed7%&( /%l&(i%'/ (% all %6 (2e eve' '&.*ered a//i)'.e'(

.a(erial-

$nstructors have a variet' of vie6s regarding the use of classroom time for home6or7 solutions:

Most instructors put solutions on a blac7board or an overhead projector: $n turn/ their students

franticall' cop' the materials in their notes: 2ur practice is to reproduce the printed home6or7

solutions for distribution either before/ during/ or after the discussion for a particular solution:

he members of the class are glad to pa' a modest fee to the school to cover the reproduction

costs: $n this 6a'/ students can spend more of their classroom time in thin7ing rather than 6riting:

Further/ the' have a complete set of notes:

Some instructors object to this procedure because it provides students 6ith a OfileO that can be

passed along to subsequent classes: Students in subsequent classes 6ill then use the OfileO to

avoid conscientious preparation of home6or7: =e used to 6orr' about such practices/ but long

ago 6e decided that there 6ould al6a's be some students 6ho hurt themselves b' not doing

home6or7 in an appropriate 6a': =h' should the vast majorit' of students be penalized b'

6ithholding the printed solutionsR he benefits of using printed solutions clearl' out6eigh the

costs: =e no longer fret about the fe6 students 6ho beat the s'stem Hand themselvesI:

Similarl'/ 6e distribute printed solutions to tests and examinations along 6ith a summar' of

overall class performance: =e do not devote class time to discussing these solutions: he students

deserve feedbac7/ but the' have sufficient motivation to scrutinize the printed solutions and chec7

their errors on an individual basis: $n this 6a' more class time is available for ne6 material:

$f students have complaints about grades/ 6e usuall' as7 them to cool off for #( hours and to then

submit a 6ritten anal'sis of ho6 the' 6ere unjustl' treated: =e then ta7e these complaints in

batches/ regrade the papers/ and return the papers: $f the student then 6ants to have a person"to""

person discussion of the matter/ he or she is 6elcome at our office: his procedure ma' seem too

impersonal/ but 6e recommend it to those teachers 6ho have been through some painful debates

that have been inefficient and frustrating for both student and teacher:

xxxiii

xxxiv

MAJOR C!AN4ES N TE;T OF T!E FOURTEENT! E"TON

4rea(er E.p2a/i/ %' S(ra(e)#

his edition deepens the boo7;s emphasis on strateg' development and execution: Several

chapters build on the strateg' theme introduced in Chapter !: Chapter !% has a greater discussion

of strateg' maps as a useful tool to implement the balanced scorecard and a simplified

presentation of ho6 income statements of companies can be anal'zed from the strategic

perspective of product differentiation or cost leadership: =e also discuss strateg' considerations

in the design of activit'"based costing s'stems in Chapter */ the preparation of budgets in Chapter

,/ and decision ma7ing in Chapters !! and !#:

"eeper C%'/idera(i%' %6 4l%*al //&e/

+usiness is increasingl' becoming more global: Even small and medium"sized companies across

the manufacturing/ merchandising/ and service sectors are being forced to deal 6ith the effects of

globalization: Blobal considerations permeate man' chapters: For example/ Chapter !! discusses

the benefits and the challenges that arise 6hen outsourcing products or services outside the

Jnited States: Chapter ## examines the importance of transfer pricing in minimizing the tax

burden faced b' multinational companies: Several ne6 examples of management accounting

applications in companies are dra6n from international settings:

'$rea/ed F%$&/ %' (2e Servi$e Se$(%r

$n 7eeping 6ith the shifts in the J:S: and 6orld econom' this edition ma7es greater use of service

sector examples: For example/ Chapter # discusses the concepts around the measurement of costs

in a soft6are development rather than a manufacturing setting: Chapter , provides several

examples of the use of budgets and targets in service companies: Several concepts in action boxes

focus on the service sector such as activit'"based costing at Charles Sch6ab HChapter *I and

managing 6ireless data bottlenec7s HChapter !3I:

Ne, C&((i')7Ed)e T%pi$/

he pace of change in organizations continues to be rapid: he fourteenth edition of Cost

Accounting reflects changes occurring in the role of cost accounting in organizations:

=e have introduced foreign currenc' and for6ard contract issues in the context of

outsourcing decisions:

=e have added ideas based on Six Sigma to the discussion of qualit':

=e have re6ritten the chapter on strateg' and the balanced scorecard and simplified the

presentation to connect strateg' development/ strateg' maps/ balanced scorecard/ and anal'sis

of operating income:

=e discuss current trends to6ards +e'ond +udgeting and the use of rolling forecasts:

=e develop the lin7 bet6een traditional forms of cost allocation and the nascent movement in

Europe to6ards -esource Consumption Accounting:

=e focus more sharpl' on ho6 companies are simplif'ing their costing s'stems 6ith the

presentation of value streams and lean accounting:

Ope'i') Vi)'e((e/

Each chapter opens 6ith a vignette on a real compan' situation: he vignettes engage the reader

in a business situation/ or dilemma/ illustrating 6h' and ho6 the concepts in the chapter are

relevant in business: For example/ Chapter ! describes ho6 Apple uses cost accounting

information to ma7e decisions relating to ho6 the' price the most popular songs on iunes:

xxxv

Chapter % explains ho6 the band J# paid for their extensive ne6 stage b' lo6ering tic7et prices:

Chapter . describes ho6 even the A+A 6as forced to cut costs after over half of the league;s

franchises declared losses: Chapter !! sho6s ho6 )et+lue uses 6itter and e"mail to help their

customers ma7e better pricing decisions: Chapter !# discusses ho6 ata Motors designed a car

for the $ndian masses/ priced at onl' S#/*44: Chapter !( sho6s ho6 +est +u' boosts profits b'

anal'zing its customers and their bu'ing habits: Chapter !1 describes ho6 +oeing incurred great

losses as it re6or7ed its much"anticipated 0reamliner airplane:

C%'$ep(/ i' A$(i%' B%5e/

Found in ever' chapter/ these boxes cover real"6orld cost accounting issues across a variet' of

industries including automobile racing/ defense contracting/ entertainment/ manufacturing/ and

retailing: Ae6 examples include

5o6 Qipcar 5elps -educe +usiness ransportation Costs

)ob Costing at Co6bo's Stadium

he L0eath SpiralM and the End of @andline elephone Service

ransfer Pricing 0ispute emporaril' Stops the Flo6 of Fiji =ater

S(rea.li'ed Pre/e'(a(i%'

=e continue to tr' to simplif' and streamline our presentation of various topics to ma7e it as eas'

as possible for a student to learn the concepts/ tools/ and frame6or7s introduced in different

chapters: Examples of more streamlined presentations can be found in Chapter %/ on the

discussion of target net income

Chapter */ on the core issues in activit'"based costing HA+CI

Chapter 1/ 6hich uses a single comprehensive example to illustrate the use of variance

anal'sis in A+C s'stems

Chapter !%/ 6hich contains a much simpler presentation of the strategic anal'sis of operating

income

Chapter !*/ 6hich uses a simpler/ unified frame6or7 to discuss various cost"allocation

methods

Chapters !. and !1/ 6here the material on standard costing has been moved to the appendix/

allo6ing for smoother transitions through the sections in the bod' of the chapter

!i)2li)2(/ %6 Ne, C2ap(er7*#7C2ap(er C2a')e/

C2ap(er <+

Chapter ! has been re6ritten to focus on strateg'/ decision"ma7ing/ and learning emphasizing the

managerial issues that animate modern management accounting: $t no6 emphasizes decision

ma7ing instead of problem solving/ performance evaluation instead of score7eeping and learning

instead of attention directing:

C2ap(er =+

Chapter # has been re6ritten to emphasize the service sector: For example/ instead of a

manufacturing compan' context/ the chapter uses the soft6are development setting at a compan'

li7e Apple $nc: to discuss cost measurement: $t also develops ideas related to ris7 6hen discussing

fixed versus variable costs:

xxxvi

C2ap(er >+

Chapter % has been re6ritten to simplif' the presentation of target net income b' describing ho6

target net income can be converted to target operating income: his allo6s students to use the

equations alread' developed for target operating income 6hen discussing target net income: =e

deleted the section on multiple cost drivers/ because it is closel' related to the multi"product

example discussed in the chapter: he managerial and decision"ma7ing aspects of the chapter

have also been strengthened:

C2ap(er 4+

Chapter ( has been reorganized to first discuss normal costing and then actual costing because

normal costing is much more prevalent in practice: As a result of this change the exhibits in the

earl' part of the chapter tie in more closel' to the detailed exhibits of normal job"costing s'stems

in manufacturing later in the chapter: he presentation of actual costing has been retained to help

students understand the benefits and challenges of actual costing s'stems: o focus on job

costing/ 6e moved the discussion of responsibilit' centers and departments to Chapter ,:

C2ap(er 5+

Chapter * has been reorganized to clearl' distinguish design choices/ implementation challenges/

and managerial applications of A+C s'stems: he presentation of the ideas has been simplified

and streamlined to focus on the core issues:

C2ap(er A+

Chapter , no6 includes ideas from relevant applied research on the usefulness of budgets and the

circumstances in 6hich the' add the greatest value/ as 6ell as the challenges in administering

them: $t incorporates ne6 material on the +e'ond +udgeting movement/ and in particular the

trend to6ards the use of rolling forecasts::

C2ap(er/ 7 a'd 8+

Chapters . and 1 present a streamlined discussion of direct"cost and overhead variances/

respectivel': he separate sections on A+C and variance anal'sis in chapters . and 1 have no6

been combined into a single integrated example at the end of Chapter 1: A ne6 appendix to

Chapter . no6 addresses more detailed revenue variances using the existing =ebb Compan'

example: he use of potentiall' confusing terms such as #"variance anal'sis and !"variance

anal'sis has been eliminated:

C2ap(er B+

=e have re6ritten Chapter 3 as a single integrated chapter 6ith the same running example rather

than as t6o distinct sub"parts on inventor' costing and capacit' anal'sis: he material on the tax

and financial reporting implications of various capacit' concepts has also been full' revised:

C2ap(er <0+

Chapter !4 has been revised to provide a more linear progression through the ideas of cost

estimation and the choice of cost drivers/ culminating in the use of quantitative anal'sis

Hregression anal'sis/ in particularI for managerial decision"ma7ing:

C2ap(er <<+

Chapter !! no6 includes more discussion of global issues such as foreign currenc' considerations

in international outsourcing decisions: here is also greater emphasis on strateg' and decision"

ma7ing:

xxxvii

C2ap(er <=+

Chapter !# has been reorganized to more sharpl' delineate short"run from long"run costing and

pricing and to bring together the various considerations other than costs that affect pricing

decisions: his reorganization has helped streamline several sections in the chapter:

C2ap(er <>+

Chapter !% has been substantiall' re6ritten: Strateg' maps are presented as a 6a' to lin7 strategic

objectives and as a useful first step in developing balanced scorecard measures: he section on

strategic anal'sis of operating income has been significantl' simplified b' focusing on onl' one

indirect cost and eliminating most of the technical details: Finall'/ the section on engineered and

discretionar' costs has been considerabl' shortened to focus on onl' the 7e' ideas:

C2ap(er <4+

Chapter !( no6 discusses the use of L6hale curvesM to depict the outcome of customer

profitabilit' anal'sis: he last part of the chapter has been rationalized to focus on the

decomposition of sales volume variances into quantit' and mix variancesK and the calculation of

sales mix variances has also been simplified:

C2ap(er <5+

Chapter !* has been completel' revised and uses a simple/ unified conceptual frame6or7 to

discuss various cost allocation methods Hsingle"rate versus dual"rate/ actual costs versus budgeted

costs/ etc:I:

C2ap(er <A+

Chapter !, no6 provides a more in"depth discussion of the rationale underl'ing joint cost

allocation as 6ell as the reasons 6h' some firms do not allocate costs Halong 6ith real"6orld

examplesI:

C2ap(er/ <7 a'd <8+

Chapters !. and !1 have been reorganized/ 6ith the material on standard costing moved to the

appendix in both chapters: his reorganization has made the chapters easier to navigate and full'

consistent Hsince all sections in the bod' of the chapter no6 use actual costingI: he material on

multiple inspection points from the appendix to Chapter !1 has been moved into the bod' of the

chapter/ but using a variant of the existing example involving Anzio Corp:

C2ap(er <B+

Chapter !3 introduces the idea of Six Sigma qualit': $t also integrates design qualit'/

conformance qualit'/ and financial and nonfinancial measures of qualit': he discussion of

queues/ dela's/ and costs of time has been significantl' streamlined:

C2ap(er =0+

Chapter #4;s discussion of E29 has been substantiall' revised and the ideas of lean accounting

further developed: he section on bac7flush costing has been completel' re6ritten:

C2ap(er =<+

Chapter #! has been revised to incorporate the pa'bac7 period method 6ith discounting/ and also

no6 includes surve' evidence on the use of various capital budgeting methods: he discussion of

xxxviii

goal congruence and performance measurement has been simplified and combined/ ma7ing the

latter half of the chapter easier to follo6:

C2ap(er ==+

Chapter ## has been full' re6ritten 6ith a ne6 section on the use of h'brid pricing methods: he

chapter also no6 includes a fuller description Hand a variet' of examplesI of the use of transfer

pricing for tax minimization/ and incorporates such developments as the recent tax changes

proposed b' the 2bama administration:

C2ap(er =>+

Chapter #% includes a more thorough description of -esidual $ncome and E&A/ as 6ell as a more

streamlined discussion of the various choices of accounting"based performance measures:

xxxix

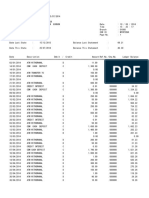

C!AN4ES N ASS4NMENT MATERAL FOR T!E FOURTEENT! E"TON

2ver ,4T of the exercises and problems in the fourteenth edition are ne6 or revised: he

remaining exercises and problems are ta7en from the thirteenth edition: he follo6ing exhibits

indicate the source of each of the exercises and problems in the thirteenth edition: hese exhibits

can be read as follo6s8

Chapter *

!(E !%E

U U

U U

U U

Categor' HaI *"xx Ae6

Categor' HbI *"'' *"'' -ev

Categor' HcI *"zz *"zz

Categor' HaI sho6s that problem *"xx in the fourteenth edition is ne6 to this edition:

Categor' HbI sho6s that problem *"'' in the fourteenth edition is a revision of problem

*"'' in the thirteenth editionK the V-ev; in V*"'' -ev; indicates that the content and numbers in

the thirteenth edition have been revised:

Categor' HcI sho6s that problem *"zz in the fourteenth edition is problem *"zz in the

thirteenth edition: he absence of a V-evM after V*"zz; means that no change in the content or

numbers has been made in continuing use of this problem in the fourteenth edition:

xl

C2ap(er < C2ap(er = C2ap(er > C2ap(er 4 C2ap(er 5 C2ap(er A

<4E <>E <4E <>E <4E <>E <4E <>E <4E <>E <4E <>E

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

!,

!.

!1

Ae6

#4

#!

## -ev

#%

#(

#*

#,

#.

Ae6

#3

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!, -ev

Ae6

!1

!3

#4

#! -ev

##

#% -ev

Ae6

#*

#,

#. -ev

#1

%4 -ev

Ae6

#3 -ev

%!

Ae6

%#

%%

%( -ev

%* -ev

Ae6

%. -ev

%1 -ev

Ae6

(4

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

(%

((

(*

(,

(.

(1

(3

!,

!. -ev

!1 -ev

!3

#4

#! -ev

## -ev

#%

#( -ev

#*

Ae6

#. -ev

Ae6

Ae6

%4 -ev

%!

%# -ev

%% -ev

%( -ev

Ae6

%,

Ae6

%1

%3

Ae6

Ae6

Ae6

(%

((

(*

(, -ev

(. -ev

(1

(3

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

!,

!.

!1 -ev

!3 -ev

#4

#! -ev

Ae6

#%

#(

#*

#,

#. -ev

#1 -ev

Ae6

%4 -ev

%! -ev

%#

%%

%(

%*

Ae6

%.

Ae6

Ae6

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

!, -ev

!. -ev

!1 -ev

!3

Ae6

#4

#!

Ae6

#%

#( -ev

#*

Ae6

#. -ev

#1

#3

%4

Ae6

%# -ev

%% -ev

%(

%* -ev

%, -ev

%.

%1 -ev

%3

(4

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

!, -ev

!.

!1

!3

#4

#! -ev

##

#%

#(

#* -ev

Ae6

Ae6

#1 -ev

Ae6

%4

%!

Ae6

%% -ev

%( -ev

%*

%,

%. -ev

%1 -ev

Ae6

Ae6

xli

C2ap(er 7 C2ap(er 8 C2ap(er B C2ap(er <0 C2ap(er << C2ap(er <=

<4E <>E <4E <>E <4E <>E <4E <>E <4E <>E <4E <>E

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!,

!.

!1

!3

#4 -ev

#!

##

#%

#(

#* -ev

#,

#.

#1

Ae6

%4 -ev

%! -ev

%#

%% -ev

%( -ev

%* -ev

%,

%. -ev

%1 -ev

%3 -ev

Ae6

Ae6

(4

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!,

!.

!1

!3

#4

#! -ev

##

#% -ev

#(

#* -ev

#,

#. -ev

#1 -ev

#3

%4

%! -ev

%# -ev

%%

%( -ev

Ae6

%, -ev

%1

%3

(4

(! -ev

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

!,

!.

!1

!3

#4

#!

## -ev

#%

#( -ev

#*

#, -ev

Ae6

#1

#3 -ev

%4

%! -ev

%#

%%

%( -ev

%* -ev

Ae6

%. -ev

%1 -ev

%3 -ev

(4 -ev

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!,

!.

!1

!3

#4

Ae6

##

#%

#( -ev

#* -ev

#, -ev

#.

#1 -ev

#3 -ev

%4 -ev

%! -ev

%# -ev

%%

%( -ev

%* -ev

%, -ev

%. -ev

%1 -ev

%3 -ev

(4 -ev

(! -ev

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!, -ev

!. -ev

!1

!3

#4

#! -ev

## -ev

#%

Ae6

#*

#,

#.

#1 -ev

#3

Ae6

%!

%# -ev

%%

%(

%*

Ae6

%.

%1 -ev

%3

(4

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

!,

!.

!1 -ev

!3

#4 -ev

#!

##

#% -ev

Ae6

Ae6

#, -ev

Ae6

#1 -ev

#3

%4

Ae6

%# -ev

%%

Ae6

%* -ev

Ae6

Ae6

xlii

C2ap(er <> C2ap(er <4 C2ap(er <5 C2ap(er <A C2ap(er <7 C2ap(er <8

<4E <>E <4E <>E <4E <>E <4E <>E <4E <>E <4E <>E

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

!, -ev

!. -ev

!1

!3 -ev

#4 -ev

#! -ev

##

#% -ev

#( -ev

#* -ev

#,

#. -ev

#1 -ev

#3 -ev

Ae6

Ae6

Ae6

Ae6

%(

%*

%,

%. -ev

%1 -ev

%3

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

!,

!. -ev

!1

!3

#4 -ev

#!

##

#%

#( -ev

#* -ev

#, -ev

#.

#1

#3

%4

%! -ev

%# -ev

%% -ev

%( -ev

%,

%. -ev

Ae6

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

!,

!.

!1

!3

#4

#!

##

#% -ev

#( -ev

#* -ev

Ae6

#. -ev

#1 -ev

Ae6

%4

%!

%# -ev

%% -ev

Ae6

%* -ev

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

!,

!.

!1

!3

#4 -ev

#!

##

#%

#( -ev

#* -ev

#, -ev

#. -ev

#1

#3

%4 -ev

%! -ev

%# -ev

%% -ev

%( -ev

%, -ev

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

(#

!,

!.

!1

!3

#4

#!

##

Ae6

#( -ev

#* -ev

#, -ev

#.

#1

Ae6

%4

%!

%#

%%

%(

%* -ev

%, -ev

%. -ev

%1 -ev

%3 -ev

(4 -ev

(! -ev

#3

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

(4

(!

!,

!.

!1

!3

#4

#!

## -ev

#% -ev

#(

#*

#,

#. -ev

#1

#3 -ev

%4 -ev

%! -ev

%# -ev

%% -ev

Ae6

%* -ev

%, -ev

%. -ev

Ae6

%3

Ae6

Ae6

xliii

C2ap(er <B C2ap(er =0 C2ap(er =< C2ap(er == C2ap(er =>

<4E <>E <4E <>E <4E <>E <4E <>E <4E <>E

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

%3

!,

!. -ev

!1 -ev

!3

#4 -ev

Ae6

## -ev

#% -ev

Ae6

#*

#,

#.

#1

Ae6

%4 -ev

%! -ev

%# -ev

%%

%( -ev

%*

%, -ev

Ae6

Ae6

%3

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

!,

!.

!1 -ev

!3

Ae6

#!

##

#%

#(

#*

#, -ev

Ae6

#1 -ev

#3

%!

%#

%% -ev

%( -ev

%* -ev

Ae6

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

%1

!, -ev

!. -ev

!1

!3

#4

#! -ev

##

#%

#(

#* -ev

#, -ev

#.

#1

#3 -ev

%4 -ev

%!

%# -ev

%% -ev

%(

%* -ev

%, -ev

%1 -ev

Ae6

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

Ae6

!.

Ae6

!3 -ev

#4

#!

##

#% -ev

#( -ev

#*

#,

#. -ev

#1

#3

%4

%!

%# -ev

%% -ev

%( -ev

Ae6

%, -ev

!,

!.

!1

!3

#4

#!

##

#%

#(

#*

#,

#.

#1

#3

%4

%!

%#

%%

%(

%*

%,

%.

!,

!. -ev

!1

!3

#4

#!

##

#%

#( -ev

#*

#,

#. -ev

#1 -ev

Ae6

%4 -ev

%! -ev

%# -ev

%%

%( -ev

%* -ev

%, -ev

Ae6

xliv

Das könnte Ihnen auch gefallen

- SPC Abc Security Agrmnt PDFDokument6 SeitenSPC Abc Security Agrmnt PDFChristian Comunity100% (3)

- Active Directory FactsDokument171 SeitenActive Directory FactsVincent HiltonNoch keine Bewertungen

- CBC-TM I Trainers Methodology Level 1Dokument105 SeitenCBC-TM I Trainers Methodology Level 1Rowell L Panuncial100% (4)

- Crawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsDokument46 SeitenCrawler Base DX500/DX600/DX680/ DX700/DX780/DX800: Original InstructionsdefiunikasungtiNoch keine Bewertungen

- Logical Framework AnalysisDokument19 SeitenLogical Framework AnalysisNahidul Islam100% (1)

- Gravity Based Foundations For Offshore Wind FarmsDokument121 SeitenGravity Based Foundations For Offshore Wind FarmsBent1988Noch keine Bewertungen

- Huawei Core Roadmap TRM10 Dec 14 2011 FinalDokument70 SeitenHuawei Core Roadmap TRM10 Dec 14 2011 Finalfirasibraheem100% (1)

- Canopy CountersuitDokument12 SeitenCanopy CountersuitJohn ArchibaldNoch keine Bewertungen

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDokument11 SeitenPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)

- Product Guide TrioDokument32 SeitenProduct Guide Triomarcosandia1974Noch keine Bewertungen

- Discipline Without Punishment-At LastDokument19 SeitenDiscipline Without Punishment-At LastSam NgNoch keine Bewertungen

- Revit 2019 Collaboration ToolsDokument80 SeitenRevit 2019 Collaboration ToolsNoureddineNoch keine Bewertungen

- Managerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Dokument40 SeitenManagerial Accounting-Fundamental Concepts and Costing Systems For Cost Analysis Module 1Uzma Khan100% (1)

- May 2010 CMA Content Specification OutlineDokument12 SeitenMay 2010 CMA Content Specification OutlineriswanbbaNoch keine Bewertungen

- See The Front Matte R of This Solutions Manual For Suggestions Regarding Your Choices of Assignment Material For Each Chapter. Management AccountingDokument16 SeitenSee The Front Matte R of This Solutions Manual For Suggestions Regarding Your Choices of Assignment Material For Each Chapter. Management AccountingArdy PiliangNoch keine Bewertungen

- Sample Evidence For FoundationDokument9 SeitenSample Evidence For FoundationroysmossNoch keine Bewertungen

- English 91 Quality-function-Deployment-qfdDokument5 SeitenEnglish 91 Quality-function-Deployment-qfdMoeshfieq WilliamsNoch keine Bewertungen

- Management Advisory Services SyllabusDokument16 SeitenManagement Advisory Services SyllabuskaderderkaNoch keine Bewertungen

- Keat and Young Editions 4 5 6 ComparisonDokument12 SeitenKeat and Young Editions 4 5 6 ComparisonshaherfuranyNoch keine Bewertungen

- Project GuidelinesDokument5 SeitenProject GuidelinesRakesh JhaNoch keine Bewertungen

- Course Reflection - Discussion FinalDokument4 SeitenCourse Reflection - Discussion FinalKatrine ClaudiaNoch keine Bewertungen

- A Project Report ON "Retail Chain Management": Diploma IN Computer EngineeringDokument34 SeitenA Project Report ON "Retail Chain Management": Diploma IN Computer EngineeringSai PrintersNoch keine Bewertungen

- Cost Accounting 4/eDokument18 SeitenCost Accounting 4/eJames MorganNoch keine Bewertungen

- Multiview Logic Operations Support V7.0Dokument45 SeitenMultiview Logic Operations Support V7.0Vivan MenezesNoch keine Bewertungen

- TFIN50 Version: 095 / 10 Days Instructor-Led Classroom: AudienceDokument4 SeitenTFIN50 Version: 095 / 10 Days Instructor-Led Classroom: AudienceSuraj PattanayakNoch keine Bewertungen

- Building OLAP CubesDokument88 SeitenBuilding OLAP CubesDevi Vara PrasadNoch keine Bewertungen

- Revision Book CAFMDokument104 SeitenRevision Book CAFMDeep Patel100% (1)

- Dwnload Full Managerial Applications of Cost Accounting A Case Study of Bakerview Dairies 1st Edition Maugers Solutions Manual PDFDokument36 SeitenDwnload Full Managerial Applications of Cost Accounting A Case Study of Bakerview Dairies 1st Edition Maugers Solutions Manual PDFladonnamerone1214100% (6)

- OBIEE Interview Questions and AnswersDokument5 SeitenOBIEE Interview Questions and AnswersJinendraabhiNoch keine Bewertungen

- ProjectbookDokument17 SeitenProjectbookbhagathnagarNoch keine Bewertungen

- NC4 CBLMDokument25 SeitenNC4 CBLMrayden22Noch keine Bewertungen

- Simple Proposal FormatDokument3 SeitenSimple Proposal FormatKatz EscañoNoch keine Bewertungen

- Apollo ReportDokument19 SeitenApollo ReporttieucuaNoch keine Bewertungen

- Comsats Institute of Information Technology LahoreDokument5 SeitenComsats Institute of Information Technology Lahoremalik2k3Noch keine Bewertungen

- Priya 732-675-7779 SummaryDokument6 SeitenPriya 732-675-7779 Summarysahastra001Noch keine Bewertungen

- Hca14 SM Ch01Dokument16 SeitenHca14 SM Ch01DrellyNoch keine Bewertungen

- Cost Accountant CertificationDokument6 SeitenCost Accountant CertificationVskills CertificationNoch keine Bewertungen